The global DVI cable market continues to experience steady demand, driven by the proliferation of high-definition audiovisual equipment in commercial, industrial, and consumer electronics sectors. According to a report by Mordor Intelligence, the global HDMI and DVI cable market was valued at approximately USD 7.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. While HDMI dominates newer installations, DVI remains critical in legacy systems, medical displays, industrial automation, and specific enterprise computing environments. Grand View Research also highlights sustained demand in developing regions where cost-effective digital video interfaces are essential for scaling IT infrastructure. As system integrators and procurement managers seek reliable, high-bandwidth connectivity solutions, the need for high-quality DVI cables from reputable manufacturers has never been more pronounced. This list highlights the top 10 DVI cable manufacturers based on production scale, global distribution, compliance certifications, customer reviews, and innovation in signal integrity.

Top 10 Dvi Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 All About DVI

Domain Est. 1995

Website: datapro.net

Key Highlights: DVI is a popular form of video interface technology made to maximize the quality of flat panel LCD monitors and modern video graphics cards….

#2 Belden

Domain Est. 1997

Website: belden.com

Key Highlights: We design, manufacture and market networking, connectivity, cable products and solutions for industrial automation, smart buildings and broadcast markets….

#3 New DVI Cables Products

Domain Est. 2003

Website: manufacturers.com.tw

Key Highlights: Full listing of DVI Cables manufacturer & digital visual interface cable suppliers online. We have a broad range of dvi cables and services which can be ……

#4 DVI Video Cables

Domain Est. 2005

#5 DVI Cables & Adapters

Domain Est. 1995

Website: extron.com

Key Highlights: Extron professional-quality DVI cables and adapters are ideal for connecting digital video sources to digital signal processing, distribution, and display ……

#6 PIC Aerospace DVI Cables

Domain Est. 1996

Website: picwire.com

Key Highlights: High-performance aerospace DVI cable engineered for aerospace applications, delivering reliable digital video transmission with superior signal integrity ……

#7 DVI Cables for Aerospace, Defense Air & Land Applications

Domain Est. 1998

Website: gore.com

Key Highlights: GORE® DVI Cables (Digital Only) deliver exceptional signal quality and high data rate video transmission in demanding EMI environments….

#8 DVIGear

Domain Est. 2001

Website: dvigear.com

Key Highlights: DVIGear is a leading supplier of digital connectivity solutions for professional, commercial and residential display applications. Call 1-888-463-9927….

#9 DVI DDC Breakout Cable

Domain Est. 2001

#10 Integrator Series DVI Cables

Domain Est. 2014

Expert Sourcing Insights for Dvi Cable

2026 Market Trends for DVI Cable: A Declining Niche in a Digital-First Landscape

As the global display interface market evolves toward higher bandwidth, streamlined connectivity, and digital consolidation, DVI (Digital Visual Interface) cables are poised to occupy an increasingly narrow and legacy-focused role by 2026. Once a standard for high-definition video, DVI faces irreversible market contraction due to technological advancements and shifting consumer and enterprise demands.

1. Steady Decline in Consumer and Commercial Adoption

By 2026, DVI will be largely absent from new consumer electronics. Monitors, laptops, gaming consoles, and TVs have long transitioned to HDMI and DisplayPort, which support higher resolutions (4K, 8K), higher refresh rates, and audio transmission—features DVI lacks. In commercial environments, even legacy systems are being phased out in favor of modern, versatile interfaces. Demand for new DVI cables will stem almost exclusively from replacement needs in older infrastructure, such as legacy PCs, industrial machines, or medical equipment, leading to a shrinking and fragmented market.

2. Replacement-Driven Demand and Niche Industrial Use

The primary market for DVI cables in 2026 will be maintenance and repair. Industries with long equipment lifecycles—such as healthcare (older imaging systems), manufacturing (control panels), and education (aging computer labs)—will continue to require DVI for backward compatibility. However, these use cases represent a niche, with sales volumes declining annually. Manufacturers will likely reduce production runs, focusing on cost-effective solutions rather than innovation, leading to potential supply chain thinning.

