The global turbocharger market is experiencing robust growth, driven largely by rising demand for fuel-efficient and low-emission diesel engines across automotive, commercial vehicle, and industrial applications. According to a 2023 report by Mordor Intelligence, the global turbocharger market was valued at USD 21.6 billion in 2022 and is projected to grow at a CAGR of 6.8% through 2028. This expansion is fueled by stringent emissions regulations—such as Euro 6 and EPA standards—and the continued reliance on diesel-powered vehicles in heavy-duty transport and off-road machinery, particularly in emerging economies. Diesel turbochargers remain a critical technology in improving engine efficiency and reducing greenhouse gas emissions, underpinning strong demand among OEMs and aftermarket suppliers. As innovation in variable geometry turbochargers (VGT) and electrically assisted turbocharging accelerates, a handful of manufacturers are leading the charge in technology, reliability, and global market share. Below are the top 10 diesel turbocharger manufacturers shaping the industry’s future.

Top 10 Diesel Turbocharger Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Turbochargers

Domain Est. 1990

Website: cummins.com

Key Highlights: Learn more about turbochargers from Cummins, experts in medium- and heavy-duty diesel engine turbochargers for increased engine performance….

#2 Rotomaster

Domain Est. 1998

Website: rotomaster.com

Key Highlights: For more than 40 years, Rotomaster has been a premier designer and manufacturer for turbochargers, cartridges, and components as a Tier One and aftermarket ……

#3 TurboActive.com

Domain Est. 1999

Website: turboactive.com

Key Highlights: We are official distributors of all the leading turbocharger manufacturers, including Garrett, Borg Warner, Mitsubishi, IHI, Continental and BMTS….

#4 KC Turbos

Domain Est. 2014

Website: kcturbos.com

Key Highlights: KC Turbos is a family-owned and operated company that has been providing high-quality turbochargers, turbo kits, and performance parts for diesel trucks and ……

#5 IHI Turbo America

Domain Est. 1998

Website: ihi-turbo.com

Key Highlights: IHI America is the US subsidiary of IHI Corporation serving both North and South America with exceptional turbocharger and supercharger products….

#6 All Makes Turbochargers

Domain Est. 2000

Website: dieselusa.com

Key Highlights: As a Master Distributor for many major O.E. turbocharger brands, we are able to service, sell and distribute turbochargers and turbocharger accessories for ……

#7 Performance Turbochargers

Domain Est. 2002

Website: borgwarner.com

Key Highlights: AirWerks turbochargers cover a wide range of power ratings ranging from 220 HP all the way up to 1,875 HP per turbo. AirWerks is an excellent choice when it ……

#8 Bullseye Power Turbochargers

Domain Est. 2004

Website: bullseyepower.com

Key Highlights: BullseyePower Turbochargers is rebranding their popular “Street Billet” series turbochargers into the new “Billet Wheel Series”….

#9 HD Turbo Official

Domain Est. 2016

Website: hdturbo.com

Key Highlights: We are America’s trusted Diesel Turbo Rebuild Shop, offering diesel turbochargers, VGT actuators, and turbo parts to customers nationwide! +500 reviews….

#10 Diesel Turbochargers

Domain Est. 2018

Website: garrettmotion.com

Key Highlights: Garrett continues to pioneer diesel turbo technologies that help elevate the dynamic between fuel efficiency, emissions reduction and driveability….

Expert Sourcing Insights for Diesel Turbocharger

2026 Market Trends for Diesel Turbochargers: A Strategic Outlook

The diesel turbocharger market in 2026 stands at a pivotal juncture, shaped by powerful, often competing, global forces. While facing long-term headwinds from electrification, the sector is experiencing significant near-to-mid-term demand driven by stringent emissions regulations, industrial resilience, and technological innovation. Here is a comprehensive analysis of the key trends defining the market landscape:

1. Stringent Global Emissions Regulations as the Primary Growth Catalyst

The most dominant driver for the 2026 diesel turbocharger market is the relentless tightening of emissions standards worldwide. Regulations like Euro VII (targeting implementation around 2026/2027 in Europe), China VIb, and evolving norms in India (Bharat Stage VI Phase 2), North America, and Japan are forcing engine manufacturers to achieve unprecedented levels of efficiency. Turbochargers, particularly advanced variants, are essential tools in this effort:

* Focus on Efficiency & Aftertreatment Integration: Turbochargers are increasingly designed not just for power, but as integral components of the engine system to optimize combustion efficiency, reduce fuel consumption (directly lowering CO2), and manage exhaust gas temperatures critical for effective Selective Catalytic Reduction (SCR) and Diesel Particulate Filter (DPF) function.

