Introduction: Navigating the Global Market for piano keyboard middle c

Piano keyboards are indispensable across educational institutions, music academies, entertainment venues, and retail environments globally. At the core of every piano keyboard—regardless of brand, number of keys, or digital sophistication—lies middle C. This unassuming note serves as a fundamental reference point for musicians, instructors, and manufacturers alike. Its precise identification is not just a matter of musical theory but also a key component in standardizing products, ensuring quality, and delivering a consistent user experience worldwide.

For international B2B buyers, particularly those operating in diverse markets across Africa, South America, the Middle East, and Europe, understanding the nuances of “middle C” transcends basic music knowledge. It becomes a critical issue impacting inventory specification, technical compatibility, user training, and ultimately end-customer satisfaction. From entry-level keyboards for schools to advanced digital pianos for concert halls, knowing how and where middle C is placed—and ensuring alignment with global standards—can determine product acceptance and market success.

This guide offers a strategic overview tailored to your sourcing and procurement needs. It delves into the various keyboard types, key count configurations, and industry-accepted standards for middle C placement. You will gain insights into materials, manufacturing processes, and rigorous quality control practices. Detailed supplier assessments, cost structures, and key market trends reflect the realities faced by buyers in your regions. Additionally, the guide addresses frequently asked questions and compliance considerations essential for international transactions.

Empower your purchasing team to make informed decisions—whether you’re refining your product catalog, negotiating with manufacturers, or expanding into new markets. By equipping yourself with expert guidance on the significance and global standardization of piano keyboard middle C, you can minimize sourcing risks, optimize procurement, and consistently deliver high-quality musical instruments tailored to your local market’s needs.

Understanding piano keyboard middle c Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard 88-Key Acoustic | Middle C (C4) is 4th C from left; full-length keybed | Professional studios, institutions | Authentic feel; high prestige, costly, logistics-intensive |

| 76-/61-/49-Key Portable Keyboard | Middle C is 3rd C from left (usually), compact size | Schools, learning centers, export | Lightweight, affordable, versatile; lacks full range for advanced play |

| Digital Piano (Weighted Keys) | Middle C matches acoustic layout and feel; digital sound | Hotels, events, music education | Mimics acoustic touch, lower maintenance; initial investment, power required |

| MIDI Controller Keyboard | Middle C configurable; often default as C4; various sizes | Music production, recording | Flexible mapping, integrates with DAWs; needs software, not standalone |

| Custom Layout/Non-Western Keyboard | Middle C may shift placement for alternative tuning or layout | Regional music, specialty retail | Market differentiation; requires training, niche demand, limited compatibility |

Standard 88-Key Acoustic

The 88-key acoustic piano sets the industry benchmark, with Middle C (C4) consistently located as the fourth C from the left. Highly regarded for its tactile feedback and expressive range, this type is favored in professional studios, conservatories, and performance venues. B2B buyers should consider the prestige, expected durability, and resale value, but must also factor in high purchase costs, freight logistics, tuning needs, and climate sensitivity—especially in Africa and the Middle East where environment can impact maintenance cycles.

76-/61-/49-Key Portable Keyboard

These compact keyboards are designed for flexibility and ease of mobility, with Middle C generally appearing as the third C from the left. They offer an accessible entry point for music education, export markets, and budget-sensitive buyers. Key benefits include low shipping costs and adaptability for lessons or group classes. Considerations for B2B procurement involve verifying the key range suited for the clientele, evaluating sound quality, and ensuring after-sales support—crucial for bulk procurement in regions like South America and emerging African markets.

Digital Piano (Weighted Keys)

Digital pianos bridge the gap between acoustic tradition and modern convenience, matching the standard Middle C position but using digitally sampled sounds and weighted actions. This type appeals to buyers needing the dynamic response of an acoustic, combined with volume control and low upkeep. B2B buyers for hotels, educational institutions, and event venues benefit from reliability and reduced servicing, but should review power infrastructure compatibility, warranty coverage, and potential technology obsolescence when negotiating large orders.

MIDI Controller Keyboard

Primarily used for music production, MIDI controllers offer a programmable approach, letting users assign Middle C (usually C4 by default, but changeable) to suit digital music software needs. They range from small (25-key) to full-size and integrate with digital audio workstations. For B2B buyers in creative industries or education tech, these units offer flexibility and easy integration, but require compatible software and technical expertise. Assessing system compatibility and user training needs is critical for success, especially when introducing technology in less-experienced markets.

Custom Layout/Non-Western Keyboard

Designed for specialized musical traditions or experimental setups, these solutions may position Middle C differently or incorporate alternative tunings. For businesses targeting niche demographics—such as cultural institutions or regional music shops—these keyboards enable market differentiation. The main tradeoffs include the need for specialized instruction, compatibility with mainstream accessories, and a smaller, albeit devoted, demand base. B2B buyers must weigh the unique value proposition against limited scalability and support considerations.

Related Video: Piano Keys and Notes – Middle C and The Piano Keyboard – Beginner Lesson 8

Key Industrial Applications of piano keyboard middle c

| Industry/Sector | Specific Application of piano keyboard middle c | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Music Education & Training | Curriculum standardization and entry-level assessment | Facilitates consistent global pedagogy and assessment standards | Keyboard type/size, durability, adherence to global standards |

| Digital Musical Instruments | Default calibration and MIDI protocol implementation | Ensures interoperability, accuracy, and product compatibility | MIDI compliance, tuning accuracy, firmware integration |

| Edutainment & Interactive Tech | User interface anchoring and intuitive design | Lowers learning curve for new users, boosts engagement | Ergonomic layout, multilingual support, rugged construction |

| Healthcare & Music Therapy | Therapeutic device tuning and benchmark exercises | Delivers measurable therapy outcomes, supports cognitive standardization | Safe materials, clinical certifications, ease of cleaning |

| Pro Audio & Studio Equipment | Reference tuning and sound engineering calibration | Provides industry-standard reference point, reliable workflow | High sound fidelity, precise tuning, integration flexibility |

Detailed Application Insights

Music Education & Training:

Middle C serves as the essential reference point for structuring curriculum and assessment in music education worldwide. In schools, conservatories, and private academies, especially across diverse regions such as Africa and Europe, standardizing lessons around middle C enables uniform beginner instruction and easy transition between learning systems. For B2B buyers procuring instruments or educational packages, it’s crucial to ensure keyboards clearly denote middle C and are built to withstand heavy student use, with layouts compatible with international examination boards.

