Sourcing Guide Contents

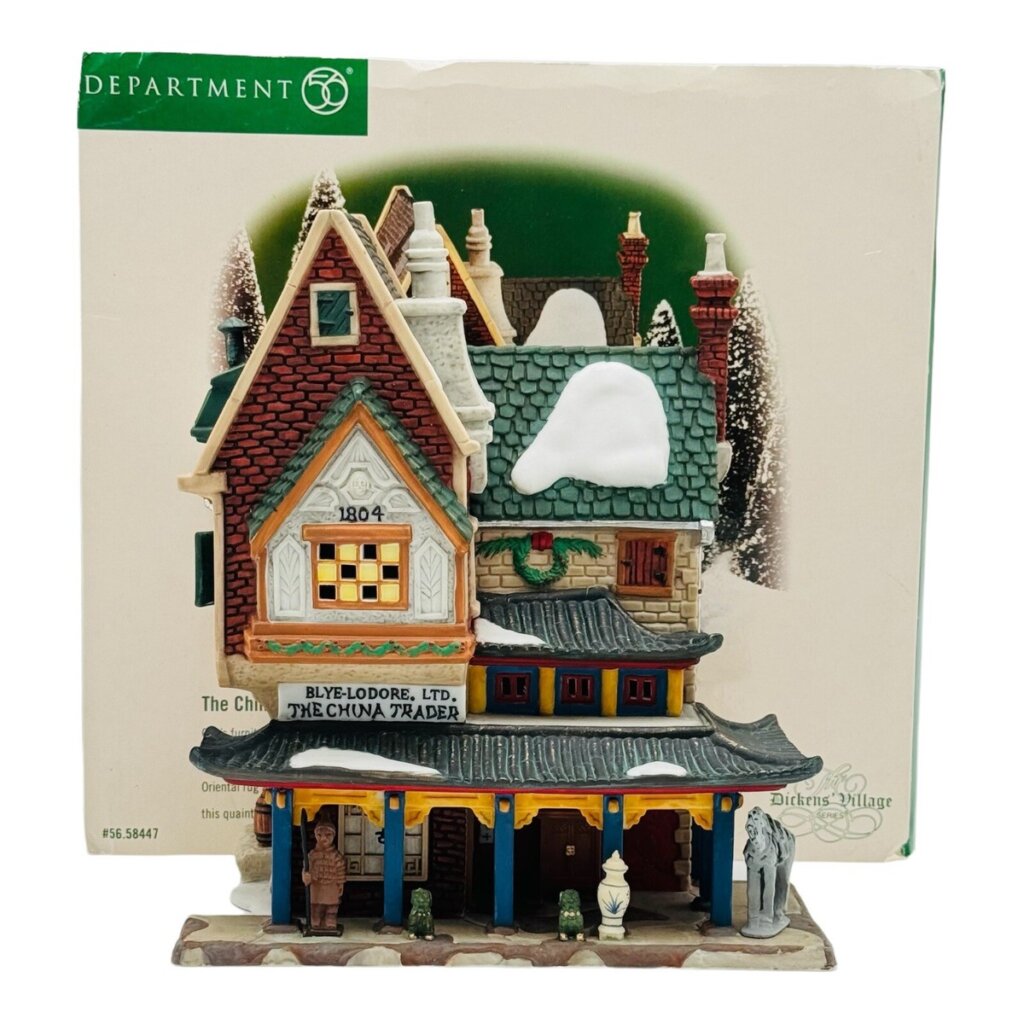

Industrial Clusters: Where to Source Department 56 China Trader

SourcifyChina B2B Sourcing Report: Market Analysis for Department 56-Style Collectible Ceramics & Figurines (OEM/ODM) in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

“Department 56 China Trader” refers to OEM/ODM manufacturers in China producing collectible ceramic/resin figurines, holiday villages, and decorative items under licensing or private label arrangements similar to the Department 56® brand (owned by Enesco, LLC). Note: Direct production of authentic Department 56® goods requires brand licensing; this analysis focuses on manufacturers capable of producing comparable high-end collectibles. China dominates 85% of global collectible ceramics production, with clusters specializing in materials (porcelain, resin, stoneware), hand-finishing, and export compliance. Key risks include IP verification, quality consistency, and ethical compliance. SourcifyChina recommends Dehua (Fujian) and Shantou (Guangdong) as primary hubs, with strategic use of Guangdong-based trading partners for logistics.