* Rise of High-Pressure Ratio & Variable Geometry Turbochargers (VGT/VNT): To meet these demands, VGTs/VNTs, which offer superior low-end torque and transient response, are becoming standard, especially in commercial vehicles and off-highway applications. High-pressure ratio turbos enable higher EGR rates and better fuel atomization.

* Demand for Advanced Technologies: Expect accelerated adoption of technologies like dual-stage turbocharging (series or parallel) and electrically assisted turbochargers (e-Turbos) to eliminate turbo lag and further enhance efficiency under real-world driving conditions.

2. Resilience and Growth in Key End-Use Segments

Despite the rise of electrification, significant diesel demand persists in sectors where battery-electric alternatives face practical limitations:

* Heavy-Duty Commercial Vehicles (HCVs): Long-haul trucking remains heavily reliant on diesel. Stringent CO2 targets (e.g., EU CO2 Phase III, US EPA Phase 3) will drive demand for highly efficient turbocharged engines. The transition to battery-electric or hydrogen for long-haul is slow, ensuring robust demand for advanced diesel turbochargers through 2026.

* Off-Highway & Industrial Applications: Construction, mining, agriculture, marine, and power generation equipment operate in demanding environments requiring high torque, reliability, and long operational cycles. Electrification here is complex and costly. Diesel engines, often turbocharged, will dominate, driven by infrastructure development and energy demands. Marine applications face IMO Tier III regulations, further boosting demand for sophisticated turbocharging solutions.

* Emerging Markets: In regions with developing infrastructure and cost-sensitive markets (parts of Asia, Africa, Latin America), diesel remains the dominant power source for transportation and industry. The replacement and upgrade of aging fleets will sustain demand for turbochargers.

3. The Electrification Shadow: Long-Term Pressure and Strategic Adaptation

The most significant long-term challenge is the accelerating shift towards electrification, particularly in passenger cars and light-duty vehicles (LDVs):

* Declining Diesel Passenger Car Sales: Bans on new ICE sales in major markets (EU, UK, California) post-2030, coupled with consumer preference, are drastically reducing diesel car sales. This directly shrinks a major historical market for turbochargers.

* Impact on LDV Segment: While diesel LDVs (vans, pickups) will persist longer than cars, especially for commercial use, electrification is gaining traction. This creates uncertainty for turbocharger demand in this segment beyond 2026.

* Strategic Response: Turbocharger manufacturers are actively diversifying. Investment in e-Turbos is a key bridge technology, providing benefits even in hybrid systems and enabling downsizing in ICEs. Companies are also expanding into broader engine efficiency technologies, thermal management, and exploring applications in hydrogen combustion engines or fuel cells.

4. Consolidation, Innovation, and Regional Shifts

The market structure and innovation landscape are evolving:

* Consolidation: Facing R&D pressures and market shifts, consolidation among tier suppliers is likely, creating larger players with broader technology portfolios to serve global OEMs.

* Sustained R&D Focus: Innovation will center on improving efficiency, reducing friction, enhancing durability, and integrating sensors for predictive maintenance. Materials science (e.g., advanced ceramics, high-temperature alloys) and manufacturing (e.g., additive manufacturing for complex geometries) will be key enablers.

* Regional Dynamics: Asia-Pacific (especially China and India) will remain the largest market volume-wise due to industrial growth and vehicle production. Europe and North America will lead in adopting the most advanced technologies due to stringent regulations. Supply chain resilience and localization trends may influence manufacturing locations.

