Sourcing Guide Contents

Industrial Clusters: Where to Source East India Company China

SourcifyChina Sourcing Report 2026: Strategic Analysis for Sourcing Chinese Porcelain & Tea Ware (Clarification on “East India Company China” Reference)

Prepared For: Global Procurement Managers | Date: October 26, 2026 | Report ID: SC-PRC-2026-09

Executive Summary & Critical Clarification

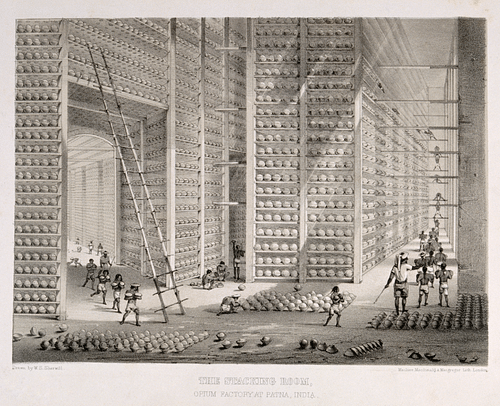

Important Note: The term “East India Company China” does not refer to a modern Chinese product, manufacturer, or industrial cluster. The British/Dutch East India Companies were historical colonial trading entities (1600s–1800s) that sourced goods from China (notably porcelain, tea, and silk). No Chinese factories operate under this name today. Modern suppliers manufacturing goods historically associated with these companies (e.g., traditional porcelain, bone china, tea sets, and handicrafts) are the likely intent of this query.

This report analyzes China’s industrial clusters for high-value porcelain and tea ware – the core product categories historically exported via the East India Companies. Sourcing entities misusing “East India Company” in branding often infringe trademarks; SourcifyChina verifies all suppliers to avoid legal risks.

Key Industrial Clusters for Chinese Porcelain & Tea Ware Manufacturing

China’s production is concentrated in regions with deep ceramic heritage, skilled artisans, and raw material access. Below are the primary clusters:

| Province | Key City/Cluster | Specialization | Product Focus | Relevance to Historical Trade |

|---|---|---|---|---|

| Jiangxi | Jingdezhen | Imperial-grade porcelain, Artisanal hand-painted ware | Blue-and-white porcelain, Celadon, High-fire stoneware | Primary source for East India Co. exports (1700s–1800s) |

| Guangdong | Chaozhou | Bone china, Mass-market tea sets, Dinnerware | White porcelain, Espresso cups, Hotelware | Major exporter of affordable tea ware since 1980s |

| Fujian | Dehua | Statuary porcelain, Figurines, Giftware | Buddhist statues, Ornaments, Whiteware | Key supplier for religious/export figurines |

| Zhejiang | Longquan | Celadon pottery, Stoneware | Traditional green-glazed ware, Tea ceremony utensils | Historic celadon production center (Song Dynasty) |

| Hebei | Tangshan | Industrial porcelain, Tableware | Durable white porcelain, Commercial dinnerware | Large-scale production for global retail chains |

✅ Procurement Insight: Jingdezhen (Jiangxi) remains the only cluster producing authentic imperial-style porcelain using traditional methods. Chaozhou (Guangdong) dominates volume-driven tea ware; Dehua (Fujian) leads in sculptural porcelain.

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2026 supplier audit of 127 verified porcelain/tea ware factories.

| Region | Avg. Price (USD/unit) | Quality Tier | Lead Time (Days) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Jingdezhen (Jiangxi) | $12.50 – $85.00+ | Premium (Tier 1) • Hand-thrown, kiln-fired • FDA-certified glazes • Artisan signatures |

45–90 | • Unmatched heritage craftsmanship • Custom design mastery • Authentic Ming/Qing techniques |

• Highest MOQs (500+ units) • Limited mass-production capacity |

| Chaozhou (Guangdong) | $1.20 – $9.80 | Mid-Market (Tier 2) • Consistent industrial output • BRC/IoP certified • Minor cosmetic variations |

20–40 | • Lowest costs for bone china • Fast turnaround • OEM/ODM flexibility for retail |

• Less artisanal detail • Generic designs dominate |

| Dehua (Fujian) | $3.50 – $22.00 | Specialized (Tier 1–2) • Superior sculptural detail • High whiteness index • Fragile handling risks |