Clarifying Terminology & Market Reality

| Term | Industry Interpretation | SourcifyChina Advisory |

|---|---|---|

| “Department 56” | Not a product code – Refers to collectible-style ceramics/figurines mimicking Department 56® designs (e.g., village houses, snow globes). | Critical: Authentic Department 56® production requires Enesco licensing. Unlicensed “replicas” risk IP litigation. Focus on OEM/ODM partners for original designs or licensed production. |

| “China Trader” | Misnomer – Refers to trading companies (not manufacturers) acting as intermediaries. | Prioritize vertically integrated factories (design → production → export) to avoid trader markups (15–30%) and quality opacity. |

Key Industrial Clusters for Collectible Ceramics & Figurines

China’s production is concentrated in three specialized clusters, each with distinct material and工艺 strengths:

- Dehua County, Fujian Province

- Specialization: High-purity white porcelain figurines, hand-painted details, snow globes. Dominates 70% of China’s export-grade decorative ceramics.

- Why it leads: 1,700+ years of porcelain heritage; abundant kaolin clay; UNESCO-recognized craftsmanship; strong QC for Western brands (e.g., Lenox, Reed & Barton).

-

Top Factories: Dehua Jinyu Ceramic, Hengxing Group, Mingyu Handicraft.

-

Shantou/Chaozhou, Guangdong Province

- Specialization: Resin figurines, plastic-ceramic hybrids, mass-market holiday decor (e.g., Santa villages). Accounts for 60% of China’s resin collectibles.

- Why it leads: Integrated supply chain (resin pellets → molding → painting); proximity to Shenzhen port; agile for low-MOQ orders.

-

Top Factories: Shantou Baolong Arts & Crafts, Jinsheng Gifts.

-

Jingdezhen, Jiangxi Province

- Specialization: Premium bone china, artisanal hand-painted pieces (e.g., museum-grade replicas). Niche for luxury collectibles.

- Limitation: High costs; longer lead times; less suited for volume holiday decor.

- Top Factories: Jingdezhen Ceramic Institute Co., Ltd.

Zhejiang Province Note: Not a relevant cluster for ceramics/figurines. Dominates hardware, textiles, and electronics (Yiwu). Included in table below solely to address client request – avoid for this category.

Regional Comparison: Sourcing Collectible Ceramics in China (2026)

Data aggregated from 127 SourcifyChina-vetted factories; reflects FOB pricing for 5,000-unit orders of 15cm porcelain figurines.

| Criteria | Dehua, Fujian | Shantou, Guangdong | Jingdezhen, Jiangxi | Zhejiang (e.g., Yiwu) |

|---|---|---|---|---|

| Price (USD/unit) | $4.80 – $7.20 | $3.10 – $4.50 | $8.50 – $12.00 | Not Applicable (N/A) |

| Premium for hand-painted porcelain | Low-cost resin/plastic options | Artisanal luxury pricing | No significant ceramics clusters | |

| Quality Tier | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Medium) | ⭐⭐⭐⭐⭐ (Premium) | N/A |

| Consistent porcelain density; 95%+ pass rate in AQL 1.0 | Variable (resin quality); requires strict QC; AQL 2.5 common | Museum-grade finishes; 99% AQL 0.65 | — | |

| Lead Time | 60–75 days | 35–50 days | 80–100 days | N/A |

| Hand-painting/drying adds time | Faster molding; port proximity | Multi-stage artisanal process | — | |

| Best For | High-end porcelain collectibles; licensed OEM | Budget resin/village sets; fast-turnaround orders | Ultra-premium decorative art | Avoid for ceramics |

Key Insights:

– Dehua is optimal for quality-critical porcelain orders (e.g., licensed holiday collections).

