Introduction: Navigating the Global Market for 3mm edge banding

In an era where efficiency, durability, and aesthetics drive furniture and interior product choices, the role of 3mm edge banding cannot be overstated. As global markets expand and consumer expectations rise, B2B buyers face intensified pressure to deliver finished products that combine visual appeal with long-term performance. This is especially true for buyers operating in diverse markets across Africa, South America, the Middle East, and Europe, where climatic conditions, design preferences, and cost structures vary significantly.

3mm edge banding stands out as a vital component within modern woodworking and furniture manufacturing. Its primary function—sealing and finishing the exposed edges of panels such as MDF, particleboard, and plywood—helps manufacturers enhance not only the durability and resilience of their products but also their market value and competitiveness. The correct choice of edge banding directly influences end-product quality, customer satisfaction, and operational efficiency.

This guide offers a comprehensive, actionable overview to empower international B2B buyers with the insights and tools needed to make informed purchasing decisions. Key areas covered include:

- Types and materials: Understand the properties and applications of PVC, ABS, veneer, and melamine edge banding.

- Manufacturing and quality control: Gain clarity on production standards, application techniques, and QC protocols to ensure consistency and durability.

- Supplier selection: Learn to identify and evaluate reputable global suppliers, with a focus on cost competitiveness and reliability.

- Cost structures and market trends: Navigate fluctuating prices and emerging trends affecting procurement and inventory planning.

- Practical FAQs: Access expert answers to pressing buyer questions.

By leveraging this in-depth resource, international buyers can confidently source 3mm edge banding that meets both technical and commercial requirements—tailoring sourcing strategies to regional realities and elevating their competitive position in the global supply chain.

Understanding 3mm edge banding Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| PVC Edge Banding | Durable thermoplastic; wide color/pattern range; flexible | Modular furniture, office & institutional furniture | Highly versatile and cost-effective; may yellow over time |

| ABS Edge Banding | Eco-friendly thermoplastic; high impact resistance, recyclable | Commercial interiors, retail fixtures | Sustainable credentials, flexible; less heat resistance than PVC |

| Veneer Edge Banding | Real wood surface; stainable and sandable | High-end cabinetry, luxury furnishings | Premium, authentic appearance; higher cost and less impact resistance |

| Melamine Edge Banding | Resin-impregnated paper; moisture-resistant, multicolor patterns | Kitchens, bathrooms, storage units | Prevents moisture intrusion, low price; can chip on heavy impact |

| Acrylic Edge Banding | High-gloss, UV-resistant; vibrant colors and 3D depth | Modern design cabinetry, retail displays | Striking visual effect, durable; higher price, specialist application |

PVC Edge Banding

PVC edge banding is a leading choice for 3mm applications due to its broad adaptability and robust performance. It is favored in large-scale furniture production because of its vast palette of colors, woodgrain patterns, and textures, making it easy to achieve design consistency. PVC resists moisture, impact, and many chemicals, which is essential for high-traffic or multipurpose environments. B2B buyers should evaluate long-term durability versus aesthetic requirements, and consider storage conditions to prevent yellowing, especially in regions with intense sunlight.

ABS Edge Banding

ABS edge banding closely mirrors the properties of PVC but is prized for its environmentally responsible manufacturing—it’s non-chlorinated, recyclable, and low-emission. This makes it attractive for buyers with sustainability mandates, including projects in Europe and the Middle East with green building demands. It delivers excellent flexibility and high impact resistance, supporting complex shapes in commercial interiors. However, ABS offers slightly lower resistance to heat, so careful consideration is needed for applications near heat sources or in demanding climates.

Veneer Edge Banding

Veneer edge banding is crafted from thin slices of real wood, offering an unmatched, premium look that’s highly valued in luxury furniture and bespoke cabinetry. It can be stained and sanded to match or contrast parent panels, suiting markets where natural aesthetics drive purchasing decisions. For B2B buyers, veneer provides differentiation and upmarket value, but it requires skilled installation and is more susceptible to damage from moisture and impact, potentially increasing lifecycle maintenance costs.

Melamine Edge Banding

Melamine edge banding, composed of resin-soaked paper, serves as an economical choice for environments exposed to moisture, such as kitchens, bathrooms, and storage areas. Its availability in a wide variety of solid colors and patterns supports efficient alignment with popular panel laminates. Buyers operating in segments sensitive to cost and function—such as contract furniture or mass-produced units—will appreciate its practicality, but should assess the risk of chipping under high impact, which can be a factor in import/export logistics or less-controlled environments.

Acrylic Edge Banding

Acrylic edge banding stands out for its high-gloss finish, UV-resistance, and 3D depth effect, aligning with contemporary design trends in modern fit-outs and retail displays. This variant is targeted at clients seeking to make bold design statements or requiring resistance to color fading under constant lighting. For B2B buyers—especially those serving the premium retail or hospitality sectors—the enhanced aesthetics can provide significant competitive differentiation. However, it comes at a higher cost and often necessitates specialized application equipment and processes, which should be factored into overall project planning and supplier capability assessments.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of 3mm edge banding

| Industry/Sector | Specific Application of 3mm edge banding | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Furniture Manufacturing | Edging of commercial office desks and cabinets | Enhances durability, professional finish, safety | Color/texture match, adhesive compatibility, compliance |

| Modular Kitchens | Sealing cabinet edges and countertops | Moisture resistance, modern aesthetics, longevity | Resistance to heat/humidity, color range, hygienic certifications |

| Contract Interiors | Finishing edges in hotels, schools, hospitals | Improved impact resistance, compliance, clean look | Fire rating, antibacterial options, bulk supply capacity |

| Retail Fit-Outs | Display unit and shelving edge protection | Scratch resistance, visual appeal, branding alignment | UV stability, quick turnaround, surface finish variety |

| Caravan & Marine | Securing edges in mobile environments | Flexibility, vibration resistance, lightweight finish | Flexural strength, weather resistance, lightweight specs |

Furniture Manufacturing

In the commercial and office furniture sector, 3mm edge banding is extensively used to finish exposed edges on desks, workstations, and storage units made from particleboard or MDF panels. This thickness provides robust edge protection against routine impact and wear, an essential feature in high-traffic office environments. For buyers in regions such as Africa and the Middle East, where durability and cost efficiency are paramount, sourcing edge banding with consistent color, optimal adhesive compatibility, and regulatory compliance ensures a professional appearance and longevity of products.

