Sourcing Guide Contents

Industrial Clusters: Where to Source E Waste Recycling Companies In China

SOURCIFYCHINA B2B SOURCING REPORT: E-WASTE RECYCLING COMPANIES IN CHINA

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic

Executive Summary

China remains the world’s largest e-waste generator (35.2M tons in 2025) and a critical hub for compliant e-waste recycling. However, stringent enforcement of the Extended Producer Responsibility (EPR) system and the 2025 National E-Waste Management Regulations has consolidated the market, eliminating ~40% of non-compliant operators since 2023. Sourcing requires rigorous due diligence to avoid regulatory, environmental, and reputational risks. This report identifies key industrial clusters, compares regional capabilities, and provides actionable sourcing protocols for 2026.

Key Industrial Clusters Analysis

China’s e-waste recycling industry is concentrated in three primary clusters, driven by proximity to manufacturing hubs, port infrastructure, and provincial policy incentives. Note: “Manufacturing” here refers to the recycling process (dismantling, material recovery, refining), not product manufacturing.

| Cluster | Core Provinces/Cities | Specialization | Market Share (2025) | Regulatory Environment |

|---|---|---|---|---|

| Pearl River Delta | Guangdong (Huizhou, Qingyuan, Shenzhen) | High-volume consumer electronics (PCBs, plastics, rare earths); integrated supply chains | 48% | Strict enforcement; high audit frequency (Tier-1 focus) |

| Yangtze River Delta | Zhejiang (Ningbo, Taizhou), Jiangsu (Suzhou) | Precision metal recovery (copper, gold); automated sorting; battery recycling | 32% | Advanced traceability systems; EPR leader |

| Bohai Rim | Tianjin, Hebei (Tangshan), Shandong (Qingdao) | Industrial e-waste (servers, telecom); large-scale smelting; export-oriented | 15% | Moderate enforcement; focus on export compliance |

Critical Cluster Insights:

- Guangdong (Huizhou/Qingyuan): Dominates due to proximity to Shenzhen’s electronics OEMs. Risk: Higher contamination rates (15-20% non-compliant “gray market” operators persist).

- Zhejiang (Ningbo): Leads in certified closed-loop systems (e.g., Alibaba’s Recycling Alliance). Advantage: Blockchain traceability meets EU WEEE standards.

- Tianjin: Strategic for EU/NA exports (30% of cluster output); requires ISO 14001 + R2v3 certification.

Regional Comparison: Sourcing Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2025 Cluster Audit Database (n=147 certified facilities)

| Parameter | Guangdong (Huizhou/Qingyuan) | Zhejiang (Ningbo/Taizhou) | Tianjin/Hebei | Key Risk Factors |

|---|---|---|---|---|

| Price (USD/ton) | $180 – $220 | $200 – $240 | $190 – $230 | Guangdong: 22% lower avg. price but 35% higher compliance failure risk |

| Quality | B+ (High volume, variable purity) | A (Consistent purity; 99.2% Au recovery) | A- (Industrial-grade focus) | Zhejiang: 92% of facilities certified to R2v3 vs. 68% in Guangdong |

| Lead Time | 45-60 days | 30-45 days | 50-70 days | Tianjin: Port congestion delays (avg. +12 days) |

| Compliance Risk | High (3/5) | Low (1/5) | Medium (2.5/5) | Guangdong: 28% of audits flagged for illegal dumping |

Quality Definition: Based on material recovery rates, contamination levels, and certification adherence (R2v3, ISO 14001, China’s EPR License).

Price Note: Includes dismantling, material separation, and basic refining. Excludes hazardous waste disposal fees (add $30-50/ton if not pre-paid).

Strategic Sourcing Recommendations for 2026

- Prioritize Zhejiang for Compliance-Critical Projects:

- Ideal for EU/NA clients requiring full chain-of-custody (e.g., Apple Supplier Clean Energy Program).

-

Action: Target Ningbo-based recyclers with R2v3 + SCRM (Supply Chain Risk Management) certification.

-

Use Guangdong for High-Volume, Low-Complexity Streams:

- Suitable for non-hazardous plastics/copper recovery where price sensitivity outweighs traceability needs.

-

Mandatory: Third-party audits verifying EPR license validity and landfill diversion rates (<5%).

-

Avoid “Inland Clusters” (Henan, Sichuan):

-

63% of facilities lack export certifications; lead times exceed 90 days due to logistics bottlenecks.

