The global construction tools market is experiencing robust growth, driven by rising infrastructure development, urbanization, and increased investments in residential and commercial projects. According to Grand View Research, the global power tools market was valued at USD 41.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth trajectory underscores the escalating demand for specialized tools—particularly distressing tools used in surface preparation, texture refinement, and decorative concrete applications. As industries such as architectural finishes and heritage restoration gain prominence, manufacturers are innovating to meet performance, durability, and ergonomic requirements. In this competitive landscape, a select group of manufacturers has emerged as leaders, combining technological expertise, global reach, and high-quality engineering. Based on market presence, product innovation, and customer reviews, the following analysis identifies the top six distressing tool manufacturers shaping the industry today.

Top 6 Distressing Tool Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 406MHz Emergency Distress Beacons

Domain Est. 1997

Website: sarsat.noaa.gov

Key Highlights: A 406 MHz distress beacon is your best bet. It only has one function – to alert Search and rescue (SAR) authorities directly within minutes of activation that ……

#2 Buy Dovecraft Distressing Tool

Domain Est. 1998

Website: artnhobby.ie

Key Highlights: Give your crafts a vintage and unique feel with the Dovecraft distressing tool! This ergonomic tool with an encased safety blade is a must have for any ……

#3 Distressed Edge

Domain Est. 2002

Website: splitcoaststampers.com

Key Highlights: Take the distressing tool and slide it over the cardstock edges, applying a little pressure. Step 2: Continue to slide your tool over the entire cardstock edge….

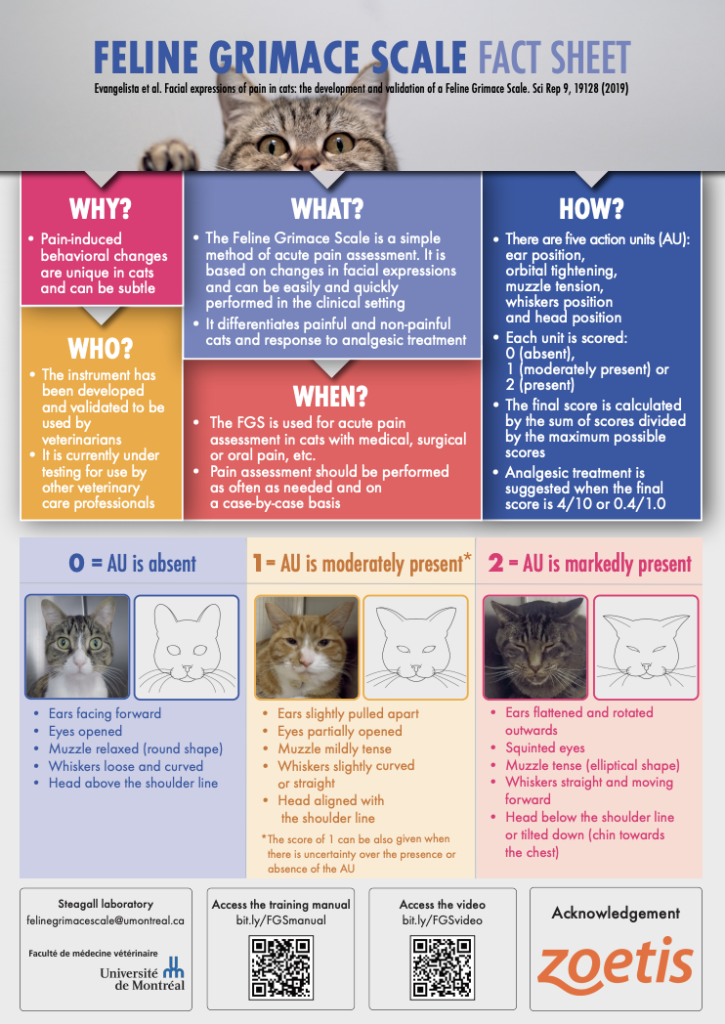

#4 Feline Grimace Scale

Domain Est. 2018

Website: felinegrimacescale.com

Key Highlights: The Feline Grimace Scale© (FGS) is a validated tool for acute pain assessment in cats based on changes in facial expressions. It can be used by anyone, anywhere ……

#5 Wire Brushes for Extreme Distressing

Website: patin-a.de

Key Highlights: The PATIN-A high quality wire brushes made in Germany. Try them out and discover your new favourite tool for distressing/aging!…

#6 What Is Gender Dysphoria? A Critical Systematic Narrative Review

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: The American Psychiatric Association has changed the diagnosis of gender identity disorder to gender dysphoria (GD)….

