The global diaphragm seal market is experiencing robust growth, driven by increasing demand across critical industries such as pharmaceuticals, food & beverage, oil & gas, and chemical processing. According to Grand View Research, the global pressure gauge market—of which diaphragm seals are a key component—was valued at USD 2.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by the rising need for contamination-free measurement systems, harsh process environments, and stringent hygiene standards in production lines. Mordor Intelligence further projects a steady rise in demand for specialized sealing solutions, citing advancements in material technology and the expansion of industrial automation worldwide. As process reliability and safety become paramount, leading manufacturers are innovating to deliver high-performance diaphragm seals with enhanced corrosion resistance, extended service life, and compliance with international standards. In this evolving landscape, identifying the top 10 diaphragm seal manufacturers offers critical insight for engineers, procurement managers, and plant operators seeking reliable, precision-engineered solutions.

Top 10 Diaphragm Seal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Pressure

Domain Est. 1995

Website: ashcroft.com

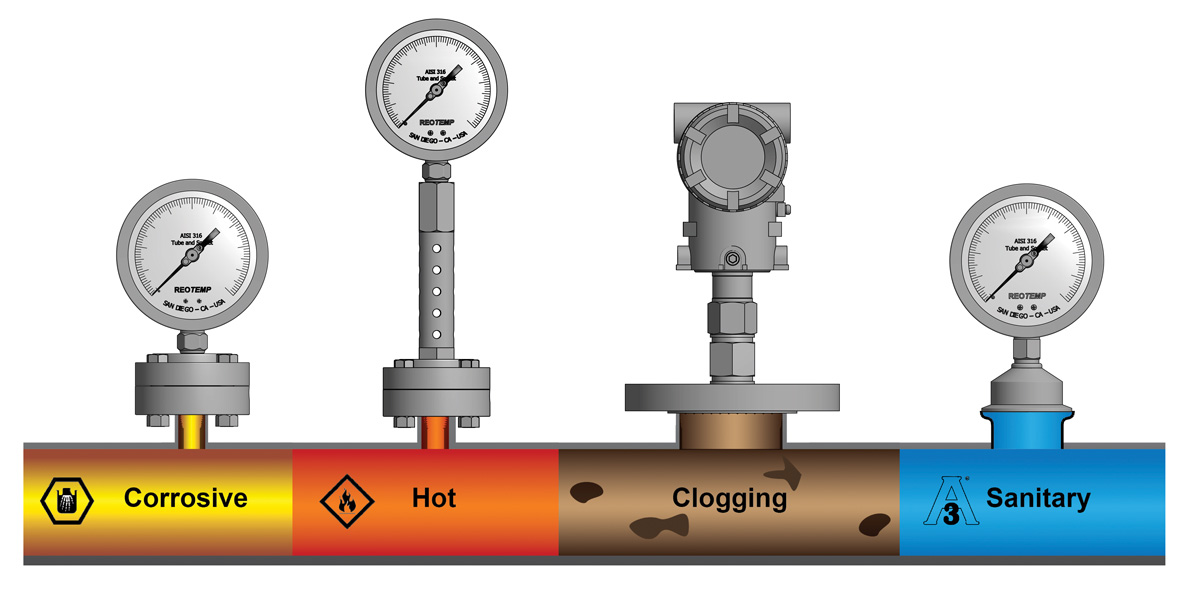

Key Highlights: Ashcroft diaphragm seals and isolation rings protect valuable instruments from potential damage caused by corrosive media or clogging from sludge or slurries….

#2 Diaphragm Seals

Domain Est. 1996

Website: reotemp.com

Key Highlights: Reotemp is the Top Choice for Diaphragm Seals Reotemp manufactures a wide range of diaphragm seals in the USA for industrial markets….

#3 Fuel Pump Rubber Diaphragm Seals

Domain Est. 1995

Website: fst.com

Key Highlights: Freudenberg Sealing Technologies has developed the diaphragm seal industry for pumps, actuators, hydro-accumulators, valves, and regulators….