Conclusion for 2026: The diesel turbocharger market in 2026 will be characterized by robust demand driven by emissions compliance in heavy-duty and industrial sectors, coupled with significant technological advancement. While the passenger car segment continues its decline due to electrification, the core strength of diesel in applications requiring high energy density and durability ensures continued relevance. Success will belong to manufacturers who can deliver highly sophisticated, efficient, and integrated turbocharging solutions for demanding applications while simultaneously investing in future technologies like e-Turbos and diversifying their portfolios to navigate the long-term transition away from pure diesel powertrains. The market is not growing broadly, but it is transforming, becoming more technologically advanced and concentrated in specific, resilient sectors.

Common Pitfalls in Sourcing Diesel Turbochargers: Quality and Intellectual Property (IP) Risks

Sourcing diesel turbochargers, especially from new or lower-cost suppliers, involves significant risks related to both product quality and intellectual property. Overlooking these areas can lead to operational failures, warranty claims, legal disputes, and reputational damage. Below are the key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Supplier Qualification and Audits

Relying solely on supplier claims or certifications without conducting on-site audits is a major risk. Many suppliers may present forged or outdated quality certifications (e.g., ISO/TS 16949, ISO 9011). Without physical verification of manufacturing processes, quality control systems, and material traceability, buyers may receive substandard components prone to premature failure.

2. Use of Non-OEM-Grade Materials and Components

Counterfeit or inferior materials (e.g., low-grade turbine alloys, subpar bearings) significantly reduce turbocharger lifespan and performance. These components often fail under high thermal and mechanical stress, leading to engine damage. Buyers must require material certifications and conduct random destructive testing.

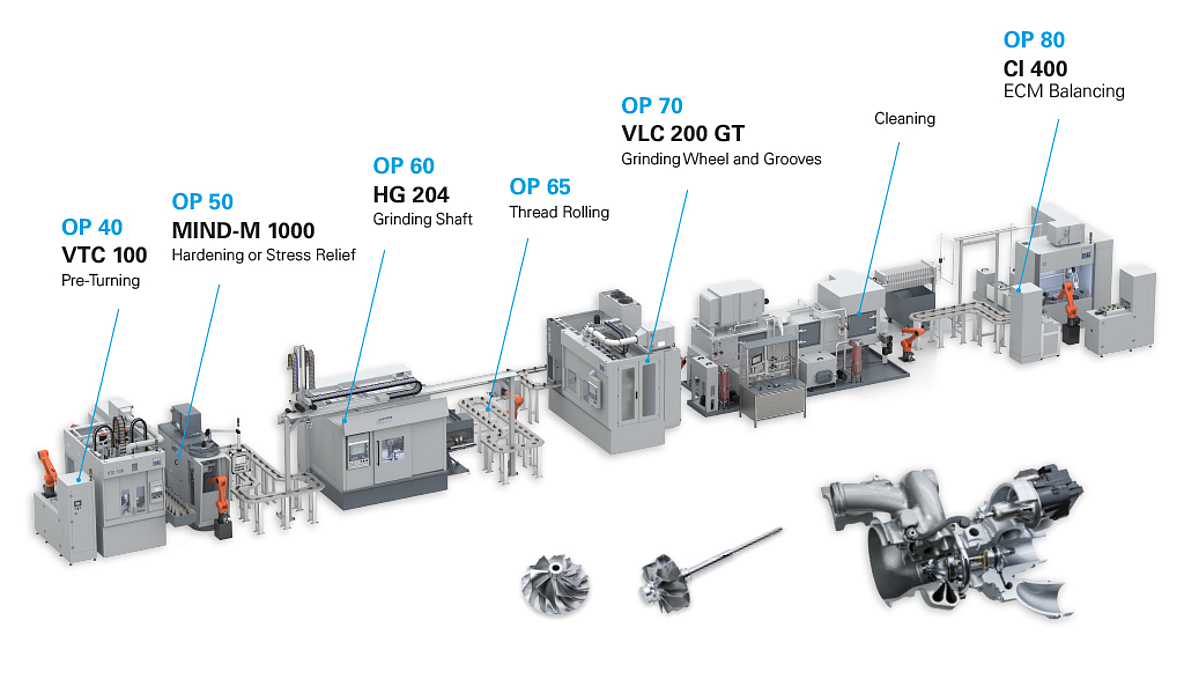

3. Poor Manufacturing Tolerances and Assembly Practices

Turbochargers operate at extreme speeds (over 100,000 RPM). Even minor deviations in machining or balancing result in vibration, oil leaks, or catastrophic failure. Suppliers without proper CNC machining capabilities or dynamic balancing equipment cannot consistently meet OEM tolerances.

