The global electrical distribution board (DB board) market is experiencing robust growth, driven by rising urbanization, expanding infrastructure development, and increased investments in smart grid technologies. According to Grand View Research, the global electrical enclosures market—of which DB boards are a critical component—was valued at USD 27.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts steady expansion in the electrical panels and boards sector, citing surging demand from the residential, commercial, and industrial sectors, particularly in emerging economies across Asia-Pacific and Latin America. With safety, efficiency, and energy management becoming top priorities, the demand for reliable and innovative DB board solutions has never been higher. In this competitive landscape, a select group of manufacturers have emerged as industry leaders, setting benchmarks in quality, scalability, and technological integration. Here are the top 9 electrical DB board manufacturers shaping the future of power distribution.

Top 9 Electrical Db Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Electrical & Electronic Enclosures, Cabinets & Racks, Outlet Strips …

Domain Est. 1996

Website: hammfg.com

Key Highlights: Hammond Manufacturing is a leading manufacturer of industrial enclosures, electronic enclosures, racks & rack cabinets, transformers, outlet strips and ……

#2 Paneltronics

Domain Est. 1996 | Founded: 1979

Website: paneltronics.com

Key Highlights: Since 1979, Paneltronics has been the industry-leading manufacturer of high quality electrical control panels and assemblies….

#3 Electrical Enclosures

Domain Est. 2001

Website: nvent.com

Key Highlights: nVent HOFFMAN is a leading designer and manufacturer of electrical enclosures to safeguard your people and equipment. Rely on us for smart, ……

#4 Distribution Boards

Domain Est. 1990

Website: new.abb.com

Key Highlights: Kabeldon distribution boards are specifically designed for outdoor installations and they come as pre-assembled systems, ready to install….

#5 Final Distribution Boards

Domain Est. 1996

Website: eaton.com

Key Highlights: Eaton designs and manufactures final DBO’s and switching and protective devices as well as pre-wired solutions, that provide reliable and safe power and circuit ……

#6 Panelboards / Switchboards and Switchgear

Domain Est. 1997

Website: se.com

Key Highlights: Square D™ NF and NQ Panelboards provide best-in-class overcurrent and advanced function protection for AC final distribution circuits and sub-panels….

#7 Powell Industries

Domain Est. 1997

Website: powellind.com

Key Highlights: Powell Industries is an electrical engineering and manufacturing company based in Houston, TX, with operations across the U.S., Canada, and the U.K…..

#8 Distribution Boards & Circuit Breakers

Domain Est. 2001

Website: madar.com

Key Highlights: They are designed to distribute electrical power reliably while protecting circuits, equipment, and users from overloads, short circuits, and electrical faults….

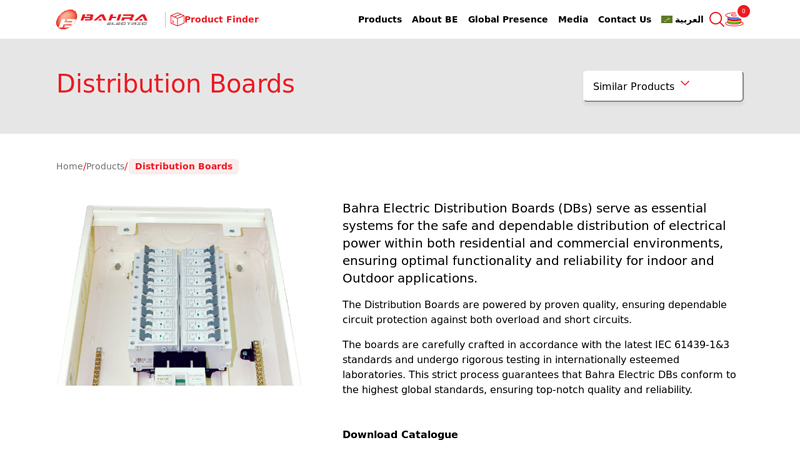

#9 Distribution Boards

Domain Est. 2015

Website: bahra-electric.com

Key Highlights: The Distribution Boards are powered by proven quality, ensuring dependable circuit protection against both overload and short circuits….

Expert Sourcing Insights for Electrical Db Board

2026 Market Trends for Electrical DB Boards

The electrical distribution board (DB board) market is poised for significant transformation by 2026, driven by technological advancements, regulatory changes, and growing demand for energy efficiency and smart infrastructure. This analysis explores key trends shaping the global electrical DB board industry in 2026.

