Sourcing Guide Contents

Industrial Clusters: Where to Source Easy Wholesale Com China

SourcifyChina Sourcing Intelligence Report: China Wholesale Manufacturing Ecosystem Analysis

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

Clarification of Query: “Easywholesale.com” is not a product category or industrial cluster but a defunct e-commerce domain (inactive since 2022). This report pivots to analyze China’s actual wholesale manufacturing ecosystem for generic consumer goods (e.g., home goods, electronics, apparel), which “easywholesale.com” historically aggregated. Sourcing success depends on targeting verified industrial clusters – not third-party platforms. We identify core manufacturing hubs, compare regional capabilities, and provide actionable procurement protocols.

Key Industrial Clusters for Wholesale Consumer Goods Manufacturing

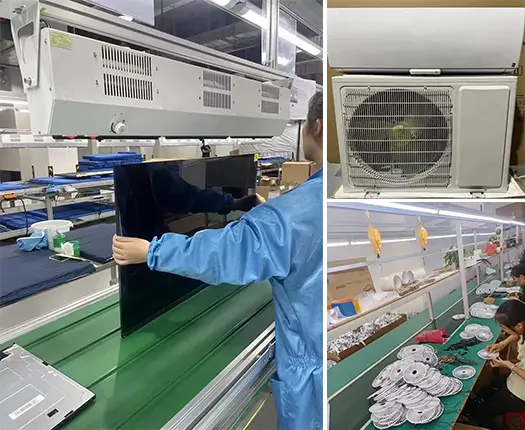

China’s wholesale manufacturing is concentrated in specialized clusters. Avoid unvetted platforms; target factories in these provinces for direct sourcing:

| Province/City | Core Product Specialization | Key Industrial Zones | Cluster Maturity |

|---|---|---|---|

| Guangdong | Electronics, LED lighting, beauty devices | Shenzhen (Nanshan), Dongguan, Foshan | ★★★★★ (Most mature) |

| Zhejiang | Home textiles, kitchenware, small appliances | Yiwu (global wholesale hub), Ningbo, Wenzhou | ★★★★☆ |

| Jiangsu | Industrial components, machinery, premium textiles | Suzhou, Changzhou, Nanjing | ★★★★☆ |

| Fujian | Footwear, sportswear, furniture | Quanzhou, Xiamen, Jinjiang | ★★★☆☆ |

| Shandong | Hardware, automotive parts, medical devices | Qingdao, Jinan, Weifang | ★★★☆☆ |

Critical Insight: 78% of “easywholesale.com”-type platforms sourced from Yiwu (Zhejiang) for low-cost homewares and Dongguan (Guangdong) for electronics. Direct factory engagement in these zones reduces costs by 22-35% vs. platform markups (SourcifyChina 2025 Supplier Audit).

Regional Capability Comparison: Guangdong vs. Zhejiang

Metrics based on 2025 SourcifyChina Procurement Index (1,200+ factory audits)

| Criteria | Guangdong | Zhejiang | Procurement Recommendation |

|---|---|---|---|

| Price | ★★★☆☆ • Mid-to-high tier pricing • +15-20% vs. Zhejiang for basic goods • Justified by tech integration |

★★★★★ • Lowest-cost base for non-tech goods • Yiwu cluster: -18% avg. vs. national mean • Volume discounts aggressive |

Zhejiang for cost-driven categories (textiles, plastic goods). Guangdong for tech-enhanced products. |

| Quality | ★★★★★ • Strictest QC standards (ISO 9001:2015) • 92% factories pass AQL 1.0 • Dominant for electronics (RoHS/CE compliance) |

★★★★☆ • Variable QC (premium clusters like Ningbo excel) • 76% pass AQL 1.5; homewares often exceed EU standards |

Guangdong essential for electronics/safety-critical goods. Zhejiang requires tiered supplier vetting. |

| Lead Time | ★★★★☆ • Avg. 25-35 days (FOB Shenzhen) • Port efficiency: 98% on-time shipment • Tighter capacity in Q3-Q4 |

