The global centrifugal pump market is experiencing robust growth, driven by rising demand across industrial, municipal, and commercial applications. According to a report by Mordor Intelligence, the market was valued at USD 54.8 billion in 2023 and is projected to reach USD 75.6 billion by 2029, growing at a CAGR of approximately 5.5% during the forecast period. Similarly, Grand View Research estimates a CAGR of 5.4% from 2024 to 2030, underpinned by expanding infrastructure, increasing water treatment initiatives, and heightened industrial automation. Amid this growth, Diagram-type centrifugal pumps—known for their reliability, energy efficiency, and performance in high-pressure applications—have gained traction in sectors such as water supply, HVAC, and industrial processing. This rising demand has positioned a select group of manufacturers at the forefront of innovation and market share. Below is an overview of the top four Diagram centrifugal pump manufacturers leading the industry through technological advancement, global reach, and proven performance.

Top 4 Diagram Centrifugal Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Centrifugal pumps

Domain Est. 1997

Website: michael-smith-engineers.co.uk

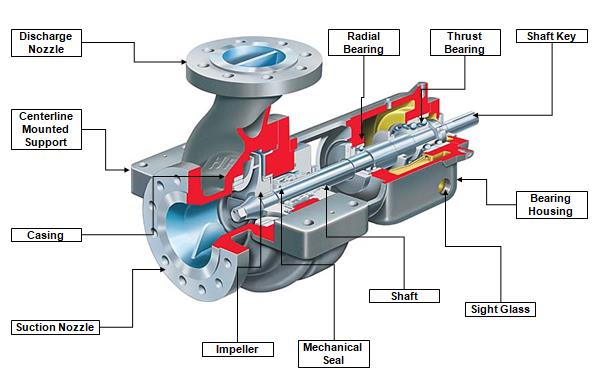

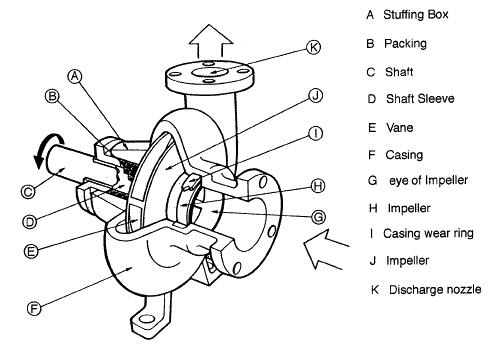

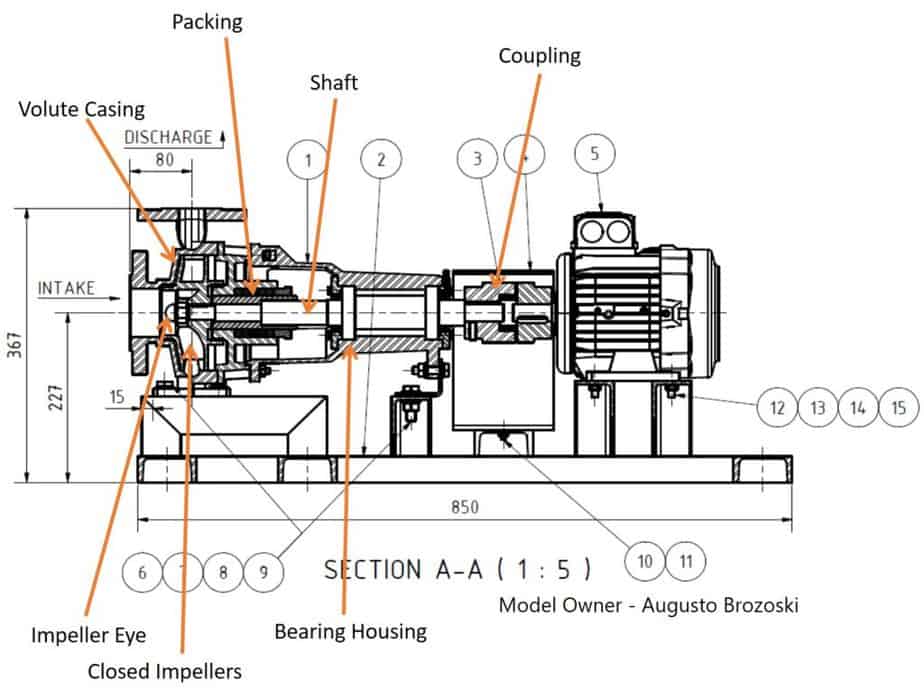

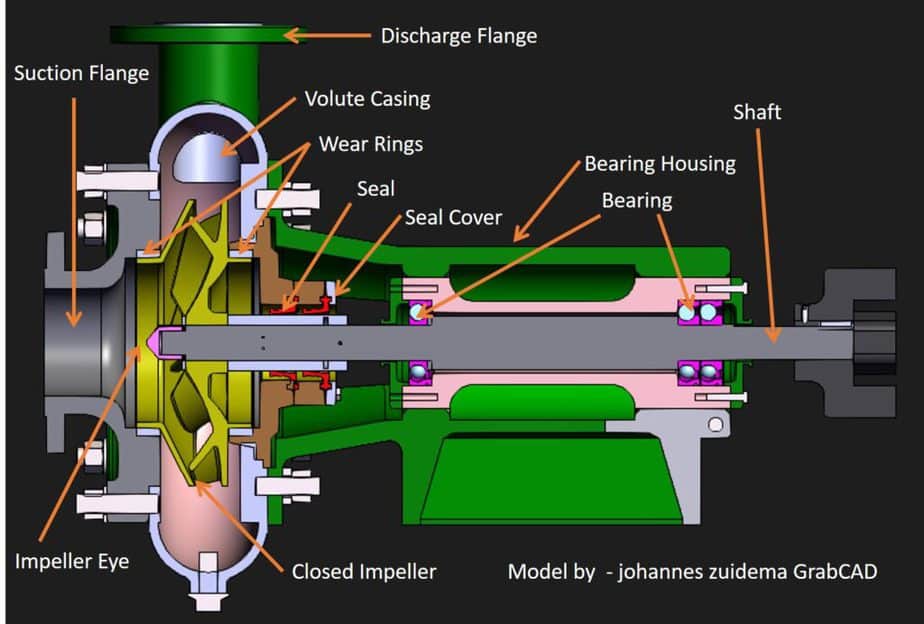

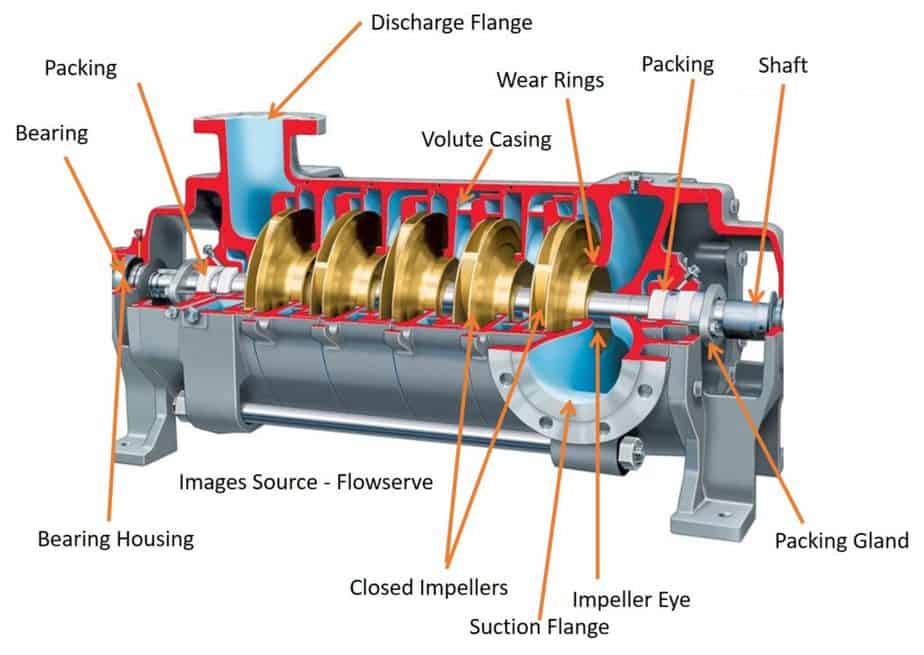

Key Highlights: Diagram of diffuser case centrifugal pump. What are the main features of a centrifugal pump? There are two main families of pumps: centrifugal and positive ……

#2 Centrifugal Pumps

Domain Est. 1997

Website: dxpe.com

Key Highlights: Centrifugal Pump Diagram. Centrifugal-Pump-diagram. The diagram above shows the essential components of any standard ……

#3 178 Series Centrifugal Pump Diagram

Domain Est. 2006

Website: holeproducts.com

Key Highlights: 178 Series Centrifugal Pump Diagram. Item Part# Description Price Qty 1 5300110 178 Series Centrifugal Pump Standard Form MS – 3″x 4″ x 13″ Log in to see price….

