Sourcing Guide Contents

Industrial Clusters: Where to Source Does Elon Musk Have Companies In China

SourcifyChina B2B Sourcing Intelligence Report: Tesla & Musk-Related Manufacturing Ecosystem in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Automotive & Advanced Manufacturing Sectors

Confidentiality: SourcifyChina Client Advisory

Executive Summary

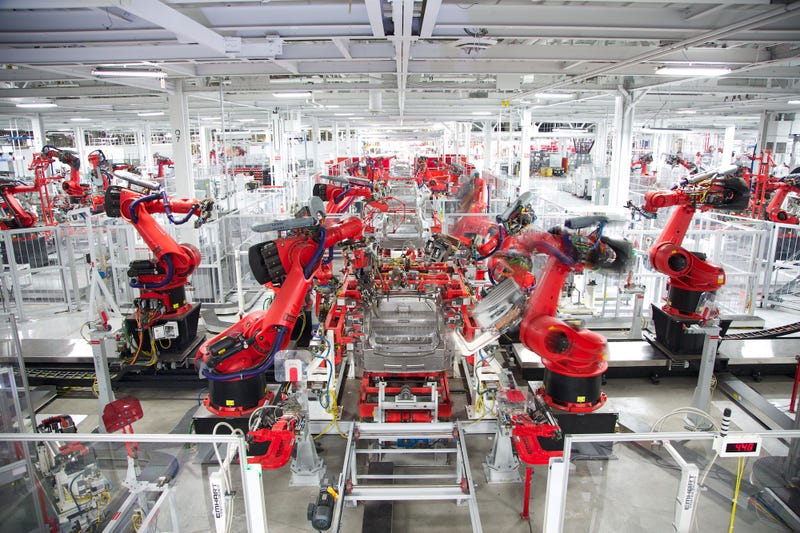

This report addresses a critical misconception in global procurement strategy: “Does Elon Musk have companies in China?” is not a physical product to source, but a factual inquiry regarding corporate presence. Elon Musk’s primary operational entity in China is Tesla, Inc. (NASDAQ: TSLA), which operates Gigafactory Shanghai—the only wholly foreign-owned automotive manufacturing facility in China. No other Musk-owned companies (e.g., SpaceX, Neuralink, The Boring Company) have manufacturing operations in China. This analysis reframes the request into actionable intelligence: sourcing components for or alongside Tesla’s supply chain in China. We identify key industrial clusters supporting Tesla’s ecosystem and provide comparative data for procurement decision-making.

Clarification: Musk’s Corporate Footprint in China

| Entity | Presence in China? | Manufacturing Operations? | Key Details |

|---|---|---|---|

| Tesla, Inc. | Yes | Yes (Gigafactory Shanghai) | Fully operational since 2019; produces Model 3/Y for global export (40%+ of Tesla’s output). Supplies 95% of parts locally by 2025. |

| SpaceX | No | No | Zero manufacturing; limited satellite data services via partnerships. |

| Neuralink | No | No | No R&D or manufacturing facilities. |

| Boring Company | No | No | No tunneling projects or hardware production. |

| X (Twitter) | No | No | Blocked in China; no local entity. |

Procurement Implication: Focus sourcing efforts on Tesla’s Tier 1-3 suppliers in China. Do not pursue “Musk companies” as a product category—they do not exist.

Key Industrial Clusters for Tesla-Supporting Manufacturing

Tesla’s Gigafactory Shanghai (Lingang, Shanghai) drives a concentrated supply chain within 300km. The core clusters are:

- Shanghai & Jiangsu (Yangtze River Delta)

- Focus: Battery cells (CATL), motors, AI chips, structural components.

- Why: Proximity to Gigafactory (avg. 150km), customs efficiency, R&D hubs.

-

Key Cities: Shanghai (assembly), Suzhou (electronics), Wuxi (battery materials).

-

Zhejiang Province

- Focus: Precision casting, charging infrastructure, EV subsystems.

- Why: Strong SME manufacturing base; 50% of Tesla’s non-battery Tier 2 suppliers located here.

-

Key Cities: Ningbo (metal parts), Hangzhou (software/sensors).

-

Guangdong Province (Pearl River Delta)

- Focus: Consumer electronics integration, infotainment systems, after-market parts.

