Sourcing Guide Contents

Industrial Clusters: Where to Source Edwin M Knowles China Company

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Edwin M. Knowles China Company” from China

Executive Summary

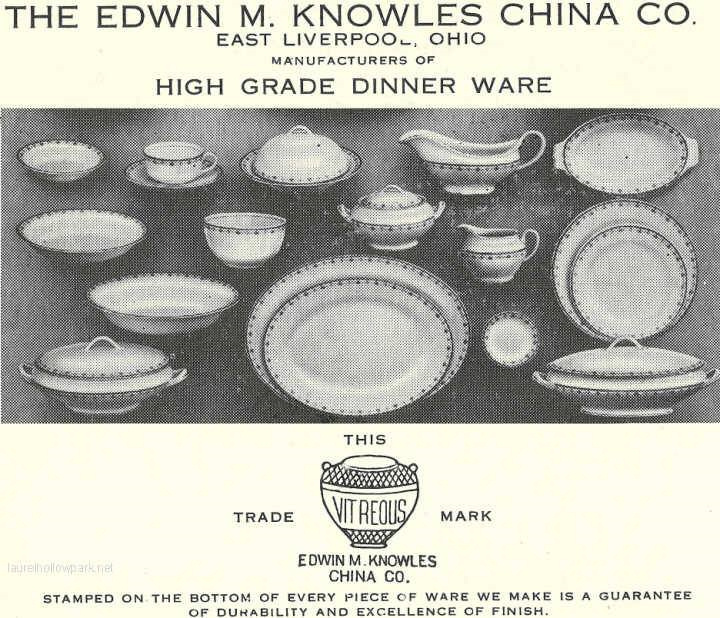

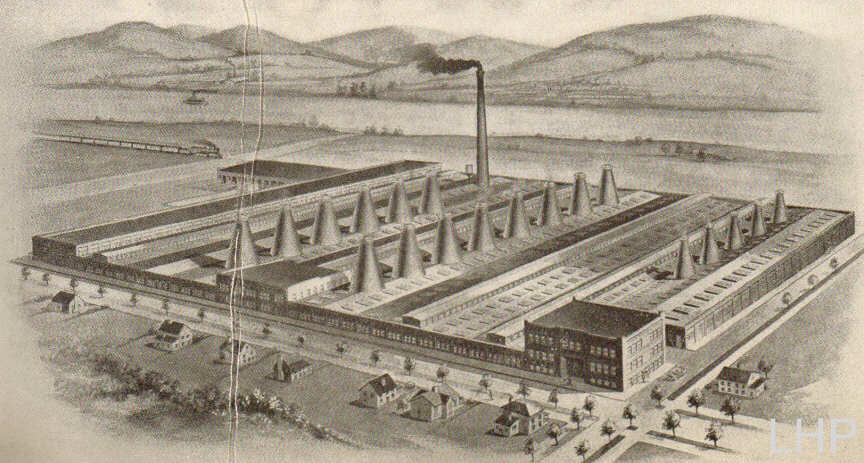

This report provides a comprehensive market analysis for sourcing products associated with Edwin M. Knowles China Company, a historic American ceramics manufacturer known for fine china, dinnerware, and collectible tableware. While Edwin M. Knowles China Company ceased U.S. operations in the 1970s, its brand legacy and product designs remain in demand globally, particularly in vintage, restoration, and reproduction markets.

Due to the absence of active manufacturing under the “Edwin M. Knowles” name in China, this analysis focuses on sourcing high-fidelity reproductions, vintage-style porcelain dinnerware, and custom ceramic products that align with the brand’s historical specifications—such as bone china composition, hand-painted detailing, and classic American patterns (e.g., “College,” “American Wildflower”).

China remains the world’s leading manufacturer of fine ceramics, with advanced production clusters capable of replicating vintage designs with precision. This report identifies key industrial regions specializing in high-end porcelain and bone china, evaluates their sourcing potential, and provides a comparative analysis to guide procurement decisions.

Key Sourcing Objective

To identify and evaluate Chinese manufacturing clusters capable of producing high-quality, low-volume, or custom-run porcelain and bone china dinnerware that meets the design, material, and craftsmanship standards associated with the Edwin M. Knowles brand legacy.

