The global dry-type transformer market is experiencing robust growth, driven by increasing urbanization, rising electricity demand, and a shift toward safer, more sustainable power distribution solutions. According to a report by Mordor Intelligence, the global dry-type transformer market was valued at USD 11.8 billion in 2023 and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. This expansion is further supported by Grand View Research, which highlights the growing adoption of dry-type transformers in commercial buildings, data centers, and renewable energy installations due to their fire-resistant properties, low maintenance, and environmental safety—offering a compelling alternative to oil-filled units in indoor and sensitive environments. With stringent regulatory standards and smart grid development accelerating across North America, Europe, and Asia-Pacific, demand for reliable and efficient dry-type transformers is on a sustained upward trajectory. In this dynamic landscape, a select group of manufacturers have emerged as market leaders, combining innovation, scalability, and global reach to deliver high-performance transformers across critical industries.

Top 9 Dry Type Transformers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dry

Domain Est. 1999

Website: federalpacific.com

Key Highlights: Federal Pacific is a major manufacturer of dry-type transformers which serve the industrial, construction, commercial, mining, OEM and utility markets….

#2 Virginia Transformer Corp

Domain Est. 1997 | Founded: 1971

Website: vatransformer.com

Key Highlights: The largest U.S.-owned custom power transformer manufacturer since 1971, with six advanced facilities across the U.S. and Mexico….

#3 Hammond Power Solutions Americas

Domain Est. 2000

Website: americas.hammondpowersolutions.com

Key Highlights: HPS is the largest manufacturer of dry-type transformers in North America. We engineer and manufacture a wide range of standard and custom transformers….

#4 TMC Transformers

Domain Est. 2006

Website: tmctransformers.com

Key Highlights: TMC is specialised in the production of dry-type transformers and cast resin transformers for different applications and installation needs. Visit our website….

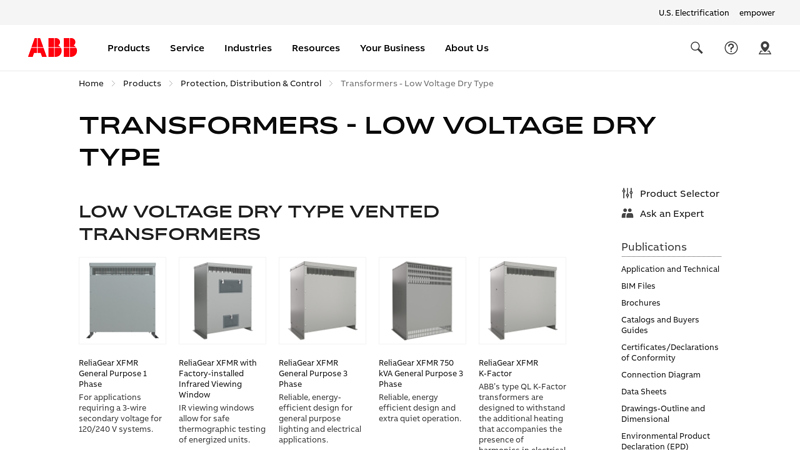

#5 Transformers

Domain Est. 1990

Website: electrification.us.abb.com

Key Highlights: ABB’s type QL K-Factor transformers are designed to withstand the additional heating that accompanies the presence of harmonics in electrical systems….

#6 Dry

Domain Est. 1994

Website: nema.org

Key Highlights: Dry Type Transformers for General Applications. Applies to single-phase and polyphase dry type transformers (including both autotransformers and noncurrent ……

#7 Alfa Transformer

Domain Est. 1996

Website: alfatransformer.com

Key Highlights: Alfa Transformer offers new, energy efficient, single-phase and three-phase low voltage (600V class) and medium voltage dry type transformers from 0.05 KVA to ……

#8 Low-voltage transformer fundamentals

Domain Est. 1996

Website: eaton.com

Key Highlights: On this page, we will explore the basics of dry-type transformers and their most common configurations. dry-type-distribution-transformers.jpg….

#9 ELSCO Transformers

Domain Est. 2007

Website: elscotransformers.com

Key Highlights: Designed with laminated steel cores, 100% copper windings and top-grade insulation, our dry type transformers lower operating costs, deliver reliable ……

Expert Sourcing Insights for Dry Type Transformers

H2: Market Trends for Dry Type Transformers in 2026

By 2026, the global dry type transformer market is poised for robust expansion, driven by a confluence of technological advancements, evolving regulatory standards, and shifting energy demands. Key trends shaping the market landscape include:

1. Accelerated Growth in Renewable Energy Integration:

The continued global push toward decarbonization will significantly boost demand for dry type transformers in solar and wind farms, data centers powered by renewables, and grid interconnection points. Their inherent safety, low maintenance, and suitability for indoor or environmentally sensitive locations make them ideal for interfacing renewable generation with distribution networks.

2. Urbanization and Smart Grid Development:

Rapid urbanization, particularly in Asia-Pacific and key emerging markets, is increasing the need for compact, fire-safe transformers in high-density infrastructure. Dry type units are favored in smart grids, metro systems, commercial buildings, and industrial complexes due to their non-flammable design and compatibility with digital monitoring systems. The integration of IoT-enabled sensors for predictive maintenance will become standard, enhancing reliability and operational efficiency.

