The demand for deionized (DI) water filtration systems has surged in recent years, driven by stringent quality standards in industries such as pharmaceuticals, electronics, power generation, and biotechnology. According to Grand View Research, the global water purification and filtration market was valued at USD 84.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. A key contributor to this growth is the rising need for high-purity water, where DI systems play a critical role by removing ionic impurities through ion exchange processes. Mordor Intelligence further underscores this trend, noting that increasing industrialization, coupled with growing concerns over water quality and regulatory compliance, is accelerating investments in advanced water treatment technologies. As the market expands, manufacturers of DI water filtration systems are innovating to deliver more efficient, scalable, and sustainable solutions. This evolving landscape has given rise to a competitive field of leading players shaping the future of high-purity water production.

Top 10 Di Water Filtration Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Deionized Ultrapure Water Systems

Domain Est. 1994

Website: meco.com

Key Highlights: Explore our custom ultrapure water system solutions for DI water and lab water, tailored for high-purity applications in the life sciences industry….

#2 Water Purification

Domain Est. 1995

Website: parker.com

Key Highlights: Parker is serving the world as a dependable source of clean water by using high performance technology within watermakers, desalination, and reverse osmosis ……

#3 Puretec Industrial Water

Domain Est. 2004

Website: puretecwater.com

Key Highlights: Puretec Industrial Water provides water treatment equipment and services, including deionized water, soft water services, and reverse osmosis systems….

#4 Hydronix

Domain Est. 2010

Website: hydronixwater.com

Key Highlights: Hydronix Water Technology is a leading supplier of conventional and innovative products used worldwide for water filtration, purification and separation….

#5 Kinetico.com

Domain Est. 1996

Website: kinetico.com

Key Highlights: Kinetico water filters and systems will eliminate impurities, restoring your water to its most pure state….

#6 ResinTech

Domain Est. 1996

Website: resintech.com

Key Highlights: ResinTech has been a global leader in the field of ion exchange for water purification since its founding in 1986….

#7 Lab Water Purification Systems

Domain Est. 1996

Website: sartorius.com

Key Highlights: Arium laboratory water purification systems for production of pure and/or ultrapure water. All instruments can be customized to meet your specifications….

#8 REsys Incorporated

Domain Est. 1998 | Founded: 1995

Website: resysinc.com

Key Highlights: Founded in 1995, REsys Incorporated has been providing high-quality manufacturing services for over 25 years….

#9 Deionized Water Systems

Domain Est. 2003

Website: uswatersystems.com

Key Highlights: Free delivery over $199Find the best deionized water system or high purity water system for your needs from US Water Systems. Get systems for reefkeeping lab manufacturing and more…

#10 Water Filtration Products Catalog

Domain Est. 2004

Website: purewaterproducts.com

Key Highlights: Online Product Catalog featuring reverse osmosis, countertop water filters, undersink filters, shower filters, ultraviolet purifiers, water filter replacement ……

Expert Sourcing Insights for Di Water Filtration

H2: 2026 Market Trends for DI Water Filtration

The market for Deionized (DI) water filtration systems is poised for significant transformation by 2026, driven by technological advancements, rising industrial demands, and increasing regulatory standards for water purity. The following analysis outlines key trends shaping the DI water filtration sector in 2026:

1. Rising Demand in High-Tech and Healthcare Sectors

The semiconductor, pharmaceutical, and biotechnology industries are expected to be primary growth drivers for DI water filtration. With the global expansion of semiconductor manufacturing—especially in regions like Asia-Pacific and North America—demand for ultrapure water with near-zero ion content is escalating. By 2026, stricter quality control standards in drug manufacturing and lab research will further boost the need for reliable DI systems.

2. Integration with Smart and IoT-Enabled Systems

DI water systems are increasingly being integrated with Internet of Things (IoT) technologies. By 2026, smart monitoring systems will enable real-time tracking of water quality, resin exhaustion, and system performance. Predictive maintenance powered by AI algorithms is expected to reduce downtime and operational costs, making DI systems more efficient and user-friendly across industrial and commercial applications.

