The global truck bed liner market is experiencing robust growth, driven by increasing demand for vehicle protection solutions across commercial and consumer segments. According to Mordor Intelligence, the market is projected to grow at a CAGR of over 4.8% from 2023 to 2028, fueled by rising heavy-duty truck production and expanding infrastructure activities worldwide. With dump trucks enduring extreme wear and tear from construction debris, gravel, and corrosive materials, durable bed liners have become essential for fleet longevity and maintenance cost reduction. This demand has spurred innovation among manufacturers specializing in high-performance polyurethane, polyethylene, and spray-on coatings. As the industry evolves, nine key players have emerged at the forefront—combining advanced materials science, scalable production, and proven field performance to capture significant market share and set industry benchmarks in durability and application efficiency.

Top 9 Dump Truck Bed Liner Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 American Made Liner Systems

Domain Est. 1996

Website: linersystems.com

Key Highlights: The premier manufacturer of rigid polymer lining systems for the transportation industry, specifically haulers using dump trucks and trailers….

#2 Dump Trailer Bed Liner Dealer

Domain Est. 2002

Website: liningsinc.com

Key Highlights: We specialize in highly engineered UHMW-PE dump trailer bed protection for dump bodies and dump trailers of all shapes and sizes….

#3 Dump Truck Coatings & Liners

Domain Est. 1995

Website: fabick.com

Key Highlights: A custom Fabick liner covers every crevice and contour of your entire dump box. Our liner is a lighter and more cost-effective alternative to a steel ……

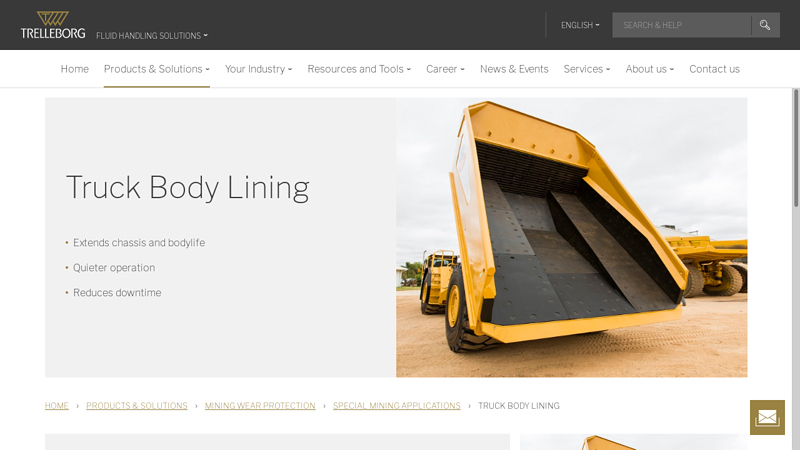

#4 Truck Body Lining

Domain Est. 1996

Website: trelleborg.com

Key Highlights: A long lasting wear liner working as an energy and noise reduction system. Absorbs impact and protects the truck structure from corrosion….

