Introduction: Navigating the Global Market for tracking usps from china

Expanding your business through cross-border trade requires more than just finding the right products at the right price—it demands complete visibility throughout the shipping journey. For B2B buyers sourcing from China and relying on USPS for global deliveries, robust tracking is not a convenience; it’s an operational necessity. Accurate shipment tracking enables you to anticipate lead times, manage customer expectations, minimize disruptions, and uphold the reliability your clients and partners expect—whether you’re based in Vietnam, Nigeria, Brazil, or the UAE.

The complexity of international shipping is amplified when shipments traverse multiple carriers, customs checkpoints, and global postal systems. This reality is especially relevant for importers in Africa, South America, the Middle East, and Europe, where local challenges—such as varying customs protocols, infrastructure limitations, or supply chain disruptions—raise the stakes for every delivery. Navigating these uncertainties with USPS tracking tools transforms guesswork into informed decision-making, protecting your bottom line and reputation.

This comprehensive guide is designed to demystify the process of tracking USPS shipments originating from China. You’ll gain actionable insights into:

- Types of USPS tracking solutions and their capabilities

- Critical materials and documentation required for seamless tracking

- Standards in manufacturing, packaging, and quality control for export

- How to choose and vet reliable suppliers offering end-to-end tracking

- Cost structures, including hidden fees impacting your total landed cost

- Current trends and market intelligence across key import regions

- Essential FAQs unique to international B2B buyers

By leveraging this resource, you’ll be empowered to make smarter sourcing decisions, improve supply chain transparency, and deliver consistent value to your partners—no matter where your business operates.

Understanding tracking usps from china Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| USPS ePacket Tracking | Lightweight, cost-effective tracking for small parcels; tracking on China Post & USPS sites | E-commerce samples, lightweight goods, direct shipments | Affordable, reliable for small items, but limited for bulk/large |

| USPS Priority Mail Express | Fastest delivery, end-to-end tracking with signature; 13-character tracking (e.g., ECxxxxxxUS) | High-value, urgent B2B samples, time-sensitive documents | Rapid, trackable delivery but premium-priced and strict weight limits |

| USPS Priority Mail International | Balanced speed/cost; 20–22 digit numeric tracking codes; broader item size options | B2B orders, commercial samples, medium parcels | Widely used, reliable for mid-size shipments, but mid-range handling speed |

| Third-Party Tracking Platforms | Aggregates tracking from USPS and other carriers; multi-shipment dashboard; API integration | Frequent multi-courier B2B shipping, supply chain monitoring | Centralized visibility and automation; may lag real-time updates from origin |

| China Post Registered/EMS + USPS Tracking | “Dual-track” visibility on China Post and USPS after US handoff; limited status granularity | Standard B2B shipments, bulk commercial cargo | Economical for bulk; status may be less granular, longer transit |

USPS ePacket Tracking

USPS ePacket offers economical tracked shipping for lightweight parcels (usually below 2 kg) from China. It provides visibility from dispatch in China (typically via China Post) to delivery in the US or third-country recipient, updating through both Chinese and USPS websites. This service suits B2B buyers who need to sample products or ship low-cost, lightweight goods—especially for e-commerce or prototype sampling. Buyers should note the weight and value restrictions, and the slower transit relative to premium options.

USPS Priority Mail Express

Priority Mail Express is the fastest USPS service for international shipments from China, often arranged through a USPS postal partner or global courier. It features end-to-end online tracking, expedited customs handling, and signature-on-delivery—key for time-sensitive or valuable B2B documents and prototypes. The tracking number format starts with two letters and ends with “US”. This service is ideal for buyers needing guaranteed speed, but it comes at a premium cost and enforces strict package dimension and weight maxima.

USPS Priority Mail International

Priority Mail International provides reliable tracking and delivery for medium-sized B2B shipments from China. Tracking numbers are 20–22 digit numeric codes, ensuring status checks from origin through to delivery. This service is a solid compromise between cost-effectiveness and speed, making it suitable for larger sample orders or small production runs. Companies benefit from solid coverage and straightforward claims, but should factor in possible customs delays and moderate shipping speeds compared to express services.

Third-Party Tracking Platforms

Third-party tracking platforms, such as Track.Global, allow aggregation of tracking data from USPS, China Post, and many other carriers. These integrated dashboards and APIs are crucial for B2B buyers managing frequent shipments or needing automated supply chain visibility. Benefits include consolidated reporting and faster response to logistics exceptions. However, there can be a slight delay in real-time updates, especially at origin points before USPS scans the package.

China Post Registered/EMS + USPS Tracking

This “dual-track” method covers packages shipped from China via China Post Registered or EMS and transferred to USPS for final delivery and updates. Tracking status may be less detailed during transit stages in China, becoming more granular once USPS scans it upon US entry. This cost-efficient method is suitable for heavier or bulk commercial B2B shipments where real-time visibility is less critical. Buyers should balance the low cost and decent reliability against potential for less transparent tracking during the international journey.

