The global drywall accessories market, which includes products such as drywall J trim, is experiencing steady growth driven by rising residential and commercial construction activities. According to Grand View Research, the global drywall market was valued at USD 54.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing demand for energy-efficient building materials, faster construction timelines, and the shift toward modular and prefabricated construction methods where drywall systems play a critical role. As a key component in finishing drywall edges and providing clean, durable corners, J trim usage is expanding across new builds and renovation projects alike. In this evolving landscape, a select group of manufacturers have emerged as leaders in quality, innovation, and global reach—shaping the standards for performance and sustainability in drywall trim solutions.

Top 8 Drywall J Trim Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Trim

Domain Est. 1996

Website: trim-tex.com

Key Highlights: Trim-Tex is the premier manufacturer of drywall beads & accessories. We coined the term “Drywall Art” and serve as a Design & Training Center….

#2 Metal Beads & Trim Products

Domain Est. 1996

Website: marinoware.com

Key Highlights: Discover MarinoWARE’s metal beads and trim options for drywall finishing, designed to enhance durability and meet various industry standards….

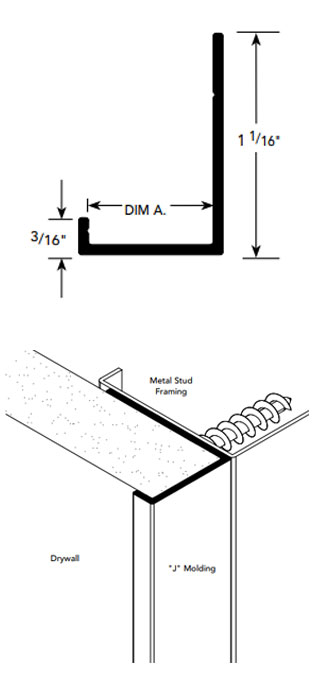

#3 Drywall J Molding

Domain Est. 1998

Website: fryreglet.com

Key Highlights: Fry Reglet J Molding is a basic interior or exterior trim used to terminate and finish plaster, stucco, drywall or wood panels….

#4 Metal Corner Bead and Trims

Domain Est. 1999 | Founded: 1955

Website: phillipsmfg.com

Key Highlights: Phillips manufactures a broad range of metal corner beads and trims, providing quality for every job. Proudly manufactured in the USA since 1955….

#5 J L and U

Domain Est. 2002

Website: buysuperstud.com

Key Highlights: J, L and U Trim are metal trim accessories used to protect free edges of gypsum wallboards ranging in thickness from 1/2” to 5/8” among a variety of uses….

#6 USG Middle East Drywall J Trims

Domain Est. 2003

#7 Architectural Trims – Drywall

Domain Est. 2010

Website: eagle-aluminum.com

Key Highlights: Our architectural drywall trims are designed to deliver clean lines, superior durability, and a refined finish for both commercial and residential interiors….

#8 J

Domain Est. 2011

Website: clarkdietrich.com

Key Highlights: J-Bead is designed to cover raw edges of drywall under all window and door casing. Found in: Interior Finishing > Commercial Beads….

Expert Sourcing Insights for Drywall J Trim

H2: 2026 Market Trends for Drywall J-Trim

The global Drywall J-Trim market is poised for steady growth through 2026, driven by rising construction activity, advancements in building materials, and increasing demand for aesthetically finished interior and exterior wall systems. J-Trim, a critical component used at the edges of drywall to provide clean finishes and protect vulnerable edges, is benefiting from broader trends in residential, commercial, and industrial construction.

-

Growth in Construction Activities

A key driver shaping the 2026 outlook is the resurgence in both residential and commercial construction, particularly in North America, Europe, and parts of Asia-Pacific. Urbanization, infrastructure development, and government-backed housing projects in emerging economies are boosting demand for drywall systems—and by extension, J-Trim products. -

Shift Toward Lightweight and Efficient Building Materials

As builders prioritize speed, cost-efficiency, and sustainability, drywall continues to displace traditional masonry in interior partitions. J-Trim complements this trend by enabling clean, fast edge finishing with minimal labor. Innovations in lightweight J-Trim made from vinyl, aluminum, and composite materials are gaining traction due to their corrosion resistance and ease of installation. -

Increased Focus on Aesthetics and Finishing Quality

With growing consumer preference for polished interiors in homes, offices, and retail spaces, the demand for high-quality trim solutions is rising. J-Trim offers a seamless transition between drywall and adjacent surfaces (e.g., windows, doors, or different wall materials), enhancing visual appeal. This trend is especially strong in the luxury housing and renovation sectors. -