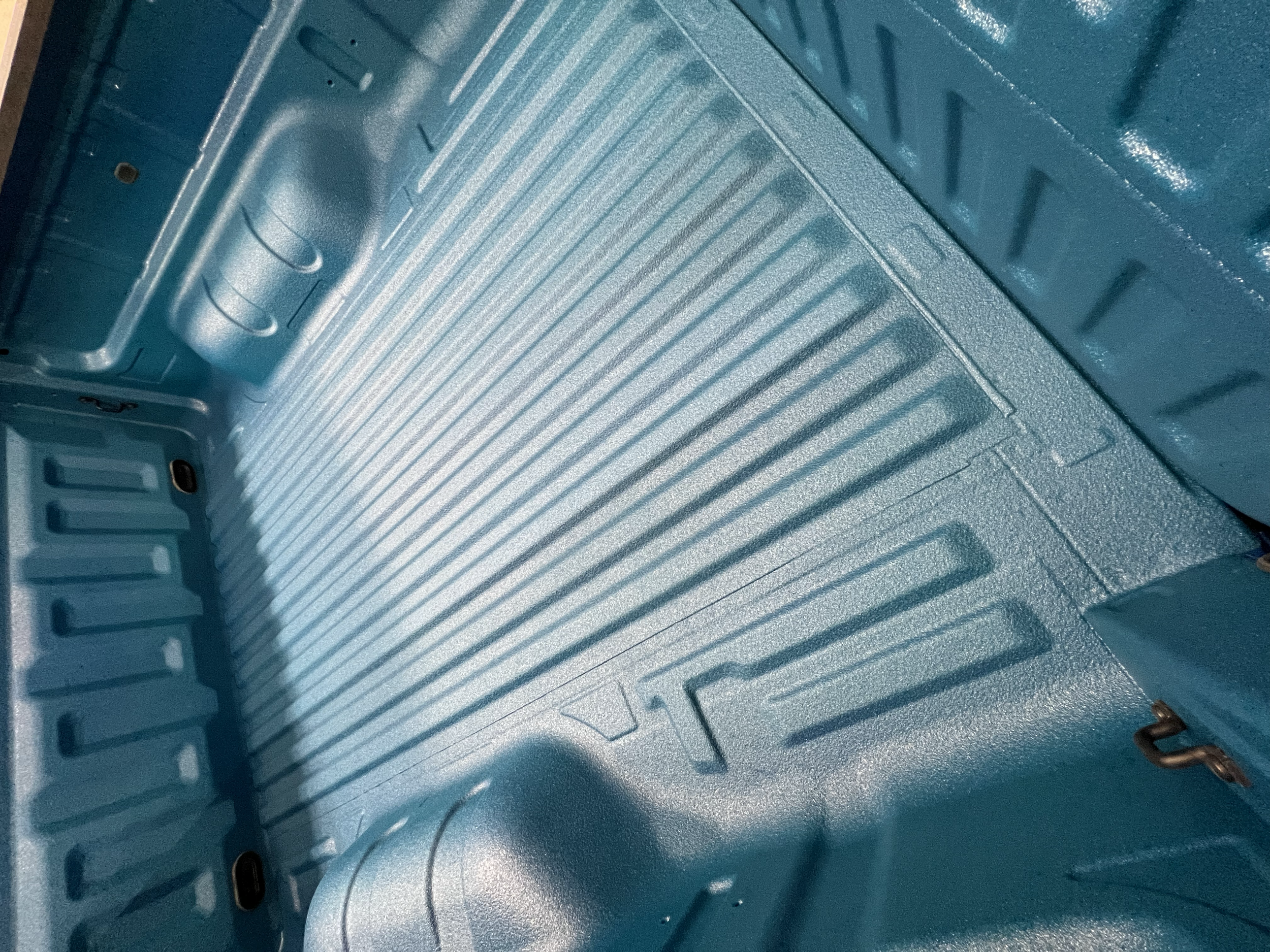

#5 Rhino Linings

Domain Est. 1996

Website: rhinolinings.com

Key Highlights: Rhino Linings specializes in advanced polyurea coatings, polyurethane foam, & flooring systems engineered for diverse application needs….

#6 Horn Plastics

Domain Est. 1998

Website: hornplastics.com

Key Highlights: High-Performance Plastics. Super-Slide UHMW and HMW plastics are industry leaders for all of your liner needs….

#7 Avalanche High Temperature Liners

Domain Est. 1998

Website: polymerindustries.com

Key Highlights: Our Heat Stabilized dump truck liner is our most durable & protective liner, while also utilizing additives to provide for our best sliding surface to fight ……

#8 Knapheide

Domain Est. 1998

Website: knapheide.com

Key Highlights: Our catalog of vehicle bodies serve many industries but we have the capability and capacity to create custom solutions too….

#9 Dump Truck Liners, Dump Trailer Liners, Plastic Dump Truck Bed …

Domain Est. 2004

Website: warnerplastics.com

Key Highlights: We specialize in dump truck and trailer liners we supply plastic for all applications where sticking, freezing and abrasion are a problem….

Expert Sourcing Insights for Dump Truck Bed Liner

2026 Market Trends for Dump Truck Bed Liner

The global dump truck bed liner market is poised for steady growth and technological evolution by 2026, driven by increasing infrastructure investment, demand for vehicle longevity, and advancements in protective materials. Key trends shaping the industry include:

Material Innovation and Performance Enhancement

By 2026, manufacturers are prioritizing advanced composite and polymer-based liners that offer superior abrasion resistance, impact absorption, and chemical protection. Polyurea and hybrid polyurethane coatings are gaining traction due to their fast curing times, flexibility, and ability to form seamless, watertight barriers. These high-performance materials reduce maintenance downtime and extend dump truck service life, appealing to fleet operators focused on total cost of ownership.