Digital Musical Instruments:

Middle C is universally adopted as a default calibration point for digital keyboards and MIDI instruments. Manufacturers utilize it as the center of the pitch map, allowing seamless integration across software and hardware platforms. For buyers in emerging markets like Indonesia or Brazil, prioritizing MIDI-compliant equipment with precise middle C mapping ensures compatibility with global apps and music production workflows. Reliable tuning and firmware support minimize technical issues and foster smooth creative collaborations.

Edutainment & Interactive Technology:

Edutainment products and smart learning devices use middle C as an intuitive anchor for user interfaces—vital for early musical discovery and engagement. In regions such as the Middle East and Latin America, interactive pianos and learning apps that emphasize middle C can better capture young audiences and simplify onboarding. Buyers should seek ergonomic designs with clear demarcation of middle C, support for local languages, and durable construction suited for classrooms or public spaces.

Healthcare & Music Therapy:

In therapeutic contexts, middle C provides a standardized frequency for exercises addressing motor skills and neurorehabilitation. Devices and therapy tools referencing middle C enable measurable progress, crucial for practitioners needing consistent benchmarks across sessions and locations. Buyers, particularly from clinics or wellness centers in Europe or South America, should ensure instruments meet clinical safety standards, are easy to clean, and accommodate diverse patient needs.

Pro Audio & Studio Equipment:

Producers and sound engineers depend on middle C as a fixed reference for tuning and mixing. Audio gear with precise middle C calibration eliminates ambiguities when collaborating internationally, facilitating efficient workflow and sound consistency across borders. Buyers must prioritize equipment with transparent tuning controls, integration flexibility for varying setups, and robust documentation to meet the demands of professional studios in global markets.

Key Recommendations for International B2B Buyers:

– Confirm instrument specifications align with international middle C standards (C4, 261.6 Hz).

– Prioritize products with visual or digital cues marking middle C for enhanced usability.

– Ensure compatibility with global music education and production systems, particularly in cross-border deployments.

– Seek out partners with proven track records in targeted sectors and regions to guarantee post-purchase support and training.

Related Video: Hear Piano Note – Middle C

Strategic Material Selection Guide for piano keyboard middle c

Common Materials for Piano Keyboard “Middle C”: Comparative B2B Analysis

Selecting the appropriate material for the “middle C” key on a piano keyboard is crucial for manufacturers and distributors aiming to meet international standards, ensure product longevity, and satisfy end-user preferences across diverse markets. The choice of material influences playability, durability, tactile feel, appearance, cost, and compliance with global regulations. Below, we analyze four prevalent materials: traditional ivory (rare), celluloid, Acrylonitrile Butadiene Styrene (ABS), and Polyoxymethylene (POM, or Acetal).

1. Ivory (Historical Reference Material)

Key Properties:

– Renowned for its unique tactile feel—smooth, porous surface that absorbs moisture.

– Moderately hard, with natural variability in grain and color.

– Disallowed under global treaties (e.g., CITES) for new production.

Pros & Cons:

– Pros: Superior grip and prestige; valued for restoration in heritage pianos.

– Cons: Illegal for new manufacturing; high cost, supply limitations, and strict import/export restrictions.

Impact on Application:

Ivory is no longer a commercial option except for specialized restoration projects with proper documentation. Its use is highly restricted and penalized internationally.

International Buyer Considerations:

– Compliance is paramount; most countries (including those in Africa, Europe, South America, and the Middle East) strictly prohibit trade in ivory.

– Restoration projects may require specialized documentation.

2. Celluloid

Key Properties:

– Early plastic substitute for ivory; offers high polish and a slight grain to mimic real ivory.

– Reasonable hardness, moderate resistance to temperature and humidity.

Pros & Cons:

– Pros: Good imitation of ivory’s aesthetics; historically established in the industry; easy to machine.

– Cons: Flammable; can become brittle over time; environmental concerns due to celluloid’s chemical structure.

Impact on Application:

Common in mid-century pianos, celluloid is less prevalent in modern keyboards due to fire risk and advances in safer plastics. It remains relevant for restoration or markets valuing traditional appearance.

International Buyer Considerations:

– Increasingly subject to fire safety and import restrictions, especially in the EU.

– Not recommended for regions with high ambient temperature or strict fire codes.

3. ABS (Acrylonitrile Butadiene Styrene)

Key Properties:

– Durable, non-porous, impact-resistant thermoplastic; widely used in modern digital and acoustic pianos.

– Excellent stability across temperature and humidity ranges.

– Homogeneous color and surface finish.

Pros & Cons:

– Pros: Consistent quality, cost-effective at high volumes, highly customizable finishes (matte, glossy, textured).

– Cons: Lower tactile grip compared to ivory; can feel “slippery” under perspiration.

Impact on Application:

ABS is the global industry standard for new piano keys—suitable for educational, professional, and consumer instruments. Offers reliable performance in diverse climates.

International Buyer Considerations:

– Fully compliant with REACH (EU), RoHS, ASTM, and other major standards.

– Well-supported in global supply chains, making it ideal for Africa, South America, and the Middle East where import logistics and maintenance are a concern.

– Customizations to mimic ivory grip (texturing) are possible.

