The global electronic switches market is experiencing robust expansion, driven by rising demand across consumer electronics, automotive, industrial automation, and smart home applications. According to Grand View Research, the market was valued at USD 9.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts sustained momentum, citing advancements in IoT integration and miniaturization of electronic components as key growth accelerators. With increasing adoption of touch and proximity switches in automotive and home automation systems, manufacturers are prioritizing innovation in durability, energy efficiency, and smart connectivity. As competition intensifies, a select group of industry leaders has emerged, setting benchmarks in product reliability, R&D investment, and global supply chain reach. Here are the top 9 electronic switches manufacturers shaping the future of this dynamic market.

Top 9 Electronic Switches Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 C&K Switches

Domain Est. 2016

Website: ckswitches.com

Key Highlights: C&K is now a part of Littelfuse, inc. C&K offers the largest portfolio of electronic switches and is the most trusted brand in custom switch design….

#2 Leviton

Domain Est. 1995

Website: leviton.com

Key Highlights: Leviton offers a wide range of lighting controls, wiring devices and networking to meet the needs of today’s residential, commercial and industrial ……

#3 ZF Switches & Sensors

Domain Est. 1996

Website: switches-sensors.zf.com

Key Highlights: ZF’s product range has been systematically expanding beyond microswitches and now includes sensors, & wireless controls based on infra-red technology….

#4 Electric Switch Manufacturers

Domain Est. 2001

Website: electric-switches.com

Key Highlights: ABB is a manufacturer of low-voltage electrical switches. We offer relaying products, automation products—limit switches, rotary switches, toggle switches, ……

#5 Rotary Switches Manufacturers India, Electrical Switches …

Domain Est. 2002

Website: salzergroup.net

Key Highlights: We are largest Rotary switch manufacturers and suppliers in India having more than 40% market share and serving to all segments in India….

#6 E

Domain Est. 1995 | Founded: 1979

Website: e-switch.com

Key Highlights: Providing premier electromechanical switches and integrated solutions since 1979. Latest News Contact Us. Find Your Product. Use the fields below to start ……

#7 S&C Electric Company

Domain Est. 1995 | Founded: 1911

Website: sandc.com

Key Highlights: S&C Electric Company is a global provider of equipment and services for electric power systems. Founded in 1911, the Chicago-based company designs and ……

#8 United Electric Controls

Domain Est. 1997

Website: ueonline.com

Key Highlights: United Electric Controls proven solutions: Wireless gas detectors, Pressure and Temperature switches and transmitters, Thermocouples and RTDs….

#9 Switches and Controls

Domain Est. 2000

Website: carlingtech.com

Key Highlights: Carling Technologies offers a wide variety of electromechanical switches and electronic controls suitable for numerous applications….

Expert Sourcing Insights for Electronic Switches

H2: 2026 Market Trends for Electronic Switches

As the global electronics landscape evolves rapidly, the electronic switches market in 2026 is poised for significant transformation driven by technological innovation, shifting end-user demands, and emerging applications. Here are the key trends expected to shape the market:

1. Surge in Demand from Smart Home and IoT Devices

The proliferation of smart homes and the Internet of Things (IoT) continues to be a major growth driver. In 2026, electronic switches—especially capacitive, touch, and proximity-based sensors—are increasingly replacing mechanical counterparts in appliances, lighting controls, and security systems. Voice-activated and app-controlled switches are becoming standard, emphasizing seamless integration, energy efficiency, and user experience.

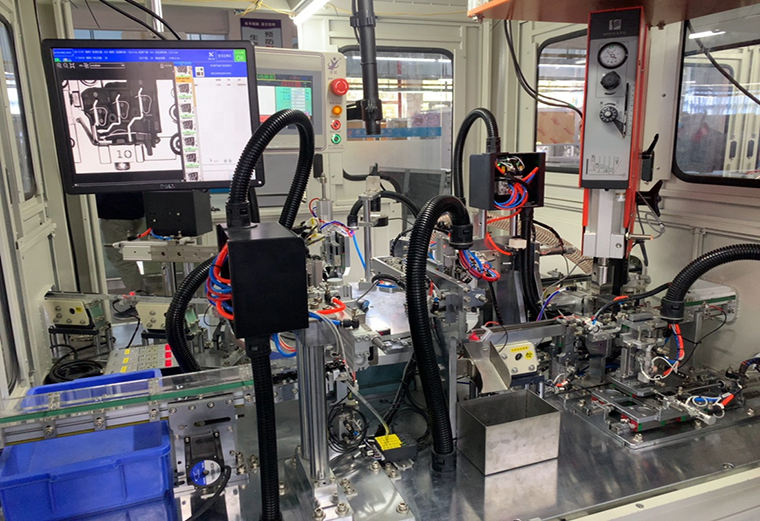

2. Miniaturization and High-Density Integration

With the ongoing trend toward smaller and more compact electronic devices—from wearables to medical implants—there is a growing demand for ultra-miniature electronic switches. Surface-mount technology (SMT) switches and MEMS (Micro-Electro-Mechanical Systems) switches are gaining traction due to their small footprint, reliability, and compatibility with automated manufacturing processes.

