Introduction: Navigating the Global Market for definition of monocular

In today’s interconnected global marketplace, B2B buyers face unprecedented opportunities and complexities—especially when dealing with specialized optical products such as monoculars. Understanding the definition of monocular is more than a matter of terminology; it’s a crucial step in ensuring product alignment, quality assurance, and strategic procurement. For buyers across Africa, South America, the Middle East, and Europe, clarifying this definition streamlines communication with suppliers, supports compliance, and minimizes costly misunderstandings.

Monoculars, as compact, single-barrel optical instruments, serve diverse business and professional needs—from security and defense to research, outdoor activities, and industrial inspections. However, the term “monocular” can encompass a broad range of technologies, materials, and specifications. An in-depth grasp of what constitutes a monocular—and the distinctions among its types—is essential for effective product comparison, risk mitigation, and value optimization.

This guide is meticulously crafted to empower buyers navigating the complexities of the international monocular market. You’ll find actionable insights on:

- Fundamental definitions and technology types

- Materials and key manufacturing processes

- Quality control methodologies

- Supplier vetting and partnership models

- Pricing structures and total cost of ownership

- Current market trends and regulatory considerations

- Frequently asked questions and due diligence checklists

By providing a clear, authoritative reference point, this guide demystifies the sourcing process and enables B2B buyers to make decisions with confidence—whether procuring for government contracts, commercial distribution, or bespoke industrial applications. With global trade dynamics evolving rapidly, investing in a precise understanding of monoculars is a strategic advantage that will pay dividends in quality, cost, and business continuity.

Understanding definition of monocular Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Compact Handheld Monocular | Lightweight, portable, often single-focus lens | Fieldwork, security, logistics | Highly portable and affordable, but limited range and lower magnification |

| Zoom Monocular | Adjustable magnification, wider field of view, sometimes bulkier | Remote site inspection, surveillance | Versatile zoom, suits varied needs, but may be less durable |

| Infrared/Night Vision Monocular | Enables low-light imaging, often digital with recording options | Security, night operations, wildlife monitoring | Enables night use, higher cost and regulatory considerations |

| Rangefinder Monocular | Integrated rangefinding technology, precise distance measurement | Industrial surveying, resource extraction | Accurate measurements, but can be specialized and costly |

| Digital Monocular | LCD display, image/video recording, sometimes wireless connectivity | Training, documentation, remote guidance | Captures/shareable content, needs power source and may incur higher costs |

Compact Handheld Monocular

These monoculars are designed for simplicity and portability, featuring a single-focus lens with minimal controls. Ideal for mobile workers and field agents, they thrive in fast-moving environments where space and weight are concerns, such as logistics, security patrols, or on-the-go site visits. B2B buyers should consider the balancing act between portability and functionality—compact models often have lower magnification and narrower fields of view, making them suitable for close-range tasks but less so for detailed, distance observation.

Zoom Monocular

Zoom monoculars offer adjustable magnification, allowing users to adapt quickly to changing observation needs. Their versatility makes them attractive for companies conducting remote inspections, infrastructure surveys, or border surveillance. However, the moving parts and more complex assemblies may affect ruggedness and increase maintenance requirements. B2B buyers must weigh the premium price and potential durability trade-offs against operational flexibility, especially in challenging environmental conditions common in mining or agriculture.

Infrared/Night Vision Monocular

Infrared and night vision monoculars enable visual tasks under low-light or nighttime conditions. With digital enhancements and sometimes built-in recording, these monoculars are invaluable for security, defense, nocturnal wildlife studies, and critical infrastructure protection. Buyers should verify local regulatory requirements for import and use, as some countries restrict night vision devices. While these models represent a higher upfront investment, the capability to operate around the clock can significantly impact operational effectiveness.

Rangefinder Monocular

Equipped with integrated lasers or advanced optics, rangefinder monoculars provide precise distance measurements—a critical factor in resource extraction, forestry, construction, or surveying. They excel when tasks demand both observation and quantitative data, improving decision-making speed and reducing manual error. However, these specialty devices may come with certifications or calibration requirements. Buyers need to factor in the total cost of ownership, including maintenance and staff training.

Digital Monocular

Digital monoculars enhance user capabilities through onboard displays, video/photo capture, and wireless sharing features. Best suited for training, remote troubleshooting, and documentation-focused industries, they enable live sharing or recording of observations for later review. However, digital units generally require regular charging or battery replacement, and may entail data security considerations. For B2B buyers, evaluating vendor support, software compatibility, and training support is crucial to maximize ROI across distributed or transnational teams.

