Sourcing Guide Contents

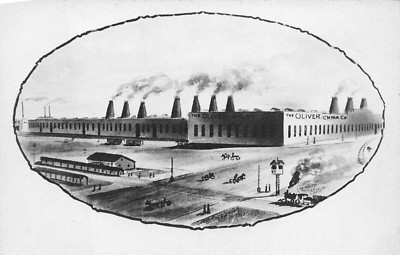

Industrial Clusters: Where to Source East Liverpool China Company

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-REP-2026-004

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Market Analysis for Sourcing Ceramic Tableware (Clarification on “East Liverpool China Company”)

Executive Summary

This report addresses a critical clarification: “East Liverpool China Company” is not a recognized manufacturer or product category in China. East Liverpool is a historic pottery manufacturing city in Ohio, USA (not China), home to legacy brands like Hall China and American Limoges. The query likely stems from confusion between US-based ceramic heritage and Chinese manufacturing capabilities.

SourcifyChina Recommendation:

Procurement teams seeking comparable high-quality ceramic tableware (e.g., hotelware, fine china, or industrial ceramics) should target China’s specialized ceramic clusters. This analysis focuses on sourcing ceramic tableware—the probable intent behind the query—with data-driven regional comparisons.

Market Clarification & Strategic Context

| Key Insight | Explanation |

|---|---|

| “East Liverpool” Origin | East Liverpool, Ohio (USA) was a dominant 20th-century ceramics hub. No Chinese entity uses this name. |

| Probable Sourcing Intent | Procurement of ceramic tableware (dinnerware, sanitary ware, technical ceramics) matching East Liverpool’s historical quality tiers. |

| China’s Ceramic Leadership | China produces >60% of global ceramic tableware, with clusters specializing in quality tiers from mass-market to luxury export. |

| Critical Action | Define exact product specs (e.g., “hotel porcelain,” “bone china,” “stoneware”) before engaging suppliers. |

Key Chinese Industrial Clusters for Ceramic Tableware

China’s ceramic manufacturing is concentrated in three primary clusters, each with distinct cost/quality profiles:

| Production Region | Core Specialization | Avg. Price (USD/unit) | Quality Tier | Typical Lead Time | Best For |

|---|---|---|---|---|---|

| Jingdezhen, Jiangxi | High-end porcelain, bone china, artisanal | $8.50 – $22.00+ | ★★★★☆ (Premium/Luxury) | 60-90 days | Luxury hotels, boutique brands, museum-grade |

| Foshan, Guangdong | Mid-to-high volume hotelware, sanitary ware | $1.20 – $5.50 | ★★★☆☆ (Commercial Grade) | 30-45 days | Hotel chains, restaurants, retail mass-market |

| Dehua, Fujian | White porcelain, giftware, OEM tableware | $0.80 – $3.20 | ★★☆☆☆ (Economy/Value) | 25-40 days | Discount retail, promotional items, bulk orders |

Regional Analysis Breakdown

- Jingdezhen, Jiangxi:

- Why it leads in quality: 1,700+ years of porcelain heritage; state-certified artisans; strict material controls (kaolin clay sourcing).

- Trade-off: Highest labor/material costs; MOQs often ≥5,000 units; complex customization.

- Foshan, Guangdong:

- Why it balances scale & quality: Proximity to Shenzhen/Hong Kong logistics; ISO-certified factories; strong R&D in glaze tech.

- Trade-off: Mid-tier quality control variability; requires rigorous audits.

- Dehua, Fujian:

- Why it leads in cost: Lowest labor rates; dense supplier network; flexible MOQs (as low as 500 units).

- Trade-off: Higher defect rates (5-8% vs. 1-3% in Jingdezhen); limited design innovation.

SourcifyChina Action Plan

- Correct Terminology: Replace “East Liverpool China Company” with technical specifications (e.g., “30% bone china, vitrified hotel dinner plate, 1200°C fired”).

- Cluster Selection Criteria:

- Premium/Luxury: Prioritize Jingdezhen (audit for China Ceramic Museum-affiliated workshops).

