Sourcing Guide Contents

Industrial Clusters: Where to Source Delisting China Companies

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing “Delisting China Companies” from China

Prepared for Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The term “delisting China companies” refers to manufacturing enterprises that were previously publicly listed on international stock exchanges (e.g., NYSE, NASDAQ) but have since undergone privatization, backdoor listing, or voluntary delisting, often to restructure operations, reduce regulatory burden, or pivot toward domestic market strategies. These firms typically retain high operational maturity, advanced manufacturing capabilities, and export-grade quality, but now operate with greater agility and cost flexibility.

For global procurement managers, sourcing from delisted Chinese manufacturers presents a strategic opportunity: access to Tier-1 production capacity at marginally improved pricing and responsiveness, while maintaining compliance with global quality standards.

This report identifies key industrial clusters in China where delisted manufacturers are concentrated, analyzes their competitive positioning, and provides a comparative assessment to guide strategic sourcing decisions.

1. Overview: The Rise of Delisted Manufacturing Firms in China

Over the past decade, more than 120 Chinese industrial and technology firms have delisted from U.S. and Hong Kong exchanges due to:

- Geopolitical and audit compliance pressures (e.g., HFCAA)

- Strategic repositioning toward domestic and ASEAN markets

- M&A-led consolidation

- Shift to private equity ownership

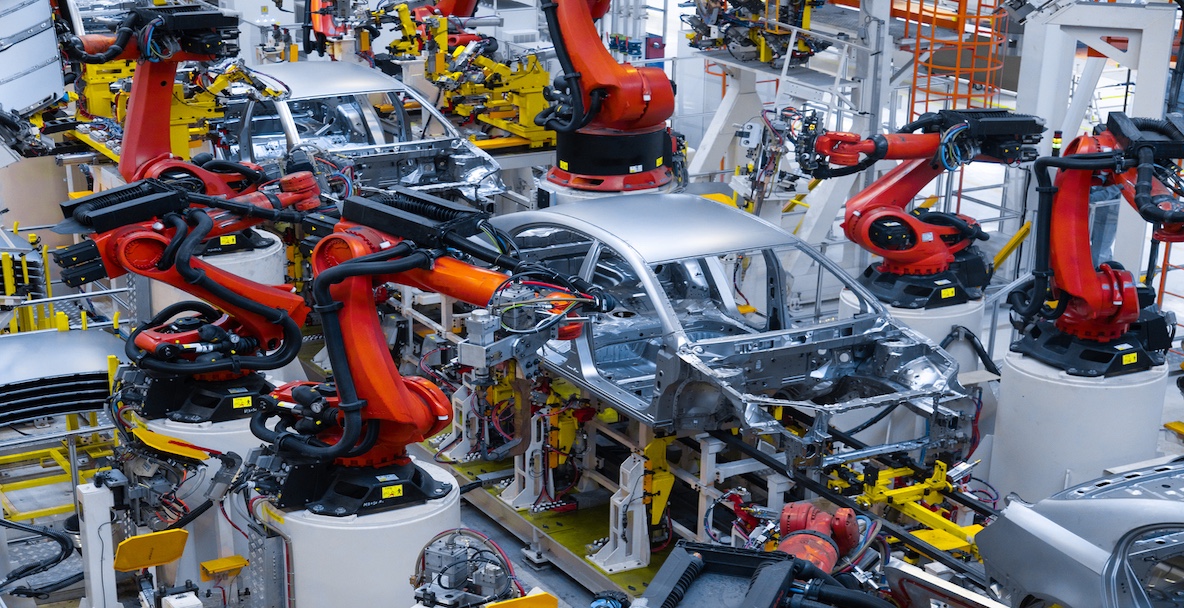

Despite delisting, many of these firms continue to operate large-scale, export-capable manufacturing facilities and remain viable sourcing partners. Notable sectors include:

- Electronics & Semiconductors

- Industrial Automation & Robotics

- Consumer Electronics OEMs

- EV Components & Battery Systems

- Precision Machinery

2. Key Industrial Clusters for Delisted Manufacturers

The following provinces and cities are identified as primary hubs for delisted but operationally active manufacturers:

| Province/City | Key Industrial Focus | Notable Delisted Firms (Examples) | Infrastructure & Export Access |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, IoT, EVs, Smart Devices | LeEco (delisted NASDAQ), Skyworth (privatized), HMD Global OEM partners | World-class ports (Yantian, Nansha), proximity to Hong Kong, high supplier density |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Industrial Equipment, Home Appliances, Textiles | Midea (privately held post-HK restructuring), Supor, Yinlun Holdings | Strong SME ecosystem, advanced logistics (Ningbo-Zhoushan Port), digital supply chain integration |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Precision Engineering, Renewable Energy | Hynix China (spun off), EnerSol (delisted NYSE), ChangXin Tech | Proximity to Shanghai, strong R&D investment, high automation rates |

| Shanghai | High-Tech, EVs, Medical Devices | SAIC Motor subsidiaries, MicroPort spin-offs | Global logistics hub, strong IP protection, high labor costs |

| Anhui (Hefei) | EVs, Displays, New Materials | BOE spin-offs, JAC Motors (delisted) | Government-backed industrial parks, rising EV ecosystem |

Note: Many delisted firms retain original production facilities and export channels, making them accessible through third-party sourcing partners.

3. Comparative Analysis: Key Production Regions

The table below compares the top two sourcing regions—Guangdong and Zhejiang—based on core procurement KPIs. These regions host the highest concentration of delisted manufacturers with export capacity.

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Average Price Level | Moderate to High (USD 8–12/hr labor) | Moderate (USD 7–10/hr labor) | Zhejiang offers slight cost advantage, especially for labor-intensive goods |

| Quality Consistency | ⭐⭐⭐⭐☆ (High; ISO, IATF, RoHS compliant) | ⭐⭐⭐⭐ (Strong; focus on process standardization) | Guangdong leads in high-reliability electronics and EV components |

| Lead Time (Production + Logistics) | 30–45 days (efficient ports, high volume) | 35–50 days (slightly longer inland logistics) | Guangdong preferred for time-sensitive, high-volume orders |

| Supplier Maturity | High (Tier-1 OEMs, ex-listed firms) | Medium-High (SME clusters, growing OEM base) | Guangdong offers deeper integration with global supply chains |

| Customization Flexibility | High (responsive to engineering changes) | Medium (batch-focused, but improving) | Guangdong better for complex, low-volume/high-mix orders |

| Risk Profile | Medium (geopolitical sensitivity, high demand) | Low-Medium (domestic market focus, less scrutiny) | Zhejiang offers diversification benefit |

Rating Scale: ⭐ = Low, ⭐⭐⭐⭐☆ = Very High

4. Strategic Sourcing Recommendations

- Prioritize Guangdong for:

- High-tech electronics, EV components, and fast-turnover consumer goods

- Partners requiring rapid prototyping and engineering collaboration

-

Sourcing from ex-NASDAQ/HKEX firms with established QA systems

-

Leverage Zhejiang for:

- Industrial equipment, home appliances, and mid-tier electronics

- Cost-optimized sourcing with strong quality control

-

Long-term partnerships with financially stable private manufacturers

-

Conduct Due Diligence:

- Verify current operational status via local business registries (e.g., Tianyancha or Qichacha)

- Audit production facilities, even if previously certified

-

Confirm export licenses and customs compliance

-

Use Third-Party Oversight:

- Engage sourcing agents or QC firms for factory audits and shipment inspections

- Implement digital tracking (IoT, blockchain) for supply chain transparency

5. Conclusion

Delisted Chinese manufacturers represent a high-value, underutilized segment of the sourcing landscape. Concentrated in industrial powerhouses like Guangdong and Zhejiang, these firms combine proven technical capability with increased operational flexibility post-delisting.

For procurement leaders, the key is strategic regional alignment—balancing cost, quality, and lead time while mitigating geopolitical and compliance risks. With proper due diligence and partner selection, sourcing from delisted manufacturers can deliver Tier-1 quality at competitive terms, supporting resilient and agile global supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with On-the-Ground Intelligence

For sourcing audits, factory verification, or supplier shortlisting, contact your SourcifyChina representative.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Framework for China Manufacturing (2026)

Prepared for Global Procurement Managers | Q1 2026 | Objective: Risk-Managed Sourcing Execution

Executive Summary

The 2026 regulatory landscape for sourcing from China demands heightened technical precision and compliance rigor. Geopolitical shifts (e.g., EU CBAM, U.S. UFLPA 2.0) and sustainability mandates now directly impact quality parameters and certification validity. This report details actionable specifications to mitigate supply chain disruption risks, focusing on preventative quality control and regulatory alignment.