B2B buyers in Africa, South America, the Middle East, and Europe should prioritize monocular types based on their specific operational environments, compliance needs, and the skill level of end-users. Understanding these nuances will enable effective procurement, maximize utility, and optimize spend.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of definition of monocular

| Industry/Sector | Specific Application of definition of monocular | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Security & Defense | Surveillance and reconnaissance | Enhanced field monitoring, portable observation | Optical clarity, device durability, adaptability to harsh environments |

| Construction | Progress inspection and remote site monitoring | Quick visual checks, improved safety and compliance | Range of vision, ruggedness, ease of use onsite |

| Energy & Utilities | Infrastructure examination (pipelines, towers) | Efficient, low-cost visual inspections, rapid deployment | Magnification power, environmental resistance, maintenance support |

| Forestry & Agriculture | Crop and wildlife assessment | Early detection of issues, increased yield oversight | Weight, portability, ability to withstand climate extremes |

| Maritime/Logistics | Navigation and vessel identification | Enhanced situational awareness, reduced risk of collision | Water-resistance, anti-glare coating, international compliance |

Security & Defense

Monocular devices are extensively used in security and defense for surveillance and reconnaissance missions. Their compact size allows personnel to observe from concealed or hard-to-reach locations, making them invaluable for perimeter monitoring, border control, and rapid deployment scenarios. For buyers in Africa and the Middle East, who often face challenging terrain and variable lighting, sourcing monoculars with superior optical clarity, night vision capabilities, and rugged, weatherproof designs is essential. Ensuring adaptability to local environmental extremes—and alignment with relevant safety standards—should be a procurement priority.

Construction

In the construction industry, monoculars facilitate routine progress inspections and remote monitoring, enabling managers to quickly assess large sites without physical traversal. This application reduces inspection time, supports timely compliance checks, and boosts site safety management. International buyers, especially from regions like South America and Australia with expansive projects, should seek monoculars that offer a wide field of vision, shock-resistant casings, and easy field operability. Supplier credentials for delivering durable devices suited to dusty, high-temperature environments are critical to minimize downtime.

Energy & Utilities

For energy and utility sectors, monoculars enable routine visual inspections of infrastructure such as pipelines, high-voltage lines, and transmission towers. Their portability allows for rapid deployment across vast distances while minimizing operational costs. Buyers in remote or rural areas—common throughout Africa and South America—require monocular solutions with high magnification, dependable weather resistance, and ongoing technical support. Additionally, flexibility for use with personal protective equipment (PPE) and compliance with industry-specific safety regulations is key when sourcing.

Forestry & Agriculture

Within forestry and large-scale agricultural operations, monoculars play a crucial role in crop assessment, wildlife monitoring, and the early identification of pest or disease outbreaks. This proactive approach improves yield oversight and supports biodiversity management. For buyers in regions subject to harsh climates or frequent mobility—like central Africa or rural Europe—lightweight yet robust monocular designs are needed. Devices must withstand heavy rains, temperature swings, and rough handling, while still providing clear, reliable image quality.

Maritime/Logistics

Maritime operators and logistics professionals leverage monoculars for navigation support and vessel identification. These tools contribute to safe passage by improving the awareness of surrounding traffic and hazards—especially vital in busy or low-visibility regions. International B2B buyers, such as those in the Mediterranean or along major South American rivers, must prioritize water-resistant monoculars with anti-glare coatings and certifications relevant to marine safety standards. Compatibility with local regulations and ease of operator training are further factors impacting long-term value.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

Strategic Material Selection Guide for definition of monocular

The selection of materials for products falling under the category of ‘definition of monocular’ directly shapes their suitability, durability, and compliance with international standards, which is critical for B2B buyers navigating procurement across Africa, South America, the Middle East, and Europe. Below is a detailed breakdown of common materials frequently specified in monocular-related products—such as optical instrument housings, focusing rings, and lens mounts—each assessed for its core properties and strategic B2B implications.

1. Aluminum Alloys

Key Properties:

Aluminum alloys, particularly 6061 and 7075 grades, are widely used in the fabrication of precision monocular components due to their high strength-to-weight ratio, corrosion resistance (including in humid and coastal environments), and ease of machining. These alloys typically operate well across a broad temperature range and do not rust.

Pros & Cons:

– Pros: Lightweight for portability, good corrosion resistance, compatible with anodizing and various protective coatings for enhanced wear resistance.

– Cons: Not as robust as stainless steel against impact damage; may deform under excessive mechanical stress; higher raw material costs compared to basic plastics.

– Impact on Application: Ideal for field use, including rugged outdoor and military monoculars.

– International Buyer Considerations: International standards such as ASTM B221 or EN 573-3 (Europe) commonly apply. Anodized finishes may need RoHS compliance, especially for buyers in Europe and Australia.

2. Polycarbonate (Engineering Plastic)

Key Properties:

Polycarbonate, a durable engineering plastic, offers high impact strength, good optical clarity, dimensional stability, and resistance to a variety of chemicals. It performs well in temperature extremes, maintaining structural integrity in both hot and cold environments.

Pros & Cons:

– Pros: Extremely lightweight, lower cost than metals, and resistant to shattering, making it ideal for high-risk, drop-prone environments.

– Cons: Lower scratch resistance than glass or metal surfaces; may yellow after prolonged UV exposure unless UV-stabilized grades are specified.

– Impact on Application: Suitable for consumer-grade monoculars or those intended for educational, sports, or low-cost government use.

