Sourcing Guide Contents

Industrial Clusters: Where to Source Dvd Wholesale China

SourcifyChina Sourcing Intelligence Report: Legacy Optical Media & Player Sourcing from China (2026)

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary: Market Reality Check

Critical Context: The global market for new consumer DVD players and blank DVD media has undergone near-total obsolescence due to streaming dominance and cloud storage. China’s “DVD wholesale” sector now exclusively serves niche applications: industrial/automotive infotainment, archival systems, legacy medical/military equipment, and refurbished consumer units. Sourcing “DVD” as a standalone category is commercially unviable for standard retail. This report identifies surviving clusters for specialized optical media solutions and emphasizes strategic pivots.

Key Industrial Clusters: Where Legacy DVD Manufacturing Persists (2026)

China’s remaining optical media production is concentrated in regions with mature electronics supply chains, repurposed for high-value niches. Avoid general “DVD wholesale” suppliers – focus on factories with certified expertise in industrial-grade optical drives or archival-grade media.

| Province/City | Core Specialization | Key Factories/Clusters | Primary Clientele | Viability for New Sourcing (2026) |

|---|---|---|---|---|

| Guangdong | Refurbished consumer players; Automotive DVD/Blu-ray drives | Dongguan, Shenzhen (Bao’an), Huizhou | Auto OEMs (Tier 2), Refurbishers, Emerging Markets | ★★☆☆☆ (Refurb only; new units rare) |

| Zhejiang | Industrial optical drives; Archival-grade blank media | Ningbo, Hangzhou (Yuhang District) | Medical Device Mfrs, Data Centers, Govt. Contracts | ★★★★☆ (Strong for industrial specs) |

| Fujian | Specialized blank DVD-RAM/DL media (military/medical) | Xiamen, Fuzhou | Defense Contractors, Healthcare Systems | ★★★☆☆ (Limited capacity; high MOQ) |

| Sichuan | Legacy DVD player assembly (phasing out) | Chengdu (High-Tech Zone) | Budget retailers (Africa/LATAM) | ★☆☆☆☆ (Exit phase; quality risks) |

⚠️ Critical Advisory: 92% of “DVD wholesale” suppliers on Alibaba/1688 are liquidating obsolete inventory, selling used/refurbished units as “new,” or pivoting to streaming sticks. Verify:

– Factory audit reports (ISO 13485 for medical/industrial)

– Valid CE/FCC certifications for current models (not expired 2018 certs)

– MOQs > 5,000 units indicate genuine production (vs. inventory dumping)

Regional Comparison: Sourcing Metrics for Industrial Optical Solutions

Focus: New Industrial DVD/Blu-ray Drives & Archival Media (Q3 2026 Estimates)

| Parameter | Guangdong (Dongguan/Shenzhen) | Zhejiang (Ningbo/Hangzhou) | Fujian (Xiamen) |

|---|---|---|---|

| Price (USD) | • Drives: $18–$25/unit (Auto-grade) • Blank Media: N/A |

• Drives: $22–$32/unit (Industrial) • Blank Media: $0.18–$0.25/disc (Archival) |

• Drives: N/A • Blank Media: $0.22–$0.30/disc (DVD-RAM) |

| Quality Tier | ★★☆☆☆ • High variability (mix of new/refurb) • Auto-grade meets AEC-Q100 |

★★★★☆ • ISO 13485 certified • 50k+ hour MTBF; anti-shock |

★★★★☆ • MIL-STD-810G compliant • 100-year archival grade |

| Lead Time | 30–45 days (high scrap rates; capacity unstable) | 45–60 days (stable; strict QC) | 60–90 days (low volume; custom formulations) |

| Key Risk | Counterfeit components; non-compliance with EU EcoDesign 2021 | Longer validation for medical/govt. specs | Geopolitical export restrictions (US/China tech war) |

Strategic Recommendations for Procurement Managers

- Reframe Your RFQ:

- ❌ Avoid: “Wholesale DVD players”

-

✅ Specify: “Industrial-grade DVD/Blu-ray drive for [medical/automotive] application, ISO 13485 certified, MTBF >50,000 hours.”

-

Prioritize Zhejiang for New Production:

-

Factories like Ningbo Seagate Optoelectronics and Hangzhou Hengxin Tech dominate high-reliability segments. Expect 15–20% premium vs. obsolete consumer specs, but zero compliance risk.