#4 Centrifugal Pump Parts

Domain Est. 2021

Website: kingdapump.com

Key Highlights: The centrifugal pump diagram below shows the main spare parts of the centrifugal pump. This diagram gives you a general idea of the ……

Expert Sourcing Insights for Diagram Centrifugal Pump

2026 Market Trends for Centrifugal Pumps

The global centrifugal pump market is poised for significant evolution by 2026, driven by technological innovation, sustainability imperatives, and shifting industrial demands. Key trends shaping the market include:

1. Accelerated Digitalization and Smart Pumping Systems

By 2026, the integration of IoT sensors, predictive maintenance algorithms, and cloud-based monitoring platforms will become standard in centrifugal pumps. Smart pumps will enable real-time performance tracking, energy usage optimization, and remote diagnostics, reducing downtime and operational costs—particularly in water treatment, oil & gas, and industrial manufacturing sectors.

2. Strong Emphasis on Energy Efficiency and Sustainability

Regulatory pressures and rising energy costs will drive demand for high-efficiency centrifugal pumps compliant with international standards like MEI (Minimum Efficiency Index). Manufacturers will prioritize designing pumps with optimized hydraulic profiles, variable frequency drives (VFDs), and eco-friendly materials to reduce carbon footprints and meet ESG goals.

3. Growth in Water and Wastewater Infrastructure Investment

Urbanization and aging infrastructure, especially in emerging economies, will fuel demand for reliable pumping solutions. Governments and municipalities are expected to increase spending on water supply, sewage treatment, and desalination projects—key applications for centrifugal pumps—boosting market expansion through 2026.

4. Rising Adoption in Renewable Energy and Green Technologies

Centrifugal pumps will see increased use in renewable energy systems, including geothermal plants, solar thermal installations, and green hydrogen production facilities. These applications require durable, corrosion-resistant pumps capable of handling diverse fluids under variable conditions, creating new growth avenues.

5. Regional Market Shifts and Localization Trends

Asia-Pacific, led by China and India, will remain the fastest-growing region due to industrialization and infrastructure development. Meanwhile, North America and Europe will focus on retrofitting existing systems with energy-efficient models. Supply chain resilience will encourage localization of manufacturing to reduce lead times and tariffs.

6. Advancements in Materials and Pump Design

Innovations in composite materials, coatings, and additive manufacturing will enhance pump durability, especially in corrosive or abrasive environments. Compact, modular designs will gain traction for ease of installation and maintenance in space-constrained applications.

In summary, the 2026 centrifugal pump market will be defined by intelligence, efficiency, and sustainability, with digital integration and environmental compliance serving as critical differentiators for manufacturers and end-users alike.

Common Pitfalls When Sourcing a Centrifugal Pump Diagram (Quality and IP)

Sourcing a centrifugal pump diagram may seem straightforward, but overlooking key aspects related to quality and intellectual property (IP) can lead to significant downstream issues. Being aware of these common pitfalls helps ensure you obtain accurate, reliable, and legally compliant documentation.

Inadequate Diagram Quality

One of the most frequent problems is obtaining diagrams that lack the necessary clarity and precision for effective use. Low-quality diagrams—such as blurry images, poorly scanned documents, or outdated versions—can lead to misinterpretation during installation, maintenance, or troubleshooting. Diagrams missing critical details like dimensions, material specifications, or flow directions reduce their practical value. Always verify that the diagram is sourced from an official manufacturer’s manual or technical documentation, and confirm it matches the exact pump model and configuration.

Use of Unverified or Unofficial Sources

Relying on third-party websites, forums, or unofficial PDF repositories increases the risk of accessing inaccurate or manipulated diagrams. These sources may host outdated revisions, generic representations not specific to your pump, or diagrams altered without proper engineering oversight. Such inaccuracies can result in incorrect spare part ordering, improper assembly, or safety hazards. Prioritize sourcing diagrams directly from the original equipment manufacturer (OEM) or authorized distributors to ensure authenticity and reliability.

Intellectual Property (IP) Violations

Using or distributing centrifugal pump diagrams without proper authorization can infringe on the manufacturer’s intellectual property rights. Many technical diagrams are protected by copyright and should not be shared, modified, or used commercially without permission. Sourcing diagrams from pirated or illegally shared repositories exposes your organization to legal risks, including fines or litigation. Always ensure that your use of the diagram complies with licensing agreements and that you have the right to access and utilize the content for your intended purpose.

