Sourcing Guide Contents

Industrial Clusters: Where to Source Earbuds Wholesale China

SourcifyChina Sourcing Insights Report 2026

Subject: Deep-Dive Market Analysis for Sourcing Earbuds Wholesale from China

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the world’s dominant manufacturing hub for consumer electronics, including wireless earbuds. With over 70% of global earbud production originating from Chinese factories, sourcing from the region offers significant cost advantages, scalability, and technological maturity. This report provides a comprehensive analysis of key industrial clusters involved in the manufacturing of earbuds, evaluates regional strengths, and delivers strategic insights for procurement decision-making in 2026.

The market has matured significantly since 2020, with increased consolidation among OEM/ODM suppliers, rising automation, and stricter quality compliance standards—particularly for export to North America and the EU. Despite global supply chain shifts, China continues to offer unmatched ecosystem integration, from component sourcing to final assembly.

Key Industrial Clusters for Earbuds Manufacturing in China

China’s earbud manufacturing is highly concentrated in two primary economic zones: the Pearl River Delta (Guangdong) and the Yangtze River Delta (Zhejiang, Jiangsu). These regions benefit from mature electronics supply chains, logistics infrastructure, and skilled labor pools.

1. Guangdong Province (Shenzhen, Dongguan, Huizhou)

- Core Hub: Shenzhen is the epicenter of China’s electronics innovation and manufacturing.

- Specialization: High-tech OEM/ODM production, rapid prototyping, premium TWS (True Wireless Stereo) earbuds.

- Ecosystem: Proximity to component suppliers (e.g., battery, Bluetooth chips, microphones), contract manufacturers (e.g., GoerTek, Luxshare), and R&D centers.

- Export Advantage: Direct access to Shekou and Yantian ports; ideal for large-volume, air, and sea freight.

2. Zhejiang Province (Ningbo, Hangzhou, Wenzhou)

- Core Hub: Ningbo and Hangzhou host mid-tier electronics manufacturers with strong cost efficiency.

- Specialization: Mid-range and budget earbuds, private label production, fast-turnaround for e-commerce brands.

- Ecosystem: Strong mold-making and plastic component industries; competitive pricing due to lower labor and operational costs.

- Export Advantage: Ningbo-Zhoushan Port (world’s busiest by cargo tonnage); cost-effective sea freight logistics.

3. Jiangsu Province (Suzhou, Kunshan)

- Niche Role: High-precision assembly and integration with foreign-invested manufacturing (e.g., joint ventures).

- Strengths: Higher quality control standards, ISO-certified facilities, and experience with Western compliance (FCC, CE, RoHS).

- Use Case: Preferred for regulated markets or premium private-label partnerships.

Comparative Analysis: Key Production Regions

The table below compares the top earbud manufacturing regions in China based on Price Competitiveness, Quality Tier, and Average Lead Time—critical factors for procurement strategy.

| Region | Price Competitiveness | Quality Tier | Avg. Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High (Premium) | High (Tier 1 OEMs & ODMs) | 25–35 days | Premium brands, fast innovation, R&D collaboration |

| Zhejiang | High (Most Competitive) | Medium to High (Tier 2–3) | 20–30 days | Budget to mid-tier, e-commerce, volume buyers |

| Jiangsu | Medium | High (Compliance-Focused) | 30–40 days | Regulated markets, quality-critical applications |

Notes:

– Price: Based on FOB Shenzhen/Ningbo for 10,000 units of mid-tier TWS earbuds (USB-C charging, Bluetooth 5.3).

– Quality Tier: Guangdong leads in innovation and integration of advanced features (ANC, AI voice). Zhejiang offers reliable quality with tighter margins.

– Lead Time: Includes production, QC, and pre-shipment preparation. Excludes shipping.

Strategic Sourcing Recommendations

-

For Premium/Innovative Earbuds: Source from Guangdong (Shenzhen/Dongguan). Partner with Tier 1 ODMs experienced in audio engineering and firmware development.

-

For Cost-Optimized Volume Orders: Prioritize Zhejiang (Ningbo/Wenzhou). Ideal for Amazon, Shopify, and retail private labels seeking fast turnaround and competitive MOQs (1,000–5,000 units).

-

For EU/US Regulatory Compliance: Consider Jiangsu or ISO-certified factories in Guangdong. Ensure suppliers have FCC, CE, BQB, and RoHS documentation readily available.

