The global electrolyzer market is experiencing robust expansion, driven by increasing investments in green hydrogen as a cornerstone of decarbonization strategies across industries and governments. According to a 2023 report by Mordor Intelligence, the market was valued at USD 6.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 14.5% from 2023 to 2028, reaching an estimated USD 15.1 billion by 2028. This growth is fueled by rising renewable energy integration, supportive policy frameworks, and aggressive net-zero targets, particularly in Europe, North America, and parts of Asia-Pacific. As demand for clean hydrogen surges, electrolyzer manufacturers are scaling production, advancing technology, and forming strategic partnerships to capture emerging opportunities. In this competitive landscape, a select group of companies are leading innovation and market share, setting the benchmark for efficiency, reliability, and scalability in electrolysis technology.

Top 10 Electrolyse Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hystar

Domain Est. 1995

Website: hystar.com

Key Highlights: Hystar’s market-leading PEM stacks have the world’s highest efficiency and are made in Høvik, Norway. We sell containerized 5 MW solutions (Vega 1000)…

#2 Quest One

Domain Est. 1998

Website: questone.com

Key Highlights: Quest One (formerly H-TEC SYSTEMS) is a global leader in PEM electrolysis. We develop cutting-edge electrolyzers and stacks for the efficient, reliable, and ……

#3 ITM

Domain Est. 2002

Website: itm-power.com

Key Highlights: ITM manufacture PEM electrolysers. A pioneering technology that generates green hydrogen enabling customers to decarbonise….

#4 Power to Hydrogen (P2H2)

Domain Est. 2019

Website: power-h2.com

Key Highlights: Power to Hydrogen creates scalable hybrid electrolyser systems to drive the global transition to hydrogen for energy, industrial & grid applications….

#5 H2B2 Electrolysis Technologies

Website: h2b2.es

Key Highlights: H2B2 is a technology company that promotes, develops, finances, designs, integrates, builds, operates and maintains hydrogen production systems based on water ……

#6

Domain Est. 1999

Website: h2new.energy.gov

Key Highlights: Enabling affordable, reliable, and efficient electrolyzers to achieve low‑cost hydrogen · Hydrogen from Next-generation Electrolyzers of Water (H2NEW)….

#7 NEXT Hydrogen: Green Hydrogen

Domain Est. 2010

Website: nexthydrogen.com

Key Highlights: We are water electrolysis experts and have dedicated the last 12 years to revolutionizing the cell design architecture of the electrolyser….

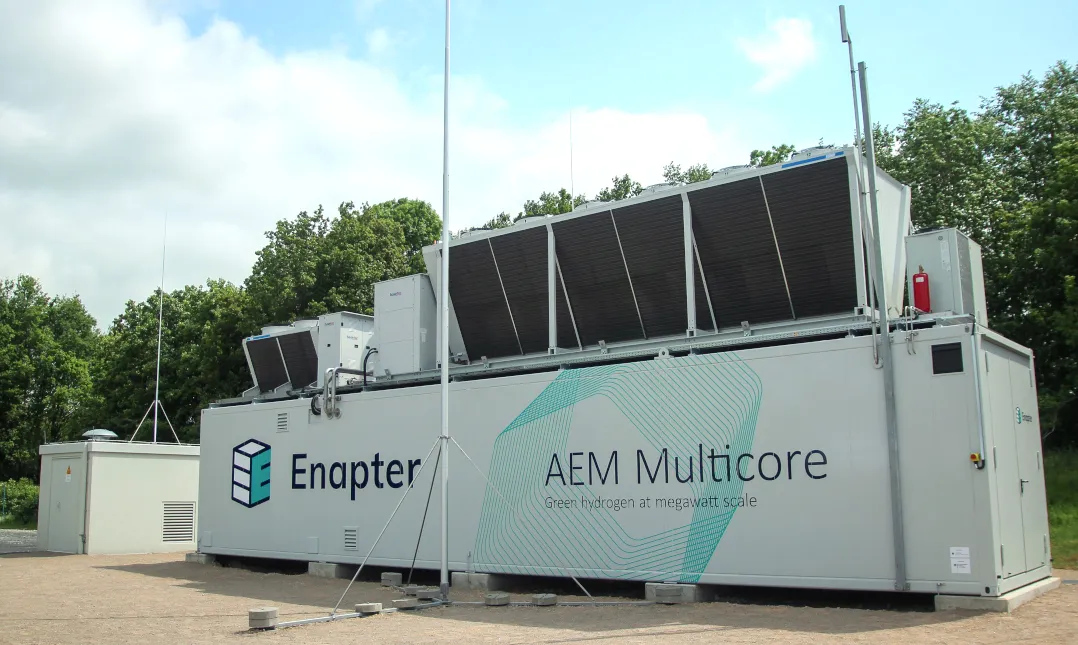

#8 Enapter

Domain Est. 2017

Website: enapter.com

Key Highlights: Enapter is the pioneer and market leader of commercialized AEM Electrolyzers and at the forefront of R&D for AEM Electrolysis….