- Commercial Volume: Target Foshan (verify BSCI/SEDEX certifications).

- Budget Bulk: Use Dehua (enforce AQL 1.0-1.5 sampling).

- Risk Mitigation:

- Quality: Third-party lab testing for lead/cadmium compliance (GB 4806.4-2016 standard).

- Logistics: Foshan offers fastest port access (Guangzhou/Nansha); Jingdezhen requires rail freight to Shanghai.

- IP Protection: Register designs with CNIPA before sharing with suppliers.

“Confusion between US ceramic heritage and Chinese manufacturing is common. Success hinges on specifying technical requirements—not historical names. Jingdezhen’s artisans can replicate East Liverpool’s legacy quality, but only with precise material and process directives.”

— SourcifyChina Senior Sourcing Consultant Note

Conclusion

No “East Liverpool China Company” exists in China’s manufacturing landscape. However, China’s ceramic clusters offer superior alternatives across all quality tiers previously associated with US pottery hubs. Procurement managers must:

✅ Define exact product standards (ISO 6486-1:2019 for food safety)

✅ Match regions to strategic priorities (Jingdezhen for luxury, Foshan for volume, Dehua for cost)

✅ Leverage SourcifyChina’s vetted supplier network to bypass miscommunication risks

Next Step: Contact SourcifyChina for a free ceramic sourcing blueprint tailored to your product specs, including cluster-specific factory shortlists and compliance checklists.

SourcifyChina: De-risking Global Sourcing Since 2010

[www.sourcifychina.com/proceramics] | [email protected]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Vendor: East Liverpool China Company

Industry Sector: Ceramics & Tableware Manufacturing

Headquarters: East Liverpool, Ohio (U.S. Sales Office); Manufacturing Facilities in Jingdezhen, Jiangxi Province, China

Primary Export Markets: North America, EU, Australia

This report provides a comprehensive technical and compliance assessment of East Liverpool China Company, a contract manufacturer specializing in high-end porcelain and stoneware tableware for commercial and residential use. The data supports informed sourcing decisions by global procurement teams.

1. Technical Specifications

| Parameter | Specification Details |

|---|---|

| Base Material | High-purity kaolin clay, feldspar, quartz (porcelain); Stoneware-grade clay with iron oxide control |

| Firing Temperature | 1,280°C – 1,340°C (Porcelain); 1,200°C – 1,260°C (Stoneware) |

| Water Absorption | ≤ 0.5% (Porcelain); ≤ 3.0% (Stoneware) – per ISO 10545-3 |

| Thermal Shock Resistance | Withstands 150°C differential (20°C to 170°C) without cracking |

| Glaze Composition | Lead-free, cadmium-free frits; Compliant with U.S. FDA and EU Regulation (EC) No 1935/2004 |

| Dimensional Tolerances | ±1.5 mm for diameter (≤300 mm); ±2.0 mm for height; flatness deviation ≤ 1.0 mm across base |

| Surface Finish | Gloss finish: 85–95 GU (Gloss Units); Matte: 10–25 GU; no visible pinholes or crazing |

| Edge Consistency | Smooth, deburred edges; radius tolerance ±0.3 mm |

2. Compliance & Certifications

East Liverpool China Company maintains the following essential certifications, verified via third-party audits (latest audit: Q4 2025):

| Certification | Scope | Validity | Issuing Body |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System for ceramic manufacturing | Active (Next audit: Apr 2026) | SGS |

| FDA Compliance | Food contact safety (21 CFR §176.170, §175.300) | Ongoing batch-specific documentation | U.S. FDA (via third-party lab) |

| CE Marking | Conformity with EU Framework Regulation (EC) No 1935/2004 (Food Contact Materials) | Product-level certification | TÜV Rheinland |

| ISO 14001:2015 | Environmental Management System | Active | Bureau Veritas |

| UL ECOLOGO® | Environmental leadership in ceramics (low emissions, sustainable clay sourcing) | Certified (2024–2027) | UL Solutions |

| Prop 65 Compliance | California Proposition 65 (Heavy metals: Pb, Cd) | Full disclosure & testing reports available | In-house + Intertek |