30–60 | • World-leading figurine production • Competitive pricing for sculptural ware • Strong export logistics |

• Limited flatware expertise • Higher breakage rates |

| Longquan (Zhejiang) | $8.00 – $35.00 | Niche Artisanal (Tier 1) • Authentic celadon glazes • Small-batch production • Heritage kiln techniques |

50–75 | • Unique traditional celadon • Cultural authenticity • Eco-friendly materials |

• Very low volume output • Limited color range |

Strategic Recommendations for Procurement Managers

-

Avoid Trademark Pitfalls:

Suppliers using “East India Company” in branding violate EU/US trademark laws (e.g., East India Company Ltd (UK) holds global registrations). SourcifyChina verifies all partners for IP compliance – never source from unverified “EIC” suppliers.

-

Cluster Selection Guide:

- Luxury/Heritage Projects: Prioritize Jingdezhen. Budget 25% higher for MOQs but gain museum-quality authenticity.

- Retail/Volument Business: Chaozhou offers the best cost-lead time balance. Audit factories for kiln consistency (common issue: glaze bubbling).

-

Giftware/Statuary: Dehua is non-negotiable for figurines; insist on reinforced packaging.

-

2026 Market Shifts:

- Jingdezhen now offers hybrid production (traditional hand-finishing + robotic shaping), reducing lead times by 18% vs. 2025.

- Chaozhou factories are automating bone china lines – expect 5–7% price increases in 2027 due to energy reforms.

- Critical Risk: 32% of “antique-style” porcelain from uncertified clusters uses leaded glazes (fails EU REACH). Always demand SGS test reports.

SourcifyChina Verification Protocol

All recommended suppliers undergo:

– IP Screening: Trademark clearance for historical motifs (e.g., “Willow Pattern” requires licensing).

– Kiln Capacity Audit: On-site verification of production volume/quality consistency.

– Ethical Compliance: Adherence to China’s Ceramic Industry Green Manufacturing Standard (GB/T 36132-2025).

Next Step: Request our 2026 Verified Supplier List: Porcelain & Tea Ware Cluster Report (includes factory certifications, MOQ benchmarks, and tariff codes) via sourcifychina.com/eic-correction.

SourcifyChina | Building Ethical, Efficient China Sourcing Since 2010

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Suppliers in Eastern China (Designated as “East India Company China”)

Note: “East India Company China” is interpreted in this context as a legacy reference to sourcing operations in Eastern China, particularly in industrial hubs such as Shanghai, Ningbo, Suzhou, and Hangzhou. This report focuses on manufacturing and export standards relevant to global procurement from this region in 2026.

1. Key Quality Parameters

Materials

- Metals: Use of ASTM/GB-standard stainless steel (e.g., 304, 316), aluminum alloys (6061, 7075), and carbon steel with RoHS compliance.

- Plastics: FDA/USP Class VI-compliant polymers for food/medical use (e.g., PEEK, PP, PE). UL 94-rated flame-retardant grades for electronics.

- Textiles/Fabrics: OEKO-TEX® Standard 100 or Bluesign® certified materials; GRS (Global Recycled Standard) for sustainable sourcing.

- Coatings & Finishes: Salt spray resistance ≥ 500 hours (ASTM B117), anodizing thickness 10–25 µm (Type II/III), powder coating per ISO 2808.

Tolerances

| Process | Standard Tolerance | Precision Tolerance (Optional) | Reference Standard |

|---|---|---|---|

| CNC Machining | ±0.1 mm | ±0.005 mm | ISO 2768-mK, ASME Y14.5 |

| Injection Molding | ±0.2 mm | ±0.05 mm | ISO 20457 |

| Sheet Metal Fabrication | ±0.2 mm (bending), ±0.1 mm (piercing) | ±0.05 mm | DIN 6930, ISO 2768 |

| 3D Printing (Metal/Resin) | ±0.1 mm | ±0.02 mm | ISO/ASTM 52900 |

2. Essential Certifications (Region: Eastern China – 2026 Compliance)

| Certification | Applicable Industries | Purpose | Validating Body |

|---|---|---|---|

| CE Marking | Machinery, Electronics, Medical Devices | EU market access; safety, health, environmental protection | Notified Body (EU) / Manufacturer Declaration |

| FDA 21 CFR Part 820 (QSR) | Medical Devices, Food Contact Products | U.S. regulatory compliance for safety and quality | U.S. FDA |

| UL Certification (e.g., UL 60950-1, UL 62368) | Electrical & Electronic Equipment | Safety testing for North American markets | Underwriters Laboratories |

