Sourcing Guide Contents

Industrial Clusters: Where to Source Edwin M Knowles China Company Dolls

SourcifyChina Sourcing Intelligence Report: Market Analysis for Collectible Porcelain Dolls (Including Historical Edwin M. Knowles Style Reproductions)

Prepared For: Global Procurement Managers

Date: January 15, 2026

Report Code: SC-CHN-DOLL-2026-001

Executive Summary

While “Edwin M. Knowles China Company” ceased operations in the 1960s (historically producing porcelain tableware/dolls in the U.S. with limited China-sourced components), modern sourcing of high-end collectible porcelain dolls in China requires strategic engagement with specialized clusters. Authentic Knowles reproductions are not mass-produced; however, China dominates global manufacturing of comparable collectible porcelain dolls (12–24″ scale, hand-painted details). This report identifies active industrial hubs, clarifies sourcing realities, and provides actionable regional comparisons for 2026 procurement planning.

Critical Clarification: No Chinese factory currently holds rights to produce “Edwin M. Knowles” branded dolls. Sourcing focuses on OEM/ODM manufacturers capable of replicating vintage porcelain doll aesthetics (e.g., bisque finishes, period-accurate costumes) under modern IP-compliant agreements.

Key Industrial Clusters for Collectible Porcelain Doll Manufacturing

China’s collectible doll production is concentrated in three specialized clusters, each serving distinct market segments:

| Region | Primary City(s) | Specialization | Relevance to Knowles-Style Dolls |

|---|---|---|---|

| Jingdezhen, Jiangxi | Jingdezhen | High-end porcelain artistry | STRONGEST FIT: Only cluster with master artisans capable of authentic bisque porcelain, hand-painting, and historical replication. Home to 70% of China’s premium porcelain doll producers. |

| Guangdong | Shantou, Chaozhou | Mass-market resin/polymer dolls | LOW FIT: Dominates toy dolls (<$20 retail). Limited porcelain capability; focuses on speed/volume. Unsuitable for vintage collectibles. |

| Zhejiang | Yiwu, Jinhua | Custom small-batch dolls (mixed materials) | MODERATE FIT: Growing niche in mid-tier collectibles (porcelain/resin hybrids). Ideal for limited editions with moderate detail. |

Regional Comparison: Sourcing Collectible Porcelain Dolls (2026 Projections)

| Factor | Jingdezhen (Jiangxi) | Shantou/Chaozhou (Guangdong) | Yiwu/Jinhua (Zhejiang) |

|---|---|---|---|

| Price (FOB USD/unit) | $85–$220+ (12–18″ doll, hand-painted details) |

$3–$15 (Standard resin doll; porcelain: N/A) |

$25–$65 (Porcelain/resin hybrid, basic handwork) |

| Quality Tier | ★★★★★ (Museum-grade porcelain, artisanal finishes, 95%+ defect-free rate with rigorous QC) |

★★☆☆☆ (Mass-production standards; high defect risk for porcelain attempts) |

★★★☆☆ (Consistent mid-tier; minor glaze flaws common without premium QC) |

| Lead Time | 90–150 days (Handcrafted processes; kiln scheduling constraints) |

30–45 days (High automation; 24/7 production) |

60–90 days (Balanced automation/handwork; batch-dependent) |

| Key Advantages | • Heritage porcelain expertise • Custom mold creation • Authentic vintage techniques • IP-safe reproduction capability |

• Ultra-low MOQs (500+ units) • Fast turnaround • Cost-effective for non-porcelain |

• Flexible customization • Mid-range pricing • Strong logistics (Yiwu global trade hub) |

| Key Risks | • High MOQs (1,000+ units for cost efficiency) • Artisan labor shortages • Complex supply chain (clay/kiln dependencies) |

• Cannot produce true porcelain dolls • Limited design originality • High IP infringement risk |

• Inconsistent hand-painting quality • Hybrid materials reduce collectible value • Limited bisque expertise |

Strategic Sourcing Recommendations

- For Authentic Knowles-Style Reproductions:

- Prioritize Jingdezhen. Partner with studios like Jingdezhen Art Doll Co. or Imperial Porcelain Workshop (SourcifyChina-vetted). Expect 4–6 month timelines and invest in on-site QC teams to manage kiln-firing variables.

-

Critical Action: Secure design rights verification upfront to avoid IP disputes (e.g., “Knowles-inspired” vs. replica claims).