Growth in Smart Building Integration

A major trend driving the DB board market is the integration of smart technologies into residential, commercial, and industrial buildings. By 2026, an increasing number of DB boards will feature embedded IoT (Internet of Things) capabilities, enabling real-time monitoring of electrical loads, energy consumption, and fault detection. Smart DB boards allow remote access via mobile apps or building management systems (BMS), supporting predictive maintenance and enhanced safety. This shift is fueled by rising urbanization and the global push toward smart cities.

Demand for Modular and Compact Designs

Space efficiency remains a priority in modern electrical installations. In 2026, manufacturers are expected to focus on modular and compact DB board designs that offer flexibility in configuration and ease of installation. These designs are particularly beneficial in retrofit projects and densely populated urban areas where space is limited. Modular systems also simplify upgrades, allowing users to add circuit breakers or monitoring devices without replacing the entire board.

Emphasis on Energy Efficiency and Sustainability

With global sustainability goals intensifying, electrical DB boards are evolving to support energy-efficient systems. Advanced DB boards in 2026 will increasingly integrate with renewable energy sources such as solar and battery storage systems. Features like load balancing, peak demand management, and energy metering will become standard, helping consumers and businesses reduce energy waste and lower utility costs. Additionally, manufacturers are adopting eco-friendly materials and recyclable components in DB board production to align with green building certifications like LEED and BREEAM.

Regulatory and Safety Standards Evolution

Stringent electrical safety regulations are expected to tighten across regions by 2026, especially in emerging markets. Compliance with standards such as IEC 61439 (for low-voltage switchgear and controlgear assemblies) will be critical. Enhanced safety features—such as arc fault detection devices (AFDDs), residual current monitoring, and improved insulation—will be incorporated into DB boards to reduce fire risks and improve personnel safety. Governments and utilities may mandate these features in new constructions and major renovations.

Rising Adoption in Residential and Renewable Sectors

The residential sector will remain a key growth driver for DB boards, especially with the proliferation of electric vehicles (EVs), home energy storage, and heat pumps. By 2026, homes will require upgraded DB boards capable of handling higher loads and managing bidirectional power flow from solar inverters. Similarly, the renewable energy sector—particularly solar PV installations—will demand specialized DB boards designed for grid-tied and off-grid systems, supporting faster market expansion in both developed and developing countries.

Regional Market Dynamics

Growth in the DB board market will vary by region. Asia-Pacific, led by countries like India, China, and Southeast Asian nations, is expected to witness the highest growth due to rapid infrastructure development and government electrification programs. North America and Europe will see steady growth, driven by building code updates and retrofitting initiatives. Meanwhile, the Middle East and Africa will experience increased demand as part of large-scale industrial and urban development projects.

Technological Innovation and Digitalization

By 2026, digital twin technology and AI-powered analytics are expected to play a role in DB board management. Digital replicas of electrical systems will allow engineers to simulate performance, optimize configurations, and anticipate failures. Additionally, manufacturers will leverage digital platforms for product configuration, ordering, and technical support, enhancing customer experience and supply chain efficiency.

Conclusion

The electrical DB board market in 2026 will be shaped by smart technology integration, sustainability imperatives, and evolving safety standards. As buildings become more connected and energy-conscious, DB boards will transition from passive enclosures to intelligent power management hubs. Companies that innovate in modular design, digital capabilities, and energy optimization will lead the market, meeting the demands of a rapidly modernizing electrical infrastructure landscape.

Common Pitfalls When Sourcing Electrical Distribution Boards (Quality & IP Rating)

Sourcing electrical distribution boards (DB boards) requires careful attention to both quality and Ingress Protection (IP) ratings. Overlooking key factors can lead to safety hazards, non-compliance, and costly failures. Below are the most common pitfalls to avoid:

Inadequate Quality of Components and Construction

One of the biggest risks is selecting distribution boards made with substandard materials or poor workmanship. Low-quality enclosures may use thin gauge steel or inferior plastics that degrade quickly, lack proper corrosion resistance, or fail under mechanical stress. Internal components like busbars, neutral links, and mounting rails may not meet required conductivity or durability standards. Cheap knock-offs often bypass rigorous testing, increasing the risk of overheating, arcing, or short circuits. Always verify compliance with recognized standards (e.g., IEC 61439, UL, or local regulations) and source from reputable manufacturers with certified quality management systems.