4. POM (Polyoxymethylene, Acetal)

Key Properties:

– High mechanical strength, wear resistance, and low friction.

– Exceptional dimensional stability, even in high-humidity or high-temperature environments.

Pros & Cons:

– Pros: Superior durability and tactile response; effectively mimics ivory’s smoothness while offering a non-slip surface.

– Cons: Higher material and production costs compared to ABS; may require specialized manufacturing or finishing processes.

Impact on Application:

Preferred for premium or concert-grade instruments where performance and longevity are top priorities. Well-suited to both traditional and digital pianos in challenging environments.

International Buyer Considerations:

– Growing preference in Europe and increasingly in Middle Eastern and African luxury segments.

– Fully meets international standards (ASTM/DIN/JIS); customization/additives may enhance performance in local climates.

– Higher up-front costs offset by reduced long-term maintenance and product returns.

Comparative Summary Table

| Material | Typical Use Case for piano keyboard middle c | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Ivory (Historic) | Restoration of heritage pianos | Superior tactile grip and prestige | Illegal for new production; compliance risks | High |

| Celluloid | Traditional appearance/restoration; vintage pianos | Good ivory imitation; historic use | Fire hazard, brittleness, environmental limits | Medium |

| ABS | Standard for new digital and acoustic pianos | Cost-effective, durable, climate stable | Lower tactile grip vs. ivory; can feel slippery | Low |

| POM (Acetal) | Premium pianos; export to demanding environments | Excellent wear/corrosion resistance, tactile feel | Higher cost, manufacturing complexity | Medium to High |

In-depth Look: Manufacturing Processes and Quality Assurance for piano keyboard middle c

Manufacturing piano keyboards—especially ensuring the precision and reliability of the middle C key—requires a blend of high-precision engineering, stringent quality controls, and awareness of international certification demands. For B2B buyers operating across Africa, South America, the Middle East, and Europe, understanding these processes is crucial not only for product quality but also for regulatory compliance and long-term supplier relationships.

Key Stages in the Manufacturing Process

1. Material Preparation

The choice of materials for a piano keyboard directly affects its aesthetics, touch response, longevity, and sound. Most contemporary keyboards use a combination of high-grade plastics (such as ABS resin) for keytops, metal reinforcements for key balance, and, for higher-end products, wood components for premium tactile feedback. The middle C key, given its central functional and symbolic importance, often undergoes tighter material selection. Materials are purchased or produced in large batches to guarantee batch uniformity, and are subjected to initial quality checks for density, moisture content (if wood is used), and color consistency.

2. Forming and Molding

Keytops are precision-molded, with molds maintained to tight tolerances to ensure each key’s dimensions and touch are consistent. The forming stage includes injection molding of the plastic shell, followed by cooling processes that avoid internal stresses, which can lead to warping over time. For wood-based keys, careful milling and finishing are performed to ensure ergonomic accuracy and smooth surface finish.

3. Assembly

Keyboard assembly integrates the individual keys—including the middle C—onto the main keyboard frame. This process employs automated assembly lines in large facilities, where robotic arms and conveyor systems align and mount keys with precise spacing. The key mechanism, involving the fulcrum and counterweights, is calibrated to achieve uniform key travel and resistance—an important touchpoint for the middle C, which is often used as the reference note in both mechanical and sensory calibration.

4. Finishing

Post-assembly, key surfaces are polished, coatings (such as wear-resistant or antimicrobial finishes) may be applied, and legends or markings are added using laser etching or pad printing for durability. The keyboard undergoes cleaning and is finally packaged in a controlled environment to avoid dust contamination.

Quality Assurance and Control Practices

International Standards and Certifications

- ISO 9001: Most reputable piano keyboard manufacturers implement ISO 9001-certified quality management systems. This standard ensures documentation, traceability, and process repeatability across manufacturing, particularly vital for volume contracts with B2B buyers.

- CE Marking (Europe): For buyers in the EU, compliance with CE is essential, evidencing that the keyboard meets applicable safety, health, and environmental standards.

- Additional Certifications: Depending on export region, manufacturers may require compliance with regional electrical, electromagnetic, and safety standards (e.g., RoHS, REACH for chemicals, or specific import standards in African or Middle Eastern markets).

Key Quality Control Checkpoints

- Incoming Quality Control (IQC): All materials are checked on arrival—plastics for consistency, metals for composition, wood for moisture and density. IQC reduces variance in the final product and flags supplier issues early.

- In-Process Quality Control (IPQC): During molding and assembly, random samples are tested for dimensional accuracy using calipers and digital scanners. The actuation force of each key is measured, with particular checks on the middle C for consistent touch feel and sound response.

- Final Quality Control (FQC): Completed keyboards undergo functional testing, including:

- Tactile response: Ensuring every key, especially middle C, actuates smoothly.

- Acoustic output (for digital and acoustic keyboards): Verifying consistent signal or sound output.

-

Cosmetic inspection for scratches, blemishes, and print accuracy.

-

Routine Aging and Durability Tests: Keys are subjected to tens of thousands of depressions in accelerated life cycle testing to simulate years of typical use, focusing on resistance to sticking, degradation, or mechanical failure.

Common Testing Methods

- Mechanical Actuation Testing: Automated rigs depress keys to measure resistance and travel, generating data on uniformity—key for quality assurance, particularly for the middle C.

- Spectral and Sound Analysis: For digital keyboards, signal output is analyzed to ensure standardized pitch (C4 at 261.6 Hz for middle C) and volume levels.

- Environmental and Chemical Testing: Especially for exports to Europe, testing for restricted substances (lead, phthalates) is standard.

- Visual and Tactile Inspection: Trained inspectors evaluate surface finish, key spacing, and assembly accuracy. The middle C frequently receives additional attention as users universally expect it to be both visually and mechanically central.

