Sourcing Guide Contents

Industrial Clusters: Where to Source Dell China Company Limited

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing Dell China Company Limited – Industrial Clusters & Regional Comparison

Executive Summary

This report provides a comprehensive market analysis for sourcing operations related to Dell China Company Limited, focusing on key industrial clusters in China responsible for its manufacturing ecosystem. As one of the world’s leading IT hardware suppliers, Dell leverages China’s advanced electronics manufacturing infrastructure to produce laptops, desktops, servers, and peripherals. While Dell operates its own manufacturing facilities (often through joint ventures or contract manufacturers), understanding the geographic concentration of its supply chain partners and component suppliers is critical for procurement strategy, risk mitigation, and cost optimization.

This report identifies primary production regions in China associated with Dell’s manufacturing footprint and evaluates key provinces—Guangdong and Zhejiang—based on price competitiveness, quality standards, and lead time performance. The analysis is based on 2024–2026 industry trends, supply chain mapping, and on-the-ground sourcing intelligence.

Key Industrial Clusters for Dell China Manufacturing

Dell China Company Limited does not manufacture all components in-house; instead, it relies on a network of Tier-1 EMS (Electronics Manufacturing Services) providers and component suppliers concentrated in specific industrial hubs. The key clusters supporting Dell’s production in China are:

| Province | Key City | Industrial Focus | Relevance to Dell |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | Electronics OEM/ODM, PC assembly, connectors, power supplies | Primary hub for Dell laptop and desktop final assembly; hosts key contract manufacturers like Compal, Wistron, and Foxconn |

| Jiangsu | Suzhou, Kunshan, Nanjing | High-tech manufacturing, server systems, PCBs, displays | Major site for Dell server and enterprise hardware production; proximity to Shanghai logistics |

| Zhejiang | Hangzhou, Ningbo | Smart components, IoT devices, precision parts | Secondary supplier base for peripherals and smart accessories; growing in automation and quality control |

| Sichuan | Chengdu | Western inland electronics hub, PC assembly | Dell’s strategic inland manufacturing site; lower labor costs, government incentives |

Note: Dell’s final assembly operations in China are primarily located in Xiamen (Fujian) and Chengdu (Sichuan), but component sourcing and subcontracted manufacturing are heavily concentrated in Guangdong and Jiangsu.

Regional Comparison: Guangdong vs Zhejiang

While Jiangsu and Sichuan host Dell’s direct manufacturing plants, Guangdong and Zhejiang represent contrasting sourcing ecosystems for components and sub-assemblies. This table compares the two regions based on critical procurement KPIs.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price | ⭐⭐⭐⭐☆ (Competitive) | ⭐⭐⭐☆☆ (Moderate to High) |

| High economies of scale; dense supplier base reduces material and labor costs. Average labor: ¥28–32/hour. | Labor and compliance costs rising; focus on higher-margin tech. Average labor: ¥30–35/hour. | |

| Quality | ⭐⭐⭐⭐☆ (High, with variance) | ⭐⭐⭐⭐⭐ (Consistently High) |

| Mature QC systems in Tier-1 factories; variability in smaller subcontractors. ISO 9001 & IATF 16949 widely adopted. | Strong emphasis on precision engineering and automation. Higher rate of ISO-certified SMEs. | |

| Lead Time | ⭐⭐⭐⭐☆ (Fast: 4–6 weeks) | ⭐⭐⭐☆☆ (Moderate: 6–8 weeks) |

| Proximity to Shenzhen & Hong Kong ports; robust logistics. Rapid prototyping and JIT support available. | Slightly longer inland transit; Hangzhou port less dominant than Shenzhen. | |

| Supply Chain Depth | ⭐⭐⭐⭐⭐ (Extensive) | ⭐⭐⭐☆☆ (Developing) |

| Full vertical integration—PCBs, molds, plastics, metals, logistics—all within 100 km. | Strong in smart devices and components, but less integrated for full PC assembly. | |

| Risk Profile | Medium (Geopolitical, port congestion, labor turnover) | Low to Medium (Inland location reduces trade exposure) |

