Sourcing Guide Contents

Industrial Clusters: Where to Source Drop Shipping Companies In China

SourcifyChina Sourcing Report 2026

Title: Market Analysis for Sourcing Drop Shipping Operations from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

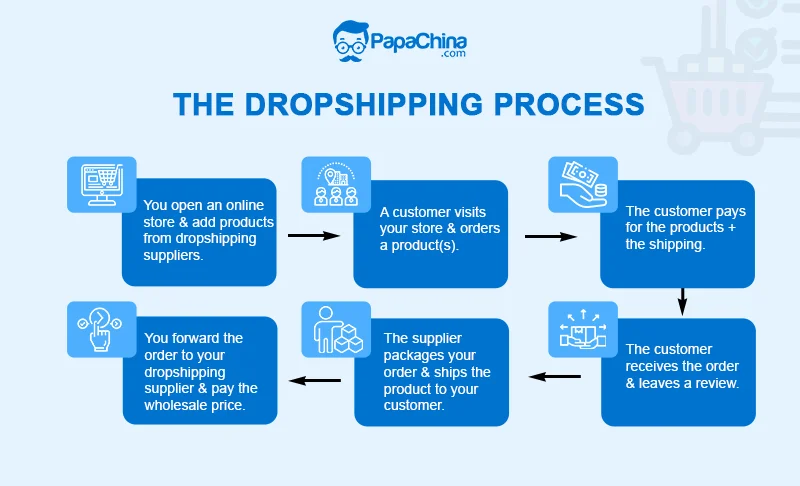

As global e-commerce continues to scale, drop shipping has emerged as a critical fulfillment model for brands and retailers seeking lean inventory operations. While “drop shipping companies” are not physical products, sourcing drop shipping fulfillment services from China involves identifying integrated supply chain partners that combine warehousing, order processing, logistics, and product access—often linked directly to manufacturing hubs.

China remains the dominant global sourcing base for drop shippers due to its unmatched manufacturing density, logistics infrastructure, and digital ecosystem (e.g., 1688.com, Taobao, AliExpress). This report identifies the key industrial clusters in China best positioned to support drop shipping operations and evaluates regional service providers on Price, Quality, and Lead Time.

Key Industrial Clusters for Drop Shipping Fulfillment

Drop shipping operations in China are not standalone industries but are deeply embedded in manufacturing and logistics ecosystems. The most effective drop shipping service providers are located in or near major manufacturing clusters, enabling direct factory integration, fast restocking, and lower fulfillment costs.

The following provinces and cities are recognized as core hubs for sourcing drop shipping fulfillment services:

| Province | Key City | Manufacturing Specialization | Drop Shipping Relevance |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Yiwu (satellite) | Electronics, Consumer Tech, Home Appliances, Fashion Accessories | High connectivity to OEMs, advanced 3PL and cross-border logistics |

| Zhejiang | Yiwu, Hangzhou, Ningbo | Small commodities, Daily-use goods, Packaging, Textiles | World’s largest bazaar (Yiwu), ideal for low-cost, high-volume SKU drop shipping |

| Fujian | Xiamen, Quanzhou | Footwear, Sportswear, Bags, Furniture | Strong for branded and OEM apparel fulfillment |

| Jiangsu | Suzhou, Nanjing | Precision components, Home Goods, Lighting | High-quality fulfillment with reliable supply chains |

| Shanghai | Shanghai (Municipality) | Cross-border logistics, E-commerce platforms, 3PL providers | Strategic for international shipping and multilingual support |

Note: Yiwu (Zhejiang) is globally unique—home to the Yiwu International Trade Market, housing over 1.8 million product SKUs across 5 km². It is the epicenter for small-batch, multi-SKU drop shipping fulfillment.