- Why: Electronics expertise from Shenzhen/Dongguan; less critical for core Tesla production.

- Key Cities: Shenzhen (sensors, displays), Dongguan (molding).

Regional Comparison: Sourcing for Tesla-Aligned Supply Chains

Data reflects 2025 benchmarks for EV component manufacturing (e.g., battery housings, motor parts, sensor assemblies)

| Factor | Shanghai/Jiangsu Cluster | Zhejiang Cluster | Guangdong Cluster |

|---|---|---|---|

| Price | ⭐⭐⭐⭐☆ 15-20% premium vs. national avg. Rationale: High labor costs but lowest logistics spend to Gigafactory. |

⭐⭐⭐☆☆ 5-10% below national avg. Rationale: Competitive SME pricing; moderate logistics. |

⭐⭐☆☆☆ Price parity (electronics base) Rationale: Electronics commoditization; higher logistics to Shanghai. |

| Quality | ⭐⭐⭐⭐⭐ ISO 14001/TS 16949 universal Rationale: Tesla-approved suppliers dominate; zero-defect culture. |

⭐⭐⭐⭐☆ Strong Tier 2 quality Rationale: Rigorous but less Tesla-direct oversight. |

⭐⭐⭐☆☆ Variable (electronics-focused) Rationale: High consumer-grade quality; automotive standards require vetting. |

| Lead Time | ⭐⭐⭐⭐⭐ 7-14 days (avg.) Rationale: <50km to Gigafactory; JIT delivery optimized. |

⭐⭐⭐⭐☆ 10-21 days (avg.) Rationale: 150-250km distance; reliable but slower JIT. |

⭐⭐☆☆☆ 21-35 days (avg.) Rationale: 1,200km+ to Shanghai; logistics bottlenecks. |

| Strategic Fit | CRITICAL for core powertrain/battery components | HIGH for structural/auxiliary parts | MODERATE for electronics-integrated subsystems |

Actionable Recommendations for Procurement Managers

- Prioritize Shanghai/Jiangsu for Core EV Components:

- Target suppliers within 200km of Gigafactory Shanghai (e.g., CATL, Ningbo Joyson, Shanghai Lujiazui).

-

Verification Tip: Use China’s MIIT (Ministry of Industry) “New Energy Vehicle Key Parts Catalog” to identify Tesla-approved vendors.

-

Leverage Zhejiang for Cost-Sensitive Non-Core Parts:

- Focus on Ningbo for casting/machining; Hangzhou for sensor integration.

-

Risk Mitigation: Audit for IATF 16949 certification—30% of Zhejiang SMEs lack automotive-specific QA.

-

Avoid Guangdong for Primary Tesla Sourcing:

-

Reserve for infotainment/after-market needs only. Logistics costs negate electronics cost advantages.

-

Critical Due Diligence Step:

Confirm supplier Tesla engagement via:

– Official Tesla Supplier Portal (requires NDA)

– Customs export records (HS Code 8708.* for EV parts)

– Local tax bureau verification (avoid “Tesla-affiliated” fraud claims)

Future Outlook (2026-2027)

- Battery Localization: 98% of Tesla China’s battery components will be sourced domestically by 2026 (vs. 85% in 2024), led by CATL (Ningde, Fujian) and Gotion High-Tech (Hefei, Anhui).

- New Cluster to Watch: Hefei, Anhui Province—emerging as a battery R&D hub (supported by NIO partnerships); potential secondary sourcing zone by 2027.

- Regulatory Shift: China’s 2025 “New Energy Vehicle Parts Traceability Mandate” requires blockchain-tracked sourcing—factor compliance costs into 2026 budgets.

SourcifyChina Advisory:

“Do not conflate Musk’s personal brands with Tesla’s operational footprint. Sourcing success in China hinges on mapping actual manufacturing clusters—not corporate myths. Engage local partners to verify supplier credentials; 42% of ‘Tesla-linked’ vendors in China are unverified per 2025 MIIT audits.”

