The global automotive engine market is undergoing a significant transformation, driven by the rising demand for fuel-efficient and low-emission powertrains. Variable Valve Timing with Intelligence (VVT-i), particularly dual VVT-i systems that optimize both intake and exhaust valve timing, has emerged as a key technology in enhancing engine performance and efficiency. According to a 2023 report by Mordor Intelligence, the global automotive engine market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, with advanced engine technologies like dual VVT-i playing a pivotal role in this expansion. Increasing regulatory pressure to reduce carbon emissions and improve fuel economy—especially in regions such as Europe and North America—is accelerating OEM adoption of intelligent valve timing systems. As a result, leading engine manufacturers are investing heavily in R&D to refine dual VVT-i architectures, ensuring better torque delivery, improved fuel consumption, and compliance with stringent emission norms. In this evolving landscape, six manufacturers stand out for their innovation, production scale, and technological leadership in dual VVT-i engine development.

Top 6 Dual Vvti Engine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

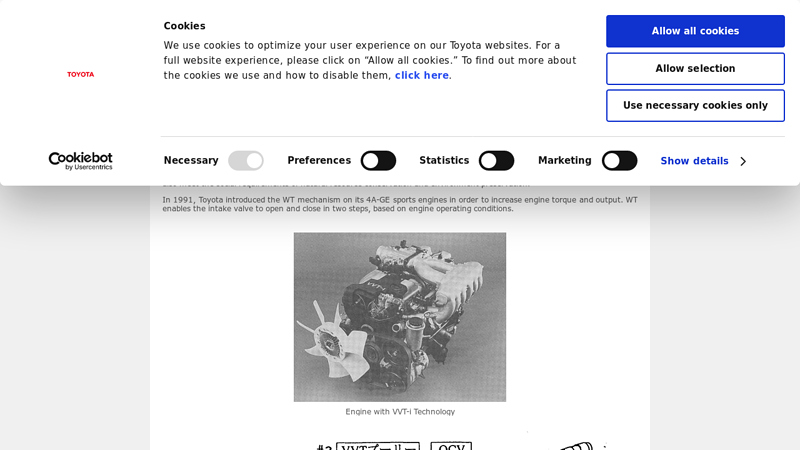

#1 Toyota Develops New VVT

Website: global.toyota

Key Highlights: Toyota Motor Corporation announced today the development of its new “Variable Valve Timing-intelligent” (VVT-i) technology, which increases performance and ……

#2 New Cars, Trucks, SUVs & Hybrids

Domain Est. 1994

Website: toyota.com

Key Highlights: Explore the newest Toyota trucks, cars, SUVs, hybrids and minivans. See photos, compare models, get tips, calculate payments, and more.Missing: dual vvti…

#3 How Toyota’s VVT

Domain Est. 1998

Website: parts.olathetoyota.com

Key Highlights: Toyota’s Variable Valve Timing with Intelligence (VVT-i) is the company’s latest-generation variable valve timing (VVT) for engine modulation and control….

#4 Toyota Corolla X

Domain Est. 2006

Website: toyota-central.com

Key Highlights: Dual VVT-i Engine. The state-of-the-art Corolla Altis X Dual VVT-i engine with Acoustic Control Induction System (ACIS) is designed to maximize performance ……

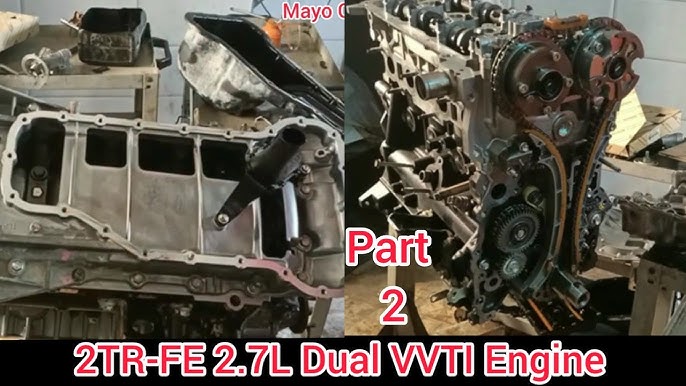

#5 4 cylinder 2.7 liter DUAL

Domain Est. 2006

Website: tacomaworld.com

Key Highlights: The new 2.7 liter with Dual VVT-i could have: 181.52 HP 189.76 TQ But because it’s an inline engine compared to the above V-style engines, coupled with being a ……