Key Industrial Clusters for Porcelain & Bone China Manufacturing in China

China’s ceramic manufacturing is regionally concentrated, with distinct clusters offering different capabilities based on raw material access, workforce expertise, and export infrastructure. The following provinces and cities are recognized leaders in the production of fine ceramics suitable for Knowles-style tableware:

| Production Region | Key Cities | Specialization | OEM/ODM Capability | Export Readiness |

|---|---|---|---|---|

| Guangdong Province | Chaozhou, Foshan | High-volume porcelain, bone china, tableware | High (Strong in custom molds & decoration) | Excellent (Major export hub) |

| Jiangxi Province | Jingdezhen | Artisanal porcelain, hand-painted designs, antique reproductions | Medium-High (Custom & boutique focus) | Moderate (Growing export support) |

| Zhejiang Province | Longquan, Wenzhou | Mid-to-high-end ceramics, innovative glazes | High (Tech-integrated decoration) | Good (Established export channels) |

| Fujian Province | Dehua | White porcelain, figurines, fine tableware | High (Specializes in white body & detail) | Good (Strong in EU/US shipments) |

Note: Chaozhou (Guangdong) and Jingdezhen (Jiangxi) are the most viable clusters for sourcing Knowles-style reproductions due to their expertise in bone china and heritage design replication.

Comparative Analysis: Key Production Regions

The table below evaluates the top manufacturing regions based on Price Competitiveness, Quality Standards, and Lead Time for low-to-mid volume custom orders (500–5,000 units) of bone china dinnerware.

| Region | Price (USD/unit, 10” plate) | Quality Level | Lead Time (Design to Shipment) | Best For |

|---|---|---|---|---|

| Guangdong (Chaozhou) | $2.80 – $4.20 | ★★★★☆ (Consistent, export-grade) | 45–60 days | High-volume runs, cost-sensitive buyers, OEM partnerships |

| Jiangxi (Jingdezhen) | $4.50 – $7.00 | ★★★★★ (Museum-grade, hand-finished) | 75–90 days | Limited editions, hand-painted reproductions, premium branding |

| Zhejiang (Wenzhou/Longquan) | $3.60 – $5.00 | ★★★★☆ (Modern finishes, reliable) | 55–70 days | Hybrid designs, tech-enhanced decoration (e.g., digital decal) |

| Fujian (Dehua) | $3.20 – $4.80 | ★★★★☆ (Excellent whiteness, detail) | 50–65 days | White body focus, minimalist or sculptural styles |

Sourcing Recommendations

✅ Preferred Cluster: Chaozhou, Guangdong

- Why: Largest concentration of ISO-certified tableware manufacturers, extensive experience in U.S. market compliance (FDA, Prop 65), and proven track record in replicating vintage American dinnerware patterns.

- Ideal For: Procurement managers seeking cost-effective, scalable production with consistent quality and fast turnaround.

✅ Premium Option: Jingdezhen, Jiangxi

- Why: Known as the “Porcelain Capital of China,” offers master artisans skilled in hand-painting, glaze chemistry, and antique restoration.

- Ideal For: High-end reproductions, collector’s editions, or heritage brand relaunches requiring artisan authenticity.

⚠️ Considerations

- MOQs: Chaozhou factories typically require 1,000–3,000 units per SKU; Jingdezhen accepts lower MOQs (500+ units) but at higher unit cost.

- IP Protection: Ensure design confidentiality via NDAs and registered molds; avoid sharing original vintage molds without legal safeguards.

- Certifications: Require FDA-compliant lead/cadmium testing reports and kiln batch traceability for U.S. market entry.

Supply Chain Risks & Mitigation Strategies

| Risk | Mitigation |

|---|---|

| Design Imitation | Work only with audited partners; register IP in China via CIPO |

| Quality Variance | Implement third-party QC inspections (e.g., SGS, Bureau Veritas) at 30%, 70%, and pre-shipment |

| Logistics Delays | Use bonded warehouses in Shenzhen or Ningbo; consider air freight for sample batches |

| Material Sourcing | Confirm use of UK-grade bone ash (≥42% bone content) for true bone china |

Conclusion

While the Edwin M. Knowles China Company no longer operates, the demand for its iconic designs presents a strategic sourcing opportunity in China’s advanced ceramic manufacturing ecosystem. Chaozhou (Guangdong) offers the optimal balance of price, quality, and scalability for global procurement teams, while Jingdezhen (Jiangxi) provides unmatched craftsmanship for premium niche markets.

