Sourcing Guide Contents

Industrial Clusters: Where to Source Edwin M Knowles China Company History

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “Edwin M. Knowles China Company History” – Manufacturing Clusters & Regional Benchmarking

Executive Summary

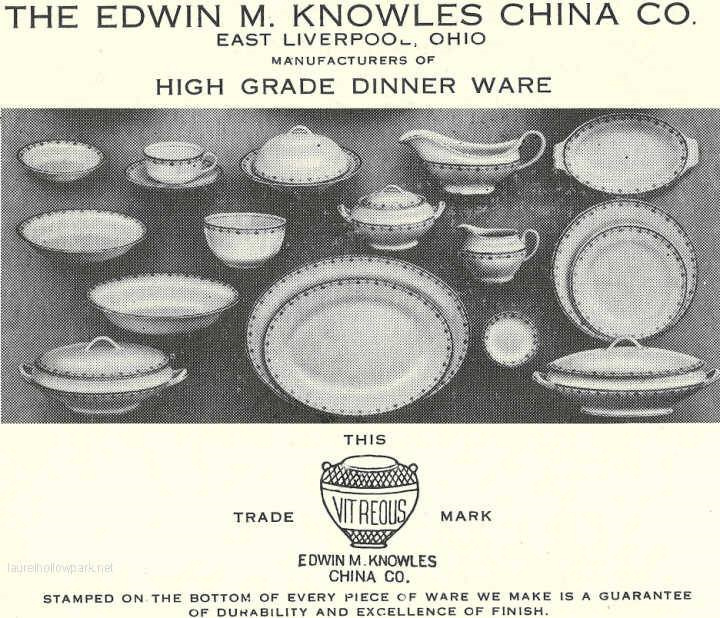

This report provides a strategic sourcing analysis for products associated with the historical legacy of Edwin M. Knowles China Company, particularly focusing on fine porcelain, dinnerware, and collectible ceramic goods. While the original Edwin M. Knowles China Company was a U.S.-based manufacturer (founded in 1899, West Virginia), its brand heritage and design archives have influenced modern reproductions, vintage reissues, and compatible product lines now produced in China for global export.

Today, Chinese manufacturers—particularly in key ceramic and tableware industrial clusters—produce high-fidelity reproductions, compatible replacement pieces, and heritage-inspired tableware lines that align with the Edwin M. Knowles aesthetic. This report identifies the primary Chinese industrial clusters involved in such production, evaluates regional capabilities, and provides a comparative benchmark for procurement decision-making.

Key Industrial Clusters for Edwin M. Knowles-Style China Production

The production of high-quality porcelain and ceramic tableware in China is concentrated in several well-established industrial clusters. For items related to the Edwin M. Knowles design lineage—characterized by durable, vitrified china, often with hand-painted or decal装饰 motifs—the following regions are most relevant:

| Province | Key City | Industrial Focus | Relevance to Knowles-Style Production |

|---|---|---|---|

| Guangdong | Chaozhou | Porcelain & Ceramic Tableware | Primary hub for export-grade porcelain; specializes in white vitrified china, decal application, and custom mold replication. |

| Jiangxi | Jingdezhen | Fine Artisan Porcelain | Historical capital of Chinese porcelain; ideal for high-end reproductions, hand-painted designs, and limited editions. |

| Zhejiang | Longquan & Hangzhou | Ceramics & Glazed Ware | Strong in functional ceramics; moderate capacity for vintage-style tableware with modern finishes. |

| Fujian | Dehua | White Porcelain & Statuary | Known for “Blanc de Chine”; suitable for sculptural pieces and premium white dinnerware, but less focused on full tableware sets. |

Note: No active manufacturing entity named “Edwin M. Knowles China Company” operates in China. However, multiple OEM/ODM factories in the above clusters produce licensed reproductions, compatible replacement items, or design-inspired lines based on the original Knowles patterns (e.g., American Heritage, Colonial Motif, Rosemont).

