Introduction: Navigating the Global Market for leathaire fabric

Leathaire fabric has rapidly become a game-changer in the global textile industry, offering an attractive alternative to traditional leather for furniture, automotive interiors, hospitality, and contract manufacturing. Its unique blend of durability, breathability, and cost-effectiveness has sparked growing interest among international B2B buyers seeking high-performance materials without compromising on aesthetics or value. As markets across Africa, South America, the Middle East, and Europe evolve—with buyers in nations like Nigeria and Saudi Arabia demanding both quality and versatility—leathaire stands out as a strategic procurement solution.

In today’s competitive sourcing landscape, selecting the right leathaire fabric can significantly impact your product’s performance, end-user satisfaction, and profitability. Decisions on material composition, supplier reliability, manufacturing consistency, and certification standards all play critical roles in successful fabric procurement. Without direct insight into the leathaire value chain, buyers risk costly missteps—from budget overruns to delayed production and market entry.

This comprehensive guide is designed to empower B2B buyers to make confident, informed decisions when navigating the leathaire fabric market. It covers a spectrum of essential topics, including:

– Leathaire fabric types and technical specifications

– Material composition and quality benchmarks

– Manufacturing processes and quality control best practices

– Supplier identification and strategic selection

– Cost structures and market price dynamics

– Regional sourcing insights tailored to your market context

– Frequently asked questions and actionable procurement tips

Armed with the strategies and insights outlined here, your procurement team will be equipped to optimize their leathaire sourcing strategy—balancing quality, cost, and supply reliability on a global scale. Whether your priorities are durability, design flexibility, or sustainable sourcing, this guide serves as your roadmap to successful leathaire procurement in an increasingly interconnected marketplace.

Understanding leathaire fabric Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Leathaire | Basic micro-porous synthetic leather; single-layer build | Upholstery, sofas, office chairs | Cost-effective, easy to maintain; less breathable, may lack tactile depth of premium variations |

| Embossed/Textured Leathaire | Surface imprinted with grain or texture patterns | Premium furniture, automotive | Enhanced aesthetics, elevated tactile feel; may cost more, cleaning in crevices can require attention |

| Breathable/3D-Knit Leathaire | Open-cell backing or 3D-knitted structure for airflow | High-traffic seating, hospitality | Superior comfort, reduces sweat buildup; higher cost, can require specialist fabrication methods |

| Flame Retardant (FR) Leathaire | Treated with or manufactured using flame-retardant agents | Commercial interiors, transport | Compliant with safety regulations, added protection; additional cost, may alter feel or drape |

| Waterproof Leathaire | Coated or laminated for liquid resistance | Cafés, restaurants, outdoor use | Resists spills and stains, easy to sanitize; may sacrifice some breathability and natural hand feel |

Detailed Overview of Leathaire Fabric Types

Standard Leathaire

This foundational type is a single-layer synthetic leather constructed for cost efficiency and broad usability. It balances affordability with the signature leathaire look, making it attractive for volume-based buyers in sectors ranging from residential to OS&E procurement. However, while easy to clean and maintain, it may not deliver the nuanced texture or breathability offered by mid- and high-tier variations. African and Middle Eastern buyers seeking robust, budget-friendly upholstery often favor this for office projects or mass-produced furniture lines.

Embossed/Textured Leathaire

Enhancing the basic template, embossed or textured leathaire features an imprinted surface resembling natural leather grains or bespoke patterns. This provides an elevated aesthetic and a tactile feel that distinguishes premium products in competitive markets such as luxury hospitality, automotive interiors, or high-end retail environments. B2B purchasers should prioritize pattern uniformity, color fastness, and the clarity of embossing—important quality differentiators when marketing to discerning end-users in Europe or the Gulf region.

Breathable/3D-Knit Leathaire

This advanced variant leverages open-cell or three-dimensional knit backing, resulting in increased air circulation and comfort, particularly for prolonged seating scenarios. Especially relevant for hospitality, healthcare, or corporate projects where user comfort and hygiene are paramount, it offers a practical advantage in tropical climates across Africa or Southern America. However, buyers should consider partner supplier experience with 3D-knits to ensure consistent structure and performance, as fabrication complexity can impact both cost and product lead times.

Flame Retardant (FR) Leathaire

Targeted at sectors with stringent safety standards—public transport, hotels, offices, or marine—FR leathaire is either inherently flame resistant or post-treated. Its purchase is often dictated by local fire compliance codes (e.g., BS5852, CAL TB117). While crucial for public tenders and high-occupancy projects in the EU or Middle East, B2B buyers must verify certification, understand the impact on tactile properties, and weigh increased costs against operational safety requirements.

Waterproof Leathaire

Engineered for moisture-rich or high-spill environments, this type integrates waterproof coatings or laminations, making it ideal for restaurants, outdoor hospitality venues, or healthcare use. It stands out for easy sanitation and resilience against staining, critical in café chains in urban Nigeria or seasonal resorts in Europe. However, the waterproofing process may reduce the softness or air permeability of the fabric—buyers are advised to trial samples, and to clarify cleaning protocol compatibility during sourcing.

Key B2B Purchasing Considerations

– Always request technical datasheets and test certificates (e.g., Martindale rub count, fire resistance, hydrostatic head).

– Factor in local climatic conditions and environmental regulations when selecting type.