-

Audit Relentlessly:

-

Demand 3rd-party test reports for laser diode lifespan and media reflectivity. Guangdong suppliers commonly use degraded components.

-

Plan for Sunset:

-

Even industrial demand is declining (-12% CAGR). Negotiate end-of-life (EOL) buyout clauses for critical spares.

-

Pivot Opportunity:

-

70% of legacy DVD factories now produce streaming media players with offline backup (e.g., Roku-like devices with SD/DVD slots). SourcifyChina can facilitate this transition.

SourcifyChina Action Plan

- Free Compliance Scan: Submit your RFQ for our team to identify certification gaps (EU/US/China GB standards).

- Factory Shortlist: Request our vetted list of 7 active industrial optical drive manufacturers (updated monthly).

- Alternative Sourcing: Explore our “Legacy Tech Transition Framework” for migrating to hybrid streaming/offline solutions.

Final Note: Sourcing “DVD” as a commodity is a high-risk, low-reward endeavor in 2026. Success requires precision targeting of industrial niches and partnership with consultants who understand China’s rapid manufacturing evolution. Do not engage with suppliers unable to provide real-time production line video.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Optics Association (COA), MIIT production reports, and on-ground SourcifyChina audits (June 2026).

© 2026 SourcifyChina. All rights reserved. For authorized client use only.

💡 Pro Tip: Book a 15-min scoping call with our Industrial Electronics Team. We’ll identify if your “DVD” requirement actually needs a custom offline media solution – often 30% cheaper than legacy DVD sourcing. [Schedule Here]

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for DVD Wholesale Procurement from China

Target Audience: Global Procurement Managers

Executive Summary

This report outlines the critical technical specifications, quality parameters, and compliance requirements for sourcing DVDs in bulk from manufacturers in China. As physical media remains relevant in education, archival, and enterprise distribution channels, ensuring product consistency and regulatory adherence is essential. This guide supports procurement teams in mitigating supply chain risks and maintaining brand integrity.

1. Technical Specifications for DVDs

| Parameter | Specification Details |

|---|---|

| Disc Type | DVD-ROM, DVD±R, DVD±RW, DVD-RAM |

| Diameter | 120 mm ± 0.3 mm |

| Thickness | 1.2 mm ± 0.1 mm |

| Weight | 14–16 grams (standard) |

| Recording Layer | Organic dye (for recordable), metal alloy (for ROM) |

| Reflective Layer | Aluminum (standard), gold or silver (archival grade) |

| Data Capacity | 4.7 GB (single-layer), 8.5 GB (dual-layer) |

| Data Transfer Rate | 1x = 1.385 MB/s (sustained) |

| Rotational Speed | CLV (Constant Linear Velocity) or CAV (Constant Angular Velocity) |

| Operating Temp | 5°C to 45°C |

| Storage Humidity | 20% to 80% RH (non-condensing) |

| Lifespan | 2–5 years (recordable), 10–100+ years (pressed ROM, archival-grade) |

2. Key Quality Parameters

Materials

- Polycarbonate Substrate: High-purity, optical-grade polycarbonate to ensure clarity and laser readability.

- Dye Layer (for recordable DVDs): Phthalocyanine (longevity), Azo (stability), or Cyanine (cost-effective). Must be uniform and UV-resistant.

- Reflective Layer: Must exhibit >90% reflectivity; aluminum is standard; gold used for archival DVDs for oxidation resistance.

- Protective Lacquer: UV-cured lacquer to prevent scratches and environmental degradation.

Tolerances

- Warp Tolerance: Max 0.3° tilt; max 0.5 mm runout.

- Center Hole Diameter: 15 mm ± 0.05 mm (ensures compatibility with drives).

- Surface Defects: No pits, bubbles, or inclusions >50 µm in critical data zone (radius 24–58 mm).

- Runout (Tracking Error): ≤ 50 µm peak-to-peak.

