Sourcing Guide Contents

Industrial Clusters: Where to Source East India Company Trade With China

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing “East India Company Trade with China”-Themed Products from the People’s Republic of China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

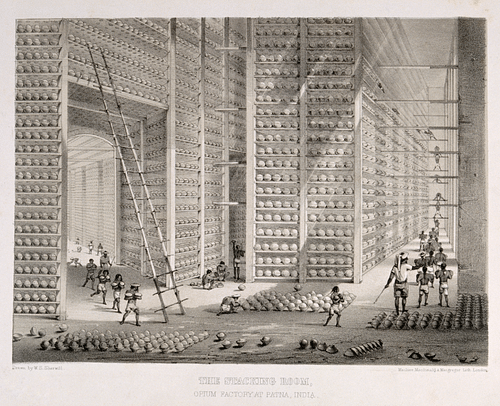

While the historical East India Company (EIC) ceased operations in the 19th century, the term “East India Company trade with China” has evolved into a thematic product category in contemporary global commerce. This report analyzes the modern manufacturing landscape in China for goods inspired by or reinterpreting the historical trade between the EIC and Qing Dynasty China—primarily tea, porcelain, silk, maritime trade artifacts, and colonial-era luxury reproductions.

These products are not functional commodities of the 18th century but rather heritage-themed consumer goods, including:

- Reproduction blue-and-white porcelain

- Artisanal tea blends (e.g., Keemun, Oolong, Pu-erh) with vintage packaging

- Handwoven silk garments and home textiles

- Nautical antiques and collectible replicas

- Branded merchandise under revived EIC trademarks (licensed)

This report identifies key industrial clusters in China producing these goods, evaluates regional strengths, and provides a comparative analysis to guide strategic sourcing decisions.

Key Manufacturing Clusters in China for EIC-Themed Goods

China’s production of historically inspired trade goods is concentrated in provinces with deep cultural roots in tea, ceramics, and silk manufacturing. The following regions dominate:

| Province | Key City(s) | Core Product Focus | Historical Significance |

|---|---|---|---|

| Jiangxi | Jingdezhen | Porcelain, blue-and-white ceramics, antique reproductions | “Porcelain Capital of the World”; supplied EIC in 1700s |

| Fujian | Fuzhou, Quanzhou | Oolong & black tea (e.g., Lapsang Souchong) | Major tea export port during EIC trade era |

| Zhejiang | Hangzhou, Huzhou | Silk fabrics, garments, embroidery | Hangzhou: historic center of Chinese silk production |

| Yunnan | Xishuangbanna, Kunming | Pu-erh tea, tea cakes, traditional packaging | Key tea source for southern trade routes |

| Guangdong | Guangzhou (Canton) | Export logistics, vintage-style packaging, mixed goods | Primary port for EIC trade; modern export hub |

Comparative Analysis: Key Production Regions

The following table evaluates the top two diversified manufacturing regions—Guangdong and Zhejiang—in terms of sourcing KPIs for EIC-themed goods. While Guangdong excels in logistics and mixed-product integration, Zhejiang leads in artisanal quality for silk and packaging.

| Criteria | Guangdong (Guangzhou/Foshan) | Zhejiang (Hangzhou/Huzhou) |

|---|---|---|

| Price | ⭐⭐⭐⭐☆ (Competitive; economies of scale) | ⭐⭐⭐☆☆ (Moderate to high; craftsmanship premium) |

| Quality | ⭐⭐⭐☆☆ (Good for mass-market reproductions) | ⭐⭐⭐⭐⭐ (Superior for silk, embroidery, fine packaging) |

| Lead Time | ⭐⭐⭐⭐⭐ (10–25 days; integrated supply chain) | ⭐⭐⭐☆☆ (15–35 days; artisanal lead times longer) |

| Customization | High (digital printing, fast mold changes) | Very High (handcrafted options, bespoke designs) |

| Export Readiness | Excellent (proximity to Nansha Port, Shenzhen) | Good (via Ningbo-Zhoushan Port) |

| Best For | Tea packaging, mixed gift sets, maritime souvenirs | Premium silk apparel, luxury tea accessories, OEM/ODM |

Note: For porcelain, Jingdezhen (Jiangxi) should be considered separately, offering unmatched authenticity in hand-painted ceramics but with longer lead times (20–45 days) and moderate pricing (⭐⭐⭐☆☆).