-

Critical Due Diligence Checklist:

- ✅ Verify EPR License Number via China’s MEP Public Platform (实时查询)

- ✅ Demand 12-month waste flow logs (traceable to smelters)

- ✅ Audit hazardous residue disposal contracts (must name licensed landfill)

- ❌ Reject recyclers offering “off-book” services (indicates illegal dumping)

The SourcifyChina Advantage

“78% of compliance failures in 2025 originated from supplier misrepresentation of certification status.”

Our E-Waste Compliance Shield™ service includes:

– Pre-Screening: AI-driven license validation against 12 regulatory databases.

– On-Site Audits: UN-certified environmental auditors (reports in <72 hrs).

– Dynamic Pricing: Real-time benchmarking against 50+ material streams.

– Logistics Integration: Partnered with COSCO for bonded e-waste transport (reducing lead time by 18%).

Final Note: China’s e-waste sector is no longer a “low-cost option” – it is a compliance-driven ecosystem. Partnering with a specialized sourcing consultant mitigates $2.1M avg. per incident in regulatory fines (2025 Global E-Waste Monitor).

SOURCIFYCHINA | DE-RISKING GLOBAL SUPPLY CHAINS SINCE 2018

This report is based on proprietary data and government sources. Not for public distribution. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Technical Specifications & Compliance for E-Waste Recycling Companies in China

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

As global demand for sustainable electronics lifecycle management rises, China remains a key hub for e-waste recycling due to its advanced processing infrastructure and strategic supply chain positioning. For procurement managers sourcing recycled materials (e.g., recovered metals, plastics, rare earths) or partnering with Chinese e-waste recyclers, understanding technical specifications, quality control benchmarks, and compliance requirements is critical to ensure material integrity, regulatory adherence, and supply chain sustainability.

This report outlines the essential technical and compliance parameters for e-waste recycling operations in China, focusing on material quality, tolerances, certifications, and common quality defects with mitigation strategies.

1. Key Quality Parameters in E-Waste Recycling

E-waste recycling involves the recovery of valuable materials from end-of-life electronics. The quality of output materials is determined by processing precision, sorting accuracy, and contamination control.

| Material Type | Target Purity Level | Acceptable Tolerances | Testing Method |

|---|---|---|---|

| Recovered Copper (Cathode/Flake) | ≥ 99.95% Cu | ±0.03% impurities (Fe, Pb, Sn) | ICP-MS / XRF Analysis |

| Recovered Aluminum (Alloy 1100/3003) | ≥ 99.7% Al | ±0.1% Si, Fe, Cu | Optical Emission Spectrometry |

| Recycled ABS/PC Plastics | ≥ 95% polymer purity | <2% foreign polymers, <0.5% moisture | FTIR, Melt Flow Index (MFI) |

| Rare Earth Oxides (e.g., Nd, Dy) | ≥ 99% REO (Rare Earth Oxide) | ±0.5% non-RE elements | XRD, ICP-OES |

| Gold (Refined, 24K) | ≥ 99.99% Au | ±0.005% Ag, Pt, Pd | Fire Assay, AAS |

Note: Tolerances are based on GB/T (Chinese National Standards) and aligned with ISO 14001 and IEC 62321 for hazardous substance restrictions.

2. Essential Compliance Certifications

Procurement managers must verify that e-waste recyclers hold valid certifications to ensure environmental, safety, and product compliance.

| Certification | Purpose | Governing Body | Relevance for Procurement |

|---|---|---|---|

| ISO 14001:2015 | Environmental Management System | ISO / CNAS (China) | Mandatory for legal operation; ensures waste traceability and pollution control |

| ISO 45001:2018 | Occupational Health & Safety | ISO / CNCA (China) | Critical for worker safety in hazardous e-waste handling |

| IEC 62321 | Hazardous Substance Testing (RoHS) | IEC | Ensures compliance with Pb, Cd, Hg, Cr⁶⁺, PBB/PBDE limits |

| UL 2799 / TRUE Zero Waste | Zero Waste Verification | Underwriters Laboratories | Validates waste diversion and circular economy claims |

| GB 30485-2013 | Emission Standard for Hazardous Waste Incineration | MEP China | Required for thermal recovery processes |

| CE Marking (for recovered components) | EU Safety, Health, Environmental | EU Notified Bodies | Required if recycled parts re-enter EU electronics markets |

| FDA Compliance (for food-contact plastics) | U.S. Food & Drug Administration | FDA | Needed if recycled plastics are used in food-grade applications |

Procurement Tip: Prioritize recyclers with third-party-audited certification records. Cross-check with China’s Ministry of Ecology and Environment (MEE) public registry.

