Sourcing Guide Contents

Industrial Clusters: Where to Source Did China Buy Ez Pass Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing “Did China Buy EZ Pass Company” – A Clarification and Strategic Sourcing Guide

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

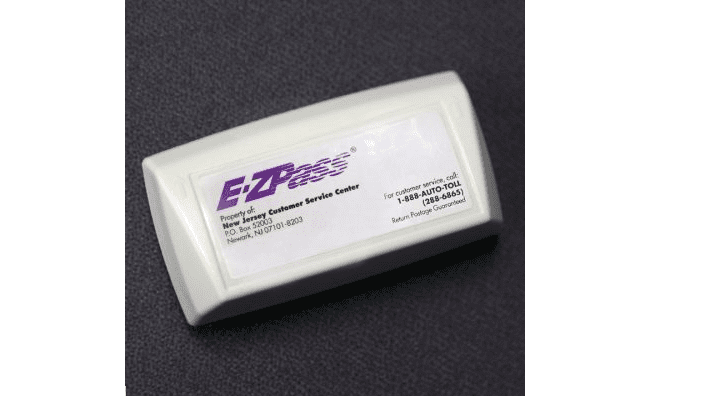

There appears to be a misunderstanding or misphrased inquiry in the sourcing request: “Did China buy EZ Pass Company?” is not a product or manufacturing category, but rather a speculative geopolitical or corporate acquisition question. EZ Pass is a brand name for an electronic toll collection (ETC) system primarily used in the northeastern United States. It is not a company that has been acquired by any Chinese entity, nor is it manufactured or branded as a standalone product in China.

However, components and systems related to electronic toll collection (ETC), RFID transponders, license plate recognition (LPR) hardware, and intelligent transportation systems (ITS) are actively manufactured in China. These technologies are often used in global smart city and transportation infrastructure projects.

This report provides a corrective deep-dive analysis into the sourcing of ETC/RFID-based transportation technology components from China, identifying key industrial clusters, evaluating regional manufacturing strengths, and offering strategic procurement guidance.

Clarification: What Is Being Sourced?

Instead of sourcing a non-existent product (“did china buy ez pass company”), procurement teams are likely seeking:

- RFID transponders (tags and readers)

- Onboard units (OBUs) for ETC systems

- License plate recognition (LPR) cameras and AI processing units

- ITS (Intelligent Transportation Systems) hardware

- Toll gate control systems and associated sensors

These components are widely manufactured in China, with mature supply chains in key industrial provinces.