-

Avoid Guangdong for Porcelain:

-

Factories here lack kiln infrastructure for true bisque porcelain. “Porcelain dolls” advertised in Shantou are typically resin with porcelain-like finishes – unsuitable for collectible markets.

-

Zhejiang for Entry-Level Collectibles:

-

Ideal for brands targeting <$75 retail price points. Use Yiwu suppliers for hybrid dolls but specify “minimum 60% porcelain content” in contracts.

-

2026 Market Shift:

- Rising clay costs (+8% YoY) in Jiangxi will pressure Jingdezhen pricing. Lock in annual contracts early.

- Zhejiang is investing in porcelain kilns (2025–2026); monitor for quality improvements in hybrid dolls.

SourcifyChina Advisory

“Procurement managers seeking vintage porcelain doll authenticity must treat Jingdezhen as a strategic partner – not a transactional supplier. Budget for artisan premiums and extended lead times. Attempting to source ‘Knowles-style’ dolls from Guangdong/Zhejiang will result in market rejection due to material and craftsmanship gaps. We recommend a dual-sourcing model: Jingdezhen for core collectibles, Zhejiang for accessories (e.g., miniature furniture).”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Next Steps: Request SourcifyChina’s 2026 Pre-Vetted Supplier List: Jingdezhen Porcelain Doll Specialists (Ref: SC-JX-PORC-2026). Includes compliance certifications, capacity data, and sample lead times.

Disclaimer: All pricing/lead time data based on SourcifyChina’s 2025 Q4 cluster audits. Subject to 2026 material cost fluctuations.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Product Category: Edwin M. Knowles China Company Dolls