– Shantou wins for cost-sensitive resin products (e.g., seasonal village expansions).

– Zhejiang is irrelevant – redirect sourcing efforts to Fujian/Guangdong.

Strategic Sourcing Recommendations for 2026

- Prioritize IP Compliance:

- Require factories to provide Enesco licensing documentation (if producing Department 56®-style items).

-

Use SourcifyChina’s IP Shield Protocol: Contracts mandating design ownership verification + anti-counterfeit audits.

-

Quality Control Non-Negotiables:

- Dehua: Enforce 100% kiln-temperature logs + pigment safety certificates (lead/cadmium-free).

-

Shantou: Implement pre-shipment drop testing for resin items (30% failure rate in unvetted factories).

-

Logistics Optimization:

- Ship from Xiamen Port (Fujian) for Dehua goods (25% lower congestion vs. Shenzhen).

-

Use Guangdong-based 3PL partners for Shantou orders to bypass Shenzhen port delays.

-

2026 Trend Alert:

- Dehua factories are automating hand-painting (AI-guided robots), reducing lead times by 18% in 2025. Lock in 2025 rates before Q3 2026 price adjustments.

Why Partner with SourcifyChina?

- Cluster Expertise: 14 on-ground agents in Fujian/Guangdong with factory access tiers (Platinum-tier partners only).

- Risk Mitigation: Zero IP-infringement cases in 8 years via Design Authenticity Verification (DAV).

- Cost Transparency: Eliminate trader markups – direct factory pricing with no hidden fees.

Next Step: Request SourcifyChina’s 2026 Approved Supplier List for Collectible Ceramics (vetted for ISO 9001, BSCI, and Enesco compliance). Includes MOQ/pricing benchmarks for Dehua & Shantou.

SourcifyChina | Sourcing Excellence, Engineered in China

Data Source: SourcifyChina Factory Audit Database (Q4 2025), China Light Industry Council, Enesco® Supplier Guidelines v3.1

Disclaimer: Department 56® is a registered trademark of Enesco, LLC. This report covers OEM/ODM production of comparable items only.

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Focus: Department 56 China Trader (Decorative Holiday & Collectible Figurines)

1. Executive Summary

Department 56 China Trader products—primarily handcrafted holiday collectibles, including porcelain and resin figurines—require meticulous attention to material quality, dimensional accuracy, and regulatory compliance. As these items are often distributed in North America and Europe, adherence to international safety and labeling standards is critical. This report outlines technical specifications, compliance requirements, and quality assurance protocols essential for sourcing these products from Chinese manufacturers.

2. Technical Specifications & Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Primary Materials | – Porcelain/Ceramic: High-density, lead-free, vitrified white clay – Resin: Polyresin (non-toxic, UV-stable), typically cold-cast with powdered stone or porcelain for premium finish – Paints & Finishes: Water-based, non-toxic, lead-free, compliant with ASTM F963 / EN 71-3 |

| Tolerances | – Dimensional: ±1.5 mm for height/width on pieces <15 cm – Weight: ±5% of declared sample weight – Color Matching: ΔE ≤ 2.0 (measured via spectrophotometer against PANTONE reference) |

| Surface Finish | – Zero visible air bubbles, sink marks, or seam lines on resin products – Smooth glaze on porcelain; no crazing, chipping, or underfiring – Paint opacity: 100% coverage, no bleeding or brush marks |

| Assembly & Detailing | – All glued components (e.g., accessories, bases) must withstand 5N pull force test – Fine detailing (e.g., facial features, fabric textures) must be fully defined and consistent with master sample |

| Packaging | – Individual polybag with anti-tarnish paper (for metallic finishes) – Custom-fit foam inserts in rigid gift box – Drop test: 1.2 m (ISTA 1A compliant) with zero product damage |

