The global diesel forklift market is experiencing steady expansion, driven by rising industrialization, growth in warehousing and logistics, and the demand for heavy-duty material handling equipment in construction and manufacturing sectors. According to Mordor Intelligence, the forklift truck market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, with diesel-powered models maintaining a significant share, particularly in regions requiring high-lifting capacity and outdoor operational durability. Their reliability in rugged environments and advancements in emission control technologies—such as Tier 4 Final compliance—have extended the relevance of diesel forklifts despite the rise of electric alternatives. As demand shifts toward fuel-efficient, low-emission diesel models, manufacturers are investing heavily in innovation and sustainability. In this competitive landscape, several key players have emerged as leaders in performance, technology integration, and global market reach. Here are the top 10 diesel forklift manufacturers shaping the industry in 2024.

Top 10 Diesel Forklift Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HELI Forklift

Domain Est. 2011

Website: helichina.net

Key Highlights: As a leading forklift equipment company, HELI has been specializing in the engineering and manufacturing of various industrial lift equipment categories….

#2 Yale Lift Truck Technologies

Domain Est. 1994

Website: yale.com

Key Highlights: Yale’s forklifts and lift trucks are designed to tackle your biggest challenges. Discover how our technology can boost your warehouse productivity!…

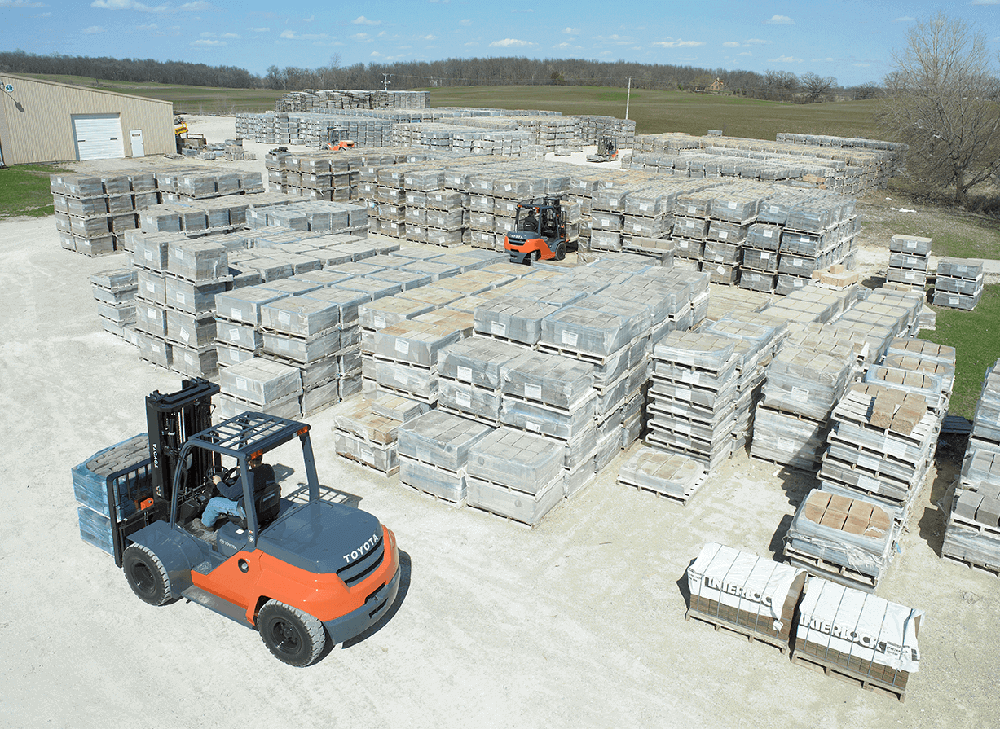

#3 Toyota Forklifts

Domain Est. 1996

Website: toyotaforklift.com

Key Highlights: Toyota Forklifts is the leader in material handling and industrial lift trucks and equipment. Learn about our solutions to maximize your warehouse ……

#4 Cat® Lift Trucks EAME

Domain Est. 1999

Website: catlifttruck.com

Key Highlights: We are one of the leading manufacturers of forklift trucks and materials handling equipment … Our range of diesel powered forklift trucks, gas powered forklift ……

#5 Forklifts

Domain Est. 1995

Website: komatsu.com

Key Highlights: Enhance your operation with high-quality, durable, high-performing forklifts from Komatsu. We combine our long history of rigorous engineering in construction ……