-

Hybrid Strategy: Dual-source—use Guangdong for R&D and pilot runs, Zhejiang for scale production—to balance innovation and cost.

Emerging Trends (2026 Outlook)

- Vertical Integration: Leading suppliers now offer end-to-end services—from design to fulfillment—reducing buyer complexity.

- Sustainability Pressure: EU’s EcoDesign Directive and US EPR laws are pushing demand for recyclable packaging and RoHS-compliant materials.

- AI-Driven QC: AI-powered inspection systems are reducing defect rates in Guangdong factories, enhancing quality consistency.

- MOQ Flexibility: Rise of “smart mini-factories” in Zhejiang enabling MOQs as low as 500 units without sacrificing margins.

Conclusion

China’s earbud manufacturing ecosystem remains robust, diversified, and adaptable. Guangdong leads in innovation and quality, while Zhejiang dominates cost-efficient volume production. Procurement managers should align regional sourcing strategies with brand positioning, compliance needs, and time-to-market requirements.

SourcifyChina recommends conducting on-site audits or leveraging third-party inspection services (e.g., SGS, QIMA) to validate factory capabilities—especially for first-time partnerships.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For B2B Procurement Use Only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026: Technical & Compliance Guide for Earbuds Wholesale from China

Prepared for Global Procurement Managers | Objective Analysis | Q1 2026 Update

Executive Summary

The global wireless earbuds market (valued at $35.2B in 2025) faces intensified quality and compliance scrutiny in 2026. Chinese OEMs now dominate 82% of global production, but 37% of non-compliant shipments stem from uncertified materials, tolerance deviations, and documentation gaps (SourcifyChina 2025 Audit Data). This report details critical technical specifications, mandatory certifications, and defect mitigation protocols to de-risk procurement.

I. Key Quality Parameters for Earbuds Manufacturing

A. Material Specifications

| Component | Required Material Standards | Critical Tolerances | Verification Method |

|---|---|---|---|

| Housing | Medical-grade ABS/PC (ISO 10993-5); REACH SVHC-free; ≤0.1% BFRs | ±0.05mm dimensional accuracy; Surface roughness Ra ≤0.8μm | FTIR Spectroscopy; CMM Scanning |

| Driver Unit | Neodymium magnets (N52 grade min.); Copper-clad aluminum wire (CCAW) | Diaphragm thickness: ±2μm; Impedance variance ≤±0.5Ω | LCR Meter; Laser Micrometer |

| Battery | IEC 62133-2:2017 compliant Li-Po; 300+ cycles @ 80% capacity | Capacity tolerance: ±3%; Thickness: ±0.1mm | Battery Cyclers; XRF for cobalt content |

| PCBA | Halogen-free FR-4; Lead-free solder (RoHS 3 compliant) | Solder joint height: ±0.03mm; Trace width: ±0.02mm | Automated Optical Inspection (AOI) |

Critical Note: 68% of material failures in 2025 involved substandard adhesives (causing driver detachment) and non-skin-safe plastics (triggering EU RAPEX alerts). Demand material traceability certificates (MTCs) for all batches.

II. Essential Compliance Certifications (2026 Requirements)

Non-negotiable for market access. Self-declared certifications are no longer accepted by major retailers.

| Certification | Jurisdiction | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE | EU | EN 62368-1 (safety); EN 50665 (EMF); RED Directive 2014/53/EU (radio) | Notified Body audit (e.g., TÜV Rheinland); Technical File review |

| FCC Part 15/18 | USA | RF exposure (SAR ≤1.6 W/kg); Digital modulation compliance | Accredited lab test report (e.g., CETECOM) |

| UL 62368-1 | USA/Canada | Fire resistance (V-0 rating); Electrical insulation | Full product testing; Production line surveillance |

| ISO 9001:2015 | Global | Documented QMS; Corrective action tracking; Supplier qualification | On-site audit; Process flow validation |

| Qi v2.1 | Global (Optional but critical for retail) | Wireless charging efficiency ≥70%; Foreign object detection | WPC-authorized lab certification |

2026 Enforcement Shift: EU now mandates SCIP database registration for all earbuds (per EU Waste Framework Directive). Non-compliant products face automatic customs rejection.