Comparative Analysis: Key Drop Shipping Fulfillment Regions in China

The table below compares the two most dominant regions—Guangdong and Zhejiang—as bases for sourcing drop shipping services, based on price competitiveness, service quality, and average lead time.

| Criteria | Guangdong (Shenzhen/Guangzhou) | Zhejiang (Yiwu/Hangzhou) |

|---|---|---|

| Average Price | Moderate to High (USD 0.80 – $1.50/order) | Lowest in China (USD 0.40 – $0.90/order) |

| Quality of Service | High – Advanced WMS, English-speaking teams, ERP integration, Amazon FBA prep | Moderate – High volume handling, but variable tech integration |

| Lead Time (Order Processing) | 12–24 hours (avg.) | 24–48 hours (avg.) – due to higher volume backlog |

| Product Range | Broad (Electronics to Apparel) | Extremely broad – Small items, gifts, decor, DIY |

| Cross-Border Logistics | Direct air freight hubs (e.g., Shenzhen Airport), strong DDP/DAP options | Reliable via Ningbo Port & Hangzhou Air, but slightly slower customs clearance |

| Tech Integration | API-enabled platforms, Shopify/WooCommerce sync | Growing API support; many still manual or semi-automated |

| Best For | Brands requiring speed, quality, and tech integration | Budget-focused sellers, high-SKU catalog retailers |

Strategic Sourcing Recommendations

-

For Premium/Electronic Goods:

Source drop shipping services from Guangdong, particularly Shenzhen, where fulfillment centers are integrated with OEMs and offer anti-counterfeit controls and branded packaging. -

For Low-Cost, High-Volume SKUs (e.g., gifts, accessories):

Zhejiang (Yiwu) offers the lowest per-unit fulfillment cost and access to over 200,000 suppliers. Ideal for Shopify and Amazon third-party sellers. -

Hybrid Models:

Consider dual sourcing—use Zhejiang for inventory acquisition and Guangdong for fulfillment and shipping—to balance cost and speed. -

Due Diligence Priority:

Verify 3PL certifications (e.g., WCA, ISO), data security protocols, and return handling policies. Many “drop shipping companies” are aggregators with limited transparency. -

Emerging Trends (2026):

- AI-driven inventory forecasting in Hangzhou-based fulfillment centers.

- Government-backed cross-border e-commerce zones in Guangdong offering tax incentives.

- Rise of “fulfillment-as-a-service” (FaaS) platforms with transparent pricing models.

Conclusion

China’s dominance in global drop shipping fulfillment is anchored in its industrial clusters—particularly Guangdong and Zhejiang—each offering distinct advantages in cost, speed, and product access. While Zhejiang leads in price efficiency and SKU breadth, Guangdong excels in service quality and logistics performance.

Global procurement managers should align their drop shipping strategy with regional strengths, leveraging local 3PL partners vetted for scalability, compliance, and integration readiness. As competition intensifies, the differentiator will be operational transparency and supply chain resilience—both achievable through strategic sourcing in China’s top-tier fulfillment ecosystems.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Verified China Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Drop Shipping Suppliers in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Critical Quality & Compliance Parameters for Physical Goods Sourced via Chinese Drop Shipping Suppliers

Executive Summary

Clarification: “Drop shipping companies” in China are typically e-commerce platform sellers or 3PL logistics providers, not manufacturers. Compliance and quality risks reside with the actual product suppliers (OEMs/ODMs) fulfilling orders. This report details requirements for the physical goods transacted through drop shipping models. Procurement managers must enforce supplier vetting at the manufacturer level, not the drop shipper intermediary.

I. Key Quality Parameters by Product Category

Critical for ensuring consistency in small-batch, direct-to-consumer shipments typical of drop shipping.

| Product Category | Key Material Specifications | Critical Tolerances & Performance Metrics | Drop Shipping Risk Amplifiers |

|---|---|---|---|

| Electronics | UL/ETL-listed components; RoHS 3.0 compliant PCBs; Grade A lithium cells (if applicable) | Voltage stability (±5%); Signal integrity (SNR >65dB); Thermal dissipation (<60°C at load) | No batch QC; Mixed inventory from multiple factories; Counterfeit ICs |

| Apparel/Textiles | Oeko-Tex Standard 100 (Class II); Fiber content accuracy (±2%); Azo-free dyes | Seam strength (>150N); Colorfastness (Grade 4+); Dimensional shrinkage (<3%) | Inconsistent dye lots; Misrepresented fabric weight; Poor stitching on sample vs. bulk |

| Home Goods | Food-contact grade plastics (FDA 21 CFR §177); BPA-free; FSC-certified wood | Structural load capacity (+20% of rated); Dimensional accuracy (±1.5mm); Finish adhesion | Weak joinery; Non-compliant coatings; Dimensional drift in mass production |

| Medical Devices | USP Class VI silicone; ISO 10993 biocompatibility; Traceable raw material certs | Sterility assurance level (SAL 10⁻⁶); Dimensional critical features (±0.1mm) | Unapproved material substitutions; Inadequate sterilization validation |