#4 DiaCom Corporation

Domain Est. 1996

Website: diacom.com

Key Highlights: DiaCom manufactures fabric reinforced diaphragms, rolling diaphragms, custom diaphragms, diaphragm seals, as well as Dish Diaphragms and Double Coat ……

#5 Diaphragm seals

Domain Est. 1996

Website: wika.com

Key Highlights: WIKA diaphragm seals, mounted with pressure gauges, process transmitters, pressure switches etc., are valued for the most difficult of measuring tasks….

#6 Diaphragm Seals

Domain Est. 1996

Website: ametekusg.com

Key Highlights: We manufacture a complete line of diaphragm seals for every application. Our CNC machines can make bottoms out of 21 different materials….

#7 Type 5 All Non

Domain Est. 1997

Website: noshok.com

Key Highlights: The NOSHOK All Non-Metallic Diaphragm Seal & Pressure Transmitter/Switch assembly is ideal for water, wastewater & chemical feed applications….

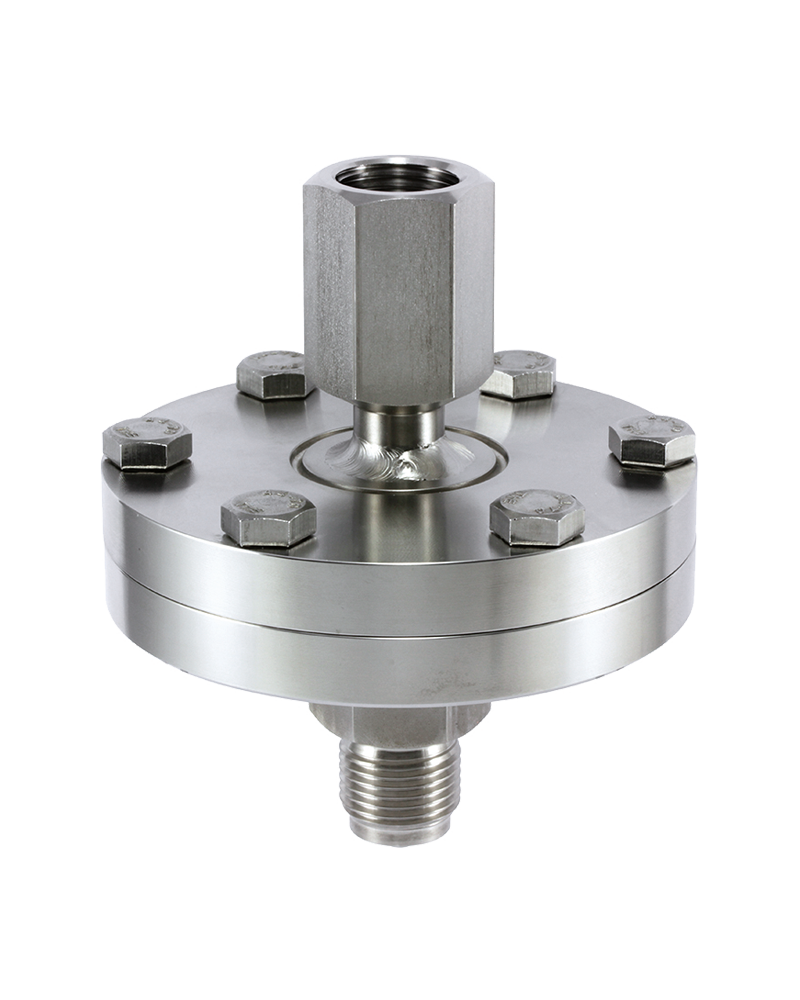

#8 Diaphragm Seals / Process-Adaption

Domain Est. 1998

Website: labom.com

Key Highlights: The diaphragm seal is suited for measuring aggressive, highly viscous media and for high process temperatures….

