The global demand for dip switches has surged alongside the rapid expansion of consumer electronics, industrial automation, and telecommunications infrastructure. According to Grand View Research, the global electronic switches market size was valued at USD 11.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is driven by increasing integration of compact, reliable switching solutions in IoT devices, smart home systems, and automotive electronics—applications where dip switches remain a preferred choice due to their durability and configurability. As the need for precision components rises, a select group of manufacturers have emerged as industry leaders, combining innovation, scalability, and global supply chain reach to meet evolving technical demands. These top eight dip switch manufacturers not only dominate in terms of market share but also set benchmarks in miniaturization, environmental resilience, and customization capabilities across diverse sectors.

Top 8 Dip Switche Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Diptronics Manufacturing Inc.

Domain Est. 1997

Website: dip.com.tw

Key Highlights: DIP switch monthly capacity. 20Millionpcs. Tactile switch monthly capacity. 148Millionpcs. Global Market Share of Server Application Switch Supplies….

#2 DIP Switches

Domain Est. 1997

Website: components.omron.com

Key Highlights: DIP switches offer flexible control with slide, piano, and rotary types, designed for compact devices. Suitable for various setting devices in industrial ……

#3 Leading DIP Switch Manufacturers

Domain Est. 2001

Website: electric-switches.com

Key Highlights: View the leading DIP switch suppliers in the United States who manufacture reliable, premium made products that are offered at affordable prices….

#4 C&K Switches

Domain Est. 2016

Website: ckswitches.com

Key Highlights: C&K offers more than 55,000 standard products and 8.5 million switch combinations to companies that design, manufacture and distribute electronics products….