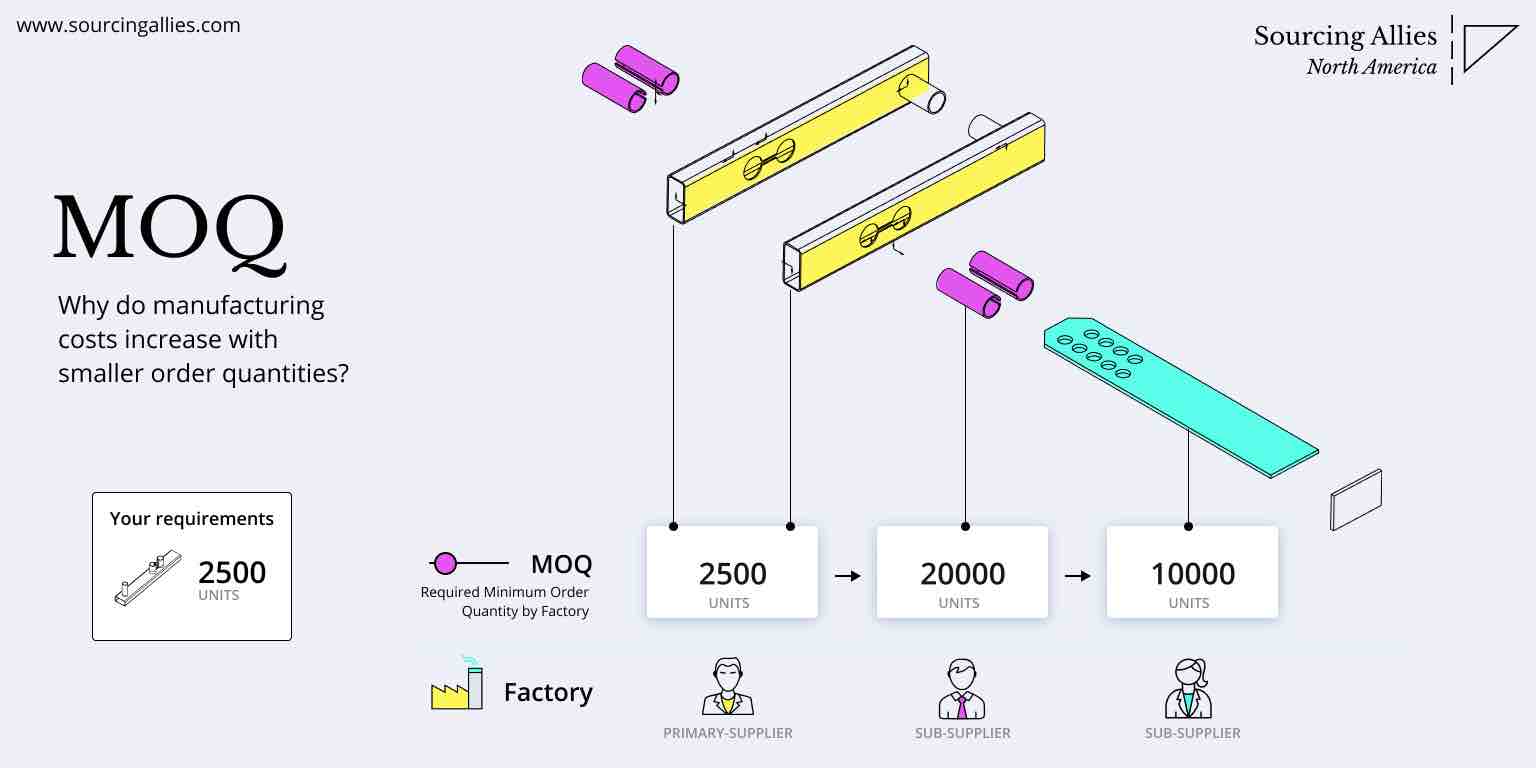

– Evaluate minimum order quantities (MOQs), as advanced types may require higher MOQs or longer lead times.

– Build strong supplier relationships to ensure consistency and after-sales support, especially when specifying specialty or compliant materials.

– Perform in-house or third-party sample testing to confirm suitability for your end-use sector and regional standards.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of leathaire fabric

| Industry/Sector | Specific Application of leathaire fabric | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Furniture & Hospitality | Upholstery for sofas, chairs, hotel lobbies, and public seating | Durable, stain-resistant, cost-effective alternative to leather; modern aesthetic | Compliance with local fire and safety standards, color fastness, bulk availability, delivery timelines |

| Automotive | Car seat covers, interiors, and transport upholstery | Resistant to wear and temperature fluctuation; easy to clean; premium look | UV resistance, performance under varying climates, certification for auto standards |

| Marine & Outdoor | Boat seats, outdoor lounges, patio furniture | Waterproof, UV-resistant, withstands harsh environments | Anti-mildew treatment, extended warranty terms, suitability for humidity and saline exposure |

| Office & Commercial Spaces | Office seating, reception furniture, paneling | Professional appearance, easy maintenance, allergy-friendly | Sustainability certifications, consistency of finish, large-scale supply capacity |

| Healthcare | Hospital waiting area seating, patient chairs | Hygienic, antibacterial options, robust for high-traffic use | Medical-grade certifications, ease of disinfection, hypoallergenic testing |

Furniture & Hospitality

Leathaire fabric is widely adopted in the furniture and hospitality sector for upholstering sofas, armchairs, headboards, public seating, and lobby furniture. It offers a contemporary leather-like appearance with enhanced breathability and easy stain removal, making it ideal for hotels, restaurants, lounges, and serviced apartments. For international buyers in regions with heavy use and diverse climate conditions—such as high humidity (Nigeria) and temperature swings (Europe)—the priority is on color fastness, bulk shipment capability, and compliance with local upholstery standards. Buyers should also confirm that supplier inventory aligns with specific design palettes and schedule requirements for project rollouts.

Automotive

Automotive interiors and seat covers are a core application for leathaire fabric, especially for commercial fleets and ride-share operators across Africa, South America, and the Middle East. Its resistance to abrasion, fading, and frequent cleaning cycles, along with a refined aesthetic, make leathaire a competitive alternative to traditional leather—especially in markets sensitive to cost and climate. Key requirements include UV stability, heat and cold resistance, and certification that meets international automotive standards (such as ISO/TS 16949 compliance). Buyers should perform accelerated wear and sunlight testing to ensure suitability for local market conditions.

Marine & Outdoor

Marine and outdoor industries benefit from leathaire fabric’s waterproof, mildew-resistant, and UV-stable properties. Typical uses include boat upholstery, sun loungers, and garden furniture. For international buyers in coastal and tropical environments—such as those in the Caribbean, Mediterranean, or Gulf regions—choosing leathaire ensures fewer replacements due to cracking or fading, cutting operational costs. It’s critical to request anti-microbial and anti-mildew treatments, validate the product’s performance in saline and high-UV environments, and secure supplier guarantees to cover extended outdoor exposure.

Office & Commercial Spaces

Leathaire fabric is increasingly used in modern office environments for seating, collaborative spaces, and paneling. It supports a clean, contemporary finish while offering hypoallergenic and low-maintenance advantages, appealing to businesses focused on employee well-being and operational efficiency. Large-scale projects in city centers (like those in Europe and the Middle East) require suppliers with consistent quality, substantial inventory, and documentation of sustainability practices. B2B buyers should specify bulk purchasing capacity, finish consistency, and ask for references from previous commercial projects.