3. Competitive Pressure from HDMI, DisplayPort, and USB-C

HDMI 2.1 and DisplayPort 2.1 dominate the high-performance segment, supporting dynamic HDR, variable refresh rates (VRR), and daisy-chaining. Meanwhile, USB-C with DisplayPort Alt Mode offers universal connectivity across devices. These interfaces consolidate power, data, and video into a single cable—something DVI cannot match. As USB-C becomes standard on laptops, tablets, and monitors, the need for DVI diminishes further, accelerating its obsolescence.

4. Market Consolidation and Reduced Innovation

By 2026, few manufacturers will invest in DVI cable development. Product lines will be streamlined, focusing on basic DVI-D and DVI-I variants for compatibility. Premium DVI cables with enhanced shielding or gold plating may persist in specialty markets but will represent a tiny fraction of overall sales. Retail shelf space and online visibility for DVI will continue to shrink, pushing it deeper into the “legacy accessories” category.

5. Regional and Sectoral Variations

Developing markets with slower technology refresh cycles may exhibit slightly higher DVI usage into 2026, particularly in budget computing and education. However, even in these regions, the shift to HDMI-enabled devices is well underway. Data centers and enterprise IT environments have already abandoned DVI in favor of KVM systems using IP-based or USB-C solutions.

Conclusion

The DVI cable market in 2026 will be characterized by decline, obsolescence, and niche relevance. While it will not disappear entirely, its role will be limited to supporting aging hardware in specific industrial and institutional contexts. For stakeholders, the trend signals a need to migrate to modern interfaces or specialize in legacy support services. DVI’s legacy will endure, but its future as a mainstream connectivity solution has effectively ended.

Common Pitfalls When Sourcing DVI Cables: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for DVI Cables

Overview

This guide outlines the essential logistics considerations and compliance requirements for the transportation, storage, and sale of Digital Visual Interface (DVI) cables. Adhering to these guidelines ensures product integrity, regulatory compliance, and smooth operations across the supply chain.

Product Classification & HS Code

DVI cables are classified as electronic accessories or components under international trade nomenclature. The most relevant Harmonized System (HS) code is:

8544.42 – Insulated electric conductors fitted with connectors, for a voltage ≤ 1,000 V.

Note: Exact HS code may vary by country; confirm with local customs authorities.

Packaging & Labeling Requirements

- Packaging: Use anti-static bags or clamshell packaging to prevent electrostatic damage. Outer cartons should be durable and clearly labeled with product details.

- Labeling: Include:

- Product name (e.g., DVI-D, DVI-I, DVI-A)

- Connector types (Male/Male, Male/Female)

- Cable length

- Manufacturer or brand name

- Model number

- Compliance marks (CE, RoHS, FCC, etc.)

- Barcodes (UPC or EAN)

Storage Conditions

- Environment: Store in a dry, temperature-controlled area (15°C to 30°C / 59°F to 86°F), away from direct sunlight.

- Humidity: Maintain relative humidity below 70% to prevent corrosion.

- Handling: Avoid bending beyond the specified minimum bend radius to prevent internal wire damage.

Transportation & Handling

- Mode of Transport: Suitable for air, sea, and ground freight. Use secure, non-conductive pallets.

- ESD Protection: Implement Electrostatic Discharge (ESD) precautions during handling and loading.

- Stacking: Limit stack height to prevent compression damage; follow manufacturer stacking guidelines.

Regulatory Compliance

DVI cables must meet regional and international standards:

– RoHS (EU): Restriction of Hazardous Substances – ensures cables are free of lead, mercury, cadmium, and other restricted materials.

– REACH (EU): Registration, Evaluation, Authorization and Restriction of Chemicals – requires disclosure of Substances of Very High Concern (SVHC).

– CE Marking (EU): Mandatory for market access; indicates conformity with health, safety, and environmental protection standards.

– FCC (USA): Federal Communications Commission – Class B limits for unintentional radiation if applicable.

