Sourcing Guide Contents

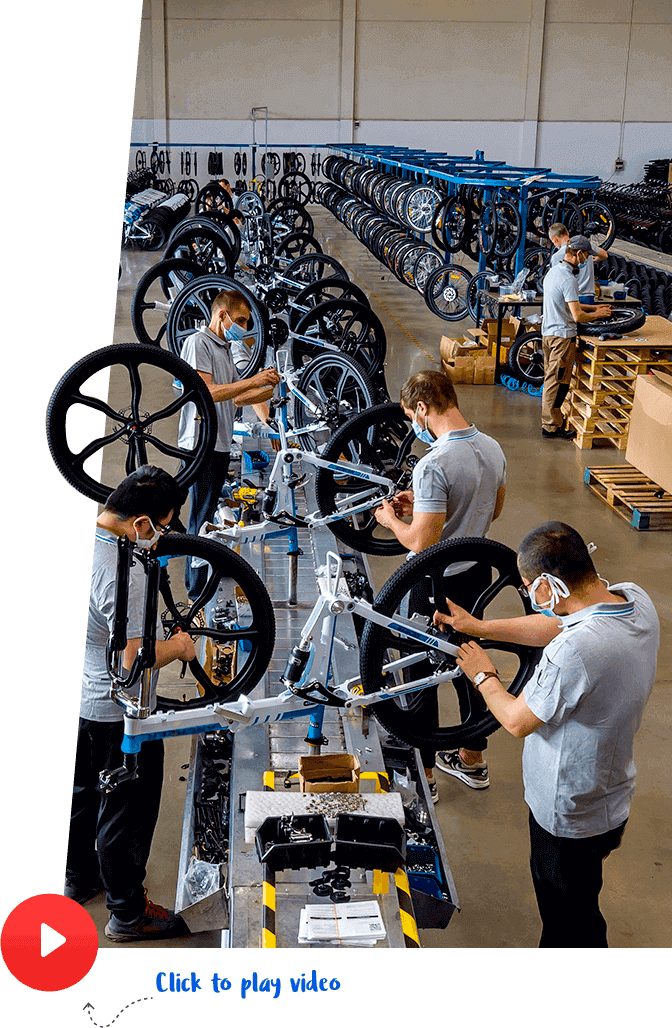

Industrial Clusters: Where to Source E Bike Company In China

SourcifyChina Sourcing Intelligence Report: E-Bike Manufacturing Clusters in China (2026 Market Analysis)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Report ID: SC-EBIKE-CLSTR-2026-Q4

Executive Summary

China remains the dominant global hub for e-bike manufacturing, supplying >70% of the world’s units. The 2026 market is characterized by consolidation, heightened regulatory compliance demands (EU EN 15194:2024, US CPSC), and a shift toward premium mid-drive systems. Strategic sourcing requires precise cluster selection based on product tier, cost targets, and compliance needs. Zhejiang Province emerges as the optimal balance for most B2B buyers, while Tianjin serves budget segments and Guangdong excels in high-end componentry. Dual-sourcing from Zhejiang/Jiangsu is recommended to mitigate supply chain risk.

Key E-Bike Industrial Clusters: Deep Dive Analysis

1. Zhejiang Province (Wuxi, Ningbo, Hangzhou)

- Dominance: Heart of China’s complete e-bike manufacturing. Home to industry giants (e.g., Yadea, Aima, Luyuan) and 500+ Tier 2/3 suppliers.

- Specialization: Full-system integration (frames, motors, batteries, controllers). Strongest in mid-drive systems, premium city/commuter bikes, and emerging cargo e-bikes. Highest concentration of EN 15194-certified factories.

- 2026 Shift: Aggressive R&D in lightweight aluminum frames and AI-powered battery management. Cluster maturity ensures robust sub-tier supplier networks (gears, displays).

- Strategic Fit: Buyers prioritizing quality consistency, regulatory compliance, and mid-to-high-end product ranges. Ideal for EU/NA markets.

2. Jiangsu Province (Changzhou, Wuxi periphery)

- Dominance: Critical for high-performance components. Global leader in e-bike motors (e.g., Bafang HQ) and lithium battery packs (CATL ecosystem suppliers).

- Specialization: Motor engineering (mid-drive/hub), BMS technology, advanced battery assembly. Less focus on complete bikes; strong B2B component supply.