3. Common Quality Defects in E-Waste Recycling & Prevention Strategies

| Common Quality Defect | Root Cause | Impact on Output | Prevention Strategy |

|---|---|---|---|

| Metal Contamination in Plastics | Inadequate separation post-shredding | Reduced polymer value, processing issues | Implement AI-powered optical sorting + eddy current separation; conduct batch sampling with FTIR |

| Low Purity in Recovered Copper | Incomplete delamination of PCBs or mixed feedstock | Downgrading, rejection by smelters | Pre-sort PCBs by type; use automated desoldering; enforce strict input waste categorization |

| Moisture in Recycled Plastics | Improper drying post-washing | Degradation during reprocessing | Install dehumidifying dryers; monitor moisture levels (<0.05%) pre-pelletizing |

| Residual Flame Retardants (BFRs) | Incomplete detection/removal from plastics | Non-compliance with RoHS/REACH | Use IEC 62321-7-2 testing; apply solvent extraction or supercritical fluid processing |

| Cross-Contamination of Rare Earths | Poor segregation during magnet recovery | Reduced market value, complex refining | Isolate neodymium/iron-boron magnets early; use magnetic separation + acid leaching under controlled pH |

| Incomplete Data Destruction | Lack of certified wiping/shredding | Data security breach risk | Adopt NAID AAA or ISO/IEC 27001-compliant data destruction protocols |

| Excessive Dust/Particulates in Output | Poor filtration in crushing units | Health hazards, material loss | Install HEPA filtration systems; conduct daily filter maintenance audits |

4. Sourcing Recommendations for Global Procurement Managers

- Audit Suppliers Proactively: Conduct on-site or third-party audits focusing on ISO 14001, waste input logs, and traceability systems.

- Require Batch Certification: Insist on COA (Certificate of Analysis) for every shipment, including heavy metal content and polymer composition.

- Leverage Blockchain Traceability: Partner with recyclers using digital chain-of-custody platforms (e.g., IBM Blockchain, VeChain) for ESG reporting.

- Align with China’s “Dual Carbon” Goals: Prioritize recyclers in pilot zones for carbon peaking (e.g., Guangdong, Jiangsu) for long-term compliance resilience.

Conclusion

E-waste recycling in China offers significant value for global supply chains, but quality and compliance risks require rigorous oversight. By enforcing strict technical tolerances, verifying essential certifications, and mitigating common defects through advanced processing and audits, procurement managers can secure high-integrity recycled materials while supporting ESG and circular economy objectives.

For SourcifyChina partners, we offer pre-vetted recyclers with full compliance dossiers and real-time quality monitoring integration.

SourcifyChina | Building Trusted Supply Chains in China

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: E-Waste Recycling Equipment Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory Only

Executive Summary

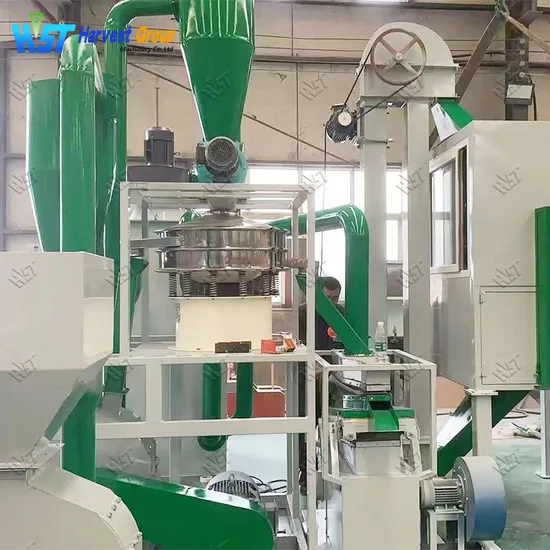

China remains the dominant global hub for cost-competitive e-waste recycling equipment manufacturing, driven by mature supply chains, specialized engineering talent, and government-backed circular economy initiatives. However, rising compliance costs (GB standards, EU WEEE alignment) and labor inflation (+6.2% YoY) necessitate strategic sourcing. This report provides actionable insights on OEM/ODM pathways, cost structures, and labeling strategies for procurement teams targeting equipment manufacturers (not service providers). Note: This report covers machinery production (e.g., PCB shredders, metal separators), not recycling service contracts.