Related Video: What is Data Modelling? Beginner’s Guide to Data Models and Data Modelling

Key Industrial Applications of tracking usps from china

| Industry/Sector | Specific Application of tracking usps from china | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Electronics & Components | Monitoring inbound shipments of high-value electronics/components | Enhanced supply chain visibility, reduced risk of loss | Real-time integration, API support, customs harmonization |

| Fashion & Apparel | Tracking seasonal or fast-fashion consignments for fulfillment | Accurate ETAs for market launches, lower inventory risk | Batch tracking, localized support, delivery timelines |

| Industrial Machinery | Ensuring timely delivery of equipment parts for assembly or maintenance | Minimized downtime, improved project scheduling | End-to-end tracking, handling oversized shipments |

| Healthcare & Medical | Overseeing cross-border delivery of medical devices and consumables | Regulatory compliance, product security, chain of custody | Cold chain tracking, data archiving, regulatory documentation |

| Automotive Parts | Tracking just-in-time (JIT) shipments of replacement or OEM parts | Avoided production delays, optimized spare parts logistics | Support for varied shipment scales, proactive notifications |

Electronics & Components

In the electronics industry, businesses frequently source semiconductors, circuit boards, and finished devices from China. Utilizing USPS tracking enables buyers to follow shipments in real-time, identify delays early, and plan downstream logistics more effectively. This fast-paced sector benefits from enhanced visibility, reducing risks tied to theft, loss, or transit issues. International buyers, notably in Africa and the Middle East, should prioritize partners offering robust API integration for real-time updates, and ensure shipments comply with international customs and labeling requirements.

Fashion & Apparel

For fashion and apparel brands, speed-to-market is critical—especially with seasonal or trend-driven items. Tracking USPS parcels from China helps these businesses synchronize launch dates, manage inventory levels, and react to potential disruptions in transit. Batch tracking features are particularly advantageous when managing multiple SKUs within a single shipment. Buyers in regions such as South America and Europe must assess the ability of tracking systems to handle local languages and customs documentation to ensure seamless budgeting and forecasting.

Industrial Machinery

Procurement of specialized machinery and parts often hinges on precise delivery schedules, as delays can stall entire production lines. Using USPS tracking from China, B2B buyers gain full visibility into each stage of transit—even for oversized or complex shipments. This level of insight supports project managers in Africa and Vietnam to better coordinate installation resources and meet client expectations. Key requirements include tracking systems capable of handling multi-modal shipments and support for bulky cargo.

Healthcare & Medical

The medical sector demands stringent controls over shipment integrity, timeliness, and traceability—especially for regulated devices or consumables sourced from China. USPS tracking is instrumental in documenting the chain of custody, meeting health authority requirements, and ensuring products arrive uncompromised. International buyers—particularly in Nigeria and the Middle East—must verify that tracking solutions offer cold chain support, comprehensive data archiving, and the ability to generate regulatory reports.

Automotive Parts

Automotive manufacturers and distributors rely on just-in-time delivery of components and replacement parts to minimize storage and production costs. USPS tracking allows close monitoring of shipments from China, supporting contingency planning should delays or route changes occur. Buyers in Europe and South America should seek solutions that provide customizable alerts, scalability for tracking many parcels, and integration with warehouse management systems to ensure rapid intake and deployment of critical components.

Related Video: USPS Tracking – How to Track Using tracking number

Strategic Material Selection Guide for tracking usps from china

Common Materials Analysis for International USPS Tracking Solutions from China

Selecting the right materials for products and solutions related to tracking USPS shipments from China is essential for international B2B buyers. Different components—including shipping labels, tracking hardware housings, packaging, and protective casings for tracking devices—must meet demanding performance, durability, and compliance criteria depending on the transit environment, local regulations, and buyer preferences across Africa, South America, the Middle East, and Europe.

1. Polypropylene (PP)

Key Properties:

Polypropylene is a robust thermoplastic commonly used for packaging materials, label stocks, and casings for lightweight tracking devices. It resists chemicals, moisture, and most acids and bases. PP operates reliably across a broad temperature range (-20°C to +100°C), making it suitable for global shipping routes that cross various climate zones.

Pros & Cons:

Pros include low density (lightweight), good mechanical durability, and cost-effectiveness for mass production via injection molding or film extrusion. However, PP can degrade under prolonged UV exposure and may not suit extremely high-temperature applications. Printing on PP requires careful treatment to ensure label durability during handling and transit.

Impact on Application:

For USPS tracking from China, PP is ideal for shipping labels and protective cases that must withstand rough handling, humidity, or accidental exposure to chemicals. The hydrophobic nature of PP ensures that labels remain legible even in moist conditions.

International B2B Considerations:

PP’s broad compliance with international packaging standards (such as ASTM D882 for tensile properties, EU RoHS) simplifies cross-border procurement. African and South American regions often prioritize cost and resilience against variable environmental conditions, while Middle Eastern and European buyers frequently request documentation of eco-friendliness or recyclability for regulatory alignment.

2. Polycarbonate (PC)

Key Properties:

Polycarbonate is a high-performance engineering plastic with exceptional impact resistance and clarity. It tolerates temperatures from -40°C to +120°C and offers significant protection against mechanical shocks, making it well-suited for the tough outer housings found in reusable electronic tracking tags.

Pros & Cons:

PC boasts high strength-to-weight ratio and flame resistance, and it can be made transparent or opaque. Its primary disadvantages are higher cost compared to basic plastics and sensitivity to scratches or certain solvents unless specially coated.

Impact on Application:

For longer transit routes or high-value shipments, devices housed in PC ensure continued operation even if dropped or exposed to vibrations. Its superior impact resistance protects sensitive electronics and RFID components, which is crucial for buyers requiring reliability in diverse transportation infrastructures.