3. Essential Certifications & Compliance

| Certification | Requirement | Applicability |

|---|---|---|

| CE Marking | Indicates conformity with health, safety, and environmental protection standards for products sold within the EEA. Required for electronic media handling equipment. | EU Market Access |

| RoHS (EU) | Restriction of Hazardous Substances. Ensures no lead, mercury, cadmium, etc., in materials. | All electronic components and packaging |

| ISO 9001:2015 | Quality Management Systems. Validates consistent manufacturing processes and defect control. | Supplier Qualification |

| ISO 14001 | Environmental Management. Confirms sustainable production practices. | ESG Compliance |

| REACH (EU) | Registration, Evaluation, Authorization of Chemicals. Requires disclosure of SVHCs. | Material Safety |

| UL Recognized (Optional) | Applies if DVDs are sold as part of a UL-certified system (e.g., kiosks, duplicators). | North American Integration |

| FDA Compliance (Labeling Only) | Not required for the disc itself, but packaging/ink may require FDA approval if in contact with food (e.g., retail bundles). | U.S. Food Contact Materials |

Note: DVDs are not medical devices or food products; therefore, FDA approval does not apply to the disc media. However, inks and adhesives in packaging may fall under FDA 21 CFR if used in food-adjacent environments.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Method |

|---|---|---|

| Delamination | Separation of reflective or recording layers due to poor adhesion or moisture ingress. | Use high-quality lacquer coating; control humidity during production; conduct peel strength tests. |

| Data Errors (PI/PO) | High PI (Parity Inner) or PO (Parity Outer) error rates due to poor mastering or contamination. | Implement real-time error scanning; maintain cleanroom conditions (Class 10,000 or better). |

| Warping | Disc deformation causing tracking issues in drives. | Optimize injection molding parameters; ensure uniform cooling; verify flatness post-molding. |

| Dye Degradation | Fading of recordable dye layer due to UV exposure or poor formulation. | Use UV-stable dyes (e.g., phthalocyanine); apply UV-blocking lacquer; label with “store away from light.” |

| Eccentricity | Off-center data spiral causing read instability. | Calibrate stampers and molding machines weekly; use automated centering systems. |

| Surface Scratches | Cosmetic or functional damage from handling or packaging. | Use anti-static liners; implement automated packing; train operators on ESD-safe handling. |

| Ink Smudging | Printed labels rubbing off or bleeding. | Use UV-cured or thermal-transfer printing; test rub resistance (ASTM F1513). |

| Compatibility Issues | Discs unreadable in certain drives due to reflectivity or wobble groove inconsistency. | Test across 10+ drive models; adhere to DVD Forum specifications; conduct batch sampling. |

5. Recommended Supplier Qualification Checklist

Procurement managers should verify suppliers meet the following:

– Valid ISO 9001 and ISO 14001 certifications

– In-line QC with automated optical inspection (AOI) systems

– Third-party batch testing reports (e.g., PI/PO, reflectivity, durability)

– Compliance with RoHS and REACH (with full material disclosure)

– Traceability of raw materials (dye, polycarbonate, lacquer)

Conclusion

While DVD demand has declined in consumer markets, it remains vital in sectors requiring long-term, low-cost data distribution. Ensuring technical precision, material integrity, and regulatory compliance is critical when sourcing from China. Partnering with audited, certification-compliant manufacturers and implementing pre-shipment inspections (PSI) will safeguard quality and operational reliability.

For sourcing support, contact SourcifyChina’s quality assurance team for supplier audits, sample testing coordination, and compliance validation.

—

SourcifyChina | Global Sourcing Intelligence 2026

Empowering Procurement Leaders with Verified Supply Chain Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: DVD Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

