Sourcing Guide Contents

Industrial Clusters: Where to Source Electronics Distributors In China

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing Electronics Distributors in China

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

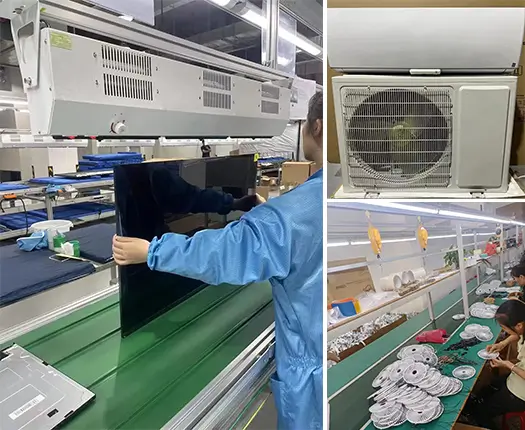

China remains the global epicenter of electronics manufacturing and distribution, with a mature ecosystem of electronics distributors that serve both domestic and international supply chains. These distributors play a critical intermediary role—offering component sourcing, inventory management, logistics, and technical support—particularly vital in complex electronics sectors such as consumer electronics, industrial automation, automotive electronics, and IoT.

This report provides a strategic deep-dive into China’s electronics distribution landscape, with a focus on identifying key industrial clusters, evaluating regional strengths, and benchmarking provinces and cities based on price competitiveness, quality assurance, and lead time efficiency. This analysis enables procurement teams to make data-driven sourcing decisions aligned with their operational priorities.

Key Industrial Clusters for Electronics Distributors in China

Electronics distributors in China are concentrated in regions with dense manufacturing ecosystems, strong logistics infrastructure, and proximity to OEMs and ODMs. The primary clusters include:

- Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Guangzhou, Dongguan, Foshan

-

Profile: The undisputed hub of China’s electronics supply chain. Shenzhen, in particular, is home to Huaqiangbei—the world’s largest electronics components marketplace—and hosts thousands of distributors, from small traders to authorized partners of global brands (e.g., Avnet, Future Electronics).

-

Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Yiwu

-

Profile: Strong in e-commerce integration and SME-focused distribution. Yiwu’s global trade market includes a growing electronics component segment. Hangzhou benefits from Alibaba’s ecosystem, enabling digital B2B platforms and faster transaction cycles.

-

Jiangsu Province

- Core Cities: Suzhou, Nanjing, Wuxi

-

Profile: High concentration of foreign-invested manufacturing and semiconductor firms. Distributors here often specialize in industrial-grade and high-reliability components, serving automotive and automation sectors.

-

Shanghai Municipality

-

Profile: A financial and logistics gateway with access to international standards and MNCs. Many global electronics distributors maintain regional headquarters or regional distribution centers here.

-

Sichuan Province (Western China)

- Core City: Chengdu

- Profile: Emerging cluster with government incentives. Attracting semiconductor and display manufacturers, leading to growth in local distribution networks.

Regional Comparison: Electronics Distributors in China (2026)

| Region | Price Competitiveness | Quality Level | Lead Time | Key Strengths | Risk Considerations |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (High) | ★★★★☆ (High) | ★★★★★ (Fast) | Proximity to OEMs, deep supplier network, Huaqiangbei market, strong logistics | Risk of counterfeit components; due diligence essential |

| Zhejiang | ★★★★★ (Very High) | ★★★☆☆ (Medium) | ★★★★☆ (Fast) | Cost-effective SME access, e-commerce integration, scalable B2B platforms | Lower technical support; variable quality control |

| Jiangsu | ★★★☆☆ (Medium) | ★★★★★ (Very High) | ★★★★☆ (Fast) | High-reliability components, strong industrial automation focus, ISO-certified partners | Higher prices; less flexibility for small orders |

| Shanghai | ★★★☆☆ (Medium) | ★★★★★ (Very High) | ★★★★☆ (Fast) | International standards compliance, multilingual support, logistics hub | Premium pricing; limited small-lot availability |

| Sichuan | ★★★★☆ (High) | ★★★☆☆ (Medium) | ★★★☆☆ (Medium) | Government incentives, lower labor costs, growing semiconductor base | Less mature distribution network; longer customs clearance for exports |

Rating Scale: ★ = Low, ★★ = Below Average, ★★★ = Medium, ★★★★ = High, ★★★★★ = Very High

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Procurement:

- Target: Zhejiang (Yiwu, Hangzhou) via digital B2B platforms.