3. Stringent Fire Safety and Environmental Regulations:

Regulatory frameworks, especially in Europe (e.g., EU Green Deal) and North America, are increasingly mandating the use of non-hazardous equipment in public and indoor spaces. Bans or restrictions on oil-filled transformers in buildings and tunnels are driving adoption of dry type alternatives. Additionally, the absence of toxic insulating liquids aligns with ESG (Environmental, Social, and Governance) goals, further bolstering market appeal.

4. Technological Innovation and Material Advancements:

Manufacturers are investing in advanced resin systems (epoxy, silicone) and vacuum pressure impregnation (VPI) techniques to improve thermal performance, reduce partial discharge, and extend lifecycle. Innovations in core materials (e.g., amorphous metal, high-permeability silicon steel) are enhancing energy efficiency, helping producers meet Tier 1 and Tier 2 efficiency standards (e.g., DOE, IEC 60076-20).

5. Regional Market Dynamics:

Asia-Pacific will remain the largest and fastest-growing market, led by China, India, and Southeast Asia, fueled by infrastructure development and energy transition initiatives. North America and Europe will see steady growth driven by grid modernization and sustainability mandates. Latin America and the Middle East will experience increased demand due to industrial expansion and investments in renewable projects.

6. Supply Chain Resilience and Localization:

Ongoing geopolitical tensions and lessons from past disruptions are prompting manufacturers to diversify supply chains and localize production. Nearshoring and regional manufacturing hubs will gain importance, especially in critical markets, to ensure timely delivery and reduce logistical vulnerabilities.

In conclusion, the 2026 dry type transformer market will be characterized by strong growth, innovation, and a shift toward smarter, safer, and more sustainable power distribution solutions, positioning dry type transformers as a cornerstone of modern electrical infrastructure.

Common Pitfalls When Sourcing Dry Type Transformers (Quality, IP)

Sourcing dry type transformers involves several critical considerations to ensure reliability, safety, and long-term performance. Overlooking key quality and Ingress Protection (IP) factors can lead to equipment failure, safety hazards, and costly downtime. Below are common pitfalls to avoid:

Inadequate IP Rating for the Environment

Selecting a transformer with an insufficient IP rating for its operating environment is a frequent oversight. For example, installing an IP20-rated unit in a dusty industrial setting or humid location can lead to insulation degradation, tracking, and short circuits. Always match the IP rating—such as IP42 for protection against solid objects >1mm and dripping water—to the specific environmental conditions, including dust, moisture, and potential hose-directed water spray.

Compromising on Insulation and Temperature Class

Opting for lower-grade insulation materials (e.g., Class B instead of Class F or H) to reduce costs can severely impact the transformer’s longevity and thermal performance. Lower temperature classes result in reduced overload capacity and accelerated aging. Ensure the insulation system meets or exceeds the required temperature class for the application, especially in high-ambient or high-load environments.

Poor Workmanship and Substandard Materials

Low-cost suppliers may use inferior copper (lower conductivity or undersized windings), subpar varnish, or inadequate core steel, leading to higher losses, overheating, and reduced efficiency. Lack of proper vacuum pressure impregnation (VPI) or resin casting can compromise moisture and contamination resistance. Always verify material specifications and request test reports (e.g., type tests, routine tests per IEC 60076).

Lack of Compliance with International Standards

Procuring transformers that do not comply with recognized standards such as IEC 60076, IEEE C57.12.01, or UL 5085 increases the risk of safety failures and non-conformance with local regulations. Non-certified units may not undergo proper dielectric, temperature rise, or short-circuit withstand testing, posing serious operational risks.

Insufficient Short-Circuit Withstand Capability

Some manufacturers may not adequately design or test transformers for the prospective fault levels at the installation site. Using a transformer with inadequate short-circuit strength can result in catastrophic failure during grid disturbances. Confirm that the unit is rated for the required fault current and duration, and request short-circuit test reports.

Overlooking Acoustic Noise Levels

In commercial or indoor applications (e.g., hospitals, offices), excessive noise from poorly constructed transformers can be disruptive. Core lamination quality, clamping pressure, and winding design affect sound levels. Specify maximum acceptable noise levels (e.g., in dB(A)) and ensure compliance.

Incomplete or Missing Documentation and Traceability

Lack of comprehensive documentation—such as test certificates, material traceability, wiring diagrams, and maintenance manuals—complicates commissioning, compliance audits, and troubleshooting. Ensure suppliers provide full technical dossiers and retain quality records for the product’s lifecycle.

Failure to Verify Factory Quality Control Processes

Sourcing from manufacturers without robust quality management systems (e.g., ISO 9001-certified) increases the risk of inconsistent production quality. Conduct supplier audits or request evidence of in-process inspections, routine testing, and final acceptance procedures to ensure reliability.

Avoiding these pitfalls requires due diligence, clear technical specifications, and engagement with reputable suppliers who prioritize quality and compliance over cost-cutting.