#6 Tianjin faw toyota engine’s plant no. 2 to mark engine production start

Website: newsroom.toyota.eu

Key Highlights: The ZR engine features Dual VVT-i (Variable Valve Timing-intelligent), which offers not only superior driving performance but also world ……

Expert Sourcing Insights for Dual Vvti Engine

2026 Market Trends for Dual VVT-i Engine

The automotive industry is undergoing a significant transformation as it moves toward electrification, sustainability, and smarter technologies. Despite this shift, internal combustion engines (ICEs), particularly those equipped with advanced efficiency technologies like Dual VVT-i (Variable Valve Timing with intelligence), are expected to maintain relevance through 2026—especially in emerging markets and hybrid applications.

Continued Demand in Emerging Markets

Dual VVT-i engines will remain in strong demand in developing regions such as Southeast Asia, Africa, and parts of Latin America. These markets prioritize fuel efficiency, reliability, and low maintenance costs—hallmarks of Dual VVT-i technology. As vehicle ownership grows in countries like India, Indonesia, and Nigeria, automakers will continue to deploy cost-effective, fuel-efficient ICEs. Dual VVT-i engines, which optimize both intake and exhaust valve timing for improved performance and reduced emissions, are well-suited for this segment. By 2026, these engines are projected to power a significant share of entry-level and mid-range vehicles in these regions.

Integration with Mild Hybrid Systems

One of the most significant trends shaping the Dual VVT-i engine’s future is its integration into mild hybrid electric vehicle (MHEV) platforms. Automakers, including Toyota and other Japanese manufacturers, are combining Dual VVT-i engines with 48-volt mild hybrid systems to meet increasingly stringent global emissions standards without the cost and complexity of full electrification. This hybridization allows for engine stop/start functionality, torque assist, and regenerative braking, further enhancing fuel economy. By 2026, the convergence of Dual VVT-i with mild hybrid technology is expected to extend the life cycle of ICEs in markets that are transitioning slowly to full electric vehicles (EVs).

Emission Regulations and Efficiency Optimization

Global regulatory pressures, such as Euro 7 standards in Europe and Bharat Stage VII considerations in India, are pushing automakers to maximize ICE efficiency. Dual VVT-i engines, already designed for optimal air-fuel mixture and combustion efficiency, are being refined with enhanced control algorithms, improved oil efficiency, and better thermal management. These upgrades help reduce NOx and CO₂ emissions, allowing automakers to comply with regulations while delaying full powertrain replacement. In 2026, expect to see next-generation Dual VVT-i variants with adaptive timing control and AI-driven engine management systems for real-time performance tuning.

Competition from Electrification

Despite their advantages, Dual VVT-i engines face growing competition from battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), particularly in North America, Europe, and China. Government incentives, charging infrastructure expansion, and consumer preference shifts are accelerating EV adoption. As a result, the market share of traditional ICEs, including Dual VVT-i models, may decline in these regions by 2026. However, due to range anxiety, charging limitations, and cost, ICEs will still dominate in rural and cost-sensitive areas, ensuring continued production and sales of Dual VVT-i-powered vehicles.

Aftermarket and Service Growth

As the global fleet of Dual VVT-i-equipped vehicles grows, the aftermarket for maintenance, performance parts, and repairs will expand. Components such as VVT-i solenoids, oil control valves, and timing actuators are common service items, driving demand for genuine and aftermarket parts. By 2026, the service ecosystem around Dual VVT-i engines—including diagnostic tools, specialized technicians, and remanufactured components—is expected to become more robust, especially in regions with high vehicle longevity.

Conclusion

While the long-term trajectory points toward electrification, the Dual VVT-i engine is poised to remain a key player in the global automotive landscape through 2026. Its strengths in fuel efficiency, reliability, and adaptability to hybrid systems ensure continued deployment, especially in cost-conscious and infrastructure-limited markets. However, its growth will be increasingly constrained by regulatory and technological shifts favoring zero-emission mobility. Automakers leveraging Dual VVT-i technology will likely do so as part of transitional hybrid strategies, balancing performance, cost, and compliance in a rapidly evolving industry.