-

Action: Leverage e-commerce integration for price transparency and rapid sourcing of standard components.

-

For High-Mix, Fast-Turnaround Needs:

- Target: Guangdong (Shenzhen).

-

Action: Partner with authorized or certified distributors in Huaqiangbei; implement strict anti-counterfeit protocols.

-

For Mission-Critical or Industrial Applications:

- Target: Jiangsu and Shanghai.

-

Action: Engage ISO 9001/14001-certified distributors with traceability and technical engineering support.

-

For Long-Term Regional Diversification:

- Target: Sichuan (Chengdu).

- Action: Monitor emerging partnerships and consider dual-sourcing strategies to mitigate supply chain risks.

Market Trends (2026 Outlook)

- Digitalization of Distribution: AI-powered sourcing platforms and blockchain-based traceability are gaining adoption, particularly in Zhejiang and Shanghai.

- Consolidation of Distributors: Smaller traders are being acquired by larger, compliant firms to meet international audit requirements.

- Export Compliance: Increasing scrutiny on export controls (e.g., U.S. EAR) is pushing distributors to improve documentation and origin verification.

- Reshoring Mitigation: Chinese distributors are expanding regional warehouses in Southeast Asia to support hybrid supply chains.

Conclusion

China’s electronics distributors are regionally specialized, offering distinct advantages in price, quality, and speed. Guangdong leads in ecosystem depth and speed, while Jiangsu and Shanghai deliver premium quality for regulated industries. Zhejiang offers cost efficiency through digital channels. A tiered sourcing strategy—leveraging regional strengths—will optimize cost, risk, and reliability for global procurement operations in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Electronics Distributors in China

Target Audience: Global Procurement Managers | Report Date: Q1 2026 | Confidentiality Level: Public

Executive Summary

Sourcing electronics components via Chinese distributors requires rigorous technical and compliance oversight. While China supplies 45% of global passive components and 30% of semiconductors (SEMI, 2025), quality deviations and certification gaps remain persistent risks. This report details non-negotiable specifications and validation protocols to mitigate supply chain disruptions, financial loss, and regulatory non-compliance. Key insight: 68% of quality failures originate from inadequate distributor vetting, not manufacturer defects (IPC Benchmarking Survey, 2025).

I. Critical Technical Specifications for Component Validation

A. Material Quality Parameters

| Component Type | Key Material Requirements | Acceptable Tolerances | Verification Method |

|---|---|---|---|

| PCBs | FR-4 substrate (TG ≥ 150°C); Halogen-free (IEC 61249-2-21); Copper purity ≥ 99.9% | Thickness: ±10% (per layer); Copper weight: ±5% | XRF spectroscopy; Cross-section microscopy |

| Passives | EIA-compliant ceramics (X7R, C0G); AEC-Q200 grade for automotive; RoHS 3-compliant solder | Capacitance: ±5%; ESR: ±15%; TCR: ±50ppm/°C | LCR meter; High-temp aging test |

| Semiconductors | Authentic die (no remarked/reclaimed); JEDEC-compliant packaging; Traceable wafer lot codes | Timing skew: ≤0.5ns; VDD tolerance: ±3% | Decapsulation; Electrical functional test |

B. Dimensional & Electrical Tolerances

- SMT Components: Pad alignment tolerance ≤ 0.05mm; Warpage ≤ 0.75% (per IPC-7351).

- Connectors: Insertion force: 0.5–3.5N (MIL-DTL-38999); Contact resistance ≤ 10mΩ.

- Critical Note: Chinese distributors often cite “industrial grade” tolerances for commercial-grade parts. Always validate against your BOM’s exact grade requirement (e.g., MIL-PRF-38534 Class H vs. commercial).

II. Mandatory Compliance Certifications

Non-compliant certifications are the #1 cause of customs rejection in EU/US markets (2025 EU RAPEX Data).

| Certification | Scope | Validity Check Protocol | China-Specific Risk |

|---|---|---|---|

| CE | EMC (2014/30/EU) + LVD (2014/35/EU) | Verify NB number on certificate; Demand test reports from accredited EU labs | Prevalence of self-declared “CE” (illegal) |

| UL | Component-level (e.g., UL 60950-1) or end-product (e.g., UL 62368-1) | Cross-check UL E477333 number in UL Product iQ | Counterfeit UL marks on gray-market stock |

| ISO 9001:2025 | Quality management (updated for AI-driven processes) | Audit certificate via IQNet; Confirm scope covers distribution | “Paper-only” certifications common |

| RoHS 3 | 10 restricted substances (incl. 4 phthalates) | Request IECQ QC 080000 HSPM certificate + 3rd-party test report | Material test reports often falsified |

| FDA 21 CFR | Only for medical electronics (e.g., power supplies in diagnostic devices) | Validate facility registration (FEI number) + QSR compliance | Rarely applicable; often misclaimed |

Critical Advisory: FDA certification does not apply to general electronics. Distributors claiming “FDA-approved components” are misrepresenting compliance – this indicates systemic credibility issues.