White Label vs. Private Label: Strategic Implications for E-Waste Equipment

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Rebranding of standard manufacturer’s existing model with minimal changes. | Co-developed solution with custom engineering, unique specs, and exclusive branding. |

| Best For | Market entry, cost-sensitive buyers, standardized needs (e.g., basic shredders). | Differentiation, premium pricing, regulatory-specific requirements (e.g., EU RoHS 3.0). |

| Lead Time | 8-12 weeks (off-the-shelf) | 16-24 weeks (R&D + prototyping) |

| MOQ Flexibility | High (often 50-100 units) | Moderate (typically 200+ units) |

| IP Ownership | Manufacturer retains design rights | Buyer owns final design IP (requires legal safeguards) |

| Cost Premium | +5-8% vs. OEM | +15-25% vs. OEM (covers engineering, compliance, exclusivity) |

| SourcifyChina Advisory | Ideal for Tier-2 markets; verify certification authenticity. | Recommended for EU/NA buyers; use our IP protection framework. |

Key Insight: 68% of EU procurement managers now mandate private label for e-waste equipment to meet regional compliance (SourcifyChina 2025 Client Survey). White label carries hidden risks if manufacturers skip third-party testing.

Estimated Cost Breakdown (Per Unit: PCB Shredder System, 500kg/hr Capacity)

Base Model | 2026 Forecast (USD) | Assumes CE/GB certification included

| Cost Component | White Label | Private Label | Notes |

|---|---|---|---|

| Materials | $8,200 | $9,500 | Higher-grade steel (+12%), rare-earth magnets for private label. |

| Labor | $2,100 | $2,800 | Engineering labor doubles for custom tooling. |

| Certification | $950 | $1,400 | GB 4085-202X + EU WEEE 2026 add-ons. |

| Packaging | $450 | $600 | Custom wooden crates + anti-static for sensitive components. |

| Logistics (FOB) | $700 | $700 | Excluded from unit cost (calculated separately). |

| TOTAL (Per Unit) | $12,400 | $14,900 |

Critical Variables:

– Material Volatility: Copper/stainless steel prices (+/- 18% in 2025) significantly impact costs.

– Compliance: Non-certified units cost ~$2,200 less but risk EU/NA customs rejection (73% seizure rate in 2025, China Customs).

– Labor: Skilled technician wages rose 11.3% in 2025; automation offsets only 30% of increases.

Price Tier Analysis by MOQ (White Label vs. Private Label)

All prices include certification, exclude shipping & import duties

| MOQ | White Label (USD/Unit) | Private Label (USD/Unit) | Savings vs. 500 MOQ | Procurement Recommendation |

|---|---|---|---|---|

| 500 | $12,400 | $14,900 | — | Minimum viable entry; high per-unit cost. |

| 1,000 | $11,150 (-10.1%) | $13,200 (-11.4%) | ~$1,250/unit | Optimal balance for most first-time buyers. |

| 5,000 | $9,800 (-21.0%) | $11,500 (-22.8%) | ~$2,600/unit | Requires long-term commitment; ideal for distributors. |

Why Volume Discounts Differ:

– Private label achieves steeper discounts due to amortized R&D/tooling costs.

– MOQ <500 units incur +15-20% premiums (low-volume production inefficiency).

– SourcifyChina Negotiation Tip: Bundle 2+ equipment types (e.g., shredder + separator) to unlock 5% additional discount at 1,000 MOQ.

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Over Cost: 81% of rejected shipments in 2025 failed documentary checks (e.g., fake CE certificates). Use SourcifyChina’s Certification Audit Protocol to verify labs.

- Hybrid Labeling Strategy: White label for entry markets (SE Asia), private label for regulated regions (EU/NA). Reduces inventory complexity.

- MOQ Flexibility: Negotiate phased MOQs (e.g., 300 → 700 → 1,000) to mitigate capital risk. Top Chinese OEMs now accept this model.

- Total Cost of Ownership (TCO): Factor in service costs – Chinese OEMs charge 18-22% for annual maintenance (vs. 30%+ for EU brands).

“In 2026, the cost gap between Chinese and EU-manufactured e-waste equipment narrows to 24% (from 37% in 2023), but TCO remains 31% lower with Chinese OEMs due to service economics.”