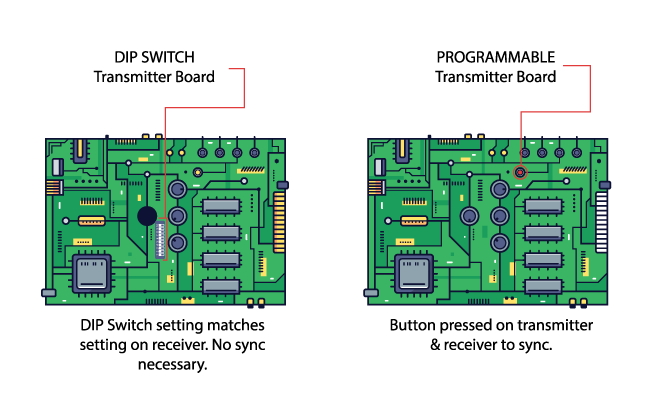

#5 DIP Switches

Domain Est. 1992

Website: te.com

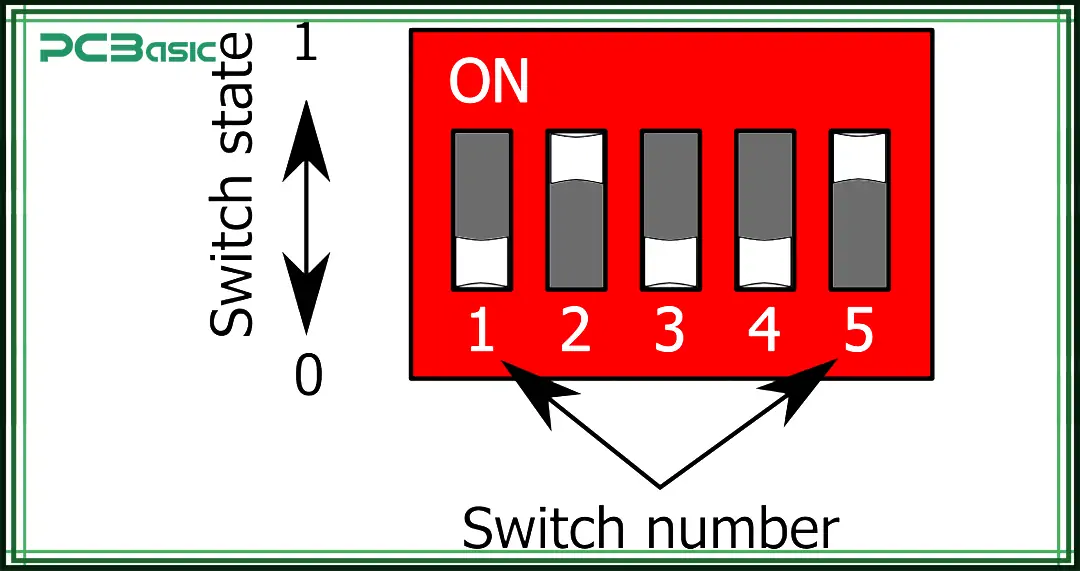

Key Highlights: A DIP switch is a manual electronic package that is composed of a series of tiny switches. Available with a variety of actuator styles and sizes….

#6 DIP Switches

Domain Est. 1993

Website: ctscorp.com

Key Highlights: Our DIP switch selection offers a broad pallet of options with various actuation styles, switch types, mounting configurations as well as terminal materials ……

#7 E

Domain Est. 1995

Website: e-switch.com

Key Highlights: E-Switch provides a vast line of switch products with multiple features suitable for agricultural related devices and equipment. Whether the application ……

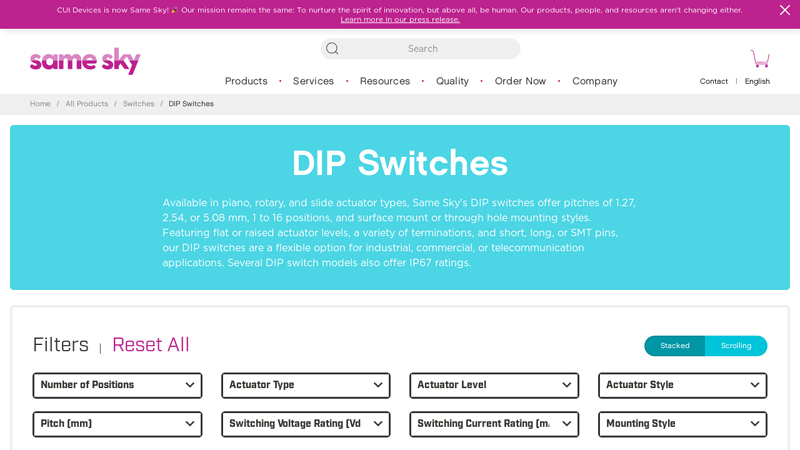

#8 DIP Switches

Domain Est. 2024

Website: sameskydevices.com

Key Highlights: Available in piano, rotary, and slide actuator types, Same Sky’s DIP switches offer pitches of 1.27, 2.54, or 5.08 mm, 1 to 16 positions….

Expert Sourcing Insights for Dip Switche

H2 2026 Market Trends for Dip Switches

While dip switches remain a legacy component in many electronic designs, the second half of 2026 is expected to solidify their transition into specialized, niche applications rather than broad market solutions. Here are the key trends shaping the dip switch market in H2 2026:

Continued Decline in Mainstream Electronics

By H2 2026, dip switches will have been largely phased out of consumer electronics, smartphones, and modern IoT devices. These markets have overwhelmingly adopted digital configuration methods such as firmware settings, mobile apps, and cloud-based interfaces. The demand for smaller form factors and automated setup further diminishes the role of manual, physical switches.

Growth in Industrial and Legacy System Maintenance

The primary market growth for dip switches in H2 2026 will be in industrial automation, building control systems, and legacy equipment servicing. As older machinery and infrastructure remain in operation—especially in manufacturing, HVAC, and transportation—there will be sustained demand for replacement dip switches. These sectors value simplicity, reliability, and backward compatibility, making dip switches a practical solution for configuration and addressing.

Shift Toward High-Reliability and Harsh Environment Variants

Manufacturers will increasingly focus on producing dip switches designed for extreme conditions—high temperature, humidity, and vibration. These ruggedized versions will find use in automotive subsystems, aerospace applications, and outdoor industrial equipment. Miniaturization with enhanced sealing (IP67/IP68 ratings) will be a key differentiator.