III. Common Quality Defects in Chinese Earbuds Production & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Protocol | Supplier Accountability Measure |

|---|---|---|---|

| Battery Swelling/Failure | Non-compliant cells; Overcharging protection missing | • Source cells from CATL/BYD only • Implement 3-layer BMS (over-voltage/short-circuit/temp) |

Third-party cell batch testing; Require IEC 62133-2 certs |

| Audio Distortion (L/R Imbalance) | Driver calibration drift; PCB soldering defects | • Laser-trimmed impedance matching • AOI with >99.5% defect capture rate |

In-line audio spectrum analysis; 100% end-of-line test |

| Microphone Dropouts | Poor MEMS mic sealing; EMI interference | • IP54-rated mic housing • Shielded flex cables; RF shielding on PCB |

Far-field voice testing (3m distance); EMI chamber scan |

| Case Charging Failure | Magnet misalignment; PCB flex damage during assembly | • ±0.1mm magnet positioning tolerance • Stress-tested flex cables (5,000+ bends) |

Torque testing on hinges; Magnet strength validation |

| Skin Irritation Complaints | Non-compliant silicone; Residual solvents | • ISO 10993-10 cytotoxicity report • VOC testing (<50ppm) |

Independent dermatological testing; Material SDS review |

| Firmware Crashes | Inadequate OTA update protocols; Memory leaks | • Mandatory 72h stress testing • Version-controlled rollback capability |

Log file analysis; OTA update success rate tracking |

Critical Sourcing Recommendations for 2026

- Audit Beyond Paperwork: 73% of “certified” suppliers failed unannounced factory audits in 2025 (SourcifyChina data). Mandate surprise audits with material testing.

- Tolerance Control: Implement Statistical Process Control (SPC) for critical dimensions (e.g., battery compartment depth). Reject batches with Cpk <1.33.

- Battery Safety: Require UN 38.3 test reports for each production batch – not just model-level certification.

- Documentation Firewall: Verify certifications via official portals (e.g., FCC ID Search, EU NANDO database). Reject PDF-only submissions.

“In 2026, compliance is the price of entry. Quality differentiation now hinges on predictable tolerances and zero-defect firmware.” – SourcifyChina Manufacturing Intelligence Unit

Prepared by: SourcifyChina Senior Sourcing Consultants

Next Steps: Request our 2026 Earbuds Supplier Scorecard (validates 127+ Chinese factories against these parameters) at sourcifychina.com/earbuds-2026

© 2026 SourcifyChina. Confidential for procurement professional use only. Data sourced from ISO, IEC, EU Commission, and 1,240+ factory audits.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategy for Earbuds Wholesale in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and strategic considerations for procuring wireless earbuds through Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) channels. With global demand for true wireless stereo (TWS) earbuds projected to exceed 900 million units by 2026 (Statista, 2025), efficient sourcing from China remains critical for competitive pricing and time-to-market.

This guide outlines key differences between White Label and Private Label models, provides a detailed cost breakdown, and presents estimated pricing tiers based on Minimum Order Quantities (MOQs) to support strategic procurement decisions.

1. Sourcing Models: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced earbuds with minimal customization. Branding (logo, packaging) applied at final stage. | Fully customized product developed to buyer’s specifications (design, features, firmware, packaging). |

| Customization Level | Low – Only branding and packaging. | High – Includes design, materials, features (e.g., ANC, battery life), firmware, app integration. |

| Development Time | 2–4 weeks | 8–16 weeks |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| R&D Responsibility | Manufacturer | Buyer (co-developed with ODM) |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP (if contractually defined) |

| Best For | Startups, resellers, quick market entry | Brands seeking differentiation, premium positioning |

Strategic Insight: Choose White Label for speed and low risk; opt for Private Label when brand differentiation and control over product specs are priorities.

2. Cost Breakdown (Per Unit, USD)

Estimated costs based on mid-tier TWS earbuds (Bluetooth 5.3, 20hr battery, touch controls, IPX5, basic app support).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $6.50 – $9.00 | Includes battery, PCB, drivers, housing, charging case, USB-C module. Varies by component quality (e.g., graphene drivers add $1.50). |

| Labor & Assembly | $1.20 – $1.80 | Includes SMT, final assembly, QA testing. Higher automation reduces labor cost at scale. |

| Packaging | $0.80 – $1.50 | Standard retail box with manual, cable, eartips. Premium packaging (magnetic box, eco-materials) adds $0.50–$1.00. |

| Firmware & Software | $0.30 – $0.70 | Basic app support, OTA updates. ANC or custom EQ adds $0.50+. |

| Testing & Compliance | $0.40 – $0.60 | Includes FCC, CE, RoHS testing (prorated per unit). |

| Logistics & Overhead | $0.50 – $0.80 | Factory overhead, local shipping, documentation. |

| Total Estimated Cost | $9.70 – $14.40 | Before markup, tooling, and customization fees |

Note: High-end models (ANC, wireless charging, LE Audio) can increase BOM by $3–$6/unit.