#9 Verdagy

Domain Est. 2021

Website: verdagy.com

Key Highlights: Verdagy dynamic electrolyzer’s single-cell architecture pairs in real-time with variable energy sources for the production of clean hydrogen….

#10 Sunfire Green Hydrogen Solutions & Electrolyzers

Website: sunfire.de

Key Highlights: Sunfire provides innovative electrolyzers for green hydrogen production ✓ Discover sustainable energy solutions now!…

Expert Sourcing Insights for Electrolyse

As of 2024, forward-looking analysis for the hydrogen (H₂) and electrolysis markets in 2026 indicates strong growth momentum driven by global decarbonization goals, supportive policy frameworks, and increasing industrial demand for clean hydrogen. Below is a comprehensive analysis of the 2026 market trends for electrolysis using H₂ as a key focus:

1. Market Overview: Global Electrolysis for H₂ Production

- Electrolysis is the process of splitting water (H₂O) into hydrogen (H₂) and oxygen using electricity. When powered by renewable energy (e.g., wind, solar), it produces green hydrogen, a zero-carbon energy carrier.

- By 2026, green hydrogen via electrolysis is expected to play a pivotal role in hard-to-abate sectors such as heavy industry (steel, chemicals), long-haul transport, and energy storage.

2. Key Market Drivers for 2026

A. Policy and Regulatory Support

- Global Hydrogen Strategies: Over 40 countries have launched national hydrogen strategies (e.g., EU Hydrogen Backbone, U.S. Hydrogen Hubs under the Infrastructure Law, Japan’s Basic Hydrogen Strategy).

- Incentives:

- The U.S. Inflation Reduction Act (IRA) offers up to $3/kg H₂ in tax credits (45V) for clean hydrogen, making green H₂ cost-competitive.

- The EU’s Renewable Energy Directive (RED III) mandates 50% renewable hydrogen in industrial gas use by 2030, accelerating electrolyzer deployment.

- Carbon Pricing: Rising carbon prices in regions like the EU ETS increase the cost competitiveness of green H₂ vs. grey (fossil-based) H₂.

B. Cost Reductions in Electrolyzers

- Electrolyzer Costs are projected to decline by 40–60% from 2020 to 2026 due to:

- Economies of scale in manufacturing.

- Technological improvements (e.g., higher efficiency, durability).

- Increased competition among manufacturers (e.g., Nel, ITM Power, Cummins, Siemens Energy).

- Average CAPEX for PEM and alkaline electrolyzers expected to fall below $500/kW by 2026.

C. Renewable Energy Integration

- Falling costs of wind and solar power (below $30/MWh in optimal regions) make green H₂ production increasingly viable.

- Hybrid Projects: Co-location of renewables with electrolyzers (e.g., solar-to-hydrogen in Chile, offshore wind in the North Sea) will scale.

D. Industrial Offtake Agreements

- Major industries are signing long-term H₂ offtake agreements:

- Steel: HYBRIT (Sweden), H2 Green Steel.

- Refining: Major oil companies (e.g., Shell, TotalEnergies) transitioning to green H₂.

- Ammonia: CF Industries, Yara piloting green ammonia production.

3. Electrolyzer Technology Trends (2026 Outlook)

| Technology | Market Share (2026 est.) | Key Developments |

|——————|————————–|——————|

| Alkaline | ~50% | Mature, low-cost; ideal for large-scale, steady-load operations. |

| PEM (Proton Exchange Membrane) | ~40% | High efficiency, dynamic response; favored for intermittent renewables. |

| SOEC (Solid Oxide) | ~5–10% | High-temperature, high-efficiency; emerging in industrial heat integration. |

| AEM (Anion Exchange) | <5% (emerging) | Lower cost potential; pilot projects underway. |

- Stack Efficiency: Average system efficiency expected to reach 60–65 kWh/kg H₂ (LHV).

- Capacity: Global electrolyzer installed capacity projected to exceed 30 GW by 2026 (up from ~1.5 GW in 2023), per IEA and BloombergNEF.