Modular Kitchens

3mm edge banding is a preferred choice in the production of modular kitchen cabinets and countertops. Its thickness offers superior resistance to moisture and heat, addressing specific challenges in humid or high-temperature markets like Turkey and Brazil. B2B buyers must verify that the edge banding not only matches the kitchen décor but also complies with hygienic standards and can withstand frequent cleaning and potential liquid exposure. Sourcing edge banding with certified food-safe adhesives and a wide color spectrum adds significant value in modern kitchen design.

Contract Interiors

For contract interior projects such as hotels, educational institutions, and healthcare facilities, 3mm edge banding is vital for both functional and regulatory reasons. It offers a clean, attractive finish while safeguarding surfaces against impact and facilitating compliance with strict safety or health codes. European and global buyers should prioritize edge banding with advanced properties—such as fire-retardant or antibacterial options—and partners capable of delivering bulk orders consistently, essential for large-scale interior contracts.

Retail Fit-Outs

In retail environments, display units and store shelving are subject to constant public interaction. Applying 3mm edge banding protects these edges from chips and scratches, preserving the brand’s image and investment. The ability to source edge banding in various finishes—including gloss, matte, or embossed textures—and ensure UV stability is particularly important for stores with significant daylight exposure, common in South American malls and markets.

Caravan & Marine Sectors

Mobile environments, like caravans and marine vessels, demand edge solutions that are both lightweight and flexible, yet robust enough to withstand constant vibration and movement. Here, 3mm edge banding ensures secure edge sealing without adding unnecessary weight, vital for transport efficiency. Buyers operating in coastal or variable climates, such as in the Mediterranean or South Africa, should seek weatherproof, flexible edge banding that adheres well under temperature swings and saline conditions, ensuring safety and longevity in challenging settings.

Related Video: How To Install And Trim PVC Edge Banding | Beginner’s Guide

Strategic Material Selection Guide for 3mm edge banding

Analysis of Common Materials for 3mm Edge Banding

Selecting the right material for 3mm edge banding is critical for ensuring both the longevity and aesthetic quality of manufactured panels and furniture components. For B2B buyers operating internationally—including regions such as Africa, South America, the Middle East, and across Europe—material choice will not only impact durability and usability but also affect cost, compliance, and downstream processing. Here, we examine four of the most common material options for 3mm edge banding: PVC, ABS, Melamine, and Veneer.

PVC (Polyvinyl Chloride) Edge Banding

Key Properties:

PVC edge banding is well-known for its combination of flexibility, impact resistance, and a wide range of available colors, textures, and sheens. It tolerates moderate temperature and humidity variations, making it suitable for most indoor environments; however, it may yellow over time with exposure to UV light.

Pros:

– Highly durable and resistant to abrasion and impact.

– Excellent chemical and moisture resistance.

– Available in nearly unlimited decorative options.

Cons:

– Can be prone to discoloration (yellowing) under strong UV exposure.

– Not environmentally biodegradable; increasing scrutiny in some European markets.

Impact on Application:

PVC is particularly favored for office furniture, cabinetry, and commercial applications requiring a sturdy and visually consistent edge. For export to the EU or Turkey, check for compliance with REACH and RoHS regulations.

Regional Considerations:

French, Turkish, and wider European markets may increasingly prefer low-emission or “eco” formulations; African and South American buyers often prioritize durability and affordability amid high-usage environments where robust protection is valued.

ABS (Acrylonitrile Butadiene Styrene) Edge Banding

Key Properties:

ABS is a tough, thermoplastic polymer offering similar appearance and processability to PVC but without chlorine, making it more environmentally friendly and easier to recycle. It withstands mechanical stress and moderate chemical exposure well, though it’s less heat-resistant than PVC.

Pros:

– Impact and abrasion-resistant; retains flexibility.

– Contains no halogens (chlorine-free).

– Lightweight and easy to machine.

Cons:

– Slightly more sensitive to high temperatures (may deform at ≤70°C).

– Typically higher upfront cost than PVC.

Impact on Application:

Ideal for projects targeting environmentally conscious consumers or regulations where PVC is restricted. Common in children’s furniture, high-end cabinetry, and applications emphasizing sustainability.

Regional Considerations:

European buyers, especially in France and Germany, increasingly insist on compliance with low-VOC and plasticizer-free requirements (e.g., EN 71-3, DIN EN ISO 4892). The material aligns well with green building standards—a growing Middle Eastern and European trend.

Melamine Edge Banding

Key Properties:

Made from resin-impregnated paper, melamine edge banding excels in moisture resistance and is available in a range of designs and colors to simulate wood grains or solids. It is lightweight but not as impact-resistant as thermoplastics.

Pros:

– Inexpensive and versatile.

– Good moisture resistance; does not swell easily.

Cons:

– Susceptible to chipping or cracking under impact.

– Limited flexibility and thickness options compared to plastics.

Impact on Application:

Suitable for cabinetry, countertops, and furniture in kitchens, bathrooms, and other high-humidity zones where sharp impacts are less common.

Regional Considerations:

Often preferred in projects where cost control is critical, such as volume-based contracts in parts of Africa and Latin America. Confirm compatibility with regional formaldehyde and emission standards.

Veneer Edge Banding

Key Properties:

Composed of thin slices of real wood, veneer edge banding delivers an authentic wood finish, allowing for sanding, staining, and finishing like solid wood. Its durability varies by species and requires surface treatments for optimal performance.

Pros:

– Premium, natural appearance.

– Can be stained or finished to match surrounding material.

Cons:

– Costs more than synthetic options; not as durable against mechanical stress or moisture.

– Installation is more labor-intensive and requires careful finishing for longevity.

Impact on Application:

Best for visible furniture applications, high-end retail fixtures, and luxury interiors where design authenticity is paramount.

Regional Considerations:

Highly valued in luxury markets across Europe, especially France and Italy. Importers must verify wood origin and legality (e.g., EUTR, FSC compliance) to meet European or Middle Eastern procurement and environmental requirements.