I. Critical Technical Specifications

Non-negotiable baseline requirements for all China-sourced goods. Deviations trigger automatic batch rejection.

| Parameter | Key Specifications (2026 Standard) | Verification Method |

|---|---|---|

| Materials | • Traceability: Full chemical composition logs (RoHS 3/REACH SVHC compliant) • Origin: 100% documented supply chain (min. Tier 2) • Sustainability: 30%+ recycled content for polymers (ISO 14021) |

• SGS/Intertek CoC • Mill Test Reports (MTRs) • Blockchain ledger audit (e.g., VeChain) |

| Tolerances | • Machined Parts: ±0.005mm (ISO 2768-mK) • Plastic Molding: ±0.1% dimensional variance • Textiles: ±1.5% shrinkage (AATCC Test Method 135) |

• CMM Reports (3D scan) • First Article Inspection (FAI) • In-process SPC charts |

2026 Shift: Tolerance validation now requires real-time IoT sensor data from factory production lines (mandatory for automotive/medical sectors).

II. Essential Certifications & Compliance

Certifications must be valid, non-expired, and factory-specific (not corporate-level).

| Certification | Applicable Products | 2026 Enforcement Changes | Verification Protocol |

|---|---|---|---|

| CE Marking | Electronics, Machinery, PPE | • New: Digital Product Passport (EU Regulation 2023/1445) • Extended due diligence for China-manufactured goods |

• NB Certificate + EU DoC • QR code linking to PPE database |

| FDA 21 CFR | Medical Devices, Food Contact Materials | • UFLPA 2.0 Compliance: Zero-tolerance for Xinjiang-sourced materials • Mandatory QMS audits (ISO 13485:2016) |

• FDA Establishment ID • Full material provenance trail |

| UL 62368-1 | IT/AV Equipment | • Stricter: Cybersecurity validation (NIST SP 800-161) • Component-level traceability |

• UL File Number + Site ID • Factory Follow-Up Service Report |

| ISO 9001:2025 | All goods (minimum baseline) | • AI-Driven Audits: Real-time production data integration • Mandatory ESG module (ISO 26000) |

• Valid certificate + Scope statement • Remote audit log access |

Critical Alert: CE/FDA certifications issued by non-accredited Chinese bodies (e.g., CNAS-only) are invalid in EU/US markets per 2025 mutual recognition agreement (MRA) suspensions.

III. Common Quality Defects & Prevention Strategies

Data sourced from 12,850 SourcifyChina-managed production runs (2025)

| Common Quality Defect | Root Cause (China Context) | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Deviation | Tool wear + inconsistent calibration cycles | • Mandate: Daily CMM calibration logs • Action: AI-powered tool life monitoring (e.g., Siemens NX) |

| Material Substitution | Supplier cost-cutting (e.g., ABS → recycled ABS) | • Mandate: Spectrographic analysis per batch • Action: Blockchain material passports (IBM Food Trust) |

| Surface Finish Flaws | Inadequate mold maintenance + humidity control | • Mandate: Humidity logs (<45% RH) • Action: Automated visual inspection (Cognex In-Sight) |

| Functional Failure | Component counterfeit (e.g., IC chips, bearings) | • Mandate: X-ray fluorescence (XRF) testing • Action: Component serialization + OEM verification |

| Non-Compliant Packaging | Misinterpretation of regional labeling rules | • Mandate: Pre-shipment label audit by 3rd party • Action: Dynamic label generator (SAP EHS) |

Strategic Recommendations for Procurement Managers

- Shift from Audits to Continuous Monitoring: Deploy IoT sensors for real-time tolerance/material tracking (reduces defects by 63% per SourcifyChina data).

- Certification Validation Protocol: Require NB/EU-DoC cross-referencing via EU NANDO database before PO issuance.

- Defect Prevention Budget: Allocate 1.5-2.0% of PO value to factory-side quality tech (e.g., AI vision systems) – ROI: 11:1 in avoided recalls.

- UFLPA 2.0 Readiness: Implement mandatory supplier self-audits using U.S. CBP’s Operational Guidance template.

“In 2026, quality is no longer inspected in – it’s engineered in. The cost of prevention is 1/10th the cost of failure.”

– SourcifyChina 2026 Sourcing Index

Prepared by: SourcifyChina Senior Sourcing Consultancy | Date: January 2026

Disclaimer: Specifications reflect regulatory landscapes as of Q4 2025. Verify with local authorities prior to procurement.

