The global DC power supply market is experiencing robust growth, driven by rising demand for precision electronic testing, advancements in renewable energy systems, and expanding applications in the automotive and semiconductor industries. According to a report by Mordor Intelligence, the DC power supply market was valued at USD 1.72 billion in 2023 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. This growth is further supported by increasing adoption of programmable and switch-mode DC power supplies in R&D and production environments. As industries prioritize energy efficiency, reliability, and smart manufacturing, the role of leading DC power voltage manufacturers becomes increasingly critical. These companies are at the forefront of innovation, delivering solutions that meet stringent performance standards across aerospace, telecommunications, and industrial automation sectors. In this evolving landscape, the following nine manufacturers have emerged as key players, distinguished by their technological expertise, global footprint, and consistent investment in R&D.

Top 9 Dc Power Voltage Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MEAN WELL Switching Power Supply Manufacturer

Domain Est. 1997

Website: meanwell.com

Key Highlights: MEAN WELL is one of the world’s few standard power supply mainly professional manufacturers, covering 0.5 to 25600W products are widely used in industrial ……

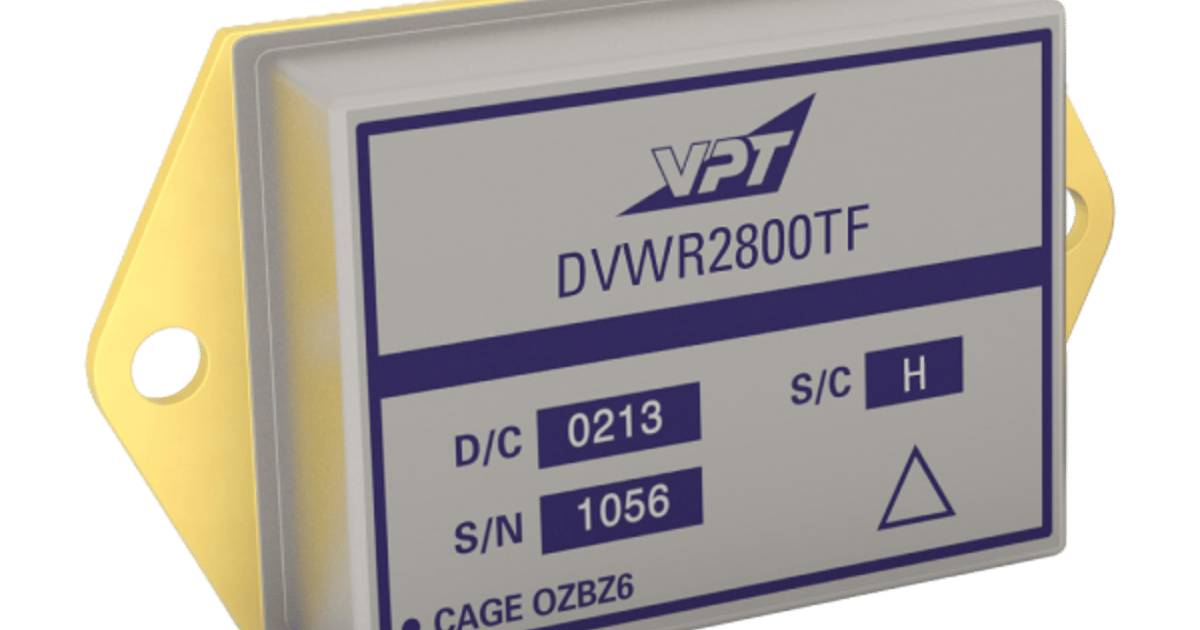

#2 VPT, Inc.: DC

Domain Est. 2012

Website: vptpower.com

Key Highlights: VPT, Inc. (VPT®) is a global leader in providing power conversion solutions for use in avionics, military, space, and industrial applications….

#3 TDK

Domain Est. 1996

Website: us.lambda.tdk.com

Key Highlights: Browse our wide range of AC-DC, DC-DC, Programmable and High Voltage power supplies, DIN rails and EMI filters, as well as Value Add solutions….