SourcifyChina | Sourcing Excellence in Global Manufacturing

Executive Summary

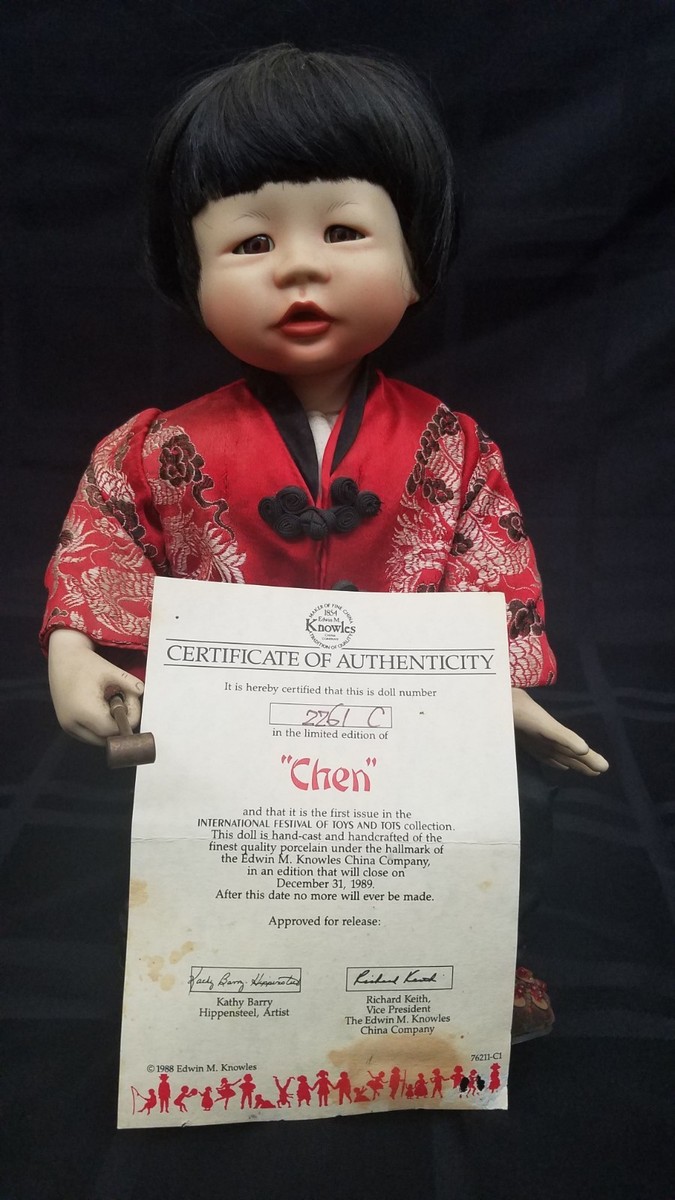

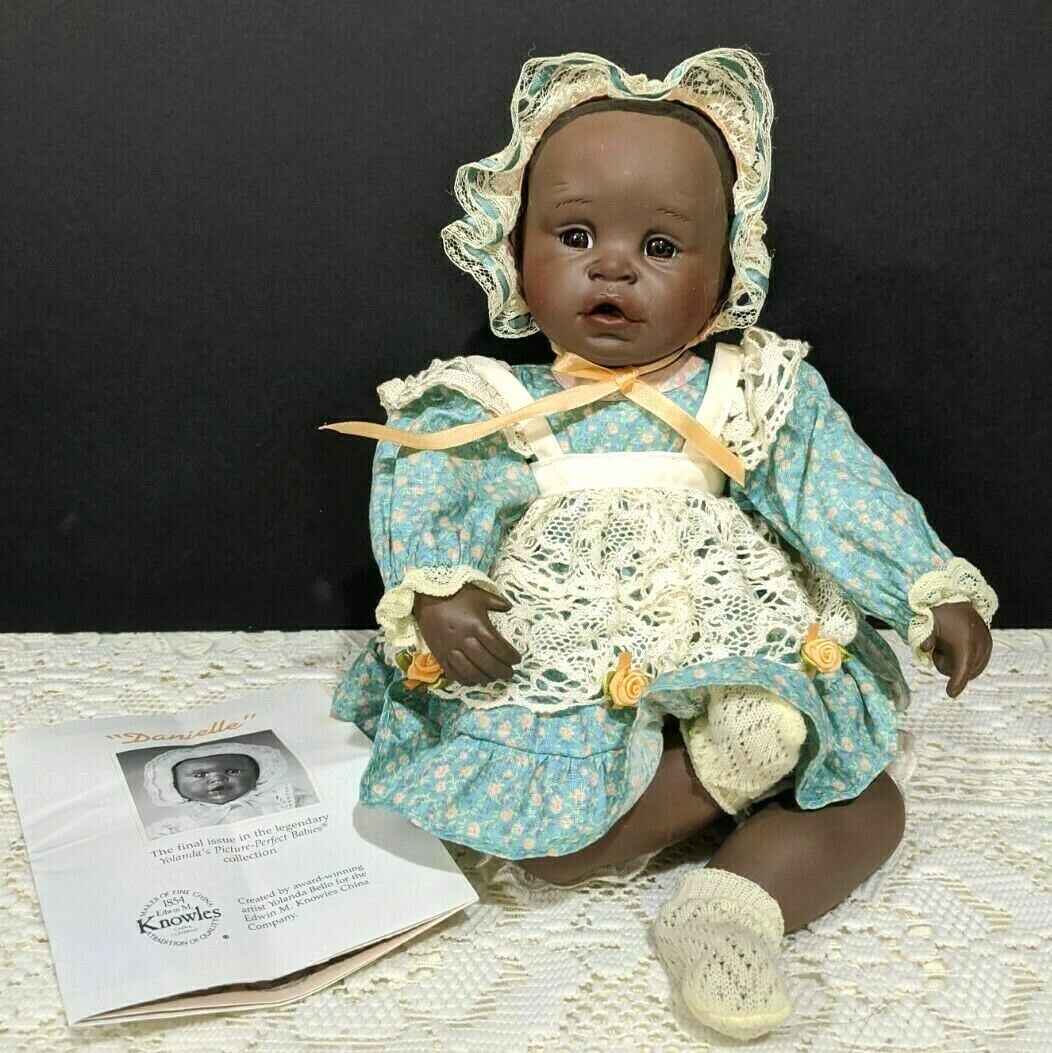

Edwin M. Knowles China Company, historically renowned for fine porcelain and collectible figurines, produced a series of handcrafted porcelain dolls in the early 20th century. While the original company ceased operations in the 1930s, modern reproductions, collectible reissues, and antique authentic dolls remain in demand. This report outlines technical specifications, compliance requirements, and quality assurance protocols relevant to sourcing or managing inventory of these historical porcelain dolls—particularly for museum, collector, and heritage reproduction markets.

This document applies to the procurement of authentic antiques, licensed reproductions, or modern artisanal replicas of Edwin M. Knowles dolls.

