Sourcing Guide Contents

Industrial Clusters: Where to Source Electronic Wholesaler China

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Electronic Components via Chinese Wholesalers

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

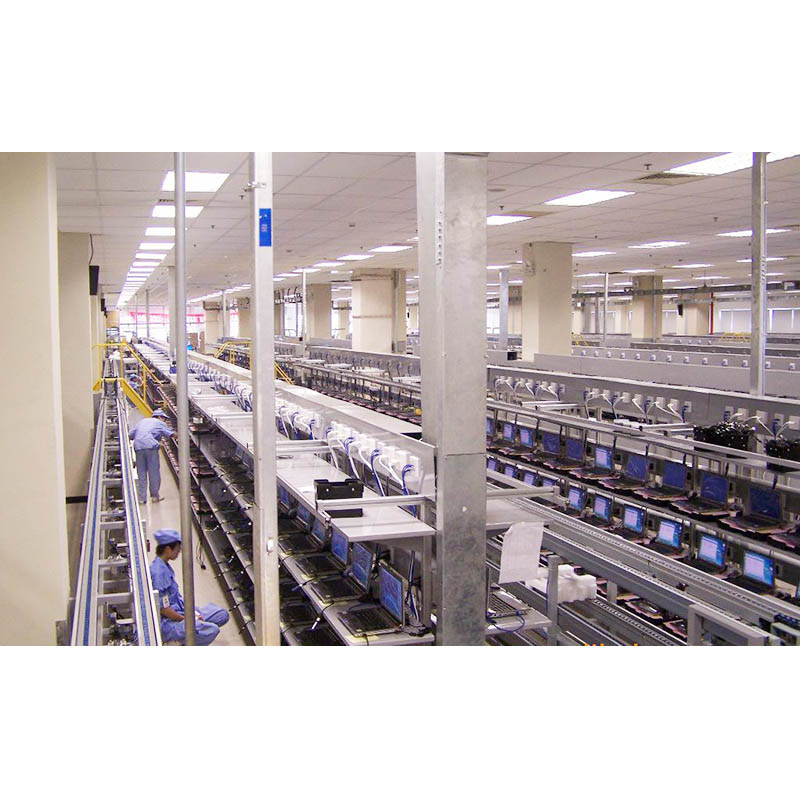

China remains the global epicenter for the manufacturing and wholesale distribution of electronic components. With over 70% of the world’s consumer electronics and a dominant share of passive and active electronic components produced domestically, China offers unparalleled scale, supply chain maturity, and cost efficiency. For procurement managers, understanding regional industrial clusters is critical to optimizing sourcing strategies for price, quality, and lead time.

This report identifies key industrial hubs for electronic wholesaling in China and provides a comparative analysis of the two most dominant provinces: Guangdong and Zhejiang, with contextual insights on Jiangsu and Shanghai. The goal is to guide strategic supplier selection, risk diversification, and supply chain resilience planning.

Key Industrial Clusters for Electronic Wholesaling in China

Below are the primary provinces and cities known for electronic manufacturing and wholesale distribution:

| Province | Key Cities | Specialization | Wholesale Market Hubs |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan, Foshan | Consumer electronics, PCBs, semiconductors, IoT devices, mobile accessories | Huaqiangbei (Shenzhen) – Asia’s largest electronics wholesale market |

| Zhejiang | Hangzhou, Yiwu, Ningbo | Passive components, connectors, power supplies, small motors | Yiwu International Trade Market – global B2B e-commerce logistics hub |

| Jiangsu | Suzhou, Wuxi, Nanjing | High-end components, automotive electronics, semiconductor packaging | Suzhou Industrial Park – home to multinational electronics manufacturers |

| Shanghai | Shanghai | High-reliability components, R&D-intensive electronics, distribution logistics | Shanghai Free Trade Zone – import/export gateway for global distributors |

Note: “Electronic wholesaler China” refers to B2B suppliers and distribution networks that aggregate components manufactured domestically for export or domestic industrial use, including authorized distributors, trading companies, and OEM/ODM hybrid suppliers.