4. Regional Market Trends (2026)

| Region | Key Trends |

|—————|———-|

| Europe | EU targeting 40 GW domestic electrolysis capacity by 2030; strong focus on H2 pipelines and cross-border trade. Germany, Spain, and the Netherlands leading deployment. |

| North America | U.S. Regional Hydrogen Hubs (e.g., HyVelocity, Gulf Coast) to become operational; IRA driving private investment. Canada investing in H₂ for oil sands decarbonization. |

| Asia-Pacific | China dominates alkaline electrolyzer manufacturing (80% global supply); Japan and S. Korea importing H₂ from Australia/Middle East. Australia advancing large-scale export projects (e.g., Asian Renewable Energy Hub). |

| Middle East & Africa | UAE, Saudi Arabia, and Oman investing in gigawatt-scale green H₂ for export (e.g., NEOM, Helios). Low-cost solar enables competitive H₂ production. |

5. H₂ Market Dynamics (2026)

- Production Cost: Green H₂ expected to reach $2–3/kg in optimal locations by 2026 (down from $4–6/kg in 2023).

- Demand Sectors:

- Industry: 40% of demand (refineries, ammonia, steel).

- Transport: 20% (heavy-duty trucks, shipping pilots).

- Power & Storage: 15% (grid balancing, seasonal storage).

- Blending in Gas Grids: 10–15% (EU and UK pilots).

- Trade & Infrastructure:

- First green H₂ shipments (liquid or as ammonia) expected from Australia, Chile, and the Middle East to Japan and Europe.

- EU building H2 backbone (28,000 km by 2030); initial segments operational by 2026.

6. Challenges & Risks (2026)

- Supply Chain Constraints: Materials (nickel, iridium, titanium) may limit PEM and SOEC scaling.

- Grid Access & Curtailment: Need for dedicated renewable power or grid upgrades.

- Standards & Certification: Lack of harmonized H₂ certification (e.g., “guarantees of origin”) may slow adoption.

- Financing: High upfront CAPEX still a barrier without subsidies.

7. Investment & Innovation Outlook

- Project Pipeline: Over $150 billion in announced green H₂ projects globally; ~15–20% expected to reach Final Investment Decision (FID) by 2026.

- Innovation Focus:

- Electrolyzer Durability: Targeting >80,000 hours of operation.

- Hybrid Systems: Integration with carbon capture (for blue H₂) or nuclear (pink H₂).

- Digitalization: AI for predictive maintenance and load optimization.

Conclusion: 2026 as a Tipping Point for Electrolysis and H₂

By 2026, the electrolysis market will transition from pilot projects to early commercial scaling. Key indicators:

– Green H₂ reaches cost parity with blue/grey H₂ in major markets.

– Electrolyzer manufacturing scales to multi-gigawatt levels annually.

– First cross-border H₂ trade routes become operational.

– H₂ begins displacing fossil fuels in niche industrial and transport applications.

The convergence of policy, cost reductions, and corporate demand positions 2026 as a pivotal year in establishing green hydrogen as a foundational element of the global energy transition.

Sources: IEA (2023), Hydrogen Council, BloombergNEF, IRENA, EU Commission, U.S. DOE Hydrogen Program, company disclosures.

When sourcing electrolysis technology for hydrogen (H₂) production, several critical pitfalls can impact project success, particularly concerning quality and intellectual property (IP). Below is a structured overview of common pitfalls and how to navigate them, with a focus on ensuring high-quality systems and protecting IP rights.

1. Quality-Related Pitfalls in Sourcing Electrolysis Systems

A. Overlooking Technology-Specific Performance Metrics

- Pitfall: Assuming all electrolyzers (e.g., PEM, Alkaline, SOEC) perform similarly without assessing real-world efficiency, durability, and response dynamics.

- Impact: Poor H₂ yield, higher OPEX due to inefficiency, or system failure under variable loads (e.g., renewable integration).

- Mitigation:

- Demand validated performance data under relevant operating conditions (load range, start-stop cycles, temperature).

- Require third-party testing reports (e.g., NREL, TÜV, DNV).

- Include performance guarantees in contracts (e.g., H₂ output, specific energy consumption in kWh/kg H₂).

B. Inadequate Assessment of Component Quality

- Pitfall: Focusing only on stack performance while neglecting balance-of-plant (BoP) components (e.g., compressors, dryers, power electronics).

- Impact: System downtime, safety risks, or suboptimal integration.