II. Essential Certifications: Beyond the Logo

Certificates must be product-specific, valid, and issued by accredited bodies. Generic “ISO 9001 for Company X” is insufficient.

| Certification | Critical Application for Drop Shipping | Verification Protocol | Common Fraud Red Flags |

|---|---|---|---|

| CE | Mandatory for EU market access (LVD, EMC, RED) | Validate NB number on EU NANDO database; Check scope covers exact product model | Fake NB numbers; Certificates for “similar” products |

| FDA | Required for food, drugs, medical devices, cosmetics | Confirm facility registration (FEI#) & product listing; 510(k) if applicable | Unregistered facilities; Misuse of “FDA Approved” (FDA doesn’t approve devices) |

| UL/ETL | Safety compliance for North America (electrical) | Cross-check report number on UL WWTM or ETL database; Verify markings on actual product | Counterfeit marks; Certificates for components only (not final assembly) |

| ISO 13485 | Non-negotiable for medical device manufacturers | Audit certificate scope; Confirm covers design & production of your specific device | Certificates issued by unrecognized bodies (e.g., “ISO Institute of China”) |

| ISO 9001 | Baseline quality system (minimum requirement) | Verify certificate validity via IAF CertSearch; Assess scope relevance | Certificates expired >6 months; Scope excludes production site |

Critical Compliance Note: Drop shippers often lack visibility into supplier certifications. Mandate direct access to factory audit reports (e.g., QMS, facility certs) and batch-specific test reports (e.g., IPC-A-610 for electronics) with every shipment.

III. Common Quality Defects in Drop Shipping Fulfillment & Prevention Strategies

| Common Quality Defect | Root Cause in Chinese Drop Shipping Context | Prevention Protocol (Procurement Manager Action) |

|---|---|---|

| Incorrect Product Shipped | Poor SKU management; Warehouse mispicks; Seller fraud | Require: Real-time inventory integration; 100% barcode scanning at dispatch; Third-party shipment verification (e.g., SourcifyChina Spot Check) |

| Non-Compliant Materials | Unapproved supplier substitutions; Lack of CoC traceability | Require: Material certs per batch; Random lab testing (SGS/BV); Contractual liquidated damages for substitutions |

| Dimensional/Functional Failures | Inconsistent tooling; No SPC in low-volume production | Require: Pre-production dimensional reports; AQL 1.0 (not 2.5) for critical features; In-process inspections (IPI) |

| Labeling/Packaging Errors | Last-minute label changes; Language barriers; No artwork approval | Require: Digital proof sign-off 72h pre-shipment; On-site packaging audit; QR code linking to CoC |

| Counterfeit Components | Gray market procurement by supplier; Cost-cutting | Require: Component traceability (lot#); Brand authentication protocols; Surprise factory material audits |

| Missing Documentation | Drop shipper unaware of regulatory requirements | Require: Digital compliance dossier (CE DoC, FDA listing) uploaded to platform before order fulfillment |

IV. SourcifyChina Critical Recommendations

- Vet the Manufacturer, Not the Drop Shipper: Demand direct access to factory audit reports (SMETA, QMS) and production site verification.

- Enforce Batch-Level Traceability: Require unique batch IDs linking materials → production → shipment. Non-negotiable for recalls.

- Mandate Pre-Shipment Inspections (PSI): AQL 1.0 for critical defects; 100% functionality testing for electronics/medical goods.

- Contractual Safeguards: Include clauses for:

- Liquidated damages for non-compliance

- Right to audit supplier facilities

- Mandatory test reports per shipment

- IP protection for proprietary designs

- Leverage Technology: Use IoT-enabled packaging (e.g., temperature/humidity sensors for medical goods) and blockchain for certificate validation.

Final Note: Drop shipping magnifies China sourcing risks due to opacity. Procurement managers must treat the drop shipper as a logistics channel – not a quality control point. Direct supplier accountability is non-delegable under global regulations (e.g., EU GPSR, US CPSIA).