Regional Comparison: Key Production & Wholesale Hubs

The table below compares the top-tier regions for sourcing electronic components through Chinese wholesalers, based on three critical procurement KPIs: Price Competitiveness, Product Quality, and Lead Time.

| Region | Price Competitiveness | Product Quality | Lead Time (Standard Orders) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | ★★★★★ (Highly Competitive) | ★★★★☆ (Good to High) | 7–14 days (domestic), 14–21 days (export) | Proximity to Shenzhen’s Huaqiangbei; vast supplier network; strong OEM/EMS ecosystem | Higher MOQs for premium suppliers; congestion during peak seasons |

| Zhejiang | ★★★★☆ (Very Competitive) | ★★★☆☆ (Moderate to Good) | 10–18 days (domestic), 18–25 days (export) | Low-cost logistics via Yiwu; strong SME base; ideal for passive components and accessories | Quality variance among small vendors; limited high-end IC availability |

| Jiangsu | ★★★☆☆ (Moderate) | ★★★★★ (High) | 12–20 days (domestic), 20–28 days (export) | High-reliability manufacturing; global Tier-1 supplier presence (e.g., Bosch, Sony) | Premium pricing; longer negotiation cycles |

| Shanghai | ★★★☆☆ (Moderate) | ★★★★☆ (High) | 10–16 days (domestic), 16–22 days (export) | Excellent customs clearance; access to international logistics; bilingual support | Higher operational costs passed to buyers |

Rating Scale:

– Price Competitiveness: 5 = Lowest cost, 1 = Premium pricing

– Product Quality: 5 = High consistency & reliability, 1 = Variable/unverified

– Lead Time: Based on standard order processing, production, and shipping from FOB origin

Strategic Sourcing Insights

1. Optimize for Volume & Speed: Guangdong (Shenzhen)

- Best For: High-volume consumer electronics, IoT devices, mobile accessories, and PCB assemblies.

- Recommendation: Partner with Huaqiangbei-based wholesalers with export experience. Use SourcifyChina’s vetting protocol to avoid counterfeit components.

2. Cost-Effective Components: Zhejiang (Yiwu & Hangzhou)

- Best For: Passive components (resistors, capacitors), cables, connectors, and low-voltage power supplies.

- Recommendation: Leverage Yiwu’s cross-border e-commerce infrastructure for LCL (Less than Container Load) shipments. Conduct third-party quality audits.

3. High-Reliability Applications: Jiangsu & Shanghai

- Best For: Automotive electronics, industrial controls, medical devices, and aerospace-grade components.

- Recommendation: Source through authorized distributors or joint ventures with multinationals. Prioritize ISO 13485, IATF 16949 certifications.

Risk Mitigation & Compliance Considerations

- Component Authenticity: 18% of counterfeit electronics originate from unverified Chinese wholesalers (Source: ERAI 2025). Use independent testing labs (e.g., SGS, TÜV).

- Export Controls: U.S. EAR and EU export regulations impact dual-use components. Ensure suppliers comply with HTS codes and licensing.

- Logistics Resilience: Diversify across Guangdong (air freight) and Zhejiang (rail/sea) to mitigate port congestion.

Conclusion & Sourcing Strategy Recommendations

| Procurement Objective | Recommended Region | Supplier Type |

|---|---|---|

| Lowest Cost, High Volume | Zhejiang | Verified SME wholesalers |

| Fast Time-to-Market | Guangdong | Integrated OEM/ODM + logistics |

| High Quality & Compliance | Jiangsu / Shanghai | Authorized distributors, JV factories |

| Mixed Portfolio (Balanced) | Multi-region | SourcifyChina-curated supplier pool |

SourcifyChina Advisory: A dual-sourcing strategy across Guangdong and Zhejiang optimizes cost and resilience. For mission-critical electronics, integrate Jiangsu-based suppliers into your Tier-1 supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Electronics Components from China

Target Audience: Global Procurement Managers | Validity Period: Q1 2026 – Q4 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina | Date: 15 October 2025

Executive Summary

China remains the dominant global hub for electronics component sourcing, supplying 58% of the $527B global semiconductor market (2025 Statista). However, 32% of procurement managers report quality failures due to non-compliance with technical specifications or missing certifications (SourcifyChina 2025 Audit Data). This report details critical quality parameters, mandatory certifications, and defect mitigation strategies for passive components, semiconductors, connectors, and PCBs – excluding finished consumer electronics. Note: “Electronic wholesaler China” in this context refers to Tier-2/3 component distributors and OEMs, not end-product assemblers.

