The global automotive transmission market is undergoing rapid transformation, driven by rising demand for fuel-efficient vehicles, the expansion of electric and hybrid drivetrains, and advancements in automated transmission technologies. According to a 2023 report by Grand View Research, the global transmission market size was valued at USD 112.6 billion and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth trajectory is further amplified by increasing vehicle production, especially in emerging economies, and stricter emissions regulations pushing automakers toward more efficient transmission systems. As competition intensifies, a select group of dynamic transmission manufacturers are leading innovation—leveraging automation, connectivity, and electrification to redefine performance, reliability, and efficiency. These top eight players are not only shaping the future of powertrain solutions but are also capturing significant market share through strategic partnerships, R&D investments, and scalable manufacturing capabilities.

Top 8 Dynamic Transmission Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 9

Domain Est. 1996

Website: zf.com

Key Highlights: ZF is the world’s first transmission manufacturer to develop the automatic passenger car transmission 9HP with nine gears. The high efficiency and the….

#2 Neugart

Domain Est. 1997

Website: neugart.com

Key Highlights: Discover the high-quality planetary and custom gearboxes from Neugart GmbH. As one of the leading gearbox manufacturers, we offer innovative drive solutions ……

#3 Mayr power transmission

Domain Est. 1997

Website: mayr.com

Key Highlights: mayr power transmission is a leading manufacturer of safety brakes, torque limiters and shaft couplings. Its wide product portfolio also includes magnetic ……

#4 American Gear Manufacturers Association

Domain Est. 1997

Website: agma.org

Key Highlights: It offers technical standards, education, and business information for manufacturers, suppliers, and users of gears and mechanical power transmission components ……