International B2B Considerations:

PC often complies with rigorous international safety standards (UL94 flame test, EN ISO 527-1 for mechanical properties). European buyers may require materials to be certified for REACH and RoHS compliance; some Middle Eastern markets favor PC for its robustness in hot climates. Documentation and certificates of compliance should be requested prior to procurement.

3. Thermal Paper

Key Properties:

Thermal paper is widely used for printable labels in shipping and tracking applications. It features a heat-sensitive coating that allows information (such as USPS tracking numbers and QR codes) to be rapidly and economically printed using thermal printers.

Pros & Cons:

Thermal paper is inexpensive and enables high-speed label production. However, it is susceptible to fading when exposed to heat, light, or solvents, which can compromise label legibility during long shipments or improper handling.

Impact on Application:

For high-volume, short-to-medium distance shipping, thermal paper is a practical choice. International shipments with prolonged exposure to sun or high temperature should consider top-coated or specialty grades of thermal paper to minimize information loss.

International B2B Considerations:

Thermal paper should meet standards like ISO 216 (paper size) and ISO 18601 (environmental impact). European markets often enforce stricter requirements on BPA content, while African buyers may be less affected by such mandates but more focused on cost. It’s vital to match the grade to the climatic and handling conditions expected along the delivery route.

4. Stainless Steel (e.g., 304/316 Grades)

Key Properties:

Stainless steel, particularly grades 304 and 316, is renowned for its high corrosion resistance and mechanical strength. Used in ruggedized tracking device enclosures or mounting brackets, it tolerates extreme weather, physical abuse, and exposure to chemicals or saline environments.

Pros & Cons:

Advantages include unmatched durability, prolonged service life, and suitability for long-term investments in tracking infrastructure. Downsides are high material and fabrication costs, as well as increased weight, which may be impractical for lightweight shipping but ideal for permanent or high-security installations.

Impact on Application:

In applications where device security, vandal resistance, or outdoor deployment is critical (such as tracking containers or assets at ports), stainless steel housings excel. Their corrosion resistance is particularly valued in humid, coastal, or industrial environments faced by B2B users in Nigeria, Vietnam, and the Middle East.

International B2B Considerations:

Compliance with ASTM, DIN, and JIS standards assures buyers world-wide. European clients may require proof of material compliance (EN 10088-1, RoHS/REACH), while South American buyers may focus on the extended operational lifespan to offset initial material costs for critical logistics hubs.

Summary Comparison Table

| Material | Typical Use Case for tracking usps from china | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polypropylene (PP) | Shipping labels, lightweight tracking device casings | Cost-effective, corrosion-resistant, easy to process | Limited UV/heat resistance, surface printing challenges | Low |

| Polycarbonate (PC) | Durable electronic tag housings, transparent device casings | High impact strength, wide temperature tolerance | Higher cost, can scratch unless coated | Medium to High |

| Thermal Paper | Printed shipping/tracking labels | Fast, economical label production; easy to use | Fades with exposure to heat/light; less durable | Low |

| Stainless Steel (304/316) | Ruggedized enclosures, mounting hardware | Top-tier corrosion and impact resistance; long service life | High cost; heavyweight, potential overkill for expendables | High |

In-depth Look: Manufacturing Processes and Quality Assurance for tracking usps from china

When sourcing tracking solutions for USPS shipments from China, international B2B buyers must understand not only the logistics and technology, but also the manufacturing processes and rigorous quality controls that underpin these products and services. Tracking hardware (such as barcode scanners, RFID labels, and digital tracking devices), as well as integrated tracking software, all demand dependable manufacturing and robust quality assurances to ensure seamless global shipping operations. Below is a comprehensive overview of these processes, with actionable verification steps for buyers from Africa, South America, the Middle East, and Europe.

Key Manufacturing Processes for Tracking Technologies

1. Material Preparation

- Components Sourcing: High-quality electronic components, sensors, PCBs (printed circuit boards), and plastic or metal casings are sourced from vetted suppliers. For tracking labels, premium substrates and adhesives are selected for durability during international transit.

- Supplier Audits: Leading manufacturers perform supplier qualification audits, particularly for critical components likely to affect compliance with USPS and international postal standards.

2. Forming and Fabrication

- PCB Assembly: Surface-mount technology (SMT) processes are used to mount chips and circuits onto PCBs in clean-room environments to minimize defects.

- Enclosure Molding: Injection molding or extrusion techniques shape plastic or metal housings. Dimensional checks ensure casings meet precise design tolerances required for compatibility with USPS scanning infrastructure.

- Label Printing: For barcodes and RFID, specialized printers generate labels capable of withstanding handling, humidity, and temperature fluctuations during export.

3. Assembly and Integration

- Module Integration: Circuitry, antennas, and batteries are assembled and tested in sequence. For software-embedded products (like smart trackers), firmware is installed during this stage.

- System Testing: Assembled units undergo initial power-up and communication checks—verifying connectivity (WiFi, Bluetooth, or GSM), barcode readability, and software pairing with USPS-compatible platforms.

4. Finishing and Packaging

- Protective Finishing: Surfaces are treated for durability and resistance to corrosion or abrasion. Labels may receive UV coatings for legibility.

- Packaging: Units are individually and bulk-packed with anti-static and shock-absorbing materials to prevent damage in long-haul ocean and airfreight conditions.

Core Quality Assurance Measures

1. Global and Industry-Specific Certifications

- ISO 9001: This is the baseline quality management certification, attesting to systematic process control, risk assessment, and continuous improvement across manufacturing.

