The global data acquisition systems market is experiencing robust growth, driven by increasing demand for real-time monitoring, automation, and predictive maintenance across industries such as manufacturing, healthcare, automotive, and aerospace. According to Mordor Intelligence, the market was valued at USD 1.89 billion in 2023 and is projected to reach USD 2.83 billion by 2029, growing at a CAGR of approximately 7.1% during the forecast period. This expansion is fueled by the integration of IoT devices, advancements in sensor technology, and the rising emphasis on data-driven decision-making in industrial applications. As organizations prioritize precision, scalability, and remote data access, leading manufacturers are innovating to deliver high-speed, reliable, and scalable data acquisition solutions. In this evolving landscape, nine key players have emerged as industry frontrunners, combining technological excellence with global reach to meet escalating market demands.

Top 9 Data Aqcuisition Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Data Acquisition Products for ANY Application and Budget

Domain Est. 1995

Website: dataq.com

Key Highlights: DATAQ Instruments, Inc. is a leader in data acquisition (DAQ) including USB DAQ, Ethernet, wireless, and data loggers….

#2 Data Acquisition Systems & Test Solutions

Domain Est. 1997

Website: dtsweb.com

Key Highlights: Diversified Technical Systems (DTS) is a leading manufacturer of ultra-reliable, miniature data acquisition systems and sensors for harsh test environments. Our ……

#3 ADInstruments: DAQ Software

Domain Est. 1996

Website: adinstruments.com

Key Highlights: ADInstruments creates easy-to-use, high-quality, powerful data acquisition software and equipment for life science researchers and educators around the world….

#4 Data Acquisition (DAQ)

Domain Est. 1998

Website: advantech.com

Key Highlights: Advantech DAQ offers a wide range of data acquisition and signal condition devices with various interfaces: PCI and PCIE cards, USB and iDAQ modules….

#5 Data Acquisition

Domain Est. 1999

Website: accuratetechnologies.com

Key Highlights: ATI offers comprehensive data acquisition solutions that include software for data management and analysis, along with hardware for collecting precise ……

#6 Data Acquisition Systems

Domain Est. 2001

Website: labjack.com

Key Highlights: Superior Data Acquisition Systems to collect analog & digital sensors. Log, automate and test. Use software like LabVIEW, MatLAB, Python, C, C++, ……