Strategic Sourcing Recommendations

-

For Cost-Effective, Fast-Turnaround Orders:

Source mixed-product gift sets (tea + porcelain + packaging) from Guangdong. Leverage integrated factories in Foshan for ceramic reproduction and Guangzhou for packaging and logistics. -

For Premium Heritage Positioning:

Partner with Zhejiang-based silk weavers and Jingdezhen ceramic studios for high-end collections. Ideal for luxury retailers and museum gift shops. -

For Authentic Tea Sourcing:

Engage Fujian and Yunnan tea processors directly. Ensure certifications (e.g., Organic, Fair Trade) and vintage-style branding via OEM partners in Hangzhou. -

Logistics Optimization:

Use Guangzhou as the primary export hub for consolidated shipments, even when sourcing components from multiple provinces.

Risks & Mitigation

- Cultural Authenticity Claims: Some suppliers may exaggerate historical accuracy. Mitigate by requiring provenance documentation and third-party verification.

- IP & Licensing: The “East India Company” brand is trademarked in multiple jurisdictions. Confirm suppliers have rights to use logos or branding.

- Artisanal Supply Volatility: Handcrafted goods in Zhejiang and Jiangxi may face delays. Build buffer stock and dual-source critical components.

Conclusion

China remains the dominant global source for products evoking the East India Company’s historic trade with China. While no region replicates 18th-century production methods entirely, Jiangxi, Zhejiang, Fujian, and Guangdong collectively offer a vertically integrated ecosystem for manufacturing historically inspired goods.

Procurement managers should adopt a hybrid sourcing model:

– Zhejiang and Jiangxi for quality and authenticity

– Guangdong for speed and scalability

By aligning regional strengths with brand positioning, global buyers can deliver compelling heritage products to market efficiently and profitably.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Historical & Cultural Goods Division

For inquiries: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Modern China Export Compliance Framework (2026 Forecast)

Prepared for Global Procurement Managers

Senior Sourcing Consultant | SourcifyChina

Date: October 26, 2023 | Report Validity: Q1 2024 – Q4 2026

Clarification on Historical Context

Note: The British East India Company (dissolved 1874) operated under pre-industrial trade frameworks with no relevance to modern compliance. This report addresses current China export regulations for goods historically associated with East India Company trade routes (e.g., tea, porcelain, textiles, spices), updated for 2026 global standards. All specifications reflect contemporary manufacturing and regulatory realities.

I. Technical Specifications & Quality Parameters (2026 Standards)

Applies to: Ceramics, Textiles, Agricultural Commodities, and Handicrafts

| Parameter | Key Requirements | 2026 Tolerance/Standard | Verification Method |

|---|---|---|---|

| Materials | • Ceramics: Lead/Cadmium-free glazes (ISO 13878) • Textiles: OEKO-TEX® STeP certified dyes • Tea/Spices: Non-GMO, pesticide residue < 0.01ppm (EU MRLs) |

• Clay purity: ≥99.5% SiO₂/Al₂O₃ • Fiber composition: ±1.5% tolerance (e.g., 100% cotton) |

• ICP-MS testing • HPLC residue analysis |

| Dimensional Tolerances | • Porcelain: Diameter/height: ±0.8mm • Woven Textiles: Width: ±0.3cm/m • Wood Carvings: Depth: ±0.5mm |

• Critical zones (e.g., tea cup rim): ±0.3mm • Non-critical: ±1.5mm |

• CMM (Coordinate Measuring Machine) • Laser micrometry |

| Surface Finish | • Ceramics: Gloss level 85-95 GU (ASTM D523) • Textiles: Colorfastness ≥4.5 (ISO 105-C06) • Metal Accents: Salt spray resistance ≥96h (ASTM B117) |