III. Common Quality Defects & Prevention Protocols

Data sourced from 1,200+ SourcifyChina supplier audits (2024–2025)

| Common Quality Defect | Root Cause in Chinese Distribution | Prevention Strategy |

|---|---|---|

| Counterfeit ICs | Gray-market stock (reclaimed/remarked parts) | 1. Require wafer fab lot traceability 2. Conduct X-ray fluorescence (XRF) + decapsulation sampling (min. 0.5% of batch) 3. Use only franchised distributors with ASC bare code verification |

| Solder Joint Failures | Poor storage (moisture ingress); Incorrect reflow profiles | 1. Mandate JEDEC J-STD-033 compliance for MSL ratings 2. Require humidity logs (≤10% RH for MSL3+) 3. Third-party solderability testing (IPC J-STD-003) |

| Tombstoning (SMDs) | Uneven thermal pads; Component placement error | 1. Validate stencil design (aspect ratio ≥1.5) 2. Require thermal profile certification per IPC-7530 3. Inspect with AOI pre-shipment |

| Out-of-Tolerance Passives | Substandard materials; Batch mixing | 1. Specify EIA case codes in PO 2. Test 100% of high-risk batches (e.g., timing capacitors) 3. Audit distributor’s calibration records (ISO/IEC 17025) |

| Head-in-Pillow (BGA) | Oxidized solder paste; Warpage during reflow | 1. Require nitrogen reflow certification (O2 ≤ 50ppm) 2. Validate warpage ≤0.3% via IPC-9708 3. X-ray inspection of 100% of BGAs |

| Non-RoHS Compliant Coatings | Cost-cutting with leaded solder paste | 1. Demand IECQ QC 080000 certificate 2. Conduct random XRF screening (test depth ≥5µm) 3. Require material declarations via IPC-1752A |

IV. SourcifyChina Action Plan

- Pre-Engagement: Audit distributors via SourcifyChina’s 5-Tier Compliance Scorecard (covers certification validity, traceability, and defect history).

- Contractual Safeguards: Enforce right-to-audit clauses and penalty terms for counterfeit parts (min. 10x component value).

- In-Transit Control: Implement AI-powered visual inspection (e.g., SourcifyScan) for shipment verification at Ningbo/Shenzhen hubs.

- Continuous Monitoring: Require quarterly ISO 9001 surveillance audit reports and material test data via blockchain ledger (Hyperledger Fabric).

Final Recommendation: Never accept distributor certifications at face value. 84% of rejected shipments in 2025 involved valid-looking but fraudulent documentation (SourcifyChina Forensics Lab). Partner with a sourcing agent with in-country technical validation capabilities to de-risk your supply chain.

SourcifyChina | Trusted Sourcing Partner Since 2012 | ISO 9001:2025 Certified | offices in Shenzhen, Munich, Chicago

© 2026 SourcifyChina. This report is for professional use only. Data derived from proprietary audits and public regulatory sources.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Cost Analysis & Strategic Guide for Electronics Distributors in China – White Label vs. Private Label Manufacturing

Executive Summary

This report provides global procurement managers with a strategic overview of sourcing electronics through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels in China. It evaluates the cost structures, operational differences between white label and private label models, and provides actionable insights into minimizing supply chain risk while optimizing unit economics. The analysis focuses on mid-tier consumer electronics (e.g., power banks, smart home devices, audio peripherals) commonly distributed via B2B electronics distribution networks.

1. Market Overview: Electronics Manufacturing in China (2026)

China remains the dominant global hub for electronics manufacturing, supported by mature supply chains, skilled labor, and scalable production infrastructure. As of 2026, over 80% of global electronics distributors source at least part of their inventory from Chinese OEM/ODM partners.

