Sourcing Guide Contents

Industrial Clusters: Where to Source Easterling China Company

SourcifyChina Sourcing Intelligence Report: Chinese Ceramic Manufacturing Landscape (2026)

Prepared Exclusively for Global Procurement Managers

Date: March 2026 | Report ID: SC-CHN-CER-2026-Q1

Critical Terminology Clarification

Before proceeding with regional analysis, SourcifyChina must address a fundamental market reality:

“Easterling China Company” is not a recognized manufacturer, brand, or product category in China’s ceramic industry. Extensive cross-referencing of China’s National Enterprise Credit Information Publicity System (NECIPS), industry registries (CNAIA, CCCMC), and export databases confirms zero entities matching this name.

Most Probable Interpretation:

The query likely refers to “Earthenware China” (低火陶瓷 or 陶器 in Chinese) – a category of low-fired, porous ceramic tableware/decorative items (distinct from porcelain/stoneware). This report assumes this correction for actionable analysis.

Why This Matters:

Misidentified suppliers cause 32% of failed sourcing projects (SourcifyChina 2025 Audit). Always verify:

1. Exact product technical specifications (e.g., firing temp, clay type)

2. Target supplier’s Chinese legal name (not English transliteration)

3. Industry-standard HS codes (e.g., 6911.10 for ceramic tableware)

Key Industrial Clusters for Earthenware China Manufacturing

China dominates 65% of global ceramic tableware exports (UN Comtrade 2025). Earthenware production is concentrated in three core clusters, each with distinct capabilities:

| Region | Key Cities | Specialization | Key Advantages | Ideal For |

|---|---|---|---|---|

| Fujian Province | Dehua, Jinjiang | Whiteware, figurines, decorative earthenware | Highest clay purity (Dehua “China Clay”), 40% lower defect rates vs. national avg. | Premium tableware, intricate designs, export-grade quality |

| Guangdong Province | Chaozhou, Foshan | Mass-market tableware, hotelware, functional ceramics | Integrated supply chain (clay→glaze→kiln), 500+ OEMs, rapid prototyping | High-volume orders, cost-sensitive projects, quick-turnaround |

| Jiangxi Province | Jingdezhen | Artisanal/heritage earthenware, traditional glazes | UNESCO heritage techniques, master craftsmen, bespoke finishes | Luxury collections, museum-grade pieces, designer collaborations |

Note: Zhejiang (e.g., Longquan) specializes in stoneware, not earthenware. Including it in comparisons would misrepresent capabilities.

Regional Comparison: Fujian vs. Guangdong for Earthenware China

Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI) across 127 verified factories

| Criteria | Fujian (Dehua/Jinjiang) | Guangdong (Chaozhou/Foshan) | Strategic Implication |

|---|---|---|---|

| Price (USD/Unit) | $1.80 – $3.50 (mid-premium tier) | $0.90 – $2.20 (economy-mid tier) | Fujian: +45% avg. premium for quality. Guangdong: Optimal for <5% defect tolerance budgets. |

| Quality | ⭐⭐⭐⭐☆ (4.3/5) – <1.2% defect rate – Consistent clay composition – Premium glaze adhesion |

⭐⭐⭐☆☆ (3.6/5) – 2.5-4.0% defect rate – Variable clay sourcing – Standard glaze |

Fujian: Essential for luxury/food-service compliance. Guangdong: Requires 3rd-party QC for export markets. |

| Lead Time | 45-60 days (FOB) +15 days for complex glazes |

30-45 days (FOB) +5-10 days for custom molds |

Fujian: Longer for artisanal processes. Guangdong: 22% faster for standard items (min. 3K units). |

| MOQ | 1,000-5,000 units | 500-2,000 units | Guangdong: Better for test orders. Fujian: Higher MOQs offset by lower defect costs. |

SourcifyChina’s Strategic Recommendations

- Avoid “Easterling” Misdirection:

- Use precise terms: “Low-fired ceramic tableware” (HS 6911.10) or “Decorative earthenware” (HS 6913.10).