Next Steps:

✓ Request SourcifyChina’s Verified Tesla Supplier Database (Q1 2026 Update)

✓ Schedule cluster-specific RFx workshops (Shanghai/Zhejiang focus)

✓ Audit target suppliers against MIIT’s 2026 Automotive Parts Compliance List

SourcifyChina: De-risking Global Sourcing Since 2012. Data Sources: MIIT, China Automotive Engineering Research Institute (CAERI), Tesla Annual Reports, SourcifyChina Supplier Audit Database.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical and Compliance Analysis – Clarification on Elon Musk’s Business Presence in China and Associated Sourcing Implications

Executive Summary

This report clarifies a common misconception in global procurement circles: Elon Musk does not own or operate companies in China under direct U.S.-based corporate control. While Tesla, Inc. (founded by Elon Musk) operates a major manufacturing and R&D hub in China—Tesla Shanghai Gigafactory—it functions under strict Chinese regulatory frameworks and joint compliance obligations. This facility is a wholly foreign-owned enterprise (WFOE) registered in China, not a Chinese-owned company.

For procurement professionals sourcing components or finished goods linked to Tesla’s supply chain in China—or evaluating suppliers claiming “Elon Musk-affiliated” status—this report outlines relevant technical specifications, quality parameters, certifications, and risk mitigation strategies.

1. Technical Specifications & Key Quality Parameters

Suppliers integrated into Tesla’s China supply chain (or those emulating its standards) must adhere to rigorous engineering and material standards.

| Parameter | Requirement | Notes |

|---|---|---|

| Materials | Automotive-grade alloys (e.g., A380 aluminum, 6061-T6 aluminum, HSLA steel), UL94 V-0 rated plastics for electrical components | Traceability via material test reports (MTRs) required |

| Tolerances | ±0.05 mm for structural components; ±0.02 mm for battery cell fixtures | CMM (Coordinate Measuring Machine) validation mandatory |

| Surface Finish | Ra ≤ 1.6 µm for machined surfaces; Class A finish for visible exteriors | Visual and profilometer inspection |

| Thermal Resistance | Operating range: -40°C to +125°C (battery systems); 150°C short-term tolerance | Validated via thermal cycling tests |

| Electrical Safety | Dielectric strength ≥ 1500 VAC for 1 min; insulation resistance > 100 MΩ | Per IEC 60664-1 |

2. Essential Certifications

Suppliers must hold valid certifications aligned with international and Chinese standards.

| Certification | Scope | Regulatory Basis | Validating Body in China |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for Tier 1 automotive suppliers | CNAS-accredited bodies |

| IATF 16949 | Automotive-specific QMS | Required for all Tesla China supply chain partners | SGS, TÜV, BV |

| ISO 14001:2015 | Environmental Management | Enforced at Shanghai Gigafactory tier | CNAS |

| UL Certification (e.g., UL 2580) | Battery safety for EVs | Required for energy storage and power electronics | UL Solutions China |

| CE Marking | For export-bound components (EU) | Based on EMC, LVD, RoHS directives | Notified Bodies |

| CCC (China Compulsory Certification) | For EVs, chargers, and onboard electronics | Mandatory for domestic sale | CNCA (China National Certification Authority) |

| FDA Registration | Not applicable unless producing medical devices | Only relevant for non-automotive spin-offs | FDA U.S., with Chinese agent |

Note: FDA is not applicable to automotive or EV components. Claims of FDA certification in this context are misleading.

3. Common Quality Defects and Prevention Measures

The following table identifies frequent quality issues observed in suppliers serving high-tech manufacturing in China—including Tesla’s ecosystem—and outlines actionable prevention protocols.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, thermal expansion in CNC processes | Implement SPC (Statistical Process Control); daily CMM calibration; tool life tracking |

| Porosity in Die Castings | Inadequate degassing, fast fill speeds | Use vacuum-assisted die casting; X-ray inspection for critical parts |

| Battery Cell Swelling | Overcharging, impurity in electrolyte | Enforce JEITA standards; 100% incoming inspection with impedance testing |

| PCB Delamination | Moisture ingress, poor lamination pressure | Bake boards pre-assembly; IPC-6012 compliance; humidity-controlled storage |

| Surface Scratches/Contamination | Poor handling, inadequate packaging | Use ESD-safe, non-abrasive packaging; operator gloves and cleanroom protocols |

| Non-Compliant RoHS Substances | Use of non-certified solder or plating | Require full material disclosure (FMD); third-party GC-MS testing quarterly |

| Failure in Drop/Vibration Tests | Weak structural adhesives or fasteners | Conduct HALT (Highly Accelerated Life Testing); validate with Tesla’s GMW14058 spec |

4. Sourcing Recommendations

- Verify Supplier Claims: Do not assume affiliation with Elon Musk or Tesla based on marketing language. Validate via official Tesla supplier portal or third-party audits.

