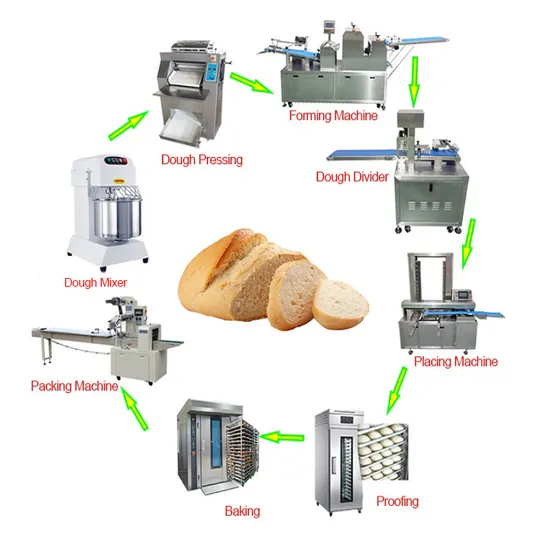

The global bakery equipment market is experiencing robust growth, driven by rising consumer demand for artisanal and fresh-baked goods, coupled with increasing automation in commercial kitchens. According to Grand View Research, the global bakery equipment market size was valued at USD 7.6 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. This surge is further amplified by the proliferation of specialty bakeries and café chains, particularly across North America and Europe, where operational efficiency and hygiene are paramount. At the heart of this transformation lies essential equipment like dough tables—critical for consistent dough handling, temperature control, and workflow optimization in high-volume production environments. As demand for advanced, customizable, and stainless steel-based dough solutions rises, manufacturers are innovating rapidly to meet evolving industry standards. In this competitive landscape, identifying the leading dough table manufacturers—those combining engineering excellence, scalability, and compliance with food safety regulations—has become crucial for bakeries aiming to scale production without compromising quality.

Top 8 Dough Table Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bakery machines and industrial dough processing lines

Domain Est. 2008

Website: rondo-online.com

Key Highlights: Smart Bread Line is a modular sheeting line using low-stress technology to produce cut, stamped, moulded and rounded bread….

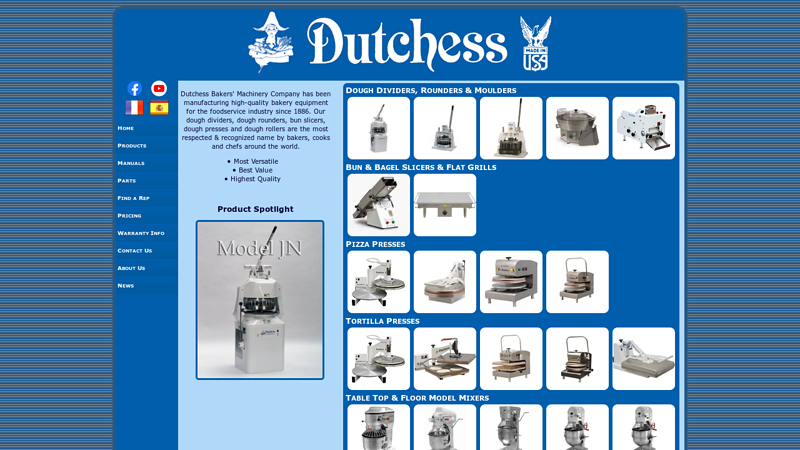

#2 Dutchess Bakers’ Machinery Co. Inc.

Domain Est. 2004

Website: dutchessbakers.com

Key Highlights: Dutchess Bakers Machinery Co. Inc. offers a wide line of industry-proven bakery machinery including dough dividers, dough divider rounders and bun and bagel ……

#3

Domain Est. 1995

Website: richs.com

Key Highlights: Rich’s is a family-owned food company that offers innovative products and expert solutions to global food professionals….