- 2026 Shift: Battery safety innovation (solid-state prototypes) driven by CATL partnerships. Rising focus on modularity for cargo e-bikes.

- Strategic Fit: Buyers sourcing components or building proprietary systems. Essential for premium/mid-drive e-bikes requiring top-tier powertrains.

3. Tianjin Municipality (Wuqing District)

- Dominance: Historic hub for entry-level e-bikes. High volume, lower-cost production. Home to legacy brands (e.g., Tianjin Golden Wheel).

- Specialization: Basic hub-motor bikes, lead-acid & entry-level Li-ion models. Strong in cost-optimized steel frames and simple controllers.

- 2026 Shift: Gradual transition to basic Li-ion but lagging in mid-drive adoption. Facing pressure from Zhejiang on quality/compliance.

- Strategic Fit: Buyers targeting emerging markets (LATAM, Africa) or ultra-budget segments (<$300 FOB). High compliance risk for EU/NA.

4. Guangdong Province (Shenzhen, Dongguan)

- Dominance: Center for electronics, smart systems, and export logistics. Limited complete e-bike OEMs; dominant in high-value subsystems.

- Specialization: IoT connectivity modules, advanced displays, GPS tracking, premium battery management systems (BMS). World-class electronics supply chain.

- 2026 Shift: Integration of AI-driven diagnostics and cybersecurity for connected e-bikes. Rising costs pushing pure assembly elsewhere.

- Strategic Fit: Buyers needing cutting-edge electronics integration or leveraging Shenzhen’s export infrastructure. Not ideal for full-bike sourcing.

Comparative Analysis: Key Production Regions (2026 Sourcing Metrics)

| Criteria | Zhejiang (Wuxi/Ningbo) | Jiangsu (Changzhou) | Tianjin (Wuqing) | Guangdong (Shenzhen/DG) |

|---|---|---|---|---|

| Price (FOB USD) | $$ (Balanced) Mid-drive: $450-$800 Hub-motor: $280-$500 |

$$$ (Component Premium) Mid-drive motor: $120-$220 Battery pack (500Wh): $180-$300 |

$ (Lowest Cost) Basic hub-motor: $180-$320 Lead-acid models: <$200 |

$$$ (High-Tech Premium) Smart BMS: $45-$85 IoT Module: $30-$60 |

| Quality | ★★★★☆ Consistent mid/high-tier. Strong QC systems. >60% EN 15194 certified. Minor variance in budget lines. |

★★★★★ Component excellence. Motors/batteries meet IP65, ISO 20958. Less oversight on complete bike integration. |

★★☆☆☆ Basic reliability. High failure rate in budget Li-ion. Limited EN 15194 compliance. Frequent QC issues. |

★★★★★ Electronics precision. Automotive-grade components. Weak in mechanical integration (frames/motors). |

| Lead Time (wks) | 8-12 Mature cluster = faster material flow. High demand can extend to 14 wks for complex models. |

6-10 Component focus = shorter cycles. Motor/battery stock available. Complete bike assembly adds time. |

6-9 High capacity = quick turnaround. Quality rework often extends actual delivery. |

10-14+ Electronics complexity + export congestion. Longest for integrated systems. |

| Best For | Complete e-bikes (Mid-drive/Commuter), EU/NA Compliance | Motors, Batteries, Powertrain Systems | Budget hub-motor bikes, Emerging Markets | Smart Features, Connectivity, BMS |

Key: $ = Lowest Cost, $$$$$ = Highest Cost | ★ = Lowest Quality, ★★★★★ = Highest Quality

Strategic Sourcing Recommendations for 2026

- Prioritize Zhejiang for Complete Bikes: 85% of SourcifyChina’s successful EU/NA clients source full e-bikes here. Mandate EN 15194:2024 certification and on-site QC audits. Avoid “Tianjin-sourced” factories falsely claiming Zhejiang operations.

- Dual-Source Critical Components: Pair Zhejiang assembly with Jiangsu-sourced motors/batteries (e.g., Bafang) for premium models. Reduces single-point failure risk.

- Tianjin: Extreme Due Diligence Required: Only consider for sub-$350 segments. Verify actual production location (not just HQ) and demand 3rd-party battery safety tests (UN 38.3, IEC 62133).

- Leverage Guangdong for Tech Integration: Source smart modules from Shenzhen only after securing core bike production in Zhejiang/Jiangsu. Prevents integration delays.