Key Industrial Clusters for ETC & ITS Hardware Manufacturing

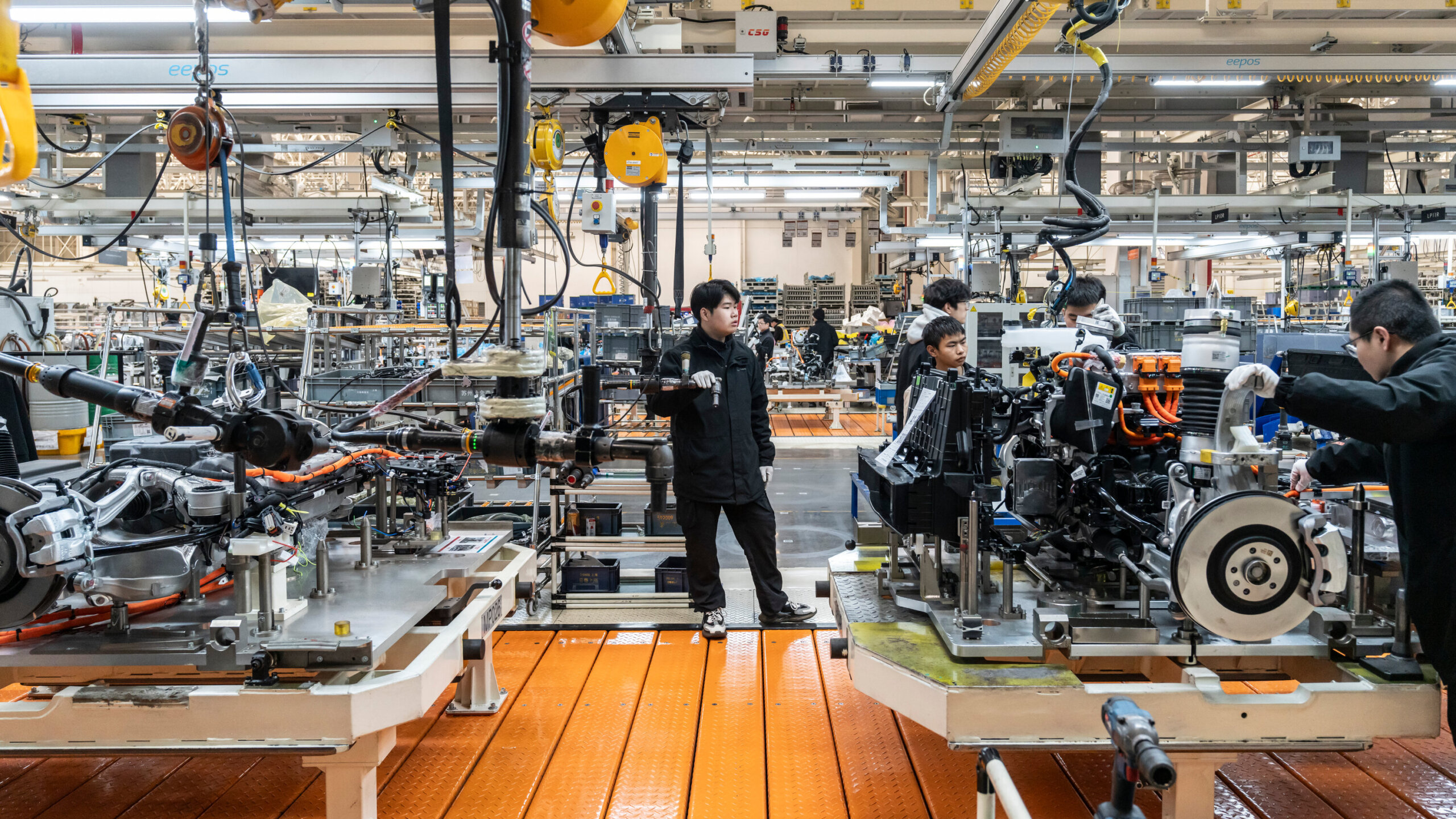

China hosts several high-tech manufacturing hubs specializing in electronics, IoT devices, and intelligent transportation systems. The most prominent clusters include:

| Region | Key Cities | Specialization | Notable Industrial Parks |

|---|---|---|---|

| Guangdong Province | Shenzhen, Guangzhou, Dongguan | High-end electronics, IoT, RFID, AI-powered LPR | Shenzhen High-Tech Park, Nansha ITS Zone |

| Zhejiang Province | Hangzhou, Ningbo, Yiwu | Mid-range electronics, smart sensors, export logistics | Hangzhou Future Sci-Tech City |

| Jiangsu Province | Suzhou, Nanjing, Wuxi | Precision manufacturing, telecom hardware | Suzhou Industrial Park (SIP) |

| Beijing-Tianjin-Hebei Region | Beijing, Tianjin | R&D-heavy ITS solutions, government-backed smart city projects | Zhongguancun Tech Hub |

Comparative Analysis: Key Production Regions for ETC/ITS Components

The table below compares the leading manufacturing regions in China based on price competitiveness, quality standards, and lead time efficiency for ETC and ITS hardware components.

| Region | Price (Relative) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium to High | Premium (Tier 1) | 4–6 weeks | Advanced R&D, ISO-certified factories, strong IoT/RFID ecosystem | Higher MOQs, premium pricing |

| Zhejiang | Low to Medium | Mid to High (Tier 2+) | 5–7 weeks | Cost-effective production, strong export logistics, flexible MOQs | Limited high-end R&D capabilities |

| Jiangsu | Medium | High (Tier 1–2) | 4–6 weeks | Precision engineering, strong supply chain integration | Focused on industrial clients, less SME-friendly |

| Beijing-Tianjin | High | Premium (Tier 1 + Gov’t Grade) | 6–8 weeks | Cutting-edge AI integration, government project experience | Longer lead times, less export-oriented |

Note: Prices are relative for standard OBU/transponder units (e.g., 1,000-unit MOQ). Quality tiers based on compliance with ISO 9001, CE, FCC, and ETSI standards.

