The global electroform gold market is experiencing robust growth, driven by rising demand in high-precision industries such as electronics, medical devices, aerospace, and luxury goods. According to Grand View Research, the global gold plating market was valued at USD 2.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, fueled by advancements in miniaturized electronics and increasing adoption of gold in semiconductor packaging. Similarly, Mordor Intelligence projects steady growth in precious metal electroforming, with particular expansion in medical and RF/EMI shielding applications due to gold’s superior conductivity, corrosion resistance, and biocompatibility. As demand for ultra-thin, high-purity gold components grows, specialized electroform manufacturers are playing a critical role in enabling next-generation technologies. In this evolving landscape, the following eight companies stand out for their technical expertise, quality control, and global footprint in electroform gold manufacturing.

Top 8 Electroform Gold Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lukfook Jewellery|Lukfook Jewellery

Domain Est. 1999

Website: lukfook.com

Key Highlights: Electroforming technology enables jewellery manufacturers to produce hollow-shaped and light-weight gold articles of complex and amazing design. Hollow ……

#2 Electroforming

Domain Est. 1996

Website: epner.com

Key Highlights: Electroforming is the process of fabricating a part from the plating itself. A shaped mandrel is plated long enough to build up a “stand alone” thickness….

#3 Electroform Jewelry

Domain Est. 2006

Website: kirinjew.com

Key Highlights: We developed a new product line – electroform products, they are big but light. Once the samples were displayed, we received very good feedback from the market….

#4 Gold Electroforming

Domain Est. 2016

Website: pschemitech.com

Key Highlights: Yellow bright finish. 21Kt hallmarkable gold. Gold copper alloy. Stress free deposit. Excellent ductility. Flame Solder friendly. Thickness upto 300 microns….

#5 Gold electroforming

Domain Est. 2018

Website: esa-electroformingchemistry.it

Key Highlights: ESA srl gained a twenty-years experience in gold electroforming, from plating solutions, develpoed in its laboratory, to a complete copnsulting service….

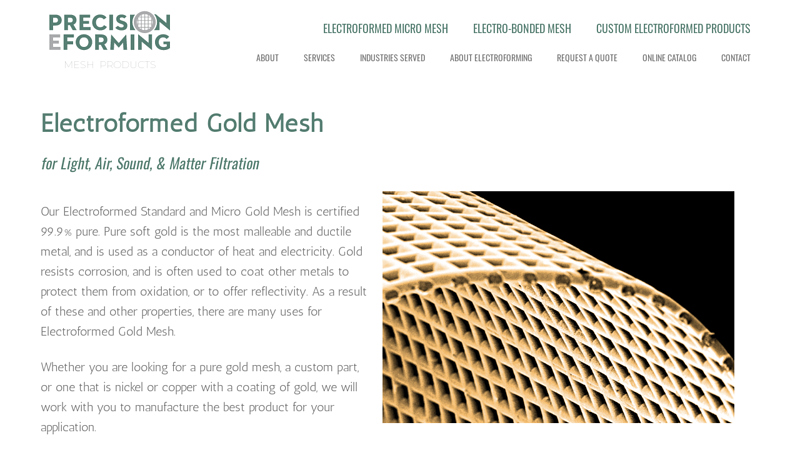

#6 Mesh Products by Precision Eforming

Domain Est. 2023

Website: precisioneforming-mesh.com

Key Highlights: Our Electroformed Standard and Micro Gold Mesh is certified 99.9% pure. Pure soft gold is the most malleable and ductile metal, and is used as a conductor of ……

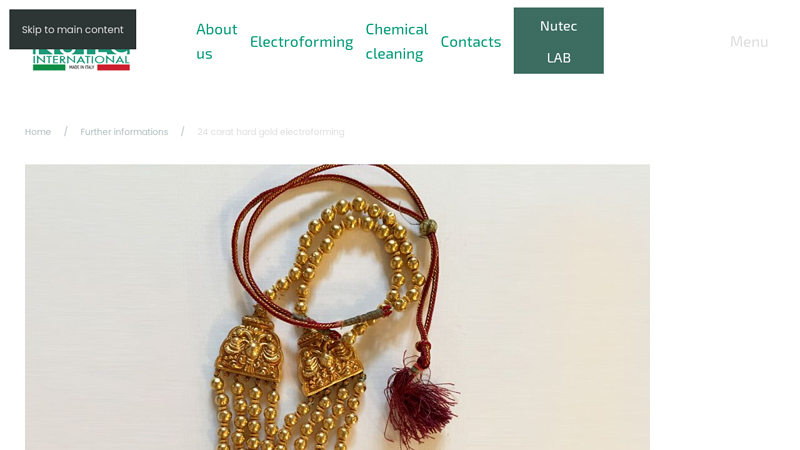

#7 24 carat hard gold electroforming

Domain Est. 2024

Website: nutecinternational.it

Key Highlights: 24 carat hard gold electroforming is a special technique used for improving the hardness and wear resistance of 24 carat gold jewellery….