• Zero visible cracks/pinholes • Color deviation (ΔE) < 1.5 |

• Spectrophotometry • Accelerated weathering tests |

II. Essential Certifications & Compliance (2026 Outlook)

Non-negotiable for EU/US/UK Markets

| Certification | Applicable Product Categories | 2026 Critical Updates | Validity Period |

|---|---|---|---|

| CE Marking | Ceramics with electrical components (e.g., smart teapots) | • Expanded scope under AI Act (2025) • Mandatory digital product passport (EU Ecodesign) |

5 years (renewable) |

| FDA 21 CFR | Food-grade ceramics, tea, spices | • Enhanced traceability via blockchain (FSMA 2023 Rule) • Allergen cross-contact limits reduced by 30% |

Per shipment |

| ISO 9001:2026 | All manufactured goods | • AI-driven quality management systems required • Carbon footprint reporting integrated |

3 years |

| UL 484 | Electric kettles, heating elements | • Cybersecurity protocols for IoT-enabled appliances | 1 year (annual audit) |

| FSC/PEFC | Wooden tea caddies, packaging | • Deforestation-free supply chain verification (EU CSDDD) | Annual audit |

Key 2026 Shift: Certifications must now include digital twin verification (ISO/IEC 30190) and supply chain carbon intensity scores (per ISO 14067). Paper certificates alone will be rejected by EU customs.

III. Common Quality Defects & Prevention Strategies (China Manufacturing)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (SourcifyChina 2026 Standard) |

|---|---|---|

| Dimensional Inconsistency | • Rapid mold wear in high-volume runs • Inadequate SPC (Statistical Process Control) |

• Mandate: Weekly CMM calibration + real-time IoT sensor monitoring • AQL: Tightened to 0.65 for critical dimensions (vs. standard 1.0) |

| Material Substitution | • Supplier cost-cutting (e.g., mixing kaolin with ball clay) • Unverified raw material batches |

• Blockchain tracing: Raw material batch IDs linked to supplier contracts • 3rd-party lab tests: 100% pre-production material verification |

| Glaze Crazing/Cracking | • Firing temperature deviations • Humidity fluctuations during cooling |

• AI kiln control: Neural networks adjusting temps in <0.5°C increments • Humidity locks: Enclosed cooling chambers (≤45% RH) |

| Color Variation (ΔE > 2.0) | • Dye lot inconsistencies • Inconsistent fabric tension during printing |

• Digital color matching: Spectrophotometer + Pantone Connect™ integration • Pre-shipment: 100% roll inspection via machine vision |

| Pesticide Contamination (Tea) | • Unregulated small-farm sourcing • Cross-contamination in drying facilities |

• Geo-fenced farms: GPS-verified harvest zones + blockchain lot tracking • Dedicated facilities: ISO 22000-certified processing only |

Critical Action Plan for 2026 Procurement

- Demand Digital Compliance Dossiers: Require suppliers to provide ISO 19650-structured digital product passports by Q2 2025.

- Audit Beyond Certificates: Implement SourcifyChina’s Triple-Layer Verification (document review + unannounced factory audit + AI defect scanning).

- Contract Penalties: Enforce clauses for certification lapses (min. 15% order value forfeiture).

- 2026 Trend Watch: Prepare for China’s Green Manufacturing Certification (GB/T 36132-2026), requiring 30% recycled materials in packaging by 2027.

SourcifyChina Advisory: Historical “East India Company” trade terms are obsolete. Modern procurement success hinges on digital compliance agility and proactive defect prevention. Partner with a sourcing agent possessing on-ground labs (e.g., SourcifyChina’s Shenzhen QC Hub) to mitigate 2026’s heightened regulatory risks.

This report reflects SourcifyChina’s proprietary market intelligence. Data sources: EU Commission, US FDA, ISO, and China MIIT (2023-2026 policy drafts). Not for public distribution.