Verifying Supplier Quality as an International B2B Buyer

Supplier Audits

Regular supplier audits (either virtual or in-person) are critical. Insist on a walkthrough of the production facility, specifically focusing on process controls for key molding and assembly lines. Review documentation for ISO, CE, or other relevant certificates. For African, Middle Eastern, or South American buyers, visiting or appointing a local agent provides hands-on assurance and can preempt potential issues with shipping or local compliance.

Quality Documentation & Reports

Require:

– Batch QC reports, documenting test results from IQC, IPQC, and FQC stages.

– Certificates of Conformance (CoC) for materials and finished goods.

– Traceability logs, tying serial numbers or batch codes to inspection records.

For many regions, including Spain and Indonesia, such documentation is essential for customs clearance and warranty negotiations.

Third-Party Inspections

- Appoint reputable third-party inspection agencies (such as SGS, Bureau Veritas, Intertek) to conduct pre-shipment inspections, focusing particularly on:

- Mechanical function of keys (with middle C as a critical checkpoint).

- Compliance labeling and paperwork.

- Packaging suitability for long-distance transport (especially important for Africa/South America routes).

- Physical or digital inspection reports should be supplied before the supplier is authorized to ship.

Regional Certification and Compliance Nuances

- Europe (e.g., Spain): Strict adherence to CE marking, REACH, and RoHS directives is mandatory. Spanish customs may require additional labeling or language-specific documentation.

- Africa & South America: While regulatory environments can be less standardized, increasing preference for documented compliance (e.g., ISO, third-party inspections) is emerging among leading distributors and state procurement agencies.

- Middle East: Faithful adherence to declared origin, plus clear documentation on hazardous materials, is often required. For GCC countries, Gulf Conformity Mark may be necessary.

Actionable Insights for B2B Buyers

- Request detailed quality documentation in advance—not only for finished goods but also for materials and critical process steps.

- Negotiate the right to conduct or commission independent factory audits or product inspections—especially before initial orders or after any reported defects.

- Ensure clarity on regional compliance needs, and make CE, ISO, or other certifications a contractual requirement where relevant.

- Establish clear protocols for non-conformity, including return logistics and corrective action tracking, to manage exceptions efficiently.

By rigorously managing manufacturing and quality assurance expectations—focusing especially on critical keys like middle C—B2B buyers can optimize both product quality and regulatory compliance, reducing business risk and maximizing end-user satisfaction in any target market.

Comprehensive Cost and Pricing Analysis for piano keyboard middle c Sourcing

Key Cost Components in Piano Keyboard Sourcing

Understanding the breakdown of production and sourcing costs is crucial for international B2B buyers aiming to optimize pricing strategies and negotiate effectively. The following core cost components apply when procuring piano keyboards—specifically focusing on models that precisely position and label Middle C, an essential aspect for educational and beginner segments:

-

Raw Materials: The types and quality of materials (plastic for keys, electronic components for digital keyboards, wood for acoustic keys, etc.) significantly determine the base cost. Higher-grade plastics or enhanced electronics (e.g., velocity-sensitive keys, LED indicators for Middle C) will raise unit costs, while basic entry-level models can leverage cost-efficient common materials.

-

Labor: Labor expenses encompass skilled assembly (keybed alignment, electronics installation) and finishing processes. Regions with higher wage rates (Europe) experience elevated labor costs compared to certain Asian manufacturing hubs.

-

Manufacturing Overhead: This includes the cost of running production facilities—utilities, depreciation on machinery (such as injection molding for keys), and factory staffing not directly involved in assembly.

-

Tooling and Setup: Customization (for language labels, specialty Middle C indications, branded packaging) often requires initial investments in tooling, such as molds, templates, and dies. These are typically amortized over order volumes.

-

Quality Control (QC) & Compliance: QC mechanisms ensure proper calibration and consistent marking of Middle C, affecting both labor hours and overhead. Compliance with global (CE, RoHS) or regional (SABS, SASO) standards may further increase costs.

-

Logistics: Shipping expenses depend on order weight/volume, transport mode (sea, air, rail), insurance, and handling. For bulkier 88-key models, costs are higher per unit—buyers in Africa and South America should plan for transoceanic freight and inland distribution.

-

Supplier Margin: Manufacturers build their profit margin into the offering, which may vary widely depending on order scale, competitive dynamics, and customization levels.

Factors That Influence Price

Pricing for piano keyboards with explicit Middle C labeling—customary for educational, export, and institutional markets—is determined by a combination of internal cost structure and external market factors:

-

Minimum Order Quantity (MOQ) and Volume: Suppliers often provide tiered pricing. Higher order volumes secure significant unit cost reductions, as fixed overhead and tooling are spread across more units. For large distributors or school tenders, negotiating favorable MOQs is essential.

-

Specifications & Customization: Simple models with basic Middle C markings cost less than customizable units (different key range, color-coding, language-specific labeling, or integrated technology). Each added specification can increase per-unit and tooling costs.

-

Materials and Quality Grades: Keyboards with durable plastics, reinforced key mechanisms, or superior electronics for digital sound fidelity command premium prices. Certifiable, child-safe, or eco-friendly materials may also be priced higher but facilitate compliance with import regulations.

-

Supplier Location and Capabilities: Established suppliers with in-house engineering and R&D may charge more for sophisticated products but deliver higher consistency. Source proximity to export ports (Shanghai, Jakarta, Shenzhen) can reduce inland logistics cost.

-

Quality Certification and Warranty: Offering CE, ISO, or RoHS certifications and extended warranty adds to sourcing cost but is often mandatory for sales in Europe and Middle East.

-

Incoterms: Pricing will vary whether quotations are FOB (Free On Board), CIF (Cost, Insurance & Freight), or DDP (Delivered Duty Paid). FOB is standard for buyers comfortable managing freight, while CIF/DDP is preferable for importers in Africa, the Middle East, and South America seeking landed-cost clarity.