3. Emphasis on Sustainability and Regenerable Systems

Environmental concerns are pushing manufacturers to develop more sustainable DI solutions. Trends in 2026 will favor hybrid systems that combine reverse osmosis (RO) with DI, reducing resin waste and energy consumption. Additionally, there will be a growing market for regenerable or electro-deionization (EDI) systems, which minimize chemical use and offer continuous operation, aligning with corporate sustainability goals.

4. Growth in Emerging Markets

Developing economies in Southeast Asia, India, and Latin America are investing heavily in industrial infrastructure and healthcare facilities, leading to increased adoption of DI water systems. Government initiatives to improve water quality standards and expand manufacturing capabilities will accelerate market penetration in these regions.

5. Consolidation and Innovation Among Key Players

The global DI water filtration market is likely to see increased consolidation, with major players acquiring niche technology firms to enhance product portfolios. Innovation will focus on compact, modular systems for decentralized applications and portable DI units for field use in laboratories and emergency medical settings.

6. Regulatory Pressure and Standardization

By 2026, tightening regulations around water quality in food & beverage, power generation, and healthcare will require higher compliance with international standards (e.g., ASTM, USP, ISO). This will drive investment in certified DI systems and create opportunities for vendors offering validated and auditable filtration solutions.

Conclusion

The DI water filtration market in 2026 will be characterized by technological sophistication, sustainability, and expanded industrial applications. Companies that invest in smart, eco-friendly, and scalable solutions will be best positioned to capitalize on the growing demand across critical industries.

Common Pitfalls Sourcing Deionized Water Filtration Systems (Quality & Intellectual Property)

Sourcing deionized (DI) water filtration systems requires careful evaluation beyond just price and specifications. Overlooking critical quality and intellectual property (IP) aspects can lead to significant operational, compliance, and financial risks. Here are key pitfalls to avoid:

Overlooking Water Quality Specifications and Validation

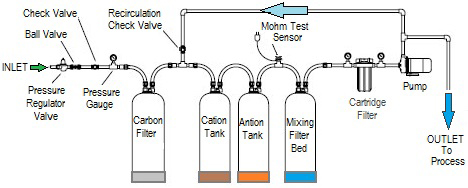

One of the most critical errors is failing to ensure the system consistently delivers water meeting your exact purity requirements. DI water quality is defined by parameters like resistivity (typically 1-18.2 MΩ·cm), total organic carbon (TOC), and specific ion concentrations. Pitfalls include:

- Assuming “DI” Means Sufficient Purity: “Deionized” is a broad term. A system labeled as DI might only achieve 1 MΩ·cm, while your application (e.g., pharmaceutical manufacturing, semiconductor rinsing) might require 18.2 MΩ·cm. Always specify the required resistivity, TOC limits, and specific ion rejection rates.

- Ignoring Feed Water Quality Variability: DI system performance heavily depends on the quality of the incoming water (feed water). Sourcing a system without analyzing your specific feed water (hardness, silica, organics, chlorine/chloramines) can lead to premature resin exhaustion, reduced output quality, and unexpected maintenance. Ensure the supplier designs the system (pre-treatment stages like RO, activated carbon) based on your feed analysis.

- Neglecting Validation and Documentation: Industries like pharma, biotech, and electronics require rigorous validation (IQ/OQ/PQ – Installation, Operational, Performance Qualification). Sourcing from a supplier unable or unwilling to provide comprehensive validation protocols, calibration records, and material certifications (e.g., FDA CFR 21, USP <1231>, ASTM D1193) creates significant compliance hurdles and delays.

Underestimating Total Cost of Ownership (TCO) and Maintenance

Focusing solely on the initial purchase price is a major pitfall. DI systems have ongoing costs that significantly impact TCO:

- Hidden Costs of Consumables: Resin beds (cationic and anionic) have finite lifespans and need periodic replacement or regeneration. Sourcing systems with proprietary, expensive, or hard-to-source resins dramatically increases long-term costs. Understand the expected resin life, regeneration requirements (chemical costs, labor), and availability/cost of replacement cartridges or resin.