#6 CLARK Material Handling Company

Domain Est. 1996

Website: clarkmhc.com

Key Highlights: CLARK offers products in all five classes, including powered pallet jacks, electric standup forklifts, narrow aisle forklifts, walkie pallet stackers, order ……

#7 Forklifts & Lift Trucks

Domain Est. 1997

Website: bobcat.com

Key Highlights: Explore the extensive forklifts and lift trucks lineup of cushion tire, pneumatic tire, electric counterbalance, narrow aisle and pallet trucks and ……

#8 Mitsubishi Forklift Trucks

Domain Est. 1999

Website: mitforklift.com

Key Highlights: Our class-leading diesel and LPG forklifts trucks deliver powerful, efficient and reliable performance. Handling up to 16.0 tonnes….

#9 Taylor Forklifts: Heavy

Domain Est. 2000

Website: taylorforklifts.com

Key Highlights: Explore heavy-duty forklifts and container handling equipment from Taylor. Built for tough industries, backed by expert service, parts, and dealer support….

#10 Forklift Truck

Domain Est. 2001

Website: linde-mh.com

Key Highlights: The H20–H35 diesel and gas forklift truck is the first of Linde’s new generation of forklift trucks which is setting new standards for performance, ergonomics, ……

Expert Sourcing Insights for Diesel Forklift

H2: 2026 Market Trends for Diesel Forklifts

The global diesel forklift market in 2026 is expected to navigate a complex landscape shaped by persistent demand in specific sectors, increasing environmental pressures, and evolving technological competition. While facing headwinds from electrification trends, diesel forklifts will maintain a crucial, albeit potentially shrinking, niche, driven by distinct operational advantages.

1. Resilient Demand in Heavy-Duty and Outdoor Applications:

Diesel forklifts will continue to dominate segments requiring high power, durability, and long operational hours in challenging environments. Industries like construction, heavy manufacturing, shipping ports, lumber, and large-scale outdoor warehousing will remain primary users. Their superior torque, ability to handle heavy loads (often exceeding 10 tons), and capacity for continuous operation without lengthy recharging cycles make them irreplaceable in these settings where electric alternatives still face limitations in power density and runtime.

2. Environmental Regulations as a Key Growth Constraint:

Stringent global emissions regulations (e.g., EU Stage V, U.S. EPA Tier 4 Final) will remain the most significant challenge. Compliance necessitates advanced (and costly) after-treatment systems (DPF, SCR), increasing purchase and maintenance costs. Urban restrictions on diesel vehicle access and growing corporate sustainability mandates will accelerate the shift towards electric and alternative fuel options (like hydrogen) in indoor and city-center logistics, limiting diesel’s market expansion, particularly in Europe and North America.

3. Intensifying Competition from Electrification:

The most profound trend is the rapid advancement and adoption of battery-electric forklifts (BEV) and emerging hydrogen fuel cell forklifts. By 2026:

* BEVs: Will capture significant market share in Class I-III (counterbalance, reach trucks) and increasingly Class IV-V (higher capacity) applications, especially indoors and in multi-shift operations due to lower TCO (Total Cost of Ownership) from reduced energy and maintenance costs, zero emissions at point of use, and quieter operation. Advancements in lithium-ion (especially LFP) batteries offer faster charging, longer life, and better performance in cold storage.

* Hydrogen: While still nascent, pilot projects and infrastructure development will grow, particularly in large distribution centers seeking rapid refueling and zero emissions. This poses a long-term threat to diesel in heavy-duty, high-utilization scenarios.

4. Focus on Efficiency, Connectivity, and TCO:

To counter competition, diesel forklift manufacturers will emphasize:

* Fuel Efficiency: Continued engine optimization and hybridization trials (diesel-electric) to reduce fuel consumption and emissions.

* Telematics and IoT: Advanced fleet management systems for predictive maintenance, route optimization, driver behavior monitoring, and utilization tracking, improving operational efficiency and reducing downtime.

* Lower TCO Messaging: Highlighting reliability, durability, and lower initial investment compared to high-capacity BEVs or hydrogen, particularly for buyers prioritizing upfront cost and proven performance in harsh conditions.

5. Regional Market Divergence:

Market dynamics will vary significantly:

* Asia-Pacific (Ex-China): Markets like India, Southeast Asia, and parts of the Middle East will see relatively stronger diesel demand due to less stringent regulations (in some areas), lower fuel costs, infrastructure limitations for widespread electrification, and ongoing industrial expansion in heavy sectors.