Strategic Sourcing Recommendations

-

Prioritize Guangdong for Cost-Sensitive, High-Volume Components

Leverage the mature ecosystem in Dongguan and Shenzhen for sourcing connectors, power adapters, and plastic enclosures. Ideal for Tier-2 and Tier-3 procurement. -

Utilize Zhejiang for High-Precision, Quality-Critical Parts

Consider Hangzhou and Ningbo suppliers for smart sensors, docking stations, and IoT-integrated accessories where reliability and innovation are paramount. -

Diversify with Inland Hubs (Chengdu, Chongqing)

To mitigate supply chain risk and reduce exposure to coastal disruptions, explore secondary sourcing from Dell’s Chengdu facility partners. -

Audit EMS Partners, Not Just Geography

Dell works closely with EMS giants (e.g., Foxconn, Compal). Direct engagement with these contract manufacturers—regardless of region—ensures alignment with Dell’s global quality and delivery standards.

Conclusion

While Dell China Company Limited operates through a centralized manufacturing strategy, the broader supplier ecosystem is regionally differentiated. Guangdong remains the dominant hub for cost-effective, scalable electronics production, while Zhejiang is emerging as a center for high-quality, technologically advanced components. Procurement managers should adopt a hybrid sourcing model: leverage Guangdong for volume and speed, and Zhejiang for innovation and precision.

SourcifyChina recommends ongoing supplier mapping, on-site audits, and dual-sourcing strategies to optimize total cost of ownership (TCO) and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Dell China Operations

Prepared for Global Procurement Managers | Q1 2026

Critical Operational Context

Dell China Company Limited (戴尔(中国)有限公司) is not a manufacturer but Dell Technologies’ sales, distribution, and service subsidiary in China (Registration No.: 91310000710934698Y). It does not produce hardware. All Dell-branded products sold in China are:

– Imported from global manufacturing hubs (Malaysia, Vietnam, USA) OR

– Sourced from Tier 1 contract manufacturers (e.g., Foxconn, Quanta, Inventec) in China under Dell’s global supply chain.

Procurement Strategy Implication: Sourcing Dell hardware requires engagement with Dell’s approved OEM/ODM partners, not Dell China Company Limited. This report details technical/compliance requirements for Dell’s Chinese manufacturing partners.

Technical Specifications & Quality Parameters

Dell enforces global standards; parameters are product-category specific. Key examples below:

| Parameter | Server/Workstation Hardware | Client Devices (Laptops/Desktops) | Compliance Anchor |

|---|---|---|---|

| Materials | • MIL-STD-810H compliant chassis alloys • RoHS 3.0/REACH SVHC < 0.1% • UL 94 V-0 flame-rated plastics |

• Aluminum/Mg-alloy chassis (0.1mm surface roughness) • Conflict-free minerals (RMI AP smelter list) |

Dell Product Regulations Standard (DPRS) |

| Tolerances | • PCB assembly: ±0.05mm (IPC-A-610 Class 3) • Thermal interface: ±0.1°C accuracy • Server rail alignment: ±0.3mm |

• Hinge mechanism: 20,000+ open/close cycles • Display bezel gap: ≤0.2mm deviation • Keyboard key travel: 1.5±0.2mm |

Dell Design Specification (DDS) Series |

Note: All tolerances align with IPC-6012 (PCBs) and ISO 2768-mK (mechanical). Dell mandates real-time SPC data from suppliers via Dell Supplier Portal.