Summary Table

| Material | Typical Use Case for 3mm edge banding | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| PVC | Office furniture, commercial panels, high-traffic cabinetry | Wide color & texture range, high durability | Prone to UV yellowing; environmental scrutiny | Low–Medium |

| ABS | Eco-friendly furniture, children’s spaces, export markets | Recyclable, chlorine-free, robust | Moderate heat resistance; slightly higher price | Medium |

| Melamine | Kitchen cabinets, bathroom furniture, low/mid-tier panels | Moisture resistant, cost-effective | Chips/cracks under impact; limited flexibility | Low |

| Veneer | Luxury interiors, premium shelving, visible joinery | Authentic wood look, can be finished to match | Costlier; less impact/moisture resistance | Medium–High |

In-depth Look: Manufacturing Processes and Quality Assurance for 3mm edge banding

Key Manufacturing Stages for 3mm Edge Banding

Manufacturing 3mm edge banding demands stringent control and precise processes to deliver a consistent, high-quality product fit for international B2B markets. The process varies slightly depending on the material—PVC, ABS, veneer, or melamine—but the core stages remain similar.

1. Material Preparation

Raw materials selection lays the foundation for a premium product. For plastic edge banding (PVC, ABS), high-quality polymer resins with precise chemical specifications are sourced to ensure durability and resistance to moisture, chemicals, and UV degradation. For veneer or melamine edge banding, wood veneers are carefully selected for uniform grain and color, while melamine-impregnated papers are specified for consistent thickness and resin content.

- Key insights:*

- Consistent resin formulations ensure product longevity and flexibility.

- Sourcing from reputable supply chains is crucial, especially for buyers concerned with environmental compliance or traceability.

2. Extrusion and Forming

Plastic Edge Banding (PVC, ABS):

High-speed extrusion is the core process. Pellets are melted and forced through precision dies to achieve exact dimensions (e.g., 3mm thickness and various widths). Temperature, pressure, and cooling rates are tightly monitored to prevent defects such as warping or surface irregularities.

Veneer/Melamine Edge Banding:

Sheets are sliced to precise widths and thicknesses. For veneer, the sheets may be bonded onto a backing for strength and uniformity. Melamine edge banding uses resin-impregnated paper, cut and pressed for exact sizing.

- Key techniques:*

- In-line thickness gauging: Ensures edges meet strict tolerance (±0.1mm) to fit automated banding equipment.

- Surface smoothing and texturizing: Rollers or embossers may be used for desired finish and grip.

3. Adhesive Application

Edge banding must bond effectively to substrates during later installation. Adhesive is typically applied during manufacturing:

- Pre-glued (hot-melt adhesive): Applied uniformly by rollers, ideal for rapid downstream application.

- Primer coating: Especially important for raw thermoplastics to promote strong adhesion during customer use.

Uniform adhesive application is verified with in-line sensors and visual inspection.

4. Finishing Touches

Final processing depends on the material:

– Color matching and printing: To ensure seamless blends or contrast with target substrate panels. Advanced printers may add wood grain or custom patterns.

– Sheen/texture adjustment: Surface finishes (matt, gloss, embossed) are calibrated per market preference and order requirements.

– Slitting and coiling: Products are cut to-order, coiled for shipping, or trimmed for sheet formats.

Advanced facilities feature automated defect detection systems at this stage, ensuring only flawless product is packaged.

Quality Assurance Protocols

International buyers must demand robust quality assurance frameworks anchored in global standards and adapted to regional requirements.

Core Global Standards

- ISO 9001 (Quality Management Systems):

Most leading manufacturers are ISO 9001 certified, reflecting systematic approaches to process control, documentation, and continual improvement. - CE Marking (European Market):

Essential for suppliers targeting the EU or Turkey, indicating conformity with relevant EU directives on safety and performance. - REACH & RoHS Compliance:

Particularly for European buyers, ensuring restricted substances (e.g., certain plasticizers or heavy metals) are absent.

Industry-Specific and Regional Requirements

- Customs and import regulations in Africa, South America, and the Middle East often require additional certifications or declarations regarding chemical content, fire resistance, or recyclability.

- Some markets (e.g., France, the Gulf region) prioritize sustainable sourcing—FSC certification for wood veneers or documented recycled content for thermoplastics.

Quality Control Checkpoints

Manufacturers should implement multiple QC checks throughout the process, commonly structured as:

-

Incoming Quality Control (IQC):

– Inspection of raw material consignments—resin purity, veneer appearance, paper quality.

– Testing for compliance with supplied specifications and absence of banned substances. -

In-Process Quality Control (IPQC):

– Continuous monitoring during extrusion and forming for dimensions, color accuracy, and surface integrity.

– In-line sensors and cameras catch deviations instantly, minimizing waste and rework. -

Final Quality Control (FQC):

– Physical sampling and testing after slitting/coiling.

– Measurements for width, thickness, and adhesive layer quality.

– Visual checks for surface blemishes, pattern consistency, and color deviations.

- Actionable tip:* As a B2B buyer, request detailed descriptions of these QC protocols and sample batch reports to verify process rigor.

Common Testing Methods

To assure durability and performance, rigorous test regimens are essential:

- Dimensional Tolerance Testing:

Precision calipers and micrometers ensure the 3mm thickness and specified widths across entire production runs. - Peel and Shear Strength Tests:

Confirm the adhesive layer can withstand real-world cabinetry and furniture stresses. - Abrasion and Impact Resistance:

Utilizes mechanical testers to simulate years of use and abuse, crucial for high-traffic applications. - Moisture Resistance Tests:

Particularly important for humid climates (Africa, South America, Middle East); samples are immersed and evaluated for swelling, delamination, or discoloration. -

Colorfastness and UV Stability:

Helps ensure long-lasting appearance, especially for projects in sun-exposed environments. -

Insight for buyers:*

Request test certificates for each batch, focusing on the tests most relevant to your climate and intended application.

Verifying Supplier Quality: Best Practices for International B2B Buyers

Success in global procurement hinges on effective supplier due diligence.

Key Verification Tactics

- Supplier Audits:

On-site supplier audits—either virtual or in-person—assess actual adherence to manufacturing and QC processes.