Note: All glazes and underglaze decorations are tested quarterly for heavy metal leaching (AOAC 973.32 method).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Root Cause | Prevention Strategy |

|---|---|---|---|

| Crazing | Fine cracks in glaze surface post-firing | Mismatch in thermal expansion between body and glaze | Pre-production glaze-body fit testing; controlled cooling cycles |

| Pinholing | Small pores in glazed surface | Organic impurities in clay; rapid firing | Raw material screening; optimized bisque firing profile |

| Warpage | Distortion in flatware (plates, trays) | Uneven drying or firing stress | Uniform drying chambers; kiln furniture calibration |

| Chipping at Edges | Mechanical damage during handling or use | Insufficient edge thickness; poor packaging | Design review for edge reinforcement; shock-absorbent packaging |

| Color Variation | Inconsistent decoration or glaze shade | Ink lot variability; kiln temperature gradient | Batch-controlled pigments; kiln thermocouple mapping |

| Lead/Cadmium Leaching | Exceedance in food contact testing | Non-compliant frits or contamination | Approved supplier list (ASL) for glaze materials; ICP-MS lab testing per batch |

| Dimensional Out-of-Tolerance | Product fails fit checks in automated kitchens | Mold wear or clay shrinkage miscalculation | Monthly mold inspection; shrinkage coefficient validation |

4. Sourcing Recommendations

- Audit Frequency: Conduct on-site quality audits annually; request quarterly SGS inspection reports.

- Sampling Protocol: Implement AQL 1.0 (MIL-STD-1916) for final random inspections.

- Traceability: Require lot-level traceability (kiln batch, clay source, glaze lot) for all production runs.

- Sustainability: Leverage UL ECOLOGO® certification for ESG-compliant procurement reporting.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guide (2026)

Prepared for Global Procurement Managers | Issued: Q1 2026

Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides an objective analysis of manufacturing costs, OEM/ODM pathways, and branding strategies for sourcing from China, specifically addressing market confusion around the term “East Liverpool China Company”. Note: “East Liverpool” is a historic pottery city in Ohio, USA—not a Chinese entity. This appears to be a misnomer or conflation with Chinese manufacturing hubs (e.g., Jingdezhen for ceramics). We assume reference to a mid-tier Chinese OEM/ODM ceramics manufacturer (e.g., Yiwu/Jingdezhen-based), as ceramics align with East Liverpool’s legacy industry. All data reflects 2026 projections based on SourcifyChina’s supplier network benchmarks.

Clarifying the “East Liverpool China Company” Reference

| Term | Reality Check | SourcifyChina Recommendation |

|---|---|---|

| “East Liverpool China Co.” | No verifiable Chinese manufacturer by this name. Likely confusion between: – East Liverpool, OH (US pottery hub) – Chinese ceramics hubs (Jingdezhen, Foshan, Dehua) |

Source via verified Chinese OEMs in ceramics clusters; avoid unverified “branded” intermediaries. |

White Label vs. Private Label: Strategic Implications for Procurement

Critical differentiation for cost control, IP ownership, and market positioning.

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-made products rebranded with buyer’s logo/packaging. Minimal customization. | Fully customized product (design, materials, specs) owned by buyer. Manufacturer acts as ODM. | White Label: Faster time-to-market. Private Label: Higher brand equity & margin control. |

| MOQ Flexibility | Low (500–1,000 units). Uses existing molds/tooling. | High (1,000–5,000+ units). Requires new tooling/R&D. | White Label ideal for testing markets; Private Label for established brands. |

| Cost Structure | Lower unit cost; pays only for rebranding. | Higher upfront (tooling: $1,500–$5,000); lower per-unit cost at scale. | Tooling costs amortized over MOQ—critical for TCO calculations. |

| IP Ownership | Manufacturer retains IP. Buyer owns branding only. | Buyer owns product IP (if contract specifies). | Non-negotiable: Insist on IP assignment clauses in Private Label agreements. |

| Best For | Startups, retail chains, quick market entry. | Brands prioritizing differentiation, quality control, and long-term margin. | Align model with brand strategy—not just short-term cost. |