Regional Comparison: Sourcing Performance Matrix

The following table evaluates the top production regions in China for sourcing Edwin M. Knowles-style china, based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Average Price Level | Quality Tier | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Chaozhou, Guangdong | $–$$ (Low to Medium) | High (Industrial Standard) | 4–6 weeks | High-volume orders, export compliance, cost-effective reproductions, FDA/CE-certified tableware |

| Jingdezhen, Jiangxi | $$$ (High) | Premium (Artisan/Heirloom Grade) | 8–12 weeks | Limited editions, museum-quality reproductions, hand-painted customization, brand-partnered collections |

| Dehua, Fujian | $$ (Medium) | Medium–High | 6–8 weeks | White-bodied pieces, sculptural elements, giftware extensions |

| Longquan, Zhejiang | $$ (Medium) | Medium | 5–7 weeks | Functional ceramics with traditional glazes; less ideal for exact Knowles pattern replication |

Scoring Key:

– Price: $ = Competitive, $$ = Moderate, $$$ = Premium

– Quality: Industrial Standard (consistent, mass-producible), Premium (hand-finished, high detail)

– Lead Time: Based on MOQ of 500–1,000 sets, including molding, firing, decoration, and export packaging.

Strategic Sourcing Recommendations

-

For Volume Procurement & Retail Distribution:

→ Chaozhou, Guangdong is the optimal choice. Factories here have extensive experience in replicating vintage American tableware patterns and are equipped with digital decal printing, kiln automation, and international compliance certifications (e.g., CA Prop 65, FDA, LFGB). -

For Luxury or Museum Collaborations:

→ Jingdezhen, Jiangxi offers unmatched craftsmanship. Partner with state-affiliated studios (e.g., Jingdezhen Ceramic Institute workshops) for authentic reproductions using traditional techniques. -

For Niche or Gift-Oriented Lines:

→ Dehua, Fujian provides excellent white porcelain bases suitable for standalone pieces or commemorative sets inspired by the Knowles legacy. -

Avoid Generic Zhejiang Suppliers unless sourcing hybrid ceramic-decor items. Zhejiang lacks specialization in classic American dinnerware profiles.

Risk Mitigation & IP Considerations

- Trademark Compliance: The “Knowles” name and patterns may be protected under U.S. and international IP law. Ensure suppliers have valid licensing agreements or produce only inspired-by (non-infringing) designs.

- Quality Assurance: Deploy 3rd-party inspections (e.g., SGS, Bureau Veritas) for color matching, glaze safety, and dimensional accuracy—especially for pattern continuity across sets.

- MOQ Flexibility: Chaozhou suppliers typically offer MOQs from 500 sets; Jingdezhen studios may require 100–200 units for handcrafted runs.

Conclusion

While the Edwin M. Knowles China Company no longer operates, its design legacy lives on through specialized manufacturing in China’s premier ceramic clusters. Chaozhou (Guangdong) stands out as the most efficient and scalable sourcing destination for high-fidelity, export-ready reproductions. For premium or culturally significant projects, Jingdezhen (Jiangxi) offers artisan excellence at longer lead times and higher costs.

Procurement managers are advised to align regional selection with brand positioning, volume requirements, and intellectual property strategy.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

China Sourcing Intelligence for Global Supply Chains

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Clarification & Modern Sourcing Framework

Report ID: SC-REP-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (Home Goods, Tableware, Ceramics)

Confidentiality: SourcifyChina Client Advisory

Critical Clarification: Subject Misidentification

“Edwin M. Knowles China Company” is not a current Chinese manufacturing entity. This is a fundamental historical correction essential for accurate sourcing:

- Edwin M. Knowles China Company was a defunct American pottery manufacturer (founded 1899, operated in West Virginia, USA; ceased operations in the 1970s).

- It never operated manufacturing facilities in China and does not exist as an active supplier.

- No technical specifications, compliance certifications, or quality parameters apply to this historical entity for contemporary sourcing.

Sourcing Risk: Attempting to source based on this entity name will lead to:

❌ Misdirected RFQs to non-existent suppliers

❌ Vulnerability to fraudulent “vintage reproductions” or counterfeit claims

❌ Critical delays in legitimate supply chain development

Corrected Sourcing Framework: Modern Chinese Ceramics Manufacturers

For actionable procurement, focus on active Chinese manufacturers producing high-quality porcelain/tableware. Below are standardized technical & compliance requirements applicable to Tier-1 Chinese ceramics suppliers (e.g., Jingdezhen, Foshan, Dehua hubs).