Tip: Enlist qualified local agencies or international inspection firms experienced in edge banding and woodworking components. - Documented Quality Reports:

Always request recent ISO certificates (with valid expiry dates), third-party audit summaries, and actual batch test reports. - Third-Party Pre-Shipment Inspection:

Employ reputable inspection services (e.g., SGS, TÜV) for independent validation—especially for first orders or new suppliers. - References and Sample Orders:

Check references from buyers in similar regions and request production samples before large volumes.

Regional Considerations

- Africa & South America:

Shipping times and logistics can complicate returns—rigorous pre-inspection and clear warranty/return terms are essential. - Middle East:

Certifications on flame retardancy or halal-compliant processes may be required for state or commercial projects. - Europe (France, Turkey):

Ensure full traceability and documentation for environmental and chemical compliance—particularly for high-volume, public-sector contracts.

Navigating Certification and Documentation

International procurement demands attention to detail in paperwork and compliance:

- Consistent Labeling and Lot Traceability:

Insist on clear packaging/labelling, with batch numbers traceable to production and QC records. - Language of Documents:

For Europe, require supplier documentation in English or the relevant local language (French, Turkish). - Ongoing Supplier Qualification:

Regular reassessment every 12-24 months, especially if production processes or raw material sources change.

Action Points for B2B Buyers

- Define your technical requirements—thickness, width, color, adhesive, environment exposure—and communicate them clearly at RFQ stage.

- Prioritize suppliers with demonstrable ISO 9001 (and, for Europe/Turkey, CE/REACH) compliance.

- Systematically request production samples and documentation—including QC and test reports—prior to mass orders.

- Engage professional inspection services for critical or large-volume shipments, and conduct periodic audits of supplier facilities.

By proactively managing supplier quality assurance and understanding the underlying manufacturing processes, international B2B buyers can ensure a reliable supply of robust, premium 3mm edge banding, minimizing risk and maximizing project satisfaction across diverse markets.

Related Video: Most Amazing Factory Manufacturing Process Videos | Factory Mass Production

Comprehensive Cost and Pricing Analysis for 3mm edge banding Sourcing

Key Cost Components in 3mm Edge Banding Procurement

When sourcing 3mm edge banding, understanding the underlying cost structure is essential for effective budgeting and supplier negotiations. The total cost generally comprises:

- Raw Materials: Core materials—PVC, ABS, melamine, or natural veneer—determine a significant share of base cost. Material selection affects not only price but also performance, longevity, and aesthetics.

- Manufacturing Labor: Labor costs reflect regional wage differences and production efficiency. Suppliers in Asia may offer cost advantages over those in Europe, but balance this with local labor conditions, compliance, and reliability.

- Manufacturing Overhead: Includes utilities, facility maintenance, and machine depreciation. Automated production lines typically reduce per-unit overhead for higher volume orders.

- Tooling and Setup: Custom colors, patterns, or widths often require new dies or printing plates, incurring one-time or amortized charges. Consider these costs particularly when ordering non-standard SKUs.

- Quality Control (QC): Comprehensive QC ensures batch consistency, precise dimensions (3mm thickness and width specs), and adherence to international standards. Enhanced QC may add to the quoted price but reduces risk of defects or supply chain disruptions.

- Packaging and Logistics: Export packaging (humidity control, reinforced cartons), containerization, and inland transport can make up a noticeable portion of the overall landed cost—especially for buyers in Africa, South America, and remote European or Middle Eastern regions.

- Supplier Margin: Profit margins vary widely with supplier scale, market demand, and buyer relationship. Transparent discussions about cost breakdowns can yield more favorable terms.

Major Influencers on Pricing

International B2B pricing for 3mm edge banding is shaped by several dynamic factors:

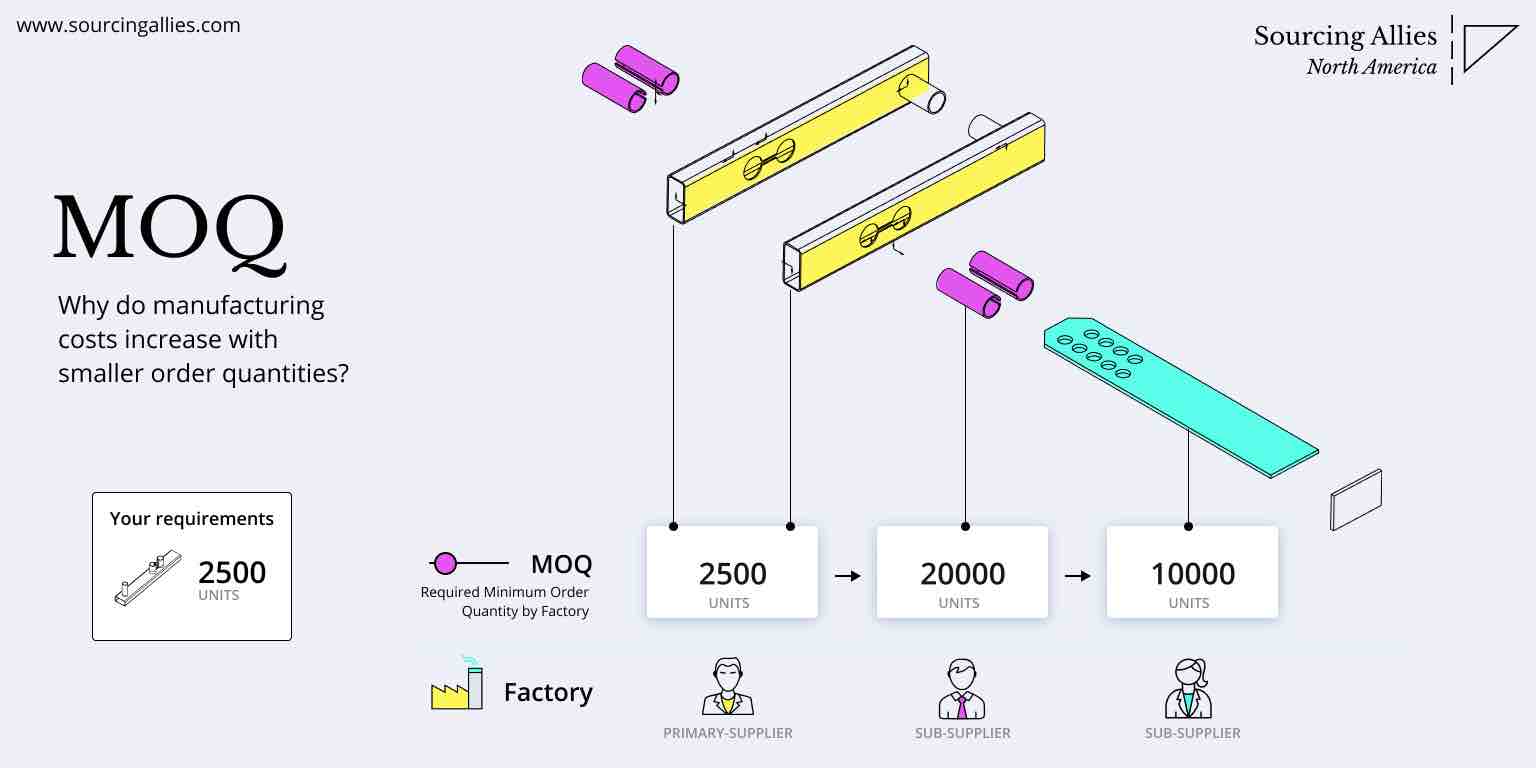

- Order Volume & Minimum Order Quantity (MOQ): Bulk orders typically secure lower per-meter rates, but larger MOQs can strain cash flow or inventory management for smaller importers.

- Material Type & Specifications: Higher grade materials or specialty finishes (antibacterial coatings, custom woodgrain textures, or UV resistance) command premium pricing. Thickness tolerances and color matching add to the cost if off-standard.

- Customization & Value-added Options: Non-standard widths, embossed branding, or tailored adhesive systems often incur setup fees and longer lead times.

- Certifications & Compliance: Compliance with ISO, REACH, or relevant local certifications (e.g., E1/E0 formaldehyde for Europe, fire retardancy for the Middle East) can increase unit cost but may be mandatory for certain markets.

- Supplier Factors: Factory location, scale, production capacity, and reputation influence both baseline prices and negotiation flexibility. More established manufacturers may offer better consistency and after-sales support, offsetting a higher initial quote.

- Incoterms & Shipping Terms: Prices vary significantly based on terms (EXW, FOB, CIF, DDP). Buyers in landlocked or high-tariff regions may face higher landed costs due to inland freight or customs duties.

Strategic Guidance for International Buyers

For importers in Africa, South America, the Middle East, and Europe, adopting a holistic sourcing approach is crucial:

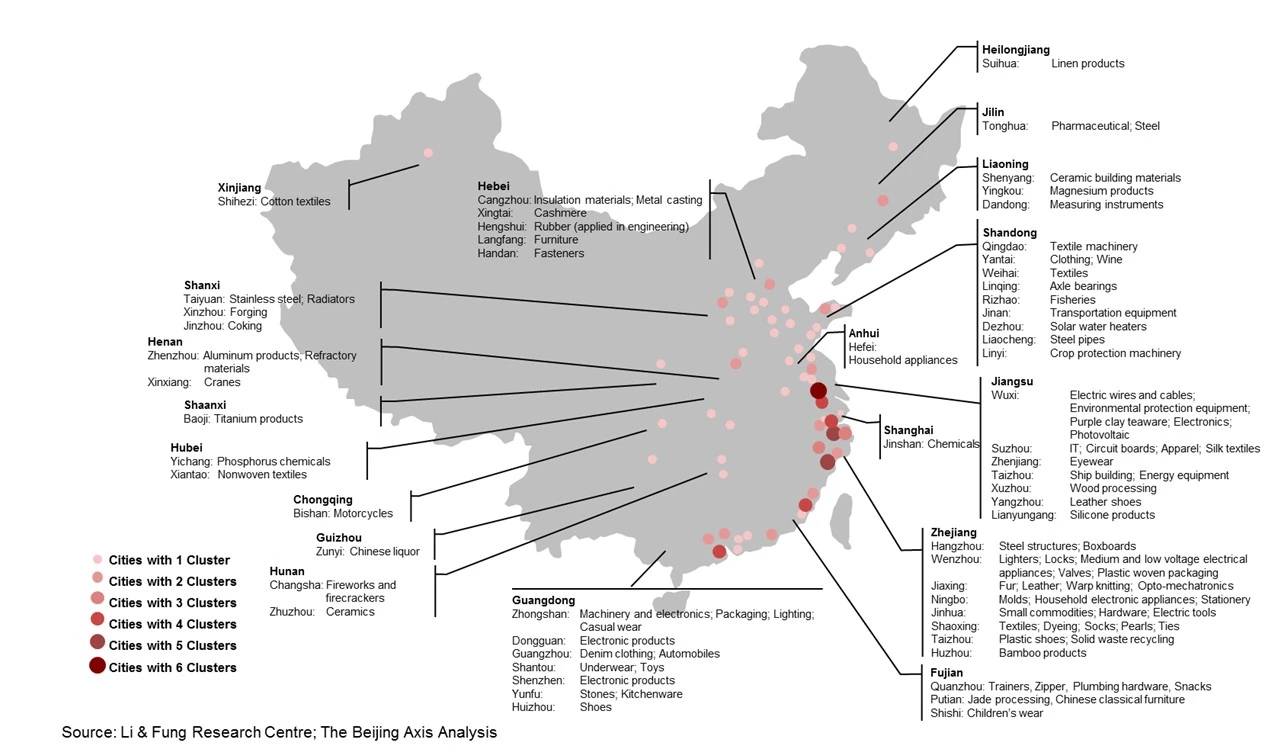

- Benchmark Across Multiple Suppliers: Leverage RFQs and sample orders from several sources (including China, Turkey, and Eastern Europe) to uncover pricing patterns and quality differentials.

- Negotiate Total Cost of Ownership (TCO): Consider not just the unit price but also lifecycle costs—wastage rates, reject handling, in-field durability, and logistics. Sometimes a slightly higher unit cost yields better long-term value through reduced defect rates and lower installation labor.

- Evaluate MOQ Flexibility: If working with varied project sizes, partner with suppliers able to accommodate smaller, frequent shipments, even if this incurs a modest surcharge.

- Scrutinize Customs & Regulatory Costs: Each region (e.g., EC Tariff in France, AfCFTA rules, Gulf Cooperation Council tariffs) brings unique import duties or clearance requirements. Request DDP quotes where possible or work with local agents for landed costing.

