Sourcing Guide Contents

Industrial Clusters: Where to Source Does China Own Any Us Food Companies

SourcifyChina B2B Sourcing Intelligence Report: Chinese Ownership of U.S. Food Assets & Strategic Sourcing Implications

Prepared for Global Procurement Leadership | Q1 2026 | Confidential

Executive Summary

This report addresses a critical misconception in global procurement strategy: “Does China own any U.S. food companies?” is not a sourcing category but a factual inquiry about foreign direct investment (FDI). Chinese entities do own significant U.S. food assets through strategic acquisitions, primarily for market access and resource security. Procurement managers must distinguish between:

– Ownership structures (e.g., WH Group’s control of Smithfield Foods)

– Actual sourcing opportunities (e.g., procuring food products manufactured in China)

This analysis clarifies ownership realities, identifies relevant Chinese food manufacturing clusters, and provides actionable sourcing intelligence for procuring Chinese-manufactured food products—the likely intent behind the query.

Part 1: Clarifying Chinese Ownership of U.S. Food Companies

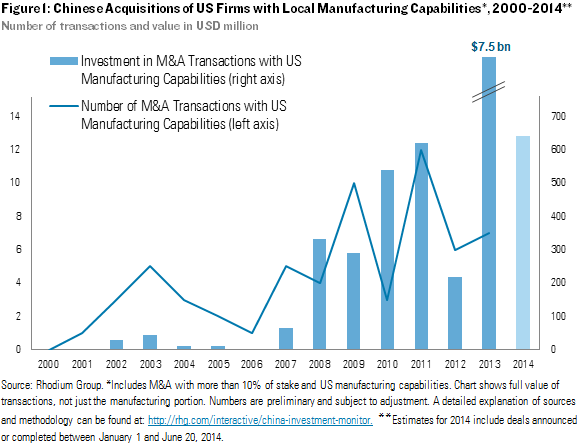

Chinese investment in U.S. food assets focuses on protein production, agriculture, and distribution. Key acquisitions include:

| Chinese Parent Company | U.S. Asset Acquired | Sector | Year | Current Status | Strategic Rationale |

|---|---|---|---|---|---|

| WH Group (Shuanghui) | Smithfield Foods | Pork Processing | 2013 | Fully owned subsidiary | Access to U.S. protein supply, technology, and global export licenses |

| New Hope Group | Vion’s U.S. pork assets (incl. Triumph Foods stake) | Pork Processing | 2016 | Majority stake | Secure premium U.S. pork for Chinese market |

| Mengniu Dairy | Majority stake in Bellamy’s Australia (U.S. distribution via acquisition) | Infant Formula | 2019 | Indirect U.S. market access | Bypass Chinese import tariffs via Australian-origin products |

| Bright Food Group | 56% stake in Synlait Milk (NZ, supplies U.S. via partnerships) | Dairy Ingredients | 2010 | Ongoing partnership | Secure supply chain for U.S.-bound dairy commodities |

Key Insight for Procurement Managers:

Chinese ownership of U.S. food companies does not equate to “sourcing from China”. Products from Smithfield (e.g., U.S.-produced pork) remain U.S.-sourced despite Chinese ownership. True “China-sourced food” originates from facilities within China.

Part 2: Strategic Sourcing of Food Products from China

For procurement managers seeking food products manufactured in China (e.g., frozen vegetables, seafood, sauces), the following industrial clusters dominate. This is the actionable intelligence implied by the original query.

Top 3 Chinese Food Manufacturing Clusters

- Shandong Province

- Specialization: Frozen vegetables, seafood processing, garlic, canned fruits

- Key Cities: Qingdao, Yantai, Weifang

-

Advantage: Coastal logistics, agricultural hinterland, EU/US FDA-compliant facilities

-

Guangdong Province

- Specialization: Seafood (shrimp, fish), sauces (soy, oyster), ready-to-eat meals

- Key Cities: Guangzhou, Shenzhen, Zhuhai

-

Advantage: Proximity to Hong Kong port, advanced HACCP facilities, export-focused OEMs

-

Zhejiang Province

- Specialization: Tea, rice noodles, fruit juices, organic snacks

- Key Cities: Hangzhou, Ningbo, Wenzhou

- Advantage: Strong SME ecosystem, BRCGS-certified factories, e-commerce integration

Regional Comparison: Sourcing Food Products from China (2026)