Healthcare

In the healthcare sector, leathaire fabric is suited for waiting rooms, patient seating, and treatment area furniture due to its antimicrobial options, ease of cleaning, and durability under constant use. This is particularly valuable for health facilities in regions with strict hygiene protocols or challenges with infection control. Buyers should demand proof of medical-grade certifications, lab-tested resistance to harsh disinfectants, and evidence of hypoallergenic properties. Suppliers should offer sample testing and provide documentation verifying compliance with local and international healthcare material standards.

Related Video: Uses of Metals and Non Metals

Strategic Material Selection Guide for leathaire fabric

Overview: Critical Materials in Leathaire Fabric Production

International B2B buyers must weigh a variety of material options when sourcing leathaire fabric—a synthetic textile engineered to emulate the look and feel of genuine leather. Each core material involved in leathaire production impacts performance characteristics, compliance requirements, pricing, and supply chain reliability. Below, the most common substrate and topcoat materials are analyzed with a focus on actionable B2B insights for buyers in Africa, South America, the Middle East, and Europe.

1. Polyester Microfiber Base

Key Properties:

Polyester microfibers serve as the foundational substrate for most leathaire fabrics. They offer high tensile strength, flexibility, and resistance to tearing. Their hydrophobic nature imparts good moisture resistance, while the dense fiber weaving creates a plush, leather-like texture. Polyester’s working temperature range is suitable for both temperate and semi-arid climates, making it appropriate for upholstery and automotive interiors.

Pros:

– Highly durable and abrasion-resistant

– Cost-effective for bulk production

– Consistent quality from batch to batch

Cons:

– Moderate UV resistance—can fade over extended outdoor use

– Not inherently breathable, may trap heat in high-temperature environments

Application Impact:

Ideal for contract furniture, automotive seats, and hotel interiors where cost, durability, and aesthetic consistency are key. Stands up well to frequent use and moderate cleaning agents.

International Considerations:

Polyester leathaire substrates are widely accepted in global markets, with compliance to REACH (EU) and OEKO-TEX standards commonly available. African and Middle Eastern buyers should confirm UV-resistance specs if outdoor or sun-exposed use is expected.

2. Polyurethane (PU) Coating

Key Properties:

The surface feel, luster, and water resistance of leathaire is often achieved with a polyurethane (PU) topcoat. PU coatings can be engineered for varying softness, gloss, and performance, allowing customization for specific end uses.

Pros:

– Excellent stain resistance and cleanability

– Can be formulated to pass flammability and non-toxicity standards (e.g., REACH, ASTM E1354)

– High flexibility, resists cracking even with repeated bending

Cons:

– Susceptible to hydrolysis in high-humidity or poorly ventilated environments (risk of peeling)

– Higher-quality PU comes at a medium to high cost

Application Impact:

Best suited for applications requiring regular sanitation (e.g., healthcare seating) or where close imitation of real leather’s surface is needed.

International Considerations:

PU quality varies widely—insist on supplier documentation of passing regional fire and chemical standards (ASTM in the Americas, EN71/REACH in Europe). Middle Eastern and African buyers must specifically check for UV and hydrolysis-resistant grades due to climate extremes.

3. Polyvinyl Chloride (PVC) Coating

Key Properties:

Some leathaire fabrics use PVC as an alternative topcoat due to its lower raw material cost and strong resistance to stains, water, and mild chemicals.

Pros:

– Water and mildew-resistant, easy to clean

– Lower cost than premium PU variants

– High abrasion resistance

Cons:

– Environmental and health concerns regarding plasticizers (phthalates); not compliant with all international standards

– Rigid feel, can crack in cold climates or after prolonged flexing

– Limited breathability, which may cause discomfort in hot/humid regions

Application Impact:

Suitable for budget-driven projects where environmental compliance is less strict and the aesthetic approximation of leather is acceptable, not premium.

International Considerations:

PVC leathaire may be restricted under EU REACH and some other regional directives due to phthalate content. Buyers in Europe and progressive African markets must confirm with suppliers regarding compliance. Also, not recommended where user comfort (breathability) is a top priority.

4. Polyester/Cotton (Poly-cotton) Blend Substrate

Key Properties:

A blend of polyester and cotton yarn yields a leathaire base that is more breathable and softer to the touch compared to 100% synthetic foundations.

Pros:

– Improved moisture wicking and comfort

– Enhanced dyeability for broader color options

– Retains sufficient strength when blended at 60% polyester / 40% cotton or similar ratios

Cons:

– Cost marginally higher than pure polyester base

– Prone to shrinkage and wrinkling if not stabilized or correctly finished

Application Impact:

Preferred for applications demanding enhanced user comfort—such as residential furniture in hot climates or for brands targeting a “premium touch” positioning. Slightly reduced durability compared to full-polyester substrates.

International Considerations:

Commonly meets US, EU, and global textile standards (e.g., OEKO-TEX 100). Buyers from Nigeria, Saudi Arabia, and similar climates benefit from extra breathability. Request certifications for fabric stabilization and colorfastness from suppliers.

Materials Summary Table

| Material | Typical Use Case for leathaire fabric | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyester Microfiber Base | Contract/commercial seating, automotive interiors | High durability, cost-effective | Limited breathability, moderate UV resistance | Low |

| Polyurethane (PU) Coating | Premium upholstery, healthcare, hospitality | Excellent stain resistance, aesthetics | Prone to hydrolysis; cost varies by quality | Medium |

| Polyvinyl Chloride (PVC) Coating | Budget commercial, utility furniture | Low cost, strong waterproofing | Poor environmental profile, rigid feel, regulatory limitations | Low |

| Poly-cotton Blend Substrate | High-comfort home furniture, hot-climate applications | Enhanced comfort and breathability | Slightly higher cost, possible shrinkage | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for leathaire fabric

Key Stages of Leathaire Fabric Manufacturing

Leathaire fabric, also known as “air leather” or “leather-look microfibre,” is a synthetic upholstery fabric prized for its leather-like appearance, breathability, and cost-effectiveness. For B2B buyers, understanding its manufacturing process is crucial for assessing quality, negotiating with suppliers, and specifying requirements suitable for diverse markets across Africa, South America, the Middle East, and Europe.

1. Material Preparation

The base material for leathaire is typically a blend of high-tenacity polyester microfibers. These microfibers are engineered for durability, flexibility, and moisture resistance. The initial stage involves:

- Fiber selection and blending: Quality polyester fibers are mixed to achieve a precise denier, strength, and hand feel.

- Pre-treatment: Fibers may be treated with anti-static, anti-pilling, or flame-retardant agents, depending on end-use and regional regulatory requirements.