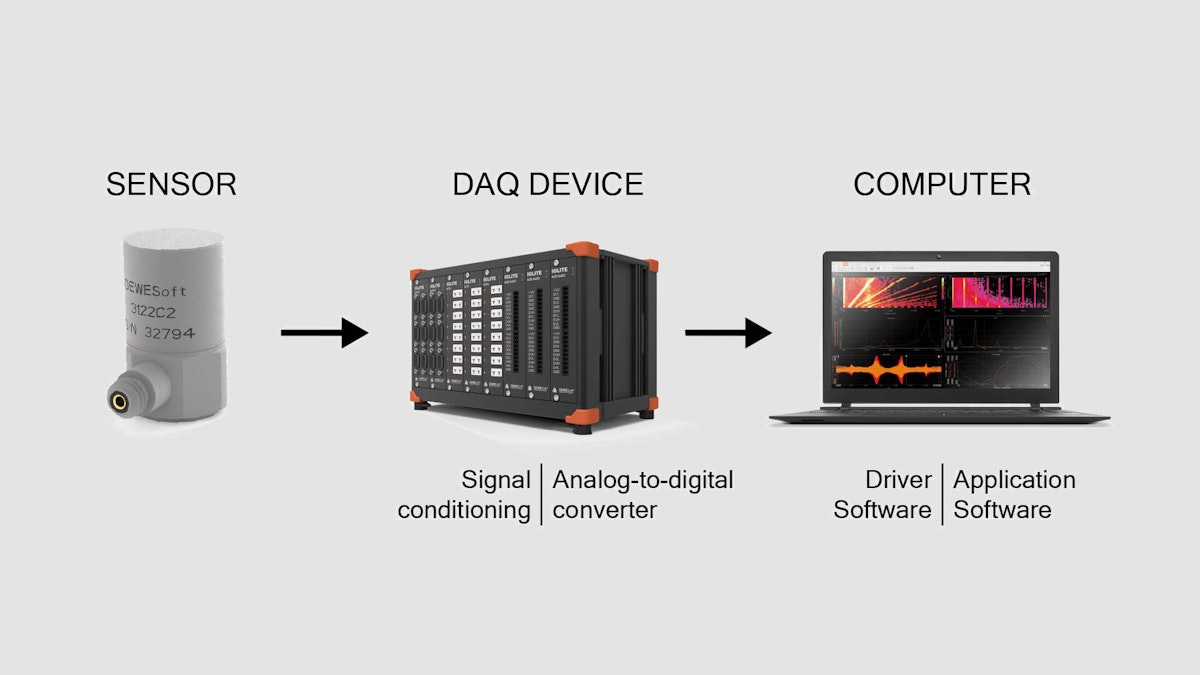

#7 Dewesoft: Data Acquisition

Domain Est. 2002

Website: dewesoft.com

Key Highlights: We design test and measurement equipment that simplifies the advancement of humanity. Our data acquisition systems are the ultimate tools for test engineers….

#8 Data Acquisition

Domain Est. 2006

Website: thermofisher.com

Key Highlights: DataTaker supplies a broad range of general purpose and specialised data loggers and data recording equipment to customers across many industries….

#9 Data Logger & Data Acquisition Solutions from CAS DataLoggers

Domain Est. 2007

Website: dataloggerinc.com

Key Highlights: CAS DataLoggers is a distributor of data loggers, data acquisition equipment and customized data acquisition systems for virtually every industry….