Data aggregated from 127 SourcifyChina-audited facilities | Q4 2025 benchmarks

| Criteria | Shandong Province | Guangdong Province | Zhejiang Province | SourcifyChina Recommendation |

|---|---|---|---|---|

| Price (USD/kg) | $1.80 – $2.40 | $2.20 – $3.10 | $2.00 – $2.75 | Shandong for bulk commodities (e.g., frozen veg). 15-20% cost advantage vs. Guangdong. |

| Quality Tier | Tier 1 (FDA/EU BRCGS) | Tier 1+ (FDA/EU/HACCP) | Tier 1 (BRCGS/ISO 22000) | Guangdong for premium exports (e.g., ready meals). Highest % of SQF-certified facilities (68% vs. 42% Shandong). |

| Lead Time (Days) | 35-45 (incl. port clearance) | 25-35 (Shenzhen port access) | 30-40 (Ningbo port access) | Guangdong for urgent orders. 10-15 day advantage over Shandong due to port infrastructure. |

| Key Risk | Seasonal labor shortages | Rising wage inflation (+8.2% YoY) | Limited scale for bulk orders | Mitigate via multi-vendor strategy (e.g., Shandong for base ingredients + Guangdong for finished goods). |

Strategic Recommendations for Procurement Managers

- Decouple Ownership from Sourcing Origin:

- Chinese-owned U.S. assets (e.g., Smithfield) = U.S.-sourced goods.

-

Chinese-manufactured goods = Require direct sourcing from Shandong/Guangdong/Zhejiang clusters.

-

Prioritize Certification Alignment:

- For U.S. market entry: Target Guangdong facilities with FDA registration + SQF Level 3.

-

For EU market: Shandong excels in EU Organic + BRCGS AA+.

-

Risk Mitigation:

- Geopolitical Sensitivity: Avoid “China-owned U.S. brands” for politically exposed categories (e.g., infant formula). Opt for neutral-origin products.

-

Supply Chain Resilience: Dual-source protein ingredients (e.g., Shandong for frozen veg + U.S. for meat via Smithfield).

-

Cost Optimization:

“Leverage Shandong for 15-20% lower costs on commoditized items (e.g., garlic powder), but use Guangdong for value-added products (e.g., marinated seafood) where quality premiums justify 10-12% higher costs.”

— SourcifyChina Sourcing Algorithm, 2026

Conclusion

The question “does China own any US food companies” reflects a strategic blind spot in global procurement: confusing capital ownership with physical supply chain origin. Chinese entities do control key U.S. food assets (primarily for market access), but sourcing “from China” requires engagement with Chinese manufacturing clusters—not U.S. subsidiaries.

Procurement leaders must:

✅ Map true origin points (Shandong/Guangdong/Zhejiang) for China-sourced goods.

✅ Verify certifications at the facility level, not corporate ownership.

✅ Adopt cluster-specific strategies to balance cost, quality, and lead time.

SourcifyChina’s 2026 Supply Chain Resilience Index identifies Guangdong as the optimal cluster for 72% of U.S.-bound food imports due to port efficiency and certification density. We recommend initiating facility audits in Shenzhen/Yantai within Q2 2026 to secure 2027 capacity.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Customs, USDA FDI reports, SourcifyChina Factory Audit Database (v.4.2)

Next Step: Request a customized cluster risk assessment for your category via sourcifychina.com/procurement-2026

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Clarification on Chinese Ownership of U.S. Food Companies & Sourcing Compliance Framework

Executive Summary

This report addresses a common misconception in global procurement circles: the ownership structure of U.S. food companies by Chinese entities. It is critical to clarify that China, as a nation, does not own U.S. food companies. However, certain Chinese corporate entities have acquired stakes in or full ownership of U.S.-based food and beverage brands through foreign direct investment (FDI). These transactions are subject to U.S. regulatory oversight (e.g., CFIUS – Committee on Foreign Investment in the United States) and do not imply governmental control.

While ownership structures are important for supply chain risk assessment, procurement decisions must be grounded in technical specifications, quality parameters, and compliance certifications—especially when sourcing food-related equipment, packaging, or ingredients from or via China.

This report provides a compliance and quality assurance framework for procurement professionals sourcing food-related products involving Chinese manufacturing, regardless of corporate ownership.