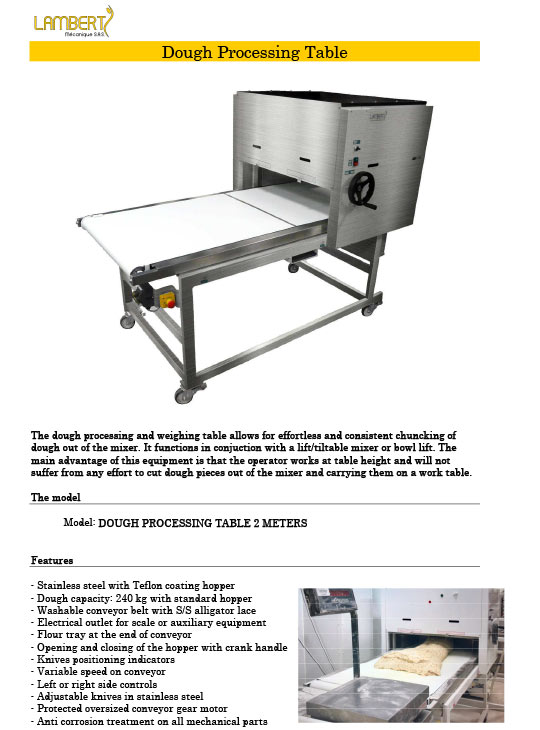

#4 Guyon West

Domain Est. 2001

Website: guyonwest.com

Key Highlights: Official Importer/Distributor · Deep freezers · Dividers · Dough Processing Table · Make-up Tables · Mixers · MOULDERS · OVENS….

#5 Dough Kneading Table

Domain Est. 2001

Website: mbico.com

Key Highlights: The work table facilitates all stages of working with dough, including dividing, shaping, and molding, in a completely hygienic and easy manner….

#6 Reversible Dough Sheeters ( Table Models)

Domain Est. 2003

Website: manufacturers.com.tw

Key Highlights: Description : Tagle top reversible dough sheeter, certificate of origin: TW/TYC 1964. Specification : 1. Conveyor spec: 500mm x 2,000mm….

#7 Rise Baking Company

Domain Est. 2016

Website: risebakingcompany.com

Key Highlights: Products · Breads · Brownies · Cakes · Cookies · Crispy Bars · Fillings · Glazes · Icings · Laminates · Muffins · Pies · Toppings · Whipped Toppings….

#8 Baked Goods

Website: vemag.de

Key Highlights: Whether it is dough portioning, processing or automation in production, VEMAG has the right solutions – customized to your individual needs….

Expert Sourcing Insights for Dough Table

2026 Market Trends for Dough Table

Rising Demand for Artisanal and Authentic Experiences

By 2026, consumers are increasingly prioritizing authenticity, craftsmanship, and experiential dining. Dough Table, with its likely focus on handmade, high-quality dough-based offerings such as flatbreads, pizzas, or pastries, is well-positioned to capitalize on this trend. Customers are seeking transparency in ingredients and production methods, favoring brands that emphasize traditional techniques and locally sourced components. Dough Table can leverage this by highlighting its artisanal process, perhaps offering open kitchens or chef-led workshops to deepen consumer trust and engagement.

Growth in Health-Conscious and Customizable Menu Options

The 2026 market will continue to favor customizable and health-oriented dining. Consumers are more attentive to dietary needs, including gluten-free, plant-based, and low-carb alternatives. Dough Table can expand its appeal by introducing innovative dough formulations—such as cauliflower, chickpea, or fermented sourdough bases—that cater to diverse nutritional preferences without sacrificing flavor. Allowing customers to build their own creations supports personalization, a key driver in fast-casual and full-service segments alike.

Expansion of Hybrid Dining Models

The integration of digital ordering, delivery, and in-store experiences will be crucial in 2026. Dough Table should optimize its presence across multiple channels, including mobile apps, third-party delivery platforms, and quick-service kiosks. Ghost kitchens or cloud kitchen partnerships could also offer cost-effective scalability, especially in urban markets. However, maintaining product quality during delivery—particularly for fresh dough items—will require investment in packaging innovation and operational efficiency.

Sustainability and Ethical Sourcing as Differentiators

Environmental responsibility will play a larger role in brand perception by 2026. Dough Table can strengthen its market position by adopting sustainable practices, such as using compostable packaging, reducing food waste through smart inventory systems, and sourcing ingredients from ethical suppliers. Communicating these efforts transparently can enhance customer loyalty, particularly among younger demographics like Millennials and Gen Z who prioritize eco-conscious brands.