Common Pitfalls When Sourcing a Dual VVT-i Engine

Sourcing a Dual VVT-i (Dual Variable Valve Timing with intelligence) engine—whether for replacement, restoration, or integration into a custom build—requires careful consideration to avoid significant issues. Two major areas where buyers often encounter problems are quality inconsistencies and intellectual property (IP) concerns. Understanding these pitfalls can help ensure a reliable and legitimate purchase.

Quality Inconsistencies in Sourced Engines

One of the most frequent challenges when sourcing a Dual VVT-i engine is variability in quality, especially with used, refurbished, or aftermarket units. Key quality-related pitfalls include:

-

Lack of Maintenance History: Used engines, particularly from unverified sources, may have unknown service records. Hidden issues like oil sludge, timing chain wear, or VVT-i actuator degradation may not be apparent during a basic inspection.

-

Counterfeit or Substandard Rebuilds: Some suppliers offer “remanufactured” engines that use inferior internal components or skip critical calibration steps. This can lead to premature failure of the VVT-i system, which relies on precise oil pressure and phaser control.

-

Wear on VVT-i Components: The VVT-i solenoids, oil control valves, and cam phasers are sensitive and prone to clogging or mechanical wear. Engines sourced from high-mileage vehicles or harsh operating conditions may have degraded VVT-i performance, resulting in poor fuel economy, rough idling, or check engine lights.

-

Inadequate Testing: Reputable suppliers test engines for oil pressure, compression, and VVT-i functionality. Many low-cost vendors skip these steps, increasing the risk of receiving a non-functional or short-lived unit.

To mitigate these risks, always request maintenance records, insist on a warranty, and purchase from certified or reputable dealers who provide detailed inspection reports.

Intellectual Property and Authenticity Risks

Another critical, often overlooked, pitfall involves intellectual property and part authenticity. Dual VVT-i is a proprietary Toyota technology, and unauthorized replication or misrepresentation can lead to legal and performance issues:

-

Non-OEM or “Compatible” Engines: Some suppliers market engines as “Dual VVT-i compatible” without licensing Toyota’s technology. These engines may mimic the design but lack the precise engineering, software calibration, and durability of genuine Toyota units.

-

Trademark and Legal Exposure: Using or distributing counterfeit engines bearing Toyota logos or model designations without authorization can result in legal action for trademark infringement.

-

Software and ECU Compatibility: Genuine Dual VVT-i engines are designed to work with specific engine control units (ECUs) and calibration files. Imitation engines may not integrate properly with OEM ECUs, leading to drivability issues or failure to meet emissions standards.

-

Lack of Manufacturer Support: Non-authentic engines typically do not qualify for warranty coverage or technical support from Toyota, leaving buyers without recourse if problems arise.

To avoid IP-related issues, ensure the engine is sourced through authorized channels, verify authenticity with Toyota part numbers, and avoid vendors offering unusually low prices—often a red flag for counterfeit goods.

By being aware of these quality and IP pitfalls, buyers can make informed decisions and reduce the risk of costly repairs, compliance issues, or vehicle downtime.

Logistics & Compliance Guide for Dual VVT-i Engine

Overview of Dual VVT-i Engine

Dual VVT-i (Dual Variable Valve Timing with intelligence) is an advanced engine technology used by manufacturers like Toyota to optimize engine performance, fuel efficiency, and emissions. These engines adjust the timing of both intake and exhaust valves based on driving conditions. Due to their sophistication and controlled technology status in certain jurisdictions, shipping and handling Dual VVT-i engines require strict adherence to international logistics and regulatory compliance standards.

Export Classification and Regulatory Compliance

Dual VVT-i engines may be subject to export control regulations depending on their technical specifications and destination country. Key compliance areas include:

- Export Control Classification Number (ECCN): Evaluate whether the engine or associated control software falls under the U.S. Commerce Control List (CCL) or similar frameworks (e.g., EU Dual-Use Regulation). Engines with advanced electronic control units (ECUs) may be classified under ECCN 9A004 or 9A104.

- ITAR vs. EAR: Ensure the engine does not contain defense-related components subject to the International Traffic in Arms Regulations (ITAR). Most automotive engines fall under the Export Administration Regulations (EAR).

- Country-Specific Restrictions: Confirm destination country import policies—some nations restrict or require licensing for advanced engine technologies due to environmental or trade regulations.