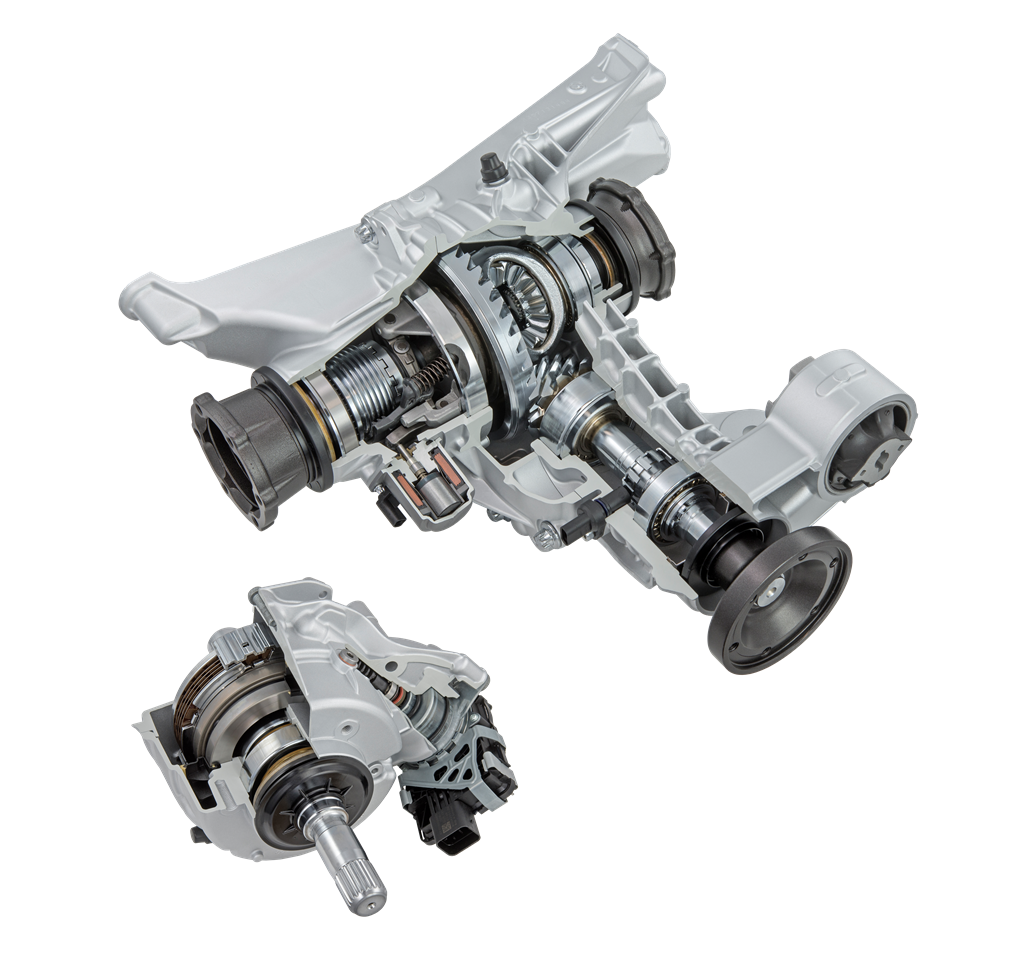

#5 ICE Powertrain Products

Domain Est. 1991

Website: magna.com

Key Highlights: Magna’s dual-clutch transmissions offer superior driving comfort, efficiency, and dynamic performance. · Up to 20% or more fuel savings compared to conventional ……

#6 American Axle & Manufacturing

Domain Est. 1997

Website: aam.com

Key Highlights: As a leading global Tier 1 Automotive and Mobility Supplier, AAM designs, engineers and manufactures Driveline and Metal Forming technologies to support ……

#7 Dayco

Domain Est. 1998

Website: dayco.com

Key Highlights: Dayco is a global leader in the research, design, manufacture and distribution of essential engine drive systems and aftermarket services for automotive, truck, ……

#8 ETE REMAN

Domain Est. 2005

Website: etereman.com

Key Highlights: HAVE ANY QUESTIONS? CALL OR TEXT US AT 1-800-934-9479 | installer locator | car care centers · Etereman menu. HAVE ANY QUESTIONS? CALL OR TEXT US. Etereman ……

Expert Sourcing Insights for Dynamic Transmission

H2: Market Trends Shaping Dynamic Transmission’s Outlook for 2026

As the global automotive and industrial sectors evolve rapidly, Dynamic Transmission—a leader in drivetrain and transmission technology—is poised to navigate a transformative market landscape by 2026. Several macroeconomic, technological, and regulatory trends are converging to redefine demand, competition, and innovation in the transmission industry. Below is an analysis of the key H2 (second half) 2026 market trends expected to impact Dynamic Transmission.

1. Accelerated Shift Toward Electrification

By H2 2026, the global push for carbon neutrality will significantly influence transmission technologies. While traditional automatic and manual transmissions remain relevant in internal combustion engine (ICE) vehicles, demand is shifting toward e-axles and integrated electric drive systems. Dynamic Transmission must continue its strategic pivot toward hybrid transmission systems and e-transmissions to remain competitive. OEMs are increasingly seeking suppliers capable of delivering compact, efficient, and software-integrated solutions for electric vehicles (EVs), presenting both a challenge and growth opportunity.

2. Growth in Commercial Vehicle and Off-Highway Applications

Despite passenger vehicle electrification, H2 2026 will see sustained demand for advanced mechanical and automated manual transmissions (AMTs) in commercial trucks, construction equipment, and agricultural machinery. These sectors are adopting smart transmission systems with predictive shift logic and fuel optimization algorithms. Dynamic Transmission can leverage its expertise in durability and efficiency to capture share in these high-margin industrial segments, especially in emerging markets where electrification adoption lags.

3. Supply Chain Resilience and Regionalization

Geopolitical tensions and trade policy shifts will continue to influence manufacturing footprints. By H2 2026, OEMs and Tier-1 suppliers are expected to prioritize nearshoring and regional supply chains, particularly in North America and Europe under incentives like the U.S. Inflation Reduction Act (IRA) and EU Green Deal. Dynamic Transmission must assess its global production strategy, potentially expanding localized manufacturing to reduce lead times and tariff exposure.

4. Integration of AI and Predictive Analytics

Intelligent transmissions with embedded sensors and AI-driven control systems will gain traction. By late 2026, vehicles equipped with predictive maintenance capabilities and adaptive gear-shifting—based on driving behavior, terrain, and traffic—will become mainstream. Dynamic Transmission has the opportunity to differentiate through software-defined transmission platforms that offer over-the-air (OTA) updates and enhanced driver experience.