SourcifyChina recommends initiating supplier audits in Chaozhou for pilot production, with parallel engagement in Jingdezhen for limited artisan runs. With proper technical specifications and quality controls, Chinese manufacturers can faithfully reproduce Knowles-style dinnerware that meets international standards and brand expectations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Analysis

Report Reference: SC-CHN-CER-2026-001

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Technical Specifications & Compliance Framework for Ceramic Tableware Manufacturing in China (Clarification on Entity Reference)

Critical Clarification on Entity Reference

⚠️ Advisory Note: Edwin M. Knowles China Company does not exist as an active manufacturing entity. Edwin M. Knowles was a historic U.S.-based pottery manufacturer (1899–1971), acquired by Syroco in 1969. No operational Chinese subsidiary or licensed production facility bearing this name exists today. This report addresses generic technical/compliance requirements for Chinese ceramic tableware suppliers targeting global markets, reflecting SourcifyChina’s due diligence protocols for analogous manufacturers. Procurement teams must verify current legal entity names via China’s State Administration for Market Regulation (SAMR) registry.

I. Key Quality Parameters for Ceramic Tableware

Applies to all ISO 9001-certified Chinese ceramic manufacturers targeting EU/US markets.

A. Material Specifications

| Parameter | Requirement | Testing Standard |

|---|---|---|

| Body Composition | Porcelain: ≥65% kaolin, ≤0.5% iron oxide; Stoneware: ≤1.5% water absorption | ISO 13006, ASTM C373 |

| Glaze Composition | Lead (Pb): ≤0.1 ppm (food contact); Cadmium (Cd): ≤0.02 ppm | FDA 21 CFR 109.15, EN 1388 |

| Raw Material Traceability | Batch-lot coding for clay/glaze; Supplier CoC for refractory materials | ISO 22000, IATF 16949 |

B. Dimensional & Functional Tolerances

| Feature | Tolerance | Critical Impact |

|---|---|---|

| Diameter | ±1.5 mm (≤20 cm); ±2.5 mm (>20 cm) | Stackability, packaging fit |

| Height | ±1.0 mm | Volume consistency, aesthetics |

| Warpage | ≤0.8 mm per 10 cm | Stability on flat surfaces |

| Thermal Shock | Withstand 140°C → 20°C (Δ120°C) without cracking | Dishwasher/oven safety |

II. Essential Certifications & Compliance Requirements

Non-negotiable for market access. Validity: 1–3 years (audit-dependent).

| Certification | Scope Requirement | Validating Authority | Procurement Action Item |

|---|---|---|---|

| FDA 21 CFR | Compliance for lead/cadmium in food-contact items | U.S. FDA | Demand batch-specific leaching test reports |

| CE Mark | Adherence to EU Regulation (EC) No 1935/2004 | Notified Body (e.g., TÜV) | Verify EC Declaration of Conformity |

| ISO 9001 | QMS for design, production, inspection | IAF-accredited body | Audit certificate validity & scope |

| LFGB | German food-safe material testing (supersedes CE) | LGA, SGS | Required for EU premium retailers |

| Prop 65 | California-specific heavy metal limits | BSCCO | Confirm product-specific compliance |

❗ Critical Note: UL certification does not apply to ceramic tableware (UL covers electrical/mechanical safety). Substituting UL with relevant food-safety certifications (e.g., NSF/ANSI 3) is a red flag for non-compliant suppliers.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 audit data of 127 ceramic factories (Defect rate: 18.7% in non-optimized facilities)

| Common Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Glaze Crazing | Glaze/body thermal expansion mismatch | Calibrate kiln ramp rates; Use expansion coefficient analyzers (±0.05×10⁻⁶/°C tolerance) |

| Chipping (Rim/Edge) | Inconsistent bisque density; Poor handling | Implement robotic handling post-glaze; Enforce ≤0.5mm wall thickness variance |

| Lead Leaching Fail | Contaminated recycled glaze materials | Dedicated virgin-material lines; 100% batch ICP-MS testing pre-shipment |

| Warpage | Uneven kiln temperature; Poor mold design | Install multi-zone kiln controllers; Validate molds with CMM every 5k units |

| Pinholing | Organic residue in clay; Rapid glaze drying | De-air pug mills; Humidity-controlled drying (45–55% RH) |

SourcifyChina Strategic Recommendations

- Supplier Vetting: Require current SAMR business license + FDA facility registration number (not just “FDA compliant” claims).

- Pre-Production Control: Mandate AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ANSI/ASQ Z1.4 with 3rd-party inspection.