- Maintenance Complexity and Downtime: Systems requiring specialized tools, complex procedures, or hard-to-find proprietary parts lead to longer downtimes and higher service costs. Evaluate the ease of maintenance, availability of service manuals, and local technical support.

- Energy and Water Consumption: Some DI systems, especially those integrated with high-pressure RO pre-treatment, consume significant energy and water (for regeneration or RO reject). Factor in utility costs over the system’s lifespan.

Ignoring Intellectual Property (IP) and Proprietary Lock-in

IP issues can create dependency and limit future flexibility:

- Proprietary Cartridges and Resins: Many suppliers use proprietary cartridge designs or resin formulations that only they supply. This creates vendor lock-in, eliminating negotiation power and potentially leading to exorbitant replacement part costs. Sourcing systems using standard, industry-available resins (e.g., mixed bed, specific ion exchange types) offers more supplier choice and competitive pricing.

- Proprietary Monitoring and Control Systems: Systems with closed-loop software, unique sensors, or non-standard communication protocols can be difficult and expensive to integrate, maintain, or troubleshoot without the original supplier. This limits your ability to perform in-house repairs or switch service providers.

- Lack of Transparency on Resin Composition: Suppliers may treat resin formulations as trade secrets. While understandable, a complete lack of information about resin type (e.g., strong acid cation, strong base anion) or regeneration chemistry can hinder troubleshooting, environmental compliance (waste disposal), and future sourcing decisions. Seek suppliers willing to provide basic technical data sheets (TDS) without revealing proprietary secrets.

Inadequate Supplier Due Diligence and Support

Choosing a supplier based on price alone, without evaluating their reliability and support structure, is risky:

- Questionable Quality Control: Assess the supplier’s manufacturing quality standards (e.g., ISO 9001 certification), material sourcing, and testing procedures. Poorly manufactured housings, valves, or sensors lead to leaks, failures, and contamination.

- Lack of Technical Expertise: Ensure the supplier has engineers who understand water chemistry and can provide application-specific advice, not just salespeople. Poor design based on incorrect assumptions leads to system failure.

- Unreliable After-Sales Support: Evaluate the availability and responsiveness of technical support, spare parts inventory (especially critical for proprietary parts), and service engineers. Delays in getting support can halt production.

- Unclear Warranty and Service Terms: Scrutinize warranty coverage (parts, labor, duration) and the terms of any service contracts. Ambiguous terms can lead to unexpected charges.

By proactively addressing these pitfalls related to water quality validation, total cost of ownership, intellectual property/proprietary lock-in, and supplier reliability, you can make a more informed sourcing decision, ensuring your DI water filtration system delivers reliable, compliant, and cost-effective performance over its entire lifecycle.

Logistics & Compliance Guide for Deionized (DI) Water Filtration Systems

Overview and Purpose

This guide outlines the key logistics considerations and compliance requirements for the transportation, installation, operation, and maintenance of Deionized (DI) Water Filtration Systems. Adherence to these guidelines ensures operational efficiency, regulatory compliance, and safety across all stages of the system’s lifecycle.

Regulatory Compliance Requirements

Environmental Regulations

DI water systems must comply with local, state, and federal environmental protection standards. Disposal of spent ion exchange resins and waste rinse water may be regulated under environmental codes such as the U.S. Environmental Protection Agency (EPA) Resource Conservation and Recovery Act (RCRA). Confirm whether spent resins are classified as hazardous waste and follow proper disposal protocols, including manifesting and documentation.

Water Quality Standards

DI water used in pharmaceutical, laboratory, and semiconductor applications must meet industry-specific water purity standards such as ASTM D1193 Type I, USP Purified Water, or ISO 3696. Maintain documented proof of compliance through regular water testing and system validation reports.