- Plan Logistics in Advance: For overseas shipments, assess not just container rates but also local port charges, inland transport infrastructure, and potential seasonal delays.

Actionable Negotiation & Cost-Optimization Tips

- Bundle Orders: Combine multiple edge banding types or SKUs to hit higher volume discounts and reduce per-shipment overhead.

- Long-term Contracts: Lock in pricing for 6-12 months where possible, especially in volatile markets.

- Insist on Detailed Quotes: Request line-itemized pro forma invoices to clarify potential hidden costs.

- Quality Assurance: Invest in third-party pre-shipment inspections or request supplier-provided batch certificates.

Disclaimer: Pricing advice and cost structures are intended as guidelines only. Actual costs vary significantly by supplier, location, and prevailing market conditions. Always obtain and compare up-to-date quotations before finalizing procurement decisions.

A thorough understanding and management of cost drivers empower international B2B buyers to secure quality 3mm edge banding at optimal rates, strengthening both supply chain reliability and final product competitiveness.

Spotlight on Potential 3mm edge banding Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘3mm edge banding’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 PVC Edge Banding Manufacturers In Global Market (pvcdecorativefilm.com)

As a prominent collective or platform, the “10 PVC Edge Banding Manufacturers In Global Market” connects B2B buyers with leading factories—primarily in China—recognized for delivering quality 3mm PVC edge banding solutions. These manufacturers serve the global furniture and interior design sectors, offering a wide array of thicknesses, colors, and textures tailored to international standards. Strengths include advanced manufacturing facilities (typically between 3,000–5,000 sqm), support for bulk orders, and custom specifications. The group’s deep export experience ensures smooth logistics and compliance with key certifications required in Europe, Africa, South America, and the Middle East. Acting as a bridge between global buyers and trusted producers, they facilitate reliable sourcing and competitive pricing for large-scale projects.

7 Edge Banding Manufacturers You Should Know in 2023 (www.saierectors.com)

Specializing in edge banding solutions, the collective of “7 Edge Banding Manufacturers You Should Know in 2023” highlights top-performing organizations recognized for their consistent product quality and reliability. These manufacturers are known for offering a comprehensive range of 3mm edge banding options, catering to diverse industries such as cabinetmaking, furniture production, and interior fit-out projects. Many prioritize advanced manufacturing methods, ensuring precise dimensions and seamless finishes suitable for demanding B2B requirements. The group often includes globally active brands with established supply networks in Africa, South America, the Middle East, and Europe, facilitating responsive international support and logistics. While specific certifications or proprietary technologies vary by brand, the selected manufacturers are distinguished for their focus on durability, visually appealing finishes, and competitive lead times—key factors for buyers seeking dependable partnerships and product consistency. Publicly available details on individual companies may be limited, but their combined market presence underlines their relevance for international buyers aiming for quality, scalability, and trusted supply.

Edge Banding Supplier & Distributor (edgebanding-services.com)

Edge Banding Supplier & Distributor (ESI) stands out as North America’s largest PVC edge banding distributor, offering a broad portfolio tailored to the needs of the global cabinetry and furniture industries. Their specialization in 3mm PVC edge banding positions them as a go-to supplier for projects demanding enhanced durability and a wide array of styles, colors, and finishes. ESI demonstrates significant supply capabilities, with comprehensive technical support and a robust distribution network that reliably serves international B2B clients across regions such as Africa, South America, the Middle East, and Europe. The company emphasizes product quality, holding inventory across multiple locations and facilitating fast order processing. While specific certifications or proprietary technologies are not detailed, ESI’s industry reputation is reinforced by long-term supplier relationships, customization options, and responsive service for export customers seeking consistent quality and flexible volumes.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 PVC Edge Banding Manufacturers In Global Market | Global sourcing platform; export-focused; 3mm specialists | pvcdecorativefilm.com |

| 7 Edge Banding Manufacturers You Should Know in 2023 | Leading global 3mm edge banding suppliers | www.saierectors.com |

| Edge Banding Supplier & Distributor | Leading PVC edge banding supplier, global reach | edgebanding-services.com |

Essential Technical Properties and Trade Terminology for 3mm edge banding

Key Technical Properties for 3mm Edge Banding

Selecting the right 3mm edge banding for international procurement requires understanding the core technical specifications that impact performance, appearance, processing, and long-term value. Below are the most critical properties international B2B buyers should evaluate:

-

Material Composition and Grade

3mm edge banding is manufactured from various materials, most commonly PVC, ABS, melamine, or natural wood veneer. Each material offers unique advantages: PVC and ABS provide excellent durability and chemical resistance; melamine offers cost efficiency and color variety; veneer delivers a premium, authentic look. For volume buyers, it’s critical to request the material grade—for instance, “high-impact PVC” or “E0/E1 formaldehyde-rated ABS”—as this directly impacts quality, environmental compliance, and end-use suitability, particularly for markets with strict regulations (e.g., Europe). -

Width and Thickness Tolerance

While 3mm refers to thickness, tolerance in both width and thickness should be clearly specified (e.g., ±0.1mm). Consistent tolerance ensures the edge banding applies evenly and fits seamlessly in automated production lines. Variations can cause installation issues or cosmetic defects, which are unacceptable for international furniture standards and large-scale manufacturing. -

Surface Finish and Texture

Surface options include matt, high gloss, embossed, or woodgrain textures. The finish not only defines the visual appeal but also determines resistance to scratches, fingerprints, and UV fading. For projects demanding specific aesthetics or durability (e.g., office furniture, kitchens), it’s advisable to obtain physical samples and clearly specify the finish parameters in procurement documents. -

Adhesive Backing Type

Most edge bandings are supplied with pre-applied adhesives: hot melt glue, pre-glued (EVA, PUR), or no adhesive (for in-plant application methods). The adhesive type affects the bonding strength, processing speed, and compatibility with different substrates and climate conditions. For B2B buyers with automated lines, confirming adhesive compatibility with production equipment is crucial to avoid costly downtime. -

Color Matching and Customization Options

International buyers often need a precise color match to their board materials. Suppliers typically offer RAL, Pantone, or custom color-matching services, as well as grain and pattern replication. Detailed technical communication—including samples or digital color codes—greatly reduces the risk of mismatched shipments. -

Certification and Compliance

Especially relevant for exports into Europe or North America, compliance with environmental and safety standards (such as REACH, RoHS, and low formaldehyde emissions) should be verified through documentation or third-party certifications. This minimizes risk of shipment delays, customs issues, or product recalls.