2. Forming (Weaving or Knitting and Surface Bonding)

Leathaire is generally produced by weaving or knitting the microfibers into a textile substrate. The construction method (woven for structured, knit for stretch) impacts the feel and drape.

- Fabric formation: Precision looms or knitting machines control density and uniformity, which are critical for downstream finishing.

- Polyurethane (PU) coating: The woven/knitted base is bonded with a breathable PU layer. This PU film provides the characteristic leather-like texture and improves water resistance.

- Embossing/Texturing: State-of-the-art rollers or digital printing systems emboss the fabric with natural leather grain patterns. The depth and realism of this embossing define the “premium” look of leathaire.

3. Assembly and Lamination

In some cases, additional layers (such as non-woven backings or foam interlayers) are laminated to the main fabric to enhance strength, dimensional stability, and comfort. This multi-layer assembly is hot-pressed or adhesive-bonded under pressure to ensure a permanent bond.

4. Finishing Processes

The finishing stage brings the fabric to its final specification and often includes:

- Dyeing: Color is applied using techniques compatible with both the microfiber base and PU layer. Solution dyeing is frequently used for colorfastness.

- Chemical treatments: Optional finishes include anti-microbial agents, stain resistance, or UV protection for markets with intense sunlight (especially relevant in Africa and the Middle East).

- Final surface inspection: Visual and mechanical checks to ensure consistency of color, grain, and tactile properties.

Essential Quality Assurance & Certification Practices

For international B2B buyers, robust quality assurance is non-negotiable. Savvy procurement teams must understand how leathaire suppliers structure quality control (QC), as well as which certifications and documentation are vital both for compliance and brand reputation.

Standard QC Checkpoints Across Production:

- Incoming Quality Control (IQC): Incoming polyester fibers and chemicals are inspected for purity, homogeneity, and compliance with regulatory bans (e.g., restricted substances in Europe).

- In-Process Quality Control (IPQC): Critical parameters—such as yarn density, PU coating thickness, and bonding strength—are monitored at various stages. On-the-fly corrective actions prevent defects propagating into finishing.

- Final Quality Control (FQC): Fully finished leathaire rolls undergo random sampling. Inspections focus on color uniformity, tactile consistency, surface flaws, and adherence to buyer specifications.

Key Testing Methods:

- Physical Testing:

- Tensile and tear strength (ISO 13934-1; ASTM D2261): Ensures durability for upholstery and automotive uses.

- Abrasion resistance (Martindale, EN ISO 12947): Critical for furniture and commercial applications.

- Colorfastness to light, rubbing, and washing (ISO 105 series): Particularly vital for regions with intense sunlight or high humidity.

- Chemical Testing:

- Restricted Substances Analysis: Verifies compliance with REACH (Europe), CPSIA (USA), and local standards (e.g., SONCAP in Nigeria, SASO in Saudi Arabia).

- Flammability: Testing as per national and international requirements, especially for contract/hospitality furniture.

- Other Functional Tests:

- Breathability and hydrostatic resistance: To ensure comfort and longevity.

Relevant International and Industry Certifications:

- ISO 9001 (Quality Management Systems): A baseline for supplier reliability and process discipline.

- OEKO-TEX® Standard 100: Demonstrates that harmful substances are below legal limits; increasingly expected by European buyers.

- CE Marking: Required for certain applications in the EU.

- Country-specific certifications:

- SONCAP (Nigeria): Mandatory for imports into Nigeria.

- SASO (Saudi Arabia): Ensures compliance with Saudi standards.

- Buyers in South America may require INMETRO certification for Brazil or equivalent as per local regulations.

How International B2B Buyers Can Verify Supplier Quality

Quality verification isn’t just about requesting test reports. Successful B2B procurement teams employ a range of tactics to minimize risk and ensure ongoing compliance:

1. Supplier Audits and Factory Visits

– Pre-contract audits: Assess process controls, worker training, traceability, and capacity. Many buyers engage third-party audit firms that specialize in textile and synthetic materials.

– On-site inspections: Especially recommended for high-volume orders or strategic markets. Factory visits foster relationships and provide direct visibility into manufacturing and QC practices.

2. Third-Party Quality Inspections

– Contract reputable inspection agencies (e.g., SGS, Intertek, Bureau Veritas) for pre-shipment inspections. Define clear sampling plans and acceptance criteria in purchase contracts.

– Inspections should typically cover both visual (AQL-based) and mechanical/chemical testing, with results documented in an official inspection report.

3. Reviewing Documentation and Traceability

– Request up-to-date ISO/OEKO-TEX® certificates: Check validity and coverage scope.

– Batch test reports: Each shipment should be accompanied by test certificates (for physical and chemical parameters), traceable to relevant production lots.

– Custom requirements: For buyers in the Middle East, Africa, or South America, specify national import documentation and certificates at the quotation stage.

4. Ongoing Performance Monitoring

– Regular feedback loops: Collaborate with suppliers to resolve any issues discovered post-delivery, e.g., premature wear or color fading in local conditions.

– Random sample testing: Particularly for repeat or large-volume contracts, periodically commission independent testing using domestic labs.

Regional Considerations for Quality and Compliance

Africa (e.g., Nigeria):

– Emphasize SONCAP and compliance with local content regulations. Certifications must be verifiable at Nigerian ports. Due diligence on supplier experience with West African logistics is critical.

South America:

– Ensure compatibility with local standard bodies (e.g., ABNT in Brazil), and confirm product labeling meets legal language and traceability requirements.

Middle East (e.g., Saudi Arabia):

– SASO (Saudi Standards, Metrology and Quality Org) compliance is mandatory. Require evidence of adherence to regional flame retardancy and durability standards, especially for commercial/contract furniture.

Europe:

– Focus on sustainable sourcing, REACH chemical compliance, and full traceability. Many European buyers expect suppliers to participate in sustainability audits and to provide eco-label certificates.

Actionable Takeaways for B2B Buyers

- Define product and compliance requirements clearly: List out required certifications, performance parameters, and country-specific import needs before RFQ stage.

- Vet and audit suppliers systematically: Use pre-contract audits and third-party inspections—never rely purely on certificates.

- Maintain open communication channels: Foster collaborative relationships with suppliers to quickly address any post-shipment issues.

- Stay current on evolving regulations: Local standards and certifications change; assign responsibility within your procurement team for monitoring compliance updates in your key markets.

- Leverage sample testing and market-specific pilots: Before full-scale orders, validate leathaire fabric suitability in the target country’s climatic and regulatory context.