#8 Homepage

Website: xhfjewelrymachine.com

Key Highlights: We specialize in advanced jewelry machinery including electroforming, electroplating, and precious metal recovery equipment. Our mission is to deliver reliable, ……

Expert Sourcing Insights for Electroform Gold

H2: Market Trends for Electroform Gold in 2026

As we approach 2026, the market for electroform gold—gold deposited through electroforming processes for precision applications—is expected to experience significant transformation driven by advancements in technology, shifts in industrial demand, and evolving supply chain dynamics. Key trends shaping the electroform gold market in 2026 include:

-

Increased Demand in Electronics and Semiconductor Industries

Electroform gold’s superior conductivity, corrosion resistance, and ability to create ultra-precise components make it indispensable in high-end electronics. With the continued miniaturization of semiconductor devices and the proliferation of 5G, AI hardware, and quantum computing components, demand for electroform gold in connectors, bonding wires, and RF shielding is projected to grow. The semiconductor industry’s push for enhanced reliability and performance in extreme environments further solidifies electroform gold’s role. -

Expansion in Aerospace and Defense Applications

The aerospace and defense sectors are increasingly relying on electroform gold for satellite components, radar systems, and avionics due to its stability in extreme temperatures and resistance to oxidation. As global space exploration and satellite deployment accelerate—especially with private space ventures and national defense modernization—the need for high-purity, precision-formed gold components is expected to rise significantly in 2026. -

Growth in Medical Device Manufacturing

Electroform gold is gaining traction in medical technologies, particularly in implantable devices such as neurostimulators and biosensors, where biocompatibility and signal fidelity are critical. Advancements in wearable health monitors and minimally invasive surgical tools are driving demand for micro-precision gold components fabricated via electroforming, contributing to market expansion. -

Sustainability and Recycling Initiatives

Environmental regulations and corporate sustainability goals are prompting manufacturers to adopt closed-loop recycling systems for gold used in electroforming. By 2026, the industry is expected to see increased investment in recovery technologies that reclaim gold from electroforming baths and production waste, reducing dependency on mined gold and lowering environmental impact. This trend is also being supported by ESG (Environmental, Social, and Governance) compliance pressures. -

Technological Innovations in Electroforming Processes

R&D efforts are enhancing the efficiency and precision of electroform gold deposition. Innovations such as pulse electroforming, nano-structured gold deposition, and digital process control systems are enabling finer feature resolution, reduced material waste, and improved throughput. These advancements are lowering production costs and expanding the feasibility of electroform gold in cost-sensitive applications. -

Supply Chain Diversification and Geopolitical Factors

Ongoing geopolitical tensions and supply chain vulnerabilities are pushing companies to diversify sources of refined gold and electroforming equipment. In 2026, regional manufacturing hubs in Asia-Pacific (particularly South Korea, Japan, and Taiwan) and North America are expected to strengthen local electroform gold production capabilities to reduce reliance on single-source suppliers. -

Price Volatility and Strategic Stockpiling

While gold prices remain subject to macroeconomic factors, industries dependent on electroform gold are increasingly adopting hedging strategies and strategic inventory management to mitigate price volatility. Long-term contracts and partnerships between gold refiners and high-tech manufacturers are becoming more common to ensure supply stability.

In summary, the 2026 electroform gold market is poised for robust growth, underpinned by rising demand across high-tech sectors, technological innovation, and a stronger focus on sustainability. Stakeholders who invest in advanced manufacturing capabilities, recycling infrastructure, and supply chain resilience are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Electroform Gold (Quality, IP)

Sourcing electroform gold—especially for precision applications in electronics, aerospace, or luxury goods—introduces several critical challenges related to quality control and intellectual property (IP) protection. Being aware of these pitfalls can help mitigate risks and ensure reliable, legally secure supply chains.

Quality Inconsistencies

Electroform gold requires precise electrochemical deposition to achieve desired thickness, purity, and structural integrity. However, many suppliers—particularly low-cost or unverified vendors—may deliver inconsistent quality due to:

- Variable Purity Levels: Gold plating may not meet specified fineness (e.g., 24K or 99.9% pure), leading to performance issues in conductive or corrosion-resistant applications.

- Inadequate Adhesion or Uniformity: Poor process control can result in uneven coating thickness or weak bonding, increasing the risk of delamination or premature failure.

- Lack of Certification: Reputable suppliers provide material test reports (MTRs) and compliance documentation (e.g., RoHS, REACH). Without these, verifying quality becomes difficult.

- Uncontrolled Process Parameters: Temperature, current density, and bath chemistry must be tightly controlled. Inexperienced providers may lack the infrastructure for consistent electroforming.

To avoid these issues, conduct rigorous supplier audits, require sample testing, and insist on process documentation and third-party certifications.