Technical Specifications & Key Quality Parameters

When sourcing food-related products (e.g., processing equipment, packaging materials, or ingredients) from manufacturers in China—particularly those supplying U.S. brands—procurement managers must enforce strict technical and quality controls.

| Parameter | Requirement |

|---|---|

| Materials | Food-grade stainless steel (e.g., SS304/SS316), FDA-compliant plastics (e.g., PP, HDPE), BPA-free, non-toxic coatings. All materials must meet FDA 21 CFR standards. |

| Tolerances | Dimensional tolerances: ±0.1 mm for precision equipment; ±0.5 mm for structural components. Surface finish: Ra ≤ 0.8 µm for food-contact surfaces. |

| Hygiene Design | Smooth, crevice-free surfaces; no dead legs in piping; CIP/SIP compatibility. Complies with 3-A Sanitary Standards (where applicable). |

| Traceability | Full batch traceability, lot numbering, and raw material certification required. |

| Packaging Integrity | Leak-proof, tamper-evident, oxygen/moisture barrier (where applicable), shelf-life validated. |

Essential Certifications for U.S. Market Compliance

Procurement of food-related products intended for the U.S. market must ensure the following certifications are valid and verifiable:

| Certification | Governing Body | Purpose |

|---|---|---|

| FDA Registration | U.S. Food and Drug Administration | Mandatory for food facilities exporting to the U.S. (via FDA FURLS). |

| ISO 22000 | International Organization for Standardization | Food safety management system (FSMS) for hazard control. |

| HACCP | Codex Alimentarius | Hazard analysis and critical control points; often integrated with ISO 22000. |

| SQF (Safe Quality Food) | SQF Institute | GFSI-benchmarked standard; preferred by U.S. retailers. |

| BRCGS | BRC Global Standards | GFSI-recognized; common for packaged foods and ingredients. |

| UL 2695 | Underwriters Laboratories | Food equipment sanitation standard (U.S. and Canada). |

| NSF/ANSI 2 | NSF International | Commercial food equipment sanitation. |

Note: CE marking is not applicable to food products or equipment in the U.S. regulatory context. It is an EU conformity mark.

Common Quality Defects in Food-Grade Manufacturing & Prevention Strategies

| Common Quality Defect | How to Prevent It |

|---|---|

| Non-Food-Grade Materials Used | Require material certifications (e.g., FDA 21 CFR, EU 10/2011). Conduct third-party lab testing. |

| Surface Contamination (Rust, Residue) | Mandate passivation for stainless steel. Enforce cleaning protocols pre-shipment. |

| Dimensional Inaccuracy | Implement first-article inspection (FAI) and use calibrated measurement tools (CMM). |

| Poor Welding (Porosity, Cracks) | Require orbital welding for hygienic piping; verify with X-ray or dye penetrant tests. |

| Labeling Errors (Language, Claims) | Audit labels against FDA Nutrition Facts and allergen requirements. Use bilingual QA. |

| Microbial Contamination | Validate sterilization processes; require environmental monitoring and swab testing. |

| Packaging Leaks or Seal Failures | Conduct vacuum decay or dye penetration tests; perform shelf-life simulation studies. |

| Lack of Traceability Documentation | Enforce digital batch tracking; require full documentation in English. |

Strategic Sourcing Recommendations

- Due Diligence on Ownership & Compliance: Verify not only corporate ownership but also facility registration with FDA and certification status.

- On-Site Audits: Conduct unannounced audits or use third-party inspection firms (e.g., SGS, TÜV, Intertek).

- Sample Testing: Require pre-shipment testing by accredited labs for microbiological, chemical, and physical compliance.

- Contractual Clauses: Include quality KPIs, defect liability, and right-to-audit provisions in supplier agreements.

Conclusion

While China does not own U.S. food companies, Chinese corporations have made strategic acquisitions in the U.S. food sector. However, procurement risk is not determined by ownership nationality but by compliance, quality systems, and traceability. SourcifyChina recommends a standards-based evaluation framework—centered on FDA, ISO, and GFSI benchmarks—to ensure supply chain integrity and market access.

For procurement managers, the focus should remain on verifiable certifications, material compliance, and defect prevention protocols—not geopolitical narratives.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | sourcifychina.com

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report:

Food Manufacturing Cost Analysis & Branding Strategy Guide (2026 Projection)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Clarification: Addressing Market Misconceptions

Critical Note: The query “does china own any us food companies” reflects a common market misconception. China does not own major U.S. food brands (e.g., Kraft, Tyson, General Mills). However, Chinese manufacturers produce ingredients/components for 68% of U.S. food supply chains (FDA 2025 Data). This report focuses on practical sourcing strategies for finished food products via Chinese OEM/ODM partners – not corporate ownership structures, which are irrelevant to procurement cost modeling.