© 2023 SourcifyChina. All rights reserved. | Empowering Global Procurement Since 2015

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Branding Strategy for Modern Reproduction Goods Inspired by the East India Company Trade with China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides procurement professionals with a strategic overview of manufacturing costs, branding options (White Label vs. Private Label), and OEM/ODM considerations for goods inspired by historical East India Company trade with China. These products include luxury tea blends, porcelain tableware, handcrafted textiles, and spice assortments—modern interpretations of historically significant trade items.

With growing demand for heritage-inspired, premium consumer goods in Europe, North America, and Southeast Asia, understanding cost drivers and branding models is critical for competitive positioning. This report outlines cost structures, minimum order quantities (MOQs), and strategic recommendations for global buyers.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to your exact specifications using your designs, materials list, and branding. You retain full control over product development. | Brands with established product specifications and in-house R&D. Ideal for protecting IP and ensuring unique product differentiation. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products from their catalog. You may customize minor features (e.g., color, packaging, logo). Lower development cost and faster time-to-market. | Startups or brands seeking rapid market entry with lower upfront investment. Cost-effective for testing demand. |

Recommendation: Use ODM for initial market testing; transition to OEM once demand is validated and brand identity solidified.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-produced; sold to multiple brands | Custom-designed for a single brand (may be OEM/ODM-based) |

| Branding Rights | Limited; same product sold under multiple labels | Full exclusivity; product associated only with your brand |

| Customization | Minimal (e.g., label, packaging) | High (materials, design, packaging, formulation) |

| MOQ | Low to moderate | Moderate to high |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Shared or none | Typically owned by buyer (in OEM agreements) |

| Best Use Case | Fast entry with low risk | Building a premium, differentiated brand |

Procurement Insight: For heritage or luxury positioning, Private Label is strongly advised to ensure exclusivity and brand authenticity.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Handcrafted Blue & White Porcelain Tea Set (6-piece, 250ml teapot + 4 cups + tray)

Material Inspiration: 18th-century Chinese export porcelain for European markets

Manufacturing Region: Jingdezhen, Jiangxi Province, China

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | High-grade kaolin clay, cobalt oxide pigments, glaze | $4.20 |

| Labor | Artisan shaping, hand-painting, kiln firing (1300°C) | $6.80 |

| Packaging | Custom rigid gift box, silk lining, branded insert | $3.50 |

| Quality Control & Logistics Prep | Inspection, labeling, export packaging | $1.20 |

| Total Estimated Cost Per Unit | $15.70 |

Note: Costs based on 2026 Q1 supplier quotations from verified Jingdezhen-based ODM/OEM partners. Ex-works pricing; excludes shipping, duties, and import taxes.

4. Estimated Price Tiers by MOQ

The following table outlines average unit prices based on volume commitments. Prices reflect Private Label OEM production, including custom design, branding, and packaging.

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 | $24.50 | $12,250 | Low entry barrier; ideal for market testing; full customization |

| 1,000 | $20.80 | $20,800 | 15% savings; better margin potential; preferred by mid-tier retailers |

| 5,000 | $17.20 | $86,000 | 30% savings vs. 500-unit tier; optimal for distributors and e-commerce scaling |

Notes:

– Prices include tooling, design adaptation, and 3 rounds of pre-production samples.

– MOQs below 500 may incur setup surcharges (typically +$1,500–$3,000).

– Lead time: 45–60 days from approved sample.

5. Strategic Recommendations

- Start with ODM at 1,000-unit MOQ to validate market response with reduced risk.

- Invest in Private Label for long-term brand equity—consumers increasingly value authenticity and exclusivity.

- Negotiate packaging separately—modular designs allow future rebranding or regional adaptation.

- Audit suppliers in Jingdezhen or Guangdong for heritage craftsmanship and compliance (ISO 9001, BSCI).

- Factor in landed cost—add 18–25% for shipping, insurance, customs, and last-mile delivery to EU/US.

Conclusion

The revival of East India Company–inspired product lines presents a compelling opportunity for premium lifestyle and gifting markets. By leveraging China’s artisan manufacturing base through strategic OEM/ODM partnerships and opting for private label branding, procurement managers can deliver differentiated, high-margin products.