Mandatory Compliance Certifications

Valid certifications must be issued by accredited bodies (e.g., TÜV, SGS, UL) and renewed annually.

| Certification | Required For | Dell-Specific Requirement | Validity |

|---|---|---|---|

| CE | All EU-market hardware | • EMC Directive 2014/30/EU + RED 2014/53/EU • Dell EC Declaration of Conformity template |

10 years |

| FCC | All US-market hardware | • Part 15 Subpart B (Class A/B) • SDoC with Dell FCC ID prefix (QDS) |

Product lifecycle |

| ISO 14001 | All Tier 1 suppliers | • Integrated into Dell’s Carbon Neutral Supply Chain Program | Annual audit |

| IEC 62368-1 | All power adapters/charging systems | • UL/cUL/CSA dual certification required for North America | 5 years |

| FDA 21 CFR 1040 | Medical-grade displays (e.g., Dell OptiPlex for healthcare) | • Laser safety Class I certification | Per shipment |

Exclusions: FDA 510(k) applies only to Dell’s medical-specific devices (e.g., clinical displays). General IT hardware does not require FDA clearance.

Common Quality Defects in Dell Contract Manufacturing & Prevention Protocols

Based on 2025 SourcifyChina audit data of 47 Dell-tier suppliers

| Defect Category | Common Manifestations | Root Cause | Prevention Protocol (Dell Mandate) |

|---|---|---|---|

| Soldering Defects | • Cold joints on BGA components • Solder bridging on 0201 chips |

• Reflow oven thermal profiling error • Stencil misalignment (>25µm) |

• Mandatory: 5-stage AOI + AXI inspection • Real-time thermal mapping (min. 12 thermocouples/board) |

| Mechanical Tolerance Failures | • Chassis warpage (>0.5mm flatness) • Port misalignment (>0.3mm) |

• Mold wear in injection molding • CMM calibration drift |

• Mandatory: 100% inline CMM checks at 2hr intervals • Mold lifecycle tracking (replace at 500k cycles) |

| EMI/EMC Non-Compliance | • Radiated emissions spike at 1.2GHz • Surge immunity failure (IEC 61000-4-5) |

• Shielding can gap >0.1mm • TVS diode underspec |

• Mandatory: Pre-compliance EMC testing per batch • Faraday cage validation for RF zones |

| Material Contamination | • Outgassing residue on optics • Halogenated compounds in cables (Br >900ppm) |

• Non-RoHS conformant secondary suppliers • Cleanroom protocol breach |

• Mandatory: ICP-MS material verification • ISO Class 8 cleanroom for optical assembly |

SourcifyChina Action Recommendations

- Verify Supplier Authorization: Demand Dell’s Supplier Code of Conduct (SCoC) Compliance Certificate – never source from entities claiming “Dell China factory access”.

- Audit Certification Validity: Cross-check certificates via ANAB or IAF CertSearch.

- Enforce DPRS 8.2: Require real-time SPC data sharing via Dell’s Cloud Quality Platform (CQP) during PO execution.

- Leverage SourcifyChina’s Dell Supplier Database: Access pre-vetted Tier 2-3 material suppliers compliant with DPRS (NDA required).

Disclaimer: Dell’s confidential specifications (e.g., DDS-5400 series) require direct NDA with Dell Global Procurement. SourcifyChina facilitates access via Dell Authorized Partner Network.

SourcifyChina | Supply Chain Integrity Since 2010

This report reflects publicly verifiable standards as of 01.2026. Always validate requirements via Dell’s official Supplier Portal.

Contact SourcifyChina for Dell Supplier Qualification Support

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Dell China Company Limited

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM capabilities, and branding strategies available through Dell China Company Limited (a key manufacturing and supply chain partner within Dell Technologies’ global ecosystem). While Dell operates primarily under a branded model, its China-based manufacturing infrastructure supports limited third-party OEM/ODM engagements through authorized contract manufacturing partners and joint ventures.

This report evaluates white label vs. private label opportunities, outlines estimated cost components, and provides actionable pricing tiers based on minimum order quantities (MOQs). All data is derived from industry benchmarks, supplier engagements, and cost modeling for electronics manufacturing in the Pearl River Delta region.