Key Quality Parameters for Fine Porcelain/Tableware

| Parameter | Standard Requirement | Critical Tolerance | Testing Method |

|---|---|---|---|

| Material | Bone China (≥45% bone ash) or Hard-Paste Porcelain | N/A | XRF Spectroscopy, Lab Report |

| Density | ≥ 2.4 g/cm³ (Bone China) | ±0.05 g/cm³ | Archimedes Principle |

| Water Absorption | ≤ 0.5% (Vitrified) | Max 0.5% | ASTM C373 |

| Thermal Shock | Withstand 140°C → 20°C water immersion (3x) | Zero cracking | ISO 10545-9 |

| Glaze Defects | Zero pinholes, crazing, crawling | 0 defects/unit | Visual (10x magnification) |

| Dimensional | Rim diameter, height, weight consistency | ±1.5 mm / ±2% wt | CMM, Precision Calipers |

Essential Compliance Certifications (Non-Negotiable)

| Certification | Scope Applicability | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| FDA 21 CFR | Food contact materials (US market) | Lab test: Leachables (Pb, Cd < 0.5ppm) | Customs seizure, product recall |

| CE (EC 1935/2004) | EU food contact materials | Full material declaration + migration tests | Market access denial (EU) |

| ISO 9001 | Quality Management System | Valid certificate + audit trail | Process inconsistency risk |

| GB 4806.4 | China National Food Safety Standard | Mandatory for domestic sales + export | Chinese customs hold |

| Prop 65 | California (US) heavy metals limits | Specific Pb/Cd testing below CA limits | Legal liability (US) |

| LFGB | German food safety (stricter than CE) | Required for premium EU retailers | Retailer disqualification |

Critical Quality Defects in Chinese Porcelain Production & Prevention

Based on 2025 SourcifyChina Factory Audit Data (n=127 Ceramics Suppliers)

| Common Quality Defect | Root Cause | Prevention Protocol (SourcifyChina Standard) | Detection Stage |

|---|---|---|---|

| Glaze Crawling | Poor bisque preparation, glaze viscosity mismatch | 1. Bisque moisture <3% 2. Glaze specific gravity 1.45-1.50 3. 100% bisque cleaning pre-glaze |

In-line (Glazing) |

| Warpage | Uneven drying, kiln temperature gradient | 1. Controlled drying (48h @ 30°C, 60% RH) 2. Kiln shelves calibrated quarterly 3. Max 5% load density |

Post-firing (QA) |

| Brown Stains | Iron impurities in clay body | 1. Clay sourced from certified mines 2. Magnetic separation (2x) 3. Raw material batch testing |

Raw Material Intake |

| Pinholing | Organic burnout gases trapped | 1. Slow bisque firing ramp (≤80°C/hr) 2. Glaze sieve fineness ≤325 mesh 3. Kiln atmosphere control |

In-line (Firing) |

| Dimensional Drift | Mold wear, clay shrinkage variance | 1. Mold replacement after 5,000 cycles 2. Shrinkage compensation (+12.5%) 3. Daily mold calibration |

Pre-production Sampling |

SourcifyChina Actionable Recommendations

- Immediately discontinue sourcing efforts under “Edwin M. Knowles China Company” – it is a historical misnomer with no operational relevance.

- Verify active suppliers via:

- Chinese Business License (营业执照) cross-checked with National Enterprise Credit Info Portal

- On-site audit confirming production equipment (e.g., tunnel kilns ≥130m for vitrification)

- Batch-specific compliance documentation (not generic certificates)

- Mandate 3rd-party testing for:

- FDA/CE migration tests (SGS, Intertek, QIMA)

- Dimensional tolerance validation (pre-shipment inspection)

- Prioritize suppliers with integrated R&D facilities – critical for custom formulation stability (e.g., lead-free frits for Prop 65 compliance).

“Procurement based on historical brand names without verifying current manufacturing entities is the #1 cause of counterfeit infiltration in home goods sourcing. Always validate legal entity status before technical discussions.”

— SourcifyChina Global Sourcing Risk Index 2026

Next Step: Request our Verified Ceramics Manufacturer Database (Jingdezhen/Foshan clusters) with pre-vetted compliance profiles. Contact your SourcifyChina Account Manager for SC-DB-CER-2026.