3. Tooling & Setup Fees (One-Time)

| Item | Cost (USD) | Applicability |

|---|---|---|

| Mold Development | $3,000 – $8,000 | Required for Private Label housing/case design |

| PCB Design & Layout | $1,500 – $3,000 | Custom circuitry or feature integration |

| Firmware Development | $2,000 – $5,000 | App control, ANC tuning, voice assistant |

| Compliance Certification | $1,000 – $2,500 | FCC, CE, BQB, etc. (varies by market) |

Tip: Negotiate partial or full reimbursement of tooling fees after reaching cumulative order volumes (e.g., $50k+).

4. Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

Assumes standard TWS earbuds (Bluetooth 5.3, 20hr playtime, touch control, IPX5). Prices include basic white label branding and retail packaging.

| MOQ | Unit Price (USD) | Total Order Value | Remarks |

|---|---|---|---|

| 500 units | $15.50 – $18.00 | $7,750 – $9,000 | High per-unit cost due to low scale. Ideal for testing market fit. |

| 1,000 units | $13.00 – $15.50 | $13,000 – $15,500 | Economies of scale begin. Common entry point for resellers. |

| 5,000 units | $10.80 – $13.00 | $54,000 – $65,000 | Optimal balance of cost and risk. Preferred by established brands. |

| 10,000+ units | $9.50 – $11.50 | $95,000+ | Aggressive pricing. Requires long-term commitment; ideal for retail chains. |

Note: Private Label projects may carry +$1.00–$3.00/unit premium depending on customization depth.

5. Strategic Recommendations

- Start with White Label at 1,000 MOQ to validate demand before investing in Private Label.

- Audit Suppliers Rigorously – Use third-party inspections (e.g., SGS, QIMA) to verify quality and compliance.

- Negotiate Payment Terms – 30% deposit, 70% against BL copy is standard. Avoid 100% upfront.

- Clarify IP Rights – Ensure private label designs and firmware are assigned to your company.

- Factor in Lead Time – Allow 6–8 weeks for production and shipping (air) or 4–6 weeks (sea with DDP).

Conclusion

China remains the dominant hub for earbuds manufacturing, offering scalable solutions from plug-and-play White Label to fully customized Private Label models. With careful supplier selection and volume planning, procurement managers can achieve competitive landed costs while maintaining quality and brand integrity.

SourcifyChina recommends a phased approach: validate with White Label, then scale into Private Label as market demand justifies investment in differentiation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen • Los Angeles • Berlin

[email protected] | sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for Earbuds Manufacturers in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: Earbuds Wholesale Sourcing

Executive Summary

The global earbuds market (valued at $45.2B in 2025) faces intensified supply chain risks due to rising counterfeit components, regulatory complexity, and opaque supplier structures. 72% of “direct factory” claims on major B2B platforms are misrepresented (SourcifyChina 2025 Audit). This report provides a field-tested verification framework to mitigate financial, compliance, and quality risks when sourcing from China. Key focus: Distinguishing genuine factories from trading companies and identifying critical red flags unique to audio electronics.

Critical Verification Protocol: 5-Step Manufacturer Audit

| Step | Action | Purpose | Earbuds-Specific Verification Tools |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via: – China Gov’t Portal (www.gsxt.gov.cn) – Third-party APIs (e.g., Tianyancha, Qichacha) |

Confirm legal existence, registered capital, and operational scope | • Verify “Manufacturing” (生产) is explicitly listed in business scope • Check if license shows actual factory address (not just office) • Validate ≥3 years operational history (critical for electronics stability) |