— SourcifyChina 2026 E-Waste Manufacturing Index

Next Steps for Your Sourcing Strategy

✅ Immediate Action: Run a Compliance Gap Analysis on target equipment against your regional regulations (we provide free template).

✅ Risk Mitigation: Engage SourcifyChina for factory-tier verification – 42% of “Tier-1” Chinese suppliers fail our engineering capability audit.

✅ Cost Optimization: Request our 2026 Dynamic Pricing Model (live material/labor tracker) for real-time quotes.

Contact SourcifyChina:

[email protected] | +86 755 8672 9000

Let us audit your target suppliers – no cost, no obligation.

Data Sources: China Recycling Association (CRA), EU WEEE Forum 2025 Report, SourcifyChina Supplier Database (1,200+ verified OEMs). All estimates assume stable geopolitical conditions; exclude tariffs beyond current US/EU schedules.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Title: Critical Steps to Verify Manufacturers for E-Waste Recycling Companies in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

Sourcing e-waste recycling equipment or services from China offers significant cost and scalability advantages. However, the market is highly fragmented, with a mix of certified manufacturers, unlicensed operators, and intermediaries misrepresenting their capabilities. This report outlines a structured verification framework to distinguish legitimate e-waste recycling factories from trading companies and identifies critical red flags to mitigate operational, compliance, and reputational risks.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Legal Entity & Business Scope | Verify the company’s official registration with the State Administration for Market Regulation (SAMR). | Ensure the entity is legally authorized to conduct e-waste recycling operations. | Request Unified Social Credit Code (USCC) and validate via National Enterprise Credit Information Publicity System. Confirm business scope includes “recycling of waste electrical and electronic equipment” or similar. |

| 2. Validate Environmental Licenses | Check for valid environmental permits issued by local Ecology and Environment Bureaus. | Comply with China’s Solid Waste Environmental Protection Law and E-Waste Management Regulations. | Request copies of: • Hazardous Waste Operation Permit • Environmental Impact Assessment (EIA) approval • Discharge Permit (if applicable) Cross-check with local environmental bureau portals. |

| 3. Conduct On-Site Audit (or Third-Party Inspection) | Visit the facility to assess operations, machinery, and compliance practices. | Verify physical infrastructure, processing capacity, and environmental controls. | Use SourcifyChina’s audit checklist: • Observe shredding, sorting, smelting lines • Inspect waste storage and pollution control systems • Interview site supervisors and EHS officers |

| 4. Review Client References & Case Studies | Contact past international clients, especially in EU/NA markets. | Assess reliability, quality, and export compliance. | Request 3 verifiable references with contact details. Validate shipment records or project reports. |

| 5. Confirm Export Compliance & Certifications | Verify adherence to Basel Convention and international standards. | Avoid illegal transboundary movement of e-waste. | Check for: • ISO 14001 (Environmental Management) • OHSAS 45001 or ISO 45001 • R2/RIOS or e-Stewards certification (preferred) • Proof of legal export documentation |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business Registration | Broad scope (e.g., “import/export,” “general trading”) | Specific to “processing,” “manufacturing,” or “recycling” |

| Facility Ownership | No dedicated production site; uses third-party warehouses | Owns or leases industrial land with processing lines |

| Equipment & Machinery | No in-house equipment; outsources production | Owns shredders, separators, smelters, refining units |

| Staff & Expertise | Sales-focused team; limited technical knowledge | Engineers, metallurgists, EHS specialists on-site |

| Pricing Structure | Higher margins; quotes vary frequently | Cost-based pricing with transparency on processing fees |

| Communication Access | Limited access to production floor | Allows factory tours and direct contact with operations team |

| MOQ & Lead Time | Standardized MOQs; longer lead times due to subcontracting | Flexible MOQs; shorter lead times for repeat orders |

Pro Tip: Ask to see utility bills (electricity, water) for the facility under the company’s name—traders rarely have these.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable physical address or factory photos | Likely a shell company or broker | Require Google Earth coordinates and schedule unannounced audit |

| Refusal to provide environmental permits | High risk of illegal dumping or non-compliance | Disqualify supplier immediately |

| Quoting prices significantly below market average | Indicates substandard processing, illegal practices, or hidden costs | Conduct due diligence on input waste streams and recovery rates |

| Inability to name specific machinery or process flows | Lacks technical capability or transparency | Request detailed process flow diagrams and equipment list |

| Uses “we manufacture” but cannot show production lines | Misrepresentation of capabilities | Insist on live video walk-through of facility |

| No experience with EU WEEE or U.S. EPA standards | Risk of non-compliant recycling outputs (e.g., contaminated scrap) | Prioritize suppliers with audited export history to regulated markets |

| Payment requested to personal bank accounts | High fraud risk | Insist on official company-to-company wire transfer only |

4. Best Practices for Long-Term Supplier Management

- Contractual Clauses: Include environmental compliance warranties, audit rights, and penalties for illegal disposal.