#4 Power Supply Manufacturer

Domain Est. 1998

Website: synqor.com

Key Highlights: SynQor designs and manufactures high-efficiency, high-reliability DC-DC power converters, AC-DC power converters, EMI filters and power systems….

#5 XP Power

Domain Est. 2000

Website: xppower.com

Key Highlights: Looking for the leading manufacturer of AC-DC power supplies, DC-DC converters, high voltage, RF & custom power products? Discover our extensive range….

#6 RECOM: DC/DC & AC/DC Converter

Domain Est. 2006

Website: recom-power.com

Key Highlights: RECOM Power is a leading manufacturer of AC/DC electronic power supplies and DC/DC converters, with over 30,000 compact standard power supplies alongside ……

#7 DC Power Supply

Domain Est. 1986

Website: tek.com

Key Highlights: Optimize Your Workflow with a DC Power Supply. A DC power supply delivers stable, adjustable voltage and current for testing, prototyping, and manufacturing….

#8 DC-DC Converters

Domain Est. 2001

Website: vicorpower.com

Key Highlights: Today’s most innovative companies trust Vicor to power their world-changing products. Explore DC-DC converter products, solutions and accessories….

#9 AMETEK Programmable Power

Domain Est. 2007

Website: programmablepower.com

Key Highlights: The AMETEK Programmable Power designs, manufactures, and markets precision, ac & dc programmable power supplies, electronic loads, application-specific ……

Expert Sourcing Insights for Dc Power Voltage

H2: Analysis of 2026 Market Trends for DC Power Voltage

As the global energy landscape evolves, direct current (DC) power voltage is poised to play a pivotal role in shaping the future of power systems by 2026. Driven by technological advancements, sustainability goals, and the growing integration of renewable energy, the DC power market is undergoing a transformative shift. This section examines key trends expected to define the DC power voltage market in 2026 under the H2 framework, which refers to both the second half of the decade and the potential role of hydrogen (H2) as a clean energy vector.

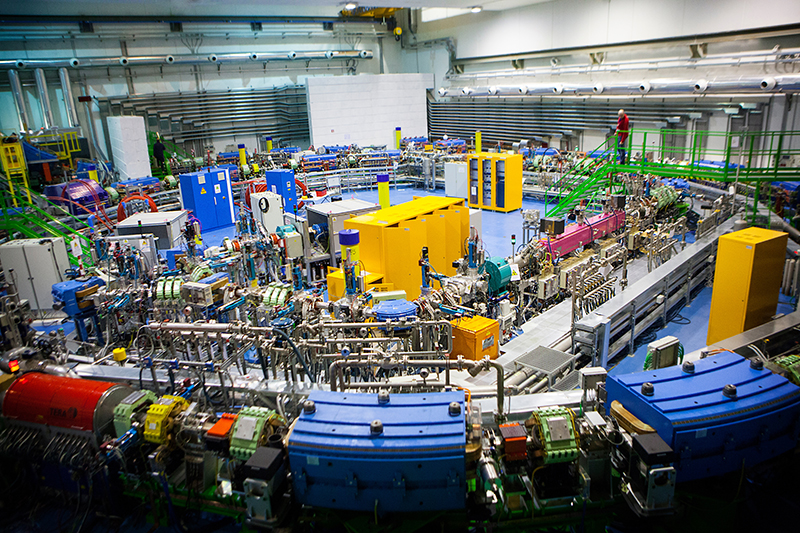

1. Growth of High-Voltage DC (HVDC) Transmission

By 2026, High-Voltage Direct Current (HVDC) systems are expected to dominate long-distance power transmission, especially in regions integrating offshore wind farms and cross-border energy grids. HVDC offers lower transmission losses over long distances compared to traditional alternating current (AC), making it ideal for transporting renewable energy from remote generation sites to urban centers. With increasing interconnectivity in Europe, Asia, and North America, investments in HVDC infrastructure are projected to rise significantly, driven by energy security and decarbonization goals.