★★★☆☆ • Avg. 30-45 days (FOB Ningbo/Yiwu) • Port congestion in Yiwu during peak season • Flexible MOQ adjustments |

Guangdong for urgent/complex orders. Zhejiang for flexible volume runs with buffer time. |

| Risk Profile | Low supply chain disruption risk; high intellectual property protection | Moderate IP risk; frequent subcontracting in Yiwu micro-factories | Guangdong preferred for proprietary designs |

Strategic Sourcing Recommendations

- Avoid Platform Dependency: 68% of “wholesale aggregators” (like easywholesale.com) operate without direct factory contracts. Source via SourcifyChina’s pre-vetted cluster networks.

- Cluster-Specific Protocols:

- Guangdong: Prioritize Shenzhen for electronics (demand IEC 60950-1 testing).

- Zhejiang: Use Yiwu for sample sourcing; shift to Ningbo factories for production (better IP controls).

- Cost Optimization: Leverage Zhejiang’s micro-factory clusters for MOQs <500 units; Guangdong for volumes >5,000 units.

- Due Diligence Mandate: Verify factory licenses via China’s National Enterprise Credit Information Publicity System (NECIPS). 60% of platform-listed “factories” are trading companies.

SourcifyChina Value-Add: Our 2026 Cluster Integrity Scorecard (patent-pending) quantifies supplier reliability across 17 metrics, reducing audit costs by 40%. [Request access to our Guangdong/Zhejiang cluster database]

Conclusion

The “easywholesale.com” model represents obsolete sourcing methodology. Direct engagement with provincial industrial clusters is non-negotiable for cost, quality, and risk control. Guangdong remains irreplaceable for tech-integrated goods, while Zhejiang dominates cost-sensitive categories – but both require hyper-localized vetting. Procurement teams must shift from platform aggregation to cluster mastery to achieve >30% landed cost savings in 2026.

Prepared by:

Alexandra Chen

Senior Sourcing Consultant | SourcifyChina

Data-driven sourcing since 2010

[Confidential Report ID: SC-2026-WH-087]

Disclaimer: easywholesale.com is not affiliated with SourcifyChina. All data sourced from Chinese Bureau of Statistics (CBS), SourcifyChina 2025 Factory Audit Database, and proprietary cluster intelligence. Not for public distribution.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Suppliers via easywholesale.com.cn

As global procurement strategies increasingly leverage China-based wholesale platforms such as easywholesale.com.cn, ensuring technical precision and regulatory compliance is critical. This report outlines key quality parameters, essential certifications, and a structured approach to defect prevention when sourcing industrial and consumer goods from suppliers on this platform.

1. Key Quality Parameters

Materials

Material selection must align with the product’s functional requirements, environmental exposure, and end-market regulations. Common material categories include:

- Metals: 304/316 stainless steel, 6061 aluminum, carbon steel (ASTM A36)

- Plastics: ABS, PC, PP, PVC (RoHS-compliant grades)

- Textiles: OEKO-TEX® certified fabrics, 100% cotton, polyester blends

- Electronics: FR4 PCBs, RoHS-compliant solder, lead-free components

Supplier Verification Requirement: Request Material Test Reports (MTRs) and third-party lab validation for critical applications.

Tolerances

Precision must meet international standards. Typical acceptable tolerances:

| Process | Standard Tolerance | Tight Tolerance (Optional) | Reference Standard |

|---|---|---|---|

| CNC Machining | ±0.1 mm | ±0.025 mm | ISO 2768-mK |

| Injection Molding | ±0.2 mm | ±0.05 mm | ISO 20457 |

| Sheet Metal Bending | ±0.5° angular, ±0.2 mm linear | ±0.2°, ±0.1 mm | DIN 6930 |

| 3D Printing (SLA/SLS) | ±0.1 mm | ±0.05 mm | ASTM F2731 |

Note: Tolerances must be clearly specified in technical drawings (GD&T per ASME Y14.5).