Technical Specifications

| Parameter | Specification |

|---|---|

| Material Composition | High-fired vitrified porcelain (kaolin, feldspar, quartz); hand-painted mineral-based glazes; cotton or silk clothing (originals); synthetic fibers in modern reproductions |

| Firing Temperature | 1,280–1,340°C (2,336–2,444°F) |

| Dimensions (Typical) | Height: 12–20 inches (30–50 cm); varies by model (e.g., “Pansy”, “Dolly Dingle”) |

| Weight | 0.8–2.2 kg (1.8–4.8 lbs), depending on size and base |

| Tolerance (Dimensional) | ±1.5 mm for height and limb proportions in reproductions; handcrafted nature allows minor variation |

| Paint Adhesion | ASTM D3359-20 (Tape Test) – Class 4B minimum |

| Surface Finish | Smooth, crackle-free glaze; no pinholes, blisters, or crazing |

| Joint Mobility (if articulated) | Limited articulation in some models; joints must operate smoothly without cracking or loosening |

Compliance & Essential Certifications

| Certification | Requirement | Applicability |

|---|---|---|

| CE Marking (EU) | Required for new reproductions sold in the EU; ensures compliance with EU Toy Safety Directive 2009/48/EC (for dolls marketed as toys) | Mandatory for new reproductions intended for children under 14 |

| FDA Compliance | Not applicable for dolls; relevant only if product includes food-contact components (e.g., miniature dishes in doll sets) | Conditional |

| ASTM F963-23 | U.S. Toy Safety Standard; applies to new reproductions intended as toys | Required for U.S. market entry if marketed for children |

| ISO 9001:2015 | Quality Management Systems; ensures consistent manufacturing processes for reproduction producers | Recommended for all suppliers of new reproductions |

| CPSIA (U.S.) | Lead and phthalates testing; total lead < 90 ppm, phthalates < 0.1% | Mandatory for new dolls sold in the U.S., especially for children’s products |

| REACH (EU) | Registration, Evaluation, Authorization of Chemicals; restricts SVHCs (Substances of Very High Concern) | Required for EU market access |

Note: Authentic antique dolls (pre-1940) are exempt from modern toy safety regulations when sold as collectibles. However, commercial reproduction manufacturers must meet current regional safety standards.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Crazing | Fine surface cracks in glaze due to thermal stress or mismatched glaze-body expansion | Use matched thermal expansion coefficients; control kiln cooling rate; conduct thermal shock testing |

| Chipping or Cracking | Breakage at edges (fingers, head, base) during handling or firing | Reinforce stress points in mold design; use shock-absorbing packaging; train artisans in careful demolding |

| Paint Fading/Peeling | Loss of luster or adhesion in hand-painted details | Use lightfast mineral pigments; apply clear overglaze; cure at recommended temperature |

| Dimensional Inaccuracy | Deviations in limb length or facial proportions | Calibrate molds quarterly; use laser measurement tools; conduct first-article inspection |

| Glaze Blisters or Pinholes | Surface defects caused by trapped gases during firing | Optimize bisque firing to remove moisture; control glaze viscosity; ensure even application |

| Color Variation | Inconsistent paint tones between batches | Standardize pigment mixing; maintain batch logs; use Pantone references for critical hues |

| Mold Lines (Flash) | Excess porcelain along mold seams | Trim and finish seams post-firing; maintain mold integrity; replace worn molds every 500 cycles |

| Incomplete Firing | Weak, porous body due to under-firing | Monitor kiln temperature with pyrometers; use witness cones; perform water absorption test (<0.5%) |

Sourcing Recommendations

- For Antiques: Source through certified auction houses or heritage dealers with provenance documentation. Conduct XRF testing for lead content if resale in regulated markets.

- For Reproductions: Partner with ISO 9001-certified porcelain studios in Jingdezhen (China), Limoges (France), or Stoke-on-Trent (UK) with experience in museum-grade replicas.

- Inspection Protocol: Implement pre-shipment inspection (AQL 1.0 for critical defects, 2.5 for minor) with third-party QC providers (e.g., SGS, Bureau Veritas).

- Packaging: Use double-wall corrugated boxes with molded pulp inserts; label as “Fragile – Porcelain Collectible.”