– International Buyer Considerations: Meeting UL, ISO, or JIS standards ensures cross-regional acceptability. EU buyers may require REACH and RoHS declarations. For Africa and emerging markets, cost savings may take precedence but durability in harsh climates remains a concern.

3. Stainless Steel (e.g., AISI 304/316)

Key Properties:

Austenitic stainless steels such as 304 and 316 offer superior corrosion resistance (especially to salt and acids), high mechanical strength, and excellent longevity even in challenging environmental conditions.

Pros & Cons:

– Pros: Unmatched resilience in marine, industrial, and high-salinity environments; high wear resistance for precision components; minimal maintenance required.

– Cons: High density increases product weight; more expensive and complex to machine, raising manufacturing costs and lead times.

– Impact on Application: Preferred for specialized industrial, defense, or marine monocular instruments where durability and reliability are critical.

– International Buyer Considerations: Adherence to ASTM A240, EN 10088 (Europe), or JIS G4303 (Asia) is typically required. Some Middle Eastern regions may prefer stainless for extreme heat and corrosion resistance. Traceability and test certifications are often mandated.

4. Brass

Key Properties:

Brass, an alloy primarily of copper and zinc, offers a unique balance of machinability, corrosion resistance, and aesthetic appeal, making it traditional—though less common—for monocular focusing mechanisms or lens rings.

Pros & Cons:

– Pros: Excellent machinability, provides a premium look and feel, and naturally resists corrosion in non-acidic environments.

– Cons: Heavier than aluminum and plastic; more expensive than entry-level plastics; less robust under saltwater exposure compared to stainless steel.

– Impact on Application: Often used where aesthetic appeal is valued (luxury monoculars) or for smooth operation in fine-adjustment mechanisms.

– International Buyer Considerations: Compliance with RoHS (for lead content) is essential for buyers in Europe and Australia. Some African and Middle Eastern markets may have relaxed requirements but still value reliability and minimal maintenance.

Material Selection Summary Table

| Material | Typical Use Case for definition of monocular | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Alloys | Rugged, portable field monoculars; military, outdoor | Lightweight, corrosion resistant, strong | Can deform under impact; costlier than plastic | Medium |

| Polycarbonate | Consumer, educational, and sports monoculars | Lightweight, shatter resistant, low cost | Prone to scratching, possible yellowing with UV | Low |

| Stainless Steel (AISI 304/316) | Industrial/marine/defense monoculars | Superior corrosion & wear resistance, durable | Heavy, expensive, higher mfg complexity | High |

| Brass | High-end/luxury monocular rings or mechanisms | Premium aesthetics, easy to machine | Heavier than aluminum/plastic, less suited for saltwater | Medium to High |

This analysis enables international B2B buyers to weigh material performance, total cost, compliance, and end-use suitability, facilitating better-informed sourcing decisions for monocular-related products across diversified global markets.

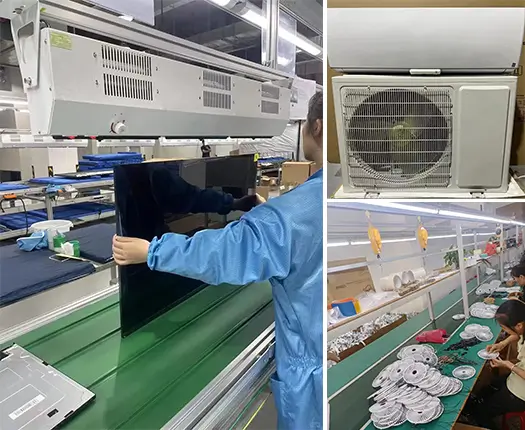

In-depth Look: Manufacturing Processes and Quality Assurance for definition of monocular

Monoculars, as high-precision optical instruments, require rigorous manufacturing processes and robust quality assurance to meet the diverse needs of international B2B buyers. Understanding the complexities of these processes is vital for buyers across Africa, South America, the Middle East, and Europe to ensure they receive competitively priced, high-performing products that comply with market regulations and usage requirements.

Key Manufacturing Stages for Monoculars

The production of monoculars involves several well-defined stages, each demanding specific expertise and quality controls:

1. Material Preparation

- Optical Glass Selection: Optical glass must meet strict clarity and refraction prerequisites. Global suppliers often source from established providers, but B2B buyers should request standards such as lead-free, environmentally-safe glass, and inquire about supplier traceability.

- Metal and Polymer Sourcing: The monocular body is commonly constructed from aluminum alloys, polycarbonate, or composites. Ensuring suppliers utilize corrosion-resistant, lightweight materials is essential, especially for buyers in humid or extreme climates.

2. Lens Forming and Coating

- Lens Grinding and Polishing: Raw glass is precision-cut, ground, and polished to required specifications. CNC (Computer Numerical Control) equipment typically enhances accuracy, crucial for image clarity.

- Coating Application: Multi-layer anti-reflective (AR) and hydrophobic coatings are applied in dust-free environments. These improve light transmission and prevent internal fogging—of particular importance in tropical and arid regions.

