The global DC LED lighting market is experiencing robust growth, driven by increasing demand for energy-efficient lighting solutions and the widespread adoption of renewable energy systems. According to a report by Mordor Intelligence, the global LED market was valued at USD 85.8 billion in 2023 and is projected to grow at a CAGR of over 12.5% from 2024 to 2029. A key contributor to this expansion is the rising use of DC-powered LED lighting in off-grid applications, solar-powered systems, and low-voltage architectural lighting, particularly in residential, commercial, and industrial sectors. The shift toward direct current (DC) infrastructure in green buildings and smart cities is further accelerating market demand. As energy efficiency standards tighten and sustainability becomes a priority, manufacturers specializing in DC LED lighting are gaining strategic importance. This growing momentum highlights the need to identify leading innovators in the space—companies at the forefront of efficiency, durability, and smart integration. Based on industry performance, technological innovation, and global reach, the following nine manufacturers have emerged as top players shaping the future of DC LED lighting.

Top 9 Dc Led Lights Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 The LightSource Company

Domain Est. 2017

Website: thelightsourcecompany.com

Key Highlights: The LightSource Company specializes in luxury wedding and event lighting, draping, staging, carpeting, dance floors, special effects, and furniture rental.Missing: led manufacture…

#2 Marshall DC Lighting

Domain Est. 2020

Website: marshalldc.com

Key Highlights: We are the Leader in 24,48125 Volt DC Light Fixtures & LED Bulbs for commercial and industrial applications using renewable sources….

#3 Keystone Technologies

Domain Est. 1996

Website: keystonetech.com

Key Highlights: Keystone Technologies is a leader in manufacturing quality lighting: LED lamps, indoor and outdoor LED fixtures, sensors & controls, and Ballast & LED ……

#4 Progress Lighting

Domain Est. 1996

Website: progresslighting.com

Key Highlights: Explore our curated selection of decorative lighting, ceiling fans, and functional fixtures. Thoughtfully designed to bring refined style, enhanced performance, ……

#5 The Benefits of DC

Domain Est. 2001

Website: insights.acuitybrands.com

Key Highlights: DC-powered LED luminaire technologies can provide reliable lighting and controls, both saving energy and helping to promote installation resiliency….

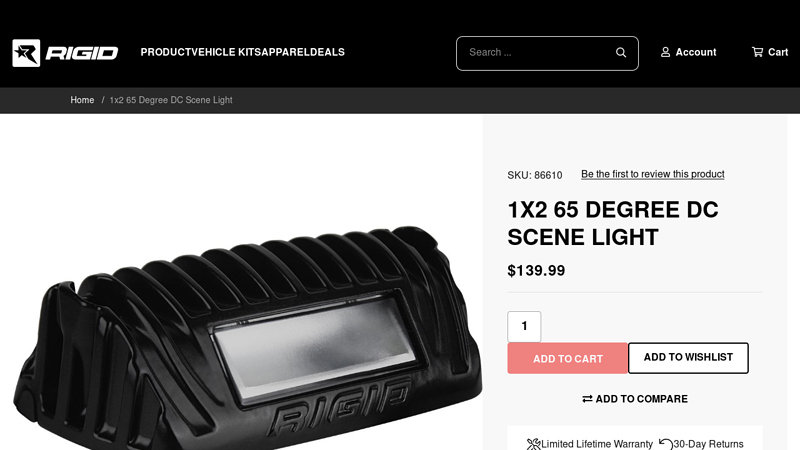

#6 1×2 65 Degree DC Scene Light

Domain Est. 2004

Website: rigidindustries.com

Key Highlights: In stock Rating 5.0 11 RIGID’s LED Scene Lighting by RIGID is an efficient way to light up any area and is available in a variety of sizes and configurations to accommodate….