This comprehensive approach to manufacturing and quality assurance not only protects your investment but also strengthens your supply chain, helping you deliver consistent value and reliability to your own customers—regardless of the country or industry segment.

Related Video: Garments Full Production Process | Order receive to Ex-Factory | Episode 2

Comprehensive Cost and Pricing Analysis for leathaire fabric Sourcing

Leathaire fabric, often marketed as a cost-effective and versatile alternative to genuine leather, has become a popular choice for international furniture, upholstery, and automotive manufacturers. For B2B buyers aiming to source leathaire at competitive prices, understanding the detailed cost composition and major price influencers is crucial for effective procurement and sustainable margin management.

Key Cost Components in Leathaire Fabric Sourcing

Each stage in the leathaire supply chain adds a specific cost element. B2B buyers should account for the following:

- Raw Materials: The core materials include a polyester or microfiber base with specialized surface treatments and finishing. Fluctuations in polymer and chemical prices, as well as the origin of the raw fibers, directly influence this component.

- Labor: Labor costs are dependent on manufacturing location and factory specialization. Factories with automated processes may offer lower labor costs but may require higher MOQs.

- Manufacturing Overhead: Energy, facility costs, equipment depreciation, and waste management all contribute. Advanced facilities investing in sustainability or quality certifications may command slightly higher overheads.

- Tooling & Setup: For customized textures, embossing, or colorways, initial tooling/setup charges may apply. These are often amortized over large orders.

- Quality Control: Costs related to in-line and post-production QC, testing for compliance (e.g., REACH, OEKO-TEX), and rejection management, are higher with stricter buyer requirements.

- Logistics: Shipping, insurance, port charges, and inland transportation must be factored in. For buyers from Africa or South America, where container routes may be more complex, logistics can constitute a significant share of total sourcing cost.

- Supplier Margin: Final pricing reflects the supplier’s structural costs as well as targeted profit margins, which may vary by region, buyer profile, and partnership longevity.

Major Price Influencers

- Order Volume & MOQs: Leathaire suppliers often distinguish between sample yardage (higher price per meter) and bulk orders. Larger volumes unlock tiered discounts and better negotiation leverage.

- Specifications & Customization: Requests for unique colors, surface grains, fire-retardancy, or eco-friendly components impact both material and tooling costs.

- Material Quality & Certification: Premium grades with higher abrasion resistance or internationally recognized certifications command higher prices but may be necessary for certain markets (e.g., Europe, Middle East).

- Supplier scale and capability: Well-established partners may offer stability but less aggressive discounts. Newer or smaller mills might offer competitive pricing to win business, potentially with higher risk.

- Incoterms and Destination: FOB, CFR, CIF, or DDP terms significantly affect landed costs. Buyers from developing logistics hubs (e.g., Nigeria, Brazil) should carefully factor in local clearance fees, duties, and inland transport.

Strategies for International B2B Buyers

- Detailed RFQs and Clear Specifications: Articulate all technical and compliance needs upfront to avoid costly miscommunication and order revisions.

- Volume Consolidation: Aggregate orders across subsidiaries or clients to reach higher discount thresholds. Explore digital procurement platforms for collaborative buying.

- Supplier Relationships & Due Diligence: Evaluate supplier financial health, audit track record, and production capacity. Prioritize long-term partnerships for better service and cost transparency.

- Negotiation Leverage: Benchmark with multiple suppliers across geographies. Leverage offers, stress-test capacity to meet peak demand, and negotiate rebates or price locks for repeat orders.

- Total Cost of Ownership (TCO): Consider not only the fabric price but also QC failures, shipping lead times, potential duties, and after-sales service. Sometimes a slightly higher unit price can yield lower ultimate TCO.

- Payment Structure & Risk Mitigation: For Africa and South America, pay attention to currency risks and pre-shipment inspection. Consider trade finance solutions or credit insurance to mitigate exposure.

Indicative Price Disclaimer: Leathaire pricing is highly sensitive to global raw material trends, logistics disruptions, and local regulatory shifts. All price examples or cost breakdowns are for reference only; B2B buyers should request updated quotations and model landed costs for their specific region and Incoterm.

In summary, successful leathaire sourcing requires a holistic approach: understanding granular cost drivers, tailoring procurement tactics to regional nuances, and building data-driven supplier relationships. With competitive benchmarks and robust RFQs, buyers across Africa, the Middle East, South America, and Europe can proactively secure value-driven supply chains and resilient cost structures.

Spotlight on Potential leathaire fabric Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘leathaire fabric’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 Popular Leather Fabric Manufacturers (www.printingsfabric.com)

With an established reputation in the leather and specialty textiles sector, 10 Popular Leather Fabric Manufacturers showcases a diverse portfolio that includes leathaire fabric—valued for its combination of luxury aesthetics, durability, and adaptability. The manufacturer offers a wide spectrum of colors and natural textures, making its products well-suited for both fashion designers and manufacturers of bags, jackets, and upholstery. Their leathaire fabrics are engineered for longevity, with a focus on maintaining visual appeal over years of use—an attractive feature for B2B buyers seeking quality and return on investment.

The company has a notable presence in international markets, appealing to buyers in Africa, South America, the Middle East, and Europe. While detailed certifications or quality standards are not broadly publicized, their longstanding industry profile and popularity among global clients underscore their reliability and market adaptability. This manufacturer is particularly well-suited for partners seeking versatile, fashionable leathaire fabrics with proven endurance and global sourcing experience.

12 Global Leaders in Fabric Production (knowingfabric.com)

With strategic partnerships across top global textile manufacturers and suppliers, this alliance of 12 leading companies offers robust capabilities in high-quality fabric production, including leathaire fabric. Collectively, they leverage cutting-edge technologies and innovative material science to serve both established and emerging markets. Their production networks are optimized for scalability and agility, matching the sourcing needs of international B2B buyers. These companies demonstrate a commitment to sustainability, often aligning with ethical and environmental standards esteemed by global brands—an important consideration for buyers targeting eco-conscious consumers. Moreover, their extensive distribution reach and experience make them well-positioned to reliably supply buyers from Africa, South America, the Middle East, and Europe, ensuring consistent quality, compliance with international norms, and efficient logistics.