Sustainability and Eco-Friendly Solutions

Environmental regulations and corporate sustainability goals are accelerating demand for recyclable liners and low-VOC (volatile organic compound) coating systems. Manufacturers are investing in bio-based polymers and waterborne formulations to meet compliance standards and reduce environmental impact during application and disposal. This trend is particularly strong in North America and Europe, influencing global supply chains.

Customization and Modular Design

The market is shifting toward customizable and modular bed liner solutions tailored to specific industries—such as mining, construction, and waste management. Pre-fabricated segmented liners allow for easier installation, repair, and replacement of damaged sections, minimizing operational disruption. Digital templating and 3D scanning technologies are enabling precise fitment, reducing material waste and labor costs.

Growth in Emerging Economies

Infrastructure development in Asia-Pacific, Latin America, and Africa is driving demand for durable dump truck accessories. Countries like India, Indonesia, and Brazil are witnessing increased heavy equipment deployment, creating opportunities for both OEM-installed and aftermarket bed liners. Local manufacturing partnerships are expected to expand to meet regional specifications and reduce logistics costs.

Integration with Fleet Management Systems

Advanced bed liners are beginning to incorporate sensor-embedded technologies to monitor wear, temperature, and load conditions. While still in early adoption, this trend aligns with the broader move toward smart fleets and predictive maintenance. By 2026, data from integrated liners could feed into telematics platforms, enabling proactive maintenance scheduling and improving operational efficiency.

Competitive Landscape and Aftermarket Expansion

The aftermarket segment is projected to grow faster than OEM channels, fueled by aging vehicle fleets and cost-conscious operators seeking performance upgrades. Established players are expanding distribution networks and offering value-added services such as on-site installation and warranty programs. Consolidation among suppliers may occur to enhance R&D capabilities and global reach.

In summary, the 2026 dump truck bed liner market will be defined by innovation in materials, sustainability, customization, and digital integration, supporting more resilient and efficient heavy-duty operations worldwide.

Common Pitfalls When Sourcing Dump Truck Bed Liners (Quality and Intellectual Property)

Sourcing dump truck bed liners involves more than just finding a low-cost supplier—quality and intellectual property (IP) concerns can significantly impact performance, safety, and legal compliance. Below are common pitfalls businesses encounter, particularly related to product quality and IP risks.

Poor Material Quality and Durability

One of the most frequent issues is receiving bed liners made from substandard materials. Low-grade polyethylene, polyurea, or UHMW (ultra-high molecular weight polyethylene) may crack, warp, or wear prematurely under heavy loads and harsh environmental conditions. Buyers often discover too late that the liner fails to resist abrasion, impact, or chemical exposure, leading to increased maintenance and replacement costs.

Inconsistent Coating Thickness and Application

For spray-on bed liners, inconsistent coating thickness can compromise protection. Thin spots are prone to punctures and corrosion, while overly thick applications may crack due to internal stress. Suppliers lacking proper quality control or using untrained applicators often deliver uneven results, reducing the liner’s effectiveness and lifespan.

Lack of Certification and Testing Data

Many suppliers fail to provide third-party testing reports or certifications (e.g., ASTM, ISO) that validate performance claims. Without proof of impact resistance, elongation, or adhesion strength, buyers risk purchasing unverified products that underperform in real-world conditions.

Misrepresentation of Product Origin and Manufacturing Process

Some suppliers falsely claim their liners are “industrially tested” or “military-grade” without evidence. Others may source generic liners from unknown manufacturers and rebrand them as proprietary solutions. This misrepresentation can lead to reliability issues and voids in warranty enforcement.

Intellectual Property Infringement Risks

Using or sourcing bed liners that mimic patented designs, formulations, or application methods can expose buyers to IP litigation. For example, certain spray-on liner chemistries or drop-in liner geometries are protected by patents. Sourcing from suppliers who replicate these without licensing may result in legal action, shipment seizures, or costly redesigns.

Inadequate Supplier Transparency

Opaque supply chains make it difficult to verify where and how a liner is manufactured. Suppliers may outsource production to unauthorized facilities using unapproved materials, increasing the risk of quality defects and IP violations. Lack of documentation on raw material sources or manufacturing processes further complicates compliance and traceability.

Overlooking Warranty and Support Terms

Many low-cost suppliers offer limited or no warranty, or include restrictive clauses that exclude normal wear and tear. Without clear support agreements, buyers have little recourse when quality issues arise, especially in international sourcing where return and repair logistics are complex.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence—request material data sheets, verify certifications, audit suppliers, and consult legal experts when IP concerns arise. Investing in reputable, transparent suppliers ultimately ensures better protection, compliance, and long-term cost savings.

