The global constant velocity (CV) joint market is experiencing robust growth, driven by rising automotive production and the increasing demand for fuel-efficient, high-performance drivetrain components. According to Mordor Intelligence, the CV Joint Market was valued at USD 11.34 billion in 2024 and is projected to reach USD 15.27 billion by 2029, growing at a CAGR of approximately 6.1% during the forecast period. This expansion is fueled by the proliferation of front-wheel-drive vehicles and the growing adoption of CV axles in both passenger and commercial vehicles. As demand intensifies, manufacturers are investing heavily in precision engineering, durability enhancements, and lightweight materials to meet OEM specifications and aftermarket requirements. In this competitive landscape, a select group of industry leaders has emerged, setting benchmarks in innovation, global supply chain efficiency, and product reliability. Here, we present the top 10 drive shaft constant velocity joint manufacturers shaping the future of automotive propulsion systems.

Top 10 Drive Shaft Constant Velocity Joint Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Neapco

Domain Est. 1997

Website: neapco.com

Key Highlights: Neapco is the leading supplier of innovative driveline solutions to original equipment manufacturers … constant velocity joints and flexible rubber couplings….

#2 Vehicle Drive Shafts & CV Joints Manufacturer|Shing Shing Long

Domain Est. 2005

Website: ssl-cvjoint.com.tw

Key Highlights: Shing Shing Long(SSL) is a leading manufacturer of drive shafts for vehicles. We have rich know-how in manufacturing vehicle drive shafts, CV joints, …Missing: constant velocity…

#3 ODM CV Joint

Domain Est. 2010

Website: cvjoint.org

Key Highlights: ODM is a prominent brand specializing in CV joints and CV axles (drive shafts) … Official website: www.odmaxle.com / www.honglee.cn. CV Joint and CV Axle ……

#4 Automotive & Industrial Constant Velocity Joints (CVJs)

Domain Est. 2012

Website: ntnamericas.com

Key Highlights: NTN provides technical expertise, developing & supplying high-performance, lightweight & compact Constant Velocity Joints (CVJs)….

#5 Constant Velocity Joints (CVJ)

Domain Est. 2015

Website: ntnglobal.com

Key Highlights: Constant Velocity Joints (CVJ) are components used to transmit rotational motion so that both shafts rotate at a constant velocity….

#6 Constant Velocity Driveshafts

Domain Est. 1996

Website: driveshafts.com

Key Highlights: CV driveshafts are a unique type of driveshaft that allows for continual rotational velocity through variable angle without a significant increase in friction ……

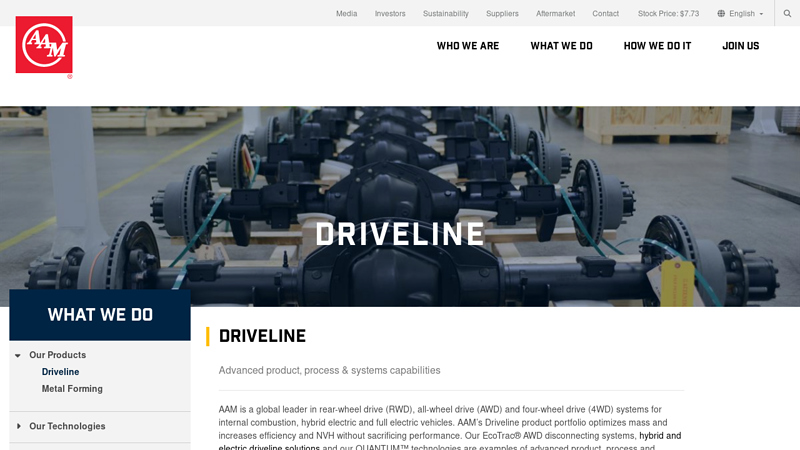

#7 Driveline

Domain Est. 1997

Website: aam.com

Key Highlights: AAM specializes in the design and manufacture of driveline products … Constant Velocity Joint Commerical Vehicle – Rear Axle Front Axle – Light ……