Intellectual Property (IP) Risks

Electroforming often involves custom tooling, mandrels, and proprietary geometries, especially in high-tech or design-sensitive industries. Key IP pitfalls include:

- Design Theft or Replication: Sharing CAD files or master patterns with unvetted manufacturers may result in unauthorized replication or resale of your designs.

- Weak Contractual Protections: Suppliers in certain jurisdictions may not honor IP clauses, especially if contracts lack enforceable non-disclosure agreements (NDAs) or clear ownership terms.

- Reverse Engineering: Electroformed parts can be reverse-engineered, particularly if the supplier retains mandrels or production data post-project.

- Lack of Traceability: Without secure digital workflows or audit trails, it’s difficult to prove design ownership in case of IP disputes.

Mitigation strategies include working only with trusted partners under strong legal agreements, using watermarking or embedded identifiers in designs, and limiting access to sensitive data on a need-to-know basis.

Conclusion

Sourcing electroform gold demands a balanced focus on technical quality and IP security. Due diligence in vetting suppliers, enforcing contractual safeguards, and verifying material specifications is essential to avoid costly failures and protect innovation.

Logistics & Compliance Guide for Electroform Gold

Electroform gold, produced through electroforming processes, presents unique logistics and compliance considerations due to its high value, material properties, and regulatory scrutiny. This guide outlines best practices for secure transportation, handling, documentation, and adherence to international regulations.

Regulatory Classification and Documentation

Electroform gold is typically classified under Harmonized System (HS) Code 7108.12 for unwrought gold or 7108.13 for semi-manufactured forms, depending on final form. Accurate classification is essential for customs clearance and trade compliance. Required documentation includes a commercial invoice detailing gold content (fineness), weight, and value; a certificate of origin; and, where applicable, an export license. For shipments exceeding certain thresholds (e.g., $10,000 USD in the U.S.), a FinCEN Currency and Monetary Instrument Report (CMIR) may be required.

Export and Import Controls

Export of gold, including electroform variants, is subject to national and international regulations. In the U.S., gold exports may require authorization from the Bureau of Industry and Security (BIS) if destined for embargoed countries. The EU and other jurisdictions may impose similar controls. Importers must comply with local precious metals regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. End-use certifications may be necessary to confirm the gold is not intended for prohibited applications.

Secure Transportation and Handling

Due to high value and theft risk, electroform gold must be transported using insured, trackable, and tamper-evident methods. Use accredited precious metals couriers with experience in high-value cargo. Packages should be discreetly labeled and not marked as containing gold. Maintain chain-of-custody records throughout transit. On-site handling requires secure storage in certified vaults or safes with restricted access and 24/7 surveillance. Personnel involved should undergo background checks and training in security protocols.

Anti-Money Laundering (AML) and Due Diligence

Companies trading electroform gold must implement a robust AML program in accordance with Financial Action Task Force (FATF) recommendations and local laws (e.g., Bank Secrecy Act in the U.S.). Conduct thorough due diligence on suppliers and customers, verifying identities and beneficial ownership. Monitor transactions for suspicious activity, such as unusual shipping patterns or attempts to under-declare value. Maintain transaction records for a minimum of five years.

Environmental and Safety Compliance

Electroforming processes involve hazardous chemicals (e.g., cyanide-based electrolytes), requiring adherence to environmental regulations such as EPA standards (U.S.) or REACH/CLP (EU). Waste disposal must follow approved protocols for cyanide and heavy metals. Transport of chemical precursors used in electroforming falls under hazardous materials regulations (e.g., DOT 49 CFR, IMDG Code). Personnel must be trained in handling, spill response, and proper use of personal protective equipment (PPE).

Recordkeeping and Auditing

Maintain comprehensive records of all gold transactions, including purchase orders, shipping manifests, assay reports, and compliance certifications. Implement internal audits to verify adherence to logistics and compliance procedures. Prepare for potential inspections by customs authorities, financial regulators, or law enforcement. Use digital tracking systems with audit trails to enhance transparency and accountability.

International Trade Considerations

Be aware of sanctions and trade restrictions affecting gold trade with specific countries (e.g., Russia, Venezuela). Monitor updates from OFAC (U.S.), UN Security Council, and EU sanctions lists. Ensure third-party logistics providers and intermediaries also comply with international trade laws. Consider using Incoterms® 2020 (e.g., DDP or CIP) to clearly define responsibilities and reduce liability risks.

In conclusion, sourcing electroform gold presents a highly effective and cost-efficient solution for industries requiring intricate, high-purity gold components, particularly in electronics, aerospace, medical devices, and high-end decorative applications. Its unique ability to produce complex geometries with excellent conductivity, purity, and minimal material waste makes it superior to traditional fabrication methods like stamping or machining. However, successful sourcing depends on selecting experienced suppliers with stringent quality controls, consistent plating processes, and compliance with industry standards. Additionally, considerations such as lead times, scalability, and environmental regulations must be factored into procurement decisions. When managed strategically, sourcing electroform gold offers a competitive advantage by combining precision, performance, and long-term value.