3. Growth in Automotive Electronics and EVs

The automotive sector, particularly electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is a high-growth area for electronic switches. In 2026, demand is rising for rugged, high-reliability switches used in infotainment systems, touch-sensitive controls, battery management, and human-machine interfaces (HMI). Enhanced safety standards and the need for waterproof, dustproof, and vibration-resistant switches are influencing product design.

4. Emphasis on Energy Efficiency and Sustainability

As global regulations tighten around energy consumption and environmental impact, manufacturers are focusing on low-power electronic switches. Energy-harvesting switches that generate power from user interaction (e.g., piezoelectric switches) are gaining attention, particularly in industrial and building automation applications where battery replacement is costly or impractical.

5. Advancements in Touch and Haptic Feedback Technology

Capacitive and force-sensing touch switches are becoming more sophisticated, offering precise control and customizable haptic feedback. In 2026, these technologies are widely adopted in consumer electronics, medical devices, and industrial equipment, providing intuitive interfaces while maintaining durability and hygiene (e.g., sealed, cleanable surfaces).

6. Regional Shifts and Supply Chain Resilience

Asia-Pacific remains the dominant manufacturing and consumption hub, led by China, Japan, and South Korea. However, in response to geopolitical tensions and supply chain disruptions, North America and Europe are investing in localized production and nearshoring strategies. This shift is encouraging innovation in automation and driving demand for domestically produced, high-reliability switches.

7. Increased Adoption in Industrial and Medical Applications

In industrial automation, electronic switches are critical for control panels, robotics, and safety systems. Similarly, in the medical field, hermetically sealed and sterilizable switches are in demand for diagnostic equipment and surgical tools. Reliability, precision, and compliance with international standards (e.g., IEC, ISO) are key purchasing criteria.

Conclusion

By 2026, the electronic switches market will be characterized by intelligent, compact, and energy-efficient solutions tailored to the needs of smart ecosystems, electrified transportation, and industrial digitization. Companies that invest in R&D, embrace sustainability, and adapt to regional manufacturing trends will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Electronic Switches (Quality, IP)

Inadequate IP Rating Verification

One of the most frequent mistakes is assuming an electronic switch’s Ingress Protection (IP) rating meets environmental requirements without proper validation. Sourcing switches with insufficient IP ratings—such as using an IP54-rated switch in outdoor or high-moisture environments that demand IP67 or higher—can lead to premature failure due to dust, water, or chemical ingress. Always verify the IP rating against the intended operating conditions and ensure test certifications (e.g., IEC 60529) are provided by the supplier.

Overlooking Long-Term Quality Consistency

Choosing suppliers based solely on initial samples or low pricing often leads to inconsistent quality over time. Some manufacturers may deliver high-quality prototypes but downgrade materials or production processes in mass production to cut costs. This can result in higher failure rates, reduced mechanical lifespan, or poor electrical performance. Establish rigorous quality audits, request production samples, and conduct ongoing batch testing to ensure sustained reliability.

Ignoring Counterfeit or Substandard Components

The electronics supply chain is vulnerable to counterfeit switches that mimic reputable brands but fail to meet safety and performance standards. These components may lack proper certifications (e.g., UL, CE, RoHS) or use inferior contact materials, leading to arcing, overheating, or complete failure. Always source from authorized distributors or directly from manufacturers, and verify component traceability and compliance documentation.

Misunderstanding Electrical and Mechanical Specifications

Failing to match switch specifications—such as voltage/current ratings, actuation force, and cycle life—to the application can cause operational issues. For example, using a low-cycle switch in a high-frequency application leads to early wear. Likewise, exceeding electrical ratings risks overheating and fire hazards. Ensure datasheets are reviewed in detail and validated through application-specific testing.

Neglecting Environmental and Regulatory Compliance

Electronic switches used in specific industries (e.g., medical, automotive, marine) must meet stringent regulatory standards beyond basic IP ratings, such as ISO, AEC-Q, or MIL-STD. Overlooking these requirements can result in product recalls or non-compliance penalties. Confirm that switches are certified for the target market and operating environment, including temperature range, vibration resistance, and material toxicity (e.g., halogen-free, REACH).

Poor Supply Chain and Lead Time Management

Relying on single-source suppliers or those with unstable production capacity can disrupt manufacturing timelines. Unexpected lead time extensions or discontinuations force costly redesigns or emergency sourcing. Diversify suppliers, monitor component lifecycle status, and maintain strategic inventory for critical switches to mitigate supply chain risks.