Integration with Smart Modules (Hybrid Solutions)

A notable trend in H2 2026 will be the integration of dip switches into hybrid control modules. These combine traditional dip switches for fail-safe or manual override functions alongside digital interfaces. For example, a smart relay module might use dip switches for initial addressing during installation but allow fine-tuning via a digital bus. This hybrid approach balances legacy compatibility with modern functionality.

Supply Chain Consolidation and Obsolescence Management

With declining overall demand, the dip switch supply chain will see further consolidation. Fewer manufacturers will dominate, focusing on high-margin, specialized products. As a result, obsolescence management and long-term component availability will become critical concerns for design engineers, particularly in industries with long product life cycles.

Regional Demand Patterns

Asia-Pacific, particularly China and India, will remain significant markets due to ongoing industrialization and infrastructure development. North America and Europe will see stable but flat demand, driven by maintenance and upgrades of existing systems rather than new designs.

Sustainability and RoHS Compliance

Environmental regulations will continue to influence design and materials. By H2 2026, all commercially available dip switches are expected to be fully RoHS-compliant, with increasing use of recyclable plastics and lead-free soldering processes. Some manufacturers may introduce “green” variants to appeal to ESG-conscious buyers.

In summary, H2 2026 will see the dip switch market evolve into a mature, specialized segment. While no longer a growth component in cutting-edge electronics, dip switches will maintain relevance through reliability, simplicity, and their critical role in maintaining and upgrading long-lifecycle industrial systems. Designers will increasingly treat them as legacy-enabling components rather than primary configuration tools.

Common Pitfalls When Sourcing Dip Switches (Quality, IP)

Sourcing dip switches may seem straightforward, but overlooking key aspects can lead to reliability issues, production delays, or even product failure. Two critical areas often misunderstood are quality consistency and ingress protection (IP) ratings. Being aware of these common pitfalls helps ensure long-term performance and compliance.

Inconsistent Quality from Low-Cost Suppliers

One of the most frequent issues when sourcing dip switches—especially from budget suppliers or non-reputable manufacturers—is inconsistent build quality. This can manifest in:

- Poor contact reliability: Switches may fail to make or break connections consistently, leading to erratic device behavior.

- Mechanical fragility: Levers or housings may crack or break during assembly or operation, especially with repeated use.

- Material degradation: Low-grade plastics may warp under heat or become brittle over time.

- Solderability issues: Terminals may not accept solder properly, resulting in cold joints or open circuits.

Mitigation: Source from established manufacturers or authorized distributors, request samples for lifecycle testing (e.g., 1,000+ actuations), and verify compliance with industry standards (e.g., UL, CE, RoHS).

Misunderstanding or Overstating IP Ratings

Ingress Protection (IP) ratings are critical for dip switches used in harsh environments (e.g., industrial controls, outdoor equipment). A common pitfall is assuming all dip switches are sealed or misinterpreting the IP code:

- Confusing IP67 with splash resistance: A switch rated IP67 is dust-tight and can withstand temporary immersion, but many low-cost switches only offer minimal splash protection (e.g., IP54) or none at all.

- Sealing degradation over time: Gaskets or seals may degrade due to UV exposure, temperature swings, or chemical contact, compromising protection.

- Improper panel mounting: Even an IP67-rated switch can fail if the panel cutout is oversized or lacks proper sealing.

Mitigation: Verify the actual IP rating with test reports, ensure compatibility with the operating environment, and consider using boot covers or secondary sealing if the application demands it. Never assume sealing based on appearance alone.

By addressing these quality and IP-related pitfalls early in the sourcing process, engineers and procurement teams can avoid field failures and ensure robust, reliable product performance.