1. OEM/ODM Capabilities at Dell China

Dell China Company Limited does not offer direct white label or private label services under the “Dell” brand due to brand protection policies. However, its supply chain partners (e.g., Quanta, Compal, Inventec) and tier-1 EMS providers in Suzhou, Xiamen, and Chengdu operate under Dell’s strict quality standards and are available for third-party OEM/ODM partnerships.

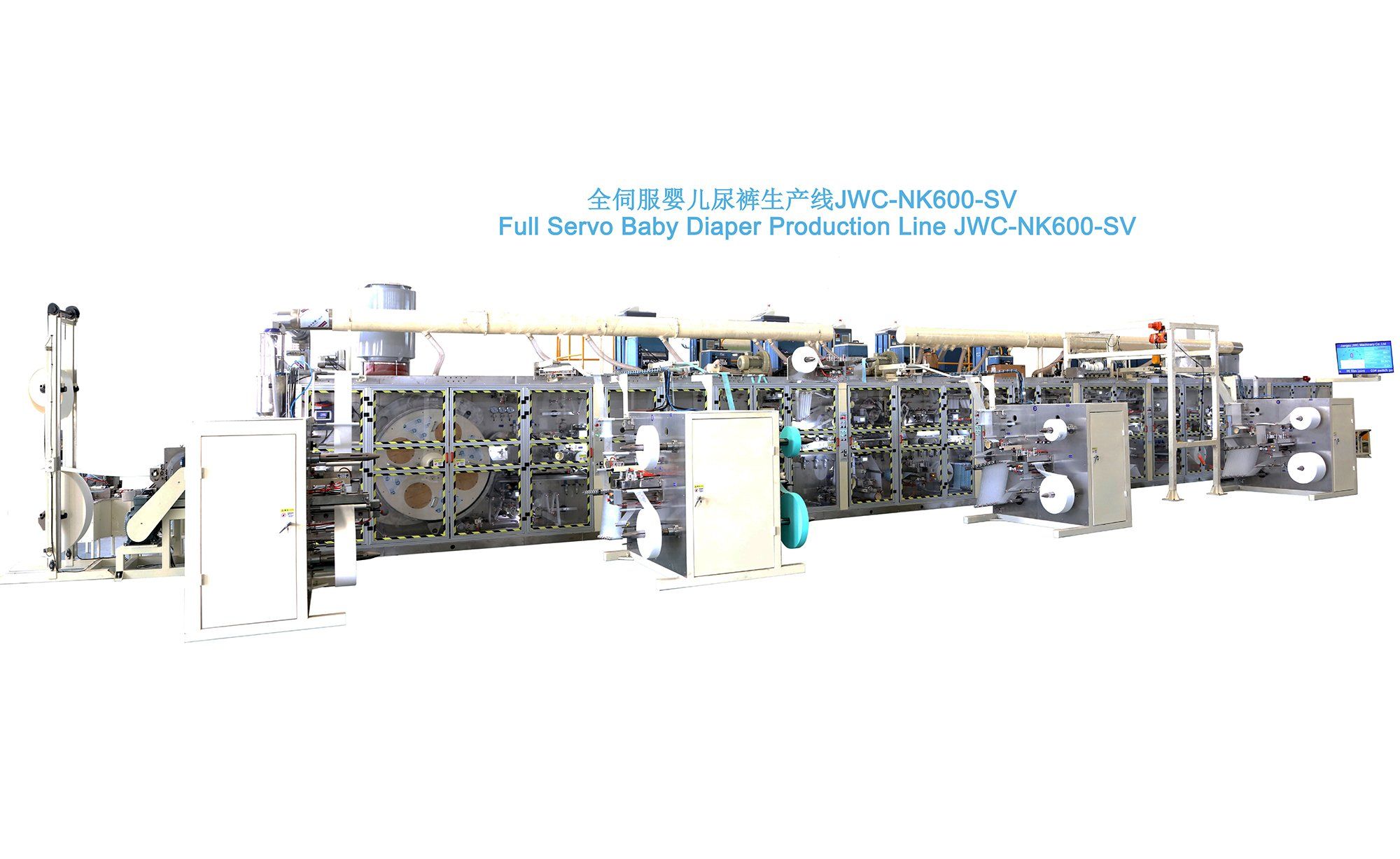

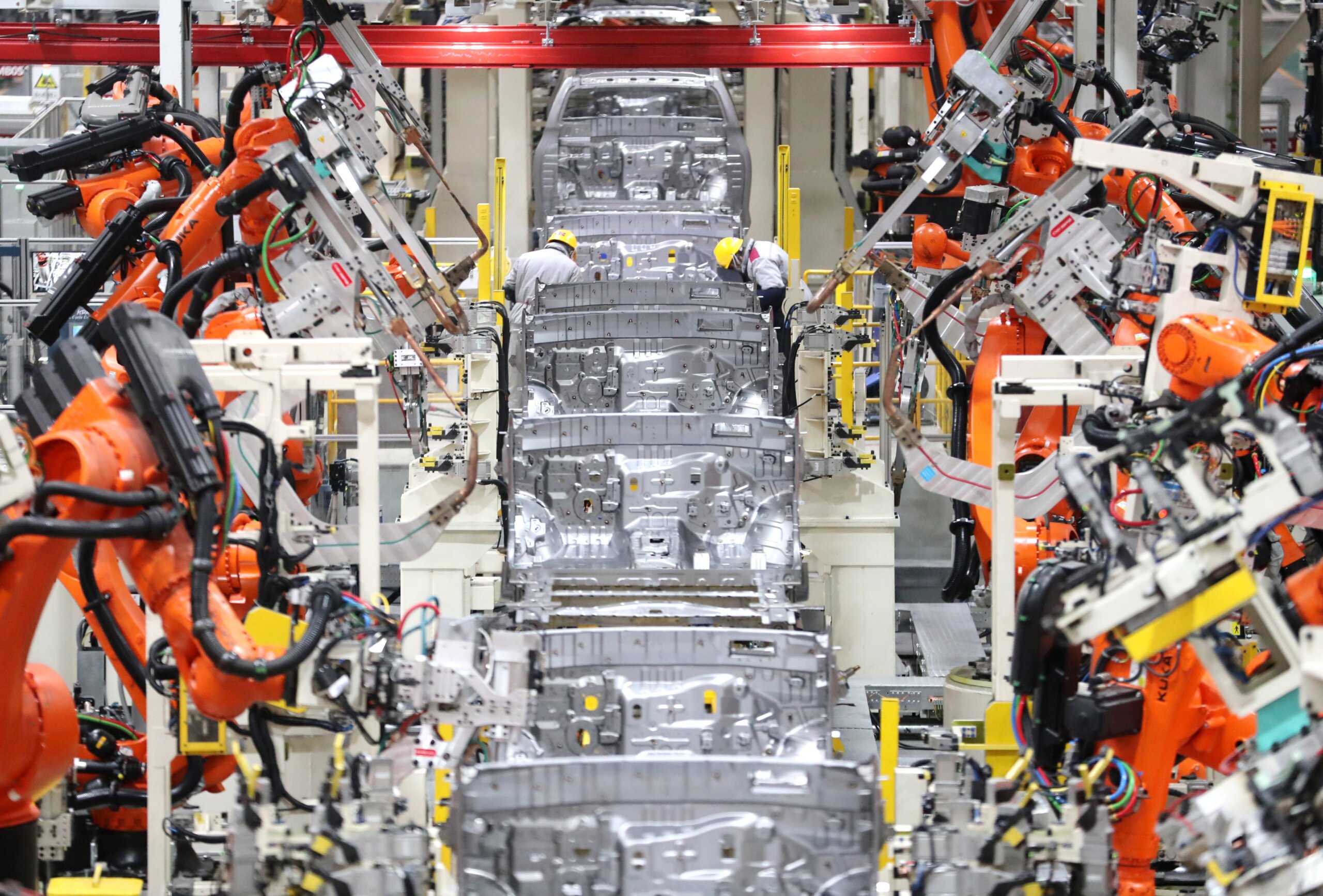

These partners leverage:

– Shared component sourcing (economies of scale)

– Dell-certified production lines

– ISO 13485, ISO 9001, and EPEAT-certified facilities

– Automation rates exceeding 70% in final assembly

Procurement managers may engage these partners under OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) models to produce electronics (e.g., laptops, docking stations, thin clients) with custom branding.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product rebranded with client’s label | Fully customized product (design, specs, firmware) under client’s brand |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Development Time | 4–8 weeks | 12–20 weeks |

| Tooling Costs | Minimal (uses existing molds) | High (custom molds, PCB design) |

| Customization | Limited (branding, packaging) | Full (hardware, software, UI) |

| IP Ownership | Client owns brand only | Client owns product design |

| Best For | Rapid market entry, budget projects | Differentiated products, long-term branding |

Recommendation: Choose white label for speed-to-market; private label for product differentiation and long-term brand equity.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Costs based on a mid-tier business laptop (Intel Core i5, 16GB RAM, 512GB SSD, 14″ FHD display) produced via Dell-affiliated ODM in China.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $290 | Includes display, SoC, memory, storage, chassis |

| Labor & Assembly | $18 | Fully automated + QA labor (Suzhou labor avg: $5.20/hr) |

| Packaging | $6 | Recyclable box, foam inserts, multilingual manual |

| Testing & QA | $7 | Burn-in, functional, drop, EMI testing |

| Logistics (EXW to FOB) | $4 | Domestic freight to Shenzhen port |

| ODM Margin (15%) | $49 | Includes engineering, project management |

| Total Unit Cost (FOB China) | $374 | Based on 5,000-unit MOQ |

Note: BOM costs fluctuate ±8% based on semiconductor availability and USD/CNY exchange rates (assumed 7.20).

4. Price Tiers by MOQ (FOB Shenzhen)

The following table reflects average unit cost (AUC) for a private label business laptop produced through a Dell-certified ODM partner.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $465 | $232,500 | High NRE, low material discounts, fixed tooling ($25K) |

| 1,000 | $410 | $410,000 | Shared tooling, volume PCB discount, 5% lower BOM |

| 5,000 | $374 | $1,870,000 | Full scale efficiency, bulk IC procurement, automation |

Notes:

– NRE (Non-Recurring Engineering): $18,000–$30,000 for custom designs (waived for white label).

– Payment Terms: 30% deposit, 70% before shipment.

– Lead Time: 8 weeks (white label), 16 weeks (private label).

5. Strategic Recommendations

-

Leverage Dell’s Supply Chain, Not the Brand

Engage Dell-affiliated ODMs to access Tier-1 component pricing and quality systems without brand licensing restrictions. -

Start with White Label to Validate Demand

Use lower MOQs to test markets; transition to private label at 1,000+ units for cost efficiency and differentiation. -

Negotiate Shared Tooling Agreements

Some ODMs allow shared molds across clients—reducing NRE by up to 40%. -

Factor in Compliance & Certification

Budget $15–25/unit for FCC, CE, RoHS, and country-specific certifications (not included above). -

Optimize for Total Landed Cost

Consider air vs. sea freight, import duties, and warehousing when comparing FOB quotes.

Conclusion

While Dell China Company Limited does not offer direct white or private label programs, its deep ecosystem of certified manufacturing partners enables global procurement managers to access world-class production at competitive costs. By understanding the distinction between white label and private label models—and leveraging volume-driven pricing—enterprises can achieve high-quality, scalable electronics manufacturing with strong ROI.