Electrical and Safety Codes

Installation must comply with the National Electrical Code (NEC) and local building codes. Ensure that all electrical components are properly grounded and that systems are equipped with emergency shutoffs where applicable. Follow OSHA guidelines for workplace safety during operation and maintenance.

Shipping and Handling Logistics

Packaging and Transportation

DI water systems should be shipped in secure, moisture-resistant packaging to prevent damage during transit. Use wooden crates or reinforced pallets for larger units. Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” indicators. Coordinate with freight carriers experienced in handling sensitive laboratory or industrial equipment.

Receiving and Inspection

Upon delivery, inspect all components for visible damage. Verify that the shipment matches the purchase order and packing list. Document any discrepancies immediately and notify the supplier. Store components in a dry, temperature-controlled environment until installation.

Installation and Site Preparation

Facility Requirements

Ensure the installation site meets minimum requirements, including adequate flooring load capacity, access to water supply and drainage, proper ventilation, and proximity to electrical outlets. Maintain sufficient clearance around the unit for maintenance access.

Utility Connections

Connect the system to a consistent supply of feed water (typically RO or municipal water) meeting specified pressure and quality parameters. Ensure drain lines are properly sloped and connected to an approved waste disposal system. Electrical connections must be performed by a licensed electrician in accordance with local codes.

Operational Compliance and Maintenance

Standard Operating Procedures (SOPs)

Develop and implement SOPs for system startup, shutdown, routine operation, and emergency response. Train all operators on these procedures and maintain training records.

Preventive Maintenance

Perform scheduled maintenance as recommended by the manufacturer, including resin bed replacement, filter changes, and sensor calibration. Keep a maintenance log documenting all servicing activities, including dates, personnel, and parts used.

Monitoring and Validation

Continuously monitor key parameters such as resistivity (typically ≥18.2 MΩ·cm at 25°C), flow rate, and pressure. Conduct periodic system validation and performance qualification (PQ) tests, especially in regulated industries. Retain records for audit purposes.

Waste Management and Disposal

Spent Resin Disposal

Spent ion exchange resins may contain absorbed contaminants and require special handling. Partner with licensed waste management companies for proper disposal or regeneration. Maintain manifests and disposal certificates for compliance audits.

Wastewater Discharge

Ensure reject water (from RO pre-treatment or resin regeneration) is discharged in accordance with local wastewater regulations. Neutralize pH if necessary and test effluent for contaminants before discharge.

Documentation and Recordkeeping

Compliance Documentation

Maintain a compliance file including system manuals, calibration certificates, validation reports, maintenance logs, training records, and waste disposal documentation. These records may be required during regulatory audits.

Change Control

Implement a formal change control process for any modifications to the system, including component replacements or process changes. Document justifications, approvals, and impact assessments.

Conclusion

Effective logistics and compliance management for DI water filtration systems minimizes operational risks, ensures regulatory adherence, and supports consistent production of high-purity water. Regular review of this guide and alignment with evolving standards are essential for sustained compliance.

Conclusion for Sourcing DI Water Filtration:

Sourcing a reliable deionized (DI) water filtration system is a critical decision for industries requiring high-purity water, such as pharmaceuticals, laboratories, electronics manufacturing, and power generation. After evaluating various vendors, technologies, and system configurations, it is evident that the optimal solution must balance water quality, operational efficiency, scalability, and total cost of ownership.

A successful sourcing strategy involves selecting a supplier with proven expertise, adherence to quality standards (such as ISO, USP, or ASTM), and the ability to provide customized solutions based on specific water feed conditions and production needs. Factors such as resin regeneration methods (disposable vs. regenerable), system automation, maintenance requirements, and service support play a significant role in long-term performance.

Ultimately, investing in a high-quality DI water filtration system from a reputable supplier ensures consistent water purity, minimizes downtime, supports regulatory compliance, and contributes to overall process reliability. A thorough evaluation and strategic partnership with the right provider will deliver both technical and economic benefits over the system’s lifecycle.