Lack of Version Control

Using an obsolete or superseded diagram version is a subtle but serious pitfall. Pump designs evolve, and older diagrams may not reflect current configurations, component layouts, or safety features. Without proper version control—such as checking revision numbers, dates, or update logs—teams risk working with outdated information. Always confirm the diagram’s revision status and cross-reference it with the pump’s serial number or service bulletin to ensure alignment with the actual equipment.

Logistics & Compliance Guide for Centrifugal Pump

This guide outlines the key logistical considerations and compliance requirements for the safe and efficient handling, transportation, storage, and operation of centrifugal pumps. Proper adherence ensures product integrity, personnel safety, and regulatory compliance.

Packaging and Handling

Centrifugal pumps must be packaged to withstand transportation stresses and environmental exposure. Use robust wooden crates or heavy-duty cardboard with internal foam or wooden supports to secure the unit and prevent movement. All flanges, ports, and shafts must be capped or plugged to prevent contamination and damage. Lifting should only be performed using designated lifting lugs or slings—never by motor, couplings, or piping connections. Always follow the manufacturer’s handling instructions and weight distribution guidelines.

Transportation Requirements

Transport centrifugal pumps on flatbed trucks or enclosed trailers, ensuring secure strapping to prevent shifting. Protect units from moisture, extreme temperatures, and direct sunlight during transit. For international shipments, comply with international transport regulations (e.g., IMDG for sea, IATA for air if applicable). Properly label packages with “Fragile,” “This Side Up,” and handling orientation indicators. Documentation, including packing lists and shipping manifests, must accompany the shipment.

Storage Conditions

Store centrifugal pumps in a clean, dry, and temperature-controlled indoor environment. Avoid exposure to corrosive atmospheres, dust, and moisture. Units should be stored horizontally or as specified by the manufacturer to prevent shaft deformation. Flange covers must remain in place. For long-term storage (over 6 months), follow manufacturer-prescribed preservation procedures, which may include shaft rotation at regular intervals and protective coating of internal components.

Import/Export Compliance

Ensure compliance with all relevant import and export regulations, including customs documentation, export control classifications (e.g., ECCN under EAR), and certification requirements. Verify that the pump meets destination country standards (e.g., CE for EU, UL/cUL for North America). Provide accurate Harmonized System (HS) codes and commercial invoices. Restricted materials or dual-use technologies may require special licensing.

Regulatory and Safety Standards

Centrifugal pumps must comply with applicable industry and safety standards, such as:

– ISO 5199: Specification for centrifugal pumps.

– API 610: Standard for petroleum, petrochemical, and natural gas industries.

– CE Marking: Compliance with EU Machinery Directive and Pressure Equipment Directive (PED), if applicable.

– ASME B73.1: Specification for chemical process pumps.

Documentation such as Declaration of Conformity, test reports, and material certifications must be maintained.

Environmental and Disposal Compliance

Adhere to environmental regulations regarding the use of lubricants, sealants, and materials (e.g., REACH, RoHS). During decommissioning or disposal, follow local and international waste management protocols for metal, plastics, and hazardous substances. Recycling components where possible supports sustainability goals and regulatory compliance.

Documentation and Traceability

Maintain complete documentation for traceability and compliance audits, including:

– Bill of Materials (BOM)

– Manufacturing and test records

– Certificates of Conformity and Material

– Shipping and customs documents

– Installation and operation manuals

Ensure all documentation is accurate, up-to-date, and accessible to relevant stakeholders throughout the pump’s lifecycle.

Conclusion for Sourcing Diagram of a Centrifugal Pump:

The sourcing diagram for a centrifugal pump provides a comprehensive overview of the supply chain and procurement process for its various components, including the impeller, casing, shaft, bearings, seals, and motor. By analyzing this diagram, it becomes evident that effective sourcing involves selecting reliable suppliers for raw materials and sub-assemblies, ensuring quality control, cost-efficiency, and timely delivery. A well-structured sourcing strategy enhances pump performance, reliability, and lifecycle while minimizing downtime and maintenance costs. Ultimately, strategic sourcing supported by a clear diagram enables manufacturers to optimize production, maintain competitiveness, and meet industry standards and customer expectations in diverse applications such as water treatment, HVAC, and industrial processing.