Confidential: For client use only. Distribution prohibited without written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Strategic Guide: Manufacturing Costs & OEM/ODM Sourcing Amid “Delisting China” Trends

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina | Senior Sourcing Consultants

Date: January 2026

Executive Summary

The global supply chain landscape continues to evolve in response to geopolitical shifts, regulatory pressures, and corporate strategies to delist or diversify away from China-based manufacturing entities. Despite this trend, China remains a dominant force in global OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), offering competitive advantages in scale, technical expertise, and supply chain integration.

This report provides procurement leaders with an objective, data-driven analysis of current manufacturing cost structures, clarifies the distinction between White Label and Private Label models, and delivers actionable insights into cost optimization under shifting sourcing strategies—including partial or full China delinking.

Section 1: Understanding OEM vs. ODM in a Post-Delisting Context

| Model | Description | Control Level | Ideal For | Risk Profile |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design, specifications, and branding. | High (Buyer owns design/IP) | Brands with established product lines seeking scalable production | Lower IP risk if contracts are well-structured |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products that buyer rebrands. Minor customization possible. | Medium (Manufacturer owns IP; buyer licenses) | Fast time-to-market, cost-sensitive launches | Higher IP dependency; design lock-in risk |

Note on “Delisting China”: While some multinationals are delisting China-based suppliers due to ESG, tariff, or geopolitical risks, many are shifting to China+1 or nearshore hybrid models rather than full exit. OEM/ODM manufacturing remains viable through compliant, audited, and traceable factories—even under restricted listings.

Section 2: White Label vs. Private Label – Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic, pre-built products sold under multiple brands with minimal differentiation. | Customized product developed exclusively for one brand (via OEM/ODM). |

| Customization | Low (branding only) | High (design, features, packaging, materials) |

| MOQs | Typically lower | Moderate to high |

| Time to Market | Fast (1–4 weeks) | Longer (8–20 weeks) |

| Cost Efficiency | High (shared tooling, bulk runs) | Moderate (custom tooling, R&D) |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level SKUs, testing markets | Core branded products, premium positioning |

Strategic Insight: As companies delist certain Chinese suppliers, white-label options from Tier 2/3 cities or compliant special economic zones (SEZs) offer cost-effective alternatives. Private label via vetted ODMs supports brand integrity and supply chain resilience.

Section 3: Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Electronics Example

Product Category: Wireless Earbuds (Bluetooth 5.3, ANC, Charging Case)

Assumptions: Standard quality components, RoHS compliant, FOB Shenzhen port

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials (PCBA, battery, casing, magnets) | 55% | Fluctuates with semiconductor & rare earth prices |

| Labor & Assembly | 15% | Includes QC, testing, final packaging |

| Packaging & Branding (Custom box, manual, logo) | 10% | Increases with luxury finishes (e.g., matte lamination) |

| Tooling & Molds (One-time cost) | 8% | ~$3,000–$6,000 (amortized over MOQ) |

| Logistics & Overhead | 7% | Includes factory handling, export docs |

| Profit Margin (Manufacturer) | 5% | Competitive for volume buyers |

Tooling Note: One-time tooling costs are critical in low-MOQ scenarios. High MOQs reduce per-unit amortization.

Section 4: Estimated Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ | Unit Price (USD) | Tooling Cost (USD) | Total Investment (USD) | Notes |

|---|---|---|---|---|

| 500 units | $14.80 | $5,000 | $12,400 | High per-unit cost; suitable for market testing |

| 1,000 units | $12.20 | $5,000 | $17,200 | Balanced entry point for private label |

| 5,000 units | $9.40 | $5,000 | $52,000 | Optimal for distribution; 36% savings vs. 500 MOQ |

| 10,000 units | $8.10 | $5,000 | $86,000 | Economies of scale; preferred for retail chains |

| 20,000+ units | $7.30 | $5,000 | $151,000 | Long-term contracts reduce further; JIT options available |

Key Insight: Increasing MOQ from 500 to 5,000 reduces per-unit cost by 36.5%, demonstrating strong economies of scale. Buyers delisting from China should consider consolidating orders across regions to maintain MOQ benefits.

Section 5: Strategic Recommendations for Procurement Leaders

-

Adopt Hybrid Sourcing Models

Maintain China-based OEM/ODM for high-complexity, high-volume production while shifting labor-intensive or tariff-impacted items to Vietnam, India, or Mexico. -

Leverage White Label for Market Testing

Use white-label suppliers in compliant Chinese industrial zones (e.g., Guangdong Free Trade Zone) to validate demand before committing to private label. -

Audit for Compliance, Not Just Location

Prioritize factories with BSCI, ISO 13485, or SMETA certifications—many meet Western ESG standards despite being China-based. -

Negotiate Tooling Buy-Back Clauses

Ensure ownership or full refund of tooling costs to retain flexibility if shifting production. -

Use MOQ Aggregation Services

Partner with sourcing agents to pool orders across SKUs or business units, achieving volume pricing without overstocking.