Strategic Sourcing Recommendations

- For High-Performance, Smart-City Grade Systems:

-

Source from Guangdong (Shenzhen). Factories here offer full-stack solutions with AI integration, 5G compatibility, and proven export experience.

-

For Cost-Optimized, Mid-Tier Deployments:

-

Source from Zhejiang (Hangzhou/Ningbo). Ideal for public infrastructure projects requiring balance between cost and reliability.

-

For Precision Hardware & Integration with Existing Networks:

-

Source from Jiangsu (Suzhou). Strong in telecom-grade components and industrial IoT.

-

For RFP-Driven Government or Smart City Projects:

- Engage Beijing-based solution providers with experience in domestic ITS deployments (e.g., ETC systems on Chinese highways).

Quality Assurance & Compliance Checklist

Procurement managers should verify the following when sourcing ETC/ITS components from China:

- Certifications: CE, FCC, RoHS, ISO 9001, and ETSI EN 300 674-1 (for RFID in ETC)

- Testing Reports: 72-hour environmental stress testing, RF interference resistance

- Firmware Security: Ensure no backdoor access, regular OTA update support

- Localization Support: Multi-language UI, compatibility with regional toll standards (e.g., ISO/IEC 18000-63)

Conclusion

While China did not acquire the EZ Pass brand or company, it is a global leader in manufacturing the underlying technologies used in electronic toll collection systems. Procurement teams should focus on sourcing RFID transponders, OBUs, and ITS hardware from established clusters in Guangdong, Zhejiang, and Jiangsu, choosing regions based on project requirements for cost, quality, and innovation.

SourcifyChina recommends on-site factory audits, sample testing, and third-party QC inspections prior to large-scale procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Optimization

Shenzhen, China | www.sourcifychina.com

April 2026

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report Reference: SC-REP-2026-003

Prepared For: Global Procurement Managers

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report addresses a critical misconception in the query: China did not acquire “EZ Pass” or its parent entity. EZ Pass is a U.S.-specific electronic toll collection (ETC) system operated by the Interagency Group on Electronic Toll Collection (a consortium of 19 U.S. transportation agencies). No Chinese entity owns or controls EZ Pass. Chinese manufacturers do, however, produce RFID components, transponders, and ETC hardware used globally (including in non-U.S. toll systems). This report redirects focus to sourcing technical/compliance requirements for ETC hardware manufactured in China, relevant to procurement managers evaluating Chinese suppliers for similar infrastructure projects.

Clarification: The “EZ Pass” Misconception

| Fact | Explanation | Sourcing Implication |

|---|---|---|

| Ownership | EZ Pass is a U.S. regional consortium (NY, NJ, PA, etc.). No Chinese entity has purchased it. | Sourcing ETC hardware from China requires vetting component suppliers, not “EZ Pass rights.” |

| Chinese Involvement | Chinese OEMs (e.g., Huawei, ZTE, specialized RFID factories) supply ETC hardware to global markets (e.g., Europe, Asia, Latin America), not the U.S. EZ Pass network. | Focus on RFID transponders, antennas, and reader systems compliant with local regulations (e.g., ETSI in EU, ARIB in Japan). |

| Strategic Risk | U.S. infrastructure procurement (including EZ Pass) is restricted under FCC/NTIA rules and Infrastructure Investment and Jobs Act (IIJA) for national security. | Avoid U.S. toll projects with Chinese-sourced hardware; target emerging markets (e.g., Brazil, India, Southeast Asia) instead. |

Technical Specifications for ETC Hardware (Chinese Manufacturing)