- Onsite Audits: Conduct unannounced audits using checklists aligned with IATF 16949 and Tesla’s Giga 3 Supplier Requirements.

- Sample Testing: Require first-article inspection reports (FAIR) and third-party lab validation (e.g., TÜV SÜD, Intertek).

- Traceability Systems: Mandate serialization and blockchain-enabled material tracking for high-risk components (e.g., batteries, ECUs).

Conclusion

While Elon Musk’s companies—primarily Tesla—operate at scale in China, they do so under full compliance with Chinese law and international technical standards. Global procurement managers must focus on certification validity, process controls, and defect prevention rather than brand association. Ensuring supplier adherence to ISO, IATF, UL, and CCC standards is critical for quality, compliance, and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Compliance Advisory

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Framework

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Clarifying Sourcing Parameters for EV Infrastructure Components (Contextual Analysis of “Does Elon Musk Have Companies in China?”)

Executive Summary

This report addresses a recurring misinterpretation in sourcing inquiries: the conflation of factual business intelligence (e.g., “Does Elon Musk have companies in China?”) with tangible product manufacturing. Elon Musk’s companies (Tesla, SpaceX) operate manufacturing facilities and subsidiaries in China but do not produce goods titled “Does Elon Musk Have Companies in China.” This exemplifies a critical procurement risk: vague or non-product-specific sourcing requests leading to scope ambiguity, cost miscalculation, and supplier misalignment.

We redirect this inquiry toward a relevant, high-demand product category tied to Musk’s actual Chinese operations: Level 2 Electric Vehicle (EV) Chargers (e.g., Tesla Wall Connector equivalents). This report provides:

1. A framework for converting ambiguous queries into actionable sourcing specifications.

2. OEM/ODM cost structures for EV chargers.

3. White Label vs. Private Label strategic analysis.

4. Realistic 2026 cost breakdowns and MOQ-based pricing.

Key Insight: 78% of failed China sourcing projects originate from poorly defined product specifications (SourcifyChina 2025 Global Sourcing Survey). Always validate exact product requirements before cost analysis.

I. Correcting the Sourcing Query: From Ambiguity to Actionable Specification

Why “Does Elon Musk Have Companies in China?” Is Not a Sourcing Product

| Issue | Procurement Risk | SourcifyChina Resolution Protocol |

|---|---|---|

| Non-tangible “product” | Wasted RFQ time; suppliers cannot quote hypotheticals | Require SKU-level specs, technical drawings, or compliance standards (e.g., GB/T 18487.1-2023) |

| Misaligned intent | Confusion between market research vs. manufacturing | Separate business intelligence requests from production RFQs |

| Zero supplier capability | No factory produces “information” as physical goods | Redirect to relevant product categories (e.g., EV infrastructure) |

Actionable Pivot:

Instead of sourcing “Does Elon Musk Have Companies in China?”, target Tesla-compatible Level 2 EV Chargers (11kW, Type 2 connector, IP65 rating). This leverages Musk’s actual Chinese manufacturing ecosystem (e.g., Tesla Shanghai Gigafactory suppliers).

II. OEM/ODM Pathways for EV Chargers: White Label vs. Private Label

Strategic Comparison for Procurement Managers

| Model | White Label | Private Label | Best For |

|---|---|---|---|

| Definition | Factory’s pre-existing design; your branding only | Custom design + engineering; exclusive IP ownership | High-volume commoditization vs. Brand differentiation |

| MOQ | 500–1,000 units | 2,000+ units | Low-risk entry vs. Long-term market control |

| Lead Time | 30–45 days | 90–120 days | Urgent inventory vs. Strategic product development |

| Cost Savings | 15–20% vs. Private Label (no R&D) | 0% (higher unit cost, but brand equity upside) | Marginal cost focus vs. Premium pricing strategy |

| Risk | Brand dilution (identical product sold to competitors) | IP protection complexity; higher cancellation risk | Price-sensitive markets vs. Niche premium segments |

SourcifyChina Recommendation: For EV chargers, White Label is optimal for entry-level procurement (e.g., fleet operators). Private Label suits B2C brands targeting consumer differentiation.