#9 High

Domain Est. 2000

Website: pci-instruments.com

Key Highlights: With over 25 years of experience and a state-of-the-art production facility in Britain, we manufacture diaphragm seals that deliver outstanding performance….

#10 Diaphragm Seal Assembly

Domain Est. 2012

Website: summit-instrument.com

Key Highlights: Diaphragm pressure gauges (chemical seals pressure gauge) are composed of a conventional pressure gauge, connector and a diaphragm seal….

Expert Sourcing Insights for Diaphragm Seal

H2: Projected 2026 Market Trends for Diaphragm Seals

The global diaphragm seal market is anticipated to experience steady growth by 2026, driven by increasing demand across critical industries such as pharmaceuticals, food and beverage, chemical processing, and oil & gas. Key trends shaping the market include technological advancements, rising emphasis on process safety and hygiene, and the integration of smart sensors.

-

Growing Adoption in Hygienic and Sanitary Applications

The pharmaceutical and food & beverage sectors are prioritizing contamination-free processing, leading to higher adoption of diaphragm seals with hygienic designs. Stainless steel and corrosion-resistant materials such as Hastelloy and PTFE-lined seals are gaining traction due to their compliance with FDA and EHEDG standards. -

Expansion in Chemical and Petrochemical Industries

Diaphragm seals are essential for protecting pressure measurement instruments from corrosive, viscous, or high-temperature media. In emerging economies—particularly in Asia-Pacific—rapid industrialization and investment in chemical processing plants are expected to boost demand by 2026. -

Technological Innovation and Material Advancements

Manufacturers are investing in advanced elastomers and fluoropolymers to enhance seal durability and chemical compatibility. Innovations such as multi-layer diaphragm designs and laser-welded seals are improving reliability and performance in extreme conditions, supporting market differentiation. -

Integration with Smart Instrumentation

With the rise of Industry 4.0, diaphragm seals are increasingly paired with digital pressure transmitters and IoT-enabled monitoring systems. This trend supports predictive maintenance, real-time diagnostics, and improved process efficiency, especially in smart manufacturing environments. -

Stringent Regulatory Standards and Safety Compliance

Regulatory frameworks such as ATEX, SIL, and ASME are pushing industries to adopt safer pressure measurement solutions. Diaphragm seals, which isolate sensitive instruments from hazardous process media, are becoming integral to compliance strategies, thereby accelerating market penetration. -

Regional Market Dynamics

North America and Europe will maintain strong market shares due to strict safety regulations and mature industrial infrastructure. However, the Asia-Pacific region—led by China, India, and South Korea—is expected to register the highest CAGR, fueled by industrial expansion and infrastructure development.

In conclusion, the diaphragm seal market in 2026 will be characterized by innovation, regulatory-driven demand, and regional growth disparities. Companies that focus on material science, digital integration, and application-specific solutions are likely to gain a competitive edge.

Common Pitfalls When Sourcing Diaphragm Seals (Quality, IP)

Sourcing diaphragm seals requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, safety risks, legal disputes, and increased costs. Below are key pitfalls to avoid:

Poor Material Quality and Construction

One of the most frequent issues in sourcing diaphragm seals is substandard material quality. Low-cost suppliers may use inferior elastomers or metals that degrade quickly under process conditions. For example, using a Buna-N diaphragm in high-temperature or aggressive chemical environments leads to premature failure, leaks, and inaccurate pressure readings. Additionally, inconsistent welding or bonding techniques compromise the seal’s integrity, risking leaks and contamination—especially critical in pharmaceutical or food processing applications.

Inadequate IP Due Diligence

Failing to verify intellectual property rights is a significant risk. Some suppliers may offer “compatible” or “generic” versions of branded diaphragm seals, which can infringe on patented designs or trademarks. Unauthorized replication not only exposes the buyer to legal liability but may also result in poor performance, as these copies often lack the engineering precision of original equipment manufacturer (OEM) products. Always confirm that the supplier has legitimate rights to produce and sell the design, especially when replacing OEM parts.