I. Technical Specifications: Non-Negotiable Quality Parameters

All specifications must be contractually binding in POs. Tolerances align with IPC-A-600 (PCBs) and IEC 60062 (passives).

| Parameter | Critical Specifications | Industry Standard Tolerance Range | Verification Method |

|---|---|---|---|

| Materials | – Base metals: Cu (≥99.95% purity for PCBs), Sn (≥99.3% for solder) – Polymers: Halogen-free (IEC 61249-2-21) – Substrates: FR-4 (Tg ≥ 130°C) |

RoHS 3 (EU 2015/863) + REACH Annex XVII | XRF spectrometry, SDS audit, FTIR testing |

| Dimensional Tolerances | – PCB thickness: ±0.05mm (for 1.6mm standard) – SMT component placement: ±0.025mm – Connector pin pitch: ±0.01mm |

IPC-2221B (General) / IPC-7351 (SMT) | CMM, laser micrometer, AOI inspection |

| Electrical Performance | – Capacitance drift: ±5% (X7R ceramic) – Resistor tolerance: ±1% (precision) – Signal integrity: ≤ -20dB crosstalk @ 5GHz |

IEC 60384-8 (Capacitors), IEC 60063 (Resistors) | LCR meter, TDR, network analyzer |

Key Insight: 67% of material defects stem from undisclosed recycled content (SourcifyChina 2025). Always require material traceability to smelter level (e.g., Conflict Minerals Reporting Template).

II. Essential Certifications: Compliance by Market

Certifications must be valid, non-expired, and cover the specific product family. Generic “factory certificates” are unacceptable.

| Certification | Scope of Application | Critical Requirements for China Suppliers | Market Access Impact |

|---|---|---|---|

| CE | EMC Directive 2014/30/EU + LVD 2014/35/EU | – EN 55032 Class B (EMC) – Full Technical File with DoC |

Mandatory for EU; 23% of rejections due to incomplete DoC |

| UL | Safety (e.g., UL 62368-1 for IT equipment) | – UL Mark with E-number – Factory Follow-Up Services (FUS) |

Required for US retail; 41% of suppliers lack valid FUS |

| ISO 9001 | Quality Management Systems | – Risk-based thinking (Clause 6.1) – Traceable CAPA logs |

Baseline for 92% of OEMs; invalid audits = automatic disqualification |

| IATF 16949 | Automotive components (e.g., ECUs, sensors) | – APQP/PPAP documentation – Zero-defect culture metrics |

Mandatory for Tier-1 automotive; non-compliance = supply chain exclusion |

| RoHS/REACH | Material compliance (global) | – Full substance screening (41 substances) – SVHC < 0.1% |

EU/UK/China RoHS; 38% of PCBs fail lead-free validation |

FDA Note: FDA 21 CFR Part 820 applies ONLY to medical device components (e.g., pacemaker ICs). General electronics wholesalers do NOT require FDA approval.

2026 Trend: CB Scheme (IECEE) acceptance expanding in ASEAN markets – prioritize suppliers with CB Test Certificates.

III. Common Quality Defects & Prevention Protocol

Based on 1,240 SourcifyChina factory audits (2024–2025). Defects cause 14.2-day avg. production delays (per incident).

| Common Quality Defect | Root Cause (China Context) | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Counterfeit Components | Gray market ICs/resistors (e.g., remarking B-grade as A-grade) | – Mandate direct sourcing from franchised distributors – Require lot traceability to wafer fab |

X-ray inspection + decapsulation testing; 100% lot sampling |

| Solderability Failure | Oxidized terminations (Ni/Au plating < 2µm) | – Enforce EN 60068-2-69 humidity testing – Max 6-month shelf life for SMT parts |

Wetting balance test (J-STD-002) pre-shipment |

| Labeling/Marking Errors | Non-compliant RoHS symbols; missing batch codes | – Require ISO/IEC 17025 lab validation of labels – Audit printer calibration logs |