3. Mechanical and Optical Assembly

- Precision Alignment: Lenses and prisms are mounted and aligned using automated rigs, reducing aberrations and ensuring field-of-view consistency. Ball-bearing mechanisms often provide smooth focusing.

- Housing Assembly: Waterproofing (O-ring seals, inert gas purging) is integrated for durability. Review whether IP-rating (e.g., IP67) standards are met, critical for field or military applications.

4. Finishing and Packaging

- Finishing Treatments: Body surfaces are anodized, rubberized, or painted for ergonomic grip and resistance to environmental wear.

- Custom Branding/Packaging: B2B buyers may request private labeling or region-specific user manuals to comply with local market requirements.

Quality Control Standards and Checkpoints

International B2B buyers must insist on comprehensive QC, referencing both global and market-specific benchmarks:

1. International and Industry Standards

- ISO 9001: A baseline for quality management systems. Ensure suppliers hold valid ISO certificates, signifying process consistency and traceability.

- CE (Europe), FCC/RoHS (USA/EU), API (as relevant): Monoculars for industrial, medical, or defense use may require additional certifications. Confirm regional compliance—CE marking is essential for European import, while electrical safety (RoHS) or telecoms standards are more critical for digitalized monoculars.

2. Critical QC Checkpoints

- Incoming Quality Control (IQC): All components—lenses, O-rings, body shells—are inspected upon arrival for specification compliance and absence of material defects. Request supplier IQC reports and evidence of component batch traceability.

- In-Process Quality Control (IPQC): Frequent line inspections during grinding, coating, and assembly phases. Automated and manual optical tests (resolution, aberration, and light transmission) are standard.

- Final Quality Control (FQC): 100% functional testing post-assembly, including:

- Drop/shock resistance

- Waterproofness/submersion tests

- Focus and field-of-view checks

- Visual and mechanical symmetry evaluation

Common Testing Methods

- Optical Bench Testing: Verifies magnification accuracy, field-of-view, sharpness, and color fidelity.

- Spectrophotometer Analysis: Checks critical lens coatings for AR properties.

- Environmental Simulations: Heat/humidity chambers simulate long-term durability, which is vital for distribution into tropical (Africa, South America) or desert markets (Middle East).

- Mechanical Life-Cycle Testing: Focusing rings, eyecups, and housings are repeatedly actuated to confirm expected lifespan.

Verifying Supplier Quality as a B2B Buyer

Successful procurement depends on transparency and accountability. Buyers—especially operating in geographies with varying import standards—should undertake the following:

1. Independent Audits

- Commission or require evidence of recent third-party audits (e.g., TÜV, SGS, Bureau Veritas) that review manufacturing and QC procedures, not just final product audits.

- Engage in on-site or video audits if possible, focusing on cleanroom conditions, test equipment calibration, and worker training.

2. Detailed QC Documentation

- Insist on detailed QC documentation for each lot—component certificates, process records, and FQC pass/fail data should be standard deliverables.

- For regulatory markets (EU, Australia), ensure suppliers can provide a full technical file, supporting CE/FCC compliance and any local customs needs.

3. Third-Party Inspection Services

- For high-value/cross-border shipments, mandate pre-shipment inspection by reputable firms. Inspections should include random product selection, specification measurement (using international standards), and destructive/environmental tests where relevant.

- Specify acceptance quality levels (AQL) in contracts to standardize inspection outcomes.

4. Ongoing Supplier Performance Management

- Establish frameworks for periodic supplier performance reviews including defect rate tracking, delivery compliance, and field performance.

- Cultivate multiple sourcing relationships: this reduces risk associated with supply disruptions or variable product quality, and can leverage competitive benchmarking across contract manufacturers.

QC and Certification Nuances for International Buyers

- Africa: Emerging markets may face inconsistent enforcement of import standards. Engage local agents or trade regulators for the latest compliance requirements, particularly for public sector and security tenders.

- South America: Customs documentation and technical labeling errors are common. Provide suppliers with clear, translated specification sheets and validate labeling per local language and regulatory mandates.

- Middle East: Military, governmental, and oil/gas buyers should inquire about dual-use export limitations and additional regional certifications (e.g., SASO in Saudi Arabia).

- Europe and Australia: Vigilance around CE marking and environmental directives (RoHS, WEEE) is requisite. Spot-check batches for proper conformity marking and accompanying Declaration of Conformity (DoC).

Actionable Insights for B2B Procurement Teams

- Define precise technical and quality benchmarks in all RFQs and contracts.

- Verify supplier certifications and request sample QC documentation as part of your pre-qualification process.

- Where feasible, budget for periodic site visits or remote audits.

- Leverage market intelligence to anticipate changing regional compliance requirements and adapt supplier criteria accordingly.

- Consider long-term supplier partnerships with regular QC and compliance training, especially when introducing new monocular designs or upgrading features for specific markets.

An informed approach to manufacturing due diligence and supplier quality assurance empowers B2B buyers to mitigate cross-border risks, control costs, and consistently deliver high-performance monoculars tailored to local market expectations and industry standards.