Regional Expansion and Menu Localization

As Dough Table grows, localized menu offerings will become essential for market penetration. In 2026, successful food concepts adapt their core products to regional tastes—such as offering spicier toppings in Southern markets or incorporating global flavors like miso or harissa. This strategy allows Dough Table to maintain brand consistency while resonating with local palates, increasing relevance and competitiveness in diverse markets.

Technology-Driven Customer Engagement

By 2026, AI-powered personalization and loyalty programs will be standard in the food industry. Dough Table can utilize data analytics to offer tailored recommendations, dynamic pricing, and targeted promotions based on customer behavior. Integrating with digital wallets and offering seamless loyalty rewards will enhance retention and frequency of visits, turning occasional diners into brand advocates.

Conclusion

To thrive in the 2026 marketplace, Dough Table must balance tradition with innovation—honoring its craft while embracing digital transformation, sustainability, and customer-centric flexibility. By aligning with these key trends, Dough Table can strengthen its brand identity, broaden its audience, and secure long-term growth in an increasingly competitive foodservice landscape.

Common Pitfalls Sourcing Dough Tables (Quality, IP)

When sourcing dough tables—specialized equipment used in food production, particularly bakeries—organizations often encounter significant challenges related to both quality and intellectual property (IP). Overlooking these pitfalls can lead to operational inefficiencies, legal exposure, and compromised product consistency.

Poor Material Quality and Construction

One of the most frequent quality issues is the use of substandard materials in dough table manufacturing. Low-grade stainless steel or improper sealing can lead to corrosion, bacterial growth, and contamination risks. Buyers may be tempted by lower prices, but these units often fail to meet food safety standards (e.g., NSF or EHEDG compliance), resulting in costly downtime or regulatory violations.

Inadequate Temperature Control

Dough tables rely on precise temperature management to maintain dough consistency. Sourcing units with poor refrigeration systems or uneven cooling surfaces compromises dough quality and leads to inconsistent product output. Some suppliers may exaggerate cooling capacity or insulation performance, leading to performance gaps once installed.

Lack of Customization and Scalability

Off-the-shelf dough tables may not align with a bakery’s specific workflow or space constraints. Failing to verify customization options—such as size, cooling zone configuration, or integration with other equipment—can result in inefficient operations. Additionally, choosing a supplier unable to support future scaling may necessitate costly replacements down the line.

Insufficient After-Sales Support and Documentation

Many suppliers, especially overseas manufacturers, provide limited technical support, spare parts, or maintenance guidance. This lack of post-purchase service can lead to extended downtimes and higher lifecycle costs. Incomplete or poorly translated manuals further complicate operation and compliance efforts.

Intellectual Property (IP) Infringement Risks

Sourcing from manufacturers that replicate patented designs or use proprietary technology without licensing exposes buyers to legal liability. For example, certain cooling mechanisms, control systems, or structural innovations may be protected under IP law. Purchasing such equipment—even unknowingly—can result in cease-and-desist orders, recalls, or litigation.

Use of Counterfeit or Unlicensed Components

Some dough tables incorporate branded components (e.g., compressors, sensors, touchscreens) that are counterfeit or used without authorization. This not only affects reliability but also breaches IP agreements. Buyers may face indirect liability if these components are identified during audits or inspections.

Inadequate Verification of Supplier Credentials

Failing to perform due diligence on suppliers increases the risk of engaging with entities that lack proper certifications, IP ownership, or manufacturing integrity. This includes not reviewing patents, trademarks, or design registrations related to the equipment.

To mitigate these risks, organizations should conduct thorough supplier audits, demand compliance documentation, verify IP rights, and, where possible, involve legal and technical experts during procurement.

Logistics & Compliance Guide for Dough Table

This guide outlines the essential logistics processes and compliance requirements for Dough Table, ensuring efficient operations, regulatory adherence, and quality assurance across all stages of the supply chain.

