The global rivet market is experiencing steady growth, driven by increasing demand from aerospace, automotive, and construction industries. According to Grand View Research, the global fasteners market—of which drive rivets are a key segment—was valued at USD 98.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by the rising need for lightweight, durable fastening solutions in manufacturing and assembly processes. Mordor Intelligence further projects that the demand for specialized rivets, including drive rivets, will be amplified by advancements in electric vehicles and aircraft production. As industries prioritize efficiency and structural integrity, the role of high-quality drive rivet manufacturers becomes increasingly critical. In this evolving landscape, a select group of companies are leading innovation, scalability, and reliability—shaping the future of fastening technology.

Top 10 Drive Rivets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Rivet & Fastener Company

Domain Est. 1995

Website: rivet.com

Key Highlights: We have the most diverse range of blind rivets in the industry with over 1.4 billion pieces of the highest quality rivets on the shelf….

#2 Military, Mil-Spec & CRES Drive Rivets

Domain Est. 1998

Website: rapidrivet.com

Key Highlights: We carry drive rivets and commercial drive rivets that are available in a comprehensive range of sizes. Our inventory includes industrial and mil-spec drive ……

#3 Aluminum and Nylon Drive Rivets

Domain Est. 2007

Website: crestindustries.com

Key Highlights: Free deliveryAluminum and Nylon Drive Rivets · 1/4X1 NYLON DRIVE RIVET MUSHROOM HEAD · 1/4X1-1/2 NYLON DRIVE RIVET MUSHROOM HEA · 1/4X1/4 BRAZIER HD ALUM DRIVE RIVET · 1/4X11/32 …..

#4 10/38

Domain Est. 1996

Website: southco.com

Key Highlights: 30-day returns10/38 – Drive Rivets. Create high-strength permanent bonding of diverse materials such as metal, wood and masonry, in through-hole and blind-hole applications ……

#5 PEM – PennEngineering

Domain Est. 1996

Website: pemnet.com

Key Highlights: PEM offers innovative fastening solutions for a variety of applications across industries like Automotive Electronics, Consumer Electronics, Datacom and more….

#6 Drive Rivet

Domain Est. 1997

Website: bralo.com

Key Highlights: The Bralo Drive rivet is a highly effective method of joining sheets and profiles to soft, fibrous surfaces such as walls or roofs….

#7 Drive Rivets

Domain Est. 1999

Website: associatedfasteners.com

Key Highlights: Effortless fastening with our Drive Rivets. Designed for simplicity and reliability, these rivets ensure secure connections in a variety of applications….

#8 Aluminum Drive Rivets

Domain Est. 1999

Website: bylerrivet.com

Key Highlights: Aluminum Drive Rivets in Brazier, Countersunk, Large Flange Low Profile & Universal Head Styles. Call (972) 986-6792 for Quote! ()…

#9 Drive rivets, rivet nuts and blind rivets

Domain Est. 2000

Website: rivetdirect.com

Key Highlights: We offer a broad line of high quality engineered blind fasteners including open and closed-end rivets in aluminum, aluminum- steel, steel and stainless steel….

#10 Drive Rivets

Domain Est. 2009

Website: rivetsonline.com

Key Highlights: Jay-Cee Sales & Rivet offers affordable, high quality Southco drive rivets in aluminum and steel, with a variety of sizes and configurations available….

Expert Sourcing Insights for Drive Rivets

H2: 2026 Market Trends for Drive Rivets

The drive rivet market in 2026 is poised for steady growth, driven by sustained demand in key industrial sectors and evolving manufacturing requirements. While facing material and cost pressures, innovation and regional shifts are shaping a dynamic landscape.

Key Growth Drivers

- Automotive Resilience: Despite the rise of adhesives and advanced welding, drive rivets remain essential in automotive assembly, particularly for joining dissimilar materials (e.g., aluminum to steel) in body-in-white and chassis applications. The ongoing shift toward electric vehicles (EVs), with their lightweight construction needs, continues to support rivet demand.

- Aerospace & Defense Expansion: The aerospace industry relies heavily on high-strength drive rivets for airframe assembly. As commercial aircraft production ramps up post-pandemic and defense spending increases globally, demand for precision, high-performance rivets is rising.

- Industrial Equipment & Construction: Robust manufacturing and infrastructure investments—especially in North America and parts of Asia—fuel demand for rivets in machinery, trailers, and structural applications where durability and vibration resistance are critical.

Emerging Trends & Innovations

- Material Advancements: Increased use of corrosion-resistant alloys (e.g., stainless steel, aluminum, and specialty coatings) to meet longevity requirements in harsh environments.

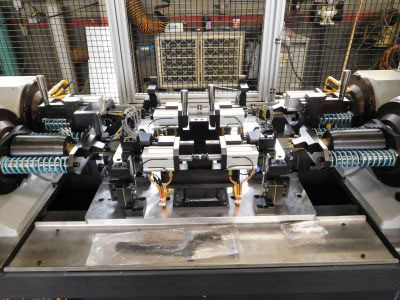

- Automation Integration: Growing adoption of automated riveting systems in high-volume manufacturing, boosting efficiency and consistency. This trend favors standardized, high-precision drive rivets compatible with robotic tooling.