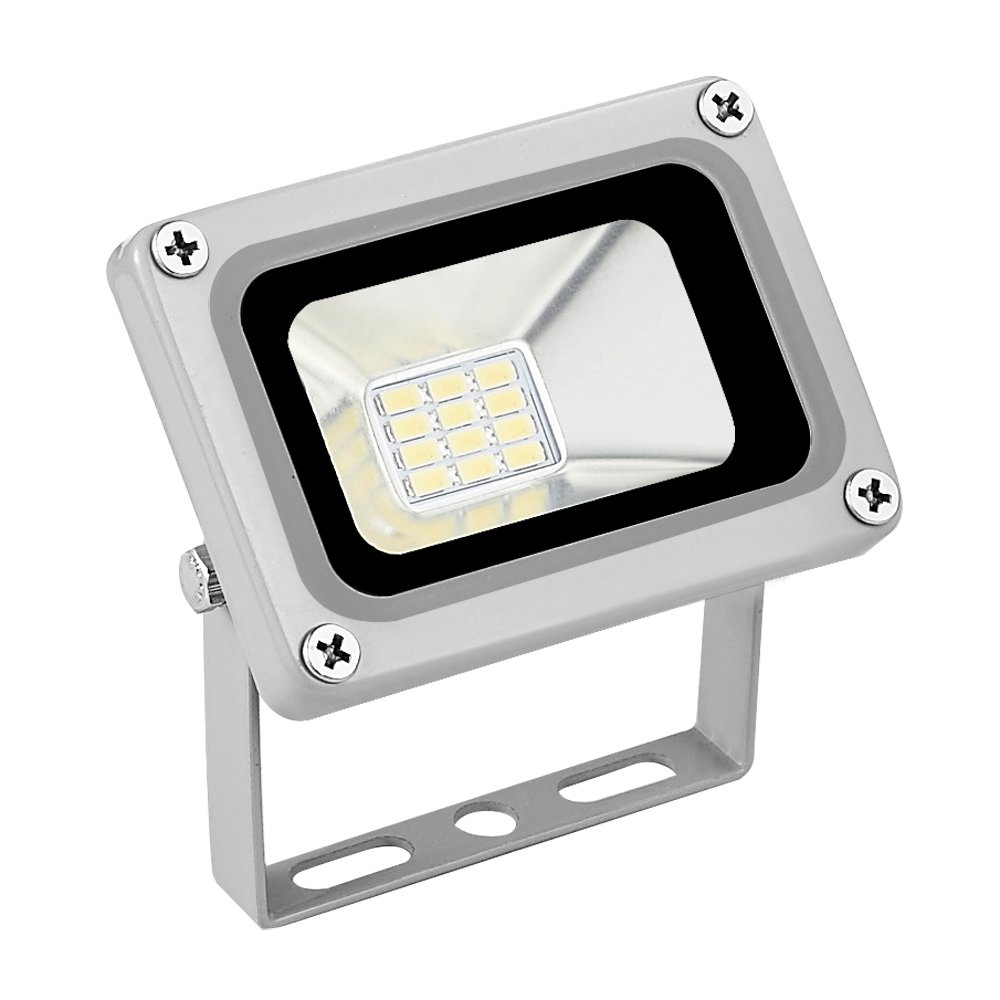

#7 Outdoor

Domain Est. 2004

Website: rablighting.com

Key Highlights: Ultra-economy, high-output floodlights with selectable lumen output and color temperature. Replace up to 2000W MH….

#8 FROST DC

Domain Est. 2007

Website: frostdc.com

Key Highlights: Top-notch service, beautiful lighting, responsive technical management, creative ideas within budget. Always willing to go the extra mile to make an event ……

#9 Products

Website: kkdc.lighting

Key Highlights: Fully customisable system of individually controllable LED modules intended for large scale Media screens, building façades, stage shows, light art and event ……

Expert Sourcing Insights for Dc Led Lights

H2: 2026 Market Trends for DC LED Lights

The global market for DC LED lights is poised for significant transformation by 2026, driven by advancements in energy efficiency, the proliferation of renewable energy systems, and increasing demand for smart lighting solutions. As industries and consumers alike prioritize sustainability and cost-effective lighting technologies, DC (direct current) LED lighting is emerging as a key player in the next generation of illumination systems. Below are the major trends shaping the DC LED lights market in 2026:

1. Integration with Renewable Energy and Off-Grid Systems

By 2026, the synergy between DC LED lights and renewable energy sources—especially solar power—is accelerating. Most solar panels and battery storage systems operate on DC power, eliminating the need for inefficient AC/DC conversions. This compatibility makes DC LEDs ideal for off-grid homes, rural electrification projects, and portable power systems, especially in developing regions. Governments and NGOs are increasingly adopting solar-DC-LED systems to expand access to clean lighting, further boosting market growth.