Misalignment with Process Requirements

A common oversight is selecting a diaphragm seal based solely on price or availability without matching it to the specific process media, temperature, pressure, and hygiene standards. For instance, using a seal with an unsuitable wetted material can cause corrosion or contamination. Similarly, choosing a seal with an IP (Ingress Protection) rating lower than required—such as IP65 instead of IP68 in washdown environments—exposes instrumentation to moisture and particulate ingress, leading to sensor failure.

Lack of Traceability and Certification

Reputable diaphragm seals should come with full traceability, including material certifications (e.g., EN 10204 3.1), test reports, and compliance with industry standards (e.g., FDA, ATEX, or 3A). Sourcing from suppliers who cannot provide these documents increases the risk of non-compliance, especially in regulated industries. Without proper documentation, proving quality during audits or troubleshooting failures becomes nearly impossible.

Insufficient Supplier Vetting

Relying on unverified suppliers, especially from online marketplaces or third-party distributors without direct manufacturer authorization, heightens the risk of receiving counterfeit or out-of-spec components. Always assess the supplier’s reputation, technical support capabilities, and after-sales service. A reliable supplier should offer application support and warranty coverage, which are often absent with low-cost or unauthorized vendors.

Avoiding these pitfalls requires thorough evaluation of both technical specifications and supplier legitimacy. Prioritizing quality, compliance, and IP integrity ensures long-term reliability and regulatory compliance in critical applications.

Logistics & Compliance Guide for Diaphragm Seals

Overview

Diaphragm seals are critical components used in pressure measurement systems to protect sensitive instruments from harsh, corrosive, viscous, or high-temperature process media. Proper logistics handling and regulatory compliance are essential to ensure product integrity, safety, and legal conformity throughout the supply chain.

Storage & Handling

Environmental Conditions

Store diaphragm seals in a clean, dry, and temperature-controlled environment. Ideal storage conditions are between 10°C and 40°C (50°F to 104°F) with relative humidity below 75%. Avoid exposure to direct sunlight, moisture, and airborne contaminants.

Packaging

Keep diaphragm seals in original manufacturer packaging until ready for use. Packaging typically includes protective caps on process and instrument connections to prevent contamination or damage. Do not remove seals or protective films prematurely.

Handling Precautions

Always handle diaphragm seals with clean gloves to prevent oil or particulate transfer. Avoid mechanical stress, impacts, or bending forces on the sealing diaphragm. Use appropriate lifting and transport equipment for bulk shipments to prevent deformation.

Transportation

Domestic & International Shipping

Ensure diaphragm seals are securely packaged in rigid containers with adequate cushioning (e.g., foam inserts) to prevent movement during transit. Label packages as “Fragile” and “Protect from Moisture.” For international shipments, comply with IATA, IMDG, or other applicable transport regulations based on accompanying materials (e.g., fill fluids).

Hazardous Fill Fluids

Some diaphragm seals contain fill fluids (e.g., silicone oil, glycerin, halogenated compounds). If the fill fluid is classified as hazardous under UN/DOT or ADR regulations, proper hazard classification, labeling, shipping documentation (e.g., SDS, dangerous goods declaration), and packaging are required. Consult the manufacturer’s Safety Data Sheet (SDS) for fluid-specific requirements.

Temperature Considerations

Avoid extreme temperatures during transit. If seals are shipped in cold environments, allow them to acclimate to room temperature before unpacking to prevent condensation.

Regulatory Compliance

Material Compliance

Ensure diaphragm seals comply with material regulations relevant to the end-use industry:

– FDA 21 CFR – For food, beverage, and pharmaceutical applications requiring food-grade wetted materials.

– EC 1935/2004 – EU regulation for materials intended to come into contact with food.

– USP Class VI – For biocompatibility in pharmaceutical and medical applications.

– REACH & RoHS – Confirm absence of restricted substances (e.g., SVHCs) in metallic or polymeric components.