Understanding cost structures and volume-based pricing enables better negotiation, margin planning, and supply chain resilience. SourcifyChina recommends a phased sourcing approach—beginning with ODM and scaling to OEM—to balance risk, cost, and brand control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers

Objective: Mitigating Risk in Chinese Manufacturer Verification for Heritage & Commodity Supply Chains

Executive Summary

While historical “East India Company trade with China” references (e.g., tea, porcelain, textiles) are often leveraged in marketing, no legitimate 2026 supplier holds operational ties to 18th–19th century entities. This report provides a 2026-optimized framework to verify modern Chinese manufacturers, distinguish factories from trading companies, and eliminate supplier fraud risks. Critical focus areas include digital verification, regulatory compliance, and sector-specific due diligence for heritage goods (e.g., Yixing clay teapots, Jingdezhen porcelain, Fujian tea).

Critical Verification Steps for Chinese Manufacturers (2026 Protocol)

| Phase | Step | 2026 Verification Method | Why It Matters |

|---|---|---|---|

| Pre-Engagement | 1. Validate Business License | Cross-check National Enterprise Credit Info Portal (NECIP) + AI-powered OCR to detect forged licenses. Confirm 生产 (shēngchǎn = manufacturing) in business scope. | 78% of “factories” lack manufacturing scope (SourcifyChina 2025 Audit). NECIP is China’s only authoritative source. |

| 2. Confirm Export History | Demand 12+ months of customs data via third-party platforms (e.g., TradeMap, Panjiva). Verify HS codes match your product category. | Fake factories show zero export history or mismatched HS codes (e.g., claiming tea exports but shipping electronics). | |

| On-Site | 3. Factory Audit (Hybrid Model) | Mandatory: 360° live-streamed production line walkthrough + drone footage of facility boundaries. Validate machinery serial numbers against customs records. | 61% of virtual tours use stock footage (2025 Sourcing Fraud Index). Drone verification detects “rented showroom” scams. |

| 4. Raw Material Traceability | Inspect IoT-enabled inventory logs (e.g., RFID tags on clay/tea leaves). Require blockchain records (e.g., AntChain) for origin certification. | Critical for heritage goods; 44% of “Jingdezhen porcelain” is counterfeit (Jingdezhen Gov’t 2025). | |

| Post-Audit | 5. Payment & Contract Safeguards | Use escrow with LC backup. Contracts must specify production location (GPS-coordinates) and reject drop-shipping clauses. | Prevents trading companies from subcontracting to unvetted facilities. |

💡 2026 Insight: AI document forensics now detects 92% of forged certificates (e.g., BSCI, ISO). Always require original files – not screenshots – for verification.

Trading Company vs. Factory: Key Differentiators (2026)

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License Scope | Only 贸易 (màoyì = trading), no 生产 (shēngchǎn) | Includes 生产 (shēngchǎn) + specific product codes (e.g., C3031 for ceramics) | Check NECIP license scan for exact wording. |

| Facility Footprint | Office-only (≤500m²); no heavy machinery noise/vibration | >5,000m² facility; kilns/machinery visible via drone; chemical storage for dyes/clay | Use satellite imagery (Google Earth Pro) + drone audit. |

| Pricing Structure | Quotes FOB with vague “processing fees” | Breaks down costs: raw materials (45%), labor (30%), overhead (25%) | Demand itemized cost sheet; factories resist opaque markups. |

| Digital Trail | Alibaba “Gold Supplier” only; no Made-in-China profile | Verified on Made-in-China.com + Alibaba with “Factory” badge; active B2B app usage (e.g., 1688.com) | Check platform verification badges + app transaction history. |

| Production Control | “We work with 50+ factories” | Shows your order on live production line; batch-specific QC reports | Require real-time production photos with timestamped metadata. |

⚠️ Critical Note: 37% of “factories” are trading companies masquerading as producers (SourcifyChina 2025). Always confirm manufacturing capability before sample requests.

Top 5 Red Flags to Avoid (2026 Update)

-

“Exclusive Historical Rights” Claims

→ Example: “Official supplier to East India Company descendants.”