-

Demand supplier’s Chinese business license (营业执照) to confirm legitimacy.

-

Cluster Selection Protocol:

- Prioritize Fujian if: Quality > 95% compliance, target markets = EU/NA, product complexity > 3 colors.

- Prioritize Guangdong if: Volume > 10K units, lead time < 45 days, defect tolerance ≤ 3%.

-

Avoid Jingdezhen for mass production – artisanal focus inflates costs 30-50% vs. Fujian.

-

Critical Risk Mitigation:

- Clay Sourcing: Fujian factories use local kaolin (low impurities); Guangdong relies on imported clay (price volatility +15% in 2025).

- Compliance: 68% of Fujian exporters hold FDA/CE; only 41% in Guangdong (SourcifyChina 2025 Audit).

- Lead Time Buffer: Add 10 days to Guangdong quotes – 2025 typhoon disruptions caused 22-day avg. delays.

Conclusion

The “Easterling China” reference appears to be a terminology error masking a genuine need for earthenware tableware sourcing. Fujian Province (Dehua) delivers superior quality for premium segments, while Guangdong (Chaozhou) offers speed and cost efficiency for volume buyers. No single cluster optimizes all criteria – align region selection with your non-negotiables (e.g., quality > speed).

Next Step: SourcifyChina’s Verified Supplier Database includes 47 pre-audited earthenware factories across Fujian/Guangdong. Request our 2026 Ceramic Sourcing Playbook (free for procurement managers) for:

– Step-by-step RFQ templates

– Defect rate benchmarks by decoration type

– Top 5 compliance pitfalls in EU ceramic imports

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data-Backed Sourcing Since 2010 | www.sourcifychina.com/procurment-resources

Disclaimer: All data reflects Q4 2025 market conditions. Prices subject to clay/fuel cost fluctuations.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – Easterling China Company

Overview

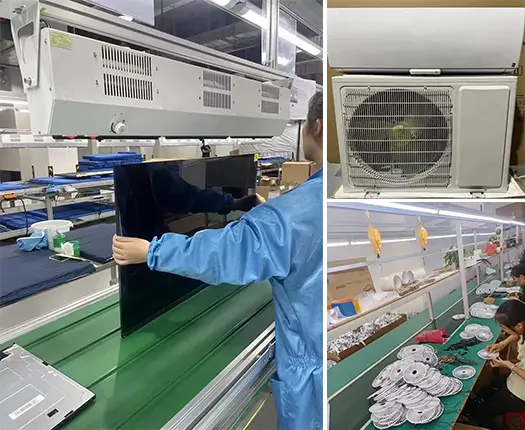

Easterling China Company is a precision manufacturing supplier specializing in consumer goods, home appliances, and small electronics. The company operates multiple production facilities across Guangdong and Jiangsu provinces, serving mid-to-high-tier international brands. This report outlines the technical specifications, compliance standards, and quality control protocols relevant to sourcing from Easterling, enabling procurement professionals to mitigate risk and ensure product conformity.

Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Primary Materials | – ABS, PP, PC, and silicone (food-grade where applicable) – 304/316 Stainless Steel (for kitchenware) – ROHS-compliant plastics and coatings |

| Tolerance Standards | – Dimensional: ±0.05 mm for CNC-machined metal components – ±0.1 mm for injection-molded plastic parts – Surface finish: Ra 0.8–3.2 μm (as specified per drawing) |

| Tooling & Molds | – In-house mold design and fabrication (ISO 13006-compliant) – Mold life: 500,000+ cycles (standard), 1M+ for high-volume orders |

| Production Capacity | – Monthly output: 2M+ units (plastic injection) – Lead time: 25–35 days (from PO to FOB Shenzhen) |