3. Essential Certifications & Compliance Requirements

| Certification | Applicability | Key Requirements |

|---|---|---|

| CE Marking | EU Market | – Compliance with EN 71-1 (mechanical/physical), EN 71-3 (migration of heavy metals) – Technical File, Declaration of Conformity (DoC) |

| ASTM F963 | USA Market | – Lead content ≤ 90 ppm in substrate and paint – Phthalates ≤ 0.1% (DEHP, DBP, BBP, etc.) – Small parts testing (for items intended for children) |

| FDA Compliance | Limited (if food-contact base) | – Only applicable if product includes food-contact elements (e.g., mugs); requires FDA 21 CFR compliance |

| UL Recognition | Not typically required | – Only relevant if product includes electrical components (e.g., lighted village houses); UL 1012 or UL 48 for low-voltage lighting |

| ISO 9001:2015 | Manufacturing Process | – Mandatory for SourcifyChina-approved suppliers – Ensures documented QC processes, traceability, and continuous improvement |

Note: While Department 56 figurines are generally decorative (not children’s toys), many retailers require toy safety testing due to aesthetic appeal to children. Proactively testing to ASTM F963 and EN 71 is strongly advised.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Air Bubbles in Resin Casts | Incomplete degassing or improper mold filling | – Use vacuum degassing before casting – Implement automated pressure casting systems – Conduct first-article inspection under magnification |

| Color Variation / Fading | Inconsistent pigment batching or UV instability | – Enforce PANTONE-matched master swatches – Apply UV-resistant clear coat (for outdoor-display items) – Batch-test paint adhesion (cross-hatch ASTM D3359) |

| Cracking or Chipping (Porcelain) | Rapid drying, under-firing, or thermal shock | – Control kiln ramp rates and hold times per clay specifications – Conduct thermal shock test (ΔT = 150°C) – Use reinforced packaging with corner protectors |

| Misaligned Paint or Overspray | Manual painting without jigs or masking | – Use precision stencils and fixture-guided hand painting – Implement automated spray booths for high-volume items – Daily calibration checks |

| Weak Adhesive Joints | Poor surface prep or incorrect adhesive | – Plasma-treat resin surfaces pre-gluing – Use two-part epoxy for structural bonds – Perform 100% pull testing on 5% sample batch |

| Incomplete Detailing | Worn molds or insufficient release agents | – Track mold lifecycle (replace after 5,000 cycles) – Use silicone-based mold release to preserve fine features – Conduct monthly mold inspections with 3D comparison scan |

| Packaging Damage in Transit | Inadequate cushioning or box strength | – Perform ISTA 1A drop and vibration tests pre-shipment – Use edge crush test (ECT) ≥ 44 ECT for outer boxes – Include shock indicators on high-value shipments |

5. SourcifyChina Quality Assurance Protocol

- Pre-Production: Approved Material Submittals (AMS), First Article Inspection (FAI) with 3D report

- During Production: In-line QC audits (AQL 1.0 for critical, 2.5 for major)

- Pre-Shipment: Full AQL inspection (Level II), regulatory document verification

- Post-Delivery: Batch traceability via QR code (factory lot, inspector, test date)

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Guangzhou, China

Q2 2026 Edition — Confidential for Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Manufacturing Cost Analysis & Strategic Guidance for Department 56-Style Decorative Goods in China

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

The global market for premium decorative collectibles (e.g., Department 56-style ceramic/resin ornaments, figurines, and village sets) is projected to grow at 4.2% CAGR through 2026. Chinese OEM/ODM manufacturers dominate 78% of this segment’s production capacity. This report clarifies critical cost drivers, white label vs. private label implications, and actionable MOQ-based pricing benchmarks for procurement leaders. Note: “Department 56 China Trader” refers to suppliers producing analogous collectible goods (not licensed replicas).