2. Rise of DC Microgrids in Commercial and Residential Buildings

The adoption of DC microgrids in smart homes, data centers, and commercial buildings is on the rise. These systems distribute DC power directly to appliances and lighting, reducing energy losses associated with power conversion. DC LED lights are a natural fit for such environments, offering higher efficiency and longer lifespan. By 2026, building-integrated DC power systems are expected to become mainstream, particularly in green building certifications like LEED and BREEAM.

3. Advancements in Smart Lighting and IoT Integration

DC LED lighting systems are increasingly being paired with Internet of Things (IoT) technologies. Smart DC LEDs can be controlled via mobile apps, voice assistants, or building automation systems, allowing for dynamic lighting adjustments based on occupancy, daylight availability, or user preferences. In 2026, expect widespread deployment of intelligent DC lighting in offices, hospitals, and retail spaces, driven by energy savings and enhanced user experience.

4. Growth in Electric Vehicle (EV) and Transportation Applications

The transportation sector is a growing market for DC LEDs. With electric vehicles relying on DC power, manufacturers are optimizing interior and exterior lighting using DC LEDs for efficiency and design flexibility. Additionally, DC LED lighting is being integrated into EV charging stations, tunnels, and public transit systems, where stable, low-voltage lighting solutions are essential.

5. Standardization and Infrastructure Development

One of the major challenges for DC LED adoption has been the lack of standardized infrastructure. However, by 2026, global initiatives such as EMerge Alliance and IEC standards are paving the way for universal DC power distribution in buildings. This standardization is encouraging manufacturers to produce compatible DC lighting fixtures and driving down costs through economies of scale.

6. Sustainability and Energy Efficiency Regulations

Stringent energy efficiency regulations and carbon reduction targets are pushing governments to phase out inefficient lighting. DC LEDs, known for their low energy consumption and reduced heat output, align with global sustainability goals. In 2026, policy support—including subsidies and tax incentives—is expected to further stimulate demand, particularly in Europe, North America, and parts of Asia-Pacific.

7. Declining Costs and Improved Technology

Ongoing advancements in semiconductor materials (like GaN-on-Si) and driver technologies are reducing the cost and size of DC LED systems while improving performance. As manufacturing scales up, prices for DC LED fixtures are becoming increasingly competitive with traditional AC LED systems, making them accessible to a broader market.

Conclusion

By 2026, the DC LED lights market is set to expand rapidly, fueled by technological innovation, energy transition trends, and evolving infrastructure. With superior efficiency, compatibility with renewable energy, and smart capabilities, DC LEDs are transitioning from niche applications to mainstream adoption across residential, commercial, industrial, and transportation sectors. Stakeholders in the lighting and energy industries must prepare for this shift by investing in R&D, embracing standards, and developing integrated DC power ecosystems.

Common Pitfalls When Sourcing DC LED Lights: Quality and IP Rating Issues

Sourcing DC LED lights can offer energy efficiency and design flexibility, but buyers often encounter significant challenges related to product quality and inaccurate or misleading IP (Ingress Protection) ratings. Overlooking these pitfalls can lead to premature failures, safety hazards, and costly replacements. Below are key areas to watch out for:

Overstated or False IP Ratings

One of the most frequent issues is suppliers claiming high IP ratings (e.g., IP65, IP67) without proper certification or testing. Many low-cost manufacturers falsify or self-assign IP ratings based on design assumptions rather than standardized testing. For example, a product may be labeled “IP65” but lack proper sealing or gaskets, leading to water and dust ingress in real-world conditions. Always request independent test reports or certification (e.g., from an accredited lab) to verify IP claims.

Poor Thermal Management and Component Quality

Low-quality DC LED lights often use substandard heat sinks, drivers, and LED chips that degrade rapidly under continuous operation. Inadequate thermal design leads to lumen depreciation, color shift, and shortened lifespan—sometimes as low as 10,000 hours instead of the claimed 50,000+. Check for reputable LED brands (e.g., Samsung, Bridgelux, Cree) and ensure the driver is compatible with your DC voltage and includes protection against overvoltage and surges.