2. Integration with Green Hydrogen (H2) Production

One of the most impactful trends is the synergy between DC power systems and green hydrogen production. Electrolyzers, which convert water into hydrogen using electricity, operate more efficiently on DC power. As green hydrogen emerges as a key pillar of the clean energy transition—especially in hard-to-abate sectors like heavy industry and transportation—DC-powered electrolysis plants are expected to proliferate by 2026. Solar and wind farms, which generate DC power natively, can directly feed into these systems, minimizing conversion losses and improving overall efficiency. This direct coupling reduces reliance on inverters and enhances system economics.

3. Rise of Medium- and Low-Voltage DC in Buildings and Data Centers

The adoption of low- and medium-voltage DC distribution in commercial buildings, data centers, and residential applications is accelerating. With the proliferation of DC-powered devices (LED lighting, EV chargers, HVAC systems, and consumer electronics), there is a growing push to eliminate AC/DC conversion losses by adopting DC microgrids. By 2026, standards such as EMerge Alliance and IEC 60364-8-1 are expected to gain broader acceptance, enabling widespread deployment of 380V DC power in smart buildings, thereby improving energy efficiency by up to 10–20%.

4. Electric Vehicles and DC Fast Charging Infrastructure

The global expansion of electric vehicles (EVs) is a major driver for DC power adoption. DC fast chargers (DCFC), which operate at voltages ranging from 400V to 1000V, are becoming standard in public and fleet charging networks. By 2026, ultra-fast charging stations (350 kW and above) will be increasingly common, requiring robust DC power management systems and grid integration solutions. The integration of battery storage with DC charging stations will further enhance grid stability and enable renewable energy use during peak charging times.

5. Advancements in Power Electronics and Semiconductor Technologies

The performance and cost-effectiveness of DC power systems are being enhanced by innovations in wide-bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN). These materials enable higher switching frequencies, reduced heat loss, and smaller form factors in DC-DC converters and inverters. By 2026, widespread commercialization of these technologies will lower the cost of DC power infrastructure and improve system reliability across industrial, automotive, and renewable energy applications.

6. Policy and Regulatory Support

Government policies aimed at achieving net-zero emissions are accelerating the adoption of DC technologies. Incentives for renewable energy, energy storage, and hydrogen production—especially within the European Green Deal, U.S. Inflation Reduction Act, and China’s dual carbon goals—are indirectly supporting DC power deployment. Regulatory frameworks are also evolving to accommodate DC microgrids and hybrid AC/DC systems, paving the way for standardized and interoperable solutions.

Conclusion

By 2026, the DC power voltage market will be shaped by a convergence of technological innovation, renewable energy integration, and the rise of green hydrogen. The H2 framework—both as a temporal marker (second half of the 2020s) and as a symbol of clean energy transformation—highlights the strategic importance of DC systems in enabling a sustainable, efficient, and resilient power infrastructure. As industries and governments align around decarbonization, DC power is transitioning from a niche solution to a foundational element of the future energy ecosystem.

Common Pitfalls When Sourcing DC Power Voltage (Quality, IP)

Sourcing DC power supplies—especially for industrial, medical, or high-reliability applications—requires careful evaluation beyond just voltage and current ratings. Overlooking critical aspects of power quality and Ingress Protection (IP) can lead to system failures, safety hazards, and increased lifecycle costs. Below are common pitfalls to avoid:

Inadequate Attention to Power Quality

-

Ignoring Ripple and Noise Specifications

Many users focus only on nominal voltage and current, neglecting output ripple and noise. High-frequency switching in DC supplies can introduce voltage fluctuations that disrupt sensitive electronics (e.g., sensors, microcontrollers). Always verify ripple (typically in mVpp) under full load and ensure it aligns with your system’s tolerance. -

Overlooking Voltage Regulation and Load Transients

Poor line and load regulation can cause voltage drift with input fluctuations or changing loads. Systems with dynamic power demands (e.g., motors, RF modules) may experience performance issues or resets if the supply cannot respond quickly to load transients. Check transient response specs and consider supplies with active regulation. -

Assuming All “Regulated” Supplies Are Equal

Not all regulated DC power supplies offer the same level of performance. Some low-cost units may claim regulation but lack proper feedback mechanisms or filtering. Always review datasheet details and, if possible, test under real operating conditions. -