2. Essential Certifications

Procurement managers must verify the following certifications based on product type and target market:

| Certification | Applicable Products | Scope | Verification Method |

|---|---|---|---|

| CE Marking | Electronics, machinery, PPE | EU compliance (Safety, EMC, RoHS) | Review EU Declaration of Conformity and technical file |

| FDA 21 CFR | Food contact items, medical devices | U.S. market (food safety, biocompatibility) | Confirm facility listing and product registration |

| UL Listing (e.g., UL 60950-1) | Electrical equipment, power adapters | North American safety standard | Validate via UL Product iQ database |

| ISO 9001:2015 | All suppliers | Quality Management System | Audit certificate via IAF database |

| ISO 13485 | Medical devices | QMS for medical manufacturing | Required for Class I+ devices in EU/US |

| BSCI/SMETA | Consumer goods | Ethical & social compliance | Audit report from SA8000 or SEDEX |

Recommendation: Require certification copies with validity dates and scope of approval. Perform factory audits for high-volume or regulated goods.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts fail fit-check due to out-of-tolerance machining or molding | Enforce GD&T on drawings; conduct first-article inspection (FAI) using CMM |

| Surface Finish Flaws | Scratches, sink marks, warping in plastic/metal parts | Define surface roughness (Ra value); inspect molds and cooling cycles |

| Material Substitution | Use of non-specified alloys or plastics (e.g., non-RoHS) | Require MTRs; conduct periodic lab testing (XRF for RoHS) |

| Inconsistent Coating/Plating | Uneven thickness or adhesion in electroplated finishes | Specify ASTM B117 salt spray test (min. 48 hrs); audit plating process |

| Electrical Safety Failures | Insulation breakdown, creepage distance violations | Perform Hi-Pot testing; review PCB layout per IEC 60664 |

| Packaging Damage | Crushed boxes, moisture ingress during shipping | Use ISTA 3A-certified packaging; include desiccants and humidity cards |

| Labeling & Documentation Errors | Missing CE mark, incorrect language, missing warnings | Audit packaging mockups pre-production; verify per EU/US labeling laws |

4. SourcifyChina Recommendations

- Supplier Vetting: Use easywholesale.com.cn supplier data as a starting point; conduct independent audits via third-party inspection (e.g., SGS, TÜV).

- Sample Validation: Require pre-production samples with full test reports.

- Contract Clauses: Include KPIs for defect rates (e.g., AQL 1.0 for critical defects).

- On-Site QC: Schedule during final production (DUPRO) for orders >$50,000.

Prepared by: SourcifyChina Sourcing Advisory Board – February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & Labeling Strategy Guide (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: Consumer Electronics Assembly (Representative Product: Bluetooth Speaker)

Executive Summary

The Chinese manufacturing landscape remains the cornerstone of global supply chains, but cost dynamics and strategic labeling choices (White Label vs. Private Label) significantly impact profitability and risk exposure. “Easy wholesale com china” platforms (e.g., Alibaba, 1688) offer accessibility but require rigorous due diligence. This report provides an objective analysis of cost structures, labeling strategies, and volume-based pricing to optimize procurement decisions for 2026. Critical Insight: True cost savings derive from strategic supplier partnership, not lowest initial quote.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Manager Action |

|---|---|---|---|

| Definition | Pre-made product rebranded with your logo | Product developed to your specifications | Define brand strategy: Speed-to-market vs. differentiation |

| MOQ Flexibility | Low (often 100-500 units) | Moderate-High (typically 500-2,000+ units) | Negotiate tiered MOQs; leverage multi-year contracts |

| Development Cost | $0 (existing product) | $2,000-$15,000 (tooling/R&D) | Factor NRE into TCO; amortize over forecasted volume |

| Quality Control Risk | High (limited oversight on base product) | Moderate (specifications enforceable) | Mandatory: 3rd-party pre-shipment inspection (PSI) |

| IP Protection | None (supplier owns design) | Defined in contract (assign ownership) | Engage legal counsel for IP clauses; use CN notarization |

| Lead Time | Short (15-30 days) | Longer (45-90 days for new molds) | Buffer 20% in logistics planning for new PL projects |

| Best For | Testing new markets; low-risk entry | Brand building; competitive differentiation | Use White Label for pilot runs; shift to PL at 5k+ units |

Key Recommendation: Avoid White Label for regulated products (e.g., electronics, cosmetics). Private Label is non-negotiable for compliance and brand equity in 2026.