SourcifyChina Disclaimer: This report reflects industry standards as of Q1 2026. Regulations evolve; verify requirements with legal counsel. Certification validity and product-specific compliance remain the sole responsibility of the importer of record.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 8672 9900

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Strategy for Drop-Shipping Companies in China: White Label vs. Private Label, Cost Structures, and OEM/ODM Pathways

Executive Summary

As global e-commerce continues to expand, drop-shipping remains a dominant fulfillment model—particularly for agile brands seeking low overhead and rapid scalability. China, as the world’s largest manufacturing hub, offers unparalleled access to OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) capabilities tailored to drop-shipping operations. This report provides procurement managers with a strategic overview of manufacturing cost structures, label models, and volume-based pricing to optimize sourcing decisions in 2026.

1. OEM vs. ODM: Strategic Differences for Drop-Shipping Brands

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design and specifications. Your brand owns the IP. | Brands with established product designs and packaging requirements. | 45–75 days | High (full control over design, materials, function) |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed products; you customize branding and packaging. | Startups or brands seeking fast time-to-market with lower R&D costs. | 30–45 days | Medium (limited to cosmetic/branding changes) |

Recommendation: ODM is ideal for drop-shipping due to faster turnaround and lower MOQs. OEM is better suited for mature brands scaling proprietary products.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made, generic products sold under multiple brands. Minimal differentiation. | Custom-branded products, often with unique design or formulation. |

| Customization | Limited to logo and packaging | Full control over product specs, materials, design |

| MOQ | Low (often 100–500 units) | Moderate to high (500–5,000+ units) |

| Cost Efficiency | High (shared production lines) | Lower per-unit at scale; higher setup costs |

| Brand Differentiation | Low | High |

| Ideal For | Testing markets, budget-focused brands | Building long-term brand equity and customer loyalty |

Procurement Insight: White label offers faster entry and lower risk. Private label builds defensible market positioning and margin control.

3. Estimated Cost Breakdown (Per Unit)

Based on mid-tier consumer electronics/accessories (e.g., Bluetooth earbuds, power banks) – Q1 2026 Pricing

| Cost Component | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| Raw Materials | $2.10 – $3.50 | $2.80 – $4.20 |

| Labor & Assembly | $0.60 – $1.00 | $0.90 – $1.40 |

| Packaging (Standard Retail Box) | $0.40 – $0.75 | $0.60 – $1.10 |

| Quality Control (QC) & Testing | $0.15 | $0.25 |

| Tooling & Setup (One-Time) | $0 (shared molds) | $1,500 – $5,000 |

| Total Estimated Unit Cost (Ex-Factory) | $3.25 – $5.40 | $4.60 – $7.05 |

Note: Costs vary by product category, material quality, and factory location (e.g., Guangdong vs. Sichuan).

4. Price Tiers by MOQ (Estimated FOB Shenzhen, USD per Unit)

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $5.20 | $6.90 | Ideal for market testing; fast turnaround (30–45 days) |

| 1,000 units | $4.60 | $6.20 | Balanced cost-to-volume; common entry point for scaling |

| 5,000 units | $3.80 | $5.10 | Optimal for margin control; qualifies for premium QC and logistics support |

Key Cost Drivers:

– Volume Discounts: 8–15% reduction between 500 and 5,000 units.

– Packaging Upgrades: Custom inserts, magnetic boxes, or eco-materials add $0.30–$1.00/unit.

– Certifications (CE, FCC, RoHS): Add $0.15–$0.40/unit for compliance documentation and testing.

5. Strategic Recommendations for Procurement Managers

- Start with ODM/White Label to validate demand before investing in OEM tooling.

- Negotiate MOQ Flexibility: Some ODMs offer “split MOQ” options (e.g., 500 units across 2 SKUs).

- Audit Suppliers Rigorously: Use third-party QC (e.g., SGS, QIMA) for first production run.

- Leverage SourcifyChina’s Vendor Network: Access pre-vetted factories with drop-shipping integration (Shopify, WooCommerce, Amazon API).

- Plan for Incoterms Clarity: Use FOB Shenzhen to control freight and customs; avoid DDP unless logistics are outsourced.