Neglecting EMI/EMC Compliance

Poor electromagnetic compatibility (EMC) can interfere with nearby equipment or fail regulatory certifications. Ensure the power supply meets relevant standards (e.g., EN 61000, FCC Part 15), especially in industrial or medical environments. -

Using Over-Spec or Under-Spec Units

Over-spec’ing (e.g., using a 100W supply for a 10W load) can reduce efficiency and increase heat, while under-spec’ing risks overheating and premature failure. Match the supply capacity to the actual load, including peak demands and safety margins (typically 20–30%).

Misjudging Ingress Protection (IP) Ratings

-

Confusing IP Ratings with General Durability

IP ratings specify protection against solids (first digit) and liquids (second digit), not mechanical strength or chemical resistance. A high IP67 rating doesn’t imply the unit is shockproof or suitable for corrosive environments. Always match IP requirements to the actual environmental conditions. -

Overlooking Installation Environment

A supply rated IP65 may be sufficient for dust and water jets in a factory, but if mounted outdoors or in high-humidity areas, condensation or prolonged exposure could still cause failure. Consider enclosures, ventilation, and orientation during installation. -

Assuming Sealed = Maintenance-Free

Even IP68-rated supplies may require periodic inspection, especially in harsh environments. Seals degrade over time, and thermal cycling can compromise integrity. Implement preventive maintenance checks. -

Ignoring Cable Entry and Connector Ratings

The IP rating applies to the enclosure as delivered. Poorly sealed cable glands or low-rated connectors can compromise the entire system’s protection. Ensure all entry points maintain the required IP level. -

Failing to Verify Real-World Certification

Some suppliers list IP ratings based on internal testing without third-party certification. For safety-critical applications, insist on certified test reports from accredited labs (e.g., TÜV, UL).

Best Practices to Avoid Pitfalls

- Define Requirements Clearly: Document voltage stability, ripple, efficiency, and environmental needs (temperature, humidity, contaminants).

- Review Full Datasheets: Don’t rely on marketing summaries; scrutinize test conditions and derating curves.

- Validate with Testing: Where possible, test the supply in your actual operating environment.

- Choose Reputable Suppliers: Prioritize vendors with proven quality control and compliance documentation.

- Consider Total Cost of Ownership: A slightly more expensive, high-quality supply often reduces downtime and maintenance costs.

By addressing both power quality and IP protection thoroughly, you can ensure reliable, safe, and long-lasting performance of your DC power systems.

Logistics & Compliance Guide for DC Power Voltage

Overview

Direct Current (DC) power systems are widely used in telecommunications, data centers, renewable energy installations, and industrial applications. Ensuring safe, efficient logistics and compliance with regulatory standards is essential when handling, transporting, and deploying DC power equipment and voltage systems. This guide outlines key considerations for logistics and regulatory compliance related to DC power voltage.

Regulatory Standards and Compliance

Compliance with international, national, and industry-specific standards is critical for legal operation and safety.

- IEC 60479 Series: Defines the effects of current on human beings and livestock, applicable to DC voltage safety thresholds.

- UL 62368-1: Safety standard for audio/video, information, and communication technology equipment, including DC power supplies.

- NEC (NFPA 70) – Article 480 and 690: Governs installation of stationary batteries and solar photovoltaic systems using DC power in the U.S.

- EN 50178: European safety standard for electronic equipment operating with DC voltage in industrial environments.

- OSHA 29 CFR 1910.303: U.S. regulations covering general electrical equipment requirements, including DC systems.

Ensure all DC power components (e.g., converters, battery banks, cabling) are certified by recognized bodies such as UL, CE, TÜV, or CSA.

Voltage Classification and Handling

DC voltage levels are categorized for safety and logistics purposes:

- Extra-Low Voltage (ELV): ≤ 60 V DC – Generally safe to handle; minimal insulation and PPE required.

- Low Voltage (LV): >60 V to ≤ 1500 V DC – Requires protective measures during handling and installation.