Packaging and Handling Requirements

Proper packaging ensures engine integrity during transit and compliance with safety standards:

- Corrosion Protection: Apply rust preventative coatings and use VCI (Vapor Corrosion Inhibitor) paper or bags to protect internal components.

- Secure Mounting: Mount the engine on a wooden pallet using bolts or straps to prevent movement. Include protective caps on all ports (oil, coolant, intake/exhaust).

- Weatherproofing: Enclose in a sealed, moisture-resistant container or wrap with industrial stretch film. For ocean freight, use desiccants inside packaging.

- Labeling: Clearly mark packages with handling symbols (e.g., “This Side Up,” “Fragile”), engine model, serial number, net weight, and hazardous material indicators if applicable (e.g., residual fluids).

Transportation and Shipping Documentation

Accurate documentation is essential for customs clearance and compliance:

- Commercial Invoice: Include detailed description (e.g., “New 2.5L Dual VVT-i Gasoline Engine, Model 2AR-FE”), value, quantity, and harmonized system (HS) code (typically 8407.31 or 8407.32 for internal combustion engines).

- Packing List: Specify packaging type, dimensions, gross/net weight, and number of units.

- Certificate of Origin: Required by many countries to determine tariff eligibility (e.g., under USMCA, ASEAN, or other trade agreements).

- Bill of Lading/Air Waybill: Ensure legal transfer of goods and accurate routing details.

- Export Declaration: File through official systems such as AES (Automated Export System) in the U.S. or ICS2 in the EU.

Customs Clearance and Import Regulations

Prepare for customs procedures at the destination:

- HS Code Verification: Confirm correct classification with local customs authorities to avoid delays or penalties.

- Duties and Taxes: Calculate applicable import duties, VAT, or GST based on declared value and origin.

- Emissions and Safety Certification: Some countries require proof of compliance with local emission standards (e.g., Euro 6, Bharat Stage VI) or safety certifications before allowing engine import.

- Local Agency Support: Engage a licensed customs broker in the destination country to facilitate clearance and ensure adherence to local regulations.

Environmental and Safety Compliance

Dual VVT-i engines must meet environmental and safety regulations throughout the supply chain:

- Hazardous Materials: Declare and properly manage any residual oils or fluids in accordance with IATA (air), IMDG (sea), or ADR (road) regulations if applicable.

- End-of-Life Vehicle (ELV) Directives: In regions like the EU, ensure engines comply with materials restrictions (e.g., RoHS, ELV Directive 2000/53/EC) regarding lead, mercury, and other hazardous substances.

- Carbon Footprint Reporting: Some jurisdictions or corporate policies require emissions tracking for transport; use logistics providers with carbon reporting capabilities.

Recordkeeping and Audit Readiness

Maintain comprehensive records for a minimum of five years:

- Retain copies of export licenses (if required), shipping documents, compliance certifications, and correspondence with regulatory bodies.

- Conduct internal audits to verify adherence to export control policies and update classifications as technology or regulations evolve.

Conclusion

Shipping Dual VVT-i engines requires a proactive approach to logistics and compliance. By correctly classifying the engine, preparing accurate documentation, ensuring secure packaging, and staying informed on international regulations, organizations can minimize delays, avoid penalties, and ensure smooth global distribution. Always consult with legal and compliance experts when shipping high-tech automotive components across borders.

Conclusion on Sourcing a Dual VVT-i Engine

In conclusion, sourcing a Dual VVT-i (Dual Variable Valve Timing with intelligence) engine presents a strategic advantage for applications requiring improved fuel efficiency, enhanced power output, reduced emissions, and smoother engine performance across a wide RPM range. The technology’s ability to optimize both intake and exhaust valve timing ensures superior engine responsiveness and efficiency compared to non-VVT or single VVT systems.

When sourcing such engines, key considerations include verifying authenticity and compatibility with the intended vehicle or machinery, evaluating the supplier’s reliability and track record, and ensuring compliance with emissions and safety standards. Additionally, cost-effectiveness should be balanced against long-term benefits such as lower fuel consumption and reduced maintenance due to optimized combustion.

Overall, the Dual VVT-i engine remains a proven and reliable choice in modern engine technology. With careful due diligence in sourcing from reputable manufacturers or suppliers—whether OEM, aftermarket, or remanufactured—organizations can achieve a strong return on investment while meeting performance and environmental goals.