The best Fabric Manufacturer companies in the world {2025} (asianbusinessside.com)

Polartec, featured among the world’s leading fabric manufacturers in 2025, is renowned for its advanced textile engineering and consistent innovation in high-performance fabrics. While their expertise began with synthetic wool and technical textiles, Polartec has extended its manufacturing capabilities to specialty segments such as leathaire fabric—an increasingly popular choice for upholstery, fashion, and automotive interiors due to its durability and modern aesthetics. Their operations demonstrate robust quality assurance, and the company is recognized for working with ISO-certified processes to ensure product consistency and global compliance.

With headquarters in the USA and a proven international footprint, Polartec is well-equipped to serve B2B buyers across Africa, South America, the Middle East, and Europe. The company offers scalable production, custom development options, and reliable logistics solutions. Their track record of supplying both mainstream and specialized markets positions them as a strategic partner for buyers seeking leathaire fabric that meets strict performance and sustainability standards.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 Popular Leather Fabric Manufacturers | Versatile leathaire fabric, strong global market reach | www.printingsfabric.com |

| 12 Global Leaders in Fabric Production | Global network, innovation, ethical sourcing, broad reach | knowingfabric.com |

| The best Fabric Manufacturer companies in the world {2025} | Innovation leader with global leathaire supply | asianbusinessside.com |

Essential Technical Properties and Trade Terminology for leathaire fabric

Key Technical Specifications for Leathaire Fabric

When sourcing leathaire fabric for furniture, automotive interiors, or fashion applications, understanding the critical technical specifications is essential for quality control, cost management, and ensuring product consistency across markets. Below are the main technical properties B2B buyers must consider:

-

Material Composition (Polyester/Polyurethane Blend)

Leathaire is a high-performance synthetic fabric, typically comprising a woven polyester base with a polyurethane (PU) surface coating. The proportion and quality of these layers directly impact durability, tactile feel, and resilience. For B2B buyers, specifying the desired composition ensures suppliers deliver material that meets the expected standards for softness, aging resistance, and ease of cleaning—key factors in high-wear sectors such as upholstery and automotive. -

Grammage or Fabric Weight (GSM)

The weight of the fabric, measured in grams per square meter (GSM), indicates its thickness, sturdiness, and suitability for various applications. Higher GSM values often translate to increased durability and a more luxurious hand feel, which are crucial in premium furniture or heavy-use commercial settings. Clarifying your minimum weight requirements during procurement helps prevent shortfalls in product performance or longevity. -

Abrasion Resistance

Abrasion resistance is typically assessed using Martindale or Wyzenbeek testing protocols and reflects how well the fabric withstands surface wear. Leathaire with high abrasion scores is better suited for high-traffic environments, such as hotels, offices, or public transportation. Buyers should request certification of abrasion test results matching their intended usage class, as this directly correlates with warranty terms and customer satisfaction. -

Color Fastness

This measures the fabric’s ability to retain color when exposed to light, rubbing, or cleaning agents. For export or projects in sun-exposed regions (e.g., Middle East, Africa), high color fastness ratings prevent fading and maintain aesthetic quality over time—reducing post-sale complaints or returns. -

Tear and Tensile Strength

Tear strength and tensile strength denote how much force the fabric can withstand before ripping or breaking. These metrics, often specified in newtons (N) or pounds (lbs), are especially important in applications involving seams and tight upholstery work. Establishing minimum strength thresholds mitigates risk of failure during installation or use. -

Surface Treatments & Special Finishes

Leathaire can be finished with treatments such as anti-microbial coatings, water repellency, or flame retardancy, tailored for specific market regulations and customer needs. Buyers in regulated sectors (e.g., hospitality, healthcare, transport) should confirm compliance and request relevant certifications from suppliers.

Critical Industry and Trade Terminology

Engaging effectively in international leathaire fabric procurement requires familiarity with key industry and trade terms. Here are some of the most important concepts to ensure smooth negotiation and execution:

-

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell, often specified in meters or rolls. Understanding MOQ helps buyers plan inventory, optimize logistics costs, and evaluate supplier suitability—especially critical for smaller operations or custom runs. -

OEM (Original Equipment Manufacturer)

Refers to suppliers who manufacture products or components to another company’s specifications, often under private label. Selecting an OEM-capable partner is advantageous for buyers seeking customized designs, exclusive finishes, or branded packaging. -

RFQ (Request for Quotation)

A formal document sent to suppliers to obtain detailed pricing and lead time information for a specified fabric grade and quantity. Crafting precise RFQs (including technical specs and quality standards) leads to more accurate offers and fewer misunderstandings later in the sourcing process. -

Incoterms (International Commercial Terms)

A set of standardized terms (e.g., FOB, CIF, DAP) dictating the responsibilities of buyers and sellers for shipping, insurance, customs, and delivery. Mastery of Incoterms is vital for controlling landed costs, managing risk, and avoiding hidden expenses in cross-border leathaire trades. -

Lead Time

The period between placing an order and receiving goods. Clarifying expected lead times with potential suppliers, and documenting them in contracts, enables better project planning and helps anticipate delays in complex supply chains. -

Continuity

Refers to a supplier’s ability to consistently provide the same fabric specification, color, and finish over time. For B2B buyers whose business depends on product uniformity (seasonal collections, long-term contracts), confirming continuity prevents supply disruptions and ensures brand consistency.

Understanding these technical specifications and trade terms empowers international B2B buyers to evaluate suppliers, negotiate more effectively, and mitigate risks—ultimately resulting in higher quality products and smoother cross-border transactions involving leathaire fabric.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the leathaire fabric Sector