- High Voltage DC (HVDC): >1500 V DC – Specialized training, equipment, and compliance with high-voltage regulations are mandatory.

Label all DC equipment clearly with voltage ratings and appropriate hazard warnings (e.g., “Danger – High Voltage DC”).

Transportation and Logistics

Safely shipping DC power systems, especially those involving batteries, requires adherence to transportation regulations.

- Lithium-Ion Batteries: Subject to IATA Dangerous Goods Regulations (DGR), IMDG Code (sea), and 49 CFR (U.S. ground). Must be shipped at ≤30% state of charge, properly packaged, and labeled with UN3480 or UN3481.

- Lead-Acid Batteries: Regulated under IATA PI 954 and 49 CFR 173.159a. Must be secured against short circuits and leakage; spill-proof designs are required.

- Voltage Isolation: Disconnect and insulate DC terminals during transit to prevent accidental arcing or short circuits.

- Packaging: Use ESD-safe and crush-resistant packaging for sensitive DC components (e.g., DC-DC converters, controllers).

Storage Requirements

Improper storage can degrade DC system performance and create safety hazards.

- Temperature Control: Store batteries and electronics between 15°C and 25°C; avoid freezing or high-heat environments.

- Ventilation: Especially important for valve-regulated lead-acid (VRLA) and flooded batteries to disperse hydrogen gas.

- Orientation: Follow manufacturer guidelines—many batteries must be stored upright to prevent leakage.

- Isolation: Keep live DC components isolated from conductive materials and moisture.

Installation and Field Compliance

Field deployment must follow design specifications and safety codes.

- Labeling: All DC circuits, disconnects, and enclosures must be clearly labeled with voltage, polarity (+/-), and arc-flash hazard warnings.

- Polarity Verification: Confirm correct polarity before connecting loads or sources to prevent equipment damage.

- Grounding and Bonding: Implement proper grounding per NEC Article 250 or IEC 60364, especially in solar and telecom systems.

- Arc Flash Risk Assessment: Required for DC systems >120 V; use appropriate PPE and tools rated for DC voltage.

Training and Documentation

Personnel handling DC power systems must be adequately trained and documentation maintained.

- Qualified Personnel: Only trained electricians or technicians should install or service DC systems.

- Safety Training: Include DC arc flash, lockout/tagout (LOTO), and emergency response procedures.

- As-Built Documentation: Maintain updated schematics, commissioning reports, and compliance certificates.

- Maintenance Logs: Record inspections, battery health checks, and corrective actions.

Environmental and Disposal Compliance

End-of-life management of DC power components must follow environmental regulations.

- Battery Recycling: Comply with EU Battery Directive, RCRA (U.S.), or local e-waste laws. Use certified recyclers for lead-acid and lithium batteries.

- Hazardous Materials: Dispose of electrolytes, capacitors, and contaminated materials as hazardous waste where applicable.

- WEEE Compliance: In the EU, ensure proper labeling and take-back procedures for electronic DC equipment.

Conclusion

Proper logistics and compliance practices are essential for the safe and legal handling of DC power voltage systems. Adhering to international standards, implementing safe transportation and storage protocols, and ensuring trained personnel manage installations will mitigate risks and support reliable system performance. Regular audits and documentation help maintain ongoing compliance across the lifecycle of DC power infrastructure.

Conclusion for Sourcing DC Power Voltage:

Selecting the appropriate DC power source is critical to the performance, efficiency, and reliability of electronic systems. The choice depends on factors such as required voltage and current levels, portability needs, efficiency, noise sensitivity, and application environment. Common DC power sources include batteries, power supplies, solar panels, and DC-DC converters, each offering distinct advantages and trade-offs. Batteries provide mobility and simplicity but require recharging or replacement. AC-DC adapters offer stable power for fixed installations, while DC-DC converters enable voltage regulation and efficient power distribution in complex systems. Ultimately, proper sourcing of DC voltage ensures optimal operation, extends device lifespan, and supports energy efficiency. Careful consideration of system requirements and power characteristics leads to a robust and sustainable power solution.