- CE Marking: For products destined to Europe, CE compliance indicates adherence to safety, health, and environmental standards—crucial for entry into the EU.

- FCC/UL/CSA: For electronic devices, compliance with US or local electrical standards is key for safe USPS integration, especially for buyers in the US and countries referencing US norms.

2. Quality Control (QC) Checkpoints

- Incoming Quality Control (IQC): Inspections upon receipt of raw materials and components. Sampling uses international standards like ANSI/ASQ Z1.4 (AQL tables) to determine batch acceptance or rejection.

- In-Process Quality Control (IPQC): During fabrication and assembly, in-line inspectors verify solder joints, component placement, microchip activation, and label printing—minimizing accumulation of defects.

- Final Quality Control (FQC): Completed units undergo functional “end-of-line” tests: power stability, RFID/barcode readability, wireless communication integrity, and overall product finish/label adhesion.

3. Testing and Reliability Protocols

- Environmental Testing: Devices and labels are tested against temperature variation, humidity, and vibration to mimic real shipping conditions from China to global destinations.

- Performance Testing: Trackers are checked for signal strength, battery life, and accurate data logging. Software elements are subjected to integration tests to ensure compatibility with USPS systems and real-time dashboards.

- Traceability: Each unit is logged with serial numbers or batch codes, enabling buyers to trace any issues post-shipment back to the production stage.

Verifying Supplier Quality as an International B2B Buyer

1. Request Documentation and Audit Reports

- Quality Certificates: Always request up-to-date ISO, CE, and, where relevant, FCC certifications directly from the supplier, verifying their registration with official bodies.

- QC Records: Ask for recent IQC, IPQC, and FQC sample reports, including defect rates and actions taken.

- Process Flow Charts: Reviewing these reveals manufacturing sophistication and bottleneck management.

2. Leverage Third-Party Inspections

- Pre-shipment Inspection (PSI): Commission third-party firms (e.g., SGS, Intertek, Bureau Veritas) for independent product inspections focusing on encoding accuracy, build quality, and labeling durability.

- Factory Audits: In-person or virtual audits assure that your supplier maintains quality processes and workplace standards, and do not merely rely on certificates.

3. Test Orders and Pilot Runs

- Batch Sampling: Prior to full-scale procurement, arrange for small-volume orders to evaluate product performance in your target geography, including compatibility with USPS tracking systems used in Africa, South America, Middle East, or European distribution hubs.

- Field Simulation: Simulate cross-border shipping scenarios to evaluate label/trackers’ performance during actual transit.

4. Ongoing Performance Monitoring

- Dashboard Integration: Require suppliers to provide APIs and reporting tools for end-to-end tracking performance analysis.

- Warranty and Post-sale Support: Include clauses for returns or technical support in case of quality failures discovered in your import markets.

International Considerations and Recommendations

Regional Regulatory Awareness

- African Markets (e.g., Nigeria): Ensure electronic tracking devices comply with local telecommunications regulations; investigate barcode readability standards required by regional postal services.

- South American Hubs: Customs and postal authorities may have additional requirements for unlicensed radio devices or battery-powered electronics—obtain advance conformity statements from suppliers.

- Middle East: Given climate exposure, place extra emphasis on environmental durability testing. Confirm whether tracking devices align with regional technical certification (e.g., G-Mark for Gulf Cooperation Council).

- Europe: If goods are routed through multiple EU states, comprehensive CE and RoHS documentation is mandatory.

Cultural and Logistical Nuances

- Language & Documentation: Request QC reports, test protocols, and user guides in your preferred language to ease audits and staff training.

- Lead Time for Quality Checks: Factor in additional lead time for 3rd-party inspections and corrective actions, especially during peak seasons or in volatile shipping periods.

Actionable Takeaways for B2B Buyers

- Always vet your supplier’s certification status and audit histories before committing to orders.

- Mandate clear, documented QC checkpoints across the full production cycle—incoming, in-process, and final.

- Invest in third-party inspections and conduct sample testing in your target shipping environments before scaling up procurement.

- Ensure regulatory compliance is met not only in China but in your intended market to avoid customs delays and penalties.

- Implement digital performance tracking for every shipment; data transparency is key to resolving disputes and improving supply chain resilience.

A meticulous approach to manufacturing and quality assurance will directly influence tracking reliability, shipment security, and customer trust when dealing with USPS parcels from China. For global B2B buyers, especially from emerging markets, establishing strong QC frameworks and supplier relationships is essential in mitigating cross-border risks and powering seamless trade.

Related Video: Top 5 Excellent Mass Production Factory Process! Best Chinese Manufacturing Plant Video!

Comprehensive Cost and Pricing Analysis for tracking usps from china Sourcing

Key Cost Components in USPS Tracking from China Sourcing

When sourcing USPS-tracked shipments from China, a clear understanding of the comprehensive cost structure is vital. The primary cost elements include:

- Materials: For tangible goods, raw materials form the baseline expense. Electronics, apparel, and consumer goods will have varying material costs depending on specifications and export standards.

- Labor: Chinese labor rates remain competitive, but wages are rising yearly, especially in skilled manufacturing sectors. Labor cost also covers packaging and handling tailored for international USPS shipments.

- Manufacturing Overhead: Facilities, energy, depreciation, and factory maintenance are bundled here. Overheads vary by region; coastal factories often have higher costs due to stricter regulations and better infrastructure.