5. Regulatory Pressures and Emission Standards

Stricter fuel economy and emissions regulations, particularly in China (China 6b), Europe (Euro 7), and California (LEV IV), will compel OEMs to adopt ultra-efficient transmission systems. Dynamic Transmission’s success will depend on its ability to deliver lightweight, low-friction gearboxes with improved torque capacity and thermal management—key factors in meeting regulatory thresholds.

6. Competitive Landscape and M&A Activity

The transmission sector is expected to see consolidation by H2 2026, as traditional suppliers merge or partner with tech firms to stay relevant amid electrification. Dynamic Transmission may consider strategic alliances or acquisitions in software, power electronics, or thermal management to broaden its value proposition and secure long-term OEM contracts.

Conclusion

By H2 2026, Dynamic Transmission will operate in a dual-demand environment: declining reliance on conventional transmissions in passenger cars, yet strong demand in commercial, off-road, and hybrid applications. To thrive, the company must accelerate innovation in electrified drivetrains, embrace digitalization, and strengthen regional supply chains. Strategic foresight and agility will be critical to maintaining leadership in a rapidly evolving mobility ecosystem.

Common Pitfalls When Sourcing Dynamic Transmission (Quality, IP)

Sourcing Dynamic Transmission solutions—particularly those involving real-time video or data streaming with adaptive bitrate (ABR) and intellectual property (IP) considerations—can be complex. Organizations often encounter several recurring challenges that impact performance, compliance, and long-term scalability. Below are key pitfalls to avoid:

1. Overlooking Video Quality Consistency Across Networks

Dynamic transmission relies on adaptive bitrate streaming to maintain playback under varying network conditions. A common mistake is assuming all solutions provide uniform quality. Poorly implemented ABR algorithms may cause excessive bitrate switching, leading to inconsistent user experience. Always test the solution under diverse network conditions and verify seamless transitions between quality levels.

2. Inadequate Support for Modern Codecs and Standards

Choosing a transmission solution that lacks support for efficient codecs (e.g., H.265/HEVC, AV1) or modern protocols (e.g., CMAF, DASH, HLS with low latency extensions) can result in higher bandwidth costs and suboptimal quality. Ensure compatibility with current and emerging industry standards to future-proof your deployment.

3. Ignoring Latency Requirements

Some dynamic transmission systems prioritize efficiency over speed, introducing unacceptable delays for live broadcasts or interactive applications. Failing to assess end-to-end latency during the sourcing phase can lead to performance issues in time-sensitive use cases like live events or remote production.

4. Underestimating IP and Licensing Risks

Many video codecs and transmission technologies are protected by patents. Sourcing a solution without verifying proper licensing (e.g., via MPEG LA, AV1 Alliance, or individual patent holders) exposes organizations to legal and financial risks. Ensure vendors provide clear documentation on IP coverage and indemnification.

5. Lack of Transparency in Quality Metrics

Vendors may promote high peak bitrates or resolution without disclosing actual delivered quality under real-world conditions. Request access to objective quality assessment tools (e.g., VMAF, PSNR, SSIM) and real user monitoring (RUM) data to validate performance claims independently.

6. Poor Integration with Existing Infrastructure

Dynamic transmission systems must integrate smoothly with content management, CDN, DRM, and monitoring platforms. Sourcing a standalone solution without assessing interoperability can lead to costly custom development and operational overhead.

7. Neglecting Security and DRM Compatibility

Transmitting high-value content requires robust security. Overlooking support for modern DRM systems (e.g., Widevine, PlayReady, FairPlay) or secure key exchange protocols can expose content to piracy. Verify end-to-end encryption and compliance with industry security standards.

8. Assuming Scalability Without Proof

High-quality dynamic transmission must scale under load. Vendors may promise performance that falters during traffic spikes. Require proof through stress testing and scalability benchmarks before committing.

9. Incomplete SLAs and Support Coverage

Service Level Agreements (SLAs) for quality, uptime, and support response times are often vague. Ensure SLAs include measurable KPIs for video quality, rebuffering rate, and incident resolution to hold vendors accountable.

10. Overreliance on Proprietary Technology

Some vendors lock customers into proprietary formats or protocols, limiting flexibility and increasing switching costs. Prefer open standards-based solutions that promote vendor neutrality and long-term adaptability.

By proactively addressing these pitfalls during the sourcing process, organizations can secure dynamic transmission solutions that deliver consistent quality, protect IP, and scale reliably across diverse use cases.