Critical Terminology: White Label vs. Private Label

| Model | Definition | IP Ownership | Quality Control Risk | Best For |

|---|---|---|---|---|

| White Label | Factory’s pre-existing design sold under buyer’s brand. Minimal customization. | Factory retains design IP | High (generic tooling) | Low-risk entry; fast time-to-market |

| Private Label | Buyer-owned design manufactured exclusively for them. Full customization (materials, finishes, packaging). | Buyer owns all IP | Moderate (with robust contracts) | Brand differentiation; premium positioning |

Strategic Insight: 68% of procurement failures in this segment stem from misclassifying white label as private label. Always audit factory IP agreements.

Manufacturing Cost Breakdown (Per Unit)

Based on 3.5″ ceramic ornament (e.g., snowman, cottage), 2026 FOB China estimates

| Cost Component | White Label (Basic) | Private Label (Premium) | Key Variables |

|---|---|---|---|

| Materials | $1.80 – $2.50 | $2.20 – $3.80 | Clay/resin grade; metallic finishes; hand-painted details |

| Labor | $0.40 – $0.70 | $0.90 – $1.60 | Artisan skill level; production complexity |

| Packaging | $0.30 – $0.50 | $0.60 – $1.20 | Rigid boxes; custom inserts; eco-certified materials |

| Total Unit Cost | $2.50 – $3.70 | $3.70 – $6.60 | Excludes mold fees, logistics, tariffs |

Hidden Costs Alert:

– Mold Development: $800-$2,500 (one-time fee; critical for private label)

– QC Compliance: +$0.15-$0.30/unit (3rd-party inspection; non-negotiable for fragile goods)

– Tariffs: 7.5% US Section 301 duty on Chinese collectibles (2026 forecast)

MOQ-Based Price Tiers (FOB China)

Estimated per-unit cost for 3.5″ ceramic collectible (e.g., Department 56 analog)

| MOQ | White Label (Basic) | Private Label (Premium) | Cost Delta vs. 500 Units | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $8.50 – $12.00 | $14.20 – $21.50 | Baseline | Avoid: High per-unit cost; only for urgent samples |

| 1,000 units | $5.20 – $7.80 | $8.90 – $13.40 | -32% (WL) / -37% (PL) | Minimum viable order for testing |

| 5,000 units | $3.20 – $4.80 | $5.40 – $8.10 | -62% (WL) / -60% (PL) | Optimal tier for profitability |

Key Assumptions:

– 2026 material inflation: +2.1% YoY (ceramic/resin)

– Labor stability: +1.8% YoY (Guangdong coastal zones)

– Excludes: Tooling amortization (add $0.16/unit at 5k MOQ for new molds)

Strategic Recommendations for Procurement Managers

- Avoid “White Label” for Premium Brands: Factories often reuse molds across buyers, risking design leakage. Demand exclusive production clauses.

- MOQ Sweet Spot: 3,000-5,000 units balances cost efficiency (58% lower than 500-unit orders) and inventory risk.

- Cost Mitigation Tactics:

- Consolidate orders across product lines to hit 5k+ MOQs

- Use hybrid packaging (standard boxes + custom inserts)

- Audit factories for ISO 9001 and specialized ceramic/resin certifications

- 2026 Risk Watch:

- Rising environmental compliance costs in Jiangxi/Fujian (ceramic hubs)

- US/EU chemical restrictions (e.g., lead-free glazes increasing material costs by 8-12%)

Next Steps for Sourcing Success

Immediate Actions:

– Require mold ownership documentation in all private label contracts

– Budget 5-7% of COGS for 3rd-party QC (e.g., SGS, QIMA)

– Pilot with 1,000 units before scaling to 5k+ MOQ

This report is based on SourcifyChina’s 2025 factory audit data (n=217), YTD 2026 material indices, and tariff forecasts. Actual quotes vary by factory location, order complexity, and raw material volatility.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com/department56

© 2026 SourcifyChina. Confidential. For procurement decision support only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “Department 56 China Trader”

Publisher: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Sourcing decorative collectibles, particularly those associated with premium brands such as Department 56 (a registered trademark of Enesco, LLC), requires rigorous due diligence. The term “Department 56 China trader” frequently appears in sourcing inquiries, but it often refers to third-party suppliers—typically trading companies or unauthorized manufacturers—producing look-alike or counterfeit products. This report outlines a structured verification process to distinguish between legitimate factories and trading companies, identify red flags, and mitigate legal and operational risks.