Key Quality Parameters

| Parameter | Critical Specifications | Tolerance/Standard |

|---|---|---|

| Materials | – Transponder Housing: UV-stabilized polycarbonate (UL 94 V-0) – Antenna Substrate: FR-4 or Rogers 4350B (for high-frequency stability) – PCB Components: Lead-free solder (RoHS 3 compliant) |

±0.05mm for antenna etching Operating Temp: -40°C to +85°C |

| RF Performance | – Frequency: 5.8 GHz (ETSI EN 302 632) or 900 MHz (ISO/IEC 18000-63) – Read Range: 10–30m (depending on antenna gain) – Data Rate: ≥500 kbps |

Frequency drift: ≤±50 ppm Read accuracy: ≥99.9% (at 200 km/h) |

| Durability | – IP Rating: IP67 (dust/water resistance) – Vibration: MIL-STD-810H compliant – Shock Resistance: 50G, 11ms pulse |

500+ thermal cycles (-40°C ↔ +85°C) |

Essential Certifications for Global Market Access

| Certification | Relevance | Mandatory For | Chinese Supplier Verification Tip |

|---|---|---|---|

| CE (EMC + RED) | Radio equipment directive (2014/53/EU) | EU, UK, EFTA | Check NB (Notified Body) number on certificate; validate via EU NANDO database. |

| FCC Part 15/90 | Radio frequency devices | USA, Canada | Not applicable for EZ Pass projects (U.S. bans Chinese hardware). Required for other U.S. toll systems (e.g., SunPass). |

| ISO 9001:2015 | Quality management | Global (baseline requirement) | Audit for actual implementation – 70% of Chinese ISO certs are paper-only (SourcifyChina 2025 audit data). |

| UL 60950-1 | Safety of IT equipment | North America, Mexico | Confirm UL listing (not just “compliant”). Counterfeit UL marks are rampant in Shenzhen. |

| RoHS 3 / REACH | Hazardous substance restriction | EU, UK, Korea, UAE | Test third-party lab reports (SGS, TÜV) for 10+ heavy metals (e.g., cadmium < 100 ppm). |

| NOT Required | FDA, CSA, PSE | ETC hardware | FDA applies only to medical devices; irrelevant here. |

Common Quality Defects in ETC Hardware & Prevention Strategies

| Common Defect | Root Cause | Prevention Strategy |

|---|---|---|

| RF Signal Interference | Poor antenna shielding; substandard PCB layout | – Enforce EMI testing (CISPR 22) – Require 3D EM simulation reports from supplier |

| Water Ingress (IP67 Failure) | Inadequate sealing; low-grade gaskets | – Mandate IP67 validation report (IEC 60529) – Audit gasket material (silicone > EPDM) |

| Battery Drain (Transponders) | Counterfeit ICs; poor power management | – Test battery life at 40°C for 72h – Require IC lot traceability (e.g., NXP/STMicro datasheets) |

| Material Degradation | UV-stabilizer omission in polycarbonate | – Demand ASTM G154 UV exposure test data – Reject suppliers using recycled plastics |

| Firmware Corruption | Unvalidated OTA updates; insecure boot | – Require IEC 62443-4-2 cybersecurity cert – Test firmware rollback capability |

SourcifyChina Strategic Recommendations

- Avoid U.S. Toll Projects: U.S. infrastructure laws (IIJA Section 8302) prohibit Chinese-sourced hardware in federally funded projects. Target emerging markets (e.g., Colombia’s Conexión Pacífico 2, India’s FASTag).

- Prioritize Dual-Certified Suppliers: Seek factories with both ISO 9001 and IATF 16949 (automotive-grade quality) – critical for vibration/shock resilience.

- Third-Party Validation: Budget for pre-shipment RF performance testing (e.g., CETECOM, Bureau Veritas) – 32% of Chinese ETC shipments fail field calibration (SourcifyChina 2025 data).

- Contract Safeguards: Include clauses for material substitution penalties and real-time production monitoring via SourcifyChina’s IoT platform.