Inconsistent Voltage and Polarity Handling

DC LED systems are sensitive to voltage fluctuations and reverse polarity. Cheap lights may lack built-in protection circuits, making them vulnerable to damage from incorrect installation or unstable power supplies. Confirm that the product includes reverse polarity protection and operates reliably within the specified voltage range (e.g., 10–30V DC for a 24V system).

Lack of Compliance and Safety Certifications

Many imported DC LED lights do not meet regional safety standards such as UL, CE, or RoHS. The absence of proper certifications increases risks of electrical shock, fire, or non-compliance with building codes. Always verify that products come with valid certifications relevant to your market and application.

Inadequate Waterproofing Despite High IP Labels

Even when IP ratings are technically accurate, poor manufacturing consistency can result in defective units with compromised seals. Batch variation is common among low-cost suppliers. Conduct sample testing—especially for outdoor or wet-location use—and consider third-party inspections before large orders.

Misleading Lumen and Efficiency Claims

Suppliers may exaggerate brightness (lumens) or efficiency (lm/W) to appear competitive. Without standardized testing conditions, these figures can be highly inflated. Request LM-79 or equivalent photometric reports to validate light output and efficiency claims.

No Warranty or Limited Support

Low-cost DC LED lights often come with no warranty or unrealistic support terms. Without recourse for defective products, buyers bear the full cost of replacement and labor. Prioritize suppliers offering clear warranty terms (e.g., 3–5 years) and responsive technical support.

By carefully vetting suppliers, demanding verifiable certifications, and testing samples under real conditions, you can avoid these common pitfalls and ensure reliable, long-lasting performance from your DC LED lighting installations.

Logistics & Compliance Guide for DC LED Lights

Product Classification and Regulatory Overview

DC LED lights are low-voltage lighting solutions typically powered by direct current (DC) sources such as batteries, solar systems, or DC power supplies. Due to their energy efficiency and growing use in automotive, marine, off-grid, and industrial applications, they are subject to various international regulations concerning safety, performance, and environmental compliance.

Key Regulatory Standards

IEC/EN 62560 – Safety of LED Lamps

This standard specifies safety requirements for LED lamps designed to operate on DC or AC mains supply. DC LED lights must comply with electrical safety, insulation, temperature rise, and mechanical strength requirements.

IEC/EN 62471 – Photobiological Safety

Applies to all electrically powered lamps, including DC LEDs. Ensures the emitted light does not pose risks to skin or eyes (e.g., blue light hazard, UV radiation).

RoHS (Restriction of Hazardous Substances) Directive (EU)

Prohibits the use of lead, mercury, cadmium, hexavalent chromium, PBB, and PBDE in electronic components. DC LED lights sold in the EU must comply with RoHS 3 (2015/863), which includes four additional phthalates.

REACH Regulation (EC 1907/2006)

Requires the registration, evaluation, authorisation, and restriction of chemicals. Manufacturers must ensure that substances used in LED components (e.g., plastics, adhesives) are compliant.

Energy Labeling Regulation (EU 2019/2015)

Mandates energy efficiency labeling for household light sources, including certain DC LED lamps. Labels must show energy class (A–G), luminous flux, power consumption, and lifespan.

North American Compliance

UL 8750 – Standard for LED Equipment

Covers safety requirements for LED light sources, drivers, and associated circuitry in the U.S. and Canada. DC LED lights must be evaluated under this standard for fire, electric shock, and mechanical hazards.

FCC Part 15 – Electromagnetic Interference (EMI)

Any device that uses digital circuitry or switching power supplies (common in DC LED drivers) must comply with radiated and conducted emission limits.

Energy Star for Illumination (if applicable)

Voluntary program in the U.S. that certifies energy-efficient lighting. DC LED products aiming for commercial or government contracts may benefit from Energy Star certification.

International Shipping and Logistics Considerations

UN/DOT Classification

DC LED lights are generally not classified as hazardous materials unless they contain lithium batteries. If integrated with lithium batteries, they must comply with:

– UN 3480 (Lithium-ion batteries)

– UN 3090 (Lithium metal batteries)

Proper packaging, labeling, and documentation (e.g., Shipper’s Declaration for Dangerous Goods) are required.