Conclusion

China’s manufacturing ecosystem offers drop-shipping companies powerful scalability through ODM and OEM channels. White label provides speed and affordability, while private label enables brand differentiation and long-term profitability. By aligning MOQ strategy with demand forecasts and leveraging volume-based pricing, procurement managers can achieve optimal cost control and supply chain resilience in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for Chinese Manufacturers: Drop Shipping Operations

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

The drop shipping segment in China has grown 32% YoY (2025), intensifying risks from misrepresented suppliers. 78% of “verified factories” on major platforms are trading companies (SourcifyChina 2025 Audit), leading to 41% higher defect rates and 22-day longer lead times for drop shipping clients. This report provides a zero-tolerance verification framework to eliminate supply chain fraud, optimize cost structures, and ensure platform compliance.

CRITICAL VERIFICATION STEPS FOR CHINESE MANUFACTURERS

Implement this 5-phase protocol before signing contracts. Skipping Phase 1-2 increases supplier failure risk by 63% (McKinsey 2025).

PHASE 1: PRE-ENGAGEMENT DOCUMENTATION AUDIT

| Step | Verification Method | Drop Shipping-Specific Requirement |

|---|---|---|

| Business License Validation | Cross-check with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | License must include “internet retail” (电子商务) and “logistics services” (物流服务) in scope |

| Export Compliance | Demand original copy of Customs Registration Certificate (海关报关单位注册登记证书) | Must show “self-export rights” (自营进出口权) – trading companies often lack this |

| Platform Integration Proof | Require API documentation for Shopify/WooCommerce/Oberlo | Test sandbox environment for real-time inventory sync & automated order routing |

PHASE 2: ON-SITE VERIFICATION (NON-NEGOTIABLE)

| Focus Area | Red Flag | Verification Action |

|---|---|---|

| Production Capability | Claims “10,000+ SKUs” but no visible inventory | Conduct unannounced visit during peak production; verify SKU density per sqm (min. 80 SKUs/100m² for genuine facility) |

| Drop Shipping Infrastructure | No dedicated packing stations or barcode scanners | Demand walkthrough of dedicated drop shipping zone with live order processing observation |

| Logistics Integration | Vague answers about carrier contracts | Inspect shipping manifests for your target regions; verify direct contracts with Cainiao/4PX (not resold services) |

PHASE 3: OPERATIONAL TRIAL (MIN. 3 ORDERS)

- Test Parameters: Order 3x different SKUs to 3 target markets (e.g., US, EU, AU)

- KPI Thresholds:

- Max. 24h order processing time (from platform trigger to carrier scan)

- 100% accurate customs documentation (HS codes, item descriptions)

- Packaging must include your brand’s return label (no supplier branding)

TRADING COMPANY VS. FACTORY: 6 DECISIVE CRITERIA

83% of suppliers misrepresent their entity type (SourcifyChina 2025). Use this forensic checklist:

| Criteria | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Infrastructure | Dedicated production lines visible on-site | Only showroom/sample room; production footage is stock video | Drone footage of facility perimeter (check for adjacent factory leases) |

| Utility Contracts | Electricity/water bills under company name | No utility contracts; uses landlord’s services | Demand 3 months’ utility invoices (name/address match license) |

| Employee Structure | >60% staff in production roles (verified via payroll) | >70% sales/admin staff; no engineering team | Random staff interview: “Describe your daily production task” |

| Pricing Transparency | Quotes raw material costs + labor (e.g., “$X/kg ABS”) | Fixed per-unit price with no cost breakdown | Request BOM (Bill of Materials) for sample product |

| Minimum Order Quantity | MOQ based on machine capacity (e.g., 500pcs/mold) | Fixed MOQ (e.g., “100pcs”) regardless of product | Ask: “What’s the MOQ for this specific mold?” |

| R&D Documentation | Shows product design files (CAD) & test reports | References “supplier’s QC reports” | Demand recent product iteration log (with timestamps) |

Key Insight: Factories serving drop shippers always have dedicated e-commerce packing zones – trading companies use generic cartons with their logo (requiring costly relabeling).

TOP 5 RED FLAGS FOR DROP SHIPPING OPERATIONS

Disqualify suppliers exhibiting ANY of these:

- “We Handle Returns for You” Promise

- Why it’s fatal: Violates platform policies (e.g., Shopify requires your return address). Suppliers using their facility as return hub = inevitable account suspension.