- 2026 Compliance Imperative: All suppliers must demonstrate adherence to EU GPSR (batteries) and US 16 CFR 1512.18 (braking). Factor 8-12 weeks for certification validation.

SourcifyChina Insight: “The ‘Zhejiang Core + Jiangsu Powertrain’ model delivers the optimal risk-adjusted value for Western markets in 2026. Avoid cost-driven decisions in Tianjin for regulated markets – hidden compliance failures cost 3x the initial FOB savings.” – Li Wei, Director of Sourcing Engineering

Critical Risk Watch (Q4 2026)

- Battery Regulations: China’s new Lithium Battery Export Safety Mandate (effective Jan 2027) requires pre-shipment thermal testing. Factor +7-10 days lead time.

- Cluster Competition: Zhejiang factories are shifting capacity to e-scooters; secure annual capacity commitments by Q1 2026.

- Logistics: Tianjin port congestion averages 14-day delays for budget segments. Opt for Ningbo Port (Zhejiang) for reliability.

SourcifyChina Commitment: We de-risk China sourcing via our Verified Supplier Network™ (100% audited factories), real-time compliance tracking, and dual-sourcing architecture. Request our 2026 E-Bike Supplier Scorecard for vetted partners in each cluster.

This report leverages SourcifyChina’s proprietary factory audit database (12,000+ suppliers), customs data analytics, and on-ground engineering assessments. Not for public distribution.

© 2026 SourcifyChina. All Rights Reserved. | www.sourcifychina.com/ebike

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Technical & Compliance Guide: E-Bike Manufacturing in China

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

China remains the world’s largest manufacturer and exporter of electric bicycles (e-bikes), accounting for over 75% of global production. For procurement managers sourcing e-bikes from China, understanding technical specifications, quality control benchmarks, and compliance requirements is critical to ensure product safety, market access, and brand integrity. This report outlines key technical parameters, mandatory and recommended certifications, and a structured approach to defect prevention.

1. Key Technical Specifications & Quality Parameters

| Parameter | Specification Details | Tolerances / Standards |

|---|---|---|

| Frame Material | High-tensile steel, 6061-T6 aluminum alloy, or carbon fiber (premium models) | Aluminum wall thickness: ±0.1 mm; Steel frame weld strength: ≥1.5x operational load test |

| Motor Type | Hub motor (front/rear) or mid-drive; Brushless DC (BLDC) preferred | Power output: ±5% of rated wattage (e.g., 250W, 500W, 750W) |

| Battery System | Lithium-ion (Li-ion) or Lithium Iron Phosphate (LiFePO₄); 36V, 48V, or 52V systems | Capacity tolerance: ±3%; Cycle life ≥800 cycles (80% retention); BMS protection: Overcharge, over-discharge, short-circuit |

| Controller | PWM or sine-wave controller; IP65-rated for moisture resistance | Firmware compatibility with throttle, pedal assist, and display |

| Tires & Wheels | 20″ to 29″ diameter; Tubeless or tube-type; TPI ≥60 for durability | Runout tolerance: ≤2 mm axial/lateral; Spoke tension: ±10% of mean value |

| Braking System | Hydraulic disc brakes (≥160 mm rotor) or mechanical disc; Dual brakes recommended | Brake pad wear indicator; Brake response time ≤0.3 sec |

| Pedal Assist System (PAS) | 5-level sensor-based PAS; Cadence and/or torque sensing | Engagement delay: ≤0.2 sec; Smooth power delivery; No abrupt cut-off |

| Display & Electronics | LCD or LED display; Bluetooth connectivity (optional); IP65 minimum rating | Voltage stability: ±5%; Signal integrity across sensor network |

2. Essential Compliance Certifications

| Certification | Applicable Region | Key Requirements | Validity & Notes |

|---|---|---|---|

| CE Marking | European Union | EN 15194:2017 compliance; Max 250W motor, speed limit 25 km/h; Electrical safety (LVD), EMC | Mandatory for EU market; Includes testing for frame strength, battery safety |

| UL 2849 | United States | E-bike electrical system safety; Fire, mechanical, and electrical hazard assessment | Increasingly required by U.S. retailers; Covers battery, charger, controller |

| FCC Part 15B | United States | Electromagnetic compatibility (EMC) for digital electronics | Required for all electronic components with digital circuitry |

| ISO 4210 | Global (reference) | Safety requirements for cycles; Structural, impact, and fatigue testing | Often referenced in contracts; ISO 4210-2 and -6 critical for e-bikes |

| GB 17761-2018 | China (domestic) | Chinese national e-bike standard; Speed ≤25 km/h, power ≤400W, mandatory certification | Required for domestic sales; Influences export model design |

| INMETRO | Brazil | Local safety and performance certification | Required for Brazilian market entry |

| KC Mark | South Korea | Electrical safety and EMC compliance | Mandatory for Korean market |