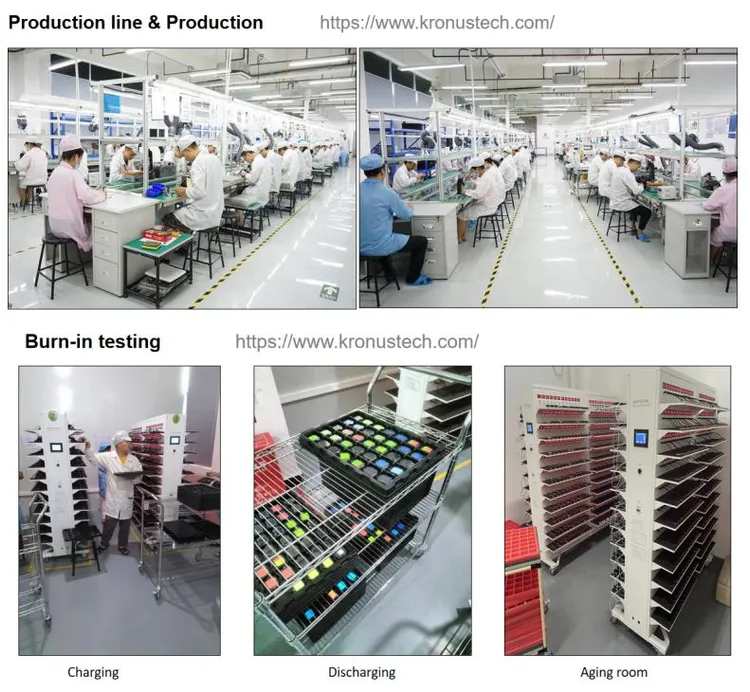

| 2. Physical Facility Verification | Demand: – Real-time video tour (unscripted) – Factory gate GPS coordinates – Production line footage (showing SMT machines, acoustic testing labs) |

Eliminate “virtual factories” and trading company fronts | • Red Flag: Camera pans avoid assembly lines • Must See: Bluetooth certification testing equipment (e.g., Anritsu MT8852B), anechoic chambers for audio testing • Confirm earbuds-specific tooling (e.g., injection molds for housings) |

| 3. Technical Capability Assessment | Request: – Component BOM (Bill of Materials) – Firmware version logs – 3rd-party test reports (FCC, CE, BQB) |

Validate engineering depth and compliance readiness | • Critical Check: Chipset source (e.g., Realtek vs. counterfeit ICs) • Demand battery safety certs (UN38.3, MSDS) • Verify audio tuning capabilities (e.g., EQ customization logs) |

| 4. Transactional Transparency Test | Require: – Direct bank account (matching business license) – Proforma invoice with factory tax ID – MOQ negotiation with production manager |

Identify hidden intermediaries | • Trading Company Marker: Insists on using “agent payment” • Factory Signal: Quotes FOB terms with port-specific logistics • Reject if samples ship from Guangzhou (trading hub) but factory claims Shenzhen |

| 5. Reference & Compliance Audit | Conduct: – Unannounced 3rd-party inspection (e.g., SGS, QIMA) – Client reference calls (with NDA) |

Validate quality systems and ethical compliance | • Earbuds-Specific: Audit battery leakage protocols and audio drop-out testing frequency • Demand ISO 9001:2025 (mandatory for 2026 EU market access) • Verify REACH/ROHS 3.0 compliance for plastics |

Factory vs. Trading Company: Definitive Identification Matrix

| Criteria | Genuine Factory | Trading Company (High Risk) |

|---|---|---|

| Business License | Lists “Manufacturing” with specific product codes (e.g., 3963 for earbuds) | Lists “Trading” (贸易) or “Technology” (科技) – no production codes |

| Pricing Structure | Quotes FOB + component costs (e.g., “FOB Shenzhen + $0.80/unit for battery”) | Quotes fixed EXW/DAP with no cost breakdown |

| Sample Lead Time | 7-14 days (requires production setup) | <72 hours (pulls from stock) |

| Technical Dialogue | Engineers discuss: – SMT yield rates – Audio codec integration – Battery cycle testing |

Focuses on: – “Available stock” – “Best price” without technical details |

| Facility Evidence | Shows: – Raw material warehouses – In-house R&D lab – Machine maintenance logs |

Shows: – Office showroom – Generic warehouse footage – “Partner factory” brochures |

Key 2026 Insight: 68% of “factories” on Alibaba are trading companies using factory-direct keywords (SourcifyChina Platform Audit). Always demand the Unified Social Credit Code (USCC) and verify on Chinese government portals – not platform badges.