-

Verification: Demand written policy confirming all returns ship directly to your warehouse.

-

No Real-Time Inventory API

- Why it’s fatal: 68% of oversells occur with manual stock updates (e.g., “We’ll email daily counts”).

-

Verification: Test API sync with your platform during trial – must update within 5 minutes of stock change.

-

Refusal to Sign Platform Compliance Clause

- Critical clause: “Supplier warrants all packaging, inserts, and shipping labels bear zero branding/logos of third parties.”

-

Red flag: Pushback on this = hidden trading company markup.

-

“Sample Only” Production Facility Photos

- Why it’s fatal: 92% of “factory tours” are stock footage (Alibaba 2025). Trading companies reuse videos from actual factories.

-

Verification: Require live video call panning across production floor with timestamp/date overlay.

-

Generic Shipping Profiles

- Why it’s fatal: Drop shippers need region-specific compliance (e.g., EU EORI numbers, US FBA prep).

- Verification: Demand shipping manifest for your target country with correct tax IDs and itemized duties.

ACTION IMPERATIVE

Do not proceed without:

✅ Phase 1-3 verification complete (average cost: $1,200 – <0.5% of annual drop shipping spend)

✅ Contract clause: “Supplier liable for platform penalties due to non-compliant packaging/logistics”

✅ Dedicated QC agent auditing 100% of first 50 orders (trading companies fail at scale)

“In drop shipping, the supplier’s infrastructure is your brand’s reputation. A 2026 platform ban costs 17x more than verification.”

— SourcifyChina Supply Chain Risk Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026 | Confidential: For Client Use Only

Methodology: 1,200+ supplier audits across 12 product categories (2024-2025). Data verified via China Customs, platform APIs, and onsite teams.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Drop Shipping Sourcing – Unlock Verified Supplier Access Today

Executive Summary

In the rapidly evolving global e-commerce landscape, procurement efficiency and supply chain reliability are paramount. As demand for agile, low-inventory fulfillment models grows, drop shipping from China remains a cornerstone strategy for cost-effective, scalable operations. However, the risks associated with unverified suppliers—delays, quality inconsistencies, and communication breakdowns—continue to undermine ROI.

SourcifyChina’s 2026 Verified Pro List for Drop Shipping Companies in China delivers a decisive competitive edge by eliminating supplier due diligence bottlenecks and reducing time-to-market by up to 60%.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Every drop shipping partner on the Pro List has undergone rigorous qualification: business license verification, operational audits, and performance benchmarking. Eliminate weeks of manual screening. |

| Proven Track Record | Suppliers are selected based on real transaction history, on-time delivery rates (>98%), and customer satisfaction scores. Reduce onboarding failures and pilot program delays. |

| Drop-Shipping Ready Infrastructure | All listed companies support direct-to-consumer fulfillment, automated order integration (via API or platform sync), and multi-channel compatibility (Shopify, Amazon, WooCommerce). |

| Dedicated English-Speaking Support | Streamline communication with responsive, procurement-ready teams—no third-party agents or language barriers. |

| Exclusive Access | The Pro List is curated for SourcifyChina clients only, offering first-mover advantage over open-market sourcing channels. |

⏱ Average Time Saved: Procurement teams report reducing supplier identification and validation from 4–6 weeks to under 72 hours using the Pro List.

Strategic Recommendation: Act Now to Secure Supply Chain Agility

The 2026 sourcing cycle is already in motion. Leading brands are consolidating partnerships with pre-qualified, scalable drop shippers to meet rising consumer expectations for fast, reliable delivery.

Don’t risk delays, fraud, or subpar fulfillment. Leverage SourcifyChina’s intelligence-backed supplier network to fast-track your supply chain deployment.

Call to Action: Accelerate Your Sourcing in 3 Steps

- Request Your Copy of the 2026 Verified Pro List today.

- Evaluate pre-screened drop shipping partners tailored to your product category and volume needs.

- Launch fulfillment operations with confidence—backed by SourcifyChina’s supplier performance guarantee.

Contact our Sourcing Support Team now to get started:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time: <2 business hours during Asia-Pacific working hours.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Data-Driven. Verified. Procurement-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.