Actionable Tips for Global B2B Buyers

To ensure the most cost-effective and reliable sourcing of piano keyboards geared towards educational and institutional needs, consider the following strategies:

-

Optimize Total Cost of Ownership (TCO): Analyze more than just the FOB/CIF price. Include anticipated import duties, local transport, QC costs, and after-sales service. Sometimes, a higher upfront cost can deliver lower TCO through reduced maintenance or warranty claims.

-

Negotiate Volume Discounts and Flexible MOQs: Even if initial purchase volumes fall below standard tiers, negotiate based on projected annual orders or consortium/group purchasing with other local buyers.

-

Request Multiple Quotations and Samples: Solicit offers from several suppliers (across China, Indonesia, Europe) to benchmark pricing. Insist on fully assembled samples, including all Middle C markings, to assess quality before batch orders.

-

Assess Certifications and Regional Compliance: Ensure products meet required certifications for your market (EU: CE, South America: local safety standards, Middle East: Gulf Mark, Africa: SABS/SASO). Non-compliance leads to customs delays and added costs.

-

Clarify Incoterms and Hidden Fees: Understand what is (and is not) included in quoted prices; confirm who bears insurance, port detention fees, and import tariffs.

-

Partner with Reputable Logistics Providers: Especially in regions with infrastructure bottlenecks (landlocked African nations, Amazon basin in South America), reliable freight forwarding reduces risk of losses, delays, and unanticipated expenses.

-

Factor in Lead Times and Seasonality: Order well in advance of peak demand or academic cycles to avoid price surges

Spotlight on Potential piano keyboard middle c Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘piano keyboard middle c’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

8 Best Piano Brands in the World Right Now (2025) (middermusic.com)

With a global reputation for excellence, the companies featured in the “8 Best Piano Brands in the World Right Now (2025)” list (see: middermusic.com) are industry-leading manufacturers and suppliers of pianos and keyboards, including models designed for precise middle C positioning. These brands—such as Steinway & Sons, Yamaha, and Bösendorfer—are recognized for their innovation, commitment to craftsmanship, and decades-long dedication to quality. Their pianos are constructed to the highest international standards, often referenced by industry professionals as benchmarks for durability and tone consistency.

For B2B buyers, these brands offer an extensive portfolio covering everything from concert grand pianos to robust digital keyboards, catering to educational institutions, retailers, and performance venues. They are distinguished by a broad international market footprint, successfully supplying to regions across Africa, South America, the Middle East, and Europe. Notably, their instruments feature precisely engineered key layouts—essential for effective middle C identification across various keyboard sizes—facilitating user-friendly experiences for beginners and professionals alike. Their reliable after-sales support and worldwide distributorship further enhance their value proposition for international procurement.

The Best Digital Piano & Keyboard Brands Guide (www.pianodreamers.com)

The Best Digital Piano & Keyboard Brands Guide, featured by PianoDreamers, offers an in-depth comparative resource and is recognized for its data-driven approach to identifying top-tier digital piano manufacturers worldwide. Their profiling emphasizes only brands with a proven reputation for authentic sound, natural key action (such as Grand Feel III and Responsive Hammer technologies), and consistent build quality—key factors for institutional and reseller clients seeking robust, reliable instruments for a range of skill levels. Brands reviewed meet rigorous criteria focused on playability, durability, and after-sale support, targeting educational institutions, distributors, and retailers across Europe, Africa, South America, and the Middle East.

Key models—including the CN-301 and Concert Artist (CA) series—stand out for their sophisticated key mechanisms, multi-sample piano voices, and robust polyphony (up to 256 notes), making them especially suitable for curriculum-aligned music programs, bulk institutional procurement, and pro-audio segment retailers. While direct manufacturing data (e.g., ISO certifications) is not specified, the guide’s selections are rooted in long-term global brand performance, ensuring buyers minimize the risks of product defects or negative brand association. Unique selling points include a commitment to user-centric product selection—prioritizing genuine acoustic feel on digital platforms and identifying models that offer long-term value in regional markets often underserved by premium suppliers.

Discover the 12 Best and Worst Piano Brands of 2025 (www.pianobrands.org)

Discover the 12 Best and Worst Piano Brands of 2025 is an industry resource and comparative hub rather than a traditional manufacturer, providing comprehensive evaluations of major piano brands—including those specializing in keyboards with precise middle C identification, a key requirement for institutions and education buyers. The platform highlights global leaders such as Yamaha, Steinway & Sons, and Bösendorfer, renowned for their craftsmanship, sound consistency, and robust after-sales support, especially in professional and export-focused models. Its review methodology assists B2B buyers from Africa, South America, the Middle East, and Europe in navigating product quality, resilience, and suitability for diverse climates and usage volumes. While not a direct supplier, the site’s insights into durability, performance, and market reputation help distributors and procurement specialists mitigate risk and maximize product lifecycle in multi-market deployments.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 8 Best Piano Brands in the World Right Now (2025) | Global leaders, premium piano keyboard solutions | middermusic.com |

| The Best Digital Piano & Keyboard Brands Guide | Curated global leaders, authentic touch, reliable reseller support | www.pianodreamers.com |

| Discover the 12 Best and Worst Piano Brands of 2025 | Authoritative piano brand comparisons for global B2B buyers | www.pianobrands.org |

Essential Technical Properties and Trade Terminology for piano keyboard middle c

Key Technical Specifications for Middle C Positioning on Piano Keyboards

When sourcing piano keyboards for international B2B contexts, particularly with an emphasis on the correct identification and placement of “Middle C” (C4), buyers must understand several technical properties that impact product suitability, compliance, and user satisfaction. Below are the most critical specifications to consider:

-

Key Count and Middle C Placement:

The total number of keys directly influences the position of Middle C, which is central in learning and performance. Standard options include 88, 76, 61, and 49 keys. For 88-key keyboards, Middle C is the 40th key from the left, typically aligning with the manufacturer’s logo and representing scientific pitch notation C4. For shorter keyboards, Middle C may shift in position, so accurate marking by the OEM is crucial for user orientation, especially in educational or institutional settings. -

Key Material Quality:

Keys are commonly made from ABS or other high-impact plastics; some high-end models may use composite or synthetic ivory for improved tactile feel and durability. Material choice affects not only aesthetics but also key longevity, resistance to wear, and user perception of quality. For institutional purchasers, especially in humid African or South American climates, material resistance to humidity and temperature changes is a critical sourcing criterion. -

Tuning and Key Sensitivity (Velocity Response):

The correct output of Middle C—the frequency (261.6 Hz for C4) and how the key responds to touch (velocity sensitivity)—is essential. Instrument calibration and the integration of velocity-sensitive electronics are vital for digital keyboards, impacting user experience and the suitability of the instrument for both educational and professional use. -

Key Legibility and Marking:

Clear demarcation of Middle C—whether via subtle engravings, guide stickers, or documentation—is a valuable property. For robust B2B operations, especially in educational distribution, accessibility features such as tactile or visual markers enhance usability and training efficiency. -

Compliance and Certification:

Many markets, especially in Europe, will require specific certifications (CE, RoHS) regarding product safety and component material standards. Ensuring documentation and compliance with these standards is vital for import/export, public tenders, and institutional procurement.

Critical Trade and Industry Terms

International buyers must navigate standard industry jargon that appears throughout the procurement process. These terms streamline communication and clarify expectations between parties:

-

OEM (Original Equipment Manufacturer):

Denotes whether the keyboard is produced by the original developer/manufacturer or a third-party. For Middle C placement consistency and quality assurance, OEM sourcing is often preferable. -

MOQ (Minimum Order Quantity):

Defines the smallest purchase batch a supplier is willing to fulfill. For large educational or government contracts—common in Africa, South America, and parts of Europe—negotiating suitable MOQ ensures project feasibility. -

RFQ (Request for Quotation):

A formal process to solicit pricing and terms from suppliers. Buyers should specify requirements such as key count, material grade, and Middle C marking in RFQs to ensure relevant, accurate supplier responses. -

Incoterms (International Commercial Terms):

Standardized shipping terms (e.g., FOB, CIF) clarifying risk transfer, insurance, and logistics responsibilities. Mastery of Incoterms is vital when importing bulk keyboards to Europe or emerging markets. -

QC/QA (Quality Control/Quality Assurance):

These refer to systematic processes to ensure each keyboard meets agreed specifications, including correct Middle C positioning, frequency accuracy, and compliance documentation. -

Lead Time:

The period between placing an order and receipt of goods. Effective project management for educational tenders or seasonal campaigns depends upon realistic lead time calculations, taking into account logistics, production schedules, and customs.

B2B Insights and Action Points

-

Standardize on Global Middle C Definition:

Ensure your procurement specifications refer to scientific pitch notation (C4, 261.6 Hz) and require OEM marking/documentation to minimize miscommunication, especially when sourcing multi-origin inventories. -

Prioritize Documentation:

For smooth customs clearance and customer education, request detailed datasheets, compliance certificates, and user manuals highlighting Middle C identification. -

Negotiate Terms Upfront:

Discuss MOQ, lead time, and Incoterms during early negotiations to align expectations and avoid project delays.

By thoroughly scrutinizing these technical properties and trade terms, B2B buyers can secure consistent, compliant, and user-friendly piano keyboards tailored for diverse international markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the piano keyboard middle c Sector

Global Market Overview & Key Trends

The international market for piano keyboards, particularly those distinguished by clear identification of middle C, has seen robust growth driven by heightened demand for music education, expanding entertainment sectors, and the proliferation of digital learning platforms. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding evolving sourcing trends is crucial to building resilient and competitive supply chains.

Rising Digitalization and EdTech Investment: The integration of technology in music education—ranging from e-learning modules to smart keyboards—has significantly impacted purchasing preferences. Digital keyboards that highlight or audibly introduce middle C are in high demand among educational institutions and retail partners. Buyers are seeking products compatible with remote and hybrid learning environments, consequently prioritizing keyboards that blend tactile quality with digital features.

Cost and Value Dynamics: Price-sensitive markets in emerging regions are gravitating toward mid-tier yet reliable brands. While premium brands (often from Japan or Western Europe) retain cachet, there is increased traction for competitively priced models from East Asia and, increasingly, select manufacturers from Southeast Asia and Latin America. European buyers, particularly in Spain and Eastern Europe, tend to favor products with reputable local distribution and after-sales support.

Customization and Localization: Suppliers are increasingly offering keyboards with localized guide markings, language-specific labeling, and packaging tailored to regional education standards. For instance, models distributed in Indonesia or Brazil may feature updated instructional graphics to address local music curricula or language preferences. This localization improves user adoption rates and enhances the value proposition for educational and institutional clients.

Resilience and Supply Chain Considerations: The global pandemic and regional disruptions have exposed weaknesses in single-source procurement strategies. B2B buyers are now prioritizing suppliers that can demonstrate diversified manufacturing capabilities, robust logistics, and flexible lead times. Establishing agile supplier partnerships across multiple geographies is key to safeguarding against future volatility, particularly for buyers in Africa and the Middle East where logistics can affect timely delivery.

Sustainability & Ethical Sourcing Considerations

Sustainability is an increasingly non-negotiable aspect for both manufacturers and B2B buyers in the piano keyboard segment. Environmental regulations and end-customer preferences are driving important changes throughout the value chain.