Logistics & Compliance Guide for Dry Type Transformers

This guide outlines key considerations for the safe, efficient, and compliant transportation, handling, storage, and regulatory adherence for dry type transformers.

Transportation & Handling

Proper Packaging and Securing

– Ensure transformers are shipped in manufacturer-approved, weather-resistant crates or packaging designed to absorb shock and prevent moisture ingress.

– Secure units firmly within transport vehicles using straps, braces, or blocking to prevent shifting during transit.

– Maintain upright orientation at all times; never lay a dry type transformer on its side or invert it unless explicitly permitted by the manufacturer.

Lifting and Rigging

– Use lifting lugs or designated lifting points only. Never lift by enclosure handles, terminal covers, or core components.

– Employ spreader bars and soft slings to avoid damaging the enclosure or internal windings.

– Ensure cranes, forklifts, and rigging equipment have adequate load capacity for the transformer’s weight.

Environmental Protection

– Protect units from rain, snow, and direct sunlight during loading, unloading, and transit.

– Avoid exposure to excessive vibration, dust, or corrosive atmospheres.

– Use temporary covers if delayed outdoors during unloading.

On-Site Storage

Indoor Storage Preferred

– Store in a clean, dry, well-ventilated indoor facility with stable temperatures.

– Maintain relative humidity below 70% to prevent condensation and insulation degradation.

Outdoor Storage (If Unavoidable)

– Elevate transformers on skids or pallets to avoid ground moisture.

– Cover completely with waterproof, breathable tarpaulins anchored to prevent wind uplift.

– Inspect covers periodically for damage and check for condensation buildup.

Duration and Monitoring

– Limit outdoor storage to the manufacturer’s recommended period (typically 30–90 days).

– Record storage conditions and conduct visual inspections every two weeks for signs of moisture, corrosion, or physical damage.

Regulatory Compliance

Electrical Safety Standards

– Ensure transformers comply with applicable regional and international standards such as:

– IEC 60076 (Power Transformers)

– IEC 61558 (Safety of Transformers)

– IEEE C57.12.01 (Standard for Dry-Type Transformers)

– UL 5085 (Standard for Safety of Transformers)

– Verify nameplate markings include voltage ratings, kVA, impedance, temperature class, and certification marks (e.g., UL, CSA, CE).

Hazardous Location Approvals

– For installations in hazardous environments (e.g., Class I, Division 2), confirm transformers are rated and certified accordingly (e.g., ATEX, IECEx).

Environmental Regulations

– Comply with RoHS (Restriction of Hazardous Substances) and REACH regulations where applicable.

– Dry type transformers typically contain no PCBs or insulating oil, minimizing environmental disposal concerns, but verify material content for recycling compliance.

Import/Export Documentation

– Prepare accurate commercial invoices, packing lists, and certificates of conformity.

– Include test reports (e.g., type tests, routine tests) as required by customs or local authorities.

– Confirm compliance with destination country’s electrical codes and certification requirements (e.g., NRCan in Canada, GOST in Russia).

Installation & Commissioning Compliance

Pre-Installation Inspection

– Inspect for shipping damage before installation.

– Verify transformer specifications match site requirements (voltage, frequency, kVA).

Electrical and Mechanical Clearance

– Maintain manufacturer-specified clearances for ventilation and cooling.

– Ensure adequate seismic bracing in earthquake-prone zones per local codes (e.g., ASCE 7, IBC).

Testing and Commissioning

– Perform insulation resistance (megger) tests and turns ratio tests prior to energization.

– Document all pre-commissioning tests per IEEE C57.12.91 or equivalent standards.

Documentation & Recordkeeping

- Retain all original manufacturer documentation: test reports, instruction manuals, warranty certificates.

- Keep logs of transport conditions, storage inspections, and commissioning results.

- Update asset records with serial numbers, installation dates, and compliance certifications.

Adherence to this logistics and compliance guide ensures operational safety, regulatory acceptance, and long-term reliability of dry type transformers across their lifecycle.

Conclusion on Sourcing Dry-Type Transformers

In conclusion, sourcing dry-type transformers requires a strategic approach that balances technical specifications, safety standards, environmental considerations, and total cost of ownership. These transformers are ideal for indoor installations, such as commercial buildings, hospitals, data centers, and industrial facilities, due to their non-flammable nature, low maintenance, and operational safety.

When sourcing dry-type transformers, it is essential to prioritize quality and reliability by selecting certified manufacturers who comply with international standards such as IEEE, IEC, and NEMA. Key factors such as efficiency ratings (e.g., DOE 2016 compliance), temperature rise, insulation class, and acoustic performance should align with the specific application requirements.

Additionally, considering lead times, local support, and after-sales service can significantly impact project timelines and long-term performance. Sustainable sourcing practices—such as opting for energy-efficient models and recyclable materials—contribute to environmental goals and reduced operational costs.

Ultimately, a well-informed procurement strategy ensures the selection of a dry-type transformer that delivers reliable power distribution, enhances safety, supports energy efficiency, and meets both current and future electrical demands.