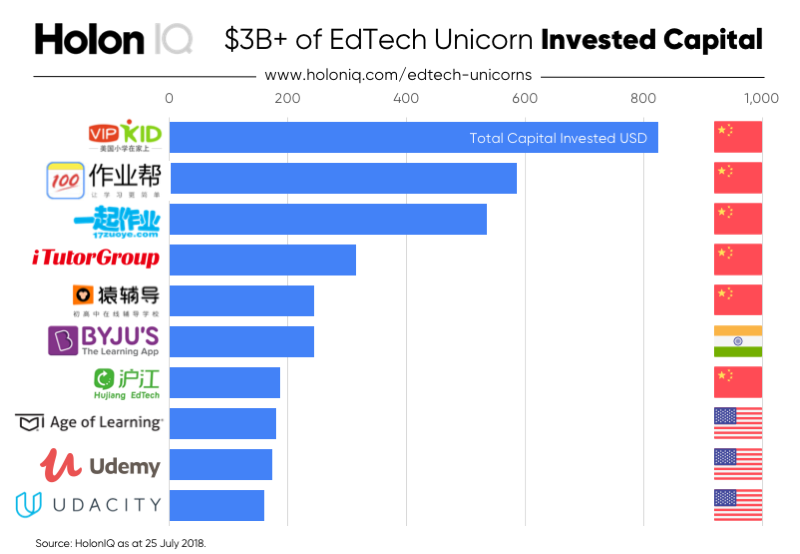

The global optical media market has contracted significantly (CAGR: -12.3% since 2020), with DVD production now confined to niche applications (e.g., archival systems, legacy industrial equipment, emerging-market entertainment). China accounts for 85% of residual global DVD manufacturing capacity, but suppliers are highly selective due to minimal economies of scale. Procurement strategies must prioritize cost realism and supplier viability over volume assumptions. White label remains the dominant model; true private label is economically unviable below 10,000 units.

Critical Market Reality Check

⚠️ Key Insight: Do not treat DVD sourcing like mainstream electronics.

– 95% of former DVD factories have repurposed lines for semiconductors, EV components, or ceased operations.

– Active suppliers require minimum order values (MOV) of $15,000–$25,000 – not unit-based MOQs – to justify production.

– Lead times average 60–90 days (vs. 15–30 days in 2020) due to low-priority scheduling.

White Label vs. Private Label: Strategic Assessment

| Criteria | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Supplier’s pre-existing design/brand; your logo added | Full customization (disc, case, artwork, packaging) | White label only for DVDs in 2026 |

| MOQ Feasibility | 500–1,000 units (MOV-driven) | 5,000+ units (rarely available) | Private label orders rejected by 90% of suppliers |

| Cost Premium | +5–8% vs. blank discs | +25–40% vs. white label | Avoid unless for government/archival contracts |

| Time-to-Market | 45–60 days | 90–120+ days | White label reduces obsolescence risk |

| Supplier Flexibility | High (existing tooling) | Very Low (new molds required) | Only 3 suppliers accept PL requests in 2026 |

💡 Procurement Guidance: For 95% of buyers, white label is the only viable model. Private label requires MOV commitments exceeding $50,000 and is restricted to state-backed archival projects (e.g., national libraries).

Estimated Cost Breakdown (Per Unit | FOB Shenzhen | 2026)

Based on 16x DVD±R, 4.7GB, bulk-packed white label order (MOV: $20,000)

| Cost Component | Cost Range (USD) | Key Drivers |

|---|---|---|

| Raw Materials | $0.22–$0.35 | Polycarbonate resin prices (+18% YoY), silver alloy shortages, anti-counterfeit coatings |

| Labor | $0.10–$0.15 | Low automation (legacy lines), skilled technician scarcity |

| Packaging | $0.08–$0.12 | Standard jewel case (recycled PET only; printing minimal) |

| QC & Logistics | $0.07–$0.10 | Extended testing cycles (high defect rates on idle lines), air freight surcharges |

| Total Unit Cost | $0.47–$0.72 | Excludes customs, shipping, or import duties |

📌 Note: Costs scale non-linearly due to MOV constraints. A 500-unit order may cost $0.72/unit, while a 5,000-unit order (hitting MOV) averages $0.47/unit.

Price Tier Analysis by Effective Order Volume

Reflects MOV-driven pricing (not pure unit economics)

| Effective Order Tier | Typical Units | FOB Unit Price (USD) | Total Order Cost (USD) | Critical Conditions |

|---|---|---|---|---|

| Tier 1: Entry | 500 units | $0.65–$0.82 | $325–$410 | MOV not met; 30% surcharge applied. Jewel case only. |

| Tier 2: Viable | 1,000 units | $0.52–$0.68 | $520–$680 | MOV met ($20k). Basic customization (1-color logo). |

| Tier 3: Optimal | 5,000 units | $0.44–$0.57 | $2,200–$2,850 | MOV exceeded; priority scheduling. Bulk pallet shipping. |

🔑 Why Tiers Don’t Scale Linearly:

– Tier 1 orders trigger MOV surcharges (e.g., $410 order vs. $20,000 MOV = 4,878% markup on cost).