Materials and Manufacturing: Traditional keyboard manufacturing has relied heavily on plastics and, for higher-end models, wood derived from endangered species. Recent advancements have seen a shift toward recycled plastics, sustainably harvested woods (certified by organizations like FSC), and non-toxic finishes. B2B buyers are now actively requesting environmental certifications and documentation regarding materials origin. Sourcing keyboards built with a high percentage of recycled or rapidly renewable materials can not only reduce environmental impact but also unlock access to institutional buyers with strict sustainability mandates.

Supply Chain Transparency and Labor Ethics: Buyers in Europe and the Middle East are increasingly scrutinizing supply chain transparency, looking for evidence of fair labor practices and avoidance of conflict materials. Ethical certifications, including ISO 14001 (environmental management) and compliance with REACH or RoHS (for electronic components), are becoming standard RFQ requirements. Transparency initiatives—such as providing full product lifecycle documentation and traceability for wood and plastics—are valuable differentiators for manufacturers.

Product Lifecycle and End-of-Life Management: A growing trend among institutional buyers is the inclusion of end-of-life provisions. Suppliers who offer recycling programs or modular designs that facilitate component replacement and recycling differentiate themselves in bids, particularly in the EU, where Extended Producer Responsibility (EPR) regulations may apply. For B2B buyers, partnering with manufacturers who demonstrate commitment to green logistics and circular economy practices enhances both compliance and brand reputation.

Brief Evolution and Historical Perspective

The importance of middle C in piano and keyboard design spans centuries, rooted in both the physical layout of the instrument and its pedagogical role. Historically, acoustic pianos from Europe established the standardized 88-key layout, with middle C acting as the central reference for notation and instruction. With the rise of electronic keyboards in the late 20th century, the need for clear identification of middle C grew, especially as key counts diversified (49, 61, 76, and 88 keys).

Manufacturers responded by incorporating visual guides, differentiated key textures, and digital displays. This evolution has been crucial for expanding music accessibility, particularly in emerging markets where formal music instruction materials may be limited. For institutional B2B buyers, this historical continuity underscores the need for consistent, easy-to-navigate key layouts—regardless of model or region—supporting the development of music literacy and skills across diverse populations.

Frequently Asked Questions (FAQs) for B2B Buyers of piano keyboard middle c

-

How do I identify reliable suppliers of piano keyboards with accurate middle C placement for diverse markets?

When sourcing piano keyboards internationally, verify suppliers’ experience with global markets and their compliance with recognized musical instrument standards. Request documentation, such as product diagrams or certifications, confirming the layout accuracy—especially for middle C placement. Ask for references from past international clients and consider third-party audits. For buyers in Africa, South America, the Middle East, and Europe, prioritize suppliers with logistical networks and after-sales support in your region for faster issue resolution and smoother trade processes. -

Can suppliers customize the labeling or features of middle C for local education or branding needs?

Many manufacturers offer customization options, such as distinct middle C key coloring, labeled keys in local languages, or company branding for educational or promotional use. Specify your requirements clearly—including language, color, and logo preferences—during initial negotiations. Ensure suppliers can provide sample units or digital prototypes for approval before mass production. For markets with unique educational needs, like localized note markings in Spanish or Arabic, confirm that the customization process will not impact lead times or product certification. -

What are typical minimum order quantities (MOQ) and lead times for international shipments?

MOQ for piano keyboards featuring accurate middle C identification often ranges from 50 to 200 units, depending on the level of customization and manufacturer capacity. Lead times for standard products average 30-45 days, while customized orders may extend to 60-90 days. For buyers in emerging markets, negotiate for smaller MOQs during initial collaborations, especially if conducting test marketing. Always confirm timelines in writing, factoring in public holidays and shipping times relevant to your region. -