- Tooling and Setup: Custom products or packaging often require unique molds, dies, or fixtures. Tooling can be a one-off investment, but should be amortized into unit pricing for smaller or custom orders.

- Quality Control (QC): Rigorous inspection practices, especially for international exports, involve pre-shipment inspections, compliance audits, and product testing. QC costs are heightened for products requiring mandatory certifications (e.g. CE, FCC).

- Logistics and Shipping: Costs involve local transportation to port, China export documentation, USPS international postage fees, tracking integration, and insurance. USPS rates for tracked parcels are determined by weight, dimensions, service level, and destination country.

- Supplier Margin: Factories and agents build profit margins atop these direct costs; negotiations, relationship strength, and order stability can influence the eventual markup.

Price Influencers Unique to International B2B Buyers

B2B buyers from Africa, South America, the Middle East, and Europe face distinctive pricing dynamics when sourcing with USPS tracking from China:

- Order Volume / MOQ: Factories and logistics partners provide tiered pricing. Larger volume orders lower per-unit costs but involve higher capital outlay and possible inventory holding risks.

- Specifications and Customization: Customizations (branding, documentation, packaging to fit USPS postal requirements) may trigger additional setup fees or higher per-unit costs.

- Material Grades and Market Volatility: Fluctuations in global commodity prices (metals, plastics, textiles) directly affect material costs. Higher-grade materials for export compliance (e.g. RoHS, Reach) often come at a premium.

- Product Quality and Certifications: Higher quality expectations and the need for international certifications result in increased QC and testing costs. Products entering the EU require specific directives (CE), while technical goods may need full documentation.

- Supplier Factors: Factory reputation, financial stability, and export experience influence pricing. Factories with a track record in USPS shipment handling or DDP capabilities (delivery duty paid) may charge more but lower risk and shipment friction.

- Incoterms Impact: FOB, CIF, and DDP terms shift responsibilities and costs between buyer and supplier. For USPS-tracked parcels, FOB or EXW may lead to separate arrangements with forwarders for USPS integration, while DDP can simplify end-to-end costing but add supplier markup.

Actionable Tips for Cost-Efficient Sourcing

- Insist on Detailed Quotations: Request line-itemized quotes covering all cost aspects—materials, labor, QC, logistics, and anticipated surcharges for USPS tracking and documentation.

- Optimize Order Quantities: Leverage aggregated buying (if possible) or consolidation with other buyers to reach cost-effective MOQs and shipping discounts.

- Negotiate Logistics Terms: Explore whether suppliers offer discounted USPS rates through bulk shipping contracts or 3PL collaborations. Evaluate the merits of using the supplier’s forwarder versus contracting your own.

- Assess Total Cost of Ownership (TCO): Go beyond landed unit price—include duties, destination customs, tracking integration fees, insurance, and last-mile delivery charges in your calculations.

- Factor in Compliance: Budget for certifications and documentation. Early communication on quality standards and target markets can prevent costly compliance retrofits.

- Build Relationships: Establishing credibility and long-term orders with suppliers often opens up better terms, such as favorable payment schedules, added services, or priority during busy shipping seasons.

- Stay Informed on Incoterms and USPS Updates: Changes in international shipping regulations, postal agreements, or fuel surcharges can significantly affect costs. Regularly monitor updates relevant to your shipping routes.

Disclaimer: All pricing references are indicative and subject to fluctuations tied to market rates, supplier policies, and international logistics dynamics. For accurate budgeting, request up-to-date quotes from suppliers and consult logistics professionals familiar with USPS tracking integration and customs procedures in your destination country.

By breaking down these cost and pricing fundamentals, B2B buyers—especially in African, Latin American, Middle Eastern, and European markets—can confidently navigate supplier discussions, avoid hidden costs, and harness USPS tracking from China to drive supply chain visibility and customer satisfaction.

Spotlight on Potential tracking usps from china Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘tracking usps from china’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Chinaparcels (chinaparcels.com)

Chinaparcels positions itself as an online platform facilitating the tracking of USPS shipments originating from China, serving as a digital interface tailored for global B2B clients receiving goods via China Post and the United States Postal Service (USPS). While comprehensive public data about internal operations or certifications is limited, Chinaparcels is recognized for streamlining cross-border parcel visibility—a critical need for international buyers managing complex supply chains, particularly across Africa, South America, the Middle East, and Europe. The platform leverages integrations with global postal tracking systems, offering unified shipment status updates and leveraging international agreements like the Universal Postal Union (UPU) for seamless tracking. B2B users benefit from consolidated tracking, easing last-mile delivery uncertainty, and enhancing transparency when engaging with Chinese suppliers for high-volume purchases.

USPS Tracking Package and Mail (parcelsapp.com)

USPS Tracking Package and Mail, featured on the ParcelsApp platform, acts as a digital solution partner for B2B clients needing reliable USPS shipment tracking from China to international destinations. The service leverages a universal postal tracker, allowing users to input a wide range of USPS tracking numbers—including formats beginning with “940”, “927”, “937”, “420”, and China-origin codes like “Lx000000000CN”—to access end-to-end visibility, historical delivery analytics, and estimated delivery windows tailored by destination. While specific certifications or manufacturing standards are not publicly detailed, their tool-centric approach is designed to support cross-border trade flows, particularly for businesses in Africa, South America, the Middle East, and Europe navigating the complexities of last-mile USPS deliveries. Their platform’s global applicability and data-driven insights set them apart for B2B buyers sourcing from China who require scalable, transparent tracking solutions.