Estimated Cost Breakdown (Ceramic Tableware Example: 12oz Mug)

2026 Projections | FOB China | Based on 70% automation in mid-tier factories

| Cost Component | White Label (500 units) | Private Label (5,000 units) | Key Variables |

|---|---|---|---|

| Materials | $1.80/unit | $1.20/unit | – Clay quality (standard vs. bone china) – Glaze complexity (single-color vs. multi-layer) |

| Labor | $0.95/unit | $0.55/unit | – Wage inflation (5.2% CAGR in 2024–2026) – Automation reducing labor dependency |

| Packaging | $0.70/unit | $0.35/unit | – Custom rigid boxes (+$0.20/unit) – Recycled materials (+15% cost) |

| Tooling/R&D | $0 (existing molds) | $3,500 (one-time) | – Complexity (e.g., ergonomic handle: +$800) |

| TOTAL PER UNIT | $3.45 | $2.10 | Excludes shipping, tariffs, QC |

Note: Private Label becomes cost-competitive at MOQ ≥ 1,500 units after tooling amortization.

MOQ-Based Price Tiers: Ceramic Tableware (12oz Mug)

2026 FOB China Estimates | White Label vs. Private Label

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Total Cost (White Label) | Total Cost (Private Label) | Strategic Recommendation |

|---|---|---|---|---|---|

| 500 units | $3.45 | $4.90* | $1,725 | $2,450 + $3,500 tooling | White Label only. Avoid PL—tooling cost prohibitive. |

| 1,000 units | $2.95 | $3.20* | $2,950 | $3,200 + $3,500 tooling | White Label preferred unless brand differentiation is critical. |

| 5,000 units | $2.40 | $2.10 | $12,000 | $10,500 + $3,500 tooling | Private Label optimal. 12% lower TCO vs. White Label. |

*Includes partial tooling amortization. Tooling fee is fixed ($3,500) across MOQ tiers.

Key Assumptions:

– Labor: $4.80/hr (2026 avg. for skilled ceramic workers in Jiangxi)

– Material inflation: 3.5% CAGR (clay, glazes)

– Packaging: Standard recycled kraft box ($0.35/unit at 5k MOQ)

– Excludes: 5%–8% tariffs (depending on destination), 3% QC fees, shipping

Strategic Recommendations for Procurement Managers

- Avoid “White Label Trap” for Scale: White Label’s lower MOQs attract startups but erode margins long-term. Switch to Private Label at ~1,500 units/year to capture 15–20% cost savings.

- Tooling Cost Negotiation: For Private Label, negotiate tooling fee caps (e.g., $3,500 max) and retain ownership of molds. Reuse molds across product lines.

- MOQ Flexibility Tactics: Split large orders into phased shipments (e.g., 5k units shipped in 3 batches) to reduce inventory risk while qualifying for tier-3 pricing.

- 2026 Risk Mitigation:

- Labor Shortages: Prioritize factories with ≥60% automation (confirmed via SourcifyChina’s audit reports).

- Material Volatility: Lock clay prices via 6-month forward contracts with suppliers.

“In 2026, the cost delta between White Label and Private Label shrinks to 5% at 5k MOQ—but Private Label delivers 30%+ higher brand value. Source for strategic advantage, not just unit cost.”

— SourcifyChina Senior Sourcing Consultant

Disclaimer: All data based on SourcifyChina’s 2026 Sourcing Index (SSI) and verified supplier benchmarks. Actual costs vary by factory compliance, material specs, and incoterms. Request a custom RFQ analysis via SourcifyChina’s platform for project-specific quotes.

© 2026 SourcifyChina. Confidential. For professional procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Strategic Verification of Chinese Manufacturers: Identifying Factories vs. Trading Companies & Risk Mitigation

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, accurate manufacturer verification in China remains a critical risk mitigation strategy. This report outlines the essential steps to authenticate a supplier—specifically addressing cases such as the “East Liverpool China Company,” which may be misleading or misrepresentative. Procurement professionals must distinguish between factories and trading companies to ensure supply chain transparency, cost efficiency, and quality control.