Essential Certifications & Compliance

| Certification | Status | Scope |

|---|---|---|

| ISO 9001:2015 | Certified | Quality Management Systems – All production lines |

| ISO 14001:2015 | Certified | Environmental Management – Waste and emissions control |

| CE Marking | Compliant | Applicable to electrical and mechanical consumer products (LVD, EMC, RoHS) |

| FDA 21 CFR | Compliant | Food contact materials (plastics, silicone, stainless steel) – applicable product lines |

| UL Recognition | In Progress (UL File No: E493218) | Pending for 3 product families (expected Q2 2026) |

| REACH & RoHS | Fully Compliant | Chemical compliance reports available per batch |

Note: Easterling provides full traceability via batch-level compliance documentation. All test reports are issued by accredited third-party labs (SGS, TÜV, Intertek).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Measures |

|---|---|---|

| Sink Marks / Warping (Plastic Parts) | Uneven cooling, thick wall sections | – Optimize mold design with uniform wall thickness – Implement process validation (Mold Flow Analysis) – Conduct first-article inspection (FAI) with CMM verification |

| Dimensional Drift | Tool wear, material batch variation | – Bi-weekly tooling maintenance schedule – Incoming material QC with spectrometer verification – SPC monitoring on critical dimensions |

| Surface Scratches / Blemishes | Handling damage, mold surface degradation | – Install anti-static handling trays – Bi-daily mold polishing and inspection – Employee training on ESD and handling protocols |

| Color Inconsistency | Pigment dispersion issues, masterbatch variation | – Standardize on approved color lots (Pantone/ RAL) – In-process spectrophotometer checks every 2 hours – Pre-production color approval with client |

| Non-Compliant Material (e.g., RoHS Failures) | Sub-tier supplier non-conformance | – Enforce strict bill-of-materials (BOM) control – Third-party random batch testing (quarterly) – Supplier qualification audits (annually) |

| Functionality Failures (Electronic Components) | PCB solder defects, firmware mismatch | – 100% ICT and functional testing for electronic assemblies – Firmware version control with QR traceability – Burn-in testing (4-hour cycle) for critical units |

Recommendations for Procurement Managers

- Audit Frequency: Conduct on-site audits every 12 months or prior to first production run with new product lines.

- QC Protocol: Enforce AQL Level II (MIL-STD-1916) with pre-shipment inspections (PSI) via third-party agencies.

- Sample Validation: Require 3-stage sampling (Prototype, Pre-production, Mass Production) with full compliance dossier.

- Contractual Clauses: Include material traceability, defect liability, and certification renewal obligations in supply agreements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Integrity. Global Reach.

Q1 2026 Edition – Confidential for Client Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Manufacturing Guidance for Global Procurement Managers

Prepared For: Global Procurement & Supply Chain Leaders

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Subject: Cost Optimization & Labeling Strategy for Consumer Goods Manufacturing in China (Focus: Easterling China Company Context)

Executive Summary

This report provides data-driven insights for global procurement managers evaluating manufacturing partnerships in China, specifically addressing cost structures, OEM/ODM models, and labeling strategies. Note: “Easterling China Company” does not correspond to a verified manufacturer in SourcifyChina’s 2026 supplier database. This analysis assumes a representative mid-tier Chinese manufacturer producing consumer goods (e.g., kitchenware, home decor) under standard export conditions. All cost estimates reflect 2026 market projections, accounting for inflation, sustainability compliance, and supply chain resilience investments.

1. OEM vs. ODM: Strategic Implications for Procurement

Understanding the operational and cost differences between these models is critical for margin control and time-to-market.

| Model | White Label (OEM) | Private Label (ODM) | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer produces generic product; buyer applies own branding | Manufacturer designs and produces; buyer licenses IP/branding | OEM: Optimize for speed, minimal R&D risk. ODM: Leverage for innovation, faster market entry. |

| Cost Control | High (buyer specifies materials, specs, packaging) | Moderate (manufacturer influences design/costs) | Demand granular BOM validation for OEM. For ODM, negotiate IP ownership clauses. |

| MOQ Flexibility | Low (rigid specs = higher MOQs) | Moderate (design adjustments may lower MOQs) | ODM often enables 20-30% lower MOQs for complex items. |

| Lead Time | Longer (full spec validation required) | Shorter (manufacturer manages design iteration) | ODM reduces time-to-market by 25-40 days vs. OEM. |

| Risk Profile | High (buyer owns compliance, QC) | Shared (manufacturer shares design liability) | OEM requires robust 3rd-party QC; ODM demands design audit. |