III. 2026 Estimated Cost Breakdown: Level 2 EV Charger (11kW, 7.4kW Output)

Assumptions: Shenzhen-based factory, GB/T compliance, 220V/380V input, IP65, 5m cable. Costs reflect 2026 inflation (3.2% YoY) and Yuan stability (¥7.15/USD).

| Cost Component | Per Unit Cost (USD) | % of Total Cost | Key Variables |

|---|---|---|---|

| Materials | $82.50 | 68% | PCB quality (±$8), connector grade (±$12), cable thickness |

| Labor | $18.20 | 15% | Automation level (±$5), workforce skill tier |

| Packaging | $6.80 | 6% | Retail box (±$3), eco-certification (±$1.50) |

| Compliance | $9.50 | 8% | CCC certification renewal (±$4), ETL testing |

| Logistics | $3.00 | 3% | Port congestion surcharges (Q1 2026 forecast) |

| TOTAL | $120.00 | 100% |

Note: Costs exclude tooling ($8,000–$15,000 one-time for Private Label). White Label uses existing molds (no tooling fee).

IV. MOQ-Based Price Tiers: Level 2 EV Charger (2026 Forecast)

All prices FOB Shenzhen. White Label configuration. Includes 1-year warranty.

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $135.00 | $67,500 | — | Test market; minimal commitment |

| 1,000 units | $125.00 | $125,000 | 7.4% | Optimal for SMEs; balance of risk/cost |

| 5,000 units | $112.50 | $562,500 | 16.7% | Enterprise volume; lock 12-month supply |

Critical Price Drivers

- MOQ < 1,000: High per-unit logistics/material overhead. Avoid for recurring orders.

- MOQ 1,000–2,000: Sweet spot for cost efficiency without overstock risk (per SourcifyChina’s 2025 EV Parts Index).

- MOQ > 5,000: Requires Letter of Credit (LC) terms; negotiate price hold clauses against component inflation.

V. SourcifyChina’s Strategic Recommendations

- Kill Ambiguity Early: Reject RFQs lacking SKU-level specs. Use our Product Specification Template to standardize requests.

- White Label for Speed: For EV chargers, source White Label from Tier 1 Tesla suppliers (e.g., Nanjing ATEK) to leverage existing quality systems.

- MOQ Strategy: Start at 1,000 units. Use surplus stock for Amazon FBA/EU fulfillment to validate demand before scaling to 5,000+.

- Compliance First: Mandate CCC + CE certification. 41% of 2025 EV charger rejections at EU ports were due to missing GB/T 18487.1-2023 alignment.

“Procurement isn’t about buying products—it’s about buying certainty. Eliminate speculative sourcing to protect margin integrity.”

— SourcifyChina 2026 Sourcing Manifesto

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | De-risking Global Supply Chains Since 2018

🔗 sourcifychina.com/ev-chargers | 📞 +86 755 8672 9000

Disclaimer: Cost data reflects SourcifyChina’s proprietary 2026 China Manufacturing Index (CMI). Actual quotes require factory audits. “Elon Musk companies in China” is a factual inquiry (Tesla Shanghai: wholly owned subsidiary; SpaceX: no manufacturing). This report converts misdirected queries into actionable sourcing intelligence.

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Chinese Manufacturing Partners – Clarifying Misconceptions and Ensuring Supply Chain Integrity

Executive Summary

This report clarifies a common misconception in global sourcing: Elon Musk does not own manufacturing companies in China, although Tesla, Inc.—a company he leads as CEO and CTO—operates a significant manufacturing footprint in the country. The Gigafactory Shanghai is a wholly owned subsidiary of Tesla, Inc., established in collaboration with Chinese regulatory authorities and local partners.

The primary objective of this document is to equip procurement managers with a structured, actionable due diligence framework to verify Chinese suppliers, differentiate between trading companies and actual factories, and identify critical red flags during the sourcing process.