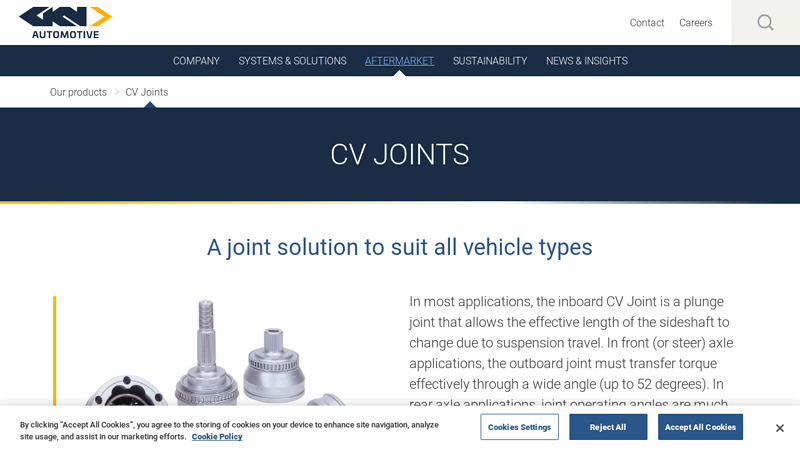

#8 CV Joints

Domain Est. 2001

Website: gknautomotive.com

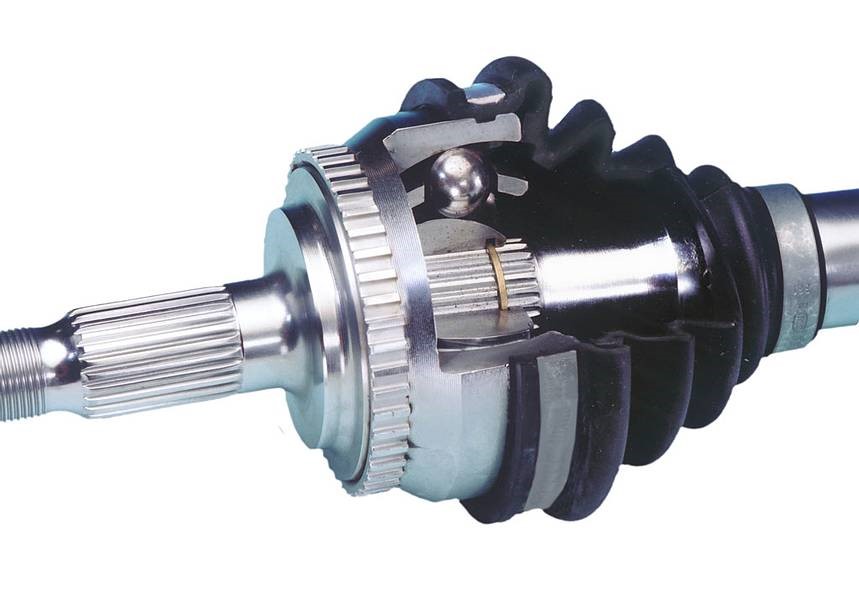

Key Highlights: In most applications, the inboard CV Joint is a plunge joint that allows the effective length of the sideshaft to change due to suspension travel….

#9 Automotive CV Joints & Kits

Domain Est. 2001

Website: patsdriveline.com

Key Highlights: Pat’s Driveline has the CV Joint components, repair parts and assemblies required to keep your Constant Velocity Driveshaft operating smoothly….

#10 Kalyani Mobility Drivelines

Domain Est. 2021

Website: kmdrivelines.com

Key Highlights: With over 22 different sizes of CV joints from 1000Nm to over 100,000 Nm, Con-Vel® is the oldest and most experienced CV joint company in the world….

Expert Sourcing Insights for Drive Shaft Constant Velocity Joint

H2: 2026 Market Trends for Drive Shaft Constant Velocity Joints

The global market for Drive Shaft Constant Velocity (CV) Joints is poised for significant evolution by 2026, driven by advancements in automotive technology, shifting vehicle production dynamics, and increasing demand for fuel efficiency and performance. Key trends shaping the CV joint market through 2026 include:

-

Rise of Electric Vehicles (EVs)

The accelerating adoption of electric vehicles is transforming drivetrain requirements. While traditional internal combustion engine (ICE) vehicles predominantly use CV joints in front-wheel drive systems, many EVs utilize in-wheel or integrated motor designs that may reduce reliance on conventional drive shafts. However, many battery electric and hybrid models still employ CV joints in dual-motor all-wheel-drive configurations, sustaining demand. OEMs are adapting CV joint designs for higher torque loads and extended durability in EV applications. -

Lightweight Material Integration

To improve fuel efficiency and extend EV range, automakers are increasingly adopting lightweight materials such as high-strength steel, aluminum, and composite alloys in drivetrain components. By 2026, CV joints made with advanced materials are expected to gain market share, offering reduced rotational mass and improved energy transfer efficiency. -

Expansion in Emerging Markets

Growth in automotive production and vehicle ownership in regions such as Southeast Asia, India, and Latin America will drive demand for cost-effective, durable CV joints. Localized manufacturing and partnerships with regional suppliers are anticipated to expand, especially for compact and mid-size vehicles that commonly use CV joint-based front-wheel drive systems. -