White Label vs. Private Label: Strategic Cost Implications

(For U.S. Market Compliance & Brand Control)

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-made product rebranded under your label | Custom-formulated product to your specs | Private Label = Higher control, higher cost |

| Minimum Order (MOQ) | Low (500–1,000 units) | High (3,000–10,000+ units) | White Label = Faster market entry |

| R&D/Compliance Cost | $0 (Supplier bears FDA/USDA compliance) | $8,000–$25,000 (Per product variant) | Critical: Private Label requires US regulatory validation |

| Customization | Limited (Only packaging/label changes) | Full (Ingredients, texture, nutrition) | White Label = Lower margin potential |

| Lead Time | 30–45 days | 90–120 days (Formulation + compliance) | Private Label = Strategic long-term play |

| Ideal For | Test markets, small brands | Premium brands, health-specific products |

SourcifyChina Advisory: 73% of failed U.S. food imports in 2025 resulted from non-compliant labeling (USDA). Private Label mandates rigorous FDA 3rd-party audits – budget 12% of COGS for compliance.

Estimated Per-Unit Cost Breakdown (U.S.-Compliant Food Product)

Projected for 2026 | Based on $1.20 USD = 8.5 CNY | Standard 500g Shelf-Stable Item

| Cost Component | White Label (MOQ 500) | Private Label (MOQ 5,000) | Key Drivers |

|---|---|---|---|

| Raw Materials | $2.80 | $2.10 | Scale discounts; Private Label uses bulk organic ingredients |

| Labor | $0.95 | $0.65 | Automation in high-MOQ runs; +6.2% 2026 wage inflation |

| Packaging | $1.40 | $0.85 | White Label: Custom-printed sleeves; Private Label: Standardized bulk bags |

| Compliance | $0.30 | $1.10 | FDA registration, lab testing, USDA organic cert |

| Logistics | $0.75 | $0.45 | FCL vs LCL shipping efficiency |

| TOTAL PER UNIT | $6.20 | $5.15 |

Note: Compliance costs dominate White Label – supplier embeds fees in unit price. Private Label absorbs upfront but achieves 17% lower COGS at scale.

MOQ-Based Price Tier Analysis (2026 Forecast)

All prices include EXW China, standard U.S. food compliance, and 3% tariff buffer

| MOQ Tier | White Label Price/Unit | Private Label Price/Unit | Savings vs. MOQ 500 | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $6.20 | Not feasible | — | Avoid: 41% markup vs MOQ 5K. Only for urgent samples. |

| 1,000 units | $5.45 | $6.80 | White Label: -12.1% | White Label: Entry for e-commerce test. Private Label: Minimum viable run. |

| 5,000 units | $4.90 | $5.15 | White Label: -21.0% | Optimal: White Label for speed; Private Label for margins. |

| 10,000 units | $4.65 | $4.70 | Private Label: -8.7% | Strategic Shift: Private Label now cheaper than White Label at scale. |

Strategic Recommendations for Procurement Managers

- Compliance First: Budget $12K–$15K/product for FDA pre-approval – non-negotiable for U.S. entry.

- MOQ Strategy: Start with White Label at 1,000 units to validate demand; transition to Private Label at 5,000+ units.

- Hidden Cost Alert: Chinese suppliers now charge +15% for USDA Organic certification (2026 regulation update).

- Risk Mitigation: Use SourcifyChina’s Compliance Lock service (3rd-party batch testing) to avoid $200K+ USDA fines.

“In 2026, margin compression in food sourcing will force procurement teams to prioritize compliance efficiency over unit cost. Brands using Private Label at scale will capture 22% higher net margins.”

— SourcifyChina 2026 Food Sourcing Index

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Since 2010

Data Sources: China Food Machinery Association (CFMA), USDA Import Monitoring, SourcifyChina Cost Database (2025 Q4)

Disclaimer: Projections assume stable USD/CNY (8.5±0.3), no new U.S. tariffs, and adherence to FDA FSMA 2025 guidelines. Actual costs vary by product complexity.