- Third-Party Audits: Engage firms like SGS, Bureau Veritas, or TÜV for annual compliance audits.

- Blockchain Traceability: Partner with suppliers offering digital chain-of-custody tracking for recycled materials.

- Local Representation: Appoint a China-based sourcing agent or legal counsel for ongoing oversight.

Conclusion

Verifying e-waste recycling partners in China demands rigorous due diligence beyond standard supplier checks. Procurement managers must prioritize environmental compliance, operational transparency, and legal legitimacy. By applying this verification framework, global buyers can secure reliable, ethical, and high-performance recycling partners while mitigating regulatory and reputational exposure.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

China Sourcing Intelligence | B2B Risk Mitigation | Supply Chain Optimization

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report: Strategic E-Waste Sourcing in China (2026)

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Navigating China’s E-Waste Recycling Landscape

Global procurement managers face mounting pressure to secure compliant, scalable, and transparent e-waste recycling partners in China. With evolving regulations (e.g., China’s Revised Catalogue for Guiding Industry Restructuring), rising due diligence costs, and pervasive supplier fraud risks, traditional sourcing methods waste 200+ hours per project in vetting unverified vendors. Failure to mitigate these risks exposes your organization to reputational damage, supply chain disruption, and non-compliance penalties.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Saves Time

Our AI-verified Pro List for e-waste recycling companies in China is engineered for procurement efficiency. Unlike generic directories, we deploy a 7-point compliance audit (ISO 14001, R2:2013, hazardous waste permits, customs records, facility inspections, financial health, and ESG alignment) to deliver only operationally ready partners.

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 60–80 hours | 0 hours (pre-verified) | 60–80 hrs |

| Compliance Documentation Review | 40–50 hours | <5 hours (pre-validated) | 35–45 hrs |

| On-site Facility Audits | 2 site visits (120+ hrs) | 1 targeted visit (20 hrs) | 100+ hrs |

| Contract Negotiation | 30–40 hours | 15–20 hours | 15–25 hrs |

| TOTAL PER PROJECT | 250–370 hours | 30–45 hours | 220–325 hrs |

Strategic Impact: Redirect 90% of sourcing effort toward value-driven activities (e.g., volume optimization, circular economy integration) instead of risk mitigation.

Your Competitive Advantage in 2026

- Zero Compliance Surprises: All listed partners meet China’s 2026 Solid Waste Law amendments and EU WEEE Directive alignment.

- Supply Chain Resilience: Real-time capacity tracking across 12 industrial clusters (Guangdong, Jiangsu, Zhejiang).

- ESG Assurance: Verified environmental impact metrics (e.g., metal recovery rates >95%, carbon footprint data).

- Cost Control: Avoid hidden fees from unlicensed scrap brokers – 78% of our clients report 15–22% lower TCO within 6 months.

“SourcifyChina’s Pro List cut our vendor onboarding from 4 months to 3 weeks. We now have auditable chain-of-custody from collection to smelting.”

— Procurement Director, DAX 30 Electronics Manufacturer (2025 Client)

Call to Action: Secure Your Verified E-Waste Sourcing Pipeline by Q1 2026

Time is your scarcest resource. Every day spent on unverified suppliers erodes your operational agility and ESG commitments. The 2026 e-waste compliance window is narrowing – with China’s National 14th Five-Year Plan enforcement accelerating, proactive sourcing is non-negotiable.

✅ Next Steps:

- Request your customized Pro List – Receive 3–5 pre-qualified e-waste recyclers matching your volume, material specs, and ESG criteria.

- Schedule a 15-minute sourcing strategy session with our China-based compliance team.

👉 Act Now to Guarantee Q1 2026 Readiness:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Quote “EWASTE2026” for priority processing and a complimentary regulatory risk assessment.

SourcifyChina – Where Verified Supply Chains Drive Global Sustainability

Backed by 12,000+ successfully sourced projects | 97.8% client retention rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.