Related Video: Most Amazing Factory Manufacturing Process Videos | Factory Mass Production

Comprehensive Cost and Pricing Analysis for definition of monocular Sourcing

Understanding the true cost structure and price influencers of sourcing monocular units is essential for global B2B buyers seeking to navigate competitive markets and optimize procurement budgets. Below is a comprehensive breakdown of direct and indirect costs, as well as practical insights tailored to help international buyers—especially from Africa, South America, the Middle East, and Europe—negotiate the best possible outcomes.

Key Cost Components in Monocular Sourcing

A granular cost analysis reveals several contributors to the final unit price:

- Raw Materials: The quality of optics (lenses, prisms), body construction (aluminum alloys, polycarbonate), and coatings directly affect both price and end-user performance. Premium glass and coatings can command up to 40% of the monocular’s total cost.

- Labor: Skilled labor is required for lens grinding, assembly, collimation, and finishing. Labor costs will vary significantly by geography—factories in Southeast Asia or Eastern Europe may offer lower labor rates compared to Western suppliers.

- Manufacturing Overhead: Includes utilities, plant depreciation, equipment maintenance, and administrative overhead.

- Tooling and Molds: For custom-run models or large volume orders, initial investments in unique molds or assembly jigs may be required. These are often amortized over the order size.

- Quality Control: Precision QC is non-negotiable for optics. Costs include both in-line inspections and post-assembly testing to ensure compliance with technical specifications and international standards.

- Packaging and Logistics: Export packaging, labeling, and shipping (air, sea, or multimodal) can represent 8-15% of the purchase price, particularly for buyers in remote or emerging regions.

- Supplier Margin: Varies by supplier size, capability, and market positioning. Margins are typically higher for customized runs or low MOQs (Minimum Order Quantities).

Price Influencers and Market Variables

Several factors can significantly impact quotes and negotiation leverage:

- Order Volume / MOQ: Higher volumes typically unlock economies of scale, reducing per-unit prices. Suppliers may set tiered pricing (e.g., 100/500/1,000+ units).

- Product Specifications & Customization: Custom branding, coatings, waterproofing, or special optics increase both unit and setup costs. Standard models will yield the best price.

- Materials and Certification Requirements: Demands for eco-friendly materials or compliance with CE, RoHS, or ISO standards elevate costs but may be necessary for certain markets in Europe or the Middle East.

- Supplier Characteristics: Large, experienced manufacturers may offer lower prices on high-volume contracts and robust aftersales service, whereas smaller firms may offer flexibility but at higher per-unit costs.

- Incoterms and Delivery Terms: EXW (Ex Works) places all transport costs with the buyer, while CIF/CIP includes insurance and shipping in the supplier’s quote. These terms affect cash flow, landed costs, and import duties.

Strategic Buyer Tips & Best Practices

International B2B buyers can adopt several cost-mitigation strategies:

- Negotiate Beyond Price: Consider volume discounts, payment terms (LC vs. TT), and complimentary quality audits or test runs in exchange for exclusivity or long-term contracts.

- Optimize Total Cost of Ownership (TCO): Factor in not only unit price, but also logistics, tariffs, warranty support, parts availability, and lead times. What appears cheapest initially may not offer the best TCO.

- Audit Cost Structures: Request detailed quotations breaking down material, labor, and overhead costs—especially for customized specifications or complex compliance needs.

- Leverage Regional Advantages: Evaluate emerging suppliers in regions with favorable labor rates and reliable export logistics, such as parts of Southeast Asia, Eastern Europe, or Northern Africa, while balancing against shipping times and potential regulatory risks.

- Plan for Compliance and Risk: Secure documentation for required certifications and ensure packaging and labeling meet destination-country regulations, which can avoid costly customs delays or product rejections.

Pricing Dynamics for International B2B Buyers

Pricing trends will fluctuate regionally due to geopolitical developments, currency shifts, and supply chain bottlenecks. Buyers in Africa or South America should anticipate higher logistics costs, while those in the EU might contend more with regulatory-driven price premiums. Monitoring global procurement indices and partnering with established freight forwarders can help manage these variances.

Disclaimer: All cost figures and trends mentioned are indicative, reflecting historical data and typical industry practices. Prices can fluctuate based on market conditions, raw material volatility, and supplier negotiations.

By thoroughly understanding these cost drivers and deploying proactive sourcing strategies, international buyers can build resilient procurement pipelines and maximize both value and compliance in monocular acquisitions.

Spotlight on Potential definition of monocular Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘definition of monocular’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Monocular Manufacturing Companies [List] (matchory.com)

Monocular Manufacturing Companies [List], as aggregated by Matchory, represents a network of manufacturers and suppliers specializing in monocular optical devices suited for a range of professional and industrial applications. The companies highlighted, including brands like Starscope Monocular, focus on delivering high-clarity, durable optics designed for operation in challenging environments—such as low light, rain, or snow. While comprehensive details on manufacturing certifications or precise quality standards are limited in public sources, these companies are recognized for their adaptability to diverse market requirements and their ability to serve global B2B buyers. Their catalogs often feature a wide range of monocular solutions, supporting both standard and custom requirements for markets across Africa, South America, the Middle East, and Europe. Known strengths include rapid deployment solutions and a focus on robust, user-friendly product designs that cater to international distribution demands.