Global Market Overview and Sourcing Trends

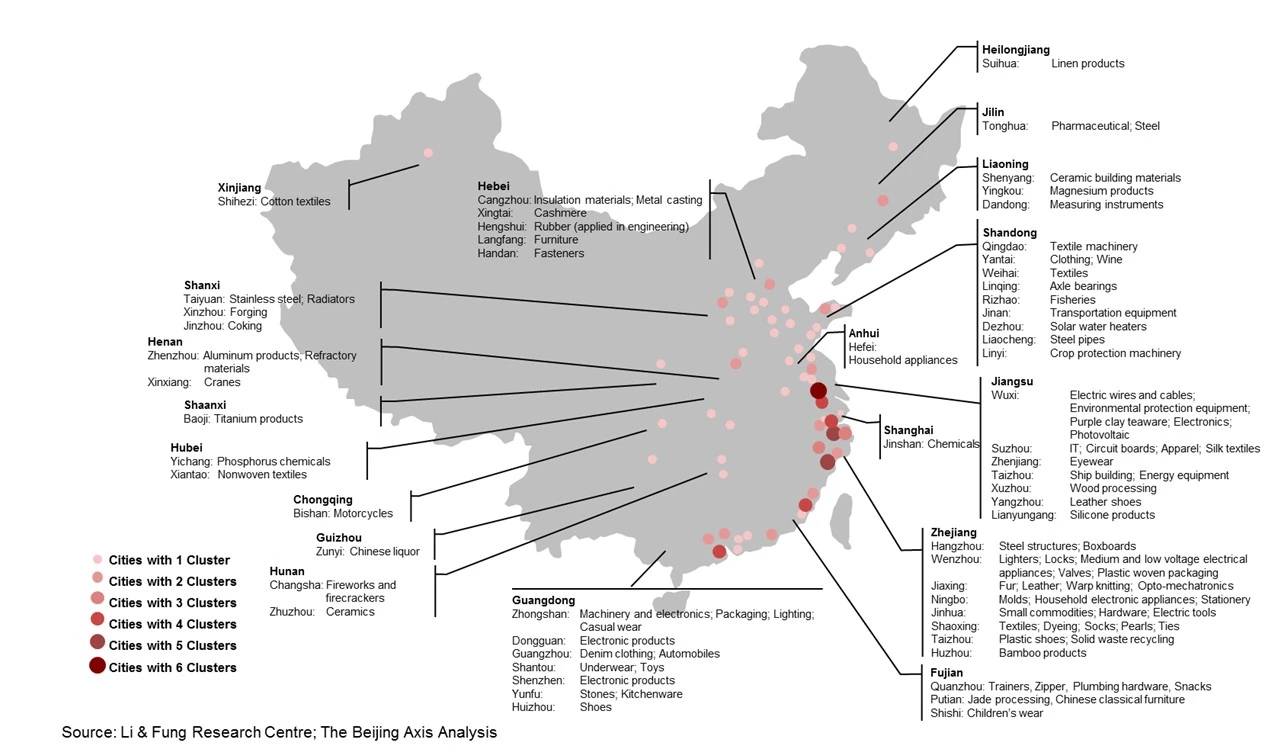

Leathaire fabric—also known as “air leather”—has rapidly gained traction as an affordable, versatile, and animal-free alternative to genuine leather. Its water-repellent, breathable, and abrasion-resistant properties have made it a favorite among furniture, automotive, and fashion manufacturers worldwide. Global demand for leathaire is being driven by shifting consumer preferences, the cost advantages of synthetic leathers, and sustainability pressures. For international B2B buyers—particularly across Africa, South America, the Middle East, and Europe—the global supply market is diverse, but also fragmented, with Asia (especially China) as the dominant manufacturing hub.

Key Market Drivers:

- Affordability and Scalability: Leathaire’s competitive price point and reliable scalability make it attractive for mass-market products targeting urbanizing regions in Nigeria, Brazil, and Saudi Arabia, where demand for contemporary, durable furnishings is rising.

- Technological Innovation: Advances in nonwoven microfiber technologies and digital printing have enabled greater design versatility, improved tactile qualities, and the ability to mimic the nuanced look of real leather.

- Dynamic Supply Chains: As global economics fluctuate and logistics costs remain volatile, buyers are increasingly seeking robust supplier networks with flexible lead times, dual sourcing strategies, and clear communication on stock continuity and shipment transparency.

- E-Procurement and Digital Platforms: Migration to e-procurement systems, sourcing marketplaces, and B2B digital showrooms has become vital for global discovery, supplier verification, and agile ordering—with added transparency on certifications, MOQ flexibility, and real-time inventory.

Emerging Sourcing Strategies:

- Supplier Diversification: In response to geopolitical risks and shipping challenges, multinational buyers are broadening their supplier base, including greater exploration of Turkey and Eastern Europe for proximity to European and Middle Eastern markets.

- MOQ Management: Many suppliers now offer low minimums for sample yardage, enabling prototyping and market testing before large-scale production—a critical advantage for both established brands and SME buyers.

- Customization & Value-Added Services: From color-matching to anti-microbial treatments, value-added customization is differentiating supplier offerings. For B2B buyers, clear articulation of product requirements—such as end-use, performance standards, and after-care needs—is essential for optimized sourcing.

Sustainability and Ethical Sourcing Imperatives

Sustainability has evolved from a market differentiator to a baseline requirement in the synthetics sector, with leathaire fabric at the crossroads of this shift. Traditional PU-based synthetics have attracted scrutiny for their petrochemical origins and end-of-life disposal challenges. However, leading manufacturers now emphasize cleaner production, responsible chemical management, and increasingly, the integration of recycled and bio-based materials.

Key Sustainability Considerations for B2B Buyers:

- Green Certifications and Standards: Certifications such as OEKO-TEX® Standard 100, Global Recycled Standard (GRS), and ISO 14001 signal compliance with health and environmental best practices. For international buyers, especially those supplying regulated markets in Europe or eco-conscious audiences in the Middle East, requesting proof of such standards reduces reputational and compliance risk.

- Supply Chain Transparency: Ethical supply chain management—rooted in traceability, responsible labor practices, and regular third-party audits—is critical for mitigating ESG (Environmental, Social, Governance) risks. B2B buyers should require updated documentation (e.g., Code of Conduct adherence, chemical use disclosures, and restricted substance lists) as part of supplier onboarding and ongoing contracts.

- Innovation in Materials: The sector is gradually adopting bio-based PU coatings, water-based adhesives, and recycled microfibers. African and South American brands catering to eco-aware consumers can leverage these advancements for product differentiation. However, it remains vital to validate actual composition and post-consumer claims.

Regional Market Insight: In regions like Saudi Arabia and Nigeria, where sustainability mandates vary, aligning with international standards can support export goals and future-proof supply chains as local regulations evolve.

Evolution and Relevance of Leathaire Fabric

Leathaire fabric emerged in the early 2000s amid rising consumer demand for vegan, low-maintenance, and cost-effective alternatives to animal leather. Its development capitalized on microfiber technology—combining polyester and polyurethane to mimic the aesthetic and tactile qualities of genuine leather while avoiding ethical concerns tied to animal products. Over the past decade, global supply chains have matured, and significant investments in R&D have led to enhancements in durability, comfort, and eco-friendliness. Today, leathaire stands at the intersection of advanced material science and conscious consumption, offering B2B buyers a practical path to innovation and market responsiveness.

Actionable Recommendations for B2B Buyers:

– Prioritize suppliers offering verifiable sustainability credentials and transparent sourcing practices.