Logistics & Compliance Guide for Dip Switches

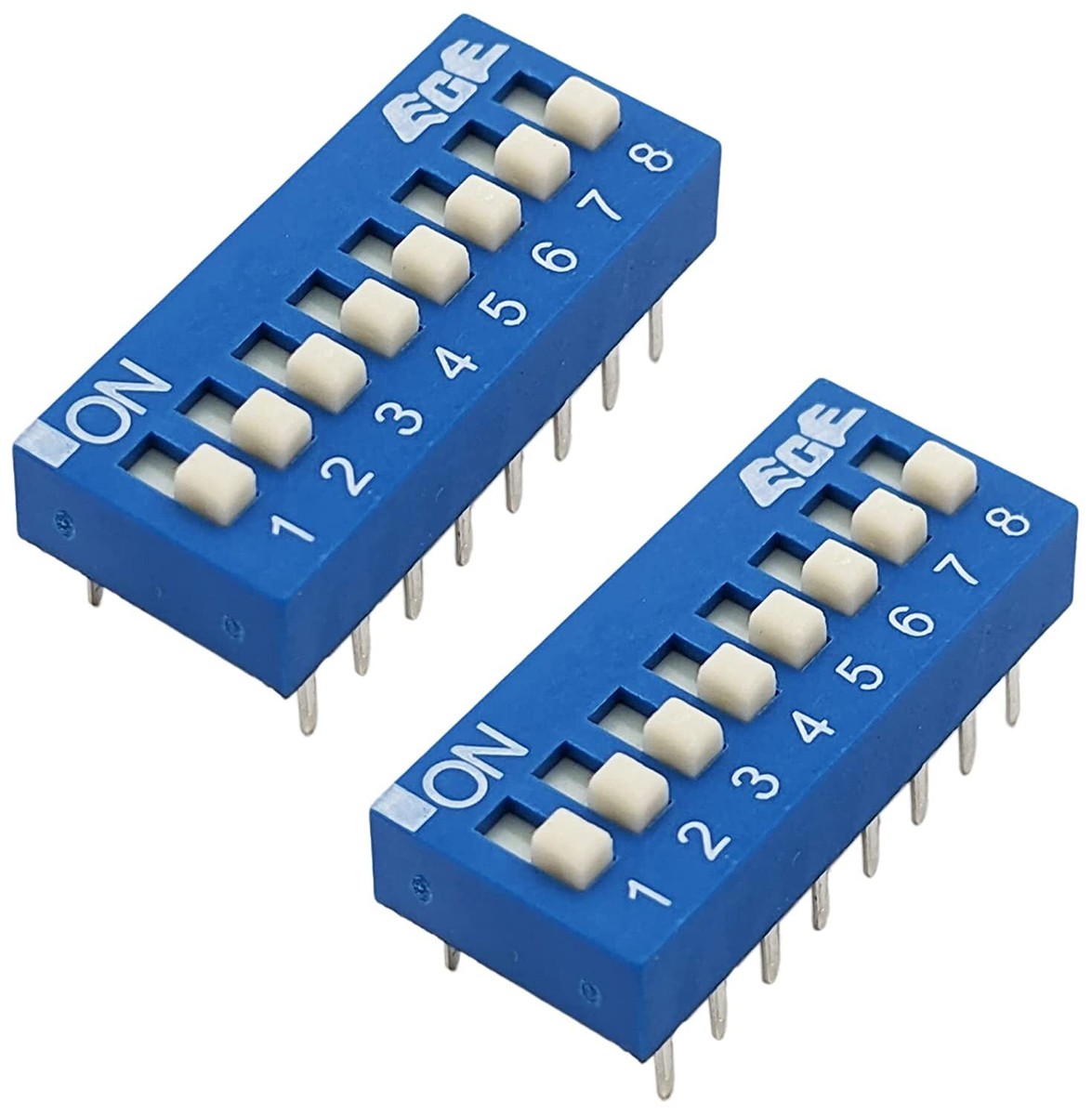

Overview

Dip switches (Dual In-line Package switches) are small electronic components used to configure hardware settings on circuit boards. While seemingly simple, their global distribution and integration into larger systems require adherence to specific logistics and compliance standards. This guide outlines essential considerations for manufacturers, distributors, and integrators.

Packaging & Handling

- Use anti-static packaging (e.g., conductive foam or static-shielded bags) to prevent electrostatic discharge (ESD) damage.