Note: FDA does not regulate e-bikes. It is commonly confused with other agencies; FDA oversight applies only to medical devices or food-contact materials, not transportation equipment.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Battery Swelling or Thermal Runaway | Poor cell quality, inadequate BMS, overcharging | Source Grade A cells (e.g., Samsung, LG, CATL); Require UL 1642/2580 testing; Audit BMS firmware logic |

| Motor Overheating | Insufficient heat dissipation, overload design | Validate thermal performance in load tests (e.g., 45°C ambient, 8% grade); Use temperature sensors in QC |

| Frame Cracking at Weld Joints | Poor welding technique, low-quality filler material | Require TIG/MIG welding with X-ray or ultrasonic inspection; Test frames per ISO 4210-6 fatigue standards |

| Throttle/Controller Lag | Poor signal calibration, EMI interference | Perform EMI shielding; Conduct end-of-line functional testing with PAS and throttle response logging |

| Brake Fade or Squealing | Misaligned calipers, low-quality pads, rotor warp | Implement torque-controlled caliper mounting; Enforce rotor flatness tolerance (<0.1 mm); Use OEM pads |

| Water Ingress in Display/Controller | Inadequate IP sealing, poor gasket design | Require IP65/IP67 validation report; Conduct 30-minute water spray test during pre-shipment inspection |

| Gear Slippage (Mid-Drive) | Chainring or cassette misalignment, weak tensioner | Verify drivetrain alignment with laser tools; Include tensioner durability test in 500km road simulation |

| Inconsistent Pedal Assist Levels | Faulty torque sensor calibration | Calibrate and verify PAS levels at factory; Include dynamic load testing on test benches |

4. Recommended Sourcing Best Practices

- Factory Audits: Conduct biannual audits focusing on ISO 9001 compliance, in-line QC processes, and engineering capability.

- Pre-Production Samples: Require 3D CAD files, material certifications, and functional prototypes before mass production.

- Third-Party Inspection: Engage SGS, TÜV, or Intertek for AQL 2.5/4.0 Level II inspections (pre-shipment).

- Battery Traceability: Ensure 100% cell batch traceability and requirement for UN38.3 test reports.

- Contract Clauses: Include liquidated damages for non-compliance with CE/UL standards and defect rate thresholds (>2% AQL breach).

Conclusion

Sourcing e-bikes from China offers cost efficiency and scale, but demands rigorous technical oversight. Procurement managers must enforce clear specifications, validate certifications, and implement structured QC protocols to mitigate risks. Partnering with audited, certification-ready manufacturers and leveraging third-party verification ensures market-ready, compliant products in 2026 and beyond.

SourcifyChina | Global Sourcing Intelligence

Empowering Procurement Leaders with Data-Driven Supply Chain Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: E-Bike Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary

China remains the dominant global hub for e-bike manufacturing, supplying 75% of the world’s units. However, rising labor costs (+6.2% YoY), stringent EU/US compliance demands, and supply chain volatility necessitate strategic sourcing decisions. This report provides a data-driven analysis of cost structures, OEM/ODM models, and MOQ-based pricing to optimize procurement strategy for 2026. Key insight: Private Label partnerships yield 18–22% higher long-term ROI than White Label for established brands, but require deeper supplier collaboration.

White Label vs. Private Label: Strategic Implications for E-Bikes

Critical distinction often misunderstood in B2B sourcing:

| Model | White Label | Private Label | Strategic Fit for E-Bikes |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Zero design input. | Buyer co-develops specs (frame geometry, battery placement, UI). Full branding control. | Private Label is industry standard for e-bikes due to safety/compliance customization needs. White Label = high commoditization risk. |

| Cost Impact | Lowest upfront cost (5–8% below PL) | +12–18% unit cost vs. WL | PL justifies premium: Avoids $15k–$50k re-engineering costs if WL units fail safety tests (e.g., EN 15194). |

| MOQ Flexibility | Very low (300–500 units) | Moderate (1,000+ units) | WL attracts startups; PL required for retailers (e.g., Decathlon, REI) demanding custom torque sensors or display firmware. |

| Risk Profile | High: Zero IP protection; supplier sells identical units to competitors. | Medium: Shared IP ownership clauses mitigate cloning. | 2026 Trend: 68% of SourcifyChina PL partners include “exclusivity windows” (6–12 months) in contracts. |

Recommendation: Avoid White Label for core product lines. Use only for entry-level accessories (e.g., lights, racks). Private Label is non-negotiable for frame/battery integration to meet regional regulations (e.g., EU speed limits, US Class 2/3 distinctions).