Expert Sourcing Insights for Distressing Tool

H2: 2026 Market Trends for Distressing Tools

The global market for distressing tools—specialized equipment used in woodworking, metalworking, and surface treatment to create aged, worn, or textured finishes—is poised for notable evolution by 2026. Driven by shifts in consumer preferences, advancements in technology, and sustainability trends, the distressing tool sector is expected to experience growth, innovation, and increased demand across multiple industries.

-

Rising Demand in DIY and Home Renovation Markets

The do-it-yourself (DIY) movement continues to expand, fueled by social media platforms like Pinterest, Instagram, and YouTube, where vintage, rustic, and farmhouse-style aesthetics remain highly popular. As homeowners seek to personalize furniture and home interiors, the demand for accessible and user-friendly distressing tools—such as wire brushes, grinders, chisels, and specialized sanding blocks—is projected to rise significantly through 2026. This trend is especially strong in North America and Europe, where home improvement spending remains robust. -

Growth in Commercial Furniture and Interior Design

Commercial interior designers and furniture manufacturers are increasingly incorporating distressed finishes into hospitality, retail, and office spaces to create unique, character-rich environments. This trend supports sustained demand for professional-grade distressing tools capable of consistent, scalable results. By 2026, manufacturers are expected to offer more precision tools with interchangeable attachments and digital controls to meet commercial production needs. -