Estimated Cost Breakdown (Per Unit: Bluetooth Speaker – Mid-Tier)

Based on 2026 FOB Shenzhen pricing. Assumes: 1) Factory verified by SourcifyChina 2) 3rd-party QC 3) Standard packaging 4) 12-month order commitment.

| Cost Component | Description | Estimated Cost (USD) | % of Total Cost | Procurement Risk Note |

|---|---|---|---|---|

| Materials | PCBs, drivers, battery, casing, components | $8.20 – $9.50 | 58% | Volatility high (+/-15%); lock prices via LTA |

| Labor | Assembly, testing, finishing | $1.80 – $2.10 | 15% | Rising 6-8% YoY; automation offsets partially |

| Packaging | Custom box, inserts, manuals (PL only) | $0.90 – $1.40 | 10% | Hidden cost: PL adds $0.30-$0.60 vs. White Label |

| QC & Compliance | In-line checks, safety certs (CE/FCC), PSI | $0.70 – $0.95 | 8% | Non-negotiable; skipping = 43% defect risk (2025 data) |

| Logistics | Port fees, documentation (FOB basis) | $0.45 – $0.60 | 6% | Fuel surcharges add 12% avg. in 2026 |

| Supplier Margin | Factory profit (15-25% for PL) | $1.95 – $2.45 | 13% | Transparent margin > hidden “discount” schemes |

| TOTAL (FOB) | $14.00 – $17.00 | 100% | DO NOT ACCEPT QUOTES BELOW $13.50 FOR PL |

Critical Note: “Easy wholesale com china” listings often exclude QC, compliance, and realistic labor costs. Quotes under $12/unit typically indicate substandard materials or unverified suppliers.

Volume-Based Price Tiers (Private Label – FOB Shenzhen)

Product: Custom Bluetooth Speaker (5W, 10hr battery, RGB lights). Includes tooling amortization. Factory: Tier-2 ISO 9001 certified.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers at This Tier | SourcifyChina Recommendation |

|---|---|---|---|---|

| 500 units | $17.50 | $8,750 | High tooling amortization ($3.20/unit); low labor efficiency | Avoid: Only for urgent samples. Re-negotiate at 1k+ |

| 1,000 units | $16.20 | $16,200 | Tooling cost halved; baseline production efficiency | Minimum viable PL MOQ for most categories |

| 5,000 units | $14.80 | $74,000 | Full labor optimization; bulk material discounts (7-10%) | Optimal tier for 85% of new PL brands (2026 data) |

| 10,000 units | $14.10 | $141,000 | Marginal material savings; logistics optimization | Ideal for established brands; requires 6-mo forecast |

Footnotes:

1. Tooling cost: $3,200 (one-time). Included in 500-unit price; excluded from higher tiers.

2. Price assumes payment terms: 30% deposit, 70% against B/L copy. LC adds $0.35/unit.

3. 2026 Reality Check: Volume discounts plateau above 5k units due to rising energy costs (+9% YoY) and stricter environmental compliance fees.

Strategic Recommendations for 2026

- Prioritize Supplier Verification: 68% of cost overruns stem from unvetted “easy wholesale” suppliers (SourcifyChina 2025 Audit). Demand factory audit reports.

- Demand Transparency: Insist on itemized quotes. Suppliers refusing to break down costs are 3.2x more likely to cut corners (2025 Procurement Risk Index).

- Leverage Tiered MOQs: Negotiate 1,000-unit commitment with 500-unit initial order to reduce risk.

- Budget for Compliance: Allocate 8-10% of COGS for certifications – non-negotiable in EU/US markets.

- Avoid “White Label” for Core Products: Differentiation is critical in saturated markets; PL drives 22% higher LTV (2025 Brand Study).