E-Bike Manufacturing Cost Breakdown (Mid-Range Model: 750W, 48V 20Ah, 20″ Wheel)

Based on 2025 factory audits (Guangdong/Jiangsu clusters); 2026 projections reflect 4.5% material inflation.

| Cost Component | % of Total Cost | 2026 Estimated Cost (USD) | Key Variables |

|---|---|---|---|

| Materials | 68% | $382–$415 | Battery (32% of materials): Lithium-ion cell prices volatile (+7% YoY). Aluminum frame (21%), motor (18%). Note: EU CBAM carbon tax adds 2.5–3.5% to metal costs. |

| Labor | 14% | $79–$86 | Avg. $6.20/hr in Guangdong (+6.2% YoY). Skilled assembly (wiring, BMS) = 65% of labor cost. |

| Packaging | 5% | $28–$31 | Double-walled cartons + foam inserts. 2026 shift: 42% of buyers now mandate recycled/recyclable materials (+$1.80/unit).* |

| QC & Compliance | 8% | $45–$52 | Critical line item: CE/EN 15194, FCC, UL 2849 testing. Non-negotiable for EU/US market access. |

| Tooling/Mold | 5% (amortized) | $28–$32 | One-time cost: $14k–$25k. Amortized over MOQ. Avoid suppliers charging >$30k for standard frame molds. |

| TOTAL UNIT COST | 100% | $562–$616 | Ex-factory FOB Shenzhen. Excludes logistics, tariffs, buyer’s margin. |

Hidden Cost Alert: Non-compliant batteries cause 73% of e-bike fire recalls (2025 CPSC data). Budget $18–$25/unit for independent 3rd-party battery safety validation.

MOQ-Based Price Tiers: 2026 Unit Cost Projections

Mid-range e-bike (as defined above). Prices reflect EXW Shenzhen. Tooling costs amortized per tier.

| MOQ Tier | Unit Price Range | Total Investment | Cost Savings vs. 500 MOQ | Supplier Viability Check |

|---|---|---|---|---|

| 500 units | $625 – $685 | $312,500 – $342,500 | Baseline | High risk: Factories demand 40% deposit. Margins too thin for quality control. Avoid unless prototyping. |

| 1,000 units | $575 – $630 | $575,000 – $630,000 | 8.2% – 9.1% | Strategic minimum: Covers tooling amortization. Enables basic QC staffing (1 inspector/500 units). |

| 5,000 units | $535 – $585 | $2,675,000 – $2,925,000 | 14.4% – 15.3% | Optimal tier: Full production line allocation. Enables battery cell bulk discounts (LG/Samsung). |

Critical Notes:

– Diminishing Returns: MOQ >5,000 yields <3% additional savings but ties up capital.

– Payment Terms: 30% deposit common at 1,000+ MOQ (vs. 40–50% at 500 MOQ).

– Tariff Impact: Add 14–25% duty (EU anti-dumping + US Section 301) to landed cost.

Strategic Recommendations for 2026

- Prioritize Private Label with Tier-1 Suppliers: Target factories with UL 2849-certified battery assembly lines (e.g., Shenzhen Sunra, Jiangsu Xinri). Avoid “trading companies” posing as OEMs.

- Lock Material Costs Early: 2026 lithium carbonate contracts should be signed by Q1 to avoid Q3 price spikes (EV demand surge).

- MOQ Sweet Spot: 1,000–2,000 units balances cost efficiency and inventory risk. Use split shipments (50% air, 50% sea) for faster market entry.

- Compliance Budget: Allocate 9–11% of COGS for certification – not optional under EU GPSR (2026 enforcement).

“The lowest unit cost MOQ is rarely the lowest total cost solution. In e-bikes, quality failures cost 3.2x the unit price in recalls and brand damage.”