IATA Dangerous Goods Regulations (Air)

For air freight, batteries (if present) must meet IATA DGR packaging standards, including:

– Protection against short circuits

– Secure placement within packaging

– Marking and labeling per IATA Section II or Section IB (based on battery type and quantity)

IMDG Code (Sea Freight)

Maritime transport of DC LED lights with batteries must follow the International Maritime Dangerous Goods Code. Compliance ensures safe handling and stowage on vessels.

Import/Export Documentation

Commercial Invoice

Must include:

– Product description (e.g., “DC LED Strip Light, 12V”)

– Harmonized System (HS) Code

– Value, quantity, and country of origin

Packing List

Details packaging type, number of boxes, gross/net weight, and dimensions.

Certificate of Conformity (CoC)

Often required by customs authorities (e.g., EU, GCC, Russia) to prove compliance with local standards. May require third-party testing and certification (e.g., CE, UKCA, EAC).

Bill of Lading / Air Waybill

Essential for tracking and legal transfer of goods.

Harmonized System (HS) Codes

Common HS codes for DC LED lights:

– 8539.50: Light-emitting diodes (LEDs), other than photosensitive or photosolar devices

– 9405.40: Electric lamps and lighting fittings, including LED lamps

Note: Final classification depends on product form (bulb, strip, module) and intended use.

Regional Market-Specific Requirements

European Union (EU)

- CE Marking required (based on LVD, EMC, RoHS, and potentially ErP directives)

- Registration in EPR (Extended Producer Responsibility) schemes for WEEE (waste electrical equipment)

United Kingdom (UK)

- UKCA marking required for goods placed on the UK market (post-Brexit)

- Compliance with UK RoHS and WEEE regulations

United States

- No federal LED-specific labeling, but FTC Lighting Facts label required for general service lamps

- State-level regulations may apply (e.g., California’s Title 20 and 24)

China

- CCC (China Compulsory Certification) may be required for certain lighting products

- China RoHS compliance (marking and substance disclosure)

Middle East (GCC)

- G Marking required under GCC Conformity Tracking System (Baheeth)

- Compliance with SASO standards (e.g., SASO IEC 62560)

Best Practices for Compliance and Logistics

- Pre-shipment Testing: Conduct third-party certification (e.g., TÜV, SGS, Intertek) to validate compliance.

- Labeling: Ensure all products have correct voltage ratings, safety symbols, and regulatory marks.

- Battery Integration: If DC LEDs include batteries, verify packaging meets UN 38.3 testing requirements.

- Documentation Audit: Maintain technical files, test reports, and CoCs for customs and audits.

- Partner with Certified Freight Forwarders: Use logistics providers experienced in handling electrical goods and hazardous materials.

Conclusion

Successfully navigating the logistics and compliance landscape for DC LED lights requires a thorough understanding of regional regulations, proper classification, and accurate documentation. Proactive compliance not only ensures smooth customs clearance but also protects brand reputation and avoids costly recalls or penalties.

Conclusion for Sourcing DC LED Lights

Sourcing DC LED lights presents a strategic advantage for applications requiring energy efficiency, reliability, and compatibility with low-voltage power systems such as solar setups, automotive environments, and off-grid installations. Direct current (DC) LED lighting operates more efficiently than AC alternatives by eliminating the need for AC-to-DC conversion, reducing energy losses and heat generation. This makes them ideal for sustainable and remote power solutions.

When sourcing DC LED lights, key considerations include voltage compatibility (e.g., 12V or 24V systems), product quality, lumens per watt efficiency, durability, and compliance with safety standards. It is essential to work with reputable suppliers or manufacturers who offer certified products with clear specifications, warranties, and technical support.

Additionally, evaluating total cost of ownership—factoring in energy savings, longevity, and maintenance—often reveals long-term cost benefits over conventional lighting. Customization options and scalability should also be considered, especially for large-scale or specialized projects.

In conclusion, sourcing high-quality DC LED lights is a forward-thinking investment that supports energy conservation, system reliability, and operational efficiency. With proper due diligence in supplier selection and product specifications, organizations and individuals can achieve optimal lighting performance while aligning with sustainability and cost-saving goals.