* Europe & North America: Diesel market share will likely contract fastest due to aggressive environmental policies, carbon pricing, and rapid BEV adoption. Growth will be minimal, focused only on specific heavy-duty niches.

* Latin America & Africa: Diesel will remain dominant due to infrastructure constraints, fuel availability, and cost sensitivity, though electrification will slowly begin to penetrate.

Conclusion for 2026:

The diesel forklift market in 2026 will be characterized by consolidation and specialization. It will not disappear but will retreat into its core strongholds: heavy-duty, outdoor, high-power, and high-utilization applications where the operational demands outweigh the environmental and TCO disadvantages compared to electric options. Success will depend on manufacturers’ ability to innovate for efficiency and connectivity while navigating increasingly complex regulatory landscapes, particularly in developed economies. The overall market trajectory points towards gradual decline in share but sustained importance in specific industrial niches.

Common Pitfalls When Sourcing Diesel Forklifts (Quality and Intellectual Property)

Sourcing diesel forklifts, especially from international or unfamiliar suppliers, presents several risks related to both product quality and intellectual property (IP) protection. Avoiding these pitfalls is essential for ensuring reliable performance, long-term cost savings, and legal compliance.

Poor Build Quality and Component Reliability

One of the most frequent issues when sourcing diesel forklifts is encountering substandard build quality. Low-cost suppliers may use inferior materials, outdated manufacturing processes, or unqualified labor, leading to premature wear, frequent breakdowns, and higher maintenance costs. Critical components such as the engine, transmission, hydraulic systems, and mast structures may not meet industry durability standards, resulting in reduced operational uptime and safety hazards.

Non-Compliance with Emissions and Safety Standards

Diesel forklifts must comply with regional emissions regulations (e.g., EU Stage V, EPA Tier 4) and safety standards (e.g., ISO 3691). Sourcing from manufacturers that do not adhere to these requirements can result in legal penalties, import restrictions, and operational limitations. Buyers may unknowingly acquire machines that cannot be legally operated in their jurisdiction, leading to costly retrofits or asset write-offs.

Misrepresentation of Specifications and Performance

Some suppliers exaggerate key performance metrics such as lifting capacity, fuel efficiency, or engine power. Without independent verification or third-party testing, buyers risk purchasing forklifts that underperform in real-world conditions. This mismatch can disrupt warehouse or logistics operations and lead to unplanned equipment replacement.

Lack of Genuine Parts and After-Sales Support

Reliable access to genuine spare parts and technical support is critical for maintaining diesel forklifts. Sourcing from unauthorized or unbranded manufacturers often means limited or no after-sales service, extended downtime during repairs, and reliance on counterfeit or incompatible replacement parts. This undermines total cost of ownership and operational efficiency.

Intellectual Property Infringement Risks

Purchasing diesel forklifts that infringe on patented designs, engine technology, or branding can expose buyers to legal liability. Some suppliers produce “clone” models that closely mimic well-known brands but lack proper licensing. Importing or operating such equipment may result in customs seizures, lawsuits, or reputational damage, particularly in regions with strong IP enforcement.

Inadequate Warranty and Lack of Traceability

Many low-cost suppliers offer vague or non-enforceable warranties, making it difficult to claim repairs or replacements when defects arise. Additionally, forged or missing documentation (e.g., serial numbers, certificates of conformity) can obscure the equipment’s origin, complicating warranty validation and resale value.

Supply Chain and Counterfeit Risks

Global sourcing increases exposure to counterfeit products and unreliable distributors. Without proper due diligence, buyers may receive reconditioned or refurbished units misrepresented as new. Transparent supply chains and verified supplier credentials are essential to mitigate these risks.

By recognizing and addressing these common pitfalls—prioritizing certified suppliers, verifying compliance, and conducting thorough due diligence—organizations can ensure they source reliable, legal, and high-quality diesel forklifts that meet both operational and regulatory requirements.

Logistics & Compliance Guide for Diesel Forklifts

This guide outlines key logistics considerations and compliance requirements for the safe and legal operation, transportation, storage, and maintenance of diesel-powered forklifts in industrial and warehouse environments.