Sustainability and Eco-Friendly Materials

By 2026, environmental regulations and green building certifications (e.g., LEED, BREEAM) are expected to influence material choices. Manufacturers are responding by introducing recyclable and low-emission J-Trim products. Aluminum and recycled plastic-based trims are likely to see increased adoption as sustainable alternatives to traditional steel. -

Technological Integration and Prefabrication

The rise of modular and prefabricated construction methods is reshaping demand. J-Trim is increasingly being integrated into off-site drywall panel production, enabling faster on-site assembly. This trend supports cost savings and consistency in finishes, aligning with industry goals for efficiency and quality control. -

Regional Market Dynamics

North America remains a dominant market due to widespread use of drywall in construction. However, rapid urbanization in India, Southeast Asia, and the Middle East is creating new growth opportunities. Local manufacturing and distribution partnerships are expected to expand to meet regional demand. -

Competitive Landscape and Innovation

Leading manufacturers such as CertainTeed, USG, ClarkDietrich, and Trim-Tex are focusing on product differentiation through improved durability, design flexibility, and compatibility with various drywall thicknesses. By 2026, smart packaging, anti-microbial coatings, and color-matched finishes may become standard features.

Conclusion:

The Drywall J-Trim market in 2026 will be shaped by construction growth, sustainability mandates, and demand for high-performance finishing solutions. As the industry evolves, J-Trim will remain essential—not just for protection, but as a value-added component in modern building practices. Companies that innovate in materials, sustainability, and application efficiency are best positioned to capture market share.

Common Pitfalls When Sourcing Drywall J-Trim (Quality, IP)

Sourcing the right drywall J-Trim is crucial for achieving clean, durable edges in drywall installations. However, several pitfalls related to quality and intellectual property (IP) can compromise project outcomes and lead to costly rework or legal issues.

Poor Material Quality and Inconsistent Gauge

One of the most frequent pitfalls is selecting J-Trim made from substandard materials. Low-quality J-Trim often uses thin-gauge steel or recycled aluminum that lacks rigidity, leading to bending or warping during installation. This results in uneven edges, visible imperfections, and difficulty achieving a smooth finish. Additionally, inconsistent metal thickness across batches can affect performance and aesthetics, especially in large-scale projects requiring uniform appearance.

Inadequate or Inconsistent Finish and Coating

J-Trim with poor or uneven protective coatings—such as inadequate galvanization or paint finishes—is prone to corrosion, especially in high-moisture environments like bathrooms or exterior soffits. Sourcing from unreliable suppliers may result in trim that chips, rusts, or discolors over time, undermining both durability and visual appeal. Lack of quality control can also lead to variations in color or sheen between production runs.

Non-Standard Dimensions and Tolerances

Off-brand or generic J-Trim may not adhere to industry-standard dimensions (e.g., flange width, leg depth, lip size). Even slight deviations can make it difficult to achieve a proper fit with drywall edges, leading to gaps, misalignment, or difficulty in taping and mudding. This is particularly problematic when mixing trim from different suppliers on the same job.

Misrepresentation of Intellectual Property (IP) and Brand Imitations

A significant but often overlooked pitfall involves IP infringement. Some suppliers market counterfeit or knock-off versions of patented J-Trim profiles (e.g., those designed by major manufacturers like CertainTeed, USG, or ClarkDietrich). These imitations may appear similar but lack the engineered performance characteristics of the original. Using such products can expose contractors and builders to legal risk, especially if the IP holder enforces trademark or patent rights. Additionally, these copies often underperform in terms of fit, finish, and long-term durability.

Lack of Traceability and Certification

Reputable J-Trim products often come with certifications for material composition, fire resistance, or compliance with building codes. Sourcing from vendors who cannot provide documentation or traceability increases the risk of using non-compliant materials. This becomes critical in commercial or institutional projects where code compliance is mandatory and subject to inspection.

Inconsistent Availability and Supply Chain Reliability

Choosing a lesser-known brand or a supplier with poor inventory management can lead to stockouts or long lead times. This disrupts project schedules and may force last-minute substitutions, increasing the likelihood of quality mismatches or using non-approved materials.

Avoiding these pitfalls requires due diligence: sourcing from trusted manufacturers, verifying product specifications and IP status, inspecting samples for quality, and ensuring consistent supply chain performance.