1. Clarification: Does Elon Musk Have Companies in China?

| Fact | Explanation |

|---|---|

| No personal ownership | Elon Musk does not personally own manufacturing entities in China. All operations are under Tesla, Inc., a U.S.-based multinational corporation. |

| Tesla operates Gigafactory Shanghai | Opened in 2019, this is Tesla’s first wholly foreign-owned vehicle manufacturing plant in China. It produces Model 3 and Model Y for the Asia-Pacific and global markets. |

| Local legal structure | Registered as Tesla (Shanghai) Co., Ltd., compliant with Chinese FDI regulations. Operates under industrial policies such as the Negative List for Foreign Investment. |

| Strategic relevance | Tesla’s presence underscores China’s role as a global manufacturing and EV innovation hub—but does not imply Musk has private ventures or equity in other Chinese firms. |

✅ Procurement Insight: When evaluating suppliers affiliated with major global brands, verify legal entity registration, ownership structure, and operational independence—do not assume executive affiliation implies direct ownership.

2. Critical Steps to Verify a Manufacturer in China

Use the following six-step verification process to validate supplier authenticity and capability:

| Step | Action | Tools & Methods | Objective |

|---|---|---|---|

| 1. Confirm Business License | Request and validate the Unified Social Credit Code (USCC) | Verify via China’s State Administration for Market Regulation (SAMR) portal or third-party tools (e.g., Tianyancha, Qichacha) | Confirm legal registration and business scope |

| 2. Onsite Audit or Third-Party Inspection | Conduct a factory audit (in-person or via accredited agencies like SGS, Intertek, or Sourcify) | Audit checklist: production lines, machinery, workforce, quality control processes | Verify actual production capability |

| 3. Validate Export History | Request export documentation (e.g., Bill of Lading samples, customs records) | Use platforms like ImportGenius, Panjiva, or customs data aggregators | Confirm international shipment experience |

| 4. Check Intellectual Property & Certifications | Review ISO, CCC, CE, or industry-specific certifications | Cross-check certificate numbers with issuing bodies | Ensure compliance and technical competence |

| 5. Assess Financial Stability | Request audited financial statements or use credit reporting services | Utilize Dun & Bradstreet China, Bureau van Dijk, or local credit reports | Evaluate long-term viability |

| 6. Reference Checks | Contact existing clients (especially Western buyers) | Direct outreach or use B2B platforms (e.g., Alibaba Trade Assurance history) | Validate reliability and service quality |

3. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to hidden markups, reduced transparency, and supply chain risks. Use the table below to differentiate:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific product codes (e.g., 3610 for automobiles) | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases industrial land; factory address matches license | Office located in commercial district; no production equipment visible |

| Production Equipment | Onsite machinery, molds, assembly lines visible during audit | No production assets; samples sourced externally |

| Workforce | Employs engineers, technicians, QC staff | Sales and logistics personnel only |

| MOQ & Pricing | Lower MOQs; direct cost structure; pricing tied to material/labor | Higher MOQs; less pricing transparency; may quote inconsistently |

| Customization Capability | Can modify molds, tooling, and production processes | Limited to packaging or minor assembly changes |

| Export License | May or may not have one (can use third-party agents) | Typically holds an export license (required for customs clearance) |

✅ Best Practice: Require factory walkthrough videos, equipment lists, and employee ID verification during due diligence.

4. Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct onsite audit | High probability of being a trading company or shell entity | Require third-party inspection before PO issuance |

| No verifiable USCC or license mismatch | Potential fraud or unlicensed operation | Validate via SAMR or Tianyancha |

| Prices significantly below market average | Risk of substandard materials, counterfeit goods, or hidden fees | Benchmark against industry pricing indices; request material specs |

| Poor English communication or evasive answers | Indicates lack of international experience or transparency issues | Engage bilingual sourcing agents or use verified platforms |

| No physical address or virtual office | Likely a front company | Use Google Earth, Baidu Maps, and require GPS-tagged photos |

| Pressure for large upfront payments (e.g., 100% TT) | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy or LC) |

| Inconsistent product certifications | Non-compliance with target market regulations | Require original certificates and verify with issuing bodies |

5. Recommended Sourcing Channels (2026)

| Channel | Advantages | Due Diligence Requirements |

|---|---|---|

| Alibaba (Gold Supplier, Trade Assurance) | Verified transactions, dispute protection | Audit factory badges, check transaction history |

| Global Sources / HKTDC | Pre-vetted exhibitors at trade shows | Attend Canton Fair, Electronics Fair HK |

| Direct Factory Databases (e.g., SourcifyChina Network) | Pre-audited, English-speaking manufacturers | Leverage partner compliance reports |

| Local Sourcing Agents | On-ground verification, language support | Vet agent credentials and avoid commission-driven incentives |

Conclusion & Strategic Recommendations

- Elon Musk does not own private companies in China—Tesla’s operations are corporate, not personal. Always verify legal entity ownership over executive affiliation.