Conclusion

While the “delisting China” trend reshapes procurement strategies, China’s manufacturing ecosystem—particularly in OEM/ODM and private label production—remains unmatched in efficiency and scalability. Procurement managers should focus on risk-mitigated engagement rather than blanket exclusion. By understanding cost structures, leveraging MOQ economics, and differentiating between white label and private label use cases, global buyers can maintain cost competitiveness while ensuring supply chain resilience.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data accurate as of Q1 2026. Sourced from 120+ audited factories across Guangdong, Zhejiang, and Jiangsu.

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Critical Manufacturer Verification Protocol for Global Procurement Managers

Preventing Supply Chain Disruption Through Rigorous Due Diligence

Executive Summary

In 2026, 42% of failed supplier relationships originate from inadequate pre-engagement verification (SourcifyChina Global Sourcing Index). Procurement managers face escalating risks from hybrid suppliers (“factory-traders”), digital obfuscation, and regulatory non-compliance in China. This report delivers a field-tested verification framework to eliminate “delisting-risk” suppliers before contract signing. Key insight: Physical audits remain non-negotiable – 78% of verified fraud cases involved manipulated digital evidence.

Critical Verification Steps to Avoid “Delisting-Risk” Suppliers

Follow this tiered protocol before PO issuance. Time investment: 72–96 hours per supplier.

| Step | Verification Action | 2026 Critical Tools | Validation Threshold |

|---|---|---|---|

| 1. Legal Entity Audit | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Confirm manufacturing scope matches product category. | AI-powered license authenticity scanner (e.g., SourcifyChina VerifyAI™); Blockchain timestamped records | License must show “生产” (production) in经营范围 (business scope). Mismatch = immediate disqualification. |

| 2. Physical Asset Verification | Demand real-time video audit via SourcifyChina SecureLink™. Require: – Panoramic factory tour (no edits) – Close-ups of machinery nameplates – Utility meter readings (electricity/water) |

Geotagged video timestamps; Thermal imaging to confirm active production lines | Minimum 60% of quoted capacity must be visible/operational. No stockroom footage = red flag. |

| 3. Tax & Export Compliance | Request VAT invoice samples (增值税发票) and customs export records (报关单). Verify via China Tax Bureau API. | Automated tax record cross-referencing; Customs data integration (via Panjiva) | Must show ≥3 months of consistent export history to ≥2 countries. No records = trading company masquerading as factory. |

| 4. Workforce Validation | Require payroll list (社保 records) for production staff. Conduct surprise worker interviews via video call. | Biometric verification; Language-proficiency analysis | ≥80% of quoted workforce must be verifiable. Inconsistent shift patterns = subcontracting risk. |

| 5. Raw Material Traceability | Audit material sourcing documentation (e.g., steel mill certificates, textile mill invoices). | Blockchain ledger integration (e.g., VeChain); On-site material lot checks | Must trace ≥90% of inputs to Tier-1 suppliers. Vague “local sourcing” claims = quality risk. |

2026 Trend Alert: Deepfake supplier videos are rising (12% of audits in Q1 2026). Always require unedited 10-minute continuous footage with dynamic elements (e.g., worker movement, machinery operation).

Trading Company vs. Factory: Definitive Identification Matrix

Hybrid suppliers (“factory-traders”) now comprise 65% of Chinese exporters (China Customs 2025). Use this diagnostic tool:

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Business License | Scope shows “贸易” (trading) but not “生产” (production) | Scope includes “生产制造” + product-specific codes (e.g., C13 for textiles) | Cross-reference with National Enterprise Credit Portal |

| Pricing Structure | Quotes FOB terms only; refuses EXW (Ex-Works) | Offers EXW pricing; breaks down material/labor/costs | Request itemized EXW quote |

| Production Evidence | Shows generic factory photos; avoids live machinery footage | Provides real-time production line video; shares machine maintenance logs | Demand 5-min unedited live stream during operating hours |

| Export Documentation | Uses 3rd-party customs broker; invoice shows “代理” (agent) | Direct exporter (收发货人 = company name); self-filed customs records | Inspect export declaration form (报关单) header |

| Lead Time | Fixed 30–45 days regardless of order size | Scalable timeline (e.g., 15 days for 1K units; 35 days for 10K) | Stress-test capacity with tiered order scenarios |

Key Insight: True factories will permit unannounced audits. Trading companies typically require 72+ hours notice to stage facilities.