Logistics & Compliance Guide for Drywall J-Trim

Product Overview and Specifications

Drywall J-Trim, also known as edge metal or corner bead, is a prefabricated metal or vinyl strip used in drywall installations to provide clean, durable edges at wall and ceiling perimeters, particularly where drywall meets windows, doors, or other non-drywall surfaces. It ensures smooth transitions, protects edges from damage, and provides a professional finish for taping and mudding. J-Trims are typically made from galvanized steel, aluminum, or PVC and come in various lengths, widths, and finishes to match different drywall thicknesses (e.g., 1/2″ or 5/8″).

Packaging and Handling Requirements

Drywall J-Trim is commonly packaged in corrugated cardboard bundles or shrink-wrapped into manageable lengths (usually 8 to 10 feet per piece). Bundles are stacked on wooden pallets for stability during transport. Handlers should avoid dropping or bending the trim to prevent warping. When storing, keep materials indoors in a dry, well-ventilated area off the ground to prevent moisture exposure and corrosion. Protect from direct sunlight if PVC-based, as UV exposure may degrade plastic components over time.

Transportation and Shipping Guidelines

Ship Drywall J-Trim via standard freight carriers using enclosed trucks or containers to protect from weather. Secure pallets with straps or shrink wrap to prevent shifting. Stack no higher than recommended by the manufacturer (typically 3–4 pallets) to avoid crushing lower layers. Label shipments as “Fragile – Do Not Bend” and “Keep Dry.” For international shipments, ensure compliance with carrier-specific dimension and weight limits, and use appropriate export-grade packaging.

Storage and Inventory Management

Store J-Trim in a controlled indoor environment with temperatures between 50°F and 80°F (10°C to 27°C) and relative humidity under 60%. Keep materials on pallets at least 6 inches off the floor and away from exterior walls to minimize condensation risks. Implement a first-in, first-out (FIFO) inventory system to reduce the chance of long-term storage degradation. Regularly inspect stock for signs of corrosion, warping, or packaging damage.

Regulatory and Safety Compliance

Ensure J-Trim products meet relevant building material standards such as ASTM C1047 (Standard Specification for Accessories for Gypsum Wallboard) and ASTM C840 (Standard Specification for Application and Finishing of Gypsum Board). In the U.S., verify compliance with OSHA regulations for safe handling, including the use of gloves and eye protection when cutting or installing metal trims. For PVC-based trims, confirm compliance with VOC (Volatile Organic Compounds) emission standards such as CA 01350 or UL GREENGUARD Gold if used in sensitive environments like schools or healthcare facilities.

Environmental and Sustainability Considerations

Choose J-Trim products with high recycled content, especially aluminum or steel variants, which are 100% recyclable. Confirm manufacturer participation in environmental product declarations (EPDs) or Health Product Declarations (HPDs) to support LEED or other green building certifications. Properly recycle packaging materials such as cardboard and shrink wrap. Avoid disposal in landfills; instead, channel metal trims to certified metal recycling facilities at project end.

Import/Export and Customs Compliance

For cross-border shipments, classify Drywall J-Trim under the appropriate Harmonized System (HS) code—typically 7308.90 (other structural elements of iron or steel) or 3918.10 (plastic decorative elements), depending on material. Provide accurate commercial invoices, packing lists, and certificates of origin. Comply with destination country regulations, such as CE marking in the EU (under Construction Products Regulation – CPR) or CCC in China. Declare any hazardous substances per RoHS or REACH if applicable.

Quality Assurance and Documentation

Maintain records of mill test reports, compliance certificates, and product data sheets for each batch. Conduct periodic visual inspections upon receipt to verify straightness, coating integrity, and dimensional accuracy. Report non-conforming materials to suppliers immediately. Use traceable lot numbers to support warranty claims or recalls if necessary. Ensure all documentation is retained for a minimum of five years for audit and compliance purposes.

In conclusion, sourcing drywall J-bead (J-trim) requires careful consideration of material quality, compatibility with your project needs, availability, and cost. Whether opting for vinyl, metal, or paper-faced J-trim, it is essential to select a product that ensures clean, durable edges and seamless integration with drywall and finishing materials. Sourcing from reputable suppliers—whether local building supply stores, national retailers, or online vendors—helps guarantee consistent quality and timely delivery. Additionally, comparing pricing, lead times, and minimum order requirements can lead to cost-effective and efficient procurement. By taking a strategic approach to sourcing J-trim, contractors and builders can maintain high standards of craftsmanship while keeping projects on schedule and within budget.