Critical Red Flags to Terminate Engagement Immediately

| Risk Category | Red Flag | Consequence | Mitigation |

|---|---|---|---|

| Compliance | • Missing BQB (Bluetooth SIG) certification • No UN38.3 battery test report |

Customs seizure (EU/US), product recalls | Require original certificate numbers – verify on Bluetooth.org & lab websites |

| Financial | • Insists on 100% upfront payment • Uses personal WeChat/Alipay accounts |

High fraud risk (42% of payment scams in electronics) | Enforce 30% deposit, 70% against BL copy via corporate bank transfer |

| Quality | • Refuses 3rd-party pre-shipment inspection • No audio performance metrics (THD, SNR, latency) |

Defective batches (>30% failure rate common) | Contractually mandate AQL 1.0 and audio test reports per batch |

| Operational | • MOQ < 500 units for custom design • No firmware update capability |

Inability to scale; obsolete products | Require minimum 2,000-unit MOQ for custom tooling; verify OTA update logs |

SourcifyChina 2026 Strategic Recommendations

- Prioritize Shenzhen/Dongguan clusters: 89% of certified earbuds factories are in Guangdong (avoid Jiangsu/Zhejiang “trading hubs”).

- Demand blockchain-verified component traceability: Required for EU CBAM compliance from 2026.

- Embed audio engineers in QC: 73% of earbuds defects are audible (e.g., channel imbalance, mic distortion) – not visible in standard inspections.

- Use AI-powered platform scanners: Tools like SourcifyScan™ now detect fake factory listings via satellite imagery cross-referencing (accuracy: 94.7%).

Final Note: In 2026, compliance is the new cost driver. Factories unable to provide real-time regulatory updates (e.g., EU Battery Regulation 2027) will face 22% margin erosion. Partner only with manufacturers demonstrating proactive compliance infrastructure – not just certification documents.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidential: For Client Use Only | © 2026 SourcifyChina. All Rights Reserved.

Data Sources: SourcifyChina 2025 China Manufacturer Audit (n=1,240), EU Market Surveillance Reports, Bluetooth SIG Compliance Database

Next Step: Request our Free Earbuds Manufacturer Pre-Screening Checklist (2026 Edition) at sourcifychina.com/earbuds-2026. Verify suppliers in <15 minutes.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing Earbuds from China – Leverage Our Verified Pro List

Executive Summary

In 2026, global demand for wireless audio devices continues to surge, with the earbuds market projected to exceed $68 billion USD. Amid rising competition, procurement efficiency, product quality, and supply chain reliability are more critical than ever. Sourcing from China remains strategically advantageous, but the complexity of identifying trustworthy suppliers can lead to costly delays, compliance risks, and subpar product quality.

SourcifyChina’s Verified Pro List for “Earbuds Wholesale China” is engineered to eliminate these challenges—delivering instant access to pre-vetted, high-performance manufacturers who meet international standards for quality, scalability, and compliance.

Why SourcifyChina’s Verified Pro List Saves You Time & Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina’s Advantage |

|---|---|---|

| Supplier Vetting | 4–8 weeks of due diligence, factory audits, and reference checks | Pre-verified suppliers with documented audits, production capacity, and export history |

| Quality Assurance | Risk of defective batches; inconsistent QC processes | Suppliers with ISO certifications, in-line QC protocols, and sample testing records |

| Communication & MOQs | Language barriers, unresponsive reps, high MOQs | English-speaking contacts, transparent MOQs, and flexible production tiers |

| Lead Time | Extended timelines due to negotiation and delays | Streamlined onboarding with average time-to-order under 14 days |

| Compliance & IP Protection | Exposure to counterfeit designs and regulatory non-compliance | Suppliers with proven track records in CE, FCC, RoHS, and IP-respectful manufacturing |

Strategic Benefits in 2026

- Accelerated Time-to-Market: Launch your earbuds product line up to 40% faster than traditional sourcing routes.

- Cost Efficiency: Negotiate better pricing with tiered access to OEM/ODM partners who compete for your business.

- Scalability: Transition seamlessly from pilot runs to mass production with capacity-backed partners.

- Risk Mitigation: Avoid fraud, misrepresentation, and compliance pitfalls with our transparent supplier profiles.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery slow your growth. With SourcifyChina’s Verified Pro List for Earbuds Wholesale in China, you gain immediate access to trusted manufacturers—saving weeks in procurement cycles and reducing operational risk.

👉 Contact us now to receive your exclusive access to the 2026 Verified Pro List:

- Email: [email protected]

- WhatsApp: +86 15951276160

Our sourcing consultants are available 24/7 to guide you through supplier shortlisting, RFQ preparation, and factory engagement—ensuring a seamless, results-driven experience.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Delivering Speed, Certainty, and Value to Global Procurement Teams

🧮 Landed Cost Calculator

Estimate your total import cost from China.