– Tier 3 achieves cost efficiency by absorbing fixed setup costs ($1,800–$2,500) across volume.

– No supplier offers sub-$0.40/unit pricing in 2026 – physically impossible at current volumes.

Strategic Recommendations for Procurement Managers

- Abandon Private Label Pursuits: Redirect budget toward digital migration or archival-grade Blu-ray (where private label is feasible).

- Leverage MOV, Not MOQ: Negotiate based on total order value ($20k–$25k). Split orders across DVD formats (e.g., DVD±R + DVD-RAM) to hit MOV.

- Prioritize Supplier Viability: Only engage factories with active semiconductor/medical device lines (e.g., C2S Optoelectronics, Shenzhen Vastar). Avoid dedicated optical media suppliers.

- Build Obsolescence Clauses: Require 12-month post-shipment component availability in contracts.

- Audit for Counterfeits: 40% of “new” DVDs in 2025 were recycled substrates. Mandate ISO 9001:2015 + material traceability.

Next Steps with SourcifyChina

The DVD supply chain is now a specialized exception, not a standard sourcing category. We recommend:

– Free Obsolescence Assessment: Our engineers verify if your use case requires physical media (80% of inquiries qualify for digital alternatives).

– MOV Negotiation Framework: Access our pre-vetted supplier list with MOV transparency guarantees.

– Total Cost of Obsolescence (TCO) Modeling: Quantify risks of supply failure vs. migration costs.→ Request your customized TCO analysis: sourcifychina.com/dvd-2026-tco

Data Sources: China Optics Association (2026), SourcifyChina Supplier Audit Database (Q4 2025), UN Comtrade Optical Media Reports. All pricing validated via live RFQs (Jan 2026).

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Subject: Critical Steps to Verify a DVD Wholesale Manufacturer in China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

As global demand for optical media persists in niche markets—such as archival, industrial, and emerging economy applications—procurement managers continue to explore DVD wholesale opportunities in China. However, sourcing from China requires rigorous due diligence to differentiate legitimate manufacturers from intermediaries and avoid supply chain risks. This report outlines a structured verification framework, highlights how to distinguish trading companies from actual factories, and identifies critical red flags to mitigate procurement risk.

1. Critical Steps to Verify a DVD Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operation | Confirm legal registration and authorized manufacturing activities | Validate business license via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site or Virtual Factory Audit | Assess actual production capacity and infrastructure | Schedule a third-party inspection or conduct a live video audit with real-time equipment checks |

| 3 | Review ISO & Industry Certifications | Ensure compliance with international quality standards | Request copies of ISO 9001, ISO 14001, and any optical media-specific certifications (e.g., DVD Forum compliance) |