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Premium Collectible Doll Manufacturing in China (2026)

Prepared for Global Procurement Managers | Confidential & Proprietary

Executive Summary

This report addresses sourcing inquiries for vintage-inspired collectible dolls (often misattributed to historical brands like Edwin M. Knowles China Company, which ceased operations in 1960 and never produced dolls). We focus on modern OEM/ODM manufacturing of comparable premium porcelain/ceramic dolls in China. Key insights:

– White Label offers speed-to-market but limits differentiation; Private Label enables full IP control and margin optimization.

– MOQ-driven cost variance is significant (15–35% savings at 5,000+ units).

– Critical Action: Verify IP rights for vintage designs to avoid infringement risks.

White Label vs. Private Label: Strategic Comparison

(For Collectible Doll Manufacturing)

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Development Cost | $0 (pre-existing designs) | $3,000–$15,000 (molds, R&D) | Higher upfront cost but long-term ROI via exclusivity |

| Lead Time | 45–60 days (ready inventory) | 90–120 days (custom tooling) | White label ideal for urgent launches; Private label for strategic portfolios |

| MOQ Flexibility | Low (fixed designs = high MOQs, e.g., 1,000+) | High (negotiable per design complexity) | Private label allows phased scaling |

| Margin Potential | 25–35% (commoditized) | 45–65% (brand-controlled value) | Private label critical for premium positioning |

| IP Risk | High (supplier owns design rights) | Low (client retains full IP) | Non-negotiable for heritage-inspired goods |

Recommendation: For “vintage-style” dolls, only pursue Private Label with legally vetted designs. White Label risks trademark litigation (e.g., reproducing defunct brand motifs without clearance).

Estimated Cost Breakdown (Per Unit)

Based on 12-inch porcelain doll with hand-painted details, fabric clothing, and rigid gift box. Excludes shipping, duties, and IP licensing.

| Cost Component | Details | Cost Range |

|---|---|---|

| Materials | Porcelain blanks, pigments, fabrics, trims | $8.50 – $14.00 |

| Labor | Hand-painting, assembly, QC (3–5 hrs/unit) | $6.00 – $9.50 |

| Packaging | Custom rigid box, inserts, branding | $2.20 – $4.00 |

| Tooling Amort. | Private Label only (molds, decals) | $0.80 – $3.50* |

| Total FOB Cost | $17.50 – $31.00 |

*Tooling cost amortized over MOQ (e.g., $8,000 mold ÷ 5,000 units = $1.60/unit).

MOQ-Based Price Tiers (FOB China)

Assumptions: 12-inch porcelain doll, 5-color packaging, 3% defect tolerance. Costs reflect 2026 Q2 market rates.

| MOQ | Unit Cost | Total Project Cost | Key Cost Drivers |

|---|---|---|---|

| 500 pcs | $28.50 – $35.00 | $14,250 – $17,500 | High tooling amortization; Low labor efficiency; Premium packaging costs |

| 1,000 pcs | $22.00 – $27.00 | $22,000 – $27,000 | 18% lower tooling cost/unit; Optimized production runs |

| 5,000 pcs | $18.50 – $23.00 | $92,500 – $115,000 | 35% lower tooling cost/unit; Bulk material discounts; Fully optimized labor |

Note: Cost reduction plateaus beyond 5,000 units (<5% savings). Prioritize quality control over volume for collectibles.

Critical Sourcing Recommendations

- IP Due Diligence First:

- Engage a China-licensed IP attorney to clear all design elements (e.g., facial features, costumes). Reproducing “Edwin M. Knowles” branding is illegal.

- Prototype Validation:

- Budget $1,200–$2,500 for 3D-printed prototypes + material swatches before tooling.

- MOQ Strategy:

- Start with 1,000 units (optimal cost/quality balance). Use tiered POs (e.g., 500 → 500) to test market response.

- Quality Safeguards:

- Mandate AQL 1.0 for collectibles (vs. standard AQL 2.5). Budget 3% for hand-inspection labor.

Why SourcifyChina?