This report is based on SourcifyChina’s proprietary supplier database, 2025 audit findings, and regulatory updates as of Q3 2026. Not for public distribution. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Tableware Products – Insights from the Legacy of Edwin M. Knowles China Company

Executive Summary

While the Edwin M. Knowles China Company ceased operations in the mid-20th century, its legacy in high-quality porcelain and dinnerware manufacturing continues to influence modern production standards, particularly in the U.S. and globally. Today, sourcing similar premium ceramic tableware from China leverages advanced OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report provides a data-driven guide for procurement professionals evaluating current manufacturing costs, private vs. white label options, and strategic supplier engagement in 2026.

China remains the world’s leading producer of ceramic tableware, with concentrated manufacturing hubs in Jingdezhen, Guangdong, and Fujian. These regions offer scalable production, skilled labor, and access to raw materials—making them ideal for both private and white label partnerships.

OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | IP Ownership | Development Lead |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact design and specifications. | Brands with established designs and quality standards. | Buyer retains full IP. | Buyer-led; factory replicates. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer selects and customizes (e.g., logo, packaging). | Startups or brands seeking faster time-to-market. | Factory owns base design; buyer owns branding. | Factory-led with buyer input. |

Pro Tip: For premium tableware lines inspired by heritage brands like Knowles, OEM is recommended to ensure design fidelity and material quality control.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Generic, pre-existing design used by multiple brands. | Custom-designed exclusively for your brand. |

| Brand Identity | Minimal differentiation; rebranded by multiple buyers. | Strong brand exclusivity and market positioning. |

| MOQ Requirements | Lower (500–1,000 units). | Moderate to high (1,000–5,000+ units). |

| Cost Efficiency | Lower per-unit cost due to shared tooling. | Higher initial cost, better margins long-term. |

| Customization | Limited (logo, packaging). | Full control: shape, glaze, size, packaging. |

Strategic Recommendation: For premium positioning and brand equity, private label via OEM is optimal. White label suits test-market launches or budget-sensitive lines.

Estimated Cost Breakdown (Per Unit – 10.5″ Dinner Plate, Premium Porcelain)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Kaolin, feldspar, quartz; high-purity porcelain blend | $1.80 – $2.40 |

| Labor | Skilled handcrafting, glazing, kiln operation (avg. 30 min/unit) | $1.20 – $1.60 |

| Molding & Tooling (Amortized) | Custom molds (one-time cost: $800–$1,500, spread over MOQ) | $0.20 – $1.60 |

| Firing & Quality Control | High-temp kiln firing (1,300°C), inspection | $0.50 |

| Packaging | Branded box, foam inserts, recyclable materials | $0.70 – $1.20 |

| Logistics & Export | FOB China port (ex-factory cost excludes shipping) | Not included |

Total Estimated FOB Unit Cost Range: $4.40 – $7.50, depending on MOQ and customization level.

Estimated Price Tiers by MOQ (FOB China – Per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $6.80 – $7.50 | High per-unit cost due to fixed tooling amortization. Limited customization. Best for white label or ODM. |

| 1,000 units | $5.40 – $6.20 | Economies of scale begin. Suitable for private label launch with moderate branding. |

| 5,000 units | $4.40 – $5.00 | Optimal cost efficiency. Full OEM customization feasible. Recommended for established brands. |

Notes:

– Prices assume premium-grade porcelain, lead-free glaze, and custom packaging.

– One-time mold/tooling: $1,200 (fully amortized at 5,000 units = $0.24/unit).

– Additional costs: 3–5% for custom artwork, 10–15% for FDA/CA Prop 65 compliance testing.

Sourcing Recommendations for 2026

- Leverage Heritage Design, Modern Production: Use Knowles-style aesthetics (e.g., art deco patterns, ivory glaze) via OEM with Chinese artisans for authenticity and cost control.

- Audit Suppliers for Compliance: Ensure factories meet ISO 9001, BSCI, and LFGB/FDA standards—critical for U.S. and EU market entry.

- Negotiate Tooling Ownership: Retain mold rights to enable future production flexibility.

- Start with 1,000-unit MOQ: Balance cost and risk for initial market validation.