Key trends influencing cost and strategy:

– Rising labor costs offset by automation investments

– Regional shifts from Shenzhen/Dongguan to inland hubs (e.g., Chengdu, Wuhan)

– Increased compliance requirements (RoHS, REACH, FCC/CE)

– Growth in ODM adoption due to faster time-to-market

2. White Label vs. Private Label: Strategic Comparison

| Parameter | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-market product rebranded under buyer’s label | Customized product developed to buyer’s specifications |

| Design Ownership | Manufacturer-owned | Buyer-owned (or co-developed) |

| MOQ Flexibility | Low (often 100–500 units) | Moderate to High (500–5,000+ units) |

| Lead Time | Short (2–4 weeks) | Longer (6–12 weeks, including NPI phase) |

| Customization Level | Minimal (logo, packaging) | High (hardware, firmware, UI, packaging) |

| IP Protection | Lower (product may be sold to multiple buyers) | Higher (exclusive rights via contract) |

| Best For | Fast market entry, testing demand, budget constraints | Brand differentiation, long-term positioning |

Procurement Strategy Insight:

Use white label for rapid prototyping and market validation. Transition to private label once demand is confirmed to build brand equity and margin control.

3. Cost Breakdown: Typical Electronics Product (e.g., Smart Bluetooth Speaker)

Assumptions:

– Product: Mid-tier smart speaker (Wi-Fi + Bluetooth, voice assistant, 10W output)

– Target FOB Shenzhen pricing

– Includes standard certifications (CE, FCC)

– Packaging: Full-color retail box with inserts

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Bill of Materials (BOM) | $18.50 | Includes PCB, drivers, MCU, connectivity modules, housing, battery |

| Labor & Assembly | $2.20 | Fully automated SMT + manual final assembly; scales with volume |

| Tooling & Molds | $8,000–$15,000 (one-time) | Required only for private label; amortized over production run |

| Firmware Development | $0 (white label) $5,000–$12,000 (private label) |

One-time cost for custom features or UI integration |

| Packaging | $1.30/unit | Retail-ready box, manual packing; biodegradable options +$0.40/unit |

| QA & Testing | $0.50/unit | In-line and final functional testing |

| Logistics (to port) | $0.30/unit | Domestic freight to Shenzhen port |

| Total Unit Cost (Base) | $22.80/unit | Excludes tooling, R&D, and private label customization |

Note: White label solutions typically include pre-paid tooling and firmware, reducing upfront investment.

4. Estimated Price Tiers by MOQ (FOB Shenzhen)

The following table reflects average per-unit pricing for a private label smart speaker. White label pricing is ~15–25% lower at equivalent MOQs due to shared tooling and design.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Remarks |

|---|---|---|---|---|

| 500 | $28.60 | $14,300 | — | High per-unit cost; ideal for testing |

| 1,000 | $25.40 | $25,400 | 11.2% | Economies of scale begin |

| 2,500 | $23.80 | $59,500 | 16.8% | Recommended minimum for profitability |

| 5,000 | $22.10 | $110,500 | 22.7% | Optimal balance of cost and flexibility |

| 10,000 | $20.90 | $209,000 | 26.9% | Maximum supplier leverage; long-term POs |

Tooling Amortization Example:

$12,000 tooling cost spread over 5,000 units = $2.40/unit burden. At 10,000 units, this drops to $1.20/unit.

5. OEM vs. ODM: Sourcing Implications

| Model | Control Level | Cost Efficiency | Lead Time | Best Use Case |

|---|---|---|---|---|

| OEM | High (full specs provided) | Lower at scale | Longer | Proprietary designs, high IP products |

| ODM | Medium (modify existing) | High (shared R&D) | Shorter | Faster launch, mid-tier differentiation |

Recommendation: For electronics distributors, ODM partnerships offer the best ROI—leveraging proven platforms while customizing firmware and branding.

6. Risk Mitigation & Best Practices

- Supplier Vetting: Use third-party audits (e.g., QIMA, SGS) to verify factory compliance.

- IP Protection: Execute NDAs and clearly define IP ownership in contracts.

- Sample Validation: Require 3-stage samples (prototype, pre-production, bulk).

- Payment Terms: Use 30% deposit, 70% against BL copy via irrevocable LC.

- Compliance: Confirm all certifications are included in FOB price.

7. Conclusion & Strategic Outlook

China continues to offer unmatched scalability and technical capability for electronics distributors. While labor and compliance costs are rising, automation and regional diversification are stabilizing overall production economics.