Increased Focus on Noise, Vibration, and Harshness (NVH) Reduction

As consumer expectations for ride comfort rise, especially in premium and electric vehicles, CV joint manufacturers are innovating to minimize NVH. Advanced boot sealing technologies, precision machining, and improved lubrication systems are being integrated into next-generation CV joints to enhance performance and longevity. -

Aftermarket Growth and Remanufacturing

With the global vehicle fleet aging and maintenance costs under scrutiny, the aftermarket for CV joints is projected to grow steadily. By 2026, remanufactured and high-performance aftermarket CV joints are expected to capture a larger share, supported by e-commerce platforms and expanded distribution networks. -

Automation and Smart Manufacturing

Leading CV joint producers are leveraging Industry 4.0 technologies—such as AI-driven quality control, predictive maintenance, and digital twin simulations—to enhance production efficiency and product consistency. These innovations support just-in-time delivery models and customization for OEMs. -

Consolidation and Strategic Partnerships

The competitive landscape is seeing increased consolidation among tier-1 suppliers. Companies like GKN, NTN, SKF, and Mevotech are forming joint ventures or acquiring niche players to strengthen their R&D capabilities and global footprint in driveline components, including CV joints.

In conclusion, the 2026 market for drive shaft CV joints will be shaped by technological adaptation to electrification, material innovation, and geographic diversification. While the core function of CV joints remains critical, their design, application, and manufacturing are undergoing transformation to meet the demands of next-generation mobility.

Common Pitfalls Sourcing Drive Shaft Constant Velocity Joints (Quality, IP)

Sourcing Drive Shaft Constant Velocity (CV) Joints involves critical considerations around quality and intellectual property (IP). Overlooking these areas can lead to performance issues, safety risks, and legal complications. Below are key pitfalls to avoid:

Poor Quality Control and Substandard Materials

One of the most prevalent risks when sourcing CV joints—especially from low-cost or unverified suppliers—is receiving components made from inferior materials or with inadequate manufacturing tolerances. Substandard steel, improper heat treatment, or imprecise machining can lead to premature wear, joint failure, vibration, and even catastrophic driveline breakdowns. Always verify supplier certifications (e.g., ISO/TS 16949), request material test reports, and conduct independent quality audits or sample testing before full-scale procurement.

Lack of IP Compliance and Risk of Counterfeiting

CV joint designs often incorporate patented engineering solutions, particularly in high-performance or OEM-specific applications. Sourcing from suppliers who do not respect intellectual property rights can expose your company to legal liability, including infringement claims from original equipment manufacturers (OEMs) or patent holders. Be cautious of suppliers offering “OEM-equivalent” joints at unusually low prices—these may be counterfeit or unauthorized reproductions. Always require documentation confirming IP clearance or licensed production rights.

Inadequate Testing and Validation Data

Reliable CV joints must undergo rigorous testing for torque capacity, angular misalignment, durability, and lifecycle performance. Suppliers that cannot provide comprehensive test reports or validation data (e.g., dyno testing, salt spray corrosion resistance) may be cutting corners. Without proper validation, the joint may fail under real-world conditions, leading to warranty claims and reputational damage.

Inconsistent Tolerances and Fitment Issues

Even minor deviations in dimensional tolerances can cause installation difficulties, increased NVH (noise, vibration, harshness), and reduced service life. Poorly manufactured CV joints may not fit properly with mating components (e.g., shafts, hubs, or boots), leading to field failures. Ensure suppliers adhere to OEM specifications and utilize precision measurement systems such as CMM (Coordinate Measuring Machines) for quality assurance.

Insufficient Supply Chain Transparency

Hidden risks often stem from opaque supply chains, where components are sourced through multiple tiers without traceability. This makes it difficult to verify material origin, production practices, or compliance with environmental and labor standards. Demand full supply chain visibility and require suppliers to disclose sub-tier sources, particularly for critical elements like cage geometry or ball tracks.

Overlooking Aftermarket vs. OEM Design Differences

Aftermarket CV joints may differ significantly in design and performance from OEM parts. While some are reverse-engineered to match specifications, others may incorporate cost-saving modifications that compromise longevity or reliability. Clearly define performance requirements and ensure compatibility with the intended application—don’t assume interchangeability without technical validation.

Failure to Secure Proper Documentation and Traceability

Quality and IP protection rely heavily on documentation. Missing or falsified certifications, lack of batch traceability, and absent serial numbering hinder quality investigations and recall management. Insist on full documentation packages, including certificates of conformance, material traceability, and production batch records.

Avoiding these pitfalls requires due diligence, technical expertise, and strong supplier vetting. Prioritize partners with proven track records, transparent operations, and a commitment to both quality and intellectual property integrity.