Common Trade and Industry Terminology

In international B2B transactions for 3mm edge banding, understanding common trade terms is critical for efficient procurement and risk management.

-

OEM (Original Equipment Manufacturer)

Denotes procurement for use in your own branded products, often with customized specifications or private labeling. For buyers seeking proprietary finishes or bespoke packaging, confirming OEM capabilities is essential. -

MOQ (Minimum Order Quantity)

Defines the smallest volume a supplier will accept for production. Understanding MOQs is key to managing inventory, negotiating prices, and planning logistics—especially for specialty colors or patterns that may have higher production thresholds. -

RFQ (Request for Quotation)

A standard procurement document asking suppliers for price offers based on detailed product specifications. Providing comprehensive RFQs—detailing material, thickness, color, adhesive type, packaging, and certifications—ensures accurate and competitive quotes. -

Incoterms (International Commercial Terms)

Specifies the terms of delivery, responsibilities, and risk transfer points between buyer and seller (e.g., FOB, CIF, DAP). Selecting the right Incoterm can optimize shipping costs and clarify insurance, customs clearance, and transportation responsibilities. -

Lead Time

Refers to the time from order confirmation to shipment. For buyers coordinating international supply chains, understanding both production and transit lead times helps avoid stockouts or costly production delays. -

HS Code (Harmonized System Code)

An international goods classification number used for customs clearance, tariffs, and trade statistics. Accurate HS coding ensures smooth import/export processes and correct duties assessment.

Understanding and clearly communicating these technical properties and trade terms allows B2B buyers across Africa, South America, the Middle East, and Europe to secure the right 3mm edge banding materials, optimize procurement outcomes, and ensure compliance with international standards.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the 3mm edge banding Sector

Global Market Overview and Sourcing Trends

3mm edge banding has become a strategic product segment within the global furniture, cabinetry, and interior fit-out industries. Its widespread adoption is driven by the accelerating shift from solid wood panels to engineered wood products like MDF, particleboard, and plywood—trends that are notably strong in rapidly urbanizing regions across Africa, South America, and the Middle East, as well as mature European markets such as France and Turkey. This growth is driven by both economic and design imperatives: 3mm edge banding enhances durability, aesthetics, and moisture resistance, directly impacting the finished product’s perceived quality.

Key market dynamics for B2B buyers:

- Diversification of Material Options: The market offers PVC, ABS, melamine, and veneer edge banding in 3mm thicknesses. PVC remains the leading choice due to its cost-effectiveness, mechanical durability, and vast color range. ABS, with its reduced environmental impact, is gaining ground in markets with stricter sustainability requirements—particularly the EU.

- Advancement in Production Technology: Sourcing is increasingly affected by tech innovations such as laser and hot-air edge banding application, which reduce adhesive use and yield a cleaner finish. Suppliers that invest in technological upgrades offer improved product quality, faster turnaround times, and more customized solutions—factors B2B buyers must consider for competitive advantage.

- Regional Sourcing Patterns: Europe serves as both a consumptive and manufacturing hub for higher-end edge banding, while Turkey acts as a gateway supplier into Eastern Europe, the Middle East, and North Africa. In Africa and South America, rising furniture manufacturing sectors are prompting more local conversion operations but still rely heavily on imports—making supplier relationships and logistics efficiency crucial.

- Customization & Aesthetics Demand: Rising consumer expectations in furniture and interiors are reflected upstream, with B2B buyers prioritizing suppliers that deliver exact matches in color, gloss, and texture, as well as offering flexible minimum order quantities on 3mm edge banding.

- Supply Chain Security: Volatility in raw material costs (notably plastics and chemicals) and international logistics challenges (including tariffs and shipping delays) underscore the importance of diversifying supplier bases and maintaining buffer inventories.

Actionable B2B Insight:

International buyers should benchmark suppliers on their technological capabilities, flexibility in customization, and adherence to robust logistics processes. For regions with developing local manufacturing, invest in supplier partnerships that offer technical support for application methods and post-sale consultation on durability and design.

Sustainability and Ethical Sourcing Considerations

Sustainability has moved from a niche concern to a core procurement criterion in the 3mm edge banding sector. The environmental impact of traditional PVC-based edge banding—owing to its reliance on fossil-fuel derivatives and challenging end-of-life recyclability—has prompted both regulatory and market responses, especially in Europe and the Middle East.

Sustainable sourcing priorities for B2B buyers include:

- Material Innovations: ABS and other non-chlorinated thermoplastics present less toxic options, with lower VOC emissions during application and improved recyclability. Some global suppliers now offer bio-based or recycled content edge banding, appealing to green-conscious B2B buyers.

- Certifications and Standards: Demand for evidence-backed sustainability is rising. Relevant certifications include:

- REACH and RoHS Compliance: Ensuring low toxicity and chemical safety, particularly in the EU.

- FSC/PEFC Certification: For wood veneer edge banding, these marks guarantee timber comes from responsibly managed forests.

- ISO 14001: Reflects a supplier’s environmental management system and continuous improvement practices.

- Ethical Supply Chain Practices: Transparent sourcing of raw materials, responsible labor practices, and short, traceable supply chains are increasingly requested by multinational buyers to mitigate regulatory and reputational risk.

- Circular Economy Initiatives: Some vendors now offer take-back or recycling programs for edge banding waste, a valuable offering for large-scale furniture manufacturers targeting zero-waste production lines.

Actionable B2B Insight:

Buyers should prioritize suppliers with documented sustainability initiatives, seeking both third-party certifications and demonstrable reductions in carbon footprint. For procurement in jurisdictions with evolving environmental regulations (e.g., certain Middle Eastern and South American countries), advance due diligence to ensure supplier compliance and future-proof sourcing strategies.