Pressure Equipment Directive (PED 2014/68/EU)

If diaphragm seals are used as part of a pressure-containing assembly within the European Economic Area, verify that the assembly complies with PED. The seal may need CE marking if supplied as part of a safety accessory or integrated pressure equipment.

ATEX/IECEx (Hazardous Areas)

If used in explosive atmospheres, ensure compatibility with ATEX (EU) or IECEx (international) standards. While the diaphragm seal itself is typically non-electrical, verify that installation and associated instruments meet zone requirements (e.g., protection methods, temperature class).

Traceability & Documentation

Maintain full traceability of materials and manufacturing. Provide or retain:

– Material Test Reports (MTRs) for wetted parts (e.g., 316L stainless steel, Hastelloy).

– Certificate of Conformance (CoC) or Inspection Certificate (e.g., ISO 9001).

– Unique serial or batch numbers for quality tracking.

Import & Export Requirements

Customs Classification

Diaphragm seals are typically classified under HS Code 9026.20 (Instruments and apparatus for measuring or checking pressure). Verify country-specific tariff codes and import duties.

Export Controls

Check for ITAR, EAR, or other export restrictions if seals contain controlled materials or are destined for embargoed regions. Most standard diaphragm seals are not subject to strict controls, but verify with the manufacturer.

Documentation

Prepare commercial invoice, packing list, and bill of lading/air waybill. Include technical specifications (material, size, pressure rating) to support customs clearance. For regulated industries, additional conformity declarations may be required.

Installation & End-Use Compliance

Industry-Specific Standards

Ensure installation and use adhere to relevant standards:

– ASME B40.100 – For pressure gauge and seal mounting in process industries.

– GMP (Good Manufacturing Practice) – In pharmaceutical settings, ensure cleanability and documentation.

– Hygienic Design (e.g., 3-A, EHEDG) – For dairy and biotech applications requiring smooth surfaces and crevice-free construction.

Leak Testing & Calibration

After installation, verify system integrity through pressure testing. Calibrate the transmitter or gauge per manufacturer instructions, accounting for fill fluid properties and elevation effects.

Disposal & Environmental Responsibility

End-of-Life Management

Dispose of diaphragm seals in accordance with local environmental regulations. If the unit contains hazardous fill fluids, handle as hazardous waste. Recycle metallic components (e.g., stainless steel) through certified recyclers.

Waste Classification

Refer to SDS and local waste codes (e.g., EPA, EWC) to determine proper disposal methods. Do not incinerate unless permitted due to potential release of toxic fumes from certain fill fluids.

Summary

Proper logistics and compliance for diaphragm seals involve careful attention to storage, transport conditions, regulatory standards, and documentation. Adhering to these guidelines ensures operational safety, legal compliance, and product reliability across industries such as oil & gas, pharmaceuticals, food processing, and chemical manufacturing. Always consult the manufacturer’s technical and safety documentation for product-specific requirements.

Conclusion for Sourcing Diaphragm Seals

In conclusion, sourcing diaphragm seals requires a comprehensive evaluation of application requirements, material compatibility, industry standards, and supplier reliability. Diaphragm seals play a critical role in protecting pressure measurement instruments from corrosive, viscous, or high-temperature media, ensuring accurate readings and extending equipment lifespan. When selecting a supplier, it is essential to prioritize quality, customization capabilities, regulatory compliance (such as CE, ATEX, or FDA), and technical support.

Opting for reputable manufacturers or distributors with proven experience in the relevant industry—whether chemical processing, pharmaceuticals, food and beverage, or oil and gas—helps ensure the diaphragm seals meet both performance and safety standards. Additionally, considering total cost of ownership, including installation, maintenance, and longevity, rather than just initial price, leads to more cost-effective and reliable solutions.

Ultimately, a well-informed sourcing strategy for diaphragm seals enhances system integrity, operational efficiency, and process safety, contributing to long-term success in critical industrial applications.