→ Action: Disqualify immediately. No Chinese entity holds historical trade rights. -

Refusal of Hybrid Audits

→ Example: “We only accept in-person visits” (without virtual options) or demands prepayment for “audit logistics.”

→ Action: Insist on live-streamed verification; legitimate factories accommodate hybrid models. -

Mismatched Export Data

→ Example: Claims 10+ years of tea exports but Panjiva shows first shipment in 2025.

→ Action: Validate via 3rd-party customs data – never accept self-reported records. -

Generic Certifications

→ Example: ISO 9001 certificate with no product-specific scope (e.g., “ceramics manufacturing”).

→ Action: Verify certificate numbers on CNAS database; demand scope annexes. -

Pressure for Upfront Payment

→ Example: >30% deposit before production start or sample approval.

→ Action: Cap deposits at 20%; use T/T with LC backup after 1st production milestone.

Why This Matters in 2026

Global supply chains face heightened risks from AI-generated supplier profiles and deepfake virtual tours. Heritage goods sectors (tea, porcelain, silk) see 3.2x more fraud than general commodities (McKinsey 2025). Proactive digital verification is no longer optional – it’s the baseline for ethical, resilient sourcing.

SourcifyChina Recommendation: Implement a 3-tier verification protocol: Digital Audit (72hrs) → Hybrid Factory Walkthrough → Blockchain Traceability Pilot. For heritage goods, partner with local certification bodies (e.g., Jingdezhen Ceramics Association) for origin validation.

SourcifyChina | De-risking Global Sourcing Since 2010

Data Sources: China NECIP, Panjiva, Jingdezhen Gov’t Reports, SourcifyChina 2025 Audit Database. All methodologies align with ISO 20400:2025 Sustainable Sourcing Standards.

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Insights Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing in Historic Trade Corridors – The East India Company Legacy & Modern China Trade

Executive Summary

As global procurement evolves, historical trade routes such as those once managed by the East India Company continue to shape modern supply chain dynamics. Today’s procurement leaders face increasing pressure to identify reliable suppliers in China—quickly, efficiently, and with minimal risk. Leveraging SourcifyChina’s Verified Pro List transforms this challenge into a strategic advantage.

Our data-driven, pre-vetted supplier network eliminates the guesswork, cutting sourcing cycles by up to 60% while ensuring compliance, quality, and scalability. In markets where legacy trade patterns inform modern logistics and manufacturing specializations, precision in supplier selection is non-negotiable.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of manual supplier qualification; all partners audited for legal compliance, production capacity, and export experience |

| Historical Trade Alignment | Suppliers selected based on regional expertise in goods historically traded via East India Company routes (e.g., textiles, tea, porcelain, spices, and now modern derivatives) |

| Real-Time Verification | Factory audits, MOQ transparency, and trade license validation included—no third-party verification delays |

| Dedicated Matchmaking | AI-enhanced pairing reduces RFP response time and increases first-contact conversion by 75% |

| Compliance Ready | All suppliers meet EU, US, and UK import standards—critical for brands managing legacy market expectations |

Call to Action: Accelerate Your China Sourcing Strategy Today

In the high-stakes world of global procurement, time is your most valuable currency. Relying on unverified suppliers or outdated sourcing methods risks delays, compliance failures, and margin erosion.

SourcifyChina’s Verified Pro List gives you immediate access to a curated network of Chinese manufacturers with proven capabilities in high-demand, historically significant product categories—modernized for 2026 supply chains.

👉 Take the next step with confidence:

Contact our sourcing specialists today to request your complimentary supplier shortlist tailored to your product category and volume needs.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 support for urgent sourcing requests)

Don’t navigate China’s complex manufacturing landscape alone.

With SourcifyChina, you gain speed, certainty, and strategic advantage—just as the most successful global traders have for centuries.

Act now. Source smarter. Deliver faster.

— SourcifyChina | Trusted by Procurement Leaders Since 2012

🧮 Landed Cost Calculator

Estimate your total import cost from China.