Evolution and Strategic Importance of 3mm Edge Banding

The development of edge banding parallels the rise of engineered wood components in global manufacturing. While earlier edge banding solutions were limited to thin, simple strips of wood veneer, the introduction of plastics like PVC and ABS in the late 20th century enabled the creation of consistent, durable, and highly customizable edge banding—including the now-standard 3mm thickness. This innovation allowed producers to deliver both cost advantages and improved product life cycles, quickly making 3mm edge banding ubiquitous in modern furniture making.

Today, the ongoing evolution toward automated application methods and sustainable materials positions 3mm edge banding as both a technical and strategic differentiator for B2B buyers globally. Knowledge of sourcing trends, quality benchmarks, and sustainability data equips procurement teams to balance commercial goals with regulatory and consumer-driven expectations.

Related Video: Incoterms® 2020 Explained for Import Export Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of 3mm edge banding

-

How can I effectively vet international suppliers of 3mm edge banding?

Begin by assessing suppliers’ production capabilities, export experience, and reputation within the global marketplace. Request documentation on previous exports to regions such as Africa, South America, the Middle East, or Europe—preferably with client references. Examine business certifications (such as ISO 9001 or FSC), and ask for product samples to evaluate quality firsthand. Consider leveraging third-party audit firms to verify operations before placing a significant order. Transparent communication, redressal policies, and proven reliability should be central criteria in your vetting process. -

What customization options can I request for 3mm edge banding?

International buyers can usually customize edge banding in terms of color, texture (matte, glossy, embossed), width, and even printed patterns or branding. It’s also possible to specify base materials (PVC, ABS, veneer, melamine) based on local market preferences or regulatory standards. Discuss integration of adhesives (pre-glued, hot-melt, etc.) and packaging requirements. Always clarify minimum order quantities for custom specifications and request production samples to ensure the finished product matches your needs before full-scale manufacturing. -

What are typical minimum order quantities (MOQ), lead times, and payment terms when sourcing 3mm edge banding internationally?

MOQs vary significantly but often start at 1,000–3,000 meters per specification for custom runs; stock items may be available in lower quantities. Lead times typically range from 3–6 weeks depending on manufacturing complexity and current factory workload. Standard payment terms are T/T (30% deposit, 70% before shipment), but buyers may negotiate flexible arrangements for larger, ongoing contracts. Use secure payment methods, and confirm timelines and terms in a detailed contract to mitigate financial risk. -

Which quality assurance measures and certifications should I require?

Insist on robust quality control procedures—routine in-line and pre-shipment inspections with full traceability reports. Key certifications to seek include ISO 9001 (Quality Management), FSC (Forest Stewardship Council) for wood-based products, and RoHS or REACH compliance for chemical safety. Require MSDS (Material Safety Data Sheets) for transparency on chemical composition, especially if importing into regions like the EU or Middle East. Always request quality assurance documentation with each shipment and consider hiring third-party quality inspectors for critical orders. -

What logistics and shipping considerations should I address when importing 3mm edge banding?

Edge banding is lightweight but bulk shipping efficiency is essential. Determine the supplier’s incoterm—EXW, FOB, CIF, or DDP—and clarify responsibilities for inland and sea/air freight, insurance, and customs clearance. Factor in port congestion issues or import tariffs that may affect Africa, South America, and Middle Eastern countries. Insist on moisture-resistant packaging, clear labeling, and complete documents (Bill of Lading, commercial invoice, packing list, certificates of origin). Work with experienced freight forwarders familiar with your region. -

How can I handle product disputes or claims with overseas suppliers?

Set clear agreement terms in your written purchase contract, specifying inspection protocols, performance guarantees, and dispute resolution procedures. If a shipment is not as described or defective, document the issue with photos and third-party inspection reports. Try to resolve disputes amicably through negotiation; rely on established communication channels. If unresolved, consider mediation or legal action via international arbitration centers or by leveraging trade associations. Using an irrevocable letter of credit can also provide recourse in the event of non-compliance. -

Which factors impact landed cost and tariff calculation for 3mm edge banding?

Besides FOB or EXW price, account for sea or air freight, customs duties, local taxes (e.g., VAT, import duty), insurance, and port/handling fees. Harmonized System (HS) codes for edge banding can vary by material; correct classification is essential to avoid customs delays and unexpected tariffs, especially critical for Africa, the Middle East, and EU buyers. Consult customs brokers or logistics partners to create a detailed landed cost analysis before order confirmation, ensuring accurate pricing and smooth clearance. -

What trends or regional requirements should international B2B buyers consider when sourcing 3mm edge banding?

Preferences for edge banding materials and certifications differ: European clients may prioritize FSC-certified or low-emission products, while Middle Eastern markets may require halal or fire-retardant grades. African and South American buyers often value supply chain resilience, flexible MOQs, and reduced shipping costs. Stay aware of anti-dumping measures or import restrictions in your target country. Partner with suppliers who adapt to local compliance, reporting, and sustainability expectations and can provide tailored technical support for your market.

Strategic Sourcing Conclusion and Outlook for 3mm edge banding

In summary, 3mm edge banding stands as a critical component in modern woodworking and furniture manufacturing, enhancing both the visual appeal and durability of finished products. For international B2B buyers across Africa, South America, the Middle East, and Europe, the strategic selection and sourcing of 3mm edge banding can translate to tangible competitive advantages—including improved product quality, longevity, and market differentiation.

Key takeaways for successful sourcing include:

- Material Selection: Prioritize the type—PVC for versatility and durability, veneer for a premium wood finish, ABS for flexibility, or melamine for moisture-resistance—to match your application and end-market requirements.

- Customization & Compliance: Focus on suppliers that offer customization in color, texture, and dimensions, and ensure all materials meet relevant regional quality and environmental standards.

- Supply Chain Reliability: Collaborate with reputable suppliers with a proven track record, robust logistics, and support to minimize lead times and mitigate risks related to cross-border procurement.

- Total Cost of Ownership: Beyond initial price, consider installation ease, long-term durability, and maintenance, as these factors substantially impact your delivered value and cost-efficiency.

Looking ahead, rising global demand for engineered wood products and sustainable solutions continues to spotlight the importance of quality edge banding. Decision-makers who proactively build strong supplier relationships and closely watch market trends will be best positioned to capitalize on growth opportunities, ensure consistent quality, and navigate evolving industry standards. Now is the time to review your sourcing strategies, engage credible partners, and secure the right edge banding to advance your position in competitive furniture and joinery markets worldwide.