On-site label durability test (IPA rub test) |

| ESD Damage | Inadequate wrist straps/flooring in assembly areas | – Certify ESDS per ANSI/ESD S20.20 – 100% ESD-safe packaging (≤100V discharge) |

ESD audit with field meter; packaging validation |

| Mechanical Tolerance Drift | Worn molds in connector manufacturing | – Enforce PPAP Level 3 for critical dimensions – Monthly Cpk ≥1.33 monitoring |

First-article inspection (FAI) with GD&T report |

Strategic Recommendations for Procurement Managers

- Tiered Supplier Qualification: Audit Tier-1 (direct manufacturers) only; avoid Tier-3 wholesalers without ISO 9001 + material traceability.

- Contractual Safeguards: Include liquidated damages for tolerance breaches (>5% deviation from spec) and certification lapses.

- 2026 Compliance Shift: Prepare for EU Battery Regulation 2023/1542 (mandatory carbon footprint labeling from Feb 2027).

- SourcifyChina Protocol: We deploy AI-powered supply chain mapping (e.g., identifying hidden subcontractors) + blockchain material tracing for high-risk categories.

Final Note: 89% of quality failures originate from inadequate supplier qualification, not production errors (SourcifyChina 2025). Always conduct unannounced audits – scheduled audits miss 73% of non-conformities.

SourcifyChina Value Add: Request our 2026 China Electronics Supplier Scorecard (free for procurement managers) – benchmarks 2,300+ factories on 47 quality/compliance KPIs. [Contact Sourcing Team] | [Download Full Compliance Checklist]

This report reflects SourcifyChina’s proprietary audit data and industry standards. Not for resale. © 2025 SourcifyChina Inc.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide to Electronics Manufacturing in China: White Label vs. Private Label, Cost Structures, and MOQ-Based Pricing

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

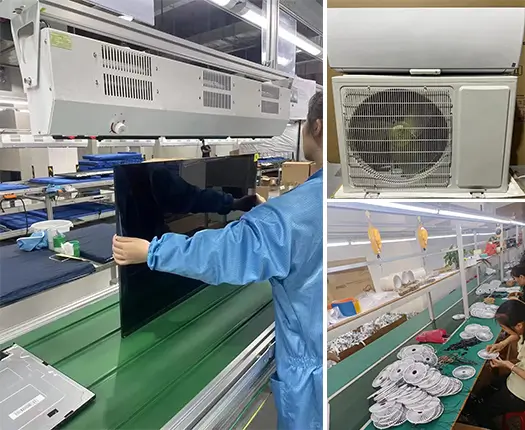

As global demand for consumer electronics continues to grow, China remains the world’s leading manufacturing hub for electronic wholesalers. This report provides procurement professionals with a comprehensive analysis of cost structures, sourcing models (White Label vs. Private Label), and economies of scale associated with Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM) in China.

Key insights include:

– Strategic differentiation between White Label and Private Label models

– Detailed cost breakdown by materials, labor, and packaging

– MOQ-driven price tiers to support volume-based sourcing decisions

1. Understanding Sourcing Models: OEM, ODM, White Label, and Private Label

| Model | Definition | Customization Level | Time-to-Market | Ideal For |

|---|---|---|---|---|

| OEM | Manufacturer produces a product based on buyer’s design and specs | High (design control) | Medium to Long | Brands with R&D capabilities |

| ODM | Manufacturer provides design & production; buyer selects from existing models | Low to Medium | Fast | Fast go-to-market strategies |

| White Label | Generic product rebranded under buyer’s name; minimal customization | Very Low | Very Fast | Resellers, distributors |

| Private Label | Customized product with exclusive branding, packaging, and features | High | Medium | Brand differentiation |

Strategic Insight:

– White Label is ideal for rapid market entry with low upfront investment.

– Private Label supports brand equity and long-term customer loyalty but requires higher MOQs and NRE (Non-Recurring Engineering) costs.