Misunderstanding or Incorrect IP Rating Selection

The Ingress Protection (IP) rating defines the level of protection against solids and liquids. A common mistake is selecting a board with an IP rating unsuitable for its environment. For example, using an IP40-rated indoor DB board in a damp or outdoor location (where at least IP54 or higher is required) exposes internal components to moisture and dust, increasing the risk of electrical faults and corrosion. Conversely, overspecifying an unnecessarily high IP rating (e.g., IP66 for a dry indoor space) can inflate costs without benefit. Always assess the installation environment—such as exposure to dust, water, or chemicals—and match the IP rating accordingly.

Compromising on Certification and Regulatory Compliance

Using uncertified or non-compliant DB boards is a serious pitfall, especially in commercial or industrial projects. Boards lacking proper certification may not have been tested for thermal performance, short-circuit withstand, or insulation integrity. This not only violates electrical codes but also voids insurance and increases liability in case of failure. Always ensure the board carries the necessary certifications for your region (e.g., CE, UKCA, CCC, or UL) and confirm that the entire assembly—not just individual components—meets regulatory requirements.

Poor Design for Future Expansion and Maintenance

Many sourced DB boards lack adequate space for future circuit additions or have poor internal layout, making maintenance difficult. Overcrowded enclosures increase heat buildup and reduce safety during servicing. Boards with insufficient knockouts, limited DIN rail space, or awkward cable entry positions lead to installation challenges and potential damage to wiring. Choose DB boards with modular designs, adequate compartmentalization, and provisions for expansion to ensure long-term reliability and ease of maintenance.

Ignoring Environmental and Installation Conditions

Environmental factors such as temperature extremes, UV exposure, chemical fumes, or vibration can severely impact DB board performance. For instance, standard plastic enclosures may become brittle in cold climates or degrade under direct sunlight. Similarly, mounting a board in a high-vibration area without proper shock-absorbing features can loosen connections over time. Always consider the specific operating environment and select materials and designs suited to those conditions—such as stainless steel enclosures for corrosive areas or polycarbonate for UV resistance.

By avoiding these common pitfalls, you ensure the electrical distribution board you source is safe, reliable, compliant, and fit for its intended application.

Logistics & Compliance Guide for Electrical Distribution Boards (DB Boards)

Overview

Electrical Distribution Boards (DB Boards) are critical components in electrical systems, responsible for safely distributing power to various circuits within residential, commercial, and industrial facilities. Due to their safety-critical nature, the logistics and compliance processes for DB Boards must adhere to stringent international, national, and regional regulations. This guide outlines best practices and requirements for the safe handling, transportation, import/export, and regulatory compliance of electrical DB Boards.

Regulatory & Standards Compliance

International Standards

DB Boards must comply with internationally recognized standards to ensure safety and interoperability. Key standards include:

– IEC 61439 – Low-voltage switchgear and controlgear assemblies (covers design, testing, and performance of DB Boards).

– IEC 60364 – Electrical installations of buildings (guides proper integration within electrical systems).

– ISO 9001 – Quality management systems (ensures consistent manufacturing and supply chain practices).

Regional & National Regulations

Compliance varies by region and must be verified prior to import or installation:

– European Union (EU): CE marking required; compliance with the Low Voltage Directive (LVD) and Electromagnetic Compatibility (EMC) Directive.

– United Kingdom (UK): UKCA marking (post-Brexit); compliance with BS 7671 (IET Wiring Regulations).

– United States (US): UL 891 or UL 67 certification; National Electrical Code (NEC) compliance.

– Australia & New Zealand: Compliance with AS/NZS 3439 and AS/NZS 3000; RCM (Regulatory Compliance Mark) required.

– Canada: CSA C22.2 No. 31 or No. 250.20 standards; compliance with Canadian Electrical Code (CEC).

Manufacturers and importers must ensure product certification and technical documentation are up to date and available for audit.