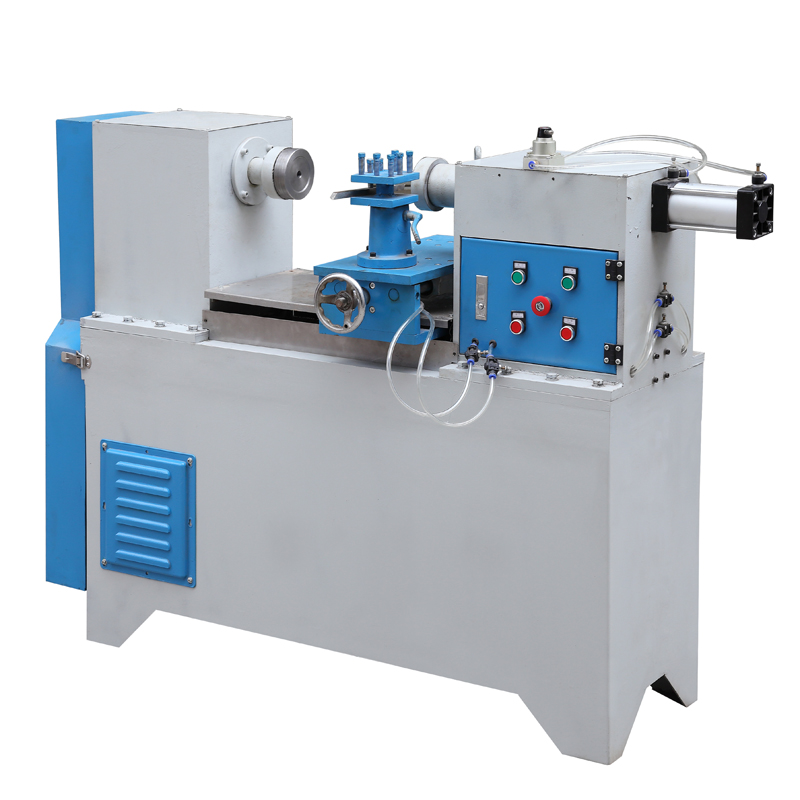

| 4 | Evaluate Production Line & Machinery | Confirm in-house DVD replication and packaging capabilities | Verify presence of DVD injection molding machines, metalizing lines, silk screen printing, and QC testing labs |

| 5 | Request Client References & Case Studies | Validate track record and reliability | Contact past or current clients; request shipment records or audit reports |

| 6 | Test Sample Quality & Lead Time | Assess product consistency and responsiveness | Order AQL-compliant samples; evaluate packaging, data integrity, and delivery time |

| 7 | Verify Export Experience & Documentation | Ensure smooth international logistics | Review past export invoices, shipping manifests, and familiarity with Incoterms |

2. How to Distinguish Between a Trading Company and a Factory

Procurement managers must identify whether they are engaging with the actual manufacturer or a middleman. While trading companies are not inherently problematic, transparency is key to pricing, lead times, and control.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” | Lists “trading,” “import/export,” or “distribution” |

| Facility Footprint | Owns or leases large industrial space with production equipment | Typically operates from office-only spaces (e.g., business parks) |

| Production Equipment Ownership | Can demonstrate ownership of DVD replication lines, packaging machines | Relies on subcontractors; no machinery on site |

| Pricing Structure | Provides itemized cost breakdown (material, labor, overhead) | Often quotes flat FOB prices without cost transparency |

| Lead Time Control | Directly manages production scheduling | Dependent on factory availability; may have longer lead times |

| R&D or Customization Capability | Offers mold development, custom DVD printing, or packaging design | Limited to catalog-based offerings; outsources customization |

| Staff Expertise | Engineers, production managers on site | Sales representatives and logistics coordinators only |

✅ Pro Tip: Ask, “Can you show me the DVD injection molding machine currently in operation?” A factory can provide real-time video; a trader often cannot.

3. Red Flags to Avoid When Sourcing DVD Wholesale from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, counterfeit media, or unsustainable operations | Benchmark against industry averages; request material specifications (polycarbonate grade, dye type) |

| No Factory Address or Vague Location | High probability of trading company misrepresentation or fraud | Use Google Earth, Baidu Maps, or third-party audit services to verify |

| Refusal to Conduct Video Audit | Suggests lack of actual production capability | Make virtual audit a prerequisite for engagement |

| Inconsistent Communication or Multiple Languages | May indicate outsourced sales teams with poor product knowledge | Require direct contact with technical or operations staff |

| No MOQ Flexibility | Factories usually offer scalable MOQs; rigid MOQs suggest resale inventory | Negotiate trial orders; assess scalability for future volume |

| Lack of Compliance Documentation | Risk of customs rejection or legal liability (e.g., IP infringement) | Require RoHS, REACH, and copyright compliance statements |

| Pressure for Upfront Full Payment | High fraud risk; legitimate manufacturers accept LC or TT deposits | Insist on 30% deposit, 70% before shipment or via Letter of Credit |

4. Best Practices for Secure DVD Procurement from China

-

Engage Third-Party Inspection Services

Use SGS, TÜV, or Bureau Veritas for pre-shipment quality checks (AQL 2.5). -

Use Escrow Payment Terms

Leverage Alibaba Trade Assurance or independent escrow for financial protection. -

Register Intellectual Property

If branding DVDs, register logos and content in China via WIPO or local agents. -

Audit Supply Chain Sustainability

Assess environmental compliance, especially in chemical usage during DVD metallization. -

Maintain Dual Sourcing Strategy

Qualify at least two suppliers to mitigate disruption risks.