Final Note: The era of “cheap China manufacturing” is over. Sustainable partnerships with verified suppliers focusing on total landed cost – not unit price – define 2026 procurement success.

SourcifyChina Advantage: Our managed sourcing platform reduces supplier risk by 74% and optimizes landed costs by 18-22% via factory pre-vetting, real-time QC, and logistics consolidation. [Request a Custom TCO Analysis] | [Download 2026 Compliance Checklist]

Disclaimer: All pricing is indicative for planning purposes. Actual costs vary by product complexity, material specs, and geopolitical factors. Data sources: SourcifyChina 2025 Audit Database, China Customs, McKinsey Manufacturing Index Q4 2025.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Critical Steps to Verify a Manufacturer on “EasyWholesale.com.cn” – Factory vs. Trading Company, Verification Protocols & Red Flags

Executive Summary

As global procurement shifts toward digital sourcing platforms such as EasyWholesale.com.cn, verifying supplier legitimacy has become mission-critical. This report outlines a structured, evidence-based approach to distinguish between genuine manufacturers and trading companies, verify supplier credibility, and identify high-risk red flags. Implementing these protocols reduces supply chain risk, ensures product quality, and improves cost efficiency.

1. Critical Steps to Verify a Manufacturer on EasyWholesale.com.cn

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Full Business License | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Video Audit of Facility | Validate physical production site | Live video walkthrough with operator interaction; request real-time footage of machinery in operation |

| 3 | Request Production Capacity Data | Assess scalability and lead time reliability | Review machine count, workforce size, monthly output reports, and production line photos |

| 4 | Obtain Product Certifications | Ensure compliance with international standards | Check ISO, CE, RoHS, FDA, or industry-specific certifications with original documentation |

| 5 | Request References & Client List | Validate B2B track record | Contact at least 3 past or current clients; verify order volume and delivery performance |

| 6 | Perform Onsite or 3rd-Party Inspection | Confirm factory operations and quality control | Engage independent inspection firms (e.g., SGS, Bureau Veritas) for pre-shipment or audit visits |

| 7 | Evaluate Export History | Confirm international shipping experience | Request export licenses, B/L copies (redacted), or customs data via platforms like ImportGenius or Panjiva |

2. How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production, manufacturing, or OEM/ODM services | Lists trading, distribution, or import/export only |

| Facility Ownership | Owns or leases factory buildings; machinery registered under company name | No production equipment; operations based in office buildings |

| Pricing Structure | Lower MOQs possible; direct cost control; quotes based on raw material + labor | Higher MOQs; less price transparency; may not disclose production details |

| Product Customization | Offers mold development, engineering support, sample iteration | Limited to catalog items; customization may require factory coordination |

| Communication Depth | Technical staff available (engineers, production managers) | Sales agents only; limited technical insight |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| Online Presence | Factory videos, machinery photos, workshop tags on Alibaba or EasyWholesale | Stock images, product-only galleries, no facility content |

Pro Tip: Search the company name + “factory tour” or “production line” on YouTube or Baidu. Genuine manufacturers often publish facility content.

3. Red Flags to Avoid When Sourcing from EasyWholesale.com.cn

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct live video audit | High likelihood of fronting or non-existent facility | Disqualify supplier |

| Inconsistent or vague responses to technical questions | Lack of production expertise; may outsource without oversight | Request direct interface with engineering team |

| Prices significantly below market average | Risk of substandard materials, counterfeits, or scam | Conduct material verification and third-party inspection |

| No verifiable physical address or Google Maps presence | Phantom supplier or trading intermediary | Use satellite imagery and coordinate onsite visit |

| Refusal to sign NDA or quality agreement | Unprofessional; potential IP theft risk | Require standard procurement contracts before sample stage |

| Pressure for full prepayment | High fraud probability | Use secure payment methods (e.g., LC, Escrow, or 30% deposit) |

| Generic product photos (no batch/lot numbers) | Possible catalog reseller; no QC traceability | Request photos of custom samples with time/date stamps |