Supply Chain Overview

Dough Table sources high-quality ingredients from approved vendors, manages in-house production of dough and baked goods, and distributes finished products to retail locations, cafes, and wholesale partners. The supply chain includes raw material procurement, cold chain transportation, production, storage, and last-mile delivery. All logistics partners must comply with food safety and transportation standards.

Ingredient Sourcing & Vendor Compliance

All ingredient suppliers must be certified by recognized food safety bodies (e.g., FDA, USDA, or equivalent local authorities). Dough Table requires suppliers to provide documentation including Certificates of Analysis (CoA), allergen statements, and proof of Good Manufacturing Practices (GMP). Non-compliance may result in supplier disqualification. Regular audits are conducted to ensure ongoing adherence to quality and ethical sourcing standards.

Cold Chain Management

Perishable ingredients and finished products must be kept within a temperature-controlled environment (0°C to 4°C) throughout transportation and storage. Temperature logs must be maintained for all shipments, with real-time monitoring via IoT sensors. Any temperature deviation exceeding 30 minutes must be reported immediately and investigated for product safety.

Production & Handling Protocols

All production facilities must follow Hazard Analysis and Critical Control Points (HACCP) guidelines. Employees are required to complete food handler certifications and wear appropriate protective gear. Equipment is sanitized daily, and production areas are inspected regularly. Batch tracking is implemented to enable full traceability from raw materials to final product.

Packaging & Labeling Standards

Packaging must be food-grade, tamper-evident, and compliant with local regulations. All labels must include: product name, ingredient list, allergen warnings (highlighting common allergens like wheat, dairy, eggs), net weight, storage instructions, and use-by date. Language requirements vary by region—labels must be in the local language for each distribution market.

Transportation & Delivery

All delivery vehicles must be licensed for food transport and equipped with refrigeration units. Drivers must follow strict hygiene practices and complete food safety training. Delivery schedules are optimized to minimize transit time, and all deliveries require recipient sign-off confirming product condition and temperature upon arrival.

Regulatory Compliance

Dough Table complies with all relevant food safety regulations including FDA Food Safety Modernization Act (FSMA), EU Regulation (EC) No 852/2004, and local health department requirements. Annual third-party audits are conducted, and compliance records are maintained for a minimum of five years. Any regulatory changes are monitored and implemented promptly.

Allergen & Cross-Contamination Control

Dough Table maintains a dedicated allergen management plan. Facilities are zoned to separate allergen-containing and allergen-free production lines. Shared equipment is thoroughly cleaned between batches. All staff are trained in allergen awareness, and product labels clearly declare potential cross-contact risks.

Recall & Incident Response

A formal recall procedure is in place. In the event of a product safety issue, Dough Table will initiate a recall within 24 hours. The logistics team coordinates immediate retrieval of affected batches using batch tracking data. All incidents are documented and reported to relevant authorities as required.

Sustainability & Waste Management

Dough Table is committed to reducing environmental impact. Packaging materials are chosen for recyclability, and waste is segregated for composting, recycling, or responsible disposal. Unused ingredients and expired products are tracked and diverted from landfills whenever possible. Carbon emissions from transportation are monitored and minimized through route optimization.

Training & Continuous Improvement

All logistics and compliance personnel undergo annual training on food safety, handling procedures, and regulatory updates. Feedback from audits, customer complaints, and delivery reports is analyzed to identify areas for improvement. Dough Table continuously refines its logistics and compliance framework to uphold the highest standards of safety and efficiency.

Certainly! Here’s a professional and concise conclusion for a sourcing dough table (commonly used in bakery or food manufacturing contexts):

Conclusion:

The sourcing of a dough table is a critical investment that directly impacts workflow efficiency, hygiene standards, and overall production capacity in a bakery or food processing environment. When evaluating suppliers, key factors such as material quality (e.g., stainless steel for durability and sanitation), size and customization options, ergonomic design, and cost-effectiveness must be carefully considered. By selecting a reliable supplier that meets food safety regulations and aligns with operational needs, businesses can ensure long-term performance, improved handling of dough, and enhanced productivity. Proper due diligence in sourcing will ultimately contribute to consistent product quality and operational success.

Let me know if you’d like this tailored for a specific industry, budget, or region.