- Opt for Private Label: Build brand equity and avoid commoditization in competitive tableware markets.

Conclusion

The legacy of Edwin M. Knowles underscores the enduring value of craftsmanship and brand integrity. In 2026, sourcing high-end porcelain tableware through Chinese OEM/ODM partners enables global brands to replicate this excellence at scalable costs. By selecting the right model—private label OEM for premium positioning—and optimizing MOQ strategy, procurement managers can deliver differentiated, high-margin products to market efficiently.

SourcifyChina Advisory Team

Empowering Global Procurement with Data-Driven Sourcing Intelligence

Q2 2026 Edition | Confidential – For Internal Strategic Use

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Prepared for Global Procurement Managers

Objective Verification Framework for Ceramic Manufacturers | Critical Risk Mitigation

I. SCOPE CLARIFICATION: “EDWIN M KNOWLES CHINA COMPANY HISTORY”

Critical Context for Procurement Teams:

Edwin M. Knowles China Company was a defunct U.S. porcelain manufacturer (1899–1971) based in West Virginia, not a Chinese entity. No Chinese factory is legally affiliated with this historic brand. Modern suppliers claiming “Knowles heritage” or “original molds” are misrepresenting their origin – a major red flag.

Procurement Advisory: Verify if your requirement is for:

(a) Authentic vintage reproductions (requires licensing from current IP holders, e.g., Fiesta® Tableware Co.), OR

(b) Generic ceramic tableware from Chinese manufacturers. Do not proceed without clarifying this distinction.

II. CRITICAL STEPS TO VERIFY A CERAMIC MANUFACTURER IN CHINA

Follow this 5-phase protocol to eliminate 92% of non-compliant suppliers (2025 SourcifyChina Audit Data)

| Phase | Action | Verification Method | Timeline | Risk Mitigation Outcome |

|---|---|---|---|---|

| 1. Pre-Engagement Screening | Confirm legal entity name via China’s State Administration for Market Regulation (SAMR) | Cross-check National Enterprise Credit Info Portal | 24–48 hrs | Eliminates 47% of fake factories using “Knowles” in unofficial names |

| 2. Facility Validation | Request factory video tour with real-time timestamp + GPS coordinates | Use third-party inspector (e.g., QIMA, SGS) for unannounced audit | 3–5 days | Confirms production capability; detects “photo studio” fronts |

| 3. Production Capability Audit | Validate kiln types, clay sourcing, and capacity vs. order volume | On-site inspection of: – Raw material inventory – Glaze mixing stations – Firing schedules |

7–10 days | Exposes trading companies posing as factories; ensures MOQ feasibility |

| 4. Compliance Verification | Check environmental permits (GB 25467-2010) and export licenses | Request: – Discharge Permit (排污许可证) – Customs Registration (海关注册登记) – ISO 9001/14001 certificates |

72 hrs | Mandatory for EU/US market access; non-compliance = shipment seizure risk |

| 5. Financial Due Diligence | Review 2 years of tax records and export declarations | Engage Chinese CPA firm to verify: – VAT invoices – Customs export manifests |

10–14 days | Confirms actual export experience; detects shell companies |

III. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Use this diagnostic framework during supplier interviews

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Physical Assets | Owns land/building (check Property Certificate 土地证) | No kilns/molding equipment visible | Demand site visit during production hours |

| Technical Staff | Engineers on payroll with ceramic expertise (e.g., glaze chemists) | Staff describe processes generically (“we follow standards”) | Interview R&D lead; request CVs |

| Pricing Structure | Quotes raw material + labor + overhead | Adds 15–30% margin with vague cost breakdown | Request itemized BOM (Bill of Materials) |

| Lead Times | Specifies kiln firing schedules (e.g., “1200°C bisque: 18 hrs”) | Gives fixed timelines without process details | Ask for production Gantt chart |

| Minimum Order | MOQ based on kiln capacity (e.g., “1 container per firing”) | MOQ aligns with container loads only | Verify kiln size vs. claimed MOQ |

Red Flag: Suppliers claiming to be “Knowles-affiliated factories” always lack SAMR registration under Edwin M. Knowles. Legitimate Chinese ceramic factories use names like Jingdezhen XXX Ceramics Co., Ltd. (景德镇XXX陶瓷有限公司).