- Sustainability Focus: Manufacturers are exploring recyclable materials and energy-efficient production processes to align with broader ESG goals, influencing product development and procurement decisions.

Challenges & Constraints

- Raw Material Volatility: Fluctuations in steel and aluminum prices can impact production costs and pricing stability.

- Competition from Alternatives: Adhesives, self-piercing rivets (SPR), and laser welding offer strong competition, especially in high-tech applications, pressuring drive rivet suppliers to emphasize cost-effectiveness and ease of use.

- Labor & Skills Shortage: While automation helps, skilled labor remains important for maintenance and customization, particularly in smaller fabrication shops.

Regional Outlook

- North America: Strong demand from automotive and aerospace sectors, supported by reshoring trends and government infrastructure spending.

- Asia-Pacific: China and India remain major production hubs and consumption centers, driven by industrialization and urban development.

- Europe: Moderate growth, with a focus on high-quality, sustainable fasteners in automotive and renewable energy sectors.

Conclusion

By 2026, the drive rivet market will maintain its relevance through adaptability and integration into modern manufacturing ecosystems. Success will depend on innovation in materials, alignment with automation trends, and strategic positioning in high-growth industries. While not experiencing explosive growth, drive rivets will remain a foundational fastening solution across critical sectors.

Common Pitfalls Sourcing Drive Rivets (Quality, IP)

Sourcing drive rivets may seem straightforward, but overlooking key quality and intellectual property (IP) considerations can lead to significant issues, including product failure, safety hazards, and legal exposure. Here are common pitfalls to avoid:

Inadequate Quality Verification

Relying solely on supplier claims without independent quality validation is a major risk. Drive rivets used in structural or safety-critical applications (e.g., aerospace, automotive) must meet strict mechanical standards (such as shear and tensile strength). Without reviewing material certifications (e.g., mill test reports), conducting in-house testing, or auditing manufacturing processes, buyers may receive substandard rivets that compromise product integrity.

Sourcing from Non-Certified or Unverified Suppliers

Engaging suppliers without recognized quality management certifications (e.g., ISO 9001, AS9100 for aerospace) increases the likelihood of inconsistent production quality. Unverified suppliers may lack traceability, proper documentation, or process controls, leading to batch variability and potential defects in finished products.

Ignoring Material Specifications and Traceability

Drive rivets are often made from specific alloys (e.g., aluminum 5056, steel, stainless steel) engineered for corrosion resistance or strength. Sourcing rivets without verifying material composition or traceability can result in premature failure. Lack of lot traceability also complicates root cause analysis during field failures or recalls.

Overlooking Dimensional and Tolerance Compliance

Even minor deviations in rivet diameter, length, or head geometry can prevent proper installation or reduce joint strength. Suppliers may offer “compatible” dimensions that fall outside OEM or engineering specifications. Failing to inspect samples against technical drawings risks assembly issues or non-compliance with design requirements.

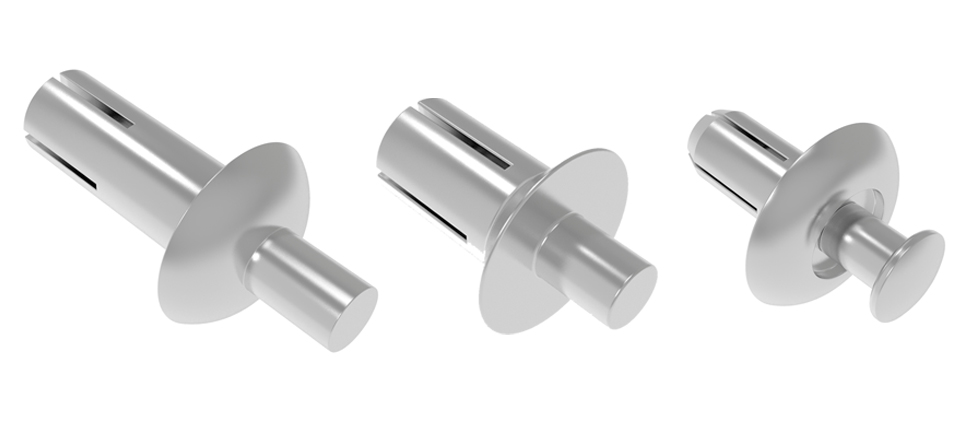

Assuming Generic Rivets Are Interchangeable

Not all drive rivets are functionally equivalent. Differences in drive pin design, break groove depth, or mandrel material affect setting behavior and performance. Substituting a generic rivet for a patented or branded design (e.g., POP®, Cherry, Huck) without testing can lead to installation problems or weakened joints.

Intellectual Property (IP) Infringement Risks

Using or sourcing drive rivets that mimic patented designs without authorization exposes companies to legal action. Many high-performance rivet designs are protected by utility or design patents. Sourcing “look-alike” products from third parties may constitute IP infringement, leading to cease-and-desist orders, financial penalties, or supply chain disruption.