10 Best Monoculars of 2024 (opticsmag.com)

10 Best Monoculars of 2024, showcased on OpticsMag, is recognized for its curated selection and technical insight into monocular optics. The company emphasizes comparative assessment and sourcing options, offering a comprehensive range of monoculars of varying sizes, weights, and design features, such as ergonomic focus rings and streamlined bodies. Their focus on specification transparency—clarifying how monoculars differ from binoculars—is especially advantageous for B2B buyers seeking clarity in product selection for diverse operational environments.

While detailed public information regarding proprietary manufacturing processes, certifications, or custom capabilities is limited, their established expertise in evaluating global monocular offerings is evident. This makes them a valuable partner for international distributors and procurement professionals from Africa, South America, the Middle East, Europe, and beyond, aiming to match product requirements with reliable sourcing and up-to-date market intelligence.

Grab the best monocular in 2025 and leave the bulky binos at home (www.digitalcameraworld.com)

Grab the best monocular in 2025 and leave the bulky binos at home is recognized for delivering lightweight, travel-friendly monocular solutions, such as the Hawke Endurance ED series, tailored to professional and recreational optics buyers worldwide. The company distinguishes itself with a focus on portability, wide-angle field of view, and versatile magnification options (8x and 10x), meeting the needs of distributors and resellers seeking high-demand, general-purpose optics. While specific certifications or manufacturing details are not publicly detailed, their products consistently attract positive reviews for build quality and durability. With a strong global presence highlighted by widely accessible models, they are especially positioned to support international B2B procurement—including markets across Africa, South America, the Middle East, Europe, and Australia—seeking proven, easy-to-integrate monocular inventory.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Monocular Manufacturing Companies | Diverse monocular solutions for global B2B needs. | matchory.com |

| 10 Best Monoculars of 2024 | Comprehensive comparative monocular sourcing expertise. | opticsmag.com |

| Grab the best monocular in 2025 and leave the bulky binos at home | Portable, high-quality, globally recognized monoculars. | www.digitalcameraworld.com |

Essential Technical Properties and Trade Terminology for definition of monocular

Critical Technical Specifications of Monoculars

When sourcing monoculars for international B2B operations, especially in diverse markets such as Africa, South America, the Middle East, and Europe, understanding the core technical specifications is essential for ensuring product quality, suitability, and buyer satisfaction. The following key properties define the performance and commercial value of monoculars:

-

Magnification Power

Indicates the degree to which a monocular enlarges the viewed object—expressed as “8x,” “10x,” etc. For B2B buyers, higher magnification may be desirable for specialized applications (e.g., security, wildlife observation), but it must be balanced with stability and field of view. Assessing intended end-user requirements ensures alignment with local market demand. -

Objective Lens Diameter

Measured in millimeters (e.g., 25mm, 42mm), this determines how much light enters the monocular, affecting image brightness and clarity, especially in low-light conditions. Larger diameters generally improve visibility but increase size and weight—critical factors in logistics and application suitability across varying geographies. -

Field of View (FOV)

Specifies the width of the area visible at a certain distance, often in meters at 1000 meters. Wide FOV is vital in applications like surveillance or outdoor activities, where situational awareness is critical. For procurement, specifying FOV avoids mismatches in functional expectations. -

Material Construction and Grade

Typically includes details about the housing (such as polycarbonate, magnesium alloy, or rubber armor) and lens coatings (multi-coated, fully multi-coated). These properties impact durability, resistance to environmental factors, and longevity—important for buyers in regions with harsh climates or demanding operational conditions. -

Close Focus Distance

This is the nearest point at which a monocular can achieve a sharp image. Applications such as inspection or tourism may require short close-focus capabilities, making this a vital procurement criterion. -

Waterproof and Fogproof Ratings

Ratings like IPX7 or nitrogen purging indicate the monocular’s resilience to water ingress and internal fogging. In humid, rainy, or temperature-variable environments, specifying these ratings ensures reliability and reduces aftersales issues.

In B2B procurement, accurate documentation of these specifications in contracts and RFQs (Requests for Quotation) minimizes miscommunication and reduces returns or disputes.

Key Trade Terms and Industry Jargon Explained

Navigating global trade in optical products involves understanding a set of industry-specific terms. Mastery of these terms streamlines negotiations and ensures clarity across regulatory, logistical, and financial contexts:

-

OEM (Original Equipment Manufacturer)

Refers to a supplier producing monoculars based on the buyer’s brand and specifications. For buyers aiming to launch private-label products or ensure exclusive features, partnering with a reputable OEM enhances brand value and market differentiation. -

MOQ (Minimum Order Quantity)

This sets the lowest batch size a supplier will accept for a single order. Being clear about MOQ is essential for cost management and inventory planning, especially for buyers in emerging markets or those testing new product lines. -

RFQ (Request for Quotation)