Chinapostaltracking (www.chinapostaltracking.com)

Chinapostaltracking specializes in providing comprehensive tracking solutions for global shipments, with a strong focus on USPS packages originating from or destined to China. The company’s platform enables B2B buyers to effortlessly monitor parcel status in real time, leveraging detailed tracking number recognition—including 20-digit, 13-character (ending with “US”), and multiple USPS-specific formats. This versatility supports seamless logistics integration for businesses regularly handling high-volume international shipments.

Noted for offering an accessible, free tracking tool, Chinapostaltracking caters to a wide range of users, including those in Africa, South America, the Middle East, and Europe. While detailed certifications or manufacturing credentials are not publicly disclosed, Chinapostaltracking is recognized within the cross-border logistics sector for its reliable, user-friendly interface and multilingual support, making it a valuable resource for importers seeking greater shipment visibility.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Chinaparcels | Unified USPS/China Post tracking for B2B importers | chinaparcels.com |

| USPS Tracking Package and Mail | Global USPS tracking interface for B2B shipments | parcelsapp.com |

| Chinapostaltracking | USPS-China parcel tracking, user-friendly, global reach | www.chinapostaltracking.com |

Essential Technical Properties and Trade Terminology for tracking usps from china

Technical Properties Critical for International USPS Tracking

When sourcing and tracking shipments via USPS from China, international B2B buyers must be aware of several core technical properties that impact the efficiency and reliability of logistics operations. Each property plays a direct role in ensuring smooth cross-border trade, supply chain visibility, and customer satisfaction.

1. Tracking Number Format and Integrity

A USPS tracking number is a unique identifier—either a 20–22 digit numeric code or, for some services, a 13-character alphanumeric ID. Correct format and digit integrity are vital. Any misquotes or errors may prevent shipment visibility entirely. In high-volume B2B transactions, automated systems should validate correct formats to avoid delays in customs clearance or proof of delivery disputes.

2. Data Update Frequency

The frequency with which tracking information is refreshed—often termed as “scan intervals”—is crucial for international buyers. Reliable, timely updates (at each postal facility, customs checkpoint, or handover) enable better demand forecasting, proactive exception handling, and more accurate delivery commitments to downstream customers.

3. System Compatibility and Integration

The ability to integrate USPS tracking data into existing ERP, WMS, or logistics management platforms is a key technical property in the B2B context. Standardized APIs and data formats (e.g., JSON, XML) allow businesses to automate monitoring, trigger alerts for shipment anomalies, and maintain an auditable trail throughout the import process.

4. Traceability Across Multiple Carriers

Shipments from China to international destinations often involve several carriers, with USPS managing the final leg. Ensuring end-to-end traceability—sometimes called “multi-modal visibility”—means disambiguating handoff points and consolidating tracking events across different logistics partners. This comprehensive visibility reduces loss risks and bolsters trust with both suppliers and buyers.

5. Proof of Delivery (POD) and Event Logging

For compliance and contractual reasons, many B2B buyers require documented proof of delivery, including digital signatures and time-stamped delivery events. USPS’s ability to archive and share event logs guarantees transparency, expedites payment cycles, and reduces the risk of litigation related to delivery failures.

6. Compliance with International Standards

USPS tracking systems should comply with international logistics and data protocols (such as those advocated by the Universal Postal Union or GS1 standards for data exchange). Adhering to these standards ensures smoother customs processing and harmonization of shipment data for global stakeholders.

Key Industry and Trade Terminology

Understanding essential trade terminology helps international buyers communicate effectively with suppliers, logistics providers, and regulatory agencies.

1. OEM (Original Equipment Manufacturer)

Refers to the producer of goods or components, often before they’re branded for resale. When arranging shipments, clarity if the seller is an OEM is vital as it impacts after-sales support, warranty policies, and traceability for recalls.

2. MOQ (Minimum Order Quantity)

The smallest batch size a supplier is willing to sell. When consolidating international USPS shipments, knowing MOQ impacts unit economics, inventory planning, and container optimization—especially important for African and South American buyers managing cash flow.

3. RFQ (Request for Quotation)

A formal request sent to suppliers or logistics partners to provide pricing and service details for a defined shipment or project. Precise RFQs that specify desired tracking levels, delivery times, and value-added features yield more accurate, comparable quotes.

4. Incoterms (International Commercial Terms)

Globally recognized trade terms that define the responsibilities of buyers and sellers during the shipping process (e.g., EXW, DDP, FOB). The chosen Incoterm affects at which point tracking passes to the buyer and where liability for loss or damage transfers.

5. POD (Proof of Delivery)

A documentation (often digital) confirming that goods have arrived at the intended destination and been accepted. Critical for release of payments, dispute resolution, and customs audit trails.

6. EDI/API (Electronic Data Interchange/Application Programming Interface)

Two types of technical protocols for automating data transmission between organizations. Businesses using EDI or API for USPS tracking can sync shipment statuses automatically, reducing manual entry and error.

Mastering these properties and terms provides B2B buyers, particularly those operating in emerging markets, with a robust foundation for managing USPS shipments from China—minimizing risks, controlling costs, and ensuring regulatory compliance throughout the supply chain.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the tracking usps from china Sector

Market Overview & Key Trends

The increased reliance on cross-border e-commerce and global supply chains has significantly bolstered demand for robust package tracking solutions, especially for shipments originating from China. For international B2B buyers across Africa, South America, the Middle East, and Europe, transparent tracking—specifically through services like USPS linked with Chinese suppliers—has become a cornerstone of operational efficiency, risk reduction, and customer satisfaction.