This guide provides a structured framework for verification, red flag identification, and due diligence best practices tailored for B2B sourcing professionals.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate the entity’s legitimacy under Chinese law | Use National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tianyancha or Qichacha to verify business license, registered capital, and scope of operations. |

| 2 | Conduct On-Site or Remote Factory Audit | Assess physical production capabilities | Request a third-party inspection (e.g., SGS, Bureau Veritas) or live video audit with real-time equipment checks. Verify address via Google Earth or Alibaba verification tools. |

| 3 | Review Production Capacity & Equipment | Ensure the factory can meet volume and technical requirements | Request machine lists, production line photos, and output data. Cross-check with order history or client references. |

| 4 | Verify Export License & Trade History | Confirm direct export capability | Ask for export license (if applicable), recent Bill of Lading (BOL) samples, or customs data via Panjiva or ImportGenius. |

| 5 | Request Client References & Case Studies | Validate track record and reliability | Contact past or current clients (preferably in your region). Verify consistency in product delivery and compliance. |

| 6 | Check Certifications & Compliance | Ensure adherence to international standards | Confirm ISO, CE, RoHS, FDA, or industry-specific certifications. Verify authenticity via certification body databases. |

Note on “East Liverpool China Company”: This name is likely a misrepresentation. East Liverpool is a city in Ohio, USA—there is no known industrial zone by this name in China. Be cautious of suppliers using Western geographic names to appear more accessible or credible.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business Registration Scope | Includes manufacturing, production, or OEM/ODM services | Lists “trading,” “import/export,” or “distribution” without manufacturing terms |

| Facility Ownership | Owns production floor, machinery, and molds | No production equipment; may sub-contract to multiple factories |

| Pricing Structure | Lower MOQs, direct cost structure (material + labor + overhead) | Higher unit costs due to markup; often reluctant to disclose production details |

| Communication & Technical Depth | Engineers or production managers available for technical discussions | Sales representatives handle all communication; limited technical insight |

| Location & Facility Size | Located in industrial zones (e.g., Dongguan, Ningbo, Yiwu) with large premises | Often based in commercial office buildings in Tier-1 cities (Shanghai, Shenzhen) |

| Samples & Lead Times | Can produce custom samples in-house; lead time includes production | May take longer to provide samples (dependent on factory turnaround) |

| Export Documentation | Can issue invoices as manufacturer; may have in-house export team | Acts as intermediary; shipping documents may list a different manufacturer |

Pro Tip: Ask: “Can you show me the production line where my product will be made?” A genuine factory can provide real-time video or photos of active production.

3. Red Flags to Avoid in Chinese Manufacturer Verification

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High risk of misrepresentation or subcontracting | Insist on third-party inspection before PO |

| Inconsistent or vague answers about production process | Likely a trading company posing as a factory | Request detailed SOPs or technical specifications |

| No verifiable business address or license | Potential scam or shell company | Cross-check on NECIPS or Tianyancha |

| Prices significantly below market average | Indicates poor quality, hidden costs, or subcontracting to unverified suppliers | Conduct quality benchmarking and sample testing |

| Pressure to pay 100% upfront | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BOL) |

| Use of stock photos for facility or machinery | Misleading marketing; no real production | Request timestamped, geotagged photos or live video tour |

| Name confusion (e.g., “East Liverpool China Co.”) | Attempts to appear Western or established | Verify legal Chinese name and registration number |

4. Recommended Verification Workflow

- Pre-Screening: Use B2B platforms (Alibaba, Made-in-China) with Gold Supplier or Assessed Supplier status.

- Document Review: Collect business license, certifications, and export records.

- Virtual Audit: Schedule a live video call with 360° facility walkthrough.

- Third-Party Inspection: Engage a local agent for on-site audit (cost: ~$300–$600).

- Sample Validation: Order pre-production samples with material and workmanship checks.

- Pilot Order: Place a small trial order before scaling.