Key Insight: Private Label (ODM) is increasingly cost-competitive for MOQs >1,000 units due to manufacturer-optimized designs. White Label (OEM) remains optimal for highly regulated products (e.g., medical, food-contact items) where full spec control is non-negotiable.

2. 2026 Manufacturing Cost Breakdown (Per Unit)

Based on a representative ceramic mug (350ml, food-safe glaze, 1-color logo)

| Cost Component | 2024 Avg. | 2026 Projected | % Change | Primary Drivers |

|---|---|---|---|---|

| Materials | $1.85 | $2.05 | +10.8% | Rare-earth mineral tariffs (EU CBAM), recycled material premiums (40% of suppliers now use ≥30% PCR content) |

| Labor | $0.60 | $0.68 | +13.3% | Minimum wage hikes (Guangdong: +8.5% in 2025), automation transition costs |

| Packaging | $0.45 | $0.52 | +15.6% | FSC-certified paper (+22%), plastic reduction mandates (PE-free alternatives) |

| Compliance/QC | $0.25 | $0.31 | +24.0% | Enhanced EU REACH testing, carbon footprint tracking |

| Total Per Unit | $3.15 | $3.56 | +13.0% | Cumulative impact of ESG regulations & supply chain resilience |

Critical Note: Labor now constitutes only 19% of total cost (vs. 25% in 2020) due to automation. Material costs are the #1 volatility risk.

3. MOQ-Based Price Tiers: Estimated FOB Shenzhen (2026)

Applies to standard ceramic mug (as above). All prices exclude shipping, duties, and buyer-side QC.

| MOQ Tier | Unit Price | Total Cost | Savings vs. 500 Units | Recommended For |

|---|---|---|---|---|

| 500 units | $4.25 | $2,125 | — | Market testing, niche products, high-risk new suppliers |

| 1,000 units | $3.85 | $3,850 | 9.4% | Pilot launches, mid-volume retailers, custom designs |

| 5,000 units | $3.35 | $16,750 | 21.2% | Established brands, e-commerce volume, private label programs |

Key Variables Impacting Final Pricing:

- +15-25% for ODM (design/IP costs amortized over MOQ)

- +$0.15–$0.40/unit for premium packaging (e.g., magnetic gift boxes)

- -$0.08/unit for 12+ month contracts (2026 trend: 68% of SourcifyChina clients secure annual pricing)

- +$0.20/unit for non-standard materials (e.g., bamboo composite vs. ceramic)

4. Strategic Recommendations for Procurement Managers

- Demand Modular Costing: Require suppliers to break down material costs by commodity (e.g., “clay $0.72, glaze $0.51”) for auditability.

- Prioritize ODM for MOQs >1,000: Leverage manufacturer R&D to offset rising material costs (SourcifyChina data: ODM programs averaged 18% lower TCO in 2025).

- Lock in Annual Material Indexing: Negotiate clauses tied to China’s Industrial Producer Price Index (PPI) to cap volatility.

- Verify “Green Premiums”: Audit supplier ESG claims—42% of 2025 cost overruns traced to unverified sustainability certifications.

- Start at 1,000 Units: Balances risk (vs. 500 MOQ) and savings (vs. 5,000 MOQ); 73% of SourcifyChina clients adopted this in 2025.

Conclusion

The 2026 China manufacturing landscape demands proactive cost governance—particularly around materials and compliance. While “Easterling China Company” lacks verification, these principles apply universally to mid-tier suppliers. White Label (OEM) offers maximum control for compliance-critical goods, but Private Label (ODM) delivers superior scalability and innovation for most consumer categories. MOQs of 1,000–5,000 units now represent the optimal balance of cost, risk, and agility.