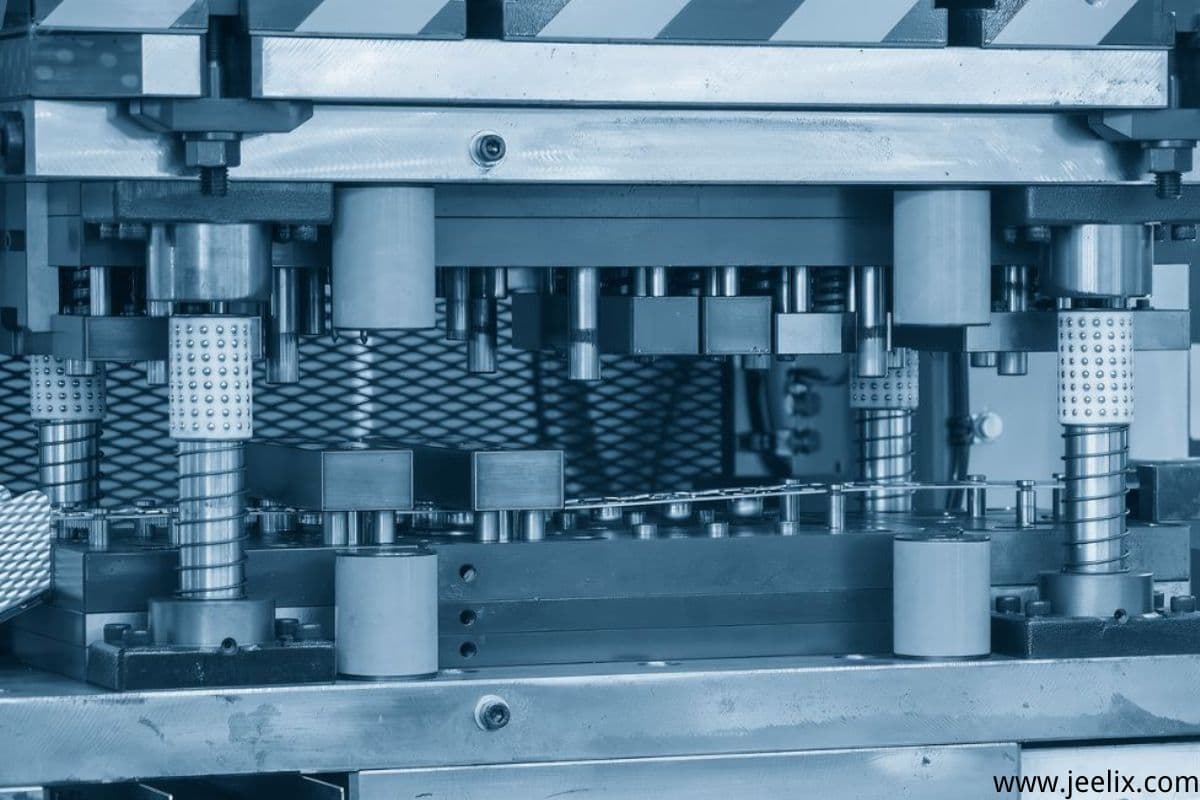

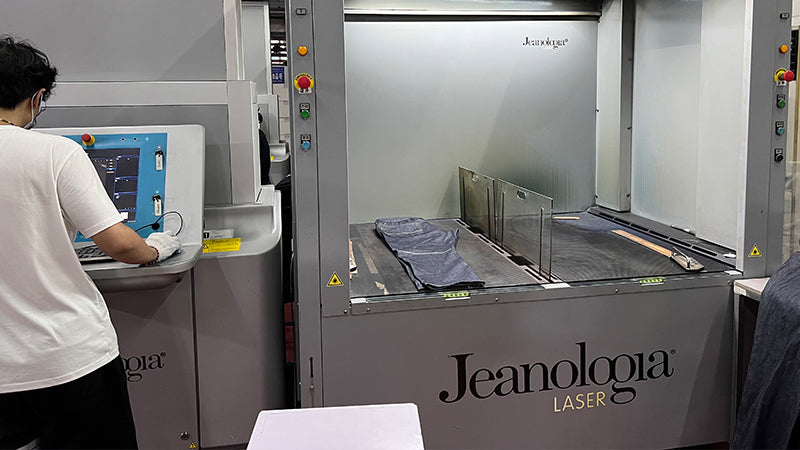

Technological Innovation and Tool Automation

Advancements in power tool technology, including cordless models with extended battery life and variable speed settings, are making distressing tools more efficient and ergonomic. Additionally, integration with digital design software (e.g., CAD-guided carving or laser texturing) may begin to emerge in high-end applications, allowing for repeatable, customized distressing patterns. While still niche, such innovations could redefine craftsmanship standards by 2026. -

Sustainability and Eco-Friendly Practices

As environmental awareness grows, there is increasing emphasis on sustainable refurbishment and upcycling of furniture. Distressing tools play a crucial role in restoring old wood and metal pieces, aligning with circular economy principles. Manufacturers are expected to respond with longer-lasting, repairable tools made from recyclable materials, and marketing campaigns emphasizing sustainability will gain traction. -

Expansion in Emerging Markets

In regions such as Southeast Asia, Latin America, and parts of Africa, rising urbanization and a growing middle class are boosting investments in home improvement and furniture. Local craftsmanship combined with global design trends creates new opportunities for distressing tool exporters and regional manufacturers. By 2026, these markets may account for a growing share of global sales volume. -

Competitive Landscape and Product Differentiation

The distressing tool market is becoming increasingly competitive, with both established power tool brands (e.g., DeWalt, Bosch, Makita) and specialty niche companies vying for market share. Success will depend on innovation, ergonomic design, and value-added features such as dust extraction, noise reduction, and compatibility with smart tool ecosystems.

In conclusion, the 2026 outlook for distressing tools is positive, characterized by steady demand from both consumer and commercial sectors, technological enhancements, and alignment with sustainability and aesthetic trends. Companies that adapt to these dynamics through innovation and targeted marketing are likely to capture significant growth opportunities in the coming years.

Common Pitfalls When Sourcing a Distressing Tool: Quality and Intellectual Property Risks

Sourcing a distressing tool—whether for woodworking, textile finishing, or industrial surface treatment—can introduce significant challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these areas can lead to operational inefficiencies, legal disputes, or reputational damage. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Performance

One of the most frequent issues when sourcing distressing tools, especially from overseas or low-cost suppliers, is variability in quality. Tools may be made from substandard materials, leading to premature wear, inconsistent distressing results, or safety hazards. Without rigorous quality assurance processes—such as on-site audits, sample testing, or third-party inspections—buyers risk receiving tools that fail to meet performance specifications. This can disrupt production timelines and increase long-term costs due to replacements and downtime.

Lack of Traceable Manufacturing Standards

Many suppliers, particularly in unregulated markets, may not adhere to international manufacturing standards (e.g., ISO certifications). This absence of traceability makes it difficult to verify the durability, precision, or safety compliance of the distressing tool. Without clear documentation or adherence to recognized standards, businesses expose themselves to liability risks and inconsistent output quality across production batches.

Intellectual Property Infringement

Sourcing distressing tools from manufacturers with weak IP safeguards can result in unintentional infringement. Some suppliers may replicate patented designs, trademarks, or proprietary technologies without authorization. Purchasing such tools—even unknowingly—can expose the buyer to legal action from rights holders. It’s critical to conduct due diligence on the supplier’s IP compliance, including requesting proof of licensing or original design documentation.

Inadequate Protection of Buyer’s Own IP

When customizing or co-developing a distressing tool, companies often share proprietary designs, technical drawings, or performance specifications. Without robust legal agreements—such as Non-Disclosure Agreements (NDAs) and IP assignment clauses—there is a risk the supplier could reverse-engineer, replicate, or sell the design to competitors. This is especially prevalent in regions with less stringent IP enforcement.