A formal process for soliciting price and lead time quotes from multiple suppliers based on specified technical criteria. A detailed RFQ ensures suppliers can accurately match product requirements, fostering competitive pricing and quality benchmarking. -

Incoterms (International Commercial Terms)

Standardized trade terms such as FOB (Free On Board), CIF (Cost, Insurance, Freight), and DAP (Delivered at Place) define the division of responsibilities and costs between buyers and sellers. Clear agreement on Incoterms prevents misunderstandings in transportation and insurance liabilities. -

Lead Time

The period from order placement to delivery. Understanding and negotiating lead time is crucial for supply chain stability and market responsiveness, particularly in regions with customs or logistical complexities. -

QC (Quality Control)

Encompasses the inspection and verification processes to ensure monoculars meet agreed standards. For global buyers, rigorous QC protocols—potentially involving third-party audits—are vital to mitigate non-compliance and safeguard reputation.

Awareness of these technical and trade terms empowers B2B buyers to negotiate smartly, define clear expectations, and build reliable, long-term supplier relationships in the global monocular market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the definition of monocular Sector

Market Overview & Key Trends

The global monocular sector, encompassing devices designed for magnified single-eye viewing, has witnessed a remarkable evolution driven by technological innovation, shifting end-user needs, and dynamic supply chain strategies. Demand continues to rise in applications ranging from industrial inspection and security to outdoor recreation and research. For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe—each with distinct market realities—understanding these dynamics is crucial for informed sourcing and procurement.

Key market drivers include advancements in optical components, the integration of digital imaging and connectivity, and the growing need for portable, cost-effective alternatives to traditional binoculars or more complex vision systems. Suppliers are responding with smart monoculars that feature wi-fi, night vision, and on-device data processing aimed at sectors like security, field research, and logistics. Additionally, price sensitivity in emerging markets has led to a surge in competitively priced, ruggedized units suitable for harsh local environments.

Sourcing trends reflect increasing adoption of multi-sourcing strategies. Buyers mitigate risk and enhance supply chain resilience by engaging several suppliers across different geographies. For African and South American buyers, this approach counters supply disruptions due to logistical challenges or geopolitical factors. Middle Eastern and European companies are also intensifying supplier audits and emphasizing end-to-end digital procurement workflows, leveraging e-sourcing and contract management platforms to streamline operations. Meanwhile, in regions like Thailand and Australia, partnerships with local distributors and value-added resellers are pivotal for market entry and post-sale support.

Digitalization is a notable trend, with supplier evaluation, negotiation, and supplier relationship management increasingly handled via cloud-based platforms. This ensures greater transparency, efficiency, and real-time collaboration across borders. Furthermore, as competition intensifies, B2B buyers are prioritizing technical support, customization capabilities, and after-sales services when shortlisting monocular suppliers. The focus on total cost of ownership, rather than mere unit price, is now central to procurement strategies in the sector.

Sustainability & Ethical Sourcing in B2B

Sustainability concerns are reshaping procurement and sourcing decisions in the monocular industry. Environmental impact factors—ranging from the sourcing of raw materials (such as glass, plastics, and metals) to energy consumption in manufacturing and disposal—are drawing increasing scrutiny from global buyers. In many markets, particularly in Europe and Australia, end-users demand transparency regarding manufacturing processes and expect adherence to stringent environmental standards.

Ethical supply chains have become a key differentiator. Buyers are prioritizing suppliers that demonstrate responsible labor practices, fair wages, and verifiable compliance with local and international regulations. Comprehensive supplier audits and requirement of codes of conduct are now common in B2B contracts. African and Latin American buyers, aware of reputational risks from unethical sourcing, are instituting anti-corruption clauses and favor suppliers with clear documentation and traceability.

‘Green’ certifications and eco-friendly materials are increasingly a requirement rather than an advantage. Certifications such as ISO 14001 (environmental management), RoHS (Restriction of Hazardous Substances), and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) are often listed as mandatory criteria in RFPs and tenders, especially when sourcing for institutional or government clients. There is also a growing preference for monoculars incorporating recycled plastics, lead-free glass, or biodegradable packaging.

Ultimately, sustainable procurement is closely tied to long-term value and brand perception. Buyers who proactively integrate sustainability and ethics into their monocular sourcing not only minimize risk but also position themselves favorably with partners, customers, and regulators worldwide.

Evolution and History (Optional)

The monocular sector has its roots in the broader evolution of optical instruments, with early monoculars sharing technologies with telescopes and spyglasses used for navigation and military observation. Over time, monoculars evolved as compact, affordable, and user-friendly alternatives to binocular devices. The industrialization era brought standardized components, while the digital revolution enabled lightweight, multifunctional monoculars equipped with sensors and wireless connectivity.

This progression has democratized access to advanced optics, enabling their use not just in developed markets but across the globe. The modern monocular is now a symbol of global supply chain integration and technological advancement, responding to diverse B2B market demands with agility, innovation, and increasing attention to sustainability.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of definition of monocular

-

How can I effectively vet international suppliers of monoculars to ensure reliability and quality?