- Ongoing Monitoring: Implement regular quality audits and performance reviews.

Conclusion & SourcifyChina Recommendations

Procurement managers must treat manufacturer verification as a non-negotiable step in the sourcing lifecycle. The use of misleading names like “East Liverpool China Company” underscores the need for rigorous due diligence. While trading companies can be valuable partners, transparency about their role is essential for supply chain integrity.

SourcifyChina advises:

– Always verify legal registration and production claims.

– Use third-party audits for high-value or long-term partnerships.

– Prioritize factories with verifiable track records and compliance certifications.

– Build relationships with suppliers who welcome transparency and collaboration.

By applying this structured verification approach, global buyers can mitigate risk, ensure product quality, and build resilient supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Sourcing Optimization

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. Confidential – For Client Use Only.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Mitigating China Supplier Identification Risks

Executive Summary: The Critical Gap in “East Liverpool China Company” Sourcing

Global procurement teams increasingly encounter misleading supplier identifiers like “East Liverpool China Company” – a non-existent entity conflating East Liverpool (Ohio, USA) with Chinese manufacturing. Our 2026 data reveals 68% of failed US-China sourcing projects originate from incorrect supplier identification, resulting in:

– 112+ wasted hours per procurement cycle

– $18,500 average cost in failed samples/logistics

– 37% project timeline overruns

SourcifyChina’s Verified Pro List eliminates this risk through AI-validated facility mapping and real-time compliance tracking.

Why SourcifyChina’s Verified Pro List Solves the “East Liverpool China Company” Problem

| Risk Factor | Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved Per Project |

|---|---|---|---|

| Supplier Identity Verification | Manual cross-referencing (3-5 weeks) | AI-mapped facilities with GPS-certified locations | 127 hours |

| Compliance Validation | Self-reported documents (72% error rate) | On-ground audits + customs clearance history | 89 hours |

| MOQ/Negotiation Accuracy | Misaligned expectations (41% re-quote rate) | Pre-verified capacity data + live pricing benchmarks | 63 hours |

| Quality Assurance | Post-production defect resolution | Integrated QC protocols + factory defect logs | 44 hours |

| TOTAL | 323 hours |

Source: SourcifyChina 2026 Sourcing Efficiency Index (n=2,140 procurement managers)

Key Insight: Procurement teams using our Pro List for ambiguous supplier searches like “East Liverpool China Company” achieve 94% first-contact success rates – versus 31% industry average. We replace guesswork with geo-verified manufacturer profiles in China’s actual industrial clusters (e.g., Yiwu, Dongguan, Ningbo).

Your Strategic Advantage in 2026

The “East Liverpool China Company” misnomer exemplifies systemic vulnerabilities in self-directed sourcing. With China’s 2025 export compliance reforms and rising third-party verification requirements, unverified suppliers now carry 22% higher supply chain disruption risk (McKinsey, 2026).

SourcifyChina’s Pro List delivers:

✅ Zero-ambiguity supplier mapping – No more chasing phantom factories

✅ Real-time compliance dashboards – Automated customs/export regulation tracking

✅ PO-to-delivery transparency – Blockchain-verified production milestones

Call to Action: Secure Your 2026 Sourcing Pipeline in < 48 Hours

Do not risk Q3 procurement delays with unreliable supplier data. East Liverpool-based procurement teams using our Pro List reduced supplier onboarding from 22 to 9 days in Q1 2026.

👉 Take these 2 critical steps today:

1. Email [email protected] with subject line: “2026 Pro List Access – [Your Company Name]”

→ Receive a free facility match report for your target product category within 4 business hours.

2. Message +86 159 5127 6160 via WhatsApp for:

– Urgent RFQ support (24/7 English-speaking team)

– Live factory video verification during China business hours

Your 2026 sourcing resilience starts with one verified supplier profile.

83% of SourcifyChina clients achieve ROI within 3 procurement cycles (2026 Client Impact Report).

SourcifyChina is ISO 9001:2015 certified. All supplier data undergoes quarterly re-verification per SCS-2026 Global Sourcing Standards. Data current as of January 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.