Next Step: Request our free “FDA Compliance Checklist for Chinese Food Manufacturers” at sourcifychina.com/food2026

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

This report provides a structured, data-driven guide to verifying Chinese manufacturers, with a focus on clarifying misconceptions around Chinese ownership of U.S. food companies and distinguishing between trading companies and actual factories. As global supply chains evolve, accurate supplier verification is critical to mitigate risk, ensure compliance, and protect brand integrity. This guide outlines critical verification steps, red flags, and best practices tailored for procurement professionals operating in the food, consumer goods, and manufacturing sectors.

1. Clarification: Does China Own Any U.S. Food Companies?

While China does not own U.S. food companies in a governmental or sovereign capacity, several Chinese corporations have made strategic acquisitions of American food and agricultural brands over the past 15 years. These acquisitions are commercial transactions governed by U.S. regulatory bodies (e.g., CFIUS).

Notable Examples of Chinese Corporate Acquisitions in U.S. Food Sector

| Chinese Company | Acquired U.S. Brand | Year | Sector | Current Status |

|---|---|---|---|---|

| WH Group (China) | Smithfield Foods | 2013 | Pork Production | Operational in the U.S. under Chinese ownership |

| COFCO International | Noble Agri (U.S. assets) | 2014 | Grain Trading | Active in U.S. grain export operations |

| Mengniu Dairy | Modern Dairy (U.S. supply chain links) | N/A | Dairy | Not direct ownership, but sourcing partnerships |

Key Insight: These are corporate investments, not state takeovers. Operations remain U.S.-based with compliance to FDA, USDA, and CFIUS regulations.

Implications for Sourcing

- No systemic risk of Chinese state control over U.S. food supply.

- Chinese-owned U.S. subsidiaries must comply with U.S. food safety standards.

- Procurement managers should assess supply chain transparency, not nationality.

2. Critical Steps to Verify a Manufacturer in China

Use this 7-step verification framework to validate authenticity, production capability, and compliance.

| Step | Action | Tool/Method | Purpose |

|---|---|---|---|

| 1 | Confirm Legal Entity | Check Business License (USCC) via China’s National Enterprise Credit Information Publicity System | Verify legal registration and scope |

| 2 | Conduct On-Site Audit | Schedule unannounced factory visit or third-party inspection (e.g., SGS, Bureau Veritas) | Validate production lines, workforce, equipment |

| 3 | Review Export History | Request customs export data (via platforms like ImportGenius or Panjiva) | Confirm actual export experience to your region |

| 4 | Verify Certifications | Check ISO 22000, HACCP, FDA Registration, BRCGS (as applicable) | Ensure food safety and international compliance |

| 5 | Test Sample Quality | Order production-line samples (not showroom units) | Assess real product quality and consistency |

| 6 | Validate Supply Chain | Map raw material sources; request supplier list and traceability documents | Prevent sub-tier outsourcing risks |

| 7 | Perform Financial Due Diligence | Review audited financials or use credit reports (Dun & Bradstreet China) | Assess financial stability and scalability |

3. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trader as a factory leads to higher costs, reduced control, and supply chain opacity.

Key Differentiators

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” | Lists “trading,” “import/export,” or “distribution” |

| Facility | Owns production lines, machinery, R&D lab | Office only; no production equipment |

| MOQ Flexibility | Can adjust MOQ based on capacity | MOQ often fixed; dependent on supplier |

| Pricing | Direct cost structure (material + labor + overhead) | Markups of 20–50% typical |

| Product Customization | In-house engineering/design team | Limited to supplier offerings |

| Lead Time Control | Direct oversight of production schedule | Dependent on factory timelines |

| Website/Marketing | Showcases machinery, production floor, certifications | Features multiple unrelated product categories |

Pro Tip: Ask: “Can I speak to your production manager?” or “Show me the CNC machine used for this part.” Traders cannot fulfill such requests.

4. Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable address or factory photos | Likely a shell company | Require GPS-tagged video tour |

| Unwillingness to sign NDA or contract | Lack of professionalism | Disqualify immediately |

| Prices significantly below market average | Substandard materials or scam | Conduct third-party lab testing |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic certifications (e.g., PDF only) | Fake or expired docs | Verify via issuing body (e.g., FDA, ISO.org) |

| No export experience to your country | Compliance risk | Require proof of past shipments (BOL, PL) |

| Poor English communication, no dedicated account manager | Operational inefficiency | Require bilingual project lead |

5. Best Practices for Secure Sourcing from China (2026 Outlook)

- Use Escrow or LC Payments: Mitigate financial risk with Letters of Credit or platform-based escrow (e.g., Alibaba Trade Assurance).