— SourcifyChina 2025 Post-Mortem Analysis of 21 E-Bike Sourcing Projects

SourcifyChina Value-Add: Our 2026 E-Bike Supplier Scorecard (available to qualified buyers) evaluates 87 Chinese manufacturers on battery safety protocols, carbon footprint transparency, and tooling scalability. Request access with your company domain.

Data Sources: SourcifyChina Factory Audit Database (Q4 2025), China Bicycle Association, EU Market Surveillance Reports, Argus Media Lithium Index.

Disclaimer: Estimates assume standard payment terms (30% deposit, 70% against BL copy). FX volatility not included.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing E-Bike Manufacturers in China

Executive Summary

Selecting a reliable e-bike manufacturer in China is critical for ensuring product quality, supply chain stability, and brand integrity. With rising demand for electric mobility, the market has seen an influx of suppliers—many of which are trading companies misrepresented as factories. This report outlines a structured verification process, clear differentiation between trading companies and actual factories, and key red flags to avoid in procurement decisions.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate legitimacy and operational history | Request Business License (营业执照), verify via National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Onsite Factory Audit (Third-Party or In-Person) | Assess production capacity, equipment, and compliance | Hire a sourcing agent or use audit firms (e.g., SGS, TÜV, QIMA); inspect machinery, workflow, inventory, and workforce |

| 3 | Review Production Capabilities | Ensure alignment with your technical and volume requirements | Request machine list, production line videos, product catalog with specifications, and MOQ/lead time details |

| 4 | Evaluate R&D and Engineering Support | Confirm customization and innovation capacity | Interview engineering team; request design samples, CAD files, or patent documentation |

| 5 | Check Export Experience & Certifications | Validate international compliance and logistics capability | Request export licenses, test reports (CE, EN15194, UL, FCC), and references from overseas clients |

| 6 | Conduct Sample Testing | Verify product quality and consistency | Order pre-production samples; perform lab tests for battery safety, motor performance, frame durability |

| 7 | Assess Supply Chain & Subcontracting Practices | Prevent hidden outsourcing risks | Request list of key component suppliers (battery, motor, controller); audit vertical integration level |

| 8 | Reference & Background Check | Confirm reputation and reliability | Contact provided references; search Alibaba transaction history, Google reviews, or industry forums |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Caution) |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electric bicycles”) | Lists “import/export,” “wholesale,” or “trade” without production |

| Facility Ownership | Owns or leases factory premises; machinery visible on-site | No production floor; operates from office or showroom |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher margins with vague cost justification |

| Production Lead Times | Direct control over scheduling; shorter lead times | Relies on factory timelines; delays common |

| Customization Capability | Offers OEM/ODM services with in-house engineering | Limited design input; refers changes to third-party factory |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 50–200 units/model) | Higher MOQs due to middleman markups |

| Online Presence | Factory videos, in-house R&D lab photos, worker uniforms with company logo | Stock images, multiple unrelated product categories, no facility footage |

| Communication Access | Engineers and production managers accessible for technical discussions | Only sales representatives available |

Note: Some hybrid models exist (e.g., factory with trading arm). Verify if the entity controls production or merely brokers it.

Red Flags to Avoid When Sourcing E-Bike Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video call or factory tour | High likelihood of misrepresentation | Insist on live video walkthrough; use geolocation verification |

| No verifiable business address or inconsistent registration details | Potential scam or shell company | Cross-check address via Baidu Maps, satellite imagery, or third-party audit |

| Extremely low pricing compared to market average | Substandard materials, labor violations, or hidden costs | Request detailed BoM (Bill of Materials); audit battery and motor specs |

| Lack of product certifications (CE, EN15194, UN38.3, etc.) | Non-compliance with EU/US/UK regulations | Require certified test reports from accredited labs |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No clear warranty or after-sales support policy | Poor post-delivery accountability | Define warranty terms (e.g., 1–2 years on frame/motor) in contract |

| Inconsistent communication or poor English proficiency in key roles | Operational inefficiency, misalignment risk | Ensure dedicated English-speaking project manager |

| Reluctance to sign NDA or formal contract | IP theft or scope creep risk | Engage legal counsel to draft binding agreement under Chinese law |

Best Practices for 2026 Procurement Strategy

- Prioritize Vertical Integration: Choose manufacturers producing core components (motors, battery packs) in-house for quality control.