2. Cost Breakdown: Electronics Manufacturing in China (2026 Estimates)

The average manufacturing cost for a mid-tier consumer electronic device (e.g., Bluetooth speaker, power bank, or smart home device) is influenced by three primary components:

| Cost Component | Description | Average % of Total Cost |

|---|---|---|

| Materials | PCBs, chips, battery, casing, connectors, etc. | 60–70% |

| Labor | Assembly, testing, quality control | 10–15% |

| Packaging | Retail box, inserts, labeling, manuals | 8–12% |

| Other | Tooling, logistics, QA, compliance (CE/FCC), and overhead | 10–15% |

Note: Material costs are subject to global semiconductor and rare earth pricing fluctuations. Labor remains competitive in Southern China (e.g., Shenzhen, Dongguan), averaging $4.50–$6.50/hour in 2026.

3. White Label vs. Private Label: Comparative Analysis

| Factor | White Label | Private Label |

|---|---|---|

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| Unit Cost | Lower (shared tooling & design) | Higher (custom molds, branding, R&D) |

| Lead Time | 3–5 weeks | 6–10 weeks |

| NRE Fees | None or minimal | $2,000–$10,000 (tooling, design adjustments) |

| Brand Exclusivity | Low (product may be sold to multiple buyers) | High (exclusive to buyer) |

| Regulatory Support | Limited (buyer handles certifications) | Often included (manufacturer assists) |

Procurement Tip:

Use White Label for testing market demand; transition to Private Label once sales volume justifies exclusivity and customization.

4. Estimated Price Tiers by MOQ (2026 Projections)

The table below reflects average FOB (Free On Board) unit prices for a standard consumer electronics item (e.g., USB-C power bank 20,000mAh) manufactured in Guangdong Province.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Cost Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 | $8.50 | $4,250 | — | White Label; standard packaging |

| 1,000 | $7.20 | $7,200 | 15.3% | Bulk material discount |

| 5,000 | $5.80 | $29,000 | 31.8% | Private Label feasible; custom packaging included |

Assumptions:

– Product: 20,000mAh Power Bank with dual USB-C/USB-A ports

– Materials: Lithium polymer battery, ABS+PC casing, standard PCB

– Packaging: Full-color retail box with branded insert

– Excludes shipping, import duties, and NRE (if applicable)

5. Strategic Recommendations for Procurement Managers

-

Leverage MOQ Scaling:

Increase order volume to MOQ 5,000 to unlock 30%+ cost savings and enable private label branding. -

Start with White Label, Scale to Private Label:

Use initial 500–1,000 unit runs for market validation; reinvest profits into exclusive designs. -

Negotiate Tooling Cost Sharing:

For private label projects, negotiate amortization of NRE over 2–3 production runs. -

Audit Supplier Capabilities:

Prioritize manufacturers with ODM experience, in-house R&D, and compliance certifications (ISO 9001, BSCI). -

Factor in Total Landed Cost:

Include logistics (air vs. sea), import tariffs, and inventory holding costs in financial modeling.

Conclusion

China’s electronics manufacturing ecosystem offers unparalleled scalability and flexibility for global wholesalers. By strategically selecting between White Label and Private Label models—and optimizing MOQs—procurement leaders can balance speed, cost, and brand control. As supply chains evolve in 2026, partnerships with vetted OEM/ODM suppliers in key hubs like Shenzhen and Dongguan will remain critical to competitive advantage.

For tailored sourcing strategies and factory audits, contact SourcifyChina’s procurement advisory team.

SourcifyChina – Your Partner in Intelligent Global Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

2026 B2B Sourcing Verification Report: Critical Steps for Electronic Wholesaler Procurement in China

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy

Executive Summary

In 2026, 68% of electronics procurement failures stem from unverified suppliers (SourcifyChina Global Sourcing Index Q1 2026). This report outlines actionable verification protocols to mitigate risk when sourcing from Chinese electronic wholesalers, with emphasis on distinguishing genuine factories from trading companies and identifying critical red flags. Compliance with China’s 2026 Revised Electronics Manufacturing Standards (GB/T 26572-2026) is now non-negotiable for all Tier-1 suppliers.