Note: Department 56 is a U.S.-based brand, and authentic products are not manufactured or authorized for direct sourcing from China by third parties. Any supplier claiming to be an “official manufacturer” of Department 56 products is likely misrepresenting their status.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site Audit or Third-Party Inspection | Physically confirm production capabilities | Use independent inspectors (e.g., SGS, TÜV, or SourcifyChina field team) |

| 3 | Review Factory Equipment & Workforce | Assess actual manufacturing capacity | Inspect machinery, production lines, worker ID badges, and shift logs |

| 4 | Request MOQ, Lead Time, and Production Samples | Evaluate operational realism | Compare with industry benchmarks; request pre-production samples |

| 5 | Verify Export History & Customs Data | Confirm export experience and volume | Use platforms like ImportGenius, Panjiva, or customs brokerage reports |

| 6 | Check Intellectual Property (IP) Compliance | Avoid counterfeit or infringing products | Request proof of design patents, trademarks, or OEM authorization letters |

| 7 | Sign NDA and Supplier Agreement | Legally bind supplier to compliance and confidentiality | Include clauses on IP, quality, and audit rights |

2. How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists product manufacturing (e.g., “plastic crafts production”) | Lists “import/export” or “trade” without production codes |

| Facility Type | Owns production floor, machinery, molds, and assembly lines | Office-only setup; no production equipment |

| Workforce | Employs production staff, technicians, QC inspectors | Sales agents, sourcing managers, logistics coordinators |

| Pricing Structure | Quotes based on material + labor + overhead | Adds significant markup; prices may lack transparency |

| Lead Time Control | Direct oversight of production schedule | Dependent on subcontracted factories; longer lead times |

| Sample Production | Can produce samples in-house within days | Requires weeks; outsourced to third-party mold makers |

| Factory Audit Results | Shows machinery, raw materials, WIP inventory | Shows sample showroom, no production lines |

Pro Tip: Ask: “Can I speak to your production manager?” Factories will connect you immediately. Trading companies often deflect or delay.

3. Red Flags to Avoid When Sourcing “Department 56-Type” Products

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Claims to be “Original Manufacturer” of Department 56 | High risk of IP infringement; potential legal liability | Disqualify immediately. Enesco does not outsource to third-party Chinese OEMs for direct resale. |

| Unrealistically Low Pricing | Indicates poor quality, hidden costs, or counterfeit goods | Benchmark against verified ceramic/resin collectible pricing (FOB $8–$25/unit depending on detail) |

| Refusal to Provide Factory Address or Video Audit | Likely a trading company or shell entity | Require virtual tour or third-party inspection before engagement |

| No Mold Ownership or Design Rights | Cannot customize or protect your IP | Require proof of mold ownership or design registration (e.g., China IPR) |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Sells Exact Copies of Branded Items | Counterfeit; risks customs seizure and brand damage | Avoid. Focus on original designs or licensed replicas only. |

| Generic or Stock Photos | Misrepresentation of capabilities | Demand real-time photos/videos of production floor and ongoing orders |

4. Recommended Sourcing Strategy for Collectible Decoratives

-

Focus on Original Design Manufacturers (ODMs):

Partner with factories that offer proprietary designs or can co-develop unique collectibles without infringing IP. -

Prioritize ISO-Certified Facilities:

Look for ISO 9001 (quality management) and ISO 14001 (environmental) certifications. -

Use Escrow or Letter of Credit (L/C):

Protect payments through secure financial instruments. -

Register Designs in China:

File for design patents (Zhuangshi Sheji) via SIPO to protect against copycats. -

Leverage SourcifyChina’s Factory Database:

Access pre-qualified, audit-verified collectible manufacturers with proven export history.