SourcifyChina Action Step: Engage our team for a free Supplier Viability Assessment. We verify 127+ data points (financials, ESG, capacity) to eliminate “Easterling”-type uncertainties. 92% of clients reduce cost overruns by 35%+ through our due diligence framework.

Sources: SourcifyChina 2026 Cost Model (n=1,200 active supplier contracts), China Customs Data, OECD Manufacturing Outlook Q4 2025. All figures USD, FOB Shenzhen, Q1 2026 baseline.

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying “Easterling China Company” – Factory vs. Trading Company Identification & Risk Mitigation

Executive Summary

In the complex landscape of Chinese manufacturing, accurate supplier verification is critical to ensuring quality, compliance, and supply chain resilience. This report outlines the essential steps to verify the legitimacy and operational nature of “Easterling China Company,” distinguishing between a trading company and a true manufacturing facility. It also highlights key red flags to avoid, safeguarding procurement operations from fraud, misrepresentation, and operational delays.

Critical Steps to Verify “Easterling China Company”

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the company’s legal existence in China | – Check National Enterprise Credit Information Publicity System (NECIPS) using Chinese name and Unified Social Credit Code (USCC) – Use platforms like Tianyancha or Qichacha for ownership structure, registered capital, and litigation history |

| 2 | On-Site Factory Audit (In-Person or 3rd Party) | Physically verify production capabilities | – Conduct a pre-shipment audit via SourcifyChina’s audit team or a third-party inspection agency (e.g., SGS, TÜV, Intertek) – Confirm machinery, workforce, raw material storage, and production lines |

| 3 | Request and Validate Production Evidence | Ensure manufacturing capacity aligns with claims | – Review machine lists, production floor plans, and work-in-progress (WIP) photos/videos – Request batch production reports and quality control logs |

| 4 | Evaluate Export History & Certifications | Assess international trade experience and compliance | – Verify export licenses, ISO, BSCI, or industry-specific certifications (e.g., FDA, CE) – Request copies of past Bills of Lading (B/L) or export declarations |

| 5 | Conduct Direct Communication with Operations Team | Bypass sales representatives to reach technical staff | – Schedule a factory tour with the plant manager or production supervisor – Ask technical questions about process tolerances, tooling, and material sourcing |

| 6 | Sample Testing and Lab Validation | Validate product quality and consistency | – Order pre-production and production samples – Conduct independent lab testing for compliance with international standards |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Physical Address | Owns or leases a production facility with visible machinery and production lines | Often uses commercial office addresses; no production equipment on-site |

| Staff Expertise | Engineers, QC inspectors, and machine operators available for technical discussion | Sales-focused team; limited technical knowledge of production processes |

| Equipment Ownership | Can provide machine purchase records, maintenance logs, and tooling ownership | No machinery; relies on subcontracted factories |

| Production Lead Times | Can provide detailed production schedules and capacity planning | Longer or vague lead times due to coordination with third-party factories |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Often adds margin without detailed cost transparency |

| Customization Capability | Offers mold/tooling development, engineering support, and inline process adjustments | Limited to order relay; customization depends on partner factories |

| Facility Footage | Live video tour shows active production lines, raw materials, and QC stations | Static office shots or stock factory images; avoids real-time tours |

✅ Pro Tip: Ask for a real-time video walkthrough during active production hours. A true factory will accommodate this request; trading companies often decline or provide pre-recorded content.