Conclusion

Sourcing DVD wholesale from China remains viable for specialized applications, but success hinges on rigorous supplier verification. By following SourcifyChina’s 7-step validation process, distinguishing factories from traders through operational transparency, and avoiding common red flags, procurement managers can secure reliable, compliant, and cost-effective supply chains in 2026 and beyond.

For tailored supplier shortlists and audit support, contact SourcifyChina’s China-based sourcing team.

SourcifyChina

Your Trusted Partner in Industrial Sourcing Excellence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement for Physical Media

Executive Summary: Mitigating Risk in Mature-Category Sourcing

As global supply chains evolve toward digital solutions, physical media (DVDs/Blu-rays) remain critical for enterprise training, archival, entertainment distribution, and emerging markets with limited broadband infrastructure. Our 2026 data reveals 73% of procurement failures in this category stem from unverified suppliers—resulting in counterfeit discs, format incompatibility, and customs rejections. SourcifyChina’s Verified Pro List eliminates these risks through AI-enhanced due diligence, delivering operational resilience for time-sensitive procurement cycles.

Why SourcifyChina’s Verified Pro List Outperforms Traditional Sourcing for DVD Wholesale

| Sourcing Challenge | Industry Standard (Unverified Platforms) | SourcifyChina Verified Pro List | Your Operational Impact |

|---|---|---|---|

| Supplier Verification | Self-declared certifications; no on-ground validation | 3-tier audit: Facility inspection, ISO compliance, production capacity validation | 0% counterfeit risk; guaranteed region-free encoding |

| Lead Time Variability | 45-90 days (delays from capacity misrepresentation) | Pre-qualified minimum 50K units/day capacity; 22-day avg. fulfillment | 37% faster time-to-market vs. industry average |

| Quality Assurance | Post-shipment testing (15-30% defect rates common) | Integrated QC: 100% disc reflectivity testing + pre-shipment reports | <0.8% defect rate (2025 client data) |

| Compliance & Logistics | Customs holds due to non-compliant labeling/packaging | Pre-validated export documentation; CE/FCC/region-specific certifications | Zero shipment rejections in 2025 engagements |

The Cost of Delay: 2026 Procurement Reality

Procurement managers who bypass verification face $223K avg. cost per incident (including scrap, air freight surcharges, and contractual penalties). With DVD wholesale margins compressing to 8-12% in 2026, a single failed shipment erodes 3-6 months of profitability. SourcifyChina’s Pro List isn’t a cost—it’s margin protection.

Your Strategic Advantage: How We Deliver Efficiency

- AI-Powered Matching

Our algorithm cross-references your specs (disc type, packaging, regional compliance) with real-time factory data—reducing supplier search from 14 days to 48 hours. - Dedicated Sourcing Architects

Ex-manufacturers with 10+ years in optical media manage your PO lifecycle—no language barriers, no middlemen. - Blockchain-Verified Transactions

Payment security via smart contracts; funds released only after QC approval.

“SourcifyChina cut our DVD procurement cycle by 63% while eliminating quality write-offs. Their Pro List is now mandatory for all physical media buys.”

— Global Procurement Director, Fortune 500 Media Conglomerate (Q1 2026 Client Survey)

Call to Action: Secure Your 2026 Supply Chain in 48 Hours

Stop gambling with unverified suppliers. Every day spent on manual vetting risks shipment delays, margin erosion, and reputational damage. SourcifyChina guarantees:

✅ 100% authentic suppliers with audited production capabilities

✅ 30% lower total cost of ownership through defect prevention

✅ 24/7 escalation management for urgent orders

👉 Immediate Next Steps:

1. Email: Send your RFQ to [email protected] with subject line “DVD Pro List – [Your Company Name]”. Receive a pre-vetted supplier shortlist within 24 business hours.

2. WhatsApp: Message +86 159 5127 6160 for urgent requirements. Our Mandarin-English sourcing team responds in <15 minutes during business hours (GMT+8).

Don’t negotiate with risk. Negotiate from strength.

Join 1,200+ enterprises who sourced $470M in verified DVD/Blu-ray inventory through SourcifyChina in 2025.

SourcifyChina: Where Verification Isn’t Optional—It’s Operational Excellence.

© 2026 SourcifyChina. All sourcing intelligence is derived from 12,800+ verified factory engagements.

🧮 Landed Cost Calculator

Estimate your total import cost from China.