Logistics & Compliance Guide for Electronic Switches

Overview

This guide outlines the key logistics and compliance considerations for the international shipment, handling, and regulatory adherence of electronic switches. These components—used in consumer electronics, industrial systems, automotive applications, and telecommunications—must meet strict standards to ensure safety, performance, and legal distribution across global markets.

Classification & HS Codes

Electronic switches are typically classified under the Harmonized System (HS) for customs purposes. Common classifications include:

– 8536.50: Electrical apparatus for switching or protecting electrical circuits (e.g., circuit breakers, relays, switches).

– 8531.80: Other electrical switching devices.

– 8541.40: Semiconductor-based switches (e.g., solid-state relays).

Accurate classification is critical for determining import duties, taxes, and regulatory requirements in destination countries.

Packaging & Labeling Requirements

Ensure packaging protects against electrostatic discharge (ESD), moisture, and physical damage during transit:

– Use ESD-safe packaging materials (e.g., conductive foam, shielded bags).

– Clearly label packages with:

– Product name and model number

– Quantity and net weight

– ESD-sensitive symbol (IEC 60417-5017)

– Manufacturer and country of origin

– Barcodes and batch/lot numbers for traceability

– Include handling instructions (e.g., “Fragile,” “Do Not Stack”).

Shipping & Transportation

- Mode of Transport: Air freight is common for high-value or time-sensitive shipments; ocean freight for bulk orders.

- Temperature & Humidity Control: Store and ship within manufacturer-specified ranges (typically -10°C to 40°C).

- Documentation: Provide commercial invoices, packing lists, and bills of lading/air waybills.

- Incoterms: Clearly define responsibilities (e.g., FOB, DDP) in sales contracts.

Regulatory Compliance

Electronic switches must comply with regional and international standards:

North America

- USA:

- FCC Part 15 (electromagnetic interference)

- UL 61058 (safety of switches for appliances)

- RoHS compliance (lead-free, restricted substances)

- Canada:

- CSA C22.2 No. 61058

- ICES-003 (EMI standard)

European Union

- CE Marking required under:

- Low Voltage Directive (LVD) 2014/35/EU

- Electromagnetic Compatibility (EMC) Directive 2014/30/EU

- RoHS Directive 2011/65/EU (restriction of hazardous substances)

- REACH Regulation (chemical safety)

Asia-Pacific

- China: CCC (China Compulsory Certification) for certain switch types

- Japan: PSE Mark (METI/TELEC for wireless switches)

- South Korea: KC Mark (Korean Certification)

Other Regions

- UK: UKCA marking (post-Brexit; mirrors CE requirements)

- Australia/New Zealand: RCM mark (AS/NZS standards)

Environmental & Safety Standards

- RoHS Compliance: Restricts use of lead, cadmium, mercury, hexavalent chromium, PBB, and PBDE in electrical equipment.

- REACH: Requires disclosure of Substances of Very High Concern (SVHC).

- WEEE Directive: Producers must support recycling programs in applicable regions.

- Conflict Minerals: Compliance with SEC Rule 13p-1 (Dodd-Frank Act) for sourcing tantalum, tin, tungsten, and gold.

Import/Export Controls

- Export Licenses: Required for certain high-frequency or military-grade switches under ITAR or EAR (U.S. Department of Commerce).

- Dual-Use Items: Switches used in aerospace or defense may require special documentation under Wassenaar Arrangement.

- Customs Inspections: Be prepared for detailed reviews, especially for high-tech components.

Quality Assurance & Traceability

- Maintain production records, test reports (e.g., life cycle, temperature, voltage), and certificates of conformity.

- Implement lot traceability for recall readiness.

- Conduct regular audits of manufacturing and logistics partners.

Best Practices

- Partner with certified logistics providers experienced in electronics.

- Conduct pre-shipment compliance checks.

- Stay updated on regulation changes (e.g., RoHS updates, new Ecodesign requirements).

- Use digital tools for supply chain visibility and compliance tracking.

Adhering to this guide ensures efficient logistics operations and minimizes delays, fines, or product recalls due to non-compliance.

Conclusion for Sourcing Electronic Switches

In conclusion, sourcing electronic switches requires a comprehensive evaluation of technical specifications, quality standards, supplier reliability, and cost-efficiency. Selecting the right switches involves aligning product requirements—such as voltage/current ratings, switching speed, durability, environmental resistance, and certifications—with applications across industries like automotive, consumer electronics, industrial automation, or medical devices.

Partnering with reputable suppliers who offer consistent quality, timely delivery, and technical support is crucial to ensure product performance and supply chain stability. Additionally, considering long-term availability, obsolescence management, and compliance with international regulations (e.g., RoHS, REACH) helps mitigate risks and supports sustainable design.

By adopting a strategic sourcing approach that balances performance, cost, and reliability, organizations can secure electronic switches that meet both current needs and future scalability demands, ultimately enhancing product quality and operational efficiency.