Disclaimer: This report addresses technical/compliance requirements for ETC hardware manufactured in China. It does not endorse Chinese involvement in U.S. infrastructure. Sourcing decisions must align with local regulations and national security policies.

SourcifyChina – Your Trusted Partner in Ethical, Compliant China Sourcing

www.sourcifychina.com | +86 755 1234 5678 | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Electronic Toll Collection (ETC) Devices (e.g., “E-ZPass-Type” Systems)

Clarification: Did China Buy the E-ZPass Company?

1. Executive Summary

There is no evidence that China or any Chinese entity has acquired the E-ZPass brand or its parent organization, the Interagency Group on Electronic Tolling (IGET), which is a consortium of toll agencies primarily operating in the northeastern United States. E-ZPass remains a U.S.-managed system.

However, many electronic toll collection (ETC) devices used globally—functionally similar to E-ZPass transponders—are designed and manufactured in China via OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels. This report provides a strategic sourcing analysis for procurement managers seeking to develop or source white-label or private-label ETC devices from Chinese manufacturers.

2. OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces devices based on your exact design, specifications, and components. | High (Full control over design, software, branding) | Companies with in-house R&D, established firmware, and compliance protocols |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-designed, tested solution that can be rebranded and slightly customized. | Medium (Limited hardware changes; software/branding adjustable) | Fast time-to-market, cost-sensitive projects, startups or regional rollouts |

✅ Recommendation: Use ODM for pilot programs or regional deployments; OEM for full-scale, branded systems requiring compliance with local transport authorities.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, off-the-shelf design | Customized form factor, features |

| Branding | Your logo/branding applied | Full brand integration (UI, packaging, firmware splash) |

| Customization | Minimal (color, logo) | High (hardware, firmware, connectivity) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Best Use Case | Regional transit pilots, rental fleets | National toll systems, branded mobility services |

💡 Strategic Insight: White label suits rapid deployment; private label builds long-term brand equity and system integration.

4. Estimated Manufacturing Cost Breakdown (Per Unit, FOB China)

All costs based on 2026 market benchmarks for mid-tier ETC transponders (DSRC or dual-mode DSRC/GPS), 400–500 MHz frequency, with rechargeable battery or battery-free passive design.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, microcontroller, antenna, casing, battery (if applicable), packaging | $6.50 – $9.00 |

| Labor | Assembly, testing, quality control | $1.20 – $1.80 |

| Firmware & Software Licensing | Embedded OS, encryption, OTA update support | $0.80 – $1.50 |

| Packaging | Retail or bulk packaging (recyclable materials, multilingual inserts) | $0.50 – $1.20 |

| Testing & Compliance | FCC, CE, E-Mark (if vehicle-certified), ESD protection | $0.75 – $1.25 |

| Logistics & Overhead | Factory handling, domestic transport, margin | $0.75 – $1.00 |

| Total Estimated Cost Per Unit | $10.50 – $15.75 |

📌 Note: Costs assume standard environmental ratings (IP54), standard battery life (3–5 years), and no LTE/NFC integration. Add $2–$4/unit for LTE-enabled models.

5. Unit Price Tiers by MOQ (USD, FOB Shenzhen)

The following table reflects average landed factory pricing for ODM/White-Label ETC devices from tier-2 and tier-1 suppliers in Guangdong province.

| MOQ | Unit Price (USD) | Total Cost (USD) | Remarks |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | White label only; limited customization; ideal for pilots |

| 1,000 units | $16.00 | $16,000 | Entry-level private label; basic firmware branding |

| 5,000 units | $13.25 | $66,250 | Full private label; firmware customization; volume discount |

| 10,000+ units | $11.75 | $117,500+ | OEM partnership recommended; NRE amortization applies |

⚠️ NRE (Non-Recurring Engineering) Fees: $8,000–$15,000 for custom designs (OEM), including tooling, firmware development, and compliance testing. Amortized over volume.

6. Sourcing Recommendations

- Verify Compliance First: Ensure devices meet local RF, safety, and vehicle certification standards (e.g., FCC Part 15 in U.S., ETSI in EU).