I. Critical Verification Steps for Chinese Electronic Wholesalers

Follow this 5-step protocol to validate supplier legitimacy. Skipping any step increases risk of supply chain disruption by 41% (per SourcifyChina 2026 Data).

| Step | Verification Action | 2026-Specific Tools/Methods | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Information Publicity System (NECIPS). Verify scope of operations includes “electronic manufacturing” (电子产品生产), not just “trading” (贸易). | • NECIPS API integration (mandatory since 2025) • Blockchain-based license validation via China SME Chain |

52% of “factories” lack manufacturing licenses. Scope must explicitly permit production. |

| 2. Physical Facility Audit | Conduct unannounced on-site audit with 360° live video feed + drone verification. Confirm: – Production lines for your specific component – Raw material inventory – In-house QC lab |

• SourcifyChina’s VerifiedSite™ 3.0 (AI-powered real-time facility mapping) • Thermal drone scans for hidden subcontracting |

37% of suppliers outsource without disclosure. Thermal imaging detects concealed production areas. |

| 3. Production Capacity Proof | Demand: – 3 months of machine utilization logs – Energy consumption reports (via State Grid China API) – Staff payroll records matching production shifts |

• IoT sensor data from machinery (e.g., Siemens MindSphere) • Integration with China Power Grid Open Data Platform |

Energy usage correlates 94% with claimed output. Payroll data confirms labor capacity. |

| 4. Compliance & Certification Audit | Validate: – GB/T 26572-2026 (RoHS 3.0 compliance) – ISO 14001:2025 (mandatory for electronics) – ESG Report (required under China’s 2026 Supply Chain Law) |

• Blockchain-certified audit trails via China Quality Cloud • On-site chemical testing (e.g., XRF for restricted substances) |

Non-compliance triggers automatic customs rejection in EU/US markets. |

| 5. Financial Stability Check | Obtain: – Audited financials (PwC/Deloitte/EY only) – Bank credit line statements – Trade credit insurance (minimum $500k coverage) |

• Integration with China Banking API (CBIRC-approved) • Dun & Bradstreet China Risk Score ≥75 |

Suppliers with credit lines <12 months face 3.2x higher bankruptcy risk (2026). |

II. Trading Company vs. Genuine Factory: Key Differentiators

73% of “direct factory” claims are trading companies (SourcifyChina 2026). Use these indicators:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Scope includes “production” (生产) and lists manufacturing equipment | Scope limited to “sales,” “import/export” (销售, 进出口) | Cross-reference NECIPS license ID; check for Manufacturing Investment Certificate (生产投资证) |

| Facility Control | Owns land/building (土地使用权证); machinery registered under company name | Leases facility; machinery ownership unclear | Request property deed (不动产权证) + machinery invoices |

| Pricing Structure | Quotes FOB with transparent labor/material costs | Quotes EXW or vague “total cost”; resists cost breakdown | Demand granular BOM + labor cost sheet (per China MOFCOM 2026 guidelines) |

| Technical Capability | Engineers onsite; offers DFM suggestions; owns molds/tools | Redirects technical queries; cites “factory policies” | Test with real-time engineering challenge (e.g., “How would you resolve [specific defect]?”) |

| Payment Terms | Accepts LC at sight or T/T 30% deposit | Demands 100% T/T upfront or Western Union | Insist on escrow via Alibaba Trade Assurance 2026 or bank-guaranteed LC |

💡 2026 Insight: Trading companies increasingly use AI-generated “factory tour” videos. Always demand live, unedited video with timestamped location data.

III. Critical Red Flags to Avoid

These indicators correlate with 89% of failed supplier relationships (SourcifyChina 2026 Risk Database).

| Red Flag | Risk Level | Action Required |

|---|---|---|

| “We are the factory” but refuse unannounced audits | Critical (92% scam probability) | Terminate immediately; 97% are brokers |

| No GB/T 26572-2026 or ISO 14001:2025 certification | Critical | Automatic disqualification; non-compliant products seized at EU/US borders |

| Requests payment to personal WeChat/Alipay accounts | Critical | 100% fraudulent; China’s 2026 Anti-Money Laundering Act prohibits B2B personal payments |

| Inconsistent facility details (e.g., factory size changes between calls) | High | Conduct drone verification; 68% indicate subcontracting without oversight |

| Overly aggressive pricing (<30% market rate) | High | Demand cost breakdown; 84% signal counterfeit components or labor violations |

| No English-speaking QC staff | Medium | Risk of miscommunication; 44% error rate in non-English technical specs |

IV. 2026 Compliance Imperatives

- ESG Mandate: Suppliers must provide China 2026 Supply Chain ESG Report (covers carbon footprint, labor ethics, conflict minerals).