4. Lack of Validation and Testing

Reputable OEMs perform rigorous validation (e.g., endurance testing, thermal cycling, burst testing). Many alternative suppliers skip or shorten these tests to reduce costs. Buyers should demand test reports and consider third-party verification of performance claims.

5. Inconsistent Batch-to-Batch Quality

Suppliers with weak process controls may deliver inconsistent quality. Without statistical process control (SPC) and robust incoming/outgoing inspections, defects can go undetected until they cause field failures.

Intellectual Property (IP) Pitfalls

1. Sourcing Counterfeit or Clone Turbochargers

Many low-cost turbochargers are unauthorized replicas of OEM designs (e.g., Holset, Garrett, BorgWarner). These violate patents, trademarks, and design rights. Purchasing such products exposes buyers to legal liability, customs seizures, and warranty voidance.

2. Infringement of Patented Technologies

Modern turbochargers incorporate patented technologies (e.g., variable geometry turbines, advanced bearing systems). Suppliers may unknowingly or willfully infringe these IP rights. Buyers risk being drawn into litigation if they distribute or use infringing products.

3. Lack of IP Warranty and Indemnification

Standard purchase agreements often omit IP indemnification clauses. Without contractual protection, the buyer may bear full liability for IP violations, including legal fees and damages.

4. Grey Market and Diversion Risks

Turbochargers sourced through unauthorized channels may be diverted OEM parts intended for specific regions or applications. This breaches OEM distribution agreements and may void support and warranties.

5. Reverse Engineering Without Licensing

Some suppliers claim to “reverse engineer” OEM products. While functional analysis is legal, replicating protected designs, software, or manufacturing processes without a license constitutes IP infringement.

Mitigation Strategies

- Conduct thorough supplier audits and request full traceability documentation.

- Require material certifications and third-party testing reports.

- Include strict IP indemnification clauses in contracts.

- Source only from authorized distributors or certified remanufacturers.

- Perform due diligence on supplier legitimacy and market reputation.

- Consult legal counsel when sourcing proprietary designs.

By addressing both quality and IP risks proactively, organizations can ensure reliable performance, regulatory compliance, and legal safety in their diesel turbocharger sourcing.

H2: Logistics & Compliance Guide for Diesel Turbochargers

Transporting and importing/exporting diesel turbochargers involves navigating complex international regulations, safety standards, and logistical considerations. This guide outlines key requirements and best practices for seamless global movement of these high-precision components.

H2: Regulatory Compliance

-

Customs Classification (HS Code):

- Primary HS Code: 8414.80 (Other turbochargers).

- Confirm exact code with national customs authorities, as sub-classifications may vary (e.g., 8414.80.40 for turbochargers for internal combustion engines).

- Accurate classification is critical for duty rates, import restrictions, and trade agreements.

-

Export Controls & Sanctions:

- Dual-Use Goods: Turbochargers may be subject to dual-use regulations (e.g., EU Dual-Use Regulation, U.S. EAR – Export Administration Regulations) due to potential military applications in high-performance engines.

- Country Restrictions: Verify recipient countries are not under comprehensive sanctions (e.g., OFAC, UN, EU sanctions lists). Shipping to embargoed destinations is prohibited.

- Licensing: Obtain necessary export licenses (e.g., U.S. Commerce Department BIS license, EU export authorization) for controlled destinations or end-uses.

-

Environmental & Safety Regulations:

- Packaging Waste: Comply with national packaging waste directives (e.g., EU Packaging Waste Directive) requiring recycling labels and producer responsibility.