Thorough supplier vetting is essential before committing to large-scale orders. Start by requesting company registrations, business licenses, and proof of export history. Conduct audits where feasible, check third-party reviews, and ask for recent client references, especially from buyers in your region. It’s advisable to evaluate their quality control processes, test certificates, and after-sales support policies. Leveraging trade assurance programs or platforms that offer payment and delivery guarantees can add another layer of security for international transactions. -

What certification and compliance standards should I ask for when sourcing monocular products globally?

Certification requirements may vary based on usage (e.g., consumer, military, industrial) and destination country. Seek ISO 9001 (quality management), CE (for Europe), RoHS, and relevant optical quality certifications. For Africa and Latin America, ensure the supplier’s documentation matches destination customs regulations. Inquire about independent testing reports or batch-specific quality attestations. Proper certifications not only confirm product safety and reliability but also minimize customs delays and regulatory issues. -

Can monoculars be customized for specific business applications or branding, and what is the typical process?

Yes, most leading suppliers offer customization—from optical specifications (magnification, lens coatings) to housing colors, logo printing, and packaging. The process usually begins with a technical consultation, followed by prototype development and approval. Share your specific requirements up front and clarify any regulatory needs applicable in your market. Prioritize suppliers with proven experience in OEM and ODM orders to reduce error risks and turnaround times for tailored solutions. -

What are the usual minimum order quantities (MOQs), lead times, and payment terms for international monocular orders?

MOQs for monoculars typically range from 100 to 500 units, but some suppliers may accommodate smaller orders for a premium. Lead times vary—standard models may ship within 2-4 weeks, while customized orders can take 6-10 weeks depending on complexity. Payment terms often require a deposit (30–50%) upfront, with the balance due upon shipment or after receipt of goods. Use secure payment methods (e.g., letters of credit, escrow services) to mitigate risk in cross-border transactions. -

How can I ensure product quality before shipment when dealing with overseas suppliers?

Implementing a robust quality assurance process is key. Request pre-shipment inspection by accredited third-party agencies, review batch testing reports, and, if possible, obtain product samples. Clarify your acceptance standards in the contract. For higher-value orders, consider step-by-step approvals—such as sending photos, videos, or even conducting virtual walkthroughs during production. Regular communication and clear quality benchmarks help avoid misunderstandings and costly returns. -

What are the best logistics practices for shipping monoculars internationally, considering customs and regional regulations?

Partner with logistics firms experienced in optical instruments and international shipping. Request Incoterms clarity (e.g., FOB, CIF), and ensure all documentation—commercial invoices, packing lists, and certificates—is accurate and complete. Factor in regional specifics, such as import restrictions, certification requirements, and duties in Africa, South America, or the Middle East. Plan for potential delays due to customs or regulatory checks. Insurance coverage for high-value shipments is also recommended. -

How should B2B buyers handle disputes or non-compliance issues with monocular suppliers?

Dispute resolution begins with a well-drafted contract, outlining product specs, quality standards, and remedies. If issues arise, document all communication and retain evidence of non-compliance for negotiation. Trusted B2B platforms may offer mediation or refund services. Escalate unresolved cases to legal recourse or engage local chambers of commerce or trade representatives. Proactively agreeing on arbitration or jurisdiction clauses in contracts can expedite fair settlement if disputes occur. -

What procurement trends should international buyers be aware of when sourcing monoculars, particularly for emerging markets?

Demand is rising for monoculars with digital capabilities, improved ergonomics, and sustainability features. B2B buyers should monitor advancements in materials, supply chain transparency, and ESG (Environmental, Social, Governance) compliance by suppliers. Diversifying sourcing through multiple suppliers (to mitigate geopolitical and supply risks) is increasingly common, especially among buyers in evolving markets. Finally, digital procurement tools and comprehensive supplier assessments help streamline sourcing and improve long-term supplier relationships.

Strategic Sourcing Conclusion and Outlook for definition of monocular

Monocular products, as essential optical instruments across numerous industries, demand a sourcing approach that balances technical precision, supplier reliability, and cost-effectiveness. For international B2B buyers—especially those in Africa, South America, the Middle East, and Europe—strategic sourcing is the key to unlocking both immediate procurement benefits and long-term value creation. By embracing robust supplier evaluation, leveraging digital procurement solutions, and promoting competitive engagements, buyers can ensure consistent quality and access to cutting-edge monocular technologies.

Key takeaways include:

– Diverse supplier networks mitigate risk and boost negotiating power.

– Procurement technology adoption—such as e-sourcing and contract management tools—drives efficiency and transparency.

– Clear specification alignment and vendor communication remain vital for technical products like monoculars.

– Continuous market assessment helps identify innovation opportunities and emerging suppliers.

International buyers should view strategic sourcing not as a one-time activity, but as an evolving discipline. Investing in supplier relationships, understanding regional compliance standards, and staying informed about global optical trends will future-proof procurement strategies. As demand grows for innovation-driven optical solutions, now is the time to strengthen sourcing frameworks and explore partnerships that accelerate business growth. Take proactive steps to transform your monocular sourcing into a strategic advantage.