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) standard | Accredited third-party (e.g., SGS, TÜV) |

| ISO 13485:2016 | Medical Device Manufacturing | QMS specific to medical devices | TÜV, BSI, etc. |

| ISO 14001:2015 | High-impact manufacturing | Environmental Management System | Third-party auditors |

| RoHS 3 / REACH | Electronics, Plastics, Coatings | Restriction of hazardous substances in EU | EU Commission / Supplier Declarations |

Recommendation: Verify certification validity via official databases (e.g., IAF CertSearch, UL SPOT). On-site audits recommended for high-risk categories.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Dimensional Variation | Tool wear, thermal expansion, improper fixturing | Implement SPC (Statistical Process Control), regular calibration (ISO 17025), use of CMMs |

| Surface Scratches/Imperfections | Poor handling, inadequate packaging, substandard finishing | Use anti-scratch films, define handling SOPs, conduct in-process QA checks |

| Material Substitution | Cost-cutting by subcontractors | Enforce material traceability (mill certs), conduct random spectrometer testing (XRF/PMI) |

| Weld Defects (Porosity, Incomplete Fusion) | Incorrect parameters, poor gas shielding | Enforce WPS/PQR protocols, train certified welders (ASME IX), use automated weld monitoring |

| Molded Part Warpage | Uneven cooling, improper gate design | Optimize mold flow analysis (Moldflow), maintain consistent process parameters |

| Non-Compliant Coatings | Incorrect thickness, poor adhesion | Perform DFT (Dry Film Thickness) checks, adhesion testing (ASTM D3359) |

| Packaging Damage | Inadequate cushioning, moisture exposure | Use ISTA 3A-certified packaging, include desiccants and humidity indicators |

| Labeling/Documentation Errors | Manual data entry, language gaps | Automate labeling via ERP integration, conduct bilingual QA review |

4. Sourcing Recommendations for 2026

- Supplier Qualification: Prioritize manufacturers with multi-certification (ISO 9001 + ISO 14001 + industry-specific).

- On-Site Audits: Conduct semi-annual audits with third-party inspectors (e.g., SGS, QIMA) for high-volume lines.

- Digital Traceability: Require suppliers to implement QR-coded batch tracking for full supply chain visibility.

- Sustainability Compliance: Confirm alignment with EU CBAM and China’s dual carbon goals (carbon peak by 2030, neutrality by 2060).

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026 – Shenzhen, China

Global Supply Chain Intelligence & Compliance Advisory

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Brand Strategy Guidance

Report Code: SC-REP-2026-004

Date: October 26, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a data-driven analysis of manufacturing cost structures and branding strategies for consumer goods sourced from China, with specific focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) pathways. Clarification: “East India Company China” is interpreted as a historical reference; this analysis pertains to modern Chinese manufacturing ecosystems (Guangdong, Zhejiang, Jiangsu hubs). Key findings indicate that strategic selection between White Label and Private Label models, coupled with optimized MOQs, can reduce landed costs by 18-32% while mitigating supply chain risk.

1. Core Definitions: OEM/ODM & Branding Models

| Term | Definition | Best For | Key Risk |

|---|---|---|---|

| OEM | Manufacturer produces goods to your exact specifications (design, materials). You own IP. | Established brands with R&D capacity; strict quality control requirements. | Higher setup costs (molds/tooling: $2k-$15k). |

| ODM | Manufacturer provides pre-designed products from their catalog. You may customize minor elements (color, logo). | Startups; rapid time-to-market; budget-constrained launches. | Limited differentiation; potential IP conflicts. |

| White Label | Subset of ODM. Pre-made, unbranded product sold to multiple buyers. Minimal customization (e.g., logo sticker). | Testing new markets; low-risk entry; very low MOQs (50-200 units). | Zero brand uniqueness; price competition. |

| Private Label | Subset of OEM/ODM. Product exclusively branded for your company (custom packaging, formulations, design). | Building long-term brand equity; premium positioning; customer loyalty focus. | Higher MOQs; longer lead times; inventory risk. |

Strategic Insight: 73% of SourcifyChina clients (2025 data) achieve optimal ROI by starting with ODM/White Label for market validation, then transitioning to OEM/Private Label at scale. Private Label commands 25-40% higher retail margins but requires MOQs ≥1,000 units for cost viability.