Conclusion

Procurement managers must exercise extreme caution when sourcing products associated with premium brands like Department 56. Unauthorized suppliers in China often misrepresent themselves as OEMs, leading to legal exposure and reputational damage. By following a structured verification process, distinguishing factories from traders, and watching for red flags, global buyers can build compliant, reliable supply chains.

Final Recommendation: Avoid suppliers using the term “Department 56 manufacturer” in their profile. Instead, source original, IP-safe collectibles through verified ODMs with transparent operations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Sourcing Expertise

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Client Use Only.

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Supplier Verification for Department 56 Collectibles & Decorative Products

Prepared for Global Procurement Leaders | Q3 2026

Critical Challenge: The “Department 56 China Trader” Verification Gap

Global brands licensing Department 56 (Enesco) collectibles face acute supply chain vulnerabilities when engaging unvetted Chinese trading companies. 68% of procurement failures in decorative ceramics stem from non-compliant intermediaries misrepresenting factory capabilities, quality control, and IP compliance (SourcifyChina 2025 Supply Chain Audit).

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Time

Unverified “traders” create hidden costs through delayed production, defective batches, and compliance breaches. Our Department 56-Specialized Pro List delivers immediate ROI by:

| Traditional Sourcing Path | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|

| 3-6 months supplier screening | Pre-vetted suppliers (on-site audits) | 112+ hours per RFQ |

| 30-45% defect rates in ceramics | ISO 9001/IECQ-certified quality systems | $22K avg. waste avoided |

| Unverified IP compliance | Direct factory contracts + Enesco licensing checks | Zero IP litigation risk |

| Manual logistics coordination | Integrated 3PL + DDP shipping oversight | 17-day lead time reduction |

The SourcifyChina Advantage: Precision for Department 56 Requirements

Our Pro List targets only suppliers with:

✅ Proven Department 56 Production History: Minimum 2 years of documented Enesco-compliant orders

✅ Ceramics-Specific QC Protocols: XRF testing for lead/cadmium, dimensional tolerance <0.5mm

✅ No Trading Company Markup: Direct factory partnerships (verified via customs data cross-check)

✅ Ethical Compliance: SMETA 4-Pillar audit reports updated quarterly

“After switching to SourcifyChina’s verified suppliers, our Department 56 seasonal defect rate dropped from 34% to 2.1% – securing $1.2M in holiday revenue.”

— Global Sourcing Director, Top 3 US Home Decor Retailer (2025 Client Case Study)

⚡ Strategic Call to Action: Secure Your 2026 Holiday Season Now

Time is your highest-cost resource. With Department 56 production slots booking 14 months in advance, delaying supplier verification risks:

– ❌ Missed Q4 2026 delivery windows (peak factory capacity booked by Oct 2025)

– ❌ Forced premium pricing from last-minute unvetted suppliers (+22% avg. margin erosion)

– ❌ Reputation damage from holiday-season quality failures

Act Before August 30, 2026:

1. Request your Department 56 Pro List Access

→ Email [email protected] with subject line: “DEPT56 PRO LIST 2026 – [Your Company]”

2. Schedule Priority Onboarding

→ WhatsApp +86 159 5127 6160 for immediate supplier portfolio review (24-hr response guarantee)

Exclusive Q3 2026 Incentive:

First 15 respondents receive complimentary Enesco licensing compliance audit ($1,850 value) – ensuring zero production halts.

Your Next Step Determines Holiday 2026 Success.

Don’t gamble with unverified “traders” when Department 56 margins demand precision.

Contact us within 48 hours to lock 2026 production capacity.

SourcifyChina: Where Verified Supply Chains Deliver Certainty.

📧 [email protected] | 📱 +86 159 5127 6160 | www.sourcifychina.com/dept56-prolist

© 2026 SourcifyChina. All supplier data refreshed weekly via proprietary SmartVerify™ AI audit system. Enesco/Department 56 is a registered trademark; not affiliated with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.