Lack of Regulatory or Industry Standard Compliance

Depending on the sector, drive rivets may need to comply with industry-specific standards (e.g., MIL-SPEC, NAS, DIN, or FAA approvals). Sourcing without confirming compliance can render end products non-certifiable or unfit for intended use, especially in regulated industries.

Failure to Secure Proper Documentation and IP Licenses

Even when a rivet design is out of patent, trademarks and technical specifications may still be protected. Using OEM part numbers or logos without permission could violate trademark law. Additionally, some high-performance fastening systems require licensed tools or installation procedures—using unlicensed alternatives may void warranties or approvals.

Supply Chain Transparency Gaps

Complex supply chains can obscure the true origin and manufacturing practices of rivets. Without transparency, buyers risk unknowingly supporting unethical labor practices or receiving counterfeit components. This also complicates compliance with import regulations and corporate social responsibility (CSR) initiatives.

By proactively addressing these pitfalls—through rigorous supplier vetting, quality assurance protocols, and IP due diligence—companies can ensure reliable performance and legal compliance when sourcing drive rivets.

Logistics & Compliance Guide for Drive Rivets

Overview

Drive rivets, also known as blind or pop rivets, are widely used fasteners in manufacturing, construction, and automotive industries. Proper logistics handling and adherence to compliance standards ensure product integrity, safety, and regulatory conformity throughout the supply chain.

Packaging and Storage

- Standard Packaging: Drive rivets are typically supplied in bulk containers, plastic bags, or reels depending on size and application. Ensure packaging is sealed to prevent contamination or moisture exposure.

- Labeling: All packages must include product specifications (material, diameter, grip range), lot number, manufacturer details, and relevant hazard symbols if applicable.

- Storage Conditions: Store in a dry, temperature-controlled environment (15–25°C) away from direct sunlight and corrosive chemicals. Avoid floor contact; use pallets or shelving.

Transportation Requirements

- Domestic Shipping: Use secure, non-compressible packaging to prevent deformation. Label cartons as “Fragile” and “Do Not Stack” if necessary.

- International Shipping: Comply with IMDG (for sea), IATA (for air), or ADR (for road) regulations if rivets contain restricted materials (e.g., certain alloys). Provide MSDS (Material Safety Data Sheet) upon request.

- Hazard Classification: Standard steel or aluminum drive rivets are generally non-hazardous. However, coatings (e.g., zinc, cadmium) may require special handling—verify SDS documentation.

Regulatory Compliance

- REACH & RoHS (EU): Ensure rivets are free from restricted substances (e.g., lead, cadmium >0.1%). Suppliers must provide compliance certificates.

- Proposition 65 (California, USA): Alert customers if rivets contain chemicals listed under Prop 65 (e.g., chromium VI).

- ITAR/EAR (USA): Most drive rivets are EAR99, but verify export control classification if used in defense or aerospace applications.

Import/Export Documentation

- Commercial Invoice: Include product description, HTS code (e.g., 7318.15 for steel rivets), value, and country of origin.

- Certificate of Origin: Required for preferential tariff treatment under trade agreements.

- Customs Declarations: Accurately declare quantities and materials to avoid delays. Coordinate with freight forwarders for destination-specific requirements.

Quality Assurance & Traceability

- Lot Traceability: Maintain records linking each batch to production date, material certification, and test results.

- Incoming Inspection: Verify dimensions, material grade, and plating thickness per ISO 15977 or customer specifications.

- Non-Conformance Handling: Segregate and report defective shipments immediately. Initiate corrective actions with suppliers.

Environmental & Safety Considerations

- Waste Disposal: Metal rivet waste is typically recyclable. Follow local regulations for disposal of coated or contaminated materials.

- Worker Safety: Provide PPE (gloves, eye protection) during handling. Avoid inhalation of metal dust during installation.

- Sustainability: Source from suppliers with ISO 14001 certification and prioritize recyclable materials.

Best Practices Summary

- Audit suppliers regularly for compliance with environmental and quality standards.

- Train logistics staff on proper handling and documentation procedures.

- Use serialized labeling for high-criticality applications (e.g., aerospace).

- Maintain up-to-date SDS and compliance certificates for all rivet types.

Following this guide ensures safe, efficient distribution of drive rivets while meeting global regulatory expectations.

Conclusion for Sourcing Drive Rivets:

In conclusion, sourcing drive rivets requires a careful evaluation of material quality, dimensional specifications, supplier reliability, and cost-effectiveness. Selecting the right type of drive rivet—considering factors such as material (steel, aluminum, stainless steel), diameter, length, and head style—is crucial to ensuring structural integrity and performance in the intended application. Establishing partnerships with reputable suppliers who adhere to industry standards and can provide consistent quality and timely delivery is key to maintaining production efficiency. Additionally, conducting regular quality checks and considering total cost of ownership—beyond just unit price—will support long-term success. By implementing a strategic sourcing approach, organizations can ensure the reliability, durability, and cost-efficiency of drive rivets in their manufacturing or assembly processes.