Regulatory Compliance

Ensure adherence to all applicable local, national, and international regulations. Key areas include:

– Occupational Safety and Health Administration (OSHA) standards (in the U.S.) for powered industrial trucks (29 CFR 1910.178)

– Environmental Protection Agency (EPA) emissions standards for non-road diesel engines

– Department of Transportation (DOT) regulations for transportation of equipment and fuels

– National Fire Protection Association (NFPA) codes for fuel storage and handling

– Local air quality management district rules (e.g., CARB regulations in California)

Operator Certification & Training

All operators must be formally trained and certified in accordance with OSHA or equivalent regulatory standards:

– Initial training must cover vehicle controls, operational limitations, and workplace-specific hazards

– Refresher training required every three years or after an accident or near-miss

– Certification records must be maintained on-site and available for inspection

– Only trained and authorized personnel may operate diesel forklifts

Emissions & Environmental Controls

Diesel forklifts emit pollutants and must comply with environmental standards:

– Use only EPA- or CARB-compliant diesel engines based on model year and application

– Equip with required emissions control systems (e.g., diesel particulate filters, DPFs)

– Never operate indoors unless specifically designed and equipped for indoor use with proper ventilation

– Perform regular emissions system inspections and maintenance

– Report and address any tampering or bypassing of emissions controls immediately

Fuel Handling & Storage

Safe handling and storage of diesel fuel are critical for compliance and safety:

– Store diesel in approved, labeled, and properly vented containers or tanks

– Keep fuel storage areas away from ignition sources and in well-ventilated locations

– Follow spill containment requirements (e.g., secondary containment, spill kits)

– Prohibit smoking and open flames in fueling areas

– Train personnel in fueling procedures and emergency response

– Comply with local fire code requirements for fuel quantity and storage location

Transportation & Logistics

When transporting diesel forklifts:

– Secure the forklift properly on trailers using straps or chains to prevent shifting

– Ensure transport vehicles comply with DOT size, weight, and safety regulations

– Drain fuel or secure fuel caps to prevent leaks during transit

– Transport documentation should include equipment details and safety data

– Comply with hazardous materials regulations if transporting with significant fuel onboard

Maintenance & Inspection Requirements

Implement a structured preventive maintenance program:

– Conduct pre-shift inspections (fluid levels, leaks, tire condition, lights, horn)

– Follow manufacturer-recommended service intervals for engine, transmission, and hydraulic systems

– Keep detailed maintenance logs accessible for audits

– Replace worn parts promptly (brakes, chains, hoses)

– Use only manufacturer-approved or equivalent replacement parts

Ventilation & Indoor Use Restrictions

Due to exhaust emissions, diesel forklifts have strict limitations for indoor use:

– Do not operate diesel forklifts in enclosed or poorly ventilated buildings unless equipped with certified exhaust filtration systems

– Ensure adequate ventilation (minimum air changes per hour) if limited indoor use is permitted

– Monitor air quality where diesel equipment operates near occupied areas

– Provide carbon monoxide (CO) and nitrogen dioxide (NO₂) detectors in applicable areas

Recordkeeping & Documentation

Maintain accurate and up-to-date records, including:

– Operator certification and training logs

– Equipment inspection checklists and reports

– Maintenance and repair records

– Fueling logs (recommended for tracking usage and compliance)

– Incident reports involving forklifts

– Emissions system service records (if applicable)

Decommissioning & Disposal

Dispose of end-of-life diesel forklifts responsibly:

– Properly drain and recycle fuel, engine oil, coolant, and hydraulic fluids

– Handle batteries and tires according to local hazardous waste regulations

– Recycle metal components through certified recyclers

– Retain disposal documentation for compliance audits

Following this guide ensures safe, efficient, and legally compliant operations involving diesel forklifts across the logistics lifecycle.

Conclusion for Sourcing Diesel Forklifts

After a comprehensive evaluation of operational needs, cost considerations, performance requirements, and environmental impact, sourcing diesel forklifts emerges as a practical and efficient solution for heavy-duty material handling operations, particularly in outdoor or large-scale industrial environments. Diesel-powered forklifts offer superior power, durability, and uptime, making them ideal for demanding applications involving heavy loads and rough terrain. Their ability to operate continuously with quick refueling minimizes downtime, enhancing overall productivity.

While diesel forklifts typically have higher initial costs and emissions compared to electric models, advancements in engine technology have significantly improved fuel efficiency and reduced emissions, bringing them in line with environmental regulations in many regions. Additionally, diesel forklifts require less infrastructure investment than electric alternatives, as they do not depend on charging stations or battery storage systems.

Ultimately, sourcing diesel forklifts is a strategic decision best suited for operations that prioritize power, endurance, and versatility. By partnering with reputable suppliers, ensuring proper maintenance, and adhering to emission standards, organizations can maximize the value, safety, and sustainability of their diesel forklift fleet.