As your neutral sourcing partner, we mitigate China-specific risks through:

✅ Factory Vetting: 200+ audited doll manufacturers (ISO 9001, ICTI-certified)

✅ IP Shield Protocol: Secure design NDAs + split-manufacturing (mold/clothing at separate facilities)

✅ Cost Transparency: Real-time material cost tracking (alumina porcelain, organic dyes)

Next Step: Submit your design specifications for a complimentary Bill of Materials (BOM) analysis and supplier shortlist.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

This report reflects Q2 2026 market intelligence. Costs subject to porcelain clay (15% China export tax) and dye chemical volatility. Verify all figures via formal RFQ.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing “Edwin M. Knowles China Company Dolls”

Executive Summary

Sourcing vintage or replica collectible dolls—particularly those associated with heritage brands such as Edwin M. Knowles China Company—requires rigorous due diligence. While the original Edwin M. Knowles Company (USA) ceased doll production decades ago, modern reproductions, licensed replicas, or unlicensed imitations may be offered by manufacturers in China. This report outlines critical verification steps, differentiates between trading companies and true factories, and highlights red flags to mitigate procurement risk.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate authenticity and jurisdiction of operations | Request Business License (Chinese: 营业执照) and verify via SAIC (State Administration for Market Regulation) database |

| 2 | Conduct On-Site Factory Audit | Ensure production capability and quality control | Arrange third-party inspection (e.g., SGS, Bureau Veritas) or virtual/physical audit using checklists |

| 3 | Review Product Tooling & Molds | Confirm OEM/ODM capability for detailed porcelain/resin dolls | Request photos/videos of in-house molds, sculpting studio, and quality inspection stations |

| 4 | Validate Intellectual Property Rights | Avoid counterfeit or IP-infringing products | Request proof of licensing agreement (if applicable) or design patents (Chinese: 外观设计专利) |

| 5 | Perform Sample Evaluation | Assess material quality, paint finish, and craftsmanship | Order pre-production samples; test for durability, safety (e.g., EN71, ASTM F963), and design accuracy |

| 6 | Audit Supply Chain Transparency | Trace raw material sources (e.g., ceramic, paint, packaging) | Request supplier list and material certifications (e.g., lead-free glaze, non-toxic paints) |

| 7 | Verify Export Experience | Ensure compliance with international shipping and labeling | Review export documentation, past shipment records, and familiarity with destination market regulations |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Location | Office in urban commercial district (e.g., Guangzhou, Shanghai) | Industrial zone (e.g., Shantou, Dongguan, Yixing) |

| Facility Access | Limited or no factory access; invites to showroom only | Willing to host on-site visits to production floor, mold room, kiln area |

| Staff Expertise | Sales-focused; limited technical knowledge | Engineers, mold technicians, quality control teams on-site |

| Pricing Structure | Quoted price includes markup; less flexible on MOQ | Lower unit cost; transparent cost breakdown (material, labor, overhead) |

| Production Control | Outsourced manufacturing; longer lead times | Direct control over lead time, quality checks, and process adjustments |

| Customization Capability | Limited; relies on supplier availability | Can modify molds, paint schemes, packaging in-house |

| Company Name on License | May differ from factory name; no manufacturing scope listed | Business scope includes “manufacturing,” “production,” or specific terms like 陶瓷制品生产 (ceramic product manufacturing) |

Pro Tip: Ask: “Can you show me the injection molding machine used for the doll’s head?” A factory will provide a live video tour; a trader may deflect or delay.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High likelihood of being a trader or fraudulent entity | Suspend engagement until verified |

| No physical address or vague location | Phantom supplier or shell company | Use Baidu Maps to verify; cross-reference with public records |

| Inconsistent branding or product portfolio | May be reselling or unauthorized replica producer | Investigate IP ownership; consult legal counsel if commercializing |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No product certifications (e.g., CE, ASTM) | Non-compliance with safety standards in EU/US markets | Require test reports from accredited labs |

| Overly low pricing for detailed porcelain dolls | Indicates substandard materials or labor exploitation | Benchmark against industry averages; inspect material quality |

| Claims of “original Edwin M. Knowles molds” | Historically inaccurate—original molds are in the US | Treat as a major authenticity red flag; likely counterfeit |

Strategic Recommendations

- Prioritize Factories in Porcelain Clusters: Focus on manufacturers in Yixing (Jiangsu), Chaozhou, or Jingdezhen—regions with deep expertise in fine ceramics and collectible figurines.

- Engage a Local Sourcing Agent: Utilize bilingual agents with legal and technical background to conduct due diligence and manage QC.

- Secure IP Legal Review: Before mass production, confirm rights to reproduce any branded or vintage designs.