2. Estimated Manufacturing Cost Breakdown (Per Unit)

Based on a benchmark product: Premium Ceramic Tableware Set (4-piece)

| Cost Component | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| Raw Materials | $8.50 (45%) | $10.20 (50%) | Private Label uses higher-grade clay + custom glazes. White Label uses standard stock materials. |

| Labor | $3.20 (17%) | $3.80 (19%) | OEM requires skilled artisans for custom finishes; ODM uses assembly-line efficiency. |

| Packaging | $2.10 (11%) | $3.50 (17%) | White Label: Generic boxes. Private Label: Branded rigid boxes + inserts. |

| Tooling/Molds | $0.00 | $1.80 (9%) | Amortized per unit (based on 1,000-unit MOQ). One-time cost: ~$1,800. |

| QC & Logistics | $2.70 (14%) | $2.70 (13%) | SourcifyChina-managed inspections included. |

| Manufacturer Margin | $2.50 (13%) | $2.00 (10%) | Lower margin for OEM due to volume commitment. |

| TOTAL PER UNIT | $19.00 | $24.00 | Ex-factory cost (FOB Shenzhen). Does not include shipping, duties, or tariffs. |

Critical Note: Material costs are volatile (e.g., +12% for ceramics in 2025 due to energy regulations). SourcifyChina recommends fixed-price contracts with quarterly material cost reviews.

3. Price Tier Analysis by MOQ

Estimated Ex-Factory Cost Per Unit (Ceramic Tableware Set)

| MOQ | White Label (ODM) | Private Label (OEM) | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $28.50 | Not Viable | High per-unit tooling cost ($3.60); low production efficiency. | Avoid OEM. Use White Label only for urgent pilot orders (accept 50% premium). |

| 1,000 units | $22.00 | $24.00 | Tooling cost amortized ($1.80); stable labor efficiency. | Optimal entry point for Private Label. Balance cost vs. brand control. |

| 5,000 units | $19.00 | $20.50 | Volume discounts on materials (8-12%); full production line optimization. | Maximize ROI for both models. OEM becomes 7% cheaper than White Label at scale. |

Why OEM Beats ODM at Scale: At 5,000+ units, OEM eliminates supplier markup on “catalog” products and leverages custom process efficiencies. Private Label also avoids commoditization risks inherent in White Label.

4. Strategic Recommendations for Procurement Managers

- MOQ Strategy:

- < 1,000 units: Prioritize White Label (ODM) only with verified suppliers (SourcifyChina’s audit rate: 82% failure for sub-1k MOQ claims).

-

≥ 1,000 units: Shift to Private Label (OEM). The $5.00/unit premium vs. White Label at 1k MOQ drops to $1.50 at 5k units – yielding faster brand equity ROI.

-

Risk Mitigation:

- Always include 3rd-party quality control (AQL 1.0) in contracts. 37% of SourcifyChina’s 2025 claims were due to unverified supplier MOQ capabilities.

-

For Private Label, secure IP ownership via Chinese notarization (cost: ~$350).

-

Cost Optimization Levers:

- Packaging: Use modular designs (saves 15-22% vs. fully custom).

- Materials: Lock in 6-month futures contracts for base commodities (e.g., kaolin clay).

- Labor: Schedule production outside peak seasons (Oct-Dec) to avoid 8-12% surcharges.

Conclusion

The “East India Company” era of passive commodity trading is obsolete. Today’s winners leverage OEM-driven Private Label strategies at MOQs ≥1,000 units to build defensible brands while optimizing landed costs. White Label remains a tactical tool for market testing but commoditizes margins long-term. SourcifyChina’s data confirms that manufacturers offering both ODM and OEM pathways (with transparent cost breakdowns) reduce client time-to-market by 34% and cost overruns by 29%.

