The global diesel outboard motor market is experiencing steady growth, driven by increasing demand for fuel-efficient, reliable marine propulsion systems in commercial and recreational applications. According to a 2023 report by Mordor Intelligence, the global outboard motor market is projected to grow at a CAGR of 5.8% from 2023 to 2028, with diesel variants gaining traction due to their durability, longer engine life, and superior torque compared to gasoline counterparts. Yanmar, a pioneer in diesel marine engines, has remained at the forefront of this niche segment, known for its innovation and rugged performance in demanding maritime environments. While the overall outboard market is dominated by gasoline-powered models from brands like Yamaha and Mercury, Yanmar stands out as one of the few manufacturers offering purpose-built diesel outboards, emphasizing efficiency and low total cost of ownership. This focus has positioned Yanmar—and its key manufacturing partners—at the cutting edge of diesel outboard technology, serving critical markets in offshore workboats, fishing vessels, and long-range cruising yachts.

Top 3 Diesel Outboard Yanmar Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Diesel Water Cooled Engines

Domain Est. 2012

Website: yanmarengines.com

Key Highlights: The Total New Value (TNV) engine series comes in 2-cylinder, 3-cylinder and 4-cylinder water cooled versions with a four-cycle, inline configuration….

#2 YANMAR USA

Domain Est. 1996

Website: yanmar.com

Key Highlights: Corporate website of Yanmar America which contains news releases, products, R&D and CSR information, and much more….

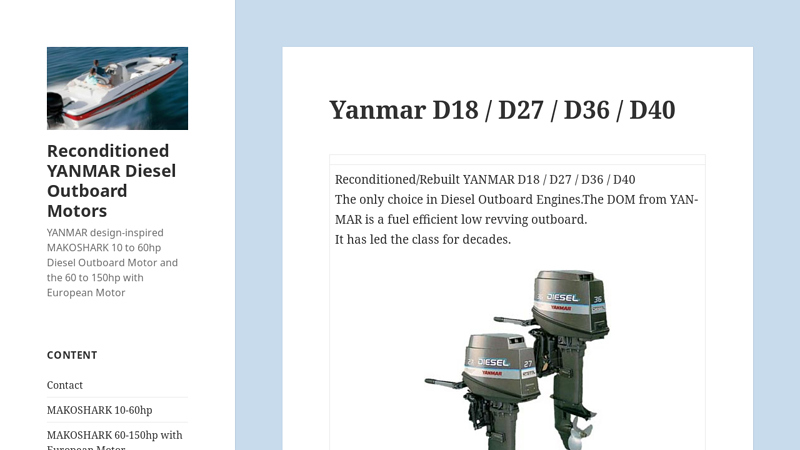

#3 Yanmar Diesel Outboard Motors

Domain Est. 2015

Website: yanmardieseloutboardmotors.com

Key Highlights: The only choice in Diesel Outboard Engines.The DOM from YANMAR is a fuel efficient low revving outboard. It has led the class for decades….

Expert Sourcing Insights for Diesel Outboard Yanmar

H2: 2026 Market Trends for Diesel Outboard Engines – Focus on Yanmar

As the marine propulsion industry evolves toward greater efficiency, sustainability, and regulatory compliance, Yanmar’s position in the diesel outboard engine sector is poised for strategic transformation by 2026. Several key market trends are expected to shape demand and innovation for diesel outboards, particularly for a long-established brand like Yanmar known for reliability and commercial-grade engineering.

-

Growing Demand in Commercial and Workboat Segments:

By 2026, the commercial marine sector—including fishing vessels, patrol boats, and utility craft—is expected to drive primary demand for diesel outboards. Yanmar’s reputation for durability and fuel efficiency aligns well with operators seeking reduced operating costs and longer service intervals. Diesel’s inherent safety (lower flammability than gasoline) and better fuel economy make it ideal for remote or extended operations, reinforcing Yanmar’s appeal in offshore and professional markets. -

Regulatory Pressures and Emissions Standards:

Global emissions regulations, such as EU Stage V and U.S. EPA Tier 4, continue to tighten. Yanmar’s ongoing investment in clean diesel technology—such as advanced common-rail fuel injection and exhaust after-treatment systems—positions it to remain compliant. By 2026, stricter environmental standards in coastal zones and inland waterways may favor diesel outboards that meet low NOx and particulate matter requirements, giving Yanmar a competitive edge over less-regulated competitors. -

Shift Toward Hybrid and Alternative Fuels:

While full electrification remains limited for high-power outboards due to battery weight and range constraints, hybrid diesel-electric systems are emerging. Yanmar is actively developing hybrid marine solutions, and by 2026, integration of diesel outboards with electric assist systems could offer improved fuel economy and silent operation modes. Additionally, Yanmar’s exploration of bio-diesel and synthetic fuel compatibility may appeal to environmentally conscious fleets seeking carbon reduction without sacrificing performance. -

Expansion in Emerging Markets:

In regions like Southeast Asia, Africa, and Latin America, where infrastructure for fuel supply favors diesel and reliability is paramount, Yanmar’s diesel outboards are likely to see increased adoption. These markets value long service life and local serviceability—areas where Yanmar’s global dealer network and modular design philosophy provide a strong advantage. -

Technological Integration and Smart Systems:

By 2026, connectivity and digitalization will play a larger role in marine propulsion. Yanmar is expected to enhance its diesel outboards with integrated monitoring systems, remote diagnostics, and IoT-enabled maintenance alerts. This shift supports predictive maintenance, reduces downtime, and appeals to fleet operators managing multiple vessels. -

Competition and Market Positioning:

Yanmar faces growing competition from other diesel outboard manufacturers, such as Cox Powertrain (UK), whose CXO300 gasoline-diesel hybrid has garnered attention. However, Yanmar’s long-standing presence in marine diesel engines, combined with its broader product ecosystem (including inboard diesels and marine electronics), allows for system-level integration that strengthens its value proposition.

Conclusion:

By 2026, Yanmar is expected to maintain a strong foothold in the diesel outboard market, particularly in commercial and institutional applications where reliability, fuel efficiency, and compliance are critical. While challenges from electrification and competition persist, Yanmar’s focus on innovation, hybridization, and global service support will likely enable it to capitalize on evolving marine industry demands.

Common Pitfalls When Sourcing Diesel Outboard Yanmar Engines (Quality & Intellectual Property)

Sourcing diesel outboard engines branded or associated with Yanmar requires careful due diligence, particularly concerning quality assurance and intellectual property (IP) rights. Several common pitfalls can lead to procurement of substandard products, legal exposure, or operational failures. Below are key risks to consider:

Misrepresentation of Yanmar Branding and IP Infringement

One of the most significant risks is encountering engines falsely marketed as “Yanmar diesel outboards” despite Yanmar not manufacturing such products. Yanmar is renowned for its marine diesel inboard and auxiliary engines, but it does not produce diesel outboard motors. Vendors may exploit Yanmar’s strong brand reputation by using its name, logos, or design cues without authorization. This constitutes trademark infringement and misleads buyers into believing they are purchasing genuine Yanmar equipment. Purchasing such counterfeit or imitation products exposes the buyer to legal liability and voids any warranty or support from Yanmar.

Poor Build Quality and Lack of Standardization

Engines advertised as “Yanmar-type” or “Yanmar-compatible” diesel outboards are often manufactured by third-party or unbranded suppliers, particularly from regions with lax manufacturing oversight. These engines frequently suffer from inconsistent build quality, substandard materials, and poor assembly practices. Components such as fuel injection systems, cooling mechanisms, and gear housings may not meet marine-grade standards, leading to premature failure, fuel inefficiency, or safety hazards. Unlike genuine Yanmar inboards, these knock-offs lack rigorous testing and certification, making reliability and durability highly unpredictable.

Absence of Genuine Support and Spare Parts

Even if a diesel outboard resembles a Yanmar engine in design or specifications, unauthorized replicas are typically unsupported by Yanmar’s global service network. This means no access to genuine spare parts, technical documentation, or factory-trained technicians. Over time, sourcing replacement parts becomes difficult and costly, often requiring custom fabrication. Additionally, warranty claims are unenforceable, leaving the buyer with limited recourse in case of defects or performance issues.

Compliance and Certification Shortfalls

Genuine marine engines must meet international standards such as ISO, CE, EPA, or IMO Tier regulations. Counterfeit or unlicensed diesel outboards often lack proper certification, making them non-compliant for use in regulated waters or commercial operations. This not only poses environmental and safety risks but can also result in fines, vessel detention, or insurance invalidation if discovered during inspection.

Supply Chain Opacity and Vendor Reliability

Sourcing from obscure suppliers or online marketplaces increases the risk of supply chain opacity. Buyers may lack visibility into manufacturing origins, quality control procedures, or the actual entity responsible for the product. Misleading product descriptions, falsified documentation, and lack of post-sale support are common. Engaging with such vendors can result in delayed deliveries, receiving incorrect models, or complete transaction fraud.

Conclusion

To mitigate these risks, buyers should verify that Yanmar does not manufacture diesel outboard engines and treat any product claiming otherwise with extreme skepticism. Always request proof of intellectual property rights, certifications, and traceable supply chain documentation. Where possible, work with authorized marine engine distributors and conduct third-party inspections prior to purchase. Avoid cost-driven decisions that compromise long-term reliability, safety, and legal compliance.

Logistics & Compliance Guide for Diesel Outboard Yanmar

Product Overview and Identification

The Yanmar diesel outboard engine is a commercial-grade marine propulsion system designed for reliability, fuel efficiency, and environmental compliance. Proper identification of the model, serial number, and technical specifications is essential for all logistics and compliance activities. Always verify the engine model (e.g., Yanmar 4LV, 6LY, etc.), emission certification (e.g., EPA Tier 3, IMO Tier II), and build year before initiating any shipment or customs process.