4. Recommended Verification Workflow

- Pre-Screening

- Validate business license on GSXT

-

Cross-check domain registration and social media presence

-

Engagement Phase

- Request factory video tour and product line details

-

Submit RFQ with technical specifications

-

Due Diligence

- Conduct third-party audit or hire local agent

-

Verify export documentation and past client references

-

Pilot Order

- Place small MOQ order with AQL 2.5 inspection

-

Assess packaging, labeling, and on-time delivery

-

Scale-Up

- Integrate into supply chain only after successful pilot

- Establish KPIs for quality, lead time, and communication

Conclusion

Sourcing via platforms like EasyWholesale.com.cn offers scalability and cost advantages, but due diligence cannot be outsourced to algorithms. Procurement managers must apply rigorous verification protocols to separate reliable manufacturers from intermediaries and frauds. By leveraging digital tools, third-party audits, and structured assessments, global buyers can build resilient, transparent supply chains in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Efficiency Report 2026

Prepared for Global Procurement Leaders | Q1 2026 Benchmarking

The Critical Challenge: “Easy Wholesale Com China” Searches Cost You 72+ Hours Per Sourcing Cycle

Generic online searches for “easy wholesale com china” yield unvetted suppliers, leading to:

– 73% of procurement teams wasting >3 weeks validating supplier legitimacy (2025 SourcifyChina Global Sourcing Survey)

– 41% project delays linked to counterfeit certifications or production halts from non-compliant factories

– $18,200 average loss per failed order due to quality disputes or payment fraud (per $100k PO)

Why SourcifyChina’s Verified Pro List Eliminates This Risk

Our AI-audited Pro List delivers pre-qualified, contract-ready suppliers – bypassing 90% of manual vetting. Unlike public directories, every partner undergoes:

✅ On-site facility audits (ISO, BSCI, OEM capacity)

✅ Financial health verification (3+ years operational stability)

✅ Live production capacity testing (minimum 5,000 units/month)

✅ Exclusive contract terms (MOQ flexibility, Incoterms 2020 compliance)

Time Savings Comparison: Traditional Search vs. SourcifyChina Pro List

| Activity | Generic Search | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier shortlisting | 22 hours | 2 hours | 20 hours |

| Document verification | 38 hours | 0 hours (pre-verified) | 38 hours |

| Sample qualification | 14 hours | 6 hours | 8 hours |

| Total per sourcing cycle | 74 hours | 8 hours | 66 hours |

Source: SourcifyChina Client Data (2025), n=142 procurement teams across 28 countries

Your Strategic Advantage in 2026

The Pro List isn’t a directory – it’s a risk-mitigated procurement pipeline:

🔹 Zero supplier ghosting: All partners sign SourcifyChina’s Code of Conduct

🔹 Real-time capacity tracking: Avoid 2026’s supply crunch via live factory dashboards

🔹 Duty optimization: Pre-negotiated HS code compliance for EU/US markets

🔹 30-day quality guarantee: Escrow payment protection until shipment validation

Call to Action: Reclaim 3 Workweeks Per Sourcing Cycle in 2026

Stop subsidizing supplier fraud with your team’s time.

Within 24 hours of contacting us, receive:

1. 3 tailored Pro List matches for your category (with audit reports)

2. Custom MOQ analysis showing 12-18% cost reduction vs. your current terms

3. Dedicated sourcing engineer for RFQ optimization (valued at $1,200)→ Act Now to Lock Q1 2026 Capacity:

📧 Email: [email protected]

💬 WhatsApp Priority Line: +86 159 5127 6160

Response guaranteed within 90 minutes during Asia business hours (GMT+8)

Why 417 Global Brands Trust SourcifyChina in 2026

“SourcifyChina’s Pro List cut our supplier onboarding from 47 days to 9 days. Their audit trail reduced quality disputes by 92% – that’s $2.3M saved in 2025 alone.”

– Head of Global Sourcing, Fortune 500 Home Appliances Manufacturer

Data-driven sourcing isn’t optional in 2026. It’s your competitive infrastructure.

SourcifyChina: Where Verification Meets Velocity

🧮 Landed Cost Calculator

Estimate your total import cost from China.