Expert Sourcing Insights for Data Aqcuisition

H2 2026 Market Trends for Data Acquisition

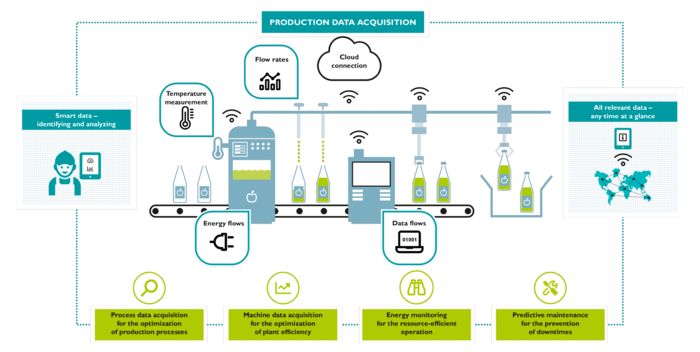

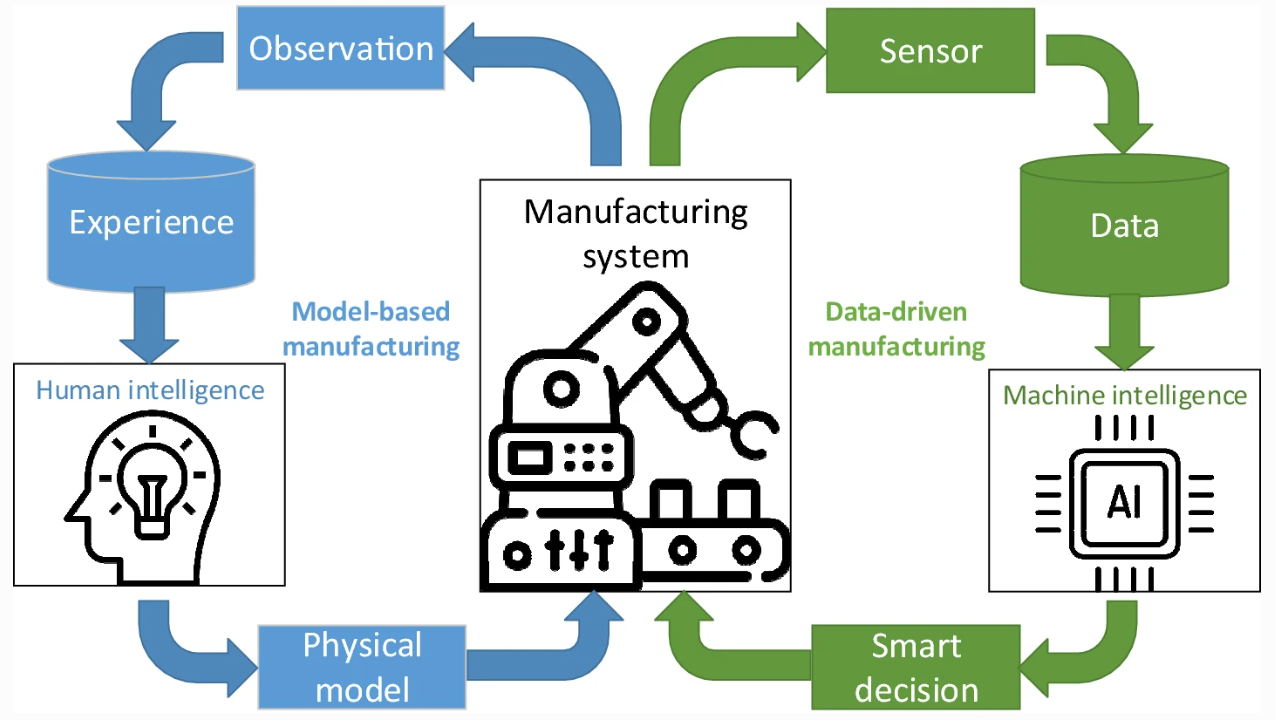

By the second half of 2026, the data acquisition market will be shaped by intensified demand for real-time, high-fidelity data across industries, driven by advancements in AI, edge computing, and IoT proliferation. Key trends include:

1. Dominance of Edge Intelligence & Distributed Acquisition

Data acquisition systems will increasingly embed AI/ML capabilities directly at the edge. Real-time analytics, anomaly detection, and data compression will happen on-device or at the gateway, reducing latency and bandwidth costs. This shift supports mission-critical applications in manufacturing (predictive maintenance), autonomous systems, and smart cities.

2. Convergence of OT and IT with Unified Data Platforms

Operational Technology (OT) data from sensors, SCADA, and industrial machines will seamlessly integrate with IT systems via unified data platforms. Vendors will offer converged DAQ solutions that support both high-speed industrial protocols (e.g., OPC UA, Modbus) and cloud-native APIs, enabling holistic data pipelines for digital twins and enterprise analytics.

3. Rise of Software-Defined and Modular DAQ Systems

Flexible, software-configurable acquisition hardware will gain traction. Modular DAQ systems—supporting interchangeable sensor inputs, sampling rates, and communication interfaces—will allow organizations to scale and reconfigure systems rapidly. This trend is fueled by demand for cost-effective, future-proof solutions in R&D and test environments.

4. Increased Focus on Data Quality and Governance

With regulatory pressures (e.g., AI Act, data localization laws) and AI reliance on clean training data, DAQ systems will incorporate built-in metadata tagging, calibration validation, and audit trails. Automated data lineage tracking from sensor to insight will become a competitive differentiator.

5. Expansion in Non-Traditional Sectors

Beyond industrial and scientific use cases, data acquisition will grow in agriculture (soil and crop monitoring), healthcare (wearable biosensors), and energy (distributed grid monitoring). Low-power, wireless DAQ systems will enable large-scale deployments in remote or mobile environments.

6. AI-Driven Predictive Calibration and Maintenance

AI models will analyze historical DAQ performance to predict sensor drift or hardware failure, enabling proactive calibration and reducing downtime. Self-calibrating sensors and automated health monitoring will become standard in high-precision applications.

7. Sustainability as a Design Criterion

Energy-efficient DAQ hardware and low-power wide-area network (LPWAN) connectivity (e.g., LoRaWAN, NB-IoT) will be prioritized to support ESG goals. Solar-powered and battery-optimized remote data loggers will expand deployment in environmental monitoring and infrastructure inspection.

Conclusion

By H2 2026, data acquisition will evolve from a passive data collection function to an intelligent, integrated layer of the data ecosystem. Success will depend on adaptability, interoperability, and the ability to deliver trusted, actionable data at scale—positioning DAQ as a foundational element of the AI-driven enterprise.

Common Pitfalls in Sourcing Data Acquisition (Quality, IP)

When sourcing data for analytics, machine learning, or business intelligence, organizations often encounter significant challenges related to data quality and intellectual property (IP). Overlooking these pitfalls can lead to inaccurate insights, legal risks, and project failures. Below are key issues to watch for:

Poor Data Quality

One of the most prevalent pitfalls is acquiring data that lacks reliability, accuracy, or consistency. Common quality issues include:

- Incomplete or Missing Data: Gaps in datasets can skew analysis and lead to incorrect conclusions.

- Inaccurate or Outdated Information: Data that is incorrect or not current reduces the validity of any insights derived.

- Lack of Standardization: Inconsistent formats, units, or terminology across sources complicate integration and analysis.

- Bias in Data Collection: Biased sampling or collection methods can result in datasets that do not represent the real-world population.

Without rigorous validation and cleansing processes, even large volumes of data may be unusable or misleading.

Intellectual Property (IP) Risks

Acquiring data without proper attention to IP rights can expose organizations to legal liabilities. Key IP-related pitfalls include:

- Unauthorized Use or Reproduction: Using data without proper licensing or consent may infringe on copyrights, trademarks, or database rights.