Regulatory Compliance Requirements

Yanmar diesel outboards must comply with multiple international and regional environmental and safety standards. Key compliance regulations include:

– EPA (Environmental Protection Agency) – United States: Engines must meet EPA Tier 3 emission standards for marine diesel engines. Documentation such as the EPA Engine Family Certificate and EPA Declaration of Conformity are required for import into the U.S.

– IMO MARPOL Annex VI – International: Applicable for commercial vessels; ensures compliance with global NOx emission limits.

– EU Stage V – Europe: Required for engines sold or operated in European Union countries, particularly for commercial applications.

– Noise and Safety Standards: Compliance with ISO 8298 (noise emission) and ISO 8846 (explosion protection) may be required depending on the destination.

Always confirm that the engine carries the appropriate certification labels (e.g., EPA, CE, IMO) and that certification documents are included in the shipping package.

Packaging and Handling Specifications

To ensure safe transport, Yanmar diesel outboards must be properly prepared and packaged:

– Engines should be drained of all fluids (fuel, oil, coolant) unless otherwise specified by Yanmar or the shipping method.

– Use original manufacturer crates or approved export-grade containers with moisture barriers and shock-absorbing materials.

– Secure the engine to prevent movement during transit; apply anti-corrosion protection (VCI packaging or desiccants) for sea shipments.

– Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include the model/serial number on external labels.

Export and Import Documentation

Complete and accurate documentation is essential for customs clearance:

– Commercial Invoice: Must include full product description, HS code (typically 8407.21 for marine diesel outboards), value, country of origin (Japan), and buyer/seller details.

– Packing List: Itemizes contents, weights, dimensions, and packaging types.

– Certificate of Origin: Required by many countries for tariff assessment; may need to be notarized or legalized.

– Bill of Lading (B/L) or Air Waybill (AWB): Issued by the carrier, serves as title and receipt.

– EPA or Equivalent Compliance Certificate: Mandatory for U.S. imports.

– Import Permits/Licenses: Required in some countries (e.g., Philippines, Brazil); verify with local authorities beforehand.

Customs Classification and Duties

The Harmonized System (HS) code for Yanmar diesel outboards is typically 8407.21.00 (marine propulsion diesel engines). Duty rates vary by country:

– United States: Often duty-free under HTSUS 8407.21.00.

– European Union: 0% import duty under CN code 8407 21 00.

– Other countries: Consult local customs authorities; VAT, GST, or import taxes may apply.

Proper classification prevents delays and ensures accurate duty assessment.

Transportation and Freight Options

Choose the appropriate mode of transport based on volume, urgency, and destination:

– Sea Freight (FCL/LCL): Most cost-effective for large shipments; use containerized shipping with proper marine insurance.

– Air Freight: Faster but more expensive; suitable for urgent or time-sensitive deliveries.

– Inland Transport: Coordinate with certified carriers for pickup and delivery; ensure vehicles are equipped for heavy machinery.

Use Incoterms® 2020 (e.g., FOB, CIF, DAP) to define responsibilities between buyer and seller.

Environmental and Disposal Compliance

At end-of-life or during servicing, diesel outboards and related components (batteries, oils, filters) must be disposed of in accordance with local environmental laws:

– Follow EPA or EU WEEE and ELV directives for waste handling.

– Recycle used engine oil and filters through certified facilities.

– Never dispose of diesel fuel or coolant into waterways or soil.

Recordkeeping and Audits

Maintain detailed records for at least five years, including:

– Shipping documents (B/L, invoice, packing list)

– Compliance certificates (EPA, CE, etc.)

– Maintenance and service logs

These records support customs audits, warranty claims, and regulatory inspections.

Support and Contact Information

For compliance verification, parts logistics, or documentation assistance, contact:

– Yanmar Marine International: https://marine.yanmar.com

– Yanmar Authorized Distributors (region-specific)

– Customs Brokers or freight forwarders experienced in marine equipment

Always verify requirements with local authorities and Yanmar representatives prior to shipment.

Conclusion for Sourcing Diesel Outboard: Yanmar

After thorough evaluation of available options in the marine propulsion market, sourcing a diesel outboard engine from Yanmar presents a compelling solution for applications requiring reliability, fuel efficiency, and durability. Yanmar’s long-standing reputation in diesel engine manufacturing, particularly in marine environments, underscores its technical expertise and commitment to quality. While diesel outboards are less common than their gasoline counterparts, Yanmar’s entry into this niche offers distinct advantages—including superior fuel economy, enhanced safety due to lower flammability of diesel fuel, and longer engine life under heavy use.

Although the initial acquisition cost may be higher and the selection more limited compared to traditional outboard brands, the total cost of ownership—factoring in maintenance intervals, fuel savings, and operational longevity—positions Yanmar as a cost-effective choice over time. Additionally, Yanmar’s global service network and support infrastructure further enhance its viability for commercial, workboat, and long-range recreational applications where uptime and dependability are critical.

In conclusion, sourcing a diesel outboard from Yanmar is a strategic decision for operators prioritizing performance, safety, and sustainability in marine operations. As the market for diesel outboards continues to grow, Yanmar is well-positioned to meet evolving industry demands with proven diesel technology adapted for outboard configurations.