- Mitigation:

- Conduct full-system audits, including BoP.

- Verify material certifications (e.g., corrosion-resistant materials in contact with KOH or humid H₂).

- Require lifecycle testing data (e.g., >60,000 hours for industrial PEM systems).

C. Underestimating Long-Term Degradation

- Pitfall: Accepting initial performance without degradation rate analysis.

- Impact: Rapid decline in H₂ output or efficiency over time; unexpected maintenance costs.

- Mitigation:

- Require degradation data (e.g., <0.5–1% per 1,000 hours for PEM).

- Include warranty clauses tied to performance decay.

- Prefer suppliers with field-proven installations.

D. Ignoring Certification and Compliance

- Pitfall: Procuring systems without proper safety and quality certifications.

- Impact: Regulatory non-compliance, insurance issues, safety hazards.

- Mitigation:

- Ensure compliance with ISO 22734, IEC 62282, ASME BPVC, and local codes.

- Verify ATEX/IECEx certification if used in hazardous areas.

2. Intellectual Property (IP)-Related Pitfalls

A. Unclear IP Ownership in Custom or Co-Developed Systems

- Pitfall: Collaborating on electrolyzer design or integration without clear IP agreements.

- Impact: Disputes over ownership, inability to scale or modify the system, or third-party infringement claims.

- Mitigation:

- Define IP ownership upfront in contracts (e.g., background vs. foreground IP).

- Use joint development agreements (JDAs) with clear clauses:

- Who owns improvements?

- Can the buyer use the design elsewhere?

- Are there licensing rights?

B. Hidden IP in Proprietary Components

- Pitfall: Using electrolyzers with black-box components (e.g., catalysts, membranes) where IP is tightly controlled.

- Impact: Vendor lock-in, inability to service or replace parts independently, cost escalation.

- Mitigation:

- Require technology transparency for key components.

- Negotiate right-to-repair or spare parts licensing.

- Evaluate open-design or modular systems where feasible.

C. Infringement Risks from Supplier

- Pitfall: Sourcing from a vendor whose technology infringes third-party patents.

- Impact: Legal liability, project delays, or forced system redesign.

- Mitigation:

- Require IP indemnification clauses in procurement contracts.

- Conduct freedom-to-operate (FTO) analysis for critical components (e.g., PEM catalysts, bipolar plates).

- Prefer suppliers with strong patent portfolios and transparent IP strategies.

D. Export Control and Geopolitical IP Risks

- Pitfall: Sourcing from jurisdictions with export restrictions or weak IP enforcement.

- Impact: Supply chain disruption, reverse engineering, or loss of proprietary integration know-how.

- Mitigation:

- Assess geopolitical risks (e.g., rare materials, dual-use tech).

- Include confidentiality and non-disclosure agreements (NDAs).

- Consider onshoring or local assembly to retain control.

Best Practices Summary (H₂-Focused)

| Area | Best Practice |

|——|—————|

| Quality | Demand real-world performance data, third-party validation, and lifecycle guarantees. |

| Technology Fit | Match electrolyzer type (PEM, Alkaline, etc.) to H₂ use case (e.g., PEM for dynamic operation). |

| IP Clarity | Define ownership, licensing, and indemnification in contracts. |

| Supply Chain | Audit supplier IP position and component sourcing. |

| Compliance | Ensure adherence to H₂ safety and quality standards (ISO, IEC). |

Conclusion

Sourcing electrolysis systems for H₂ production requires balancing technical performance, long-term reliability, and IP security. Avoiding these pitfalls ensures not only a high-quality hydrogen output but also protects your organization from legal, operational, and financial risks. Always conduct due diligence, involve technical and legal experts early, and prioritize transparency with suppliers.

Logistics & Compliance Guide for Electrolysis-Based Hydrogen (H₂) Production and Distribution

1. Introduction

This guide outlines the critical logistics and compliance considerations for facilities utilizing electrolysis to produce hydrogen (H₂) from water and renewable or grid-sourced electricity. As green hydrogen becomes a cornerstone of the global energy transition, safe, efficient, and compliant operations are essential across production, storage, transport, and end-use applications.

2. Overview of Hydrogen via Electrolysis

Electrolysis splits water (H₂O) into hydrogen (H₂) and oxygen (O₂) using electricity. When powered by renewable energy, this process produces “green hydrogen” with near-zero carbon emissions.

Electrolyser Types:

– Alkaline Electrolysers (AEL) – Mature technology, cost-effective.

– Proton Exchange Membrane (PEM) – High efficiency, dynamic operation.