Logistics & Compliance Guide for Drive Shaft Constant Velocity Joint (CVJ)

This guide outlines key logistics and compliance considerations for the transportation, handling, import/export, and regulatory adherence of Drive Shaft Constant Velocity Joints (CVJs) across global supply chains.

Logistics Considerations

Packaging & Handling

– CVJs must be packaged in protective, non-abrasive materials (e.g., foam inserts, corrugated cardboard, or plastic wraps) to prevent damage to the joint surfaces, boot, and grease seals.

– Use moisture-resistant packaging in humid or marine environments to prevent corrosion; include desiccants if necessary.

– Clearly label packages with handling instructions such as “Fragile,” “Do Not Stack,” and “Keep Dry” as appropriate.

– Orient packaging to minimize stress on the CVJ’s internal components during transit.

Storage Conditions

– Store in a dry, temperature-controlled environment (typically 5°C to 40°C) to prevent grease separation and rubber boot degradation.

– Avoid exposure to direct sunlight, ozone sources (e.g., electric motors), and chemicals such as solvents or petroleum-based oils.

– Keep packages sealed until ready for use to maintain cleanliness and prevent contamination.

Transportation

– Use reliable carriers with experience in automotive component shipping to minimize shocks and vibrations.

– For international shipments, ensure compliance with IATA (air), IMDG (sea), or ADR (road) regulations if lubricants or packaging materials are classified as hazardous.

– Monitor shipment conditions (temperature, humidity, shock) using data loggers when required for quality assurance.

Inventory Management

– Apply FIFO (First In, First Out) stock rotation to ensure older stock is used first and prevent grease degradation over time.

– Track batch/lot numbers for traceability in case of field failures or recalls.

Compliance Requirements

Import/Export Regulations

– Classify CVJs correctly under the Harmonized System (HS Code), typically under 8708.93 (Parts and accessories of motor vehicles, drive shafts and joints).

– Obtain required documentation: Commercial Invoice, Packing List, Certificate of Origin, and Bill of Lading/Air Waybill.

– Comply with country-specific import duties, tariffs, and trade agreements (e.g., USMCA, RCEP, EU trade preferences).

– Verify if export licenses are needed, especially for dual-use or high-precision components under national security regulations.

Product Standards & Certifications

– Ensure CVJs meet regional automotive standards such as:

– ISO 9001 (Quality Management)

– IATF 16949 (Automotive Quality Systems)

– ISO 11149 (CVJ performance testing)

– Confirm compliance with OEM specifications (e.g., Volkswagen Group, Toyota TSH, Ford WSS).

– For the European Union, ensure conformity with the EU Automotive Regulation (EU) 2018/858 and relevant ECE regulations.

Environmental & Safety Compliance

– Adhere to REACH (EU) and RoHS directives restricting hazardous substances (e.g., lead, cadmium, certain phthalates).

– Comply with Proposition 65 (California) if selling in the U.S. market, particularly regarding lubricant composition.

– Ensure proper labeling of packaging containing substances of very high concern (SVHCs) if applicable.

Labeling & Documentation

– Include part numbers, batch/serial numbers, manufacturing date, and country of origin on both product and packaging.

– Provide multilingual labels or documentation as required by destination country.

– Maintain technical documentation (DoC – Declaration of Conformity) for CE-marked products.

Recall & Traceability

– Implement a traceability system capable of tracking CVJs from raw material to final assembly.

– Establish protocols for handling product recalls, including communication with distributors and regulatory bodies (e.g., NHTSA in the U.S., RAPEX in the EU).

By adhering to these logistics and compliance guidelines, manufacturers, distributors, and importers can ensure the reliable delivery and regulatory acceptance of Drive Shaft Constant Velocity Joints in global markets.

Conclusion for Sourcing Drive Shaft Constant Velocity (CV) Joints:

Sourcing high-quality constant velocity (CV) joints for drive shafts is a critical factor in ensuring the reliability, performance, and longevity of automotive and industrial drivetrain systems. After evaluating various suppliers, manufacturing standards, material quality, and cost-effectiveness, it is evident that selecting CV joints from reputable manufacturers who adhere to OEM specifications and international quality standards (such as ISO/TS 16949) significantly reduces the risk of premature failure and maintenance costs.

Key considerations such as joint type (e.g., Rzeppa, plunging, tripod), material durability, grease compatibility, boot integrity, and proper balancing must be prioritized during the sourcing process. Additionally, engaging suppliers who offer comprehensive product testing, technical support, and warranty coverage enhances supply chain resilience and operational efficiency.

In conclusion, a strategic sourcing approach that balances cost, quality, and reliability—supported by strong supplier partnerships and rigorous quality assurance—ensures optimal performance of drive shaft CV joints in demanding applications. This ultimately contributes to improved vehicle safety, reduced downtime, and long-term cost savings.