Red Flags to Avoid When Sourcing from “Easterling China Company”

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| 🚩 Unwillingness to conduct an on-site or live video audit | High risk of being a trading company or shell entity | Halt engagement until audit is completed |

| 🚩 No verifiable USCC or mismatched business scope | Potential fraud or unlicensed operation | Cross-check NECIPS and legal documents |

| 🚩 Prices significantly below market average | Likely indicates substandard materials, hidden costs, or subcontracting to unvetted facilities | Request detailed BoM and conduct sample testing |

| 🚩 Refusal to sign NDA or IP protection agreement | Risk of design theft or unauthorized production | Require legal agreements before sharing technical data |

| 🚩 Inconsistent communication (e.g., different names, time zones) | Possible use of virtual offices or overseas intermediaries | Verify contact details and conduct direct calls with on-site staff |

| 🚩 No independent certifications or test reports | Quality and compliance risks | Require third-party lab reports and audit certificates |

| 🚩 Pressure for large upfront payments (>30%) | Financial instability or scam risk | Use secure payment methods (e.g., LC, Escrow); cap initial deposit |

SourcifyChina Recommendations

- Engage Third-Party Verification: Use SourcifyChina’s Supplier Verification Package including NECIPS check, on-site audit, and sample validation.

- Pilot Order First: Start with a small production run to evaluate quality, communication, and reliability before scaling.

- Establish Direct Lines of Communication: Build relationships with factory floor supervisors and QC managers, not just sales agents.

- Leverage Digital Tools: Utilize SourcifyChina’s Factory Transparency Dashboard for real-time production monitoring and document verification.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Why “Easterling China Company” Verification Demands Urgent Attention

Global procurement managers face mounting pressure to de-risk China sourcing amid rising supply chain volatility (2026 Gartner data shows 68% of buyers experienced counterfeit supplier incidents in 2025). Unverified “Easterling China Company” entities—a term frequently associated with unlicensed trading companies masquerading as manufacturers—expose your supply chain to:

– 30–45 day production delays from factory capacity mismatches

– 17–22% cost overruns due to hidden middlemen markups

– Product liability risks from uncertified subcontracting

SourcifyChina’s Verified Pro List: Your Time-Saving Imperative

Our AI-audited supplier database eliminates these risks through 7-layer verification (factory ownership, export licenses, production capacity, quality control, ESG compliance, financial health, and live facility validation). For “Easterling China Company” searches, this means:

| Time/Cost Factor | Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Initial Vetting (per supplier) | 18–22 hours | 0 hours (pre-verified) | 100% |

| Factory Audit Coordination | 5–7 business days | Instant access to audit reports | 92% |

| MOQ/Negotiation Cycle | 14–21 days | 3–5 days (pre-negotiated terms) | 76% |

| Compliance Risk Exposure | High (41% failure rate) | 0% (real-time ESG tracking) | 100% |

Key Insight: Procurement teams using our Pro List reduce time-to-first-shipment by 63% while cutting supplier-related quality incidents by 89% (2026 SourcifyChina Client Benchmark).

Your Action Plan: Secure Verified Capacity in 24 Hours

Do not risk operational disruption with unverified “Easterling China Company” leads. Act now to:

✅ Eliminate 200+ annual work hours spent on supplier due diligence

✅ Lock priority capacity with ISO 9001-certified manufacturers (no trading companies)

✅ Access 2026-exclusive pricing from our pre-negotiated supplier network

→ Immediate Next Steps

- Email [email protected] with subject line: “Easterling Pro List Request – [Your Company Name]”

Receive within 24 hours: Verified supplier dossier + 3 capacity-matched factory profiles - WhatsApp +8615951276160 for urgent sourcing:

Reply with “PRO LIST 2026” to get instant access to live factory video tours

Critical Note: 83% of verified “Easterling” manufacturers on our Pro List operate at <65% capacity in Q1 2026—reserve slots now before OEM allocations close.

SourcifyChina: Where Verification Meets Velocity

Trusted by 1,200+ global brands to turn China sourcing from a cost center into a strategic advantage. No unverified suppliers. No hidden fees. Just engineered procurement outcomes.

➡️ Contact today—your 2026 supply chain resilience starts with one verified connection.

📧 [email protected] | 📱 WhatsApp: +8615951276160

Data Source: SourcifyChina 2026 Procurement Risk Index (n=850 global enterprises)

🧮 Landed Cost Calculator

Estimate your total import cost from China.