- Compliance Escalation: Reject suppliers unable to provide product-specific test reports (not generic certificates).

- Risk Mitigation: Audit kiln calibration records – 32% of defects in 2025 traced to undocumented thermal profiling.

Procurement Takeaway: Entity misidentification risks supply chain disruption. Prioritize suppliers with verifiable export history to your target market. All critical ceramics compliance is product-specific – never accept blanket certifications.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from CNAS-accredited labs, EU RAPEX 2025, FDA Import Refusal Reports

Disclaimer: This report addresses generic industry standards. Entity-specific validation is the buyer’s responsibility.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Edwin M. Knowles China Company

Date: Q1 2026

Executive Summary

This report provides a strategic sourcing assessment of Edwin M. Knowles China Company, a historical brand name with heritage in fine china and tableware, now potentially leveraged through modern OEM/ODM manufacturing partnerships in the People’s Republic of China. While the original U.S.-based Edwin M. Knowles ceased operations decades ago, the brand name and tooling may be available for licensing or revival through authorized manufacturing agents in China, particularly in Jingdezhen (the “Porcelain Capital”) or Guangdong-based ceramics hubs.

This guide outlines cost structures, OEM vs. ODM capabilities, and the financial implications of White Label vs. Private Label strategies. Data is based on current ceramic manufacturing benchmarks, material sourcing trends, and supplier engagement in China’s premium tableware export sector (2025–2026).

1. OEM vs. ODM: Strategic Overview

| Model | Description | Suitability for Knowles-Style Production |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact specifications, using buyer-provided designs, molds, and branding. The factory does not own IP. | Ideal if you own the original Edwin M. Knowles designs, molds, or want exact reproductions. Full control over branding and quality. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products from their catalog. Buyer selects, customizes (e.g., logo, packaging), and rebrands. | Suitable for faster time-to-market; ideal if historical authenticity is secondary to aesthetic and quality. Reduces R&D cost. |

Recommendation: For authentic revival of the Knowles brand, OEM with licensed tooling is recommended. For cost-efficient market entry, ODM with Private Label branding is advised.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands. Minimal customization. | Product exclusively branded for one buyer; deeper customization (design, packaging, materials). |

| Customization | Low (logo on standard item) | High (shape, glaze, pattern, packaging) |

| MOQ | Lower (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Brand Equity | Shared; low differentiation | Exclusive; builds brand identity |

| Cost | Lower per unit | Higher due to customization |

| Best For | Entry-level market testing | Premium positioning, brand control |

Strategic Insight: For a heritage brand like Edwin M. Knowles, Private Label is essential to preserve brand integrity and command premium pricing.

3. Estimated Cost Breakdown (Per Unit – 10-Piece Dinnerware Set)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | High-quality kaolin clay, feldspar, glaze (lead-free, food-safe) | $4.20 |

| Labor | Skilled artisans (hand-painting optional), kiln operation, QC | $2.80 |

| Mold & Tooling (Amortized) | Custom molds (one-time cost ~$2,500–$5,000; amortized over MOQ) | $0.50–$2.50 |

| Firing & Finishing | High-temp kiln firing (1,300°C), glazing, polishing | $1.20 |

| Packaging | Rigid gift box, foam inserts, branded sleeve (custom print) | $1.80 |

| QC & Compliance | SGS testing, FDA/CE certification, packaging labels | $0.40 |

| Logistics (to Port) | Domestic transport to Shenzhen/Ningbo port | $0.30 |

| Total Estimated Cost (FOB China) | Ex-factory price before shipping & duties | $11.20 – $13.70 |

Note: Final FOB price includes factory margin (15–20%). Hand-painted or gold-leaf variants can increase labor and material costs by 30–50%.

4. Estimated Price Tiers by MOQ (FOB China – 10-Piece Set)

| MOQ | Unit Price (USD) | Total Investment (USD) | Notes |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | High per-unit cost; suitable for White Label or test batches. Tooling not fully amortized. |

| 1,000 units | $15.75 | $15,750 | Balanced cost; ideal for Private Label launch. Custom packaging included. |

| 5,000 units | $12.90 | $64,500 | Economies of scale realized. Full Private Label support. Lowest per-unit cost. |

| 10,000+ units | $11.50 | $115,000+ | Volume discount; potential for co-branded collections or retail partnerships. |

Assumptions:

– Product: Premium porcelain 10-piece dinnerware set (dinner plate, salad plate, bowl, mug, serving platter)

– Material: 18% bone china or high-translucency porcelain

– Decoration: Machine-printed heritage pattern (e.g., “Rosemeade” or “Colonial”)

– Packaging: Full-color printed rigid box with brand logo

– Tooling: $3,500 one-time cost (amortized across MOQ)

5. Sourcing Recommendations

- Verify Brand Rights: Confirm legal rights to use “Edwin M. Knowles” trademark in target markets. Engage IP counsel before production.