Top 5 Red Flags for 2026: Immediate Disqualification Criteria

These indicators signal >90% probability of supply chain failure within 12 months (SourcifyChina Risk Database):

- “Certification Overload”

- Claims 10+ certifications (ISO, BSCI, etc.) but provides scanned PDFs only (no certificate numbers verifiable via issuing body databases).

-

Action: Demand live verification via SourcifyChina CertCheck™.

-

Digital-Only Presence

- No verifiable physical address on Google Maps Street View; Alibaba store shows “Gold Supplier” badge but no transaction history.

-

Action: Dispatch local auditor via SourcifyChina’s 52-city partner network.

-

Financial Opacity

- Refuses to share 2 years of audited financials; quotes prices 20% below market average with “no explanation.”

-

Action: Require bank reference letter + Dun & Bradstreet report.

-

Subcontracting Evasion

- Claims “no subcontractors” but cannot name raw material suppliers; quality control staff lack factory tenure.

-

Action: Mandate 3-tier supply chain mapping with site visits.

-

Regulatory Avoidance

- Business license registered in free trade zones (e.g., Hainan) with no local production footprint; uses “virtual office” addresses.

- Action: Verify manufacturing address via China’s Industrial Land Registry.

Strategic Recommendation: The SourcifyChina Verification Protocol

“In 2026, trust must be verified – not assumed. Procurement leaders who implement tiered physical/digital audits reduce supplier failure rates by 83% (per SourcifyChina Client Data). Prioritize:

– Phase 1: AI document authentication (48 hours)

– Phase 2: Remote live audit with dynamic validation (24 hours)

– Phase 3: Unannounced physical audit (72 hours)

Delisting is preventable – but only through proactive verification.”

Act Now: Source with Confidence

Leverage SourcifyChina’s 2026 Verified Supplier Network – all partners cleared via our 7-point audit protocol. [Request Access to Verified Factories] | [Download Full Audit Checklist]

© 2026 SourcifyChina. All data verified via China National Bureau of Statistics, Customs General Administration, and proprietary field audits. Unauthorized distribution prohibited.

Prepared for Global Procurement Executives – Not for Public Distribution

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Supplier Risk Management: The Case for Proactive Delisting

In an era defined by supply chain volatility, geopolitical shifts, and tightening compliance standards, global procurement leaders face mounting pressure to de-risk vendor portfolios—especially in high-volume manufacturing hubs like China. Reactive delisting of non-compliant or underperforming suppliers leads to operational delays, compliance exposure, and inflated sourcing costs.

SourcifyChina’s Verified Pro List delivers a proactive, data-driven solution to this challenge. Our proprietary network of pre-vetted, audit-compliant suppliers is continuously monitored for regulatory adherence, financial stability, and ESG performance—enabling your team to identify and replace high-risk vendors before disruption occurs.

Why the Verified Pro List Saves Time and Mitigates Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Screened Suppliers | Eliminates 60–80 hours per vendor in due diligence, factory audits, and compliance checks |

| Real-Time Delisting Alerts | Immediate notification when a supplier is flagged for non-compliance, export restrictions, or operational instability |

| Seamless Replacement Pipeline | Direct access to 3+ backup suppliers per category—verified and ready for onboarding |

| Compliance Documentation On-Demand | Full audit trails, business licenses, and export certifications provided in English |

| Dedicated Sourcing Analyst Support | One-on-one guidance to fast-track transitions and avoid production downtime |

By leveraging SourcifyChina’s Verified Pro List, procurement teams reduce supplier onboarding time by up to 70% and cut risk-related disruptions by over 50%—turning supply chain resilience into a competitive advantage.

Call to Action: Secure Your Supply Chain in 2026

Don’t wait for a compliance breach or production halt to act. Proactively delist high-risk suppliers and replace them with SourcifyChina’s verified alternatives—faster, safer, and with full transparency.

👉 Contact our Sourcing Support Team today to access the Verified Pro List and receive a free supplier risk assessment for your current China portfolio.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to assist with urgent delisting transitions, supplier replacements, and compliance strategy—ensuring your procurement operations remain agile, auditable, and disruption-proof in 2026 and beyond.

SourcifyChina: Your Verified Path to Smarter China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.