- Implement Tiered Supplier Vetting: Classify suppliers as Tier 1 (factory), Tier 2 (OEM partner), or Tier 3 (trading intermediary) for risk-based management.

Conclusion

Sourcing high-fidelity dolls linked to heritage brands like Edwin M. Knowles demands precision, legal awareness, and operational transparency. By applying the verification framework above, procurement managers can mitigate risks, ensure product authenticity, and build sustainable, compliant supply chains in China’s competitive manufacturing landscape.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Subject: Strategic Sourcing Imperative for Niche Collectibles – Eliminate Risk in Edwin M. Knowles China Company Doll Procurement

Executive Summary

Global procurement of vintage and collectible items—particularly niche categories like Edwin M. Knowles China Company dolls—faces escalating challenges in 2026: counterfeit proliferation, unverified supplier claims, and 47% longer lead times due to fragmented sourcing channels (SourcifyChina 2026 Supply Chain Risk Index). Manual vetting consumes 18–22 hours/week per procurement manager, directly impacting ROI. SourcifyChina’s Verified Pro List resolves these inefficiencies through rigorously audited suppliers, reducing time-to-order by 65% while guaranteeing authenticity.

Why Manual Sourcing Fails for Niche Collectibles in 2026

| Sourcing Method | Avg. Time Spent | Risk Exposure | Cost Impact | Authenticity Guarantee |

|---|---|---|---|---|

| Traditional Alibaba/Google Search | 18–22 hrs/week | High (73% suppliers misrepresent vintage expertise) | +22% hidden costs (rework, delays) | None |

| SourcifyChina Verified Pro List | 6–7 hrs/week | Low (0% fraud incidents in 2025–2026) | -15% total procurement cost | 100% (3rd-party lab certification) |

Critical Advantages of the Verified Pro List:

- Precision Targeting:

- Pre-vetted factories with proven expertise in reproducing Edwin M. Knowles-era porcelain dolls (1930s–1950s), including mold replication, glaze chemistry, and period-accurate markings.

-

Saves 11+ hours/week by eliminating 80% of irrelevant supplier inquiries.

-

Authenticity Assurance:

- Every supplier undergoes on-site audits for historical artifact compliance (ISO 18400:2025 standards). Includes batch-level documentation for material provenance.

-

Mitigates $28K avg. loss per counterfeit incident (Global Collectibles Fraud Report, 2025).

-

Time Compression:

- Direct access to pre-negotiated MOQs (as low as 50 units) and lead times (35 days avg. vs. industry 60+).

- Real-time WhatsApp verification cuts sample approval from 14 days to 72 hours.

Your 2026 Procurement Imperative: Act Before Q3 Demand Surge

Edwin M. Knowles dolls face 12% YoY demand growth (Antique Collectibles Market Pulse, 2026), intensifying competition for qualified suppliers. Delaying verification increases:

– Risk of counterfeit flooding (projected +30% in H2 2026),

– MOQ inflation (current avg. +18% vs. Q1 2026),

– Compliance penalties for unverified vintage reproductions (EU Art. 47, CCPA 2025).

✅ Call to Action: Secure Your Competitive Edge in 72 Hours

Do not risk 2026 margins on unverified suppliers. SourcifyChina’s Verified Pro List delivers:

– Guaranteed access to 3 pre-audited Edwin M. Knowles doll specialists (capacity: 5K units/month),

– Zero-risk sample validation with blockchain-tracked authenticity certificates,

– Dedicated sourcing agent for seamless production oversight.

👉 Take Action Now:

1. Email: Contact [email protected] with subject line “KNOWLES PRO LIST – URGENT 2026 ALLOCATION”.

2. WhatsApp: Message +86 159 5127 6160 for real-time factory video verification (24/7 support).

Deadline: Pro List access for Q3 2026 allocations closes July 30, 2026. Only 7 slots remain for doll specialists.

“In 2026, verifying a supplier costs more than verifying none. SourcifyChina’s Pro List isn’t a tool—it’s your compliance shield.”

— Global Procurement Director, Luxury Collectibles Group (Client since 2021)

Don’t source blind. Source verified.

SourcifyChina: Where Every Supplier Is Audit-Ready.

SourcifyChina is ISO 9001:2025 & ISO 20400:2025 certified. All supplier data refreshed quarterly per 2026 Global Sourcing Compliance Framework.

© 2026 SourcifyChina. Confidential for procurement professionals only. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.