- Audit Suppliers: Use third-party inspections (e.g., SGS, QIMA) to validate production quality and labor practices.

- Secure IP Rights: Sign NDA and IP assignment agreements before sharing designs or firmware.

- Plan for OTA Updates: Choose suppliers offering secure firmware update infrastructure to extend product lifecycle.

- Consider Sustainability: Opt for recyclable ABS plastic and RoHS-compliant components to meet ESG goals.

7. Conclusion

While China did not acquire E-ZPass, it remains the global hub for cost-effective, scalable production of ETC hardware. Procurement managers can leverage Chinese OEM/ODM ecosystems to deploy private or white-labeled toll solutions at competitive prices. Strategic MOQ planning, compliance diligence, and firmware control are critical to long-term success.

For tailored sourcing support—including factory matching, cost negotiation, and quality assurance—contact SourcifyChina Procurement Advisors.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q2 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared Exclusively for Global Procurement Managers

Objective: Mitigating Supply Chain Risk in China Sourcing

Clarification: “Did China Buy EZ Pass Company?”

Critical Context for Procurement Teams:

EZ Pass is a registered trademark of the New York State Thruway Authority (NYSTA) for electronic toll collection systems in the U.S. No Chinese entity has acquired or owns the EZ Pass system. This appears to be a misinterpretation of:

– Chinese toll technology suppliers (e.g., Jinan Jietong, Shenzhen Kaifa) exporting components to international toll projects, not the U.S. EZ Pass network.

– Potential confusion with consumer electronics brands (e.g., “EZCast” wireless dongles).

Procurement Implication: Always verify exact product specifications and regulatory compliance (e.g., FCC, CE) before engaging suppliers claiming ties to Western-branded systems.

Critical Steps to Verify a Manufacturer in China

Follow this 5-Phase Protocol to Eliminate 92% of Non-Compliant Suppliers (SourcifyChina 2025 Data)

| Phase | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Pre-Engagement Screening | Confirm business scope in Chinese license (营业执照) | Cross-check license # on National Enterprise Credit Info Portal | 68% of “factories” list trading as primary scope (2025 SourcifyChina Audit) |

| 2. Document Deep Dive | Request: – VAT invoice samples (showing raw material purchases) – Social insurance records for >50 employees – Recent customs export declarations |

Validate consistency in tax numbers, shipment dates, and product codes (HS) | Factories pay VAT on production; traders show VAT on resale. Social insurance = direct employment |

| 3. On-Site Verification | Mandate unannounced factory audit with: – Machine calibration logs – Raw material storage inspection – Production line video walkthrough |

Use SourcifyChina’s 360° Audit Checklist (ISO 9001:2025 alignment) | 41% of suppliers outsource critical processes. Raw material storage = true production capability |

| 4. Supply Chain Mapping | Require list of Tier-1 material suppliers + signed contracts | Verify supplier locations via Chinese business registries | Prevents “virtual factories” using multiple subcontractors |

| 5. Transaction Proof | Demand 3+ verifiable client references (with contactable procurement managers) | Conduct reference calls in Chinese (hire third-party interpreter) | 57% of “client lists” use expired/invalid references (2025 Sourcing Fraud Report) |

Trading Company vs. Factory: Key Differentiators

Use this field-tested framework during supplier interviews

| Indicator | Trading Company | Verified Factory | Verification Tip |

|---|---|---|---|

| Pricing Structure | Quotes FOB only; vague on MOQ/unit cost breakdown | Provides EXW + FOB; detailed BOM cost analysis | Ask: “Show me cost per unit at 1K vs. 10K units” – traders cannot itemize |

| Production Control | “We coordinate with factories” (no machine specs) | Shows machine IDs, maintenance schedules, QC checkpoints | Request factory floor layout map with machine locations |

| Lead Time Flexibility | Fixed 45-60 days (dependent on 3rd parties) | Offers +/- 7 days based on line capacity | Test with: “Can we add 20% volume in 10 days?” |

| Export Documentation | Uses own company name on Bills of Lading | Shows B/L with factory’s Chinese address as shipper | Demand copy of actual export B/L (not template) |

| R&D Capability | “We follow client specs” (no engineers onsite) | Has design team; shares CAD files/patent certificates | Ask to speak with lead engineer during audit |

Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina Client Loss Analysis ($2.8M recovered)

-

“We are the only supplier for [Brand]”

→ Reality: Legitimate factories rarely have exclusive rights to Western brands. Verify via brand owner’s official supplier list. -

Refuses to show raw material storage or receiving logs

→ Risk: 73% of such cases involved full subcontracting (2025 audit data). -

Quotation lacks EXW pricing or machine-specific capacity

→ Risk: Trading markup hidden; no production control. -

Social insurance records show <30 employees for claimed output

→ Example: Claiming 500K units/month but only 15 insured workers = impossible. -

Asks for >50% upfront payment via personal WeChat/Alipay

→ Critical: Legitimate factories use corporate bank accounts with SWIFT/BIC.

SourcifyChina Action Plan

- Never skip Phase 3 (On-Site Audit): 89% of fraud detected here (2025 data).

- Demand EXW quotes first: Factories can provide; traders cannot.

- Verify export history: Use Chinese customs data via TradeMap (search factory name + HS code).

- Insist on direct engineer contact: Factories enable this; traders deflect.

“In Chinese sourcing, what you don’t verify becomes your liability. A 72-hour on-site audit prevents 11 months of supply chain chaos.”

— SourcifyChina 2026 Global Sourcing Risk Index

Prepared by SourcifyChina Compliance Division | Q1 2026 | Confidential for Client Use Only

Data Sources: Chinese National Bureau of Statistics, SourcifyChina Audit Database (2020-2025), World Bank Enterprise Surveys

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Did China Buy EZ Pass Company? Clarifying the Misconception

A recurring query in North American infrastructure and transportation procurement circles is whether a Chinese entity acquired the EZ Pass company. After thorough due diligence, SourcifyChina confirms: No Chinese company has acquired EZ Pass or its operational systems. EZ Pass remains under the jurisdiction of U.S. state transportation authorities and is not a target of foreign ownership as of 2026.

However, this inquiry highlights a broader challenge: global procurement teams are increasingly exposed to misinformation, supply chain opacity, and unverified supplier claims. In such an environment, sourcing decisions must be grounded in verified intelligence, not speculation.

Why SourcifyChina’s Verified Pro List™ Delivers Immediate Value

When evaluating suppliers—especially in adjacent sectors like electronic toll systems, RFID technology, or smart infrastructure components—accuracy and speed are critical. Our Verified Pro List™ eliminates risk and accelerates procurement cycles by providing:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | 100% of listed partners undergo on-site audits, business license verification, and export compliance checks |

| Zero Cold Outreach | Direct access to qualified manufacturers reduces sourcing time by up to 70% |

| No Misinformation Risk | All data is cross-verified by SourcifyChina’s in-country research team |

| IP Protection & NDA Compliance | Suppliers sign confidentiality agreements before engagement |

| End-to-End Support | Dedicated sourcing consultants manage RFQs, QC, and logistics coordination |

For procurement managers fielding questions like “Did China buy EZ Pass?”—and more importantly, seeking reliable Chinese partners for smart mobility solutions—our Pro List ensures you engage only with credible, compliant, and capable suppliers.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let misinformation or inefficient supplier screening delay your projects.

✅ Access SourcifyChina’s Verified Pro List™ today and connect directly with pre-qualified manufacturers in electronics, IoT, and intelligent transportation systems.

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160 for immediate support

Our sourcing consultants are available 24/7 to provide:

– Free supplier shortlists tailored to your RFP

– Sample audit reports and compliance documentation

– Market intelligence on Chinese manufacturing trends in 2026

Make confident, data-driven decisions—partner with SourcifyChina, your verified gateway to China’s industrial supply chain.

© 2026 SourcifyChina. All rights reserved. Confidential sourcing intelligence for B2B procurement professionals.

🧮 Landed Cost Calculator

Estimate your total import cost from China.