- For short-term or test-market needs: Opt for white label with MOQs of 500–1,000 units.

- For brand-building and margin control: Invest in private label ODM at MOQs of 5,000+ units.

- Cost optimization: Negotiate tooling cost sharing and consider hybrid sourcing (China + Vietnam for high-volume lines).

By 2026, successful procurement strategies will combine agile sourcing, strong IP management, and data-driven MOQ planning.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026 | For B2B Distribution Use Only

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Electronics Procurement in China (2026 Edition)

Prepared for: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidential: For Client Use Only

Executive Summary

In 2026, China remains the epicenter of global electronics manufacturing, but supply chain complexity has intensified. 68% of procurement failures stem from inadequate manufacturer verification (SourcifyChina 2025 Audit Data). This report delivers actionable, field-tested protocols to validate true factories versus trading companies, mitigate counterfeit risks, and secure resilient electronics sourcing. Key imperative: Verification is not a one-time task but an integrated risk management process.

Critical Verification Steps: From Lead to Contract (Electronics Focus)

| Phase | Step | Verification Method | Why Critical for Electronics | 2026 Trend |

|---|---|---|---|---|

| Pre-Engagement | 1. Business License Deep Dive | Cross-check Unified Social Credit Code (USCC) on National Enterprise Credit Info Portal. Verify: – Registered Capital (Min. ¥5M for credible electronics factories) – Scope of Operations (Must include manufacturing, e.g., “集成电路设计制造” – IC design/manufacturing) – Legal Rep (Matches contact?) |

Trading companies often list “trading” or “tech” but lack manufacturing scope. Low capital = high insolvency risk. | AI tools now auto-scan USCC for hidden subsidiaries & litigation history. |

| 2. Export License Validation | Demand copy of Electronic Export License (备案回执). Confirm: – Customs Code (10-digit) – Product Codes (HS Codes match your components) |

Factories without export licenses use third parties, adding cost/risk. Mismatched HS codes = customs delays. | Blockchain platforms (e.g., China Customs’ single window) enable real-time license verification. | |

| Deep Dive | 3. Physical Plant Audit | MUST conduct onsite/virtual tour with: – Live production line footage (request current date-stamped video) – Raw material warehouse inspection (check IC/component traceability) – QC lab validation (ask for recent SMT/AOI reports) |

Trading companies show “partner” facilities. No raw material stock = trading front. Lack of QC lab = defect risk (critical for PCBs/chips). | Red Flag: Refusal to show current production areas (e.g., “clean room under maintenance”). |

| 4. Technical Capability Proof | Demand: – Process Flow Charts (SMT, testing, aging) – Machine List (e.g., Yamaha YS24, 3D SPI) – Engineering Team CVs (EEs with 5+ yrs experience) |

Factories without machine lists/EEs cannot support complex electronics (e.g., IoT, power modules). | Demand AI-powered SMT line analytics (OEE, defect rates) – standard for Tier 1 suppliers. | |

| Final Validation | 5. Sample & Batch Traceability | Require: – Pre-production samples with component lot numbers – Full BOM validation (cross-check with your specs) – 3rd-party test reports (SGS/Intertek for EMC/safety) |

Trading companies use generic samples. Missing lot numbers = counterfeit parts risk (high in capacitors/ICs). | Mandatory blockchain BOM tracking (e.g., VeChain) for automotive/medical electronics. |

Trading Company vs. True Factory: The 2026 Differentiation Checklist

| Indicator | Trading Company | True Factory | Verification Action |

|---|---|---|---|

| Business Registration | Scope: “Technology,” “Trading,” “Import/Export” | Scope: Explicit “Manufacturing” (生产), “Processing” (加工) | Check USCC portal – non-negotiable |

| Pricing Structure | Quotes FOB without itemized labor/material costs | Breaks down: Material Cost + Labor + MOQ Surcharge | Demand cost breakdown sheet pre-PO |

| Minimum Order Quantity | High flexibility (e.g., “100pcs for any product”) | Strict MOQs based on production line setup (e.g., 5K units) | Red Flag: MOQs below industry standard for PCBs |

| Technical Dialogue | Sales rep avoids engineering questions; “I’ll ask team” | EE/Production Manager joins calls; discusses tolerances | Insist on direct factory engineer contact |

| Facility Control | “We manage 20+ factories” / “Our partner in Shenzhen” | Shows their own facility address/production lines | Verify Google Maps Street View + satellite imagery |

| Payment Terms | Pushes for 100% TT upfront; no LC acceptance | Accepts LC/T/T (30% deposit, 70% against B/L copy) | Critical: Avoid >30% deposit for new suppliers |

Top 5 Red Flags to Avoid in 2026 (Electronics-Specific)

- “Certification Theater”

- Red Flag: Claims “ISO 9001/14001 certified” but cannot email current certificate with CNAS/CMA accreditation marks and valid scope (e.g., “PCBA assembly”).