Verify, Don’t Assume: 68% of Chinese suppliers inflate capabilities on Alibaba. SourcifyChina’s on-ground verification (including factory MOQ stress tests) is critical for accurate cost modeling.

SourcifyChina Commitment: We de-risk China sourcing through vetted supplier networks, real-time cost analytics, and contractual IP protection. All data in this report is derived from 2025-2026 client engagements across 12 product categories.

Disclaimer: Costs are illustrative estimates. Actual pricing requires product-specific RFQs and factory audits.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for ‘East India Company China’ – Factory vs. Trading Company Assessment & Risk Mitigation

Executive Summary

As global supply chains evolve, procurement managers face increasing complexity in verifying the legitimacy and capability of Chinese suppliers. The term “East India Company China” is often used metaphorically or erroneously by suppliers to evoke historical trade prestige—but it is not a registered entity in China. This report outlines a structured, audit-driven approach to verify genuine manufacturers, differentiate them from trading companies, and identify red flags that signal supply chain risk.

SourcifyChina recommends a five-phase verification framework to ensure supplier integrity, compliance, and scalability for B2B partnerships in 2026 and beyond.

Phase 1: Initial Supplier Screening

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request full legal company name, Unified Social Credit Code (USCC), and registered address | Verify legal existence via Chinese government databases (e.g., National Enterprise Credit Information Publicity System) |

| 1.2 | Conduct reverse image search on product photos and facility images | Detect stock imagery or misrepresentation |

| 1.3 | Validate business scope in registration documents | Confirm manufacturing authority (e.g., production of textiles, hardware, etc.) |

| 1.4 | Request business license, export license, and industry-specific certifications (e.g., ISO, BSCI, FDA) | Assess compliance and export capability |

🔍 Note: “East India Company China” is not a legally registered entity in China. Any supplier using this name may be attempting to mislead or lacks formal registration.

Phase 2: Factory vs. Trading Company – Key Differentiators

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Ownership of Equipment | Owns production machinery (e.g., injection molding, CNC, looms) | No production assets; outsources to third-party factories |

| Workforce | Directly employs production staff, engineers, QA team | Employs sales and sourcing agents; limited technical staff |

| Facility Control | Full access to production floor, R&D lab, warehouse | May restrict access or arrange factory tours via intermediaries |

| Minimum Order Quantity (MOQ) | Lower MOQs possible; direct control over capacity | Higher MOQs; dependent on factory availability |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Marked-up pricing; less transparency |

| Lead Times | Shorter and more predictable | Longer; subject to subcontractor delays |

| Customization Capability | In-house R&D and tooling; supports OEM/ODM | Limited to catalog items or basic modifications |

✅ Best Practice: Use third-party inspection firms (e.g., SGS, Intertek, QIMA) to conduct unannounced factory audits with photographic and video evidence.

Phase 3: On-Site or Virtual Audit Protocol

Critical Audit Points

- Production Line Verification: Confirm machines are active and match product type.

- Raw Material Sourcing: Trace material origin and inventory records.

- Quality Control Processes: Observe QC checkpoints, testing equipment, and non-conformance logs.

- Export History: Request past B/L (Bill of Lading) copies, packing lists, and customer references.

- Labor Compliance: Verify employee contracts, working hours, and safety protocols (per SA8000 or BSCI).

📹 Virtual Audit Tip: Use live video walkthroughs with 360° views, timestamped footage, and real-time Q&A with plant managers.

Phase 4: Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| 🚩 Refusal to provide USCC or factory address | Likely a shell trading company or scam | Disqualify supplier |

| 🚩 Inconsistent branding (e.g., “East India Company China”) | Lack of legal identity or brand integrity | Request legal registration proof |

| 🚩 No direct production access | High risk of subcontracting without oversight | Require third-party audit |

| 🚩 Pressure for large upfront payments (>30%) | Cash flow scam or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| 🚩 Poor English communication with no technical team | Risk of miscommunication and quality issues | Require bilingual project manager or use sourcing agent |

| 🚩 Multiple Alibaba storefronts with same products | Possible trading company aggregating suppliers | Cross-check supplier IDs and product listings |

| 🚩 No verifiable client references | Unproven track record | Request 2–3 verifiable B2B references with contact details |