– UL/ETL Listing (North America): May be required depending on end-use; confirms safety standards compliance.

– UKCA (UK): Required for sales in Great Britain; replaces CE marking for UK market.

– KC Mark (South Korea): Required for sale in South Korea.

– PSE (Japan): Mandatory for electrical products in Japan.

Import/Export Documentation

Ensure the following documents accompany shipments:

– Commercial Invoice

– Packing List

– Bill of Lading / Air Waybill

– Certificate of Origin

– RoHS / REACH Declarations

– Test Reports (e.g., from accredited labs)

– Import License (if required by destination country)

Environmental & Disposal Considerations

- End-of-Life Management: DVI cables are classified as WEEE (Waste Electrical and Electronic Equipment) in the EU.

- Recycling: Partner with certified e-waste recyclers.

- Labeling: Include WEEE symbol on packaging if sold in EU markets.

Quality Assurance & Testing

- Conduct periodic electrical performance tests (signal integrity, impedance).

- Verify shielding effectiveness and connector durability.

- Maintain test records for audits and compliance verification.

Conclusion

Proper logistics and compliance management for DVI cables minimizes risks, avoids customs delays, and ensures product safety and market access. Regularly review regulatory updates and adapt procedures accordingly to maintain compliance across global markets.

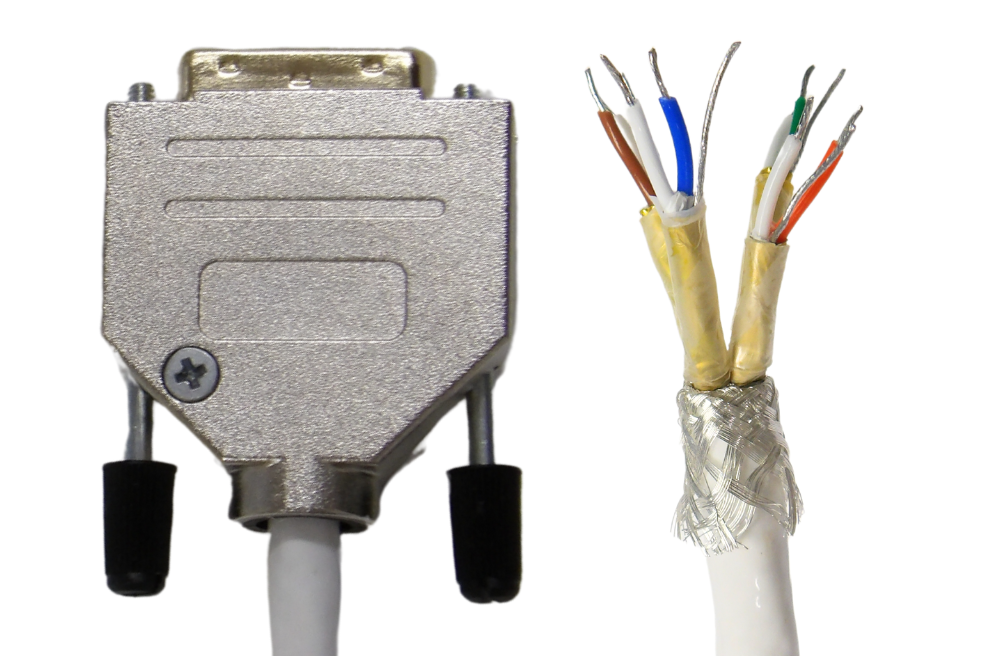

In conclusion, sourcing a DVI cable requires careful consideration of the specific type (DVI-D, DVI-I, single-link, or dual-link), the required length, build quality, and compatibility with your devices. While DVI is a legacy connection standard gradually being replaced by HDMI and DisplayPort, it remains relevant in certain professional, industrial, and older computing environments. When purchasing, prioritize cables from reputable suppliers or brands to ensure signal integrity and durability. Additionally, verify technical specifications and, if possible, choose shielded cables to minimize interference. Properly sourced, a DVI cable can reliably support high-quality digital or analog video transmission for monitors, projectors, and other display devices.