- Ambiguous Licensing Terms: Vague or overly restrictive licenses can limit how data is used, shared, or commercialized.

- Third-Party Ownership: Data may contain embedded content (e.g., images, text) owned by others, creating exposure if not properly cleared.

- Data Provenance Uncertainty: Lack of transparency about a dataset’s origin makes it difficult to verify legal compliance and ethical sourcing.

Failing to conduct due diligence on IP rights can result in costly litigation, reputational damage, and forced data disposal.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Implement data quality assessments before acquisition.

– Establish clear data governance policies.

– Conduct thorough legal reviews of licensing and usage rights.

– Maintain detailed records of data provenance and consent.

Proactively addressing quality and IP concerns ensures that sourced data is both reliable and legally sound.

Logistics & Compliance Guide for Data Acquisition

This guide outlines the essential logistical and compliance considerations for acquiring data in a secure, legal, and efficient manner. Adhering to these principles ensures data integrity, protects stakeholder rights, and supports organizational accountability.

1. Define Data Requirements and Scope

Clearly identify the type, format, volume, and purpose of the data to be acquired. Establishing precise requirements early minimizes unnecessary collection and ensures alignment with project objectives and regulatory obligations.

2. Identify Legal and Regulatory Frameworks

Determine applicable laws and regulations based on data type and jurisdiction, including but not limited to:

– General Data Protection Regulation (GDPR) for EU data subjects

– California Consumer Privacy Act (CCPA)

– Health Insurance Portability and Accountability Act (HIPAA) for health data

– Industry-specific standards (e.g., PCI-DSS for payment data)

Ensure all acquisition activities comply with data protection, privacy, and cross-border transfer rules.

3. Obtain Necessary Permissions and Consent

Secure informed consent from data subjects where required. Consent must be freely given, specific, informed, and unambiguous. For third-party data, verify that the provider has lawful rights to share the data and that data use agreements are in place.

4. Assess Data Sources and Vendors

Evaluate the legitimacy, reliability, and compliance posture of data sources or vendors. Conduct due diligence including:

– Reviewing vendor privacy policies and data handling practices

– Performing security assessments or audits when appropriate

– Signing Data Processing Agreements (DPAs) if the vendor processes data on your behalf

5. Ensure Secure Data Transfer and Storage

Implement secure methods for data transmission (e.g., encrypted channels such as HTTPS, SFTP) and storage (e.g., AES-256 encryption at rest). Limit access to authorized personnel and maintain audit logs of data access and transfers.

6. Maintain Data Provenance and Documentation

Keep detailed records of:

– Source of the data

– Date and method of acquisition

– Consent or legal basis for processing

– Data inventory and classification

This supports compliance audits, data lineage tracking, and accountability.

7. Implement Data Minimization and Retention Policies

Acquire only the data necessary for the specified purpose. Define and adhere to data retention schedules, ensuring data is securely deleted or anonymized when no longer needed.

8. Conduct Regular Compliance Reviews

Schedule periodic audits of data acquisition practices to ensure ongoing compliance with legal, regulatory, and organizational standards. Update procedures in response to new laws or operational changes.

9. Train Personnel on Compliance Obligations

Provide regular training to staff involved in data acquisition on privacy principles, security protocols, and compliance requirements to reduce the risk of breaches or violations.

10. Establish Incident Response Procedures

Prepare for potential data breaches or compliance incidents by defining clear response protocols, including notification obligations to regulators and affected individuals within required timeframes.

Following this guide ensures that data acquisition is conducted responsibly, ethically, and in full compliance with all relevant legal and operational standards.

Conclusion for Data Acquisition Sourcing

In conclusion, effective data acquisition sourcing is a critical foundation for any data-driven initiative. The process involves identifying reliable data sources, evaluating their quality, accessibility, and relevance, and selecting the most appropriate methods for collection—whether through internal systems, external vendors, public repositories, APIs, or direct data generation. A well-structured sourcing strategy ensures data accuracy, completeness, and timeliness, while also addressing legal, ethical, and privacy considerations such as compliance with data protection regulations (e.g., GDPR, CCPA).

Moreover, organizations must balance cost, scalability, and integration capabilities when choosing data sources. Leveraging a mix of primary and secondary data, combined with robust validation and governance practices, enhances the reliability and utility of acquired data. As data continues to drive innovation and decision-making, a strategic and sustainable approach to data acquisition sourcing will remain essential for maintaining competitive advantage and achieving long-term success in an increasingly data-centric world.