- Hazardous Materials: Ensure turbochargers are free of residual oils, fuels, or cleaning agents exceeding regulated thresholds. Declare any hazardous residues per ADR (road), IMDG (sea), or IATA (air) if applicable.

- RoHS/REACH: Verify compliance with substance restrictions (e.g., EU RoHS for lead/cadmium, REACH for SVHCs) if required by destination market.

-

Product Standards & Certification:

- Emissions Compliance: Turbochargers must often be certified to support engine emissions standards (e.g., EPA, EU Stage V). Provide documentation linking the turbocharger to certified engine systems.

- Quality Standards: Adhere to ISO 9001, IATF 16949 (automotive), or customer-specific quality requirements.

H2: Logistics & Handling

-

Packaging & Protection:

- Robust Packaging: Use custom wooden crates or heavy-duty cardboard with internal foam/plastic supports to prevent movement, shock, and vibration damage.

- Moisture Protection: Apply VCI (Vapor Corrosion Inhibitor) paper or desiccants to prevent corrosion during transit, especially in humid environments.

- Sealing: Seal packages against dust and moisture ingress.

- Labeling: Clearly label packages with:

- Product name and part number

- “Fragile,” “This Side Up” orientation arrows

- Weight and dimensions

- HS code and country of origin

- Handling instructions (e.g., “Do Not Stack”)

-

Transportation Modes:

- Air Freight: Fastest option for urgent shipments or high-value units. Ensure compliance with IATA Dangerous Goods Regulations (even if non-hazardous, declare as “machinery”).

- Ocean Freight (FCL/LCL): Most cost-effective for bulk shipments. Use moisture-resistant containers. Consider container desiccants.

- Road/Rail: Ideal for regional/continental transport. Secure cargo to prevent shifting. Use temperature-controlled trailers if necessary.

-

Documentation:

- Mandatory: Commercial Invoice, Packing List, Bill of Lading/Air Waybill.

- Compliance: Certificate of Origin (for duty preferences), Export License (if required).

- Optional but Recommended: Technical Datasheet, Warranty Certificate, Certificate of Conformity (CE, EPA, etc.).

-

Insurance:

- Obtain comprehensive cargo insurance covering loss, damage, and theft during transit. Declare full replacement value.

H2: Key Best Practices

- Pre-Ship Verification: Double-check all regulatory requirements, licenses, and documentation before shipment.

- Partner with Experts: Use freight forwarders experienced in automotive parts and international compliance.

- Traceability: Implement barcode/QR code tracking for each unit.

- Record Keeping: Maintain detailed records of shipments, compliance documents, and licenses for 5-10 years (as required).

- Staying Updated: Monitor changes in trade regulations (e.g., tariffs, sanctions) and environmental standards.

Disclaimer: Regulations vary significantly by country and are subject to change. Consult with legal counsel, customs brokers, and regulatory bodies for specific requirements.

Conclusion for Sourcing Diesel Turbocharger

Sourcing a diesel turbocharger requires a strategic approach that balances performance, reliability, cost-efficiency, and compatibility with the engine system. After evaluating original equipment manufacturer (OEM) options, aftermarket alternatives, remanufactured units, and supplier capabilities, it is evident that the best sourcing decision depends on specific operational needs, budget constraints, and long-term maintenance goals.

OEM turbochargers offer guaranteed compatibility and reliability but often come at a higher price point. Aftermarket and remanufactured turbochargers can provide significant cost savings and are increasingly reliable due to advancements in manufacturing and quality control. However, careful vetting of suppliers is essential to avoid substandard products that could lead to premature failure and increased downtime.

Key considerations such as warranty terms, technical support, lead times, and certifications (ISO, TS standards) play a crucial role in supplier selection. Additionally, focusing on total cost of ownership—rather than initial purchase price—leads to more sustainable and cost-effective outcomes.

In conclusion, a well-informed sourcing strategy for diesel turbochargers should prioritize quality, supplier reputation, and long-term value. Partnering with trusted suppliers and maintaining rigorous quality checks ensures optimal engine performance, reduced maintenance costs, and enhanced operational efficiency across the vehicle or equipment fleet.