– Solid Oxide Electrolysers (SOEC) – High-temperature, high-efficiency (emerging).

3. Regulatory & Compliance Framework

Compliance must align with national, regional, and international standards governing safety, environmental impact, and energy use.

3.1 International & Regional Standards

- ISO 22734: Hydrogen generators using water electrolysis – performance requirements.

- IEC/TS 62282-3-100: Safety standards for fuel cell power systems (including H₂ from electrolysis).

- ASME Boiler and Pressure Vessel Code (Section VIII): For pressure vessels storing H₂.

- NFPA 2: Hydrogen Technologies Code (USA) – Covers production, storage, and use.

- EU Hydrogen and Fuel Cell Regulation – Under the EU Renewable Energy Directive (RED III), green H₂ must meet additional sustainability criteria.

3.2 Environmental & Emissions Compliance

- Carbon Intensity Certification: In the EU, green H₂ must meet <3 kg CO₂e/kg H₂ threshold (based on LCA).

- REEL (Renewable Energy for Electrolysis) Tracking: Use of Guarantees of Origin (GOs) or Power Purchase Agreements (PPAs) with renewables.

- Water Use Permitting: Ensure sustainable sourcing; electrolysis uses ~9 liters of high-purity water per kg H₂.

3.3 Safety & Operational Regulations

- ATEX/IECEx: For equipment in explosive atmospheres (H₂ is highly flammable; 4–75% in air).

- Pressure Equipment Directive (PED) – EU: Applies to H₂ storage and piping systems.

- DOT 49 CFR (USA): Regulates H₂ transport in cylinders, tube trailers, and pipelines.

- Local Fire Codes: Permitting from fire marshals and local authorities for H₂ facilities.

4. Logistics of Hydrogen Production and Handling

4.1 Site Selection & Facility Design

- Zoning: Locate in industrial zones with buffer distances from public areas.

- Ventilation: Prevent H₂ accumulation (lighter than air, but can accumulate at ceilings).

- Separation: Oxygen and hydrogen output lines must be isolated to prevent explosive mixtures.

- Redundancy: Include backup power and emergency shutdown systems.

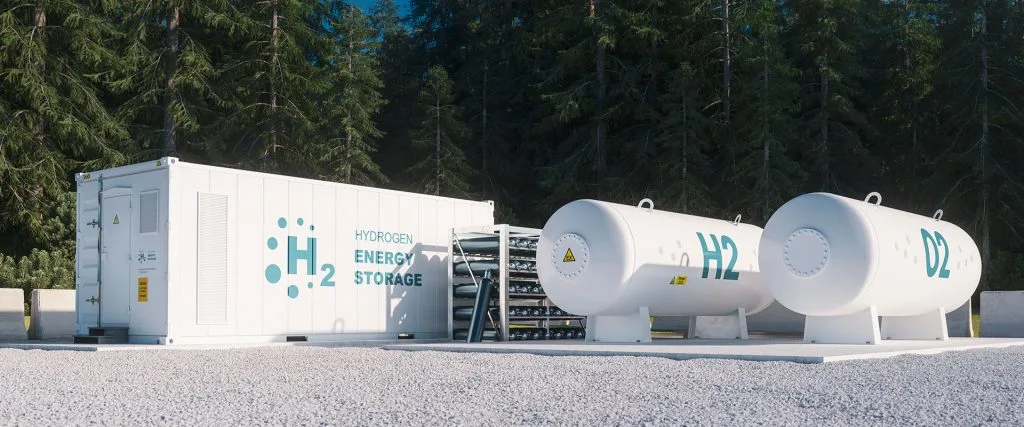

4.2 Hydrogen Storage

Options based on scale and application:

| Method | Pressure/Temp | Energy Density | Use Case |

|——-|—————-|—————-|———-|

| Compressed Gas (CGH₂) | 350–700 bar | Medium | On-site, transport |

| Liquid Hydrogen (LH₂) | –253°C | High | Long-haul transport, aviation |

| Metal Hydrides | Ambient pressure | Low | Portable/mobile use |

- Safety: Storage tanks must include pressure relief devices (PRDs), flame arrestors, and leak detection.

- Materials: Use H₂-compatible materials (e.g., stainless steel 316L, aluminum alloys) to avoid embrittlement.

4.3 Transportation & Distribution

- Tube Trailers (CGH₂): Up to 400 kg H₂ per trailer; suitable for short/medium distances (<300 km).