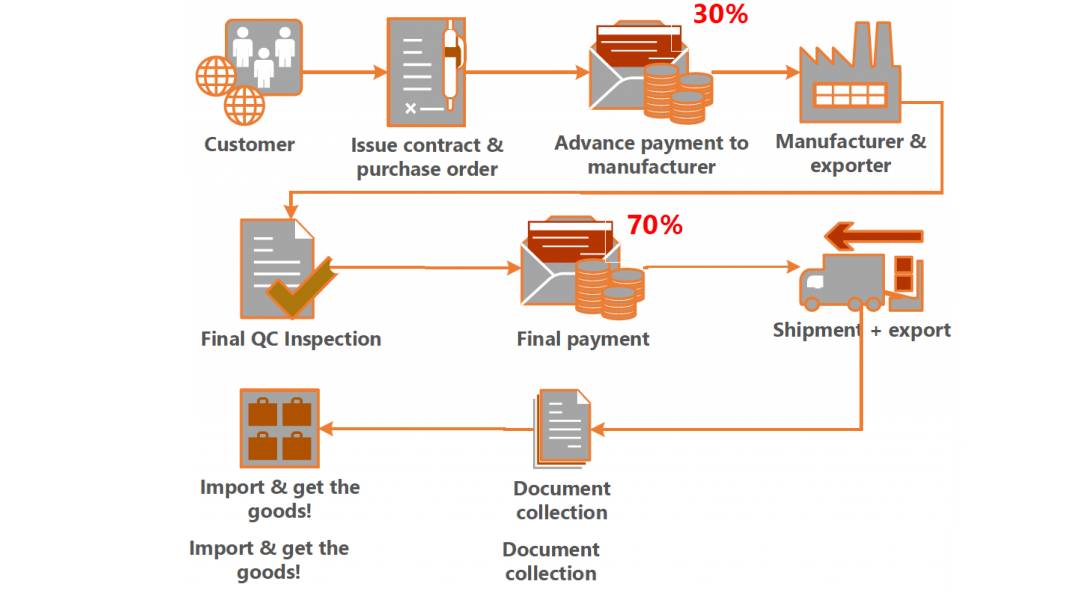

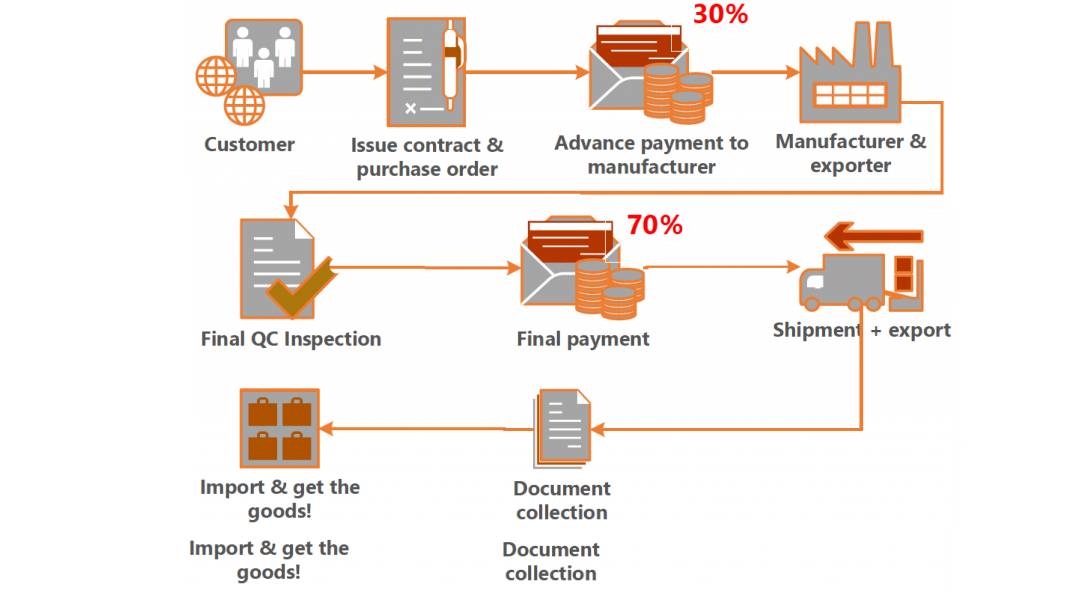

What payment methods and terms are commonly accepted for B2B international orders of piano keyboards?

Suppliers typically accept wire transfers (T/T), Letters of Credit (L/C), and occasionally PayPal for smaller orders. Secure payment terms—such as a 30% initial deposit with the balance against shipping documents—are regarded as industry standard. In risk-prone regions, opt for escrow services or partner with established local agents to reduce exposure. Confirm all payment details through proforma invoices and clarify responsibilities regarding currency conversions and bank fees. -

How can I ensure the quality and authenticity of the piano keyboard’s middle C layout and functionality?

Request samples before placing full orders, and specify quality assurance protocols, especially for the placement and clarity of middle C. Seek products tested to internationally recognized musical or electronic standards (e.g., ISO, CE, or RoHS certifications for electronics). Use inspection services—either in-house or independent agencies—to verify each shipment prior to dispatch. For added confidence, set contractual penalties for non-compliance with agreed-upon quality terms, especially concerning keyboard accuracy. -

Which certifications or compliance marks should I require when importing piano keyboards to my country?

Depending on your market, request evidence of compliance with regional safety, quality, and educational standards. For Europe, CE marking is essential; for electrical models, RoHS and EMC certifications may also be required. In the Middle East and Africa, check if local standards—like SONCAP (Nigeria) or SASO (Saudi Arabia)—apply. Demand up-to-date compliance documents and consider consulting with customs brokers or trade consultants to avoid costly import delays or rejections. -

What are the best practices for managing logistics and importation challenges for keyboard orders?

Work with suppliers who offer a range of Incoterms (like FOB, CIF, DDP) and have experience shipping to your destination. Confirm the product’s HS code for customs classification, and communicate all local import requirements to avoid misunderstandings. Establish clear agreements on packaging to protect keyboards in transit, and request tracking for all shipments. For cost optimization, consolidate shipments when possible and ensure necessary insurance coverage for international transportation. -

How are after-sales disputes, warranty issues, or damages typically handled in international B2B transactions?

Before ordering, agree with your supplier on clear warranty terms (usually 12-24 months for electronic components) and define return or replacement procedures for damaged or non-compliant products. For international disputes, use contracts specifying dispute resolution mechanisms—such as arbitration or mediation in neutral jurisdictions. Retain all purchase, shipping, and inspection records to support any claims. Working with suppliers who maintain responsive, English-speaking support teams or local partners can accelerate dispute resolution.

Strategic Sourcing Conclusion and Outlook for piano keyboard middle c

International B2B buyers seeking piano keyboards optimized for educational, retail, or institutional settings must pay close attention to clarity and accuracy regarding the middle C position. Ensuring that imported models, whether standard 88-key or more compact types, highlight middle C with clear labeling or tactile indicators can streamline onboarding for educators and new users—an especially critical factor in expanding piano literacy across diverse markets.

Key strategic sourcing insights include:

- Verification of Standards: Validate that suppliers adhere to international norms in keyboard layout, ensuring middle C aligns as the fourth C (or third on 61-/76-key models) from the left. This consistency simplifies integration into global music education frameworks.

- Adaptation for Local Needs: Assess user preferences in your region—demand may differ, for example, for 61-key portable keyboards in emerging markets or robust 88-key instruments in institutional settings.

- Supplier Collaboration: Engage manufacturers who offer customization, such as middle C markers, localized instructions, or durable packaging for international transit—essential for Africa, South America, the Middle East, and Europe.

With global demand for accessible music education on the rise, proactive sourcing strategies will position your organization to meet growing requirements for precision and ease of use. Secure partnerships with reliable, innovative suppliers to ensure your inventory empowers end users—fostering music learning and market growth across continents. Now is the time to act: leverage these sourcing best practices to capture opportunity and drive lasting impact in your region’s music ecosystem.