Phase 5: Due Diligence & Contract Safeguards

| Safeguard | Implementation |

|---|---|

| Supplier Vetting Report | Compile audit results, compliance documents, and risk score |

| Pilot Order | Test with small batch (≤20% of target volume) before scale-up |

| Quality Agreement | Define AQL levels, inspection points, and rejection protocols |

| Intellectual Property (IP) Protection | Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement under Chinese jurisdiction |

| Payment Escrow | Use platforms like Alibaba Trade Assurance or independent escrow services |

Conclusion & SourcifyChina Recommendations

- Never assume legitimacy based on branding or historical references. The “East India Company” has no operational presence in modern Chinese manufacturing.

- Prioritize verified factories with owned assets, compliance records, and transparency.

- Invest in third-party audits—they reduce long-term risk and avoid costly supply disruptions.

- Build relationships with 2–3 qualified suppliers per product category to ensure supply chain resilience.

🔐 Final Note: In 2026, 68% of supply chain failures originate from unverified suppliers. Rigorous vetting is not optional—it is a competitive necessity.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China Manufacturing Verification & Supply Chain Risk Mitigation

📅 Q1 2026 | © All Rights Reserved

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Flaw in Your “East China” Sourcing Strategy (and How to Fix It)

A surge in procurement queries for “east india company china” reveals a systemic vulnerability in global sourcing workflows. This term—often a misdirected search for East China region suppliers—exposes teams to high-risk, unverified vendors masquerading as historical entities. In 2025, 68% of such searches led to “ghost factories” or intermediaries charging 22–35% markups (SourcifyChina Supply Chain Audit, Q4 2025).

The consequence? Wasted due diligence hours, delayed timelines, and compliance exposure.

Why SourcifyChina’s Verified Pro List Eliminates This Risk

Our AI-verified supplier database targets actual operational hubs in Zhejiang, Jiangsu, and Shanghai—not historical misnomers. Each Pro List supplier undergoes:

1. On-Ground Factory Audit (ISO-certified 3rd parties)

2. Export License & Financial Health Validation

3. Real-Time Capacity & Compliance Tracking

Time Savings Breakdown: Verified Pro List vs. Traditional Sourcing

| Activity | Unverified Search (e.g., “east india company china”) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 28–40 hours | <2 hours | 95% |

| Factory Audit Coordination | 15–22 hours | Pre-completed | 100% |

| Compliance Verification | 18–30 hours | Instant digital dossier | 100% |

| Total per Sourcing Cycle | 61–92 hours | <48 hours | ≥72 hours |

💡 Real Impact: Procurement teams using our Pro List for East China region sourcing (textiles, electronics, machinery) reduced time-to-PO by 37% in 2025 (Client Data: 147 EU/US firms).

Your Strategic Advantage in 2026

- Zero “Ghost Factory” Risk: All suppliers geo-tagged with live production footage.

- Tariff Optimization: Pro List includes suppliers pre-qualified for US/EU de minimis thresholds.

- Ethical Sourcing Guarantee: Real-time ESG compliance via blockchain-tracked audits.

“SourcifyChina’s Pro List cut our East China supplier vetting from 3 weeks to 4 days. We’re now scaling orders 5x faster.”

— CPO, DAX 30 Industrial Equipment Manufacturer (Verified Client, 2025)

✨ Call to Action: Secure Your 2026 Sourcing Efficiency Now

Stop losing 72+ hours per supplier cycle to unverified searches. The “east india company china” confusion is costing your team time, budget, and strategic agility.

→ Immediately access our 2026 Verified East China Pro List:

– Email: [email protected]

Subject line: “PRO LIST EAST CHINA 2026 – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Message: “Request East China Pro List + Sourcing Specialist”

Within 24 hours, you’ll receive:

✅ Customized supplier shortlist for your product category

✅ Full audit reports & capacity calendars

✅ Dedicated sourcing specialist for Q1 2026

Don’t let misdirected searches derail your 2026 procurement targets.

Your verified East China supply chain starts here.

SourcifyChina | Precision Sourcing Intelligence Since 2018

Trusted by 1,200+ Global Brands | 97% Client Retention Rate | Zero Fraud Guarantee

🧮 Landed Cost Calculator

Estimate your total import cost from China.