- LH₂ Tankers: For large volumes over long distances; energy-intensive liquefaction (~30% of H₂ energy).

- Pipeline Blending: Inject H₂ into natural gas pipelines (up to 20% H₂ by volume in many jurisdictions).

- Dedicated H₂ Pipelines: High capital cost but efficient for large-scale distribution (e.g., European Hydrogen Backbone).

Transport Compliance:

– ADR/RID/IMDG: International rules for road, rail, and sea transport of dangerous goods (Class 2.1, UN1049).

– DOT Special Permits: Required for high-pressure or cryogenic transport in the US.

5. Monitoring, Maintenance & Record Keeping

5.1 Operational Monitoring

- Use online sensors for:

- H₂ purity (>99.97% for fuel cell use)

- Leak detection (H₂ sensors with <1% LFL alarm)

- O₂ cross-contamination (critical safety parameter)

5.2 Maintenance Protocols

- Regular inspection of:

- Electrolyser stacks

- Compressors and coolers

- Piping and valves (for leaks or embrittlement)

- Follow OEM maintenance schedules.

5.3 Compliance Documentation

- Maintain records of:

- Electrolyser performance (H₂ output, energy use)

- Electricity source (renewable certification)

- Emissions calculations (Life Cycle Assessment)

- Safety inspections, incident reports

- Training logs for personnel (HAZOP, PHA)

6. Personnel Training & Emergency Response

- Training: All staff to be trained in:

- H₂ safety (flammability, embrittlement, asphyxiation risks)

- Emergency shutdown procedures

-

Use of PPE (non-sparking tools, flame-resistant clothing)

-

Emergency Response Plan (ERP):

- Include H₂ leak protocols, evacuation routes, fire suppression (use inert gas or dry chemical extinguishers).

- Coordinate with local fire departments; provide facility diagrams.

7. Sustainability & Certification

To qualify as “green hydrogen”:

– Additionality: New renewable capacity must be linked to H₂ demand (EU requirement).

– Temporal & Geographical Correlation: Matching renewable generation with electrolysis in time and location.

– Certification Schemes:

– EU Renewable Fuels of Non-Biological Origin (RFNBO)

– California Low Carbon Fuel Standard (LCFS)

– CertifHy (Europe)

8. Future-Proofing & Digital Integration

- Digital Twins: Simulate electrolyser performance and optimize efficiency.

- Blockchain: For tracking H₂ origin, carbon intensity, and compliance.

- Grid Integration: Use smart controls to operate electrolyser during low electricity prices or surplus renewable generation.

9. Summary Checklist

| Action | Compliance/Logistics Focus |

|——-|—————————-|

| ✅ Site Permitting | Zoning, environmental, fire codes |

| ✅ Electrolyser Installation | ISO 22734, IEC 62282 |

| ✅ H₂ Storage | PED, ASME, NFPA 2 |

| ✅ Transport Plan | ADR/DOT, cylinder certification |

| ✅ Renewable Energy Proof | GOs, PPAs, additionality |

| ✅ Staff Training | HAZOP, emergency drills |

| ✅ Emissions Reporting | LCA, carbon intensity |

| ✅ Monitoring Systems | Leak detection, purity control |

10. Conclusion

Successful deployment of electrolytic hydrogen requires a holistic approach integrating technical excellence with rigorous compliance and logistics planning. As regulations evolve and markets scale, early adoption of best practices ensures operational safety, environmental integrity, and commercial viability.

Disclaimer: This guide provides general best practices. Always consult local regulatory authorities and conduct site-specific risk assessments.

Prepared by: [Your Organization]

Version: 1.1

Date: April 2025

Contact: [email protected]

Conclusion on Sourcing Electrolysis Equipment and Technology

Sourcing electrolysis systems for hydrogen production requires a strategic evaluation of technology types, supplier reliability, cost-efficiency, and alignment with sustainability goals. As global demand for green hydrogen rises, proton exchange membrane (PEM), alkaline, and solid oxide electrolyzers each present distinct advantages depending on application, scalability, and operational conditions. Selecting the right supplier involves assessing technical expertise, proven track record, service support, and compliance with international standards.

Regional supply chain dynamics, raw material availability (e.g., iridium for PEM), and local policy incentives also significantly influence procurement decisions. Partnerships with established manufacturers or participation in collaborative initiatives can mitigate risks and accelerate deployment. Ultimately, successful sourcing hinges on a balanced approach that integrates long-term performance, scalability, and environmental impact—ensuring that investments in electrolysis contribute effectively to the clean energy transition.