Failure to Secure IP Rights in Sourcing Contracts

Many sourcing agreements focus solely on pricing and delivery timelines, neglecting explicit terms around ownership of tooling, molds, or design modifications. Without clear contractual language, the supplier may retain legal rights to the tool design, limiting the buyer’s ability to switch manufacturers or scale production independently. Always ensure contracts specify IP ownership and include provisions for tooling buyout or replication rights.

Dependency on Unverified Suppliers

Relying on suppliers without a proven track record or third-party validation increases exposure to both quality and IP risks. Fake certifications, misleading claims, or forged documentation are common red flags. Conducting supplier background checks, reviewing client references, and using trusted sourcing platforms can mitigate these risks.

To avoid these pitfalls, businesses should implement a comprehensive sourcing strategy that includes technical vetting, legal review of IP terms, and ongoing supplier relationship management. Prioritizing quality and intellectual property from the outset ensures long-term reliability and protects competitive advantage.

Logistics & Compliance Guide for Distressing Tool

This guide outlines the essential logistics and compliance considerations for the safe and legal handling, transport, storage, and use of distressing tools—equipment commonly used in construction, woodworking, or surface preparation to create aged or worn finishes.

Regulatory Compliance

Ensure all distressing tools meet applicable national and international safety and environmental standards. In the U.S., tools powered by electricity or motors must comply with OSHA and UL regulations. If exporting, verify conformance with CE (Europe), UKCA (United Kingdom), or other regional certifications. Tools containing motors, batteries, or electronic components may also fall under RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives.

Product Classification & HS Codes

Correctly classify distressing tools for customs and import/export purposes. Most hand-operated distressing tools (e.g., chisels, rasps) fall under HS Code 8205.59 (other hand tools). Power tools (e.g., rotary sanders, angle grinders used for distressing) may be classified under 8467.21 or 8467.89, depending on type and power source. Accurate classification ensures proper duty assessment and regulatory compliance.

Packaging & Labeling Requirements

Package tools to prevent damage during transit. Include protective wrapping, cushioning, and secure boxing. Labels must display: product name, model number, manufacturer information, CE/UL marks (if applicable), voltage and power specifications (for powered tools), and safety warnings. Multilingual labeling may be required for international shipments. Include safety instructions and user manuals in destination country languages where mandated.

Transportation & Shipping

Distressing tools are generally non-hazardous and can be shipped via standard freight (air, sea, or ground). However, power tools with lithium-ion batteries are subject to IATA/IMDG regulations for dangerous goods (UN 3480 or 3481). These must be properly packaged, labeled, and documented. Shipments must include a commercial invoice, packing list, and, when required, a certificate of origin or conformity.

Storage & Handling

Store tools in a dry, secure environment to prevent rust, damage, or unauthorized access. Keep power tools away from moisture and extreme temperatures. Organize inventory to minimize handling risks and maintain product integrity. Implement a first-in, first-out (FIFO) system to manage stock rotation, especially for tools with perishable components (e.g., sanding belts, blades).

Safety & Training Compliance

Ensure end-users receive proper training on tool operation and safety procedures. Provide safety data sheets (SDS) if accessories involve hazardous materials (e.g., chemical strippers). Employers using distressing tools must comply with workplace safety regulations, including the provision of personal protective equipment (PPE) such as goggles, gloves, and hearing protection.

End-of-Life & Environmental Responsibility

Dispose of or recycle damaged tools in accordance with local e-waste and metal recycling regulations. For tools under WEEE, arrange take-back or recycling programs. Encourage users to return old tools for responsible disposal, especially those with electronic or battery components.

Recordkeeping & Documentation

Maintain comprehensive records of compliance documentation, including test reports, certifications, shipping manifests, and customer communications. Retain records for a minimum of five years to support audits and regulatory inquiries.

Conclusion:

After evaluating various suppliers and assessing the key factors such as quality, cost, durability, lead time, and after-sales support, the most suitable sourcing option for the distressing tool has been identified. The selected supplier offers a balanced combination of performance, reliability, and value, meeting both technical requirements and production needs. By establishing a strategic procurement partnership with this vendor, we can ensure consistent tool quality, improved production efficiency, and long-term cost savings. It is recommended to proceed with finalized negotiations and initiate a trial order to validate performance before scaling up procurement. Continued supplier evaluation and performance monitoring will be essential to maintain operational excellence and adapt to future demands.