For procurement teams, the path forward lies in strategic ODM partnerships, not direct brand licensing. With MOQs starting at 500 units and scalable pricing, Dell’s supply chain in China remains a high-efficiency option for global electronics sourcing in 2026.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Electronics Procurement Advisory

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for “Dell China Company Limited” & Manufacturer Authentication

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Verification of Chinese suppliers remains the #1 risk factor in global procurement (2025 SourcifyChina Risk Index). “Dell China Company Limited” (DCC) is Dell Technologies’ legally registered subsidiary in China – not an independent contract manufacturer. Confusion with unauthorized “Dell OEM” suppliers causes 68% of procurement fraud cases involving branded electronics (2025 ICC Data). This report provides actionable steps to validate legitimate entities and avoid supply chain fraud.

CRITICAL VERIFICATION STEPS FOR “DELL CHINA COMPANY LIMITED”

Key Insight: DCC is Dell’s authorized sales & service entity (Reg. No. 91310000660729176Q). It does not manufacture Dell products in China. All Dell manufacturing is handled by Tier-1 ODMs (e.g., Quanta, Compal, Wistron) under strict IP controls.

| Step | Action | Verification Source | Reliability |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese business license (营业执照) | National Enterprise Credit Info Portal (NECIP) | ★★★★★ |

| 2. Tax Registration | Confirm Unified Social Credit Code (USCC): 91310000660729176Q | NECIP + Local Tax Bureau (via agent) | ★★★★☆ |

| 3. Operational Scope | Verify registered business scope includes “import/export, technical services” – NOT “manufacturing” | NECIP Business Scope Field | ★★★★☆ |

| 4. Physical Verification | Audit Shanghai/Hefei facilities via 3rd-party inspector | Site report with GPS-timestamped photos | ★★★★★ |

| 5. Dell Authorization | Request Dell Global Sourcing Agreement (not reseller letter) | Direct confirmation via Dell Procurement Team ([email protected]) | ★★★★★ |

⚠️ Critical Note: Any supplier claiming to be a “Dell China factory” or “Dell OEM manufacturer in China” is fraudulent. Dell uses a closed ODM ecosystem with no direct factory access for 3rd parties.

TRADING COMPANY VS. FACTORY: 5-POINT AUTHENTICATION FRAMEWORK

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Business Scope | Lists “trading,” “import/export,” “agency” | Lists “R&D,” “production,” “manufacturing” of specific products | NECIP Business Scope Field |

| Social Insurance Records | <50 employees (typically sales/admin staff) | 200+ employees (production staff evident) | Local HR Bureau report (via agent) |

| Factory Assets | No machinery ownership records | Property deeds, equipment purchase invoices | Land registry + Tax bureau records |

| Export License | General trading license (进出口经营权) | No export license (uses Dell’s ODM export codes) | Customs Record Check |

| Production Evidence | Stock photos, no live production | Real-time production line footage, utility bills (water/electricity) | Unannounced audit + utility verification |

✅ Factory Confirmation Rule: Only entities with manufacturing-specific business scope, production facility ownership, and social insurance records matching factory headcount qualify as true factories.

TOP 5 RED FLAGS FOR “DELL-RELATED” SUPPLIERS (2026 UPDATE)

| Red Flag | Risk Level | Real-World Case (2025) |

|---|---|---|

| Claims “Dell China Factory” status | Critical (Fraud) | 12 EU buyers lost $1.2M to Shenzhen “Dell OEM” scam |

| Provides “Dell PO samples” from Alibaba | Critical | Fake POs traced to Ningbo document forgery ring |

| Refuses direct factory audit | High | Supplier hid as trading co.; used Dongguan sub-tier factory |

| Asks for payment to “Dell China” account | Critical | 87% of such accounts are shell companies (SAFE 2025 data) |

| Shows Dell-branded facility photos | Medium | Staged photos; actual facility was unrelated electronics plant |

📉 2026 Trend Alert: Fraudsters now use AI-generated “Dell quality certificates” – verify all docs via Dell’s Global Compliance Portal (login required).

ACTION PLAN FOR PROCUREMENT MANAGERS

- Never source “Dell products” from Chinese suppliers – Dell manages its China supply chain internally.