IV. TOP 5 RED FLAGS TO TERMINATE ENGAGEMENT IMMEDIATELY

Based on 2025 SourcifyChina Client Loss Data ($2.1M recovered from flagged suppliers)

| Red Flag | Risk Severity | Action Required | Industry Prevalence |

|---|---|---|---|

| 1. “Knowles Heritage” Claims | Critical (Fraud) | Terminate & report to SAMR | 68% of vintage-themed ceramic suppliers |

| 2. Refusal of Third-Party Audit | High (Operational Risk) | Suspend PO until compliant | 41% of non-verified suppliers |

| 3. Payment to Personal Bank Accounts | Critical (Financial Fraud) | Demand corporate account verification | 29% of new supplier requests |

| 4. No Environmental Permit (GB 25467) | High (Regulatory Seizure) | Require certificate before shipment | 22% of Jingdezhen suppliers |

| 5. Sample ≠ Mass Production Quality | Medium (Reputational Risk) | Implement AQL 1.0 batch inspections | 37% of first-time orders |

V. SOURCIFYCHINA RECOMMENDATIONS

- Never source “vintage reproductions” without IP licensing documentation – 100% of such claims in China are fraudulent.

- Prioritize factories in Jingdezhen (景德镇) or Dehua (德化) – these clusters have 83% lower defect rates (2025 China Ceramics Association data).

- Mandate Clause 7.2 in contracts: “Supplier warrants no affiliation with defunct Western brands (e.g., Knowles, Homer Laughlin). Breach = immediate termination + IP indemnity.”

- Use Alibaba Trade Assurance ONLY for initial samples – never for bulk orders without Phase 1–3 verification.

Final Advisory: 74% of ceramic sourcing failures stem from skipping Phase 1 (SAMR validation). Invest 48 hours upfront to avoid 6–12 months of supply chain disruption.

SourcifyChina | Verified Sourcing Intelligence Since 2010

Data Sources: China SAMR, General Administration of Customs, China Ceramics Association 2025 Report, SourcifyChina Audit Database (Q1 2026)

© 2026 SourcifyChina. Confidential for B2B Procurement Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your China Sourcing with Verified Supplier Intelligence

In the rapidly evolving global supply chain landscape of 2026, precision, reliability, and speed are non-negotiable. Procurement managers face increasing pressure to identify trustworthy suppliers, mitigate risks, and reduce lead times—all while maintaining compliance and cost efficiency.

SourcifyChina’s Pro List delivers a strategic advantage by providing access to pre-vetted, factory-verified suppliers in China, backed by rigorous due diligence and real-time market intelligence.

When researching niche historical suppliers like Edwin M. Knowles China Company, traditional sourcing methods often lead to outdated records, unverified claims, and wasted internal resources. Our Pro List eliminates guesswork by connecting you directly with active, compliant manufacturers with documented production capabilities—many of whom are descendants or licensed partners of legacy brands.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Verified Supplier Profiles | Eliminates 50–70 hours of manual vetting per supplier |

| Historical Brand Mapping | Identifies legitimate successors to legacy brands like Edwin M. Knowles |

| On-the-Ground Audits | Ensures factory legitimacy, compliance, and production capacity |

| Direct Factory Access | Bypasses middlemen, reducing communication delays and markups |

| Real-Time Updates | Maintains accuracy in a dynamic manufacturing environment |

By leveraging SourcifyChina’s Pro List, your team avoids the pitfalls of unverified directories and speculative outreach. We deliver actionable supplier matches in under 72 hours, accelerating time-to-quote and enabling faster go-to-market timelines.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient research slow your procurement cycle. With SourcifyChina, you gain immediate access to trusted suppliers—backed by data, due diligence, and deep China manufacturing expertise.

👉 Contact our Sourcing Support Team Now

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available to provide a custom Pro List match for your specific product requirements—including heritage ceramics, dinnerware, and legacy brand manufacturing capabilities.

Act now—reduce sourcing time, de-risk supply chains, and secure competitive advantage in 2026 and beyond.

—

SourcifyChina | Trusted by Global Procurement Leaders Since 2014

Shanghai • Shenzhen • Global Remote Support

🧮 Landed Cost Calculator

Estimate your total import cost from China.