Key global drivers include rising B2B e-commerce volumes, expectations for end-to-end shipment visibility, and tighter delivery timeframes. International buyers are prioritizing shipment traceability to address customs complexities, minimize losses, and provide proactive updates to downstream clients or partner networks. The proliferation of digital platforms offering consolidated tracking dashboards—capable of aggregating multiple carriers like USPS, China Post, and local couriers—has changed sourcing strategies. These platforms integrate APIs and automation, empowering buyers to monitor diverse shipments from a single interface and receive actionable alerts, which optimizes inventory management and logistics decision-making.

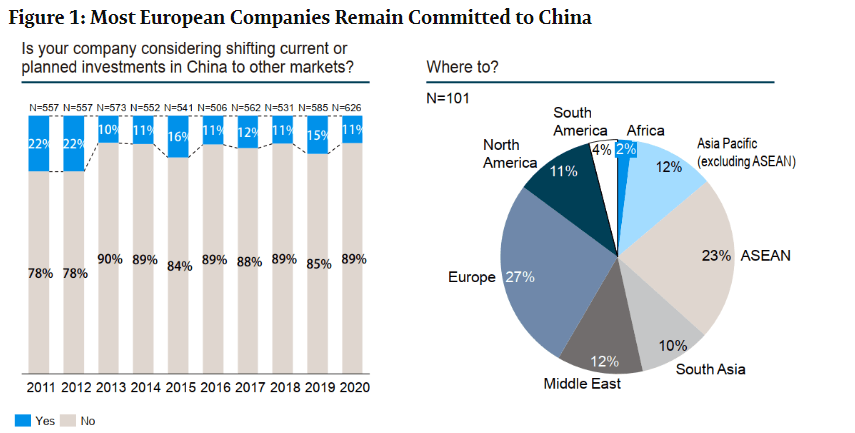

Emerging B2B sourcing trends involve greater usage of integrated logistics tech platforms, preference for suppliers capable of providing real-time tracking, and requests for digital documentation throughout the shipping process. Supply chain partners in regions such as Vietnam, Nigeria, and Egypt increasingly seek carriers that ensure seamless data handoffs between Chinese vendors, USPS, and last-mile local providers. Responsiveness to unexpected events—such as delays, regulatory inspections, or disruptions in China’s export supply chain—is now critical. Additionally, B2B buyers are negotiating contracts that stipulate mandatory tracking thresholds and service-level agreements (SLAs) for visibility.

Buyers in Africa and South America, in particular, are using tracking data not only for logistics oversight but also for credit adjudication, insurance claims, and proof-of-delivery for cross-border payments. In Europe and the Middle East, compliance-focused buyers look for tracking solutions that integrate with customs clearance data and enable adherence to localized VAT/import regulations. This broad market dynamic underscores the centrality of advanced tracking—especially via USPS—for buyers seeking consistent, competitive, and resilient sourcing from China.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a non-negotiable requirement for international procurement, even within logistical domains like tracking and delivery. B2B buyers increasingly scrutinize the environmental footprint of cross-border shipping from China, keen to minimize carbon emissions, packaging waste, and non-compliant carrier practices. Selecting shipping partners that are transparent about their own sustainability initiatives—including fleet modernization, sustainable packaging, and emissions reporting—provides both risk mitigation and reputational value.

Ethical supply chain management is a growing focus throughout the logistics sector. Buyers are encouraged to collaborate with suppliers and freight forwarders that can demonstrate compliance with global environmental and labor standards. This includes requiring documentation of shipping materials sourced from recycled or certified sustainable sources, and verification of anti-forced labor and fair wage certifications throughout the supply chain—elements now commonly demanded in Europe’s CSR (Corporate Social Responsibility) frameworks and by conscious buyers in the Middle East and Africa.

For tracking solutions specifically, partnering with logistics providers using digital-first platforms has been shown to reduce paperwork, cut unnecessary touchpoints, and lower overall resource consumption. Many leading couriers and platforms are pursuing ‘green’ certifications such as ISO 14001 for environmental management and leveraging electronic proof-of-delivery to minimize physical documentation. Enhanced tracking also enables buyers to consolidate shipments more efficiently, further decreasing the carbon footprint per unit shipped.

Actionable Tip: When negotiating with Chinese exporters, request disclosures on the sustainability of their shipping partners, packaging standards, and end-to-end supply chain certifications. Insist on digital documentation and tracking integrations to support both environmental and ethical sourcing goals.

Brief Evolution/History

Historically, international package tracking for shipments transitioning from China to other continents was fraught with gaps and uncertainty. Initially, once parcels left China’s borders, buyers experienced a ‘blind spot’ until local postal services—such as USPS for the U.S.—picked up the trail. Over time, global postal collaborations and the emergence of centralized tracking platforms have closed these information gaps.

The adoption of standardized barcode systems and electronic data interchange (EDI) has refined global tracking practices, making real-time visibility increasingly possible for B2B transactions. Today, multi-carrier tracking solutions aggregate status updates from diverse touchpoints across China, intermediary hubs, and destination countries, allowing seamless information sharing between suppliers, carriers, customs, and buyers. This evolution continues to shape more transparent, responsive, and data-driven sourcing practices for international B2B buyers managing complex supply chains from China.