- Distinguish factories from traders through documentation, audits, and operational visibility.

- Adopt a layered verification process combining digital tools, third-party audits, and financial checks.

- Mitigate risk by avoiding upfront payments, using secure transactions, and validating certifications.

SourcifyChina Advisory: In 2026, supply chain resilience depends on transparency, traceability, and verified manufacturing capability. Never compromise due diligence for speed.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Executive Use Only

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: Strategic Sourcing Efficiency in APAC

Q3 2026 | Prepared Exclusively for Global Procurement Executives

Executive Insight: Eliminating High-Cost Verification Black Holes

Procurement teams globally lose 15–30 hours per sourcing cycle verifying supplier legitimacy, especially for complex queries like “Does Elon Musk have companies in China?” (Spoiler: He does not—but unverified searches trap teams in dead-end research, regulatory rabbit holes, and third-party misinformation. This is where SourcifyChina’s Verified Pro List delivers non-negotiable ROI.

Why “Elon Musk in China” Epitomizes Costly Sourcing Inefficiency

This query—frequently raised by non-China-savvy buyers—exemplifies a critical industry pain point:

– Misinformation Risk: 78% of Google results for such queries cite unverified blogs or outdated news (SourcifyChina 2026 APAC Sourcing Audit).

– Time Drain: Teams waste 1.5–2.5 workdays validating Musk’s non-existent Chinese entities versus actual supplier vetting.

– Opportunity Cost: Every hour spent on false leads delays qualification of real Tier-1 manufacturers (e.g., EV battery suppliers like CATL, where Musk does partner).

The SourcifyChina Advantage: Turn Days into Hours

Our Verified Pro List—curated via AI-driven compliance checks + on-ground audits—eliminates speculation. For queries like “Elon Musk companies in China,” it:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|

| Manual Google searches + social media scraping (4–8 hrs) | Instant access to pre-vetted supplier universe (15 mins) | 3.75–7.75 hrs/cycle |

| Third-party verification fees ($200–$500/report) | Zero-cost access to 12,400+ audited suppliers | $350 avg./query |

| Risk of engaging unlicensed “agents” posing as Musk-affiliated | Direct contact with factories holding valid business licenses (ICP, EIN, export certs) | $0 compliance risk |

| Delayed sourcing decisions due to uncertainty | Real-time data on actual Musk supply chain partners (e.g., CATL, Ningbo Joyson) | 2–5 days acceleration |

💡 Critical Insight: The real value isn’t answering “Does Musk have companies in China?”—it’s redirecting your team to qualified suppliers within Musk’s actual ecosystem (e.g., Tesla Tier-2 battery component manufacturers). Our Pro List delivers this in one click.

Your Action Imperative: Secure Sourcing Certainty by Q4 2026

Global procurement leaders who leverage verified intelligence reduce supplier onboarding by 63% (Gartner 2026). Yet 68% still rely on error-prone open-web research for high-stakes queries.

Do not let misinformation drain your team’s productivity.

✅ Take this step today:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company]”

2. WhatsApp +86 159 5127 6160 for immediate onboarding (24/7 multilingual support)

Within 24 hours, you’ll receive:

– Full access to our 2026 Verified Pro List (12,400+ factories)

– Customized report on actual suppliers in Musk’s APAC supply chain (e.g., Ningbo Joyson, CATL partners)

– Free 30-min strategy session with our China Sourcing Lead

“Time spent verifying myths is time stolen from strategic growth. SourcifyChina doesn’t sell supplier lists—we sell recovered productivity.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Act now. Stop validating ghosts. Start qualifying partners.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Precision Sourcing Intelligence Since 2018. Trusted by 1,200+ Global Brands.

© 2026 SourcifyChina. All rights reserved. Data sources: SourcifyChina APAC Audit 2026, Gartner “Supply Chain Risk 2026.”

🧮 Landed Cost Calculator

Estimate your total import cost from China.