Product Classification & HS Codes

For customs and import/export purposes, DB Boards are classified under Harmonized System (HS) codes. Typical classifications include:

– 8536.30 – Switches for voltage ≤ 1000 V

– 8537.10 – Boards, panels, consoles for electrical control

– 8535.20 – Fusegear and switchgear assemblies

Accurate classification ensures correct duty application and prevents customs delays. Consult local customs authorities or a licensed customs broker for precise code assignment.

Packaging & Handling Requirements

Proper packaging is essential to prevent damage during transit:

– Use robust, moisture-resistant packaging (e.g., corrugated cardboard with internal foam or wood crating for large enclosures).

– Secure components to prevent internal movement; label fragile parts.

– Include moisture-absorbing desiccants for long-distance or maritime shipments.

– Clearly label with handling instructions: “Fragile,” “This Side Up,” and “Do Not Stack.”

– Protect terminals and busbars with insulating caps or tape to prevent short circuits.

Transportation & Shipping

Land, Air, and Sea Freight

- Air freight: Suitable for urgent, smaller shipments; subject to IATA regulations for electrical equipment.

- Sea freight: Cost-effective for bulk shipments; use containerized shipping with climate-controlled options if needed.

- Overland transport: Use cushioned vehicles with secure load fastening to minimize vibration damage.

Temperature & Environmental Conditions

- Avoid extreme temperatures (typically store and transport between -10°C to +50°C unless specified otherwise by the manufacturer).

- Minimize exposure to humidity, dust, and corrosive atmospheres to prevent component degradation.

Import/Export Documentation

Ensure the following documents are prepared and accurate:

– Commercial Invoice (with detailed product description, value, and HS code)

– Packing List (itemizing contents and weights)

– Certificate of Conformity (CoC) or Test Reports (e.g., IEC 61439 compliance)

– Bill of Lading or Air Waybill

– Certificate of Origin (for preferential tariff treatment)

– Import Licenses or Permits (if required by destination country)

Customs Clearance & Duties

- Engage a licensed customs broker familiar with electrical equipment regulations.

- Provide complete technical specifications (voltage, current rating, materials, certifications).

- Anticipate potential inspections; have product samples and documentation readily available.

- Be aware of anti-dumping or safeguard duties that may apply in certain jurisdictions.

On-Site Receiving & Storage

Upon delivery:

– Inspect packaging for damage; document and report any issues immediately.

– Verify contents against packing list and purchase order.

– Store in a clean, dry, indoor environment off the ground.

– Avoid long-term outdoor storage; protect from moisture and temperature extremes.

– Retain all compliance documentation for installation and inspection purposes.

Installation & Final Compliance

Only qualified electricians should install DB Boards:

– Follow manufacturer’s installation instructions and local wiring regulations (e.g., BS 7671, NEC).

– Conduct initial verification tests (e.g., insulation resistance, continuity, earth fault loop impedance).

– Maintain complete records for certification and future audits (e.g., Electrical Installation Certificate).

Environmental & Disposal Compliance

- Comply with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

- Recycle metal enclosures and electronic components through authorized treatment facilities.

- Do not dispose of in general waste due to hazardous materials (e.g., PCBs in older models).

Summary

Safe and compliant logistics of Electrical DB Boards require attention to international standards, accurate documentation, proper handling, and adherence to local regulations. Proactive planning and verification at every stage—from manufacturing to installation—ensure reliability, legal compliance, and operational safety. Always consult regulatory bodies and certified professionals to stay updated on evolving requirements.

Conclusion for Sourcing Electrical DB Board

In conclusion, sourcing the appropriate electrical distribution board (DB board) is a critical step in ensuring the safety, efficiency, and reliability of any electrical installation. Through careful evaluation of technical specifications, load requirements, compliance with national and international standards (such as IEC, NEC, or local regulations), and the quality of components, a suitable DB board can be selected to meet the specific needs of the project.

Key considerations such as the number of ways, breaking capacity, short-circuit protection, ease of maintenance, and future expandability must be balanced with cost-effectiveness and supplier reliability. Engaging reputable suppliers or manufacturers with proven track records, proper certifications, and after-sales support further minimizes risks and ensures long-term performance.

Ultimately, a well-sourced DB board not only enhances electrical system integrity but also contributes to the overall safety of the installation, protecting equipment and occupants alike. A strategic sourcing approach—combining technical diligence, quality assurance, and value for money—leads to an optimal solution that supports efficient power distribution and sustainable operations.