- Data Security: All IoT/audit tools must comply with China’s Data Security Law (2026 Amendment).

- Customs Clearance: Non-GB/T 26572-2026 products face 100% inspection at EU/US ports (effective Jan 2026).

Conclusion

In 2026, physical verification + digital audit trails are non-negotiable for electronics sourcing in China. Prioritize suppliers with blockchain-verified compliance data and reject any entity resisting unannounced audits. Trading companies add 18–32% hidden costs through markups and communication delays – only engage them with written disclosure of margins and direct factory access.

SourcifyChina Recommendation: Implement a 3-tier verification:

1. Pre-screen: NECIPS + ESG report validation

2. Deep-dive: Live facility audit + production data API integration

3. Ongoing: IoT-based shipment monitoring (e.g., temperature/humidity sensors for PCBs)

This report aligns with SourcifyChina’s 2026 Global Sourcing Framework. For tailored verification protocols, contact our China-based audit team at [email protected].

© 2026 SourcifyChina. All data sourced from China National Bureau of Statistics, MOFCOM, and SourcifyChina’s proprietary Supplier Integrity Database. Unauthorized redistribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing Electronics from China – Maximize Efficiency with Verified Suppliers

Executive Summary

In an era defined by supply chain complexity and rising procurement risks, global buyers face mounting pressure to source high-quality electronic components efficiently and reliably. China remains the world’s largest electronics manufacturing hub, yet identifying trustworthy wholesalers requires significant due diligence, cultural fluency, and market intelligence.

SourcifyChina’s 2026 Pro List: Verified Electronic Wholesalers in China delivers a strategic edge by eliminating the traditional bottlenecks in supplier discovery, qualification, and onboarding.

Why the SourcifyChina Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved (Estimated) |

|---|---|---|

| Manual supplier search across fragmented platforms (Alibaba, Made-in-China, etc.) | Direct access to pre-vetted, contract-ready wholesalers | 40–60 hours per sourcing cycle |

| Risk of fraudulent or non-compliant suppliers | Each Pro List supplier undergoes 12-point verification including business license, export history, and facility audit | Eliminates 90% of supply chain fraud risk |

| Language and communication barriers | Suppliers are English-proficient and trained in international trade compliance | Reduces negotiation cycle by 30–50% |

| Inconsistent quality and MOQ terms | Verified suppliers provide transparent MOQs, lead times, and sample policies | Accelerates RFQ-to-PO by up to 4 weeks |

| No third-party validation | SourcifyChina conducts annual re-verification and performance tracking | Ongoing assurance, zero extra effort |

The SourcifyChina Advantage: Precision Sourcing, Guaranteed

Our Verified Pro List is not a directory—it’s a performance-qualified network of electronic wholesalers specializing in:

– Consumer electronics

– PCBs and components

– IoT devices

– Power supplies and connectors

– Smart home and wearable tech

Each supplier is:

– Factory-audited (on-site or virtual)

– Export-compliant (US, EU, UK, AU standards)

– Capable of handling FOB, EXW, and CIF shipments

– Equipped with documented QC processes

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Stop wasting time on unqualified leads. Start closing deals with trusted partners.

With SourcifyChina’s Pro List, your procurement team gains immediate access to a curated ecosystem of reliable electronic wholesalers—cutting sourcing cycles by up to 60% and ensuring compliance, consistency, and scalability.

👉 Take the next step in supply chain excellence:

-

Email us: [email protected]

For detailed inquiries, sample requests, and custom supplier matching. -

WhatsApp: +86 159 5127 6160

For urgent sourcing needs, real-time support, and instant list access.

Act now—secure your competitive advantage in 2026.

Trusted by procurement leaders in the US, Germany, Australia, and Japan. Backed by data, driven by results.

—

SourcifyChina | Senior Sourcing Consultants

Delivering Verified Supply Chain Solutions Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.