Logistics & Compliance Guide for Dump Truck Bed Liner

Product Overview and Handling Guidelines

Dump truck bed liners are protective coatings or materials applied to the interior of dump truck beds to prevent wear, corrosion, and material adhesion. These liners are typically made from polyurethane, polyurea, rubber, or steel. Proper handling ensures product integrity and safety during storage, transport, and installation.

Packaging and Storage Requirements

- Packaging: Liquid spray-on liners are shipped in sealed containers (drums or pails); sheet or drop-in liners are palletized and wrapped in protective film.

- Storage Conditions: Store in a dry, well-ventilated area with temperatures between 50°F and 80°F (10°C–27°C). Avoid direct sunlight and moisture.

- Shelf Life: Most spray-on coatings have a shelf life of 12 months from manufacture date. Check manufacturer labels for specific expiration.

- Segregation: Keep flammable or chemically reactive materials separate from oxidizers and incompatible substances.

Transportation Logistics

- Mode of Transport: Suitable for road transport via dry van or flatbed trailers. Air or sea freight possible, but subject to hazardous material regulations if applicable.

- Load Securing: Palletized liners must be shrink-wrapped and secured with straps to prevent shifting. Drums should be upright and braced.

- Temperature Control: Avoid extreme cold or heat during transit; use climate-controlled transport if necessary, especially for chemical-based coatings.

- Labeling: Clearly label packages with contents, handling instructions (e.g., “Keep Upright”, “Protect from Freezing”), and manufacturer contact.

Regulatory Compliance and Safety

- Hazardous Materials Classification: Spray-on polyurethane/polyurea liners may contain isocyanates—regulated under OSHA and classified as hazardous materials (UN1866, ORM-D or limited quantity). Verify SDS before shipping.

- Safety Data Sheets (SDS): Maintain up-to-date SDS for all chemical components. Required for workplace safety and emergency response.

- OSHA & WHMIS Compliance: Ensure proper worker training for handling, ventilation, and PPE (respirators, gloves, goggles) during application.

- DOT Regulations (USA): Comply with 49 CFR for marking, labeling, and documentation when transporting hazardous components. Use appropriate hazard class labels.

- EPA & Environmental Regulations: Follow EPA guidelines for VOC (volatile organic compound) emissions. Some coatings may be subject to regional air quality regulations (e.g., SCAQMD Rule 1113).

International Shipping Considerations

- Customs Documentation: Include commercial invoice, packing list, and SDS. Declare product composition accurately.

- REACH & RoHS (EU): Confirm liner materials comply with EU chemical regulations. Registration may be required for certain substances.

- TSCA (USA): Verify all chemical ingredients are listed on the TSCA Inventory.

- Import Restrictions: Some countries restrict isocyanate-containing products. Consult local authorities before export.

Installation and Waste Disposal Compliance

- Application Standards: Follow manufacturer instructions for surface prep, temperature, and curing. Use certified applicators where required.

- Waste Management: Dispose of empty containers and overspray per local regulations. Rinse containers if permitted; classify waste as hazardous if contaminated with isocyanates.

- Spill Response: Have spill kits (absorbents, PPE) on hand. Report significant spills to appropriate environmental agencies per federal/state laws.

Recordkeeping and Documentation

- Maintain shipping logs, SDS files, training records, and disposal manifests for at least three years.

- Keep certificates of compliance for raw materials and final products.

- Document all safety incidents or regulatory inspections.

Summary

Proper logistics and compliance management ensures safe handling, legal transport, and environmental responsibility for dump truck bed liners. Adherence to OSHA, DOT, EPA, and international standards minimizes risk and supports sustainable operations. Always consult product-specific guidelines and regulatory updates from manufacturers and authorities.

In conclusion, sourcing a durable and effective dump truck bed liner is a critical investment for protecting your equipment, enhancing operational efficiency, and reducing long-term maintenance costs. By evaluating key factors such as material quality (e.g., polyurea, rubber, or spray-on liners), supplier reputation, customization options, installation ease, and cost-effectiveness, businesses can identify the most suitable solution for their specific needs. Additionally, considering environmental conditions and payload types ensures the liner provides optimal abrasion, impact, and corrosion resistance. A well-sourced bed liner not only extends the lifespan of the dump truck bed but also improves productivity and lowers downtime, ultimately contributing to better return on investment. Therefore, taking a strategic approach to sourcing—prioritizing performance, durability, and supplier reliability—is essential for long-term success in demanding hauling and transportation operations.