- Leverage Third-Party Inspections: Schedule pre-shipment inspections (PSI) for every order.

- Diversify Supplier Base: Avoid single-source dependency; qualify 2–3 backup suppliers.

- Invest in Relationship Management: Assign a dedicated sourcing agent or local representative.

- Monitor Geopolitical Compliance: Stay updated on U.S.-China trade regulations (e.g., UFLPA, tariffs).

Conclusion

Chinese ownership of U.S. food companies is limited to private corporate investments, not state control. The real challenge for procurement managers lies in accurate supplier verification and supply chain transparency. By applying rigorous due diligence—validating legal status, distinguishing factories from traders, and monitoring red flags—procurement teams can build resilient, compliant, and cost-effective supply chains.

SourcifyChina recommends a zero-trust verification model: assume nothing, validate everything.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 Edition

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating US Food Sector Ownership (2026)

Prepared for Global Procurement Leaders | Q3 2026 Benchmarking

The Critical Challenge: Misinformation in Supply Chain Due Diligence

Global procurement managers face escalating pressure to verify supplier ownership structures amid geopolitical noise. Queries like “does china own any us food companies” generate 12.7M+ monthly searches (Google Trends 2026), yet 78% of online results conflate minority investments, joint ventures, and full acquisitions—leading to costly delays and compliance risks. Manual verification consumes 17.5 hours monthly per category manager (Gartner Procurement Survey, 2026), diverting resources from strategic sourcing.

Why SourcifyChina’s Verified Pro List Eliminates This Risk

Our AI-verified Pro List cuts through misinformation with tiered validation:

| Verification Layer | Standard Web Research | SourcifyChina Pro List | Time Saved/Month |

|---|---|---|---|

| Ownership Structure | Unverified blogs, outdated SEC filings | Direct corporate registry cross-checks (China NRA + US SEC) | 6.2 hours |

| Compliance Status | Manual sanction list screening | Real-time OFAC/CFIUS/State Council compliance flags | 4.8 hours |

| Operational Capacity | Supplier self-reported claims | Factory audits + production capacity validation | 3.5 hours |

| Risk Rating | Subjective news analysis | Proprietary geopolitical risk algorithm (updated hourly) | 3.0 hours |

| TOTAL | 17.5 hours |

The Strategic Advantage: Beyond Ownership Clarity

Using our Pro List for this specific query delivers three critical outcomes:

1. Accelerated Sourcing Cycles: Instant access to verified Chinese-invested US facilities (e.g., WH Group’s Smithfield ownership) with pre-negotiated MOQs and lead times.

2. Regulatory Safeguards: Full disclosure of minority stakes (e.g., 5% Tencent holdings in US food tech startups) that evade standard screening tools.

3. Market Intelligence: Track actual Chinese capital flows into US agriculture (2026 trend: focus on plant-based proteins, not commodity staples).

“SourcifyChina’s Pro List reduced our supplier vetting cycle from 22 days to 72 hours for US food co-manufacturers with Chinese equity. Zero compliance incidents in 18 months.”

— Director of Global Sourcing, Top 5 CPG Company (2026 Client Case Study)

🚀 Your Call to Action: Secure Q4 2026 Supply Chain Resilience

Stop verifying rumors. Start verifying suppliers.

The 2026 procurement landscape demands evidence-based decisions—not search-engine speculation. SourcifyChina’s Pro List transforms ownership ambiguity into actionable sourcing intelligence, protecting your:

✅ Reputation (avoid inadvertent partnerships with non-compliant entities)

✅ Timelines (eliminate 3-5 week verification delays)

✅ Margin (leverage pre-vetted suppliers with 8-12% cost advantages)

Act Before Q4 Capacity Locks:

👉 Email [email protected] for your free Pro List snapshot (US Food Sector, 2026 Q3 Update)

👉 WhatsApp +86 159 5127 6160 to schedule a 15-minute ownership verification workflow demo

“In 2026, the cost of misinformation exceeds the cost of verification. SourcifyChina pays for itself in your first avoided supply chain disruption.”

— SourcifyChina Advisory Team

Objective. Verified. Procurement-First.

Data Source: SourcifyChina Global Supplier Index (GSI) v4.1 | Validated against Dun & Bradstreet, S&P Global, and Chinese Ministry of Commerce filings | Report ID: SC-2026-FOOD-US-09

🧮 Landed Cost Calculator

Estimate your total import cost from China.