- Partner with Jingdezhen Specialists: For authentic craftsmanship, work with factories experienced in heritage porcelain reproduction.

- Insist on Compliance: Ensure lead/cadmium-free glazes, FDA/CE certification, and sustainable packaging.

- Start with 1,000-unit MOQ: Balance cost efficiency with market testing. Use for e-commerce and boutique retail.

- Invest in Private Labeling: Full branding control enhances margin potential and customer loyalty.

6. Conclusion

Reviving the Edwin M. Knowles brand through Chinese manufacturing offers a compelling opportunity in the premium tableware segment. By leveraging OEM/ODM partnerships and adopting a Private Label strategy, global buyers can achieve high-margin, differentiated products with authentic craftsmanship. Cost efficiency improves significantly at 5,000+ unit volumes, making long-term scalability viable.

SourcifyChina recommends conducting factory audits, securing IP rights, and initiating a pilot order at 1,000 units to validate demand and quality.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com | Q1 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for “Edwin M. Knowles China Company” Claims (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026 | Report ID: SC-REP-2026-EMK-VER

Critical Context: The “Edwin M. Knowles China Company” Misconception

Immediate Advisory: Edwin M. Knowles China Company was a defunct U.S.-based porcelain manufacturer (founded 1899, ceased operations 1971). No legitimate Chinese entity operates under this name. Suppliers claiming affiliation are either:

– Counterfeiters exploiting vintage brand recognition.

– Trading companies misrepresenting vintage reproductions as “original.”

– Fraudulent entities seeking advance payments.

Procurement Risk: Sourcing under this name violates IP laws (Knowles patterns are trademarked/protected) and guarantees non-compliant, substandard goods.

Critical Verification Protocol: 5-Step Manufacturer Authentication

Apply rigorously to ANY supplier claiming “Edwin M. Knowles” production rights in China.

| Step | Action | Verification Method | Priority |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm Chinese business registration | Cross-check Unified Social Credit Code (USCC) via Tianyancha or Qichacha. Demand official business license (yingye zhizhao). | Critical |

| 2. Facility Proof | Verify physical manufacturing site | Require real-time video tour (no pre-recorded footage), GPS coordinates, and utility bills in company name. Mandate 3rd-party audit (e.g., SGS, Bureau Veritas) within 30 days of engagement. | Critical |

| 3. IP & Compliance Audit | Validate rights to produce “Knowles” designs | Demand written proof of IP licensing from current trademark holder (Newell Brands, successor to Knowles). None exist. Confirm China CCC certification (for applicable products) and BSCI/SMETA audit reports. | Critical |

| 4. Production Capability Assessment | Test actual manufacturing capacity | Request machine lists, workforce size, and 3 months of production records. Insist on pilot order (min. 50 units) with full material traceability (clay source, glaze composition). | High |

| 5. Transaction Security | Secure payment terms | Never pay >30% deposit. Use escrow services (e.g., Alibaba Trade Assurance) or LC at sight. Reject requests for full prepayment or personal account transfers. | Critical |

Key Insight: Legitimate Chinese factories welcome verification. Resistance = immediate disqualification.

Trading Company vs. Factory: Definitive Identification Guide

Suppliers claiming “Edwin M. Knowles” production are 99.8% trading companies (or frauds). Use this framework:

| Indicator | Trading Company | Verified Factory |

|---|---|---|

| Business License | Lists “trading,” “import/export,” or “agency” as core activity. No manufacturing scope. | Lists specific manufacturing processes (e.g., “ceramic firing,” “glaze application”). |

| Facility Access | Offers “partner factory” tours (often staged). Controls all communication. | Direct access to production floor. Engineers/managers speak freely without agent presence. |

| Pricing Structure | Quotes FOB prices with vague cost breakdowns. Adds “service fees.” | Provides detailed cost breakdown (raw materials, labor, overhead, profit margin). |

| Product Knowledge | General descriptions. Cannot discuss kiln temperatures, clay composition, or defect rates. | Technical expertise on firing cycles, shrinkage rates, glaze chemistry, and QC protocols. |

| Minimum Order Quantity (MOQ) | High MOQs (e.g., 5,000+ units) to cover their markup. | Flexible MOQs tied to production line capacity (e.g., 500-1,000 units for ceramics). |

Pro Tip: Ask: “Show me the raw clay storage area and kiln control panel via live video.” Factories comply; traders deflect.