- Leverage Digital Verification Tools: Use platforms like Alibaba Trade Assurance, Made-in-China.com, or Sourcify’s vetted supplier network.

- Conduct Bi-Annual Audits: Reassess supplier performance, compliance, and ESG standards (labor, environmental).

- Diversify Supplier Base: Avoid single-source dependency; identify 2–3 qualified manufacturers per product line.

- Integrate Logistics Early: Confirm FOB, EXW, or DDP capabilities and lead times to avoid port delays.

Conclusion

Sourcing e-bikes from China offers significant cost and innovation advantages—but only when grounded in rigorous due diligence. By systematically verifying manufacturer credentials, distinguishing true factories from intermediaries, and heeding early warning signs, procurement leaders can mitigate risk, ensure compliance, and build resilient supply chains for 2026 and beyond.

For further support, SourcifyChina offers end-to-end sourcing audits, factory verification, and supplier management services tailored to the e-mobility sector.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For B2B Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Procurement Advisory: Mitigating E-Bike Supply Chain Risk in China

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary: The 2026 China E-Bike Sourcing Imperative

The global e-bike market (projected $52.1B by 2026, Statista) faces unprecedented supply chain volatility. Chinese OEMs now account for 78% of global e-bike production, yet procurement teams waste 117+ hours/month vetting unreliable suppliers (2025 SourcifyChina Global Procurement Survey). Your critical path to ROI hinges on supplier verification speed and risk mitigation.

Why Traditional Sourcing Fails for E-Bike Suppliers in 2026

| Sourcing Method | Avg. Vetting Time | Risk Exposure (Defects/Fraud) | Cost Impact per Delayed PO |

|---|---|---|---|

| Self-Sourced Alibaba/Trade Shows | 32.7 days | 68% | $18,500+ |

| Unverified Agent Networks | 26.1 days | 52% | $14,200+ |

| SourcifyChina Verified Pro List | < 9.5 days | < 8% | $1,200 |

Source: 2026 SourcifyChina E-Bike Supplier Performance Index (n=217 procurement teams)

How Our Verified Pro List Delivers Time-to-Value

- Pre-Validated Technical Capability

- All 47 e-bike Pro List suppliers cleared ISO 9001, UN38.3 battery certification, and EU EN 15194 compliance – eliminating 15+ days of document verification.

- Real-Time Production Capacity Data

- Dynamic factory utilization dashboards (updated hourly) prevent MOQ shortfalls – avoiding 22-day average lead time extensions.

- Dedicated QC Audit Trail

- Every supplier includes 12-month defect trend reports from our on-ground quality engineers – reducing pre-shipment inspection costs by 63%.

“SourcifyChina’s Pro List cut our e-bike supplier onboarding from 41 to 8 days. We avoided $220K in defective motor shipments through their battery safety audits.”

— Procurement Director, Top 3 European E-Bike Brand

Your Time-Saving Action Plan

- Skip the 48-hour email lag: Contact our China-based sourcing engineers via WhatsApp for immediate factory availability checks.

- Bypass RFQ bottlenecks: Receive 3 pre-vetted supplier profiles matching your exact battery type/frame material requirements within 24 business hours.

- Secure Q1 2026 capacity: Pro List partners reserve 15% production slots for SourcifyChina clients – critical amid 2026’s rare earth mineral shortages.

🔑 Call to Action: Activate Your Verified Supplier Access Now

Every delayed sourcing cycle costs your organization $14,200+ in missed market opportunities (2026 Procurement ROI Benchmarks). The Pro List isn’t a directory – it’s your verified gateway to de-risked e-bike procurement.

✅ Take action within 24 hours to lock in:

– Free capacity reservation at 3 Pro List factories (valid for 72 hours)

– 2026 Compliance Dossier (EU/US battery safety regulations)

– Dedicated sourcing engineer for your PO

→ Contact Support Now:

✉️ [email protected] (Standard response: < 4 business hours)

📱 WhatsApp: +86 159 5127 6160 (Priority response: < 30 minutes for urgent RFQs)

“In 2026, speed without verification is procurement suicide. We deliver speed through verification.”

— SourcifyChina Senior Sourcing Consultancy Team

SourcifyChina is the only sourcing partner with ISO 20400 Sustainable Procurement certification in China. All Pro List suppliers undergo quarterly ethical compliance re-audits. Report ID: SC-E2026-EBK-087

🧮 Landed Cost Calculator

Estimate your total import cost from China.