- Ensure packaging is secure to avoid mechanical stress during transit.

- Label packaging with ESD-sensitive symbols and product identifiers (e.g., part number, quantity, date code).

- Store in dry, temperature-controlled environments (typically 10°C to 30°C) to prevent moisture absorption or material degradation.

Transportation & Shipping

- Ship via carriers compliant with IATA/ICAO regulations for electronic goods, particularly for air freight.

- For international shipments, ensure proper documentation including commercial invoices, packing lists, and Harmonized System (HS) codes (typically under 8536.90 for electrical switches).

- Consider using serialized tracking for high-value or traceability-critical shipments.

- Avoid exposure to extreme temperatures, humidity, or vibration during transport.

Regulatory Compliance

- RoHS (Restriction of Hazardous Substances): Ensure dip switches comply with EU Directive 2011/65/EU, restricting lead, mercury, cadmium, and other hazardous materials.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Confirm compliance with SVHC (Substances of Very High Concern) requirements.

- Conflict Minerals (Dodd-Frank Act Section 1502): Provide documentation showing no use of tin, tantalum, tungsten, or gold sourced from conflict-affected regions, if applicable.

- China RoHS: Label products with environmental protection icons if sold in China, and provide compliance documentation.

Export Controls

- Verify if dip switches fall under export control regulations such as:

- EAR (Export Administration Regulations): Check ECCN (Export Control Classification Number); most dip switches are EAR99 (low concern), but verify based on technical specs.

- ITAR (International Traffic in Arms Regulations): Generally not applicable unless used in defense systems.

- Obtain necessary export licenses for restricted destinations (e.g., embargoed countries).

Marking & Labeling

- Clearly mark dip switches or packaging with:

- Manufacturer name or trademark

- Part number and revision

- RoHS and CE marks (if applicable)

- Date code and manufacturing location

- Include compliance labels per regional requirements (e.g., UKCA for UK, CCC for China if integrated into regulated devices).

Supply Chain Traceability

- Maintain records of component sourcing, batch numbers, and testing results.

- Implement traceability systems (e.g., barcode/QR code scanning) to support recalls or audits.

- Require suppliers to provide Certificates of Compliance (CoC) and material declarations.

End-of-Life & Recycling

- Design for disassembly and recyclability in accordance with WEEE (Waste Electrical and Electronic Equipment) Directive.

- Provide take-back or recycling instructions where legally required.

- Avoid materials that complicate recycling processes.

Quality Assurance

- Conduct incoming inspection for damage, correct part number, and packaging integrity.

- Perform periodic audits of suppliers and logistics partners.

- Maintain ISO 9001 and/or IATF 16949 (for automotive applications) quality management systems.

Special Considerations for High-Reliability Applications

- For aerospace, medical, or industrial systems, ensure dip switches meet additional standards such as:

- MIL-PRF-39017 (military performance specs)

- IPC-A-610 (acceptability of electronic assemblies)

- ISO 13485 (medical devices)

Conclusion

Proper logistics and compliance management for dip switches ensure product reliability, legal conformity, and smooth global distribution. Always verify regional regulations and application-specific requirements when integrating dip switches into final products.

Conclusion for Sourcing Dip Switches:

Sourcing dip switches requires a strategic approach that balances technical specifications, supplier reliability, cost-efficiency, and long-term availability. Through thorough evaluation of suppliers, consideration of quality certifications (such as ISO standards), and assessment of material and performance requirements (e.g., current rating, size, actuation force, and durability), an optimal dip switch can be selected to meet application needs.

Key factors in successful sourcing include lead times, minimum order quantities (MOQs), and the supplier’s capacity for scalability and consistency. Additionally, evaluating both domestic and international manufacturers offers flexibility in cost and delivery, though potential risks such as supply chain disruptions and quality variance must be mitigated through due diligence.

In conclusion, effective dip switch sourcing hinges on establishing strong supplier relationships, maintaining design flexibility for component alternatives, and staying informed about market trends and obsolescence risks. A well-structured procurement strategy ensures reliable supply, product performance, and support for manufacturing continuity.