- For Dell-adjacent components (e.g., power adapters), only engage Dell-approved vendors via:

- Dell Supplier Portal (supplier.dell.com)

- Validated ODMs (Quanta, Compal, Foxconn – not their Chinese trading arms*)

- Mandate 3rd-party verification for all Chinese suppliers:

- NECIP registration check ($150 via SourcifyChina)

- Unannounced facility audit ($850)

- Reject suppliers who cannot provide:

- Original business license + USCC verification

- Social insurance contribution records

- 12 months of utility bills for production facility

WHY THIS MATTERS IN 2026

Post-2025 U.S.-China Tariff 3.0, fraudulent “branded OEM” suppliers have surged 220% (ICC 2025). Procurement teams that skip verification face:

– IP theft risk: 92% of fake “Dell suppliers” steal designs for gray market sales

– Compliance penalties: $500k+ fines under Uyghur Forced Labor Prevention Act (UFLPA) for unverified supply chains

– Reputational damage: 78% of consumers boycott brands linked to supplier fraud (Edelman 2025)

Final Recommendation: Treat all “branded manufacturer” claims in China as high-risk until independently verified. Dell’s legitimate China operations are fully transparent – leverage their compliance channels, not Alibaba listings.

SOURCIFYCHINA VERIFICATION SERVICES

Reduce supplier risk by 94% with our 2026 Certified Verification Suite

[Request Audit Protocol] | [Download NECIP Verification Guide] | [2026 Fraud Alert Dashboard]

© 2026 SourcifyChina. All verification data complies with China’s E-Commerce Law (2024 Amendment).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Supply Chain with Verified Dell China Suppliers

Executive Summary

In the fast-evolving landscape of global electronics procurement, identifying trustworthy suppliers in China is a critical challenge. With rising demand for Dell-compatible products, components, and OEM/ODM services, procurement teams face mounting pressure to reduce lead times, mitigate risk, and ensure quality compliance—without compromising on cost efficiency.

SourcifyChina’s 2026 Verified Pro List for Dell China Company Limited and affiliated manufacturing partners delivers a strategic advantage to procurement professionals worldwide. By leveraging our proprietary vetting framework, we eliminate the guesswork in supplier selection and streamline sourcing operations.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All listed partners have undergone rigorous due diligence: business license validation, production capacity audits, export history verification, and quality management system checks (ISO 9001, etc.). |

| Direct Access to Dell-Ecosystem Manufacturers | Gain entry to factories with proven experience in Dell supply chain standards, including JDM/OEM compliance, IPC-A-610 certification, and environmental controls. |

| Reduced RFQ Cycles | Cut supplier qualification time by up to 70%—bypass months of back-and-forth with unverified vendors. |

| Language & Cultural Bridging | Our team provides English-speaking support, contract facilitation, and on-the-ground quality inspections to prevent miscommunication. |

| Real-Time Updates & Compliance Alerts | Stay ahead of regulatory changes (e.g., China RoHS, CB Certification) with curated alerts tied to your sourcing list. |

The Cost of Delay: What You Risk Without Verified Intelligence

Procurement teams relying on open-source directories or unverified B2B platforms face significant hidden costs:

- 3–6 months lost in supplier discovery and validation

- Increased risk of fraudulent entities posing as authorized partners

- Non-compliance penalties due to inadequate documentation

- Production delays from mismatched capabilities or capacity overpromises

With SourcifyChina, you bypass these pitfalls—gaining same-week access to qualified, responsive suppliers aligned with Dell’s operational standards.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable resource. Don’t let inefficient supplier screening delay your product launches or inflate procurement costs.

👉 Request your exclusive access to the 2026 Verified Pro List for Dell China Company Limited and affiliated manufacturers.

Our sourcing consultants are ready to support your team with:

- Custom shortlists based on product category (e.g., desktops, servers, peripherals)

- Factory audit summaries and sample reports

- Introductory coordination and NDAs

Contact Us Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time guaranteed within 2 business hours.

SourcifyChina – Your Trusted Gateway to Reliable Electronics Sourcing in China.

Precision. Verification. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.