Logistics & Compliance Guide for Dynamic Transmission

This guide outlines the essential logistics and compliance procedures for Dynamic Transmission to ensure efficient operations, regulatory adherence, and risk mitigation across all supply chain activities.

Overview of Logistics Framework

Dynamic Transmission’s logistics framework is designed to support seamless movement of goods from procurement through to final delivery. It encompasses transportation, warehousing, inventory management, and distribution processes aligned with industry best practices and customer requirements.

Transportation Management

All transportation activities must comply with local and international regulations. Key considerations include carrier selection, route optimization, shipment tracking, and delivery timeframes. Use approved third-party logistics (3PL) providers with valid certifications and insurance coverage. Ensure all freight documentation (bills of lading, delivery notes, etc.) is accurate and retained for audit purposes.

Warehousing and Inventory Control

Maintain organized and secure warehouse facilities with clear labeling, FIFO (First In, First Out) inventory rotation, and regular cycle counts. Implement a Warehouse Management System (WMS) to track stock levels in real time. Conduct quarterly warehouse audits to verify inventory accuracy and ensure compliance with health, safety, and fire regulations.

Regulatory Compliance

Adhere to all applicable laws and standards, including but not limited to:

– International Commercial Terms (Incoterms® 2020)

– Customs regulations (e.g., Import/Export Controls, HS Code classification)

– Environmental regulations (e.g., hazardous material handling, WEEE compliance)

– Trade sanctions and embargo lists (OFAC, EU, UN)

Ensure all personnel involved in logistics are trained on compliance requirements and updated on regulatory changes.

Documentation and Recordkeeping

Maintain complete and accurate records for a minimum of seven years, including:

– Shipping and delivery confirmations

– Customs declarations and duty payments

– Certificates of origin

– Compliance certifications (e.g., ISO, CE marking)

– Carrier contracts and insurance policies

All documents must be securely stored and readily accessible for internal audits or regulatory inspections.

Risk Management and Contingency Planning

Identify potential logistics risks (e.g., supply chain disruptions, natural disasters, geopolitical issues) and develop mitigation strategies. Establish backup suppliers, alternative shipping routes, and emergency communication protocols. Conduct biannual risk assessments and update contingency plans accordingly.

Sustainability and Ethical Standards

Dynamic Transmission is committed to sustainable logistics practices. Optimize fuel efficiency, reduce packaging waste, and partner with environmentally responsible carriers. Ensure all suppliers and logistics partners adhere to ethical labor practices and anti-corruption policies in line with the company’s Code of Conduct.

Performance Monitoring and Continuous Improvement

Track key performance indicators (KPIs) such as on-time delivery rate, order accuracy, freight cost per unit, and inventory turnover. Review performance data monthly and implement corrective actions where necessary. Encourage feedback from customers and partners to drive continuous improvement in logistics operations.

Training and Accountability

All employees and contractors involved in logistics must complete mandatory compliance and safety training upon onboarding and annually thereafter. Assign clear roles and responsibilities, and maintain a compliance officer to oversee adherence to this guide and relevant regulations.

Revision and Governance

This Logistics & Compliance Guide will be reviewed annually or as regulatory requirements change. Updates must be approved by the Operations Director and communicated company-wide. Version control and change logs will be maintained for audit transparency.

Conclusion for Sourcing Dynamic Transmission:

In conclusion, sourcing a dynamic transmission system requires a strategic and comprehensive approach that balances performance requirements, cost efficiency, supplier reliability, and long-term sustainability. As automotive and industrial technologies continue to evolve, dynamic transmissions—capable of adapting to varying load and speed conditions—have become critical for enhancing efficiency, responsiveness, and overall system performance.

Effective sourcing involves evaluating technical specifications, scalability, integration capabilities, and after-sales support from suppliers. It is essential to partner with vendors who demonstrate innovation, quality assurance, and a commitment to advancing transmission technology, such as those incorporating electrification, smart controls, and predictive maintenance features.

Furthermore, global supply chain dynamics, geopolitical factors, and sustainability regulations must be considered to ensure resilient and responsible procurement practices. By adopting a holistic sourcing strategy that aligns technical needs with business objectives, organizations can secure dynamic transmission solutions that deliver improved performance, reduce operational costs, and support future-ready applications across automotive, industrial, and mobility sectors.