– Clearly define product specifications, performance expectations, and MOQ needs before initiating RFQs.

– Leverage digital sourcing platforms and request physical samples to validate quality before bulk orders.

– Monitor regional trends and regulatory changes to anticipate future requirements and market opportunities.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of leathaire fabric

-

How can I effectively vet leathaire fabric suppliers for reliability and compliance?

Thorough supplier vetting is crucial. Begin by requesting documentation on company registration, export licenses, and recent client references. Evaluate their production capabilities through factory audits or third-party verification, either remotely or onsite. Insist on viewing recent QA inspection reports and evidence of compliance with applicable international standards (such as ISO, OEKO-TEX, or REACH). For African, Middle Eastern, and South American buyers, prioritize suppliers with established shipping records to your market. Use trade assurance tools or verified sourcing platforms to minimize risks associated with new partnerships. -

Is bespoke customization of leathaire fabric (color, finish, backing) feasible for international B2B orders?

Most reputable leathaire manufacturers offer customization in aspects such as color, backing materials, surface finish, and pattern. Ensure that your supplier is equipped for sample development and can provide lab dips or swatches for approval before bulk production. Share detailed technical requirements—specifying weight (GSM), treatments (e.g., anti-microbial, flame retardant), and intended end-use. Confirm that the supplier can match your customization requests to required industry standards and test results, especially if importing into regions with unique product regulations such as the European Union or the Gulf Cooperation Council (GCC). -

What are typical minimum order quantities (MOQs) and lead times for leathaire fabric, and how can buyers negotiate these?

MOQs for leathaire fabric often range from 300 to 1,000 meters per color or style for custom runs, though in-stock goods may be available in lower quantities. Lead times can vary: standard orders take about 3-6 weeks, while highly customized runs can require 8-12 weeks, including sampling. African and South American buyers with developing textile ecosystems should clearly communicate volume requirements early. Negotiation is possible, especially if you offer ongoing or high-volume business. When negotiating, factor in supplier production schedules and upcoming holidays (such as Chinese New Year, Ramadan, or local events) that might impact timelines. -

Which quality assurance and certification standards should leathaire fabric suppliers provide?

Request QA documentation verifying product consistency and performance, such as ISO 9001 (quality management), OEKO-TEX Standard 100 (chemical safety), and, where relevant, REACH compliance for EU-bound shipments. Ask for recent batch test reports on colorfastness, abrasion resistance, tensile strength, and breathability. Quality checks should include both pre-shipment inspections and in-production monitoring. Specify your target market’s regulatory requirements—such as EAC for Russia/Eurasia, SASO for Saudi Arabia, or SONCAP for Nigeria—to ensure your supplier can deliver the right documentation for smooth customs clearance. -

What payment terms and methods are standard for international leathaire fabric transactions?

Typical terms include 30% advance payment with the balance on bill of lading copy, or irrevocable letters of credit (L/C) for greater security. Payment methods range from wire transfer (T/T) to L/C or trusted online trade assurance services. For buyers in Europe and the Middle East, L/Cs are often preferred for larger orders. Always verify bank details independently to avoid fraud. For new suppliers, consider third-party escrow services or staggered payments aligned with production milestones. Ensure all terms—including penalties for late delivery or non-conformance—are clearly detailed in the purchase contract. -

How can I ensure efficient logistics and avoid common shipping pitfalls for leathaire fabric imports?

Clarify the Incoterms used (e.g., FOB, CIF, DAP) to determine responsibility during transit. Engage reputable freight forwarders experienced in your destination market’s import procedures and textile regulations. For African and South American countries, pay close attention to required customs documentation, labeling, and pre-shipment inspection certificates. Ensure pallets or rolls are packed and labeled per destination customs requirements to avoid clearance delays. Consider insurance for high-value shipments to mitigate the risk of damage or loss during transit. -

What steps should I take if disputes arise regarding quality, delivery delays, or contract performance?

Clearly document all specifications, quality criteria, delivery deadlines, and penalties in the sales contract before production begins. If issues emerge, communicate in writing and provide photographic or video evidence. Initiate resolution per the contract—starting with supplier dialogue, then moving to third-party arbitration or mediation if needed. Utilize trade assurance services or export insurance where possible. Buyers operating in regions with less developed legal redress mechanisms may benefit from specifying neutral arbitration locations (such as Singapore or London) in contract terms. -

Are there region-specific considerations B2B buyers from Africa, South America, the Middle East, or Europe should keep in mind when sourcing leathaire fabric?

Yes, consider local regulatory requirements such as SASO certification for the Middle East, ECOWAS standards for West Africa, or CE compliance for the EU. Also, factor in transit times and potential port congestion, which can be significant in some African and South American hubs. Buyers should stay informed on currency fluctuations, import tariffs, and evolving trade agreements affecting textiles. Cultivate long-term supplier relationships by visiting factories when possible, or by leveraging local agents for quality inspections and communications—helping to bridge cultural and language gaps for smoother collaboration.

Strategic Sourcing Conclusion and Outlook for leathaire fabric

As global demand for innovative upholstery solutions grows, leathaire fabric stands out as a versatile, cost-effective, and stylish alternative to traditional materials. For B2B buyers in emerging and established markets—including Africa, South America, the Middle East, and Europe—success in sourcing leathaire hinges on a strategic approach rooted in thorough market research, precise quality criteria, and effective supplier partnerships.

Key Takeaways for International Buyers

- Clearly Define Requirements: Specify end-use applications, durability standards, and any performance certifications needed; this streamlines supplier selection and ensures product suitability.

- Prioritize Supplier Evaluation: Assess suppliers not only on price, but also on reliability, production capacity, compliance with safety and sustainability standards, and their track record in export logistics.

- Leverage Sample Testing: Always request samples for functional testing and quality verification. Utilize prototypes to gauge colorfastness, texture, and real-world performance relevant to regional climates and customer expectations.

- Negotiate Favorable Terms: Focus negotiations on minimum order quantities (MOQs), delivery timelines, after-sales support, and payment terms that protect your business amid global supply chain fluctuations.

Looking Ahead

Strategic sourcing of leathaire fabric offers a pathway to competitive advantage and growth. By embracing systematic sourcing methodologies, nurturing supplier relationships, and maintaining agility in response to evolving market dynamics, B2B buyers across continents can secure dependable supply chains and deliver differentiated products. Now is the time to evaluate your leathaire sourcing strategy, strengthen your procurement team’s expertise, and forge partnerships that will future-proof your business in the global marketplace.