Related Video: US-China Trade: As Trade Tensions Soar, White House Says Trump, Xi Call Likely This Week | WION

Frequently Asked Questions (FAQs) for B2B Buyers of tracking usps from china

-

How can I reliably track USPS shipments originating from China for my business orders?

USPS tracking begins once your package enters the USPS network, typically at a U.S. entry point after customs clearance. To track seamlessly from China, request the end-to-end tracking number from your supplier—often an EMS, ePacket, or China Post code that upgrades to a USPS number when it arrives in the U.S. Use USPS’s official tracking portal or integrated tracking tools like Track.Global for consolidated updates. For large, recurring shipments, insist suppliers use traceable shipping services, and schedule periodic status checks to maintain supply chain visibility. -

What should international B2B buyers consider when vetting Chinese suppliers for USPS-shipped orders?

Thorough vetting is critical. Request documentation verifying the supplier’s export experience and validate their ability to generate verifiable tracking numbers. Check if they have established logistics partnerships with USPS-compliant carriers (e.g., China Post, EMS). Ask for references from buyers in your region and verify their track record for timely shipments and accurate order fulfillment. Assess their responsiveness to tracking inquiries and readiness to supply tracking codes promptly after dispatch. -

Are there customization options or special handling services available for USPS shipments from China?

Some Chinese suppliers, especially larger or specialized exporters, may offer value-added services such as custom labeling, branded packaging, consolidated shipments, or priority mail handling. Communicate your requirements early and confirm these services are compatible with USPS workflow requirements. Ensure all customization details are included in the sales contract and that tracking numbers will reflect any special handling to avoid delays or processing errors during U.S. import clearance. -

What minimum order quantities (MOQ), lead times, and payment methods should I expect when using USPS tracking from China?

MOQ depends on the supplier’s policy and the shipping method. For USPS-compatible services like ePacket or EMS, smaller MOQs are often possible (sometimes as low as 20-50 units), but lead times vary—typically 7–21 days for most international destinations. Confirm production and shipping timelines explicitly in your agreement. Payment terms commonly include bank transfer (T/T), PayPal, or Letter of Credit; opt for methods offering buyer protection. Tie final payment milestones to shipment tracking confirmation for added security. -

How can I verify product quality and certifications for goods shipped via USPS from China?

Request certificates of conformity (COC), test reports, and international compliance documentation relevant to your market (such as CE, FDA, or SONCAP). Consider engaging third-party inspection agencies for pre-shipment checks. Ensure your supplier facilitates returns or replacements for defective or non-compliant shipments and that shipping labels, packaging, and tracking documents reflect the correct product information to prevent customs delays. -

What logistics arrangements help avoid common pitfalls in USPS tracking for international B2B shipments?

Maintain clear communication with your supplier regarding the handover point to USPS, typical transit schedules, and potential customs hold-ups. Double-check goods are properly labeled and insured. Schedule shipments to avoid peak U.S. holidays and provide accurate recipient information with international format to prevent misrouting. For high-value or time-sensitive shipments, explore USPS Priority Mail Express International, which provides faster service and enhanced tracking. -

How are disputes and delivery failures managed when using USPS tracking for China-to-international B2B trade?

Establish clear dispute resolution terms in your contract, specifying responsibilities in case of lost, delayed, or damaged goods. Retain all tracking records, shipping documentation, and digital communications. If a delivery fails or tracking ceases, contact both the supplier and USPS (or your logistics partner) to initiate a trace. For unresolved claims, leverage trade assurance services or escrow payment mechanisms if used, and document all claims for possible insurance reimbursement. -

What actionable tips help African, South American, Middle Eastern, and European B2B buyers optimize USPS tracking from China?

Start by ensuring every shipment has a valid, scannable tracking number viewable on USPS’s platform. Use multilingual tracking tools if needed and set up notifications for status changes. Partner with suppliers familiar with your country’s import procedures and USPS delivery timelines. Periodically test different shipping methods to balance speed and cost, and monitor package performance to inform future logistics decisions for improved efficiency and customer satisfaction.

Strategic Sourcing Conclusion and Outlook for tracking usps from china

Leveraging USPS tracking solutions for shipments from China represents a pivotal advantage for international B2B buyers seeking visibility, reliability, and operational efficiency. Mastering the essentials—from identifying accurate tracking numbers to integrating multi-courier tools such as Track.Global—enables procurement teams across Africa, South America, the Middle East, and Europe to better manage timelines, mitigate supply chain risks, and build trust with stakeholders.

Key Takeaways for International B2B Buyers:

– End-to-End Transparency: Utilizing official USPS tracking and aggregator tools offers real-time updates, empowering buyers to monitor shipments across borders and anticipate delays before they impact business operations.

– Process Integration: Embedding advanced tracking into your sourcing workflows boosts responsiveness and customer confidence, as updates can be shared promptly with teams and clients.

– Agility in Sourcing: Accurate tracking facilitates quicker issue resolution and better adaptability when circumstances change, supporting just-in-time inventory strategies and improved cash flow management.

As global sourcing from China continues to grow, proactive use of USPS tracking—combined with strategic digital tools—will be vital for competitive B2B procurement. Now is the time to invest in streamlined tracking systems and supplier collaboration, laying the foundation for resilient, scalable supply chains. International buyers can confidently shape the future of cross-border commerce by placing visibility and data-driven decision-making at the core of their sourcing strategy.