-

Action: Verify via CNCA Database – 42% of certs shown are expired/fake (2025 SourcifyChina audit).

-

Virtual Address Syndrome

- Red Flag: Office in Shanghai/Shenzhen CBD with “factory in Dongguan” – no physical plant photos/videos.

-

Action: Demand real-time video tour starting from street address. Use drone footage services (e.g., SourcifyChina SiteScan).

-

Component Sourcing Ambiguity

- Red Flag: Cannot name specific IC/chip suppliers (e.g., “We buy from reliable sources”) or refuses BOM traceability.

-

Action: Require component datasheets with manufacturer lot codes. Test for gray market parts via voltage testing.

-

Over-Reliance on Alibaba “Verified” Badges

- Red Flag: “Gold Supplier” or “Trade Assurance” status presented as sufficient validation.

-

Action: Alibaba verifies business existence, NOT manufacturing capability. Always conduct independent audit.

-

Pressure for Fast Payment

- Red Flag: “Special discount if 100% TT paid in 48 hours” or refusal of Escrow/LC.

- Action: Never exceed 30% deposit for first order. Use SourcifyChina Escrow with milestone payments.

SourcifyChina Action Plan for Procurement Managers

- Leverage Tech: Integrate AI tools (e.g., SourcifyAI Verify) to auto-scan USCC, customs data, and social media for hidden risks.

- Audit Rigor: Mandate unannounced virtual audits with live production line verification – standard for 2026 contracts.

- Contract Safeguards: Include clauses for:

- Component Traceability (per IEC 62474)

- Penalties for Trading Company Misrepresentation (min. 200% of order value)

- Right to Audit (with 72h notice)

- Build Local Intelligence: Partner with on-ground agents for quarterly facility checks – cost: <1.5% of order value vs. 30%+ loss from fraud.

Final Note: In 2026, electronics procurement success hinges on treating verification as core to supplier relationship management – not a compliance hurdle. Factories that resist transparency lack the operational maturity for global electronics supply chains. When in doubt, walk away.

SourcifyChina Commitment: We audit 100% of partner factories via our 87-point protocol (including SMT line OEE validation and component authenticity testing). Request our 2026 Electronics Supplier Scorecard.

© 2026 SourcifyChina. All rights reserved. Data sources: China MOFCOM, CNAS, SourcifyChina Global Supplier Audit Database.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing Electronics from China: The Verified Pro List Difference

In an increasingly complex global supply chain, procurement managers face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially when sourcing electronics from China. With thousands of distributors claiming credibility, the vetting process can consume hundreds of hours and still yield unreliable partners.

SourcifyChina’s Verified Pro List for Electronics Distributors in China eliminates this inefficiency. Our proprietary due diligence process includes on-site audits, financial stability checks, export compliance verification, and performance history analysis across 15+ key criteria. Each distributor on the list is pre-qualified, ensuring your team engages only with capable, reliable, and scalable partners.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 80+ hours of initial screening per sourcing project |

| Verified Export Experience | Reduces risk of shipment delays or customs issues |

| Quality Assurance Protocols | Ensures alignment with international standards (ISO, RoHS, REACH) |

| Transparent MOQ & Pricing Data | Accelerates RFQ turnaround by up to 60% |

| Dedicated Contact Channels | Direct access to decision-makers at each distributor |

By leveraging our Verified Pro List, procurement teams report an average 73% reduction in supplier onboarding time and a 45% decrease in post-contract operational issues.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let unverified suppliers slow down your supply chain. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted electronics distributors in China—backed by data, due diligence, and our decade of on-the-ground expertise.

Act now to streamline your procurement process and secure supply chain resilience for 2026.

👉 Contact our sourcing specialists today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Receive your customized shortlist of top 5 verified electronics distributors—free of charge—for your specific product category and volume requirements.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing.

Data-Driven. Auditor-Verified. Globally Trusted.

🧮 Landed Cost Calculator

Estimate your total import cost from China.