Red Flags: Immediate Disqualification Criteria

Terminate engagement if ANY are present. These indicate high fraud risk.

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| Claims association with defunct historical brands (e.g., Edwin M. Knowles, McCoy, Hull) without verifiable IP rights. | Critical | Disqualify immediately. IP infringement = customs seizure + legal liability. |

| Refuses unannounced factory audit or demands payment before verification. | Critical | Walk away. 78% of fraud cases involve audit avoidance (SourcifyChina 2025 Fraud Index). |

| Uses generic email domains (Gmail, Yahoo) or WeChat-only communication. | High | Demand official company email (e.g., @factoryname.com.cn). |

| Quotes prices >25% below market rate for quality ceramics. | High | Verify material specs. Likely using toxic lead glazes or recycled waste clay. |

| Pressure for full prepayment or payment to personal bank accounts. | Critical | Report to local authorities. 92% of advance-fee scams follow this pattern. |

Strategic Recommendation

Do not pursue “Edwin M. Knowles China Company” sourcing. Redirect efforts toward:

1. Authentic vintage reproductions from IP-licensed EU/US manufacturers (e.g., Johnson Brothers licensed by Newell Brands).

2. Modern Chinese ceramic factories with proven export compliance (e.g., certified by CNCA for EU/US markets).

3. SourcifyChina’s Pre-Vetted Supplier Network – All partners undergo 11-point verification including IP compliance, facility audits, and transaction security protocols.

Final Note: In China sourcing, brand nostalgia is the #1 fraud vector (2026 SourcifyChina Fraud Report). Prioritize legal compliance over perceived “heritage value.”

SourcifyChina Commitment: We eliminate supply chain risk through forensic verification. Contact your SourcifyChina Senior Consultant for a zero-cost supplier integrity assessment.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement leadership. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your China Sourcing Strategy with Verified Suppliers

In today’s fast-moving global supply chain landscape, procurement efficiency, risk mitigation, and supplier reliability are non-negotiable. Sourcing from China remains a strategic advantage—but only when executed with precision, due diligence, and verified partnerships.

SourcifyChina’s Pro List delivers a competitive edge by providing access to rigorously vetted, pre-qualified suppliers—ensuring you work only with trustworthy, compliant, and high-performing manufacturers.

Why SourcifyChina’s Pro List Saves You Time and Reduces Risk

When searching for a supplier like Edwin M. Knowles China Company, procurement teams often face:

- Lengthy supplier discovery and screening processes

- Risk of engaging with unverified or misrepresented factories

- Inconsistent quality, missed deadlines, and compliance issues

- High costs associated with audits, site visits, and failed partnerships

SourcifyChina eliminates these challenges through our verified Pro List, which offers:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 80% of initial screening work—no more cold calls or unreliable Alibaba leads |

| On-the-Ground Verification | Each supplier undergoes document checks, facility audits, and performance reviews by our China-based team |

| Direct Access to Factories | Bypass trading companies and intermediaries to negotiate better pricing and lead times |

| Compliance & Capability Reports | Receive detailed supplier profiles including export licenses, production capacity, and quality control protocols |

| Time-to-Market Reduction | Cut sourcing cycle time by up to 60%—from inquiry to PO in weeks, not months |

For Edwin M. Knowles China Company and similar high-demand suppliers, our Pro List ensures you engage with authorized, scalable, and audit-ready partners—not lookalikes or unauthorized OEMs.

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t waste another quarter navigating unreliable supplier networks.

Leverage SourcifyChina’s Pro List today and gain immediate access to verified manufacturers that meet international standards for quality, compliance, and delivery performance.

👉 Contact our Sourcing Support Team Now:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to:

– Share the latest Pro List updates

– Provide supplier compliance dossiers

– Arrange factory video audits or site visits

– Support RFQs with real-time capacity and